Professional Documents

Culture Documents

TEC - Nega Tewold - Dakar

Uploaded by

Obo KeroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TEC - Nega Tewold - Dakar

Uploaded by

Obo KeroCopyright:

Available Formats

Travel Authorization

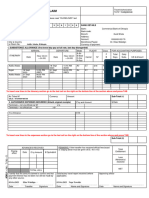

TRAVEL EXPENSE CLAIM TA Nº: TAHQ365126

INSTRUCTIONS: Before completing this set please read “GUIDELINES” last

page.

TRAVELLER Index No. 3 0 5 6 6 1 8 BANK DETAILS

Surname Bank: Commercial Bank of Ethiopia

Name Nega Tewolde Bank code:

Branch:

Street & No.

Address:

or Division

Account: 1000006286732

City & Country Beneficiary/Payee: Nega Tewolde

or Room No.

Currency of payment:

1. SUBSISTENCE ALLOWANCE (first travel day pay at full rate, last day disregarded)

ARRIVAL DEPARTURE Mode FLIGHT Class FOR ACCOUNTING PURPOSES

A-Air

Hour F Total Daily

ITINERARY Hour (00.01 B-Boat

Date (00.01 – Date Carrier Nº B Days Subs. US $ Amount

– 24.00) C-Car

24.00) Y Travel $ Rate

R-Rail

Addis Ababa 18 Sep 2023 10:45 AM Air ET318 Y

Nairobi 18 Sep 2023 12:55 PM 21 Sep 2023 6:00 PM Air ET319 Y

Addis Ababa 21 Sep 2023 8:00 PM

To insert new lines in the itinerary section go to the last cell on the right on the bottom line of the section above and press TAB

Air Ticket Nº Currency Amount Sub-Total (1)

TKT: 0719360748739

2. AUTHORIZED EXPENSES INCURRED (Attach original receipts) C’cy and Amount $ Rate

Terminals – not via official car Nº x $-

Terminals – via official car Nº - x $-

To insert new lines in the expenses section go to the last cell on the right on the bottom line of the section above and press TAB

Sub-Total (2)

ADVANCES RECEIVED REMARKS: If the traveller has received official free board

or lodging detail must be given (M.S. 401.415) Total

Paying $ Entitlement

Date C’cy Amount

office Equivalent

ADM 27 – 296 - T1782 – G.

14 Less

FAO Advance(s)

Sept USD 311.74

Ethiopia received

23

NET

TOTAL US $ 311.74

I certify that the amount claimed is correct and that Satisfactory travel report received (where Approving officer

payment thereof has not been nor will be made by applicable).

any other source.

3 Oct 2023 Nega Tewolde

…………… ………………………………………… …………… …………………………………… …………… …………………………………………

Date Traveller Date Name and Signature Date Name and Signature

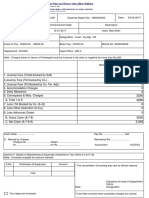

GUIDELINES FOR THE PREPARATION OF TRAVEL EXPENSE CLAIM (TEC) - ADM 27 (Manual Section 450

refers)

General information

A Travel Expense Claim is to be submitted whenever a Travel Authorization (TA) is raised.

After completing the form in all its parts, please retain a copy for your records, forward the claim and supporting

documentation to the authorizing office for review and input in Atlas. The claim will then be onforwarded to the

responsible Travel Unit for processing and file.

Claims must be submitted within one month of completion of journey, or every 60 days for long trips.

Please attach all receipt and/or used and unused ticket stubs to the claim form, preferably in an envelope.

Any information, detail, clarification should be indicated in the box "Remarks" or in a covering letter.

Section 1. - Subsistence Allowance

Days and hours of departure/arrival are to be indicated for a correct payment of the Daily Subsistence Allowance

(DSA or “per diem”) according to the purpose of travel (see TA).

DSA covers the hotel accommodation (board and lodging) as well as miscellaneous expenses, i.e. intra-urban

transportation, tipping, etc. Entitled dependents receive 50% of the DSA.

