Professional Documents

Culture Documents

ACCA PM Budgeting

Uploaded by

Aysha ZulfiquarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA PM Budgeting

Uploaded by

Aysha ZulfiquarCopyright:

Available Formats

Achievers Budgeting Devinda Weerasekara

WHAT IS A BUDGET?

A budget is a quantitative, forward looking, plan of action prepared for a specific time period. It is

expressed in financial terms. Common used budget periods are, monthly, quarterly, semi-annually and

annually. However, Annual Budgets are the most popular.

PURPOSES OF BUDGETS

Budgeting serves a number of purposes such as:

• Planning: A budget is a plan which is prepared for the future. This forces the management to look

into the future and this is vital since it stops the management from ad hoc or poorly coordinated

planning.

• Authorisation: A budget will be a formal authorisation to incur expenditure. A manager may incur

expenses for reasons such as hiring staff, pursuing plans or strategies. However, the spending

should be done within the budget. If the expenses exceed the budget, this will reflect negatively

on the manager.

• Control: A budget will control the expenses of an organisation. After a variance analysis,

corrective action could be taken if needed.

• Communication: A budget will allow the Managers and Subordinates to communicate. A budget

is a communication by the managers to the subordinates regarding the targets which should be

achieved.

• Evaluation (Performance Measurement): Organisation is divided into budget centres and for each

budget centre, there will be a manager who is responsible for the performance of the centre. A

budget will be used to evaluate the performance or the actions of the manager.

• Motivation: A budget is a target for the managers. If a manager can achieve the budget allocated

to the particular budget centre, then the manager will be rewarded. Therefore, managers will be

motivated and will be constantly taking proper actions to achieve the budget.

Page | 1 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

LEVELS OF BUDGETING

Strategic Planning

Strategic plans are designed with the entire organization in mind and begin with an organization's

mission. Top-level managers, such as CEOs or presidents, will design and execute strategic plans

to paint a picture of the desired future and long-term goals of the organization and allocate

resource accordingly. Essentially, strategic plans look ahead to where the organization wants to

be in three to five years. Strategic plans, provided by top-level managers, serve as the framework

for lower-level planning.

Tactical Planning

Tactical Plans are medium term and will focus on the next one to two years. This will be prepared

in line with the Strategic Plan. This will look at the department and divisional level and specifies

how to use the resources.

Operational Planning

Operational plans are the plans that are made by frontline, or low-level, managers. All operational

plans are focused on the specific procedures and processes that occur within the lowest levels of

the organization. Managers must plan the routine tasks of the department using a high level of

detail. This is short term Budgeting and will have a plan which is less than one year.

• The aim is that if a manager achieves short term budgetary goals (operational plan) there is

a high chance of meeting the tactical goals and ultimately make the strategic plan a success.

Page | 2 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

APPROACHES TO BUDGETING

Different organisations adopt different budgeting techniques. The most commonly used

techniques are:

• Rolling Budgets (Continuous Budgets) -Covered in F2

• Incremental Budgeting -Covered in F2

• Top down Budgeting (Imposed Budgeting)- Covered in F2

• Bottom up Budgeting (Participative Budgeting) - Covered in F2

• Zero Based Budgeting (ZBB) - Covered in F2

• Activity Based Budgeting – New Area of F5

Rolling Budgeting

A budget (Usually Annually) which is constantly updated after each period (Monthly or Quarterly)

when the earliest accounting period has expired.

A rolling budget could be prepared in the following manner:

• Prepare the budget for a period of 4 quarters (E.g.: January to December).

• At the end of the first period (E.g.: 1st Quarter-: 31st March), variance analysis is made of that

period’s results against the budget. The conclusions drawn from this variance analysis are

used to update the budgets for the remaining periods and add a budget for a further three

months.

• This process is repeated at the end of each period (In this case, each quarter).

Page | 3 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

• For example, lets take the sales budget:

A rolling budget is suitable if:

• If the business operating in a dynamic environment where forecasting is difficult.

• If the organisation requires tighter control.

Advantages and Disadvantages of Rolling Budgets are:

Advantages Disadvantages

Planning and Controlling will be based on a More Costly and Time consuming compared to

more accurate budget an incremental budget.

Will reduce the element of uncertainty in Employees will spend majority of their time

budget since it will concentrate on the short preparing budgets which is not their main

term. role and this may demotivate them. Also

they will not like to see their targets revised

so many times.

