Professional Documents

Culture Documents

Gstr3a Za290923126946y

Uploaded by

Suresh CAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gstr3a Za290923126946y

Uploaded by

Suresh CACopyright:

Available Formats

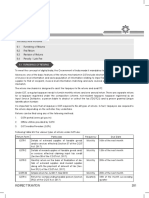

Form GSTR-3A

[See rule 68]

Reference No: ZA290923126946Y Date: 25/09/2023

To

29AAJFV4038N2ZG

VMD STUDIO

27,GROUND FLOOR,

RAMAKRISHNAPPA ROAD,COXTOWN,

BANGALORE,

Bengaluru Urban,Karnataka,560005

Notice to return defaulter u/s 46 for not filing return

Tax Period: August, 2023-24 Type of Return: GSTR-3B

1. Being a registered taxpayer, you are required to furnish return for the supplies made or

received and to discharge resultant tax liability for the aforesaid tax period by due date. It has

been noticed that you have not filed the said return till date.

2. You are, therefore, requested to furnish the said return within 15 days failing which the tax

liability may be assessed u/s 62 of the Act, based on the relevant material available with this

office. Please note that in addition to tax so assessed, you will also be liable to pay interest

and penalty as per provisions of the Act.

3. Please note that no further communication will be issued for assessing the liability.

4. The notice shall be deemed to have been withdrawn in case the return referred above, is filed

by you before issue of the assessment order.

5. This is a system generated notice and will not require signature.

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Gstr3a Za190523080091pDocument1 pageGstr3a Za190523080091pSunil AccountsNo ratings yet

- Gstr3a Za330821134798aDocument1 pageGstr3a Za330821134798aArun Nahendran SNo ratings yet

- Gstr3a Za240923175515cDocument1 pageGstr3a Za240923175515csachinkotadiyaaNo ratings yet

- Gstr3a Za371223046629dDocument1 pageGstr3a Za371223046629drao murtyNo ratings yet

- Gstr3a Za0904233497655Document1 pageGstr3a Za0904233497655FUTURE POINTNo ratings yet

- Gstr3a Za180322024284wDocument1 pageGstr3a Za180322024284wIMRADUL HUSSAINNo ratings yet

- Gstr3a Za330222248273zDocument1 pageGstr3a Za330222248273zmanianNo ratings yet

- Gstr3a Za231022119498tDocument1 pageGstr3a Za231022119498tRISHI PARMARNo ratings yet

- Gstr3a Za270522237835dDocument1 pageGstr3a Za270522237835dFatima SayyedNo ratings yet

- Gstr3a Za0710212084361Document1 pageGstr3a Za0710212084361Karan NishadNo ratings yet

- Form GSTR-3A: Notice To Return Defaulter U/s 46 For Not Filing ReturnDocument1 pageForm GSTR-3A: Notice To Return Defaulter U/s 46 For Not Filing Returnksmbashir.09No ratings yet

- 3a Notices Ysk Amar SubDocument1,066 pages3a Notices Ysk Amar SubKrishna ReddyNo ratings yet

- Cancellation & Revocation of GST RegistrationDocument5 pagesCancellation & Revocation of GST RegistrationshenbhaNo ratings yet

- ITC Reversal For Non-Payment of Tax by Supplier and Re-Availment - Taxguru - inDocument7 pagesITC Reversal For Non-Payment of Tax by Supplier and Re-Availment - Taxguru - inaeudaipur5500No ratings yet

- Composition Scheme RulesDocument10 pagesComposition Scheme Rulesnallarahul86No ratings yet

- Composition SchemeDocument9 pagesComposition Schemenallarahul86No ratings yet

- Complete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - inDocument3 pagesComplete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - insuraj shekhawatNo ratings yet

- Summary of Notifications Issued by CBIC Dated March 31 2023 PDFDocument14 pagesSummary of Notifications Issued by CBIC Dated March 31 2023 PDFclareson serraoNo ratings yet

- Gst Compliance Booklet June 2023Document56 pagesGst Compliance Booklet June 2023taxqoof1No ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- GST Compliance Booklet Grant Thornton Bharat 1657896868Document56 pagesGST Compliance Booklet Grant Thornton Bharat 1657896868Gopal SutharNo ratings yet

- DRC-03 (4 ) Applicability and Procedure to Pay Additional TaxDocument3 pagesDRC-03 (4 ) Applicability and Procedure to Pay Additional Taxevertry27387No ratings yet

- Analysis of GST Notification - Sudhir HalakhandiDocument10 pagesAnalysis of GST Notification - Sudhir HalakhandiJaisika SoniNo ratings yet

- ECRRSDocument3 pagesECRRSMaunik ParikhNo ratings yet

- Various Time Limits Under GSTDocument10 pagesVarious Time Limits Under GST.No ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentShubh DixitNo ratings yet

- gst amendmentDocument14 pagesgst amendmentbcomh2103012No ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- GST Notice for DiscrepanciesDocument69 pagesGST Notice for DiscrepanciesPrashant ZawareNo ratings yet

- Registration in Gst NovDocument8 pagesRegistration in Gst Novvinod.sale1No ratings yet

