Professional Documents

Culture Documents

Tax Calendar 2022 2023 Deloitte Private

Uploaded by

Prativa RayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Calendar 2022 2023 Deloitte Private

Uploaded by

Prativa RayCopyright:

Available Formats

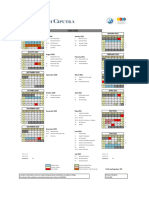

Tax Calendar Table 1: Provisional Tax and Terminal Tax Dates for 2023 income year Tax Rates

Table 1: Provisional Tax and Terminal Tax Dates for 2023 income year Tax Rates for the 2023 income year

Month of

balance A B C D E F G H NZ Tax Rates for Individuals

April 2022 May 2022 June 2022

S M T W

F S S M T T W T F S S M T W T F S date

Personal Tax Rates ESCT Tax Rates

1 2 1 2 3 4 5 6 7 1 2 3 4 Oct 28 Jan 28 Mar 28 May 28 Jul 28 Sep 28 Nov 7 Sep 7 Nov

Taxable Income $ Tax Rate % ESCT Rate Threshold Amount $ Tax Rate %

3 4 5 6 7 8 9 8 9 10 11 12 13 14 5 6 7 8 9 10 11 Nov 28 Feb 7 May 28 Jun 28 Aug 28 Oct 15 Jan 7 Oct 7 Dec

10 11 12 13 14 15 16 15 16 17 18 19 20 21 12 13 14 15 16 17 18 0 – 14,000 10.5% 0 – 16,800 10.5%

Dec 28 Mar 28 May 28 Jul 28 Sep 28 Nov 28 Jan 7 Nov 15 Jan

17 18 19 20 21 22 23 22 23 24 25 26 27 28 19 20 21 22 23 24 25 14,001 – 48,000 17.5% 16,801 – 57,600 17.5%

Jan 7 May 28 Jun 28 Aug 28 Oct 15 Jan 28 Feb 7 Dec 7 Feb 48,001 – 70,000 30% 57,601 – 84,000 30%

24 25 26 27 28 29 30 29 30 31 26 27 28 29 30

Feb 28 May 28 Jul 28 Sep 28 Nov 28 Jan 28 Mar 15 Jan 7 Mar 70,001 – 180,000 33% 84,001 – 216,000 33%

July 2022 August 2022 September 2022

Mar 28 Jun 28 Aug 28 Oct 15 Jan 28 Feb 7 May 7 Feb 7 Apr 180,001 upwards 39% 216,001 upwards 39%

S M T W T

F S S M T W T F S S M T T W

F S

Apr 28 Jul 28 Sep 28 Nov 28 Jan 28 Mar 28 May 7 Feb 7 Apr

1 2 1 2 3 4 5 6 1 2 3 Fringe Benefit Tax (FBT) Single rate option Alternate rate option

May 28 Aug 28 Oct 15 Jan 28 Feb 7 May 28 Jun 7 Feb 7 Apr

3 4 5 6 7 8 9 7 8 9 10 11 12 13 4 5 6 7 8 9 10 Quarters 1–3 63.93% 49.25%

10 11 12 13 14 15 16 14 15 16 17 18 19 20 11 12 13 14 15 16 17 Jun 28 Sep 28 Nov 28 Jan 28 Mar 28 May 28 Jul 7 Feb 7 Apr Quarter 4 63.93% or rates for attributed benefits Rates for attributed benefits

17 18 19 20 21 22 23 21 22 23 24 25 26 27 18 19 20 21 22 23 24 Jul 28 Oct 15 Jan 28 Feb 7 May 28 Jun 28 Aug 7 Feb 7 Apr

24 25 26 27 28 29 30 28 29 30 31 25 26 27 28 29 30 Aug 28 Nov 28 Jan 28 Mar 28 May 28 Jul 28 Sep 7 Feb 7 Apr Rates for attributed benefits (All-inclusive pay) Tax Rate %

31 0 – 12,530 11.73%

Sep 15 Jan 28 Feb 7 May 28 Jun 28 Aug 28 Oct 7 Feb 7 Apr

October 2022 November 2022 December 2022 12,531 – 40,580 21.21%

S M T W

S S M T T F W T F S S M T T W

F S A person who pays provisional tax in 3 instalments will follow columns B, D and F. 40,581 – 55,980 42.86%

1 1 2 3 4 5 1 2 3 A person who pays on a GST ratio 6 instalment basis will follow columns A–F. A person 55,981 – 129,680 49.25%