Page | 4 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

There is always a budget (A plan) extending If the employees get tired of preparing the

into the future. budgets so often, they might simply add or

deduct a percentage from the previous

budget just for the sake of completion which

exposes it to the risk of becoming an

incremental budget.

Forces the management to re-assess the Increased budgeting work may lead to less

budgets regularly and to produce budgets focus on control of the actual results.

more up-to-date.

Focusing mainly on budgeting will distract

the organisation form key issues and they

might not be able to identify and capitalize

on opportunities or might not foresee threats

Incremental Budgeting

An incremental budget is a budget which is simply prepared by taking the previous year’s

budget and adding a percentage to cover up for inflation and other changes.

This will work in a static business environment where the changes are very minimal. However, in

a dynamic business environment, this technique will definitely not work since a lot can change

since the previous budget.

Incremental Budget = Last Year’s actual results + Inflation

Example: If the 2019 Actual expenses were $ 10 Million and the inflation rate of the country is

10%, then the 2020 expense budget would be as follows:

2020 Expense Budget = 2019 Actual Expenses + Inflation

= $ 10 Mn + ($ 10 Mn x 10%)

= $ 11 Million

Page | 5 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

Advantages and Disadvantages of Incremental Budgets are:

Advantages Disadvantages

Quickest and Easiest Budgeting Technique. Carries the previous budget inefficiencies to

the future budgets.

Suitable for organisations in a static business Uneconomic activities may be continued due

environment. to previous practices. (E.g.: producing a

component in-house when it is cheaper to

outsource).

Managers may tend to use up the budget

simply because it’s available, hoping to

obtain a larger budget for the next period.

Top down (Imposed) Budgeting

An imposed budget is a budget allowance which is set without permitting the ultimate budget

holder to have the opportunity to participate in the budgeting process.

In other words, the Top level of an organisation will prepare the budget and impose (force) it on

to the lower level managers to achieve it.

The lower level managers are not consulted when preparing these budgets but they have achieve

it even though it might be an unrealistic budget.

Page | 6 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

Advantages and Disadvantages of imposed budgets:

Advantages Disadvantages

Involving managers are more time It may result in dissatisfaction, defensiveness

consuming than the top level simply and low morale among employees, who

imposing it. must implement the budget.

Managers may not have the skills to be It is the lower level workers who are closer

involved in the budgetary process and they to the customers and hence they will be

may not be motivated. able to give a more practical input to the

process.

The directors have a better overall view of The accountability of the ultimate budget

the organisation can place the resources to holder towards the budget will be low since

get the maximum utilization. it was prepared by a third party.

Budgetary slack could be avoided.

The top level is aware about the long term

goals which the lower level managers may

not be aware of to prepare the ideal budget.

When directors prepare the budgets, it is

someone outside the division a fresher

perspective may be incorporated into the

budget.

Page | 7 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

Bottom up Budgeting (Participative Budgeting)

A bottom up budget is a system of budgeting in which budget holders have the opportunity to

participate in setting their own budgets. Also called participative budgeting. In other words, the

lower level managers will also get an opportunity to participate in the budgeting process.

Advantages and Disadvantages of participative budgets:

Advantages Disadvantages

Increased motivation due to the ownership of Director may lose control.

budgets.

The operational level workers are closer to the Dysfunctional Behaviour: The budgets will reflect

customer and hence a more practical input could divisional concerns, but it may not be in line with

be obtained. the overall corporate objectives.

Increases the manager’s understanding and Bad decisions from inexperienced lower level

commitment because it is his or her own budget. managers.

Directors could concentrate on strategy. Budgetary slack may arise.

Significant time will be consumed.

May not reflect long term objectives of the

organization since the lower levels are more

focused on short to medium term.

Page | 8 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

Budgetary Slack:

Budget slack is simply an employee purposely understating a revenue budget or overstating an

expense budget just to ensure that the targets are met easily, and the employee obtains a good

bonus. This occurs when the employees are given the chance to prepare their own budgets.

Zero Based Budgeting

A method of budgeting that requires each cost element to be specifically justified, as though

the activities to which the budget relates were being undertaken for the first time. Without

approval, the budget allowance is zero'

It is suitable for:

• allocating resources in areas were spend is discretionary (optional). For example, research

and development, advertising and training.

• public sector organisations such as local authorities.