- 2022A HKTF - T1 - Overview - AnsDocument4 pages2022A HKTF - T1 - Overview - Ans周小荷No ratings yet

- PO 7300000312 Bajrange WireDocument6 pagesPO 7300000312 Bajrange WireSM AreaNo ratings yet

- QRMP Scheme Under GSTDocument7 pagesQRMP Scheme Under GSTshraddhaNo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- Aa081023053771h RC20102023Document1 pageAa081023053771h RC20102023ANISH SHAIKHNo ratings yet

- M-P INVOICE Excise Duty June 2023Document1 pageM-P INVOICE Excise Duty June 2023ALPHONCENo ratings yet

- Order Ms K S Corporation 116243 Paper Yellow Tag - SignedDocument7 pagesOrder Ms K S Corporation 116243 Paper Yellow Tag - Signedwh8tksqjntNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- PO 7300000152 Bajrang WireDocument6 pagesPO 7300000152 Bajrang WireSM AreaNo ratings yet

- Analysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFDocument4 pagesAnalysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFPawan AswaniNo ratings yet

- Notice - 18 JanDocument24 pagesNotice - 18 JancgstportalNo ratings yet

- GST REGISTRATION GUIDEDocument19 pagesGST REGISTRATION GUIDESunita PatilNo ratings yet

- GSTR-3B vs GSTR 1 Mismatch – Rule 88C Perspective- Taxguru.inDocument4 pagesGSTR-3B vs GSTR 1 Mismatch – Rule 88C Perspective- Taxguru.inRamkumar SNo ratings yet

- 2.signed Part BDocument1 page2.signed Part Btoday.sureshjk6No ratings yet

- Instruction No 022022 GST Dated 22032022Document13 pagesInstruction No 022022 GST Dated 22032022GroupA PreventiveNo ratings yet

- PDF - 28-09-23 07-02-29Document18 pagesPDF - 28-09-23 07-02-29jalodarahardik786No ratings yet

- Notice 18 JanDocument24 pagesNotice 18 JancgstportalNo ratings yet

- NITYA - Indirect Tax Bulletin: January 2022 - Week 1Document9 pagesNITYA - Indirect Tax Bulletin: January 2022 - Week 1swastik groverNo ratings yet

- GST Weekly Update - 53 - 2023-24Document4 pagesGST Weekly Update - 53 - 2023-24Sarabjeet SinghNo ratings yet

- Protective Cover TenderDocument5 pagesProtective Cover TenderAMM GSD JODHPURNo ratings yet

- Extension of Time Limits For GST Refund - Taxguru - inDocument2 pagesExtension of Time Limits For GST Refund - Taxguru - inRAZA & RAZANo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Cancellation of RegistrationDocument2 pagesCancellation of RegistrationRajdev AssociatesNo ratings yet

- GSTDocument20 pagesGSTSanjaygowda55k100% (2)

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- e-invoiceDocument1 pagee-invoicegurdyal672No ratings yet

- 180 days ITC reversal on non-payment of consideration – A dilemma for taxpayer- taxguru.in (1)Document9 pages180 days ITC reversal on non-payment of consideration – A dilemma for taxpayer- taxguru.in (1)kvmkinNo ratings yet

- VedicReport 1597629198954Document57 pagesVedicReport 1597629198954Suresh CANo ratings yet

- Form GST REG-02 Acknowledgment: (See Rule - 8 (5) )Document1 pageForm GST REG-02 Acknowledgment: (See Rule - 8 (5) )Amit KumarNo ratings yet

- Form 13: (See Rules 28 and 37G)Document2 pagesForm 13: (See Rules 28 and 37G)Suresh CANo ratings yet

- Corp Bank SB Application FormDocument4 pagesCorp Bank SB Application FormManikanda BalajiNo ratings yet

- 243 Weekly Equity ReportDocument7 pages243 Weekly Equity ReportSuresh CANo ratings yet

- Brochure - Crest Lifestyle 2Document4 pagesBrochure - Crest Lifestyle 2Suresh CANo ratings yet

- Tax invoice for Suresh with service charge and GST detailsDocument1 pageTax invoice for Suresh with service charge and GST detailsSuresh CANo ratings yet

- Fixedline and Broadband Services: Your Account Summary6N®Åév Zææð Ûåé Âæâæ Àå This Month'S Charges6 Åýå Æ Üâ÷Document4 pagesFixedline and Broadband Services: Your Account Summary6N®Åév Zææð Ûåé Âæâæ Àå This Month'S Charges6 Åýå Æ Üâ÷Suresh CANo ratings yet

- Advisory-Social MediaDocument1 pageAdvisory-Social MediaSuresh CANo ratings yet

- Tax invoice for Suresh with service charge and GST detailsDocument1 pageTax invoice for Suresh with service charge and GST detailsSuresh CANo ratings yet

- Rent Detail For Godown PDFDocument1 pageRent Detail For Godown PDFSuresh CANo ratings yet

- Bda Arkavathi Layout Second Final Notification Is Legally CorrectDocument2 pagesBda Arkavathi Layout Second Final Notification Is Legally CorrectSuresh CANo ratings yet

- Checklist for Branch AttachmentDocument12 pagesChecklist for Branch AttachmentSuresh CANo ratings yet