Stop-overs for rest (if the entitlement exists) are to be specifically claimed on this form.

Section 2. - Claimable Expenses

The Organization reimburses a flat amount to entitled traveller's for transportation between city/airport and vice-

versa. Entitled dependents receive a reduced amount. Similarly when official transportation is provided the terminal

allowance is reduced.

Some example of authorized expenses:

- Air, rail or bus tickets - NB: purchase of airtickets (except for not prepayable internal

sectors) MUST be authorized by FAO

- Airport taxes

- Authorized accompanied excess baggage

- Passport photos (up to 12)

- Passport fee for issuance or renewal

- Cost of official mail cables or telexes, provided that full details and receipt are submitted

- Cost of vaccination and inoculation

- Cost of medical examination to Staff Members (if requested by FAO)

- Reimbursement of mileage for legs of journey performed by private car (if covered by third

party insurance)

You might also like

- Strengths Finder Book SummaryDocument11 pagesStrengths Finder Book Summaryangelcristina1189% (18)

- Slave Rebellions & The Black Radical Tradition: SOC3703 Social Movements, Conflict & Change Week 14Document16 pagesSlave Rebellions & The Black Radical Tradition: SOC3703 Social Movements, Conflict & Change Week 14rozamodeauNo ratings yet

- 1 Updated 364744718 Past BillsDocument1 page1 Updated 364744718 Past BillskjfdsjsdjkdkjNo ratings yet

- 1 Updated 364744718 Past BillsDocument1 page1 Updated 364744718 Past BillskjfdsjsdjkdkjNo ratings yet

- Air Algerie Confirmation SAID ZIANI L9TV38Document2 pagesAir Algerie Confirmation SAID ZIANI L9TV38ziani1976No ratings yet

- Alfonsomiguelrcaballero : Jb129Hillsidesquare Kilometer4Latrinidad 2601benguetDocument6 pagesAlfonsomiguelrcaballero : Jb129Hillsidesquare Kilometer4Latrinidad 2601benguetBastille BastillionNo ratings yet

- Vietnam Airline Ticket TemplateDocument2 pagesVietnam Airline Ticket TemplateEthan HONo ratings yet

- TLC Nov22Document1 pageTLC Nov22ABhshekNo ratings yet

- To The Lighthouse To The SelfDocument36 pagesTo The Lighthouse To The SelfSubham GuptaNo ratings yet

- AminaDocument2 pagesAminaKendrick Edwardo100% (1)

- Logistics Specialist NAVEDTRA 15004BDocument970 pagesLogistics Specialist NAVEDTRA 15004Blil_ebb100% (5)

- Listo Si Kap!Document32 pagesListo Si Kap!Bluboy100% (3)

- Cheap Flight Tickets - Book Holidays, Forex & Visa - Akbar TravelsDocument2 pagesCheap Flight Tickets - Book Holidays, Forex & Visa - Akbar TravelsPanruti S Sathiyavendhan0% (1)

- Grand Boulevard Hotel Vs Genuine Labor OrganizationDocument2 pagesGrand Boulevard Hotel Vs Genuine Labor OrganizationCuddlyNo ratings yet

- TN 8 BhihinDocument1 pageTN 8 BhihinNatarajNo ratings yet

- TEC ADD-NBO-ADD - EliasDocument2 pagesTEC ADD-NBO-ADD - EliasObo KeroNo ratings yet

- Claim FormDocument4 pagesClaim Formabhineet.jkaiNo ratings yet

- Please Attach Supporting Documents in Ess. Hard Copies Need Not Be Submitted To FinanceDocument2 pagesPlease Attach Supporting Documents in Ess. Hard Copies Need Not Be Submitted To FinanceVikashJangirNo ratings yet

- Punjab National Bank: Name Designation Substantive Salary: Grade: Purpose of Journey VerifiedDocument3 pagesPunjab National Bank: Name Designation Substantive Salary: Grade: Purpose of Journey VerifiedPrashant PhanseNo ratings yet

- Travel Expenses Claim FormDocument1 pageTravel Expenses Claim Formabhineet.jkaiNo ratings yet