Implementation of ZBB:

There are 4 key steps in implementing ZBB in an organization:

1. List down all activities planned across all departments for the next financial year

Example: Marketing department may have the following 3 activities planned for the next

year:

I. TV Advertisement

II. Newspaper Advertisement

III. Sponsorship

2. Perform a cost benefit analysis for all activities

Example: Cost benefit analysis for TV Advertisement:

Cost of the TV advertisement - ($ 15,000)

Benefit of the TV Advertisement

(Increase in Profit due to the TV advertisement) - $ 50,000

Net Benefit / Cost Benefit - $ 35,000

Page | 9 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

3. Rank all activities based on the cost benefit. Rank 1 will be the activity with the highest cost

benefit.

4. Allocate resources based on the rank. First allocation will be done for the rank 1 activity.

Advantages and Disadvantages of ZBB are:

Activity Based Budgeting (ABB)

ACCA Official Terminology describes activity-based budgeting (ABB) as a method of budgeting

based on an activity framework, using cost driver data in the budget setting and variance

feedback processes.

The most basic form of ABB uses cost drivers (identified through activity-based costing, ABC) to

help derive budgets. As its name suggests, ABB focuses on activities rather than functions

(departments).

In simple terms, ABB follows four stages:

1. Identify activities and their cost drivers

2. Calculate the cost driver rate (cost per unit of activity).

3. Forecast the number of units of cost driver for the required activity level

4. Calculate the budget (Cost drive rate x number of units of cost driver)

Page | 10 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

The following simple example uses a sales order processing cost scenario, where the cost driver

is number of sales orders.

• Activity is sales order processing and the cost driver is the number of sales orders

• Calculate the forecast cost of processing a single sales order using ABC. Let’s say this is

$5 per sales order

• Forecast the number of sales orders for the budget period. Assume it is calculated to be

40,000 sales orders.

• Finally, calculate the total sales order processing cost budget -: 40,000 x $5 = $200,000

Flexed Budgets

A flexed budget is a budget that is prepared for the actual activity level. The budget prepared at

the start of the year is known as the “fixed budget”.

However, the budgeted activity level and the actual activity levels are different in most

situations. Hence, we cannot do a variance analysis, since we cannot compare costs and

revenues at different activity levels.

As a result, we need to prepare the budget at the actual activity level and then compare with

the actual results. The budget prepared at the actual activity level is known as the “Flexed

Budget”.

For variance analysis, it is always the flexed budget and the actuals that should be compared.

Example:

Raw Material Budget - 1000 Kg @ a total cost of $ 20,000

Actual Raw Material Purchases – 2500 Kg @ a total cost of $ 46,000

Calculate:

1. Flexed budget for 2500 Kg of Raw Material Purchases

2. Material Price Variance

Page | 11 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

What is Budgetary Control ?

It is a system through which the organizations tend t monitor and control whether the set

budgets are achieved and to take corrective actions.

Types of Budgetary Control

There are 2 main types of budgetary control:

• Feed-back Control System

• Feed-forward Control System

Feed-back Control System

The aim of this control system is to take corrective actions for the problems that have already

occurred.

The budget is set at the start of the year and the actual results are compared at the end of the

year (nothing is done in the year to monitor the budget achievement) and a variance analysis is

performed. Based on the findings and the reasons for the variance, corrective action will be

taken for the next year.

However, the current year is already lost, and we are reacting to the variance in the current

year to take actions for the next year.

Therefore, a feedback control system is known as a Reactive Control System since it waits for

the problem to occur and then react to it.

Example:

Page | 12 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

Feed-forward Control System

The aim of this system is to anticipate problems and take actions in order to prevent the

problems from occurring.

The budget is set at the start of the year and after few months, let’s say 3 months, a forecast is

made using the first 3 months actual results. The forecast will indicate what the actual results

would be at the end of the year. This forecast is then compared with the budget to calculate a

forecasted variance. The reasons for the variance will then be used to take actions for the

current year.

Through this method we ensure that the current year is not lost, and the targets are achieved.

Since the Feed-forward control system anticipates problems and prevents them from occurring,

it is known as a Proactive Control System.

Page | 13 ACCA PM – Performance Management

Achievers Budgeting Devinda Weerasekara

Positive Feedback

In Feed-back and Feed-forward control, if the variance /forecasted variance is favourable, then

it is known as positive feedback since it indicates that we will be achieving the budget.

Negative Feedback

In Feed-back and Feed-forward control, if the variance /forecasted variance is adverse, then it is

known as negative feedback since it indicates that we will not be achieving the budget.