- Formulario de Liquidación. F-10 Monitore de LempiraDocument4 pagesFormulario de Liquidación. F-10 Monitore de LempiraLElena SilvaNo ratings yet

- Formulario de Liquidación. F-10 Monitore de OcotepequeDocument4 pagesFormulario de Liquidación. F-10 Monitore de OcotepequeLElena SilvaNo ratings yet

- MSRTC - Online Reservation SystemDocument1 pageMSRTC - Online Reservation SystemDinesh KumarNo ratings yet

- Form Mci 14 (Ta)Document2 pagesForm Mci 14 (Ta)kumaraswamikalmathNo ratings yet

- Monthly Bill 01 - 30 Nov NNDocument2 pagesMonthly Bill 01 - 30 Nov NNkamranNo ratings yet

- TA BillDocument2 pagesTA BillSawan YadavNo ratings yet

- Expense FormatDocument10 pagesExpense FormatMAKE OF JOKE :Laughter Club, Fun Zone, Tension FreeNo ratings yet

- Ztngze: E-Ticket Itinerary & ReceiptDocument3 pagesZtngze: E-Ticket Itinerary & ReceiptdedeNo ratings yet

- Expense Claim Form: Internet ReimbursementDocument1 pageExpense Claim Form: Internet Reimbursementmodesto66No ratings yet

- MSRTC - Online Reservation SystemDocument1 pageMSRTC - Online Reservation Systemclubconixion.sunitaNo ratings yet

- 457 Vamona Developer PVT LTD 22-23 - 20220720 - 0001Document5 pages457 Vamona Developer PVT LTD 22-23 - 20220720 - 0001Ankit dixitNo ratings yet

- This Month's Summary: Total 1178.82Document4 pagesThis Month's Summary: Total 1178.82it proNo ratings yet

- Jessica Parra, 08nov 1845 Santa CruzDocument2 pagesJessica Parra, 08nov 1845 Santa CruzCalderon VanessaNo ratings yet

- Invoice CT-2237500Document2 pagesInvoice CT-2237500ABALUNo ratings yet

- LTA Claim FormDocument1 pageLTA Claim FormcuraajNo ratings yet

- Disbursement Voucher Checking Account MOOEDocument7 pagesDisbursement Voucher Checking Account MOOEMark Patrics Comentan VerderaNo ratings yet

- Torres Er 2Document1 pageTorres Er 2Cammy TorresNo ratings yet

- Delivery Challan: N/A N/A N/A N/A N/A N/A 0% - 1Document1 pageDelivery Challan: N/A N/A N/A N/A N/A N/A 0% - 1Laxminarayan KarNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- Expenses Voucher SheetDocument2 pagesExpenses Voucher Sheetguptaprabha951No ratings yet

- Tax Invoice: On Time Shipping Services (LLC)Document8 pagesTax Invoice: On Time Shipping Services (LLC)Bala PraveenNo ratings yet

- BilletPdfV2 - 2023-03-20T170524349 - 230320 - 170542 PDFDocument2 pagesBilletPdfV2 - 2023-03-20T170524349 - 230320 - 170542 PDFleader aliNo ratings yet

- National Engineering Services Pakistan (PVT.) Ltd. Power and Mechanical DivisionDocument10 pagesNational Engineering Services Pakistan (PVT.) Ltd. Power and Mechanical DivisionNESPAK Field Office SukkurNo ratings yet

- SOA Acct 1184350 1704067200 1704844800Document1 pageSOA Acct 1184350 1704067200 1704844800hrd.avdiNo ratings yet

- Act September 2021Document2 pagesAct September 2021siva vNo ratings yet

- Amount Claimed: TotalDocument2 pagesAmount Claimed: Totalsonur135No ratings yet

- Julio Cesar Inquillay Quispe: Bill To FORDocument5 pagesJulio Cesar Inquillay Quispe: Bill To FORJULIO INQUILLAYNo ratings yet

- 1DTD1KDocument1 page1DTD1KAbdullah Al-MousliNo ratings yet

- MSRTC - Online Reservation SystemDocument1 pageMSRTC - Online Reservation SystemSwapnil KokadwarNo ratings yet

- INV 0142 22 (Air Sial Limited)Document1 pageINV 0142 22 (Air Sial Limited)BILAL FAROOQUINo ratings yet

- Travel Expense Sheet1-YDocument4 pagesTravel Expense Sheet1-YRobel KebedeNo ratings yet

- CommunautoQuebec 2023-09Document1 pageCommunautoQuebec 2023-09raphael.touze1No ratings yet

- E-Tolls - ItemizedasDocument1 pageE-Tolls - ItemizedasEnneko IxteparreNo ratings yet

- Expenses Voucher BillsDocument1 pageExpenses Voucher Billsguptaprabha951No ratings yet

- Invoice CT-2237144Document2 pagesInvoice CT-2237144ABALUNo ratings yet

- AircelDocument4 pagesAircelit proNo ratings yet

- 1 ETicketDocument4 pages1 ETicketaddy 2373No ratings yet

- External Expenses Claim Form 010812Document4 pagesExternal Expenses Claim Form 010812Khush SeraiNo ratings yet

- C. Tiwari and Company: Main Road Kamptee-441001 (07109) 288211Document1 pageC. Tiwari and Company: Main Road Kamptee-441001 (07109) 288211mahesh.katlaNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Service DetailsDocument1 pageService DetailssabeerNo ratings yet

- 22-23 Olp 841690Document1 page22-23 Olp 841690ajay sNo ratings yet

- Shi0838126 - Ramasamy KarthiDocument9 pagesShi0838126 - Ramasamy Karthisyahmi.ramzi09No ratings yet

- VIETNAMNOREENDocument2 pagesVIETNAMNOREENNorianne DavidNo ratings yet

- EA PSEA Workshop - OERDocument7 pagesEA PSEA Workshop - OERObo Kero100% (1)

- El Niño - Climate - Influenced - Zoonotic - Diseases - Status - 2023. ZAMBIADocument7 pagesEl Niño - Climate - Influenced - Zoonotic - Diseases - Status - 2023. ZAMBIAObo KeroNo ratings yet

- CL172 - DG Manifesto - 27 April 2023Document28 pagesCL172 - DG Manifesto - 27 April 2023Obo KeroNo ratings yet

- Esop1 30 06Document25 pagesEsop1 30 06Obo KeroNo ratings yet

- CC 7302 enDocument62 pagesCC 7302 enObo KeroNo ratings yet

- Agricultural SystemsDocument13 pagesAgricultural SystemsObo KeroNo ratings yet

- Climate-Smart Livestock Production Systems in Practice: B2-3.1 Land-Based SystemsDocument8 pagesClimate-Smart Livestock Production Systems in Practice: B2-3.1 Land-Based SystemsObo KeroNo ratings yet

- Climate Smart Livestock BlogDocument3 pagesClimate Smart Livestock BlogObo KeroNo ratings yet

- Cost-Benefit Analysis of Improved Livestock Management Practices in The Oromia Lowlands of EthiopiaDocument50 pagesCost-Benefit Analysis of Improved Livestock Management Practices in The Oromia Lowlands of EthiopiaObo KeroNo ratings yet

- Country Programming Framework For Ethiopia 2016 - 2020Document24 pagesCountry Programming Framework For Ethiopia 2016 - 2020Obo KeroNo ratings yet

- Climate-Smart AgricultureDocument8 pagesClimate-Smart AgricultureObo KeroNo ratings yet

- Universty and Its LocationsDocument2 pagesUniversty and Its LocationsEyuNo ratings yet

- Temporary Copy: Edna Nega Tewolde Name: 368145 Admission NoDocument1 pageTemporary Copy: Edna Nega Tewolde Name: 368145 Admission NoObo KeroNo ratings yet

- Ethiopia Country Partnership Framework - Presentation August 2016 0Document15 pagesEthiopia Country Partnership Framework - Presentation August 2016 0Obo KeroNo ratings yet