Single loop Feedback

If the corrective action taken is to improve the processes, efficiency and ways of working, it is

known as single loop feedback.

Double loop Feedback

If the corrective action taken is to change the budget, it is known as double loop feedback.

Page | 14 ACCA PM – Performance Management

You might also like

- Multiple Choice Questions - Theoretical and ComputationalDocument276 pagesMultiple Choice Questions - Theoretical and ComputationalIzzy B75% (12)

- Work Life BalanceDocument20 pagesWork Life BalanceGaara16567% (18)

- ZBB method justifies all expenses each periodDocument10 pagesZBB method justifies all expenses each periodYu-zap Mpesa OcampoNo ratings yet

- MS 3406 Short-Term Budgeting Additional Financing Needed and ForecastingDocument7 pagesMS 3406 Short-Term Budgeting Additional Financing Needed and ForecastingMonica GarciaNo ratings yet

- BUDGETINGDocument11 pagesBUDGETINGCeceil PajaronNo ratings yet

- Budget & Budgetary Control - Sem-IDocument37 pagesBudget & Budgetary Control - Sem-Ishital_vyas19870% (1)

- Budgeting - IntroductionDocument46 pagesBudgeting - Introductionkamasuke hegdeNo ratings yet

- Budgeting BasicsDocument18 pagesBudgeting BasicsSuleyman TesfayeNo ratings yet

- Budgeting and MBO ReportDocument20 pagesBudgeting and MBO ReportjoiabelaNo ratings yet

- Procurement PlanDocument5 pagesProcurement PlanKISHORENo ratings yet

- 2-2.2. Pokayoke Check SheetDocument1 page2-2.2. Pokayoke Check SheetRavi YadavNo ratings yet

- Section C. Budgetary System & Variance - TuttorsDocument61 pagesSection C. Budgetary System & Variance - TuttorsNirmal Shrestha100% (1)

- MAS.2906 - Short-Term BudgetingDocument9 pagesMAS.2906 - Short-Term BudgetingEyes SawNo ratings yet

- Budgeting BasicsDocument18 pagesBudgeting BasicsYakini entertainmentNo ratings yet

- Maintenance and Its Types PDFDocument35 pagesMaintenance and Its Types PDFSamwel MmariNo ratings yet

- Ifrs s2 - Spanish VersionDocument37 pagesIfrs s2 - Spanish VersionComunicarSe-ArchivoNo ratings yet

- Budgeting: By: M. Luqman RafiqDocument7 pagesBudgeting: By: M. Luqman RafiqsulukaNo ratings yet

- MAF551 - Exercise 1 - Answer Question 1 - Ridzuan Bin Saharun - 2017700141Document14 pagesMAF551 - Exercise 1 - Answer Question 1 - Ridzuan Bin Saharun - 2017700141RIDZUAN SAHARUNNo ratings yet

- GCE Business BudgetsDocument13 pagesGCE Business BudgetsAbigail TrevinoNo ratings yet

- Chapter 33-BudgetsDocument5 pagesChapter 33-BudgetsRanceNo ratings yet

- Budgeting Theory F5 NotesDocument19 pagesBudgeting Theory F5 NotesSiddiqua KashifNo ratings yet

- BUDGETINGDocument17 pagesBUDGETINGstannis69420No ratings yet

- Essay Los 2015 Section B. Planning, Budget and Forecasting 30 %Document24 pagesEssay Los 2015 Section B. Planning, Budget and Forecasting 30 %lassaadNo ratings yet

- Budgeting Budgetary Systems 1. Rolling Budget: Shazwi Azid (SM'20)Document8 pagesBudgeting Budgetary Systems 1. Rolling Budget: Shazwi Azid (SM'20)Amir ArifNo ratings yet

- Unit 3 Section 2Document4 pagesUnit 3 Section 2Babamu Kalmoni JaatoNo ratings yet

- Budget by ArmaanDocument37 pagesBudget by Armaansyed bilalNo ratings yet

- Business Studies AS Unit 2 Section 3 Topic 1: BudgetsDocument13 pagesBusiness Studies AS Unit 2 Section 3 Topic 1: BudgetsAzoraNo ratings yet

- Module 3 - BudgetingDocument24 pagesModule 3 - Budgetinganalyst7788No ratings yet

- Bcd Budgeting and Budgetary Control 2021Document55 pagesBcd Budgeting and Budgetary Control 2021Oreratile KeorapetseNo ratings yet

- Budgetary ControlDocument32 pagesBudgetary ControlanishaNo ratings yet

- Y12.U5.32 - BudgetsDocument3 pagesY12.U5.32 - BudgetsRuxandra ZahNo ratings yet

- BSM PG College Roorkee: Assignment On AuditingDocument42 pagesBSM PG College Roorkee: Assignment On AuditingNeeraj Singh RainaNo ratings yet

- Financial Planning and Budgets ChapterDocument3 pagesFinancial Planning and Budgets ChapterMixx MineNo ratings yet

- BudgetingDocument16 pagesBudgetingNusrath zahan tasnimNo ratings yet

- Budget ControlDocument33 pagesBudget Controladnan arshadNo ratings yet

- Budgetary ControlDocument20 pagesBudgetary ControlSailesh RoutNo ratings yet

- BudgetsDocument10 pagesBudgetsRindai TinarwoNo ratings yet

- Budget and Budgetary ControlDocument10 pagesBudget and Budgetary Controlzeebee17No ratings yet

- BudgetingDocument13 pagesBudgetingUditha Muthumala100% (1)

- Profit Planning: Asic Framework of Budgeting AccountingDocument5 pagesProfit Planning: Asic Framework of Budgeting AccountingMichaela CruzNo ratings yet

- 4 - Budgetary ControlDocument31 pages4 - Budgetary ControlFahim HussainNo ratings yet

- ZBB Budgeting Explains Cost SavingsDocument11 pagesZBB Budgeting Explains Cost SavingsJEFF SHIKALINo ratings yet

- Chapter - Three Budgets and Budgetary ControlDocument83 pagesChapter - Three Budgets and Budgetary ControlHace AdisNo ratings yet

- Budgets & Budgetary Control GuideDocument39 pagesBudgets & Budgetary Control GuideNeeraj Singh RainaNo ratings yet

- Guru Ghasidas Vishwavidyalaya: Department of Management Studies Mba 1St SemesterDocument39 pagesGuru Ghasidas Vishwavidyalaya: Department of Management Studies Mba 1St SemesterDivyansh Singh baghelNo ratings yet

- Chapter 12 Budgeting GuideDocument59 pagesChapter 12 Budgeting GuideCristineNo ratings yet

- Esg Budget Management Final VersionDocument66 pagesEsg Budget Management Final Versionrita tamohNo ratings yet

- F2 Sir Rameez Notes Budgeting 4Document6 pagesF2 Sir Rameez Notes Budgeting 4Wajahat IzzatNo ratings yet

- BUDGETING AND BUDGETARY CONTROLDocument4 pagesBUDGETING AND BUDGETARY CONTROLesmuraguNo ratings yet

- Budgeting ConceptsDocument19 pagesBudgeting ConceptsJitendra NagvekarNo ratings yet

- 2020 PDFDocument39 pages2020 PDFNeeraj Singh RainaNo ratings yet

- BSM PG College Roorkee: Assignment On AuditingDocument39 pagesBSM PG College Roorkee: Assignment On AuditingNeeraj Singh RainaNo ratings yet

- Budget Front OfficeDocument28 pagesBudget Front OfficeTarun GarhwalNo ratings yet

- Chapter 12 Objectives of Budgetary ControlDocument4 pagesChapter 12 Objectives of Budgetary ControlDOODGE CHIDHAKWANo ratings yet

- CVP Analysis Break-Even PointDocument7 pagesCVP Analysis Break-Even PointMarjorie ManuelNo ratings yet

- 202004061919580294audhesh Kumar Capital BudgetingDocument9 pages202004061919580294audhesh Kumar Capital BudgetingHarsh ShawNo ratings yet

- Q # 1. Explain How Budgetary Systems Fit Within The Performance Hierarchy?Document5 pagesQ # 1. Explain How Budgetary Systems Fit Within The Performance Hierarchy?Hammad AnwarNo ratings yet

- BSM PG College Roorkee Budgetary Control AssignmentDocument39 pagesBSM PG College Roorkee Budgetary Control AssignmentNeeraj Singh RainaNo ratings yet

- Budgetary Control: Part A: TheoryDocument9 pagesBudgetary Control: Part A: TheoryAditi TNo ratings yet

- Functional and Activity Based BudgetingDocument5 pagesFunctional and Activity Based BudgetingBrithney ButalidNo ratings yet

- Presentation On Budget Preparation: Presented byDocument15 pagesPresentation On Budget Preparation: Presented bysunaina22chdNo ratings yet