- Temporary Copy: Edna Nega Tewolde Name: 368145 Admission NoDocument1 pageTemporary Copy: Edna Nega Tewolde Name: 368145 Admission NoObo KeroNo ratings yet

- Country Programming Framework For Ethiopia 2016 - 2020Document24 pagesCountry Programming Framework For Ethiopia 2016 - 2020Obo KeroNo ratings yet

- Temporary Copy: Yabsira Wondmu Nigguse Name: 368213 Admission NoDocument1 pageTemporary Copy: Yabsira Wondmu Nigguse Name: 368213 Admission NoObo KeroNo ratings yet

- Sofonias StudyDocument37 pagesSofonias StudyObo KeroNo ratings yet

- Creative Writing PieceDocument3 pagesCreative Writing Pieceapi-608098440No ratings yet

- Public Service Application For ForgivenessDocument9 pagesPublic Service Application For ForgivenessLateshia SpencerNo ratings yet

- Translation UasDocument5 pagesTranslation UasHendrik 023No ratings yet

- Evening Street Review Number 1, Summer 2009Document100 pagesEvening Street Review Number 1, Summer 2009Barbara BergmannNo ratings yet

- StarbucksDocument19 pagesStarbucksPraveen KumarNo ratings yet

- A Review Essay On The European GuildsDocument11 pagesA Review Essay On The European GuildsAnonymous xDPiyENo ratings yet

- Stabroek News Poetry of AJ Seymour Celebrated - Stabroek News - Georgetown, GuyanaDocument1 pageStabroek News Poetry of AJ Seymour Celebrated - Stabroek News - Georgetown, GuyanaPaulina MassayNo ratings yet

- Unit 1 PDFDocument5 pagesUnit 1 PDFaadhithiyan nsNo ratings yet

- Aaron VanneyDocument48 pagesAaron VanneyIvan KelamNo ratings yet

- Chapter 06 v0Document43 pagesChapter 06 v0Diệp Diệu ĐồngNo ratings yet

- AR 700-84 (Issue and Sale of Personal Clothing)Document96 pagesAR 700-84 (Issue and Sale of Personal Clothing)ncfranklinNo ratings yet

- MhfdsbsvslnsafvjqjaoaodldananDocument160 pagesMhfdsbsvslnsafvjqjaoaodldananLucijanNo ratings yet

- ENT300 - Module07 - BUSINESS PLANDocument23 pagesENT300 - Module07 - BUSINESS PLANSahira AdwaNo ratings yet

- Cagayan Capitol Valley Vs NLRCDocument7 pagesCagayan Capitol Valley Vs NLRCvanessa_3No ratings yet

- Evergreen Park Arrests 07-22 To 07-31-2016Document5 pagesEvergreen Park Arrests 07-22 To 07-31-2016Lorraine SwansonNo ratings yet

- Unit Iv - Lesson 1Document2 pagesUnit Iv - Lesson 1SHIERA MAE AGUSTINNo ratings yet

- BB Winning Turbulence Lessons Gaining Groud TimesDocument4 pagesBB Winning Turbulence Lessons Gaining Groud TimesGustavo MicheliniNo ratings yet

- Witherby Connect User ManualDocument14 pagesWitherby Connect User ManualAshish NayyarNo ratings yet

- Mental Health EssayDocument4 pagesMental Health Essayapi-608901660No ratings yet

- CH03 - Case1 - GE Becomes A Digital Firm The Emerging Industrial InternetDocument4 pagesCH03 - Case1 - GE Becomes A Digital Firm The Emerging Industrial Internetjas02h10% (1)

- Judgments of Adminstrative LawDocument22 pagesJudgments of Adminstrative Lawpunit gaurNo ratings yet

- Hilti 2016 Company-Report ENDocument72 pagesHilti 2016 Company-Report ENAde KurniawanNo ratings yet

- SUDAN A Country StudyDocument483 pagesSUDAN A Country StudyAlicia Torija López Carmona Verea100% (1)

- Gerson Lehrman GroupDocument1 pageGerson Lehrman GroupEla ElaNo ratings yet