- CH 6 Zimmerman - Budgeting SummaryDocument6 pagesCH 6 Zimmerman - Budgeting SummaryMarina ProdanNo ratings yet

- Budgeting ProcessDocument51 pagesBudgeting ProcessayiahNo ratings yet

- Zero Based BudgetingDocument10 pagesZero Based Budgetingmisbah mohamedNo ratings yet

- TheoryDocument3 pagesTheorykingaisyah01No ratings yet

- Financial Accounting AssesmentDocument5 pagesFinancial Accounting AssesmentAnn Calabdan100% (1)

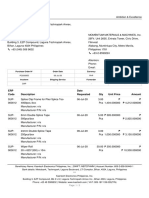

- Bradley Caldwell Inc. 200 Kiwanis Blvd. Hazleton, PA 18202 Tel: (570) 455-7511 Fax: (570) 455-0385Document3 pagesBradley Caldwell Inc. 200 Kiwanis Blvd. Hazleton, PA 18202 Tel: (570) 455-7511 Fax: (570) 455-0385Martin StrahilovskiNo ratings yet

- 09.01.01.07 KNA Supplier Quality Manual Rev 0Document22 pages09.01.01.07 KNA Supplier Quality Manual Rev 0Marco SánchezNo ratings yet

- Aleksandra Rakocevic CV EngDocument7 pagesAleksandra Rakocevic CV EngAleksandra RakočevićNo ratings yet

- Knowledge Sharing Communities of Practices (KSCOPDocument9 pagesKnowledge Sharing Communities of Practices (KSCOPSai MeghanaNo ratings yet

- Abul Kalam Azad - 200806-001-A3Document3 pagesAbul Kalam Azad - 200806-001-A3coy iviNo ratings yet

- Final Assessment OutlineDocument2 pagesFinal Assessment OutlineMeshack MateNo ratings yet

- Bsi MD Psur MDR Webinar 290921 en GBDocument57 pagesBsi MD Psur MDR Webinar 290921 en GBVidyashree PujariNo ratings yet

- L3 Parts Written Assessment V9Document55 pagesL3 Parts Written Assessment V9Enoch MwesigwaNo ratings yet

- Letter of Credit ExercisesDocument7 pagesLetter of Credit ExercisesHabdana Clariza Aliaga SamaniegoNo ratings yet

- Core Values of Total Quality Management 1. Customer-Driven QualityDocument6 pagesCore Values of Total Quality Management 1. Customer-Driven QualityLloydNo ratings yet

- AOM No. 2022-001 (21-22) - Audit of Accounts and Transactions Brgy. San Leonardo, BambangDocument27 pagesAOM No. 2022-001 (21-22) - Audit of Accounts and Transactions Brgy. San Leonardo, BambangGilbert D. AfallaNo ratings yet

- Zero Based Budgeting (ZBB)Document11 pagesZero Based Budgeting (ZBB)sagarNo ratings yet

- Akmonlink College Furi Campus Department of Management Mba Weekend ProgramDocument6 pagesAkmonlink College Furi Campus Department of Management Mba Weekend ProgramEbisa AdamuNo ratings yet

- Workshop BrochureDocument1 pageWorkshop Brochureshatabdi mukherjeeNo ratings yet

- Williams Machine Tool CompanyDocument3 pagesWilliams Machine Tool CompanyMister CatalanNo ratings yet

- Invoice 92013866 9100011081 MapalDocument2 pagesInvoice 92013866 9100011081 MapalSaulo TrejoNo ratings yet

- Co Module Entrep q1 ST 1 Qad For Cnhs Shs OnlyDocument4 pagesCo Module Entrep q1 ST 1 Qad For Cnhs Shs Onlymycah hagadNo ratings yet

- Manage people performanceDocument10 pagesManage people performanceraj ramukNo ratings yet

- Mac Midterm ExamDocument5 pagesMac Midterm ExamBEA CATANEONo ratings yet

- Kaertech Electronics PO for Splice Clips and TapesDocument2 pagesKaertech Electronics PO for Splice Clips and TapesElena MosnitNo ratings yet

- Guidelines On ProcurementDocument20 pagesGuidelines On Procurementdawn obligacionNo ratings yet

- The Operations FunctionDocument35 pagesThe Operations FunctionrajNo ratings yet

- Memo Vehicle DispatchDocument4 pagesMemo Vehicle Dispatcheugene juliusNo ratings yet