2 3 4 5 6 7 8 6 7 8 9 10 11 12 4 5 6 7 8 9 10 who files GST returns 6 monthly and who makes 2 instalments will follow columns C 129,681 upwards 63.93%

9 10 11 12 13 14 15 13 14 15 16 17 18 19 11 12 13 14 15 16 17

and F. Terminal tax is due based on column G (or H if the tax agents’ extension of time The FBT rate for pooling non-attributed benefits is 49.25% (or 63.93% for major shareholder-

applies). Refer note 1 for when due date is not a ‘working day’. employees). A pooled alternate rate option allows an employer to use a 49.25% rate on attributed

16 17 18 19 20 21 22 20 21 22 23 24 25 26 18 19 20 21 22 23 24

23 24 25 26 27 28 29 27 28 29 30 25 26 27 28 29 30 31 benefits where certain thresholds for an employee are not exceeded. Other options may be available.

The above table does not cover payment dates for a person who uses the AIM

30 31 method of calculating provisional tax. Contact your Deloitte advisor for more

Corporate Tax — Flat rate for all companies 28%

January 2023 February 2023 March 2023 information on this method.

S M T W T F S S M T W T F S S M T W T F S Trust Tax Rates Tax Rate %

A person who changes balance date will be subject to special rules and should call their Trustee Income 33%

1 2 3 4 5 6 7 1 2 3 4 1 2 3 4

Deloitte advisor. Minor Beneficiary (exemptions may apply) 33%

8 9 10 11 12 13 14 5 6 7 8 9 10 11 5 6 7 8 9 10 11

15 16 17 18 19 20 21 12 13 14 15 16 17 18 12 13 14 15 16 17 18 Use of Money Interest Rates Beneficiary Income (non minor) marginal rate

22 23 24 55 26 27 28 19 20 21 22 23 24 25 19 20 21 22 23 24 25 From 10 May 2022, the Commissioner’s paying rate on overpayments is 0.00% while the Distributions from non-complying trusts 45%

29 30 31 26 27 28 26 27 28 29 30 31 taxpayer’s paying rate on underpayments is 7.28%. These rates were correct at time of

printing; however, they are reviewed regularly and subject to change. Relief from UOMI Goods and Services Tax (GST)

may be available for certain taxpayers who have been adversely affected by COVID-19. On taxable supplies in NZ (excluding zero rated supplies) 15%

Key: Tax Payment and Filing Dates Late Payment Penalties Withholding Tax on Resident Passive Income (RWT)

An initial late payment penalty is applied in two stages – 1% is charged on the day after

Date Type of Tax Due the due date. A further 4% penalty may be charged if there is still unpaid tax (including Individual Company

PAYE & Employer’s Superannuation Contribution Tax (ESCT) for the 16th of the previous month penalties) at the end of the 7th day from due date. The incremental late payment Dividends (DWT) 33% 33%

5 to the end of that month, for employers deducting > $500,000 pa. Refer Note 2.

penalty of 1% has been removed from some tax types with effect from 2018 and Interest 10.5%, 17.5%, 30%, 33%, 39% or 45% 28%, 33%, 39% or 45%

7 Terminal tax date – the month is determined by balance date per Table 1. subsequent years. A warning notice will be issued for first offences in certain cases.

This warning notice does not apply to late payments of provisional tax. Applicable rate depends on various conditions and whether a rate election has been

PAYE & ESCT for the previous month for taxpayers deducting < $500,000 pa. made. A 0% rate applies if a recipient has RWT-exempt status.

20 1st to 15th of the current month for employers deducting > $500,000 pa. Refer Note 2.

ACC Earners’ Levy

RWT, NRWT, AIL, RSCT and RWLT deducted in previous month if payable monthly. If total The ACC Earners’ Levy rate for the 2022/23 year is $1.46 per $100 liable earnings Withholding Tax on Non-resident Passive Income (NRWT)

20 yearly RWT, NRWT and AIL < $500, amounts are payable in 2 instalments. Refer Note 3.

(GST inclusive). Maximum income the earners’ levy is charged on is $136,544. Royalties 15%

20 FBT return and payment for previous quarter ended 30 June, 30 September or 31 December. Interest* 15%

GST return and payment where the previous month was the end of the GST period. Dividends** 0%, 15%, 30%

28 Provisional tax due – months are determined by balance date and method per Table 1. Deloitte New Zealand Directory

Rates may be subject to modification by a double tax agreement.

Takapuna PO Box 33541 Ph +64 (0) 9 303 0700

GST return and payment for taxable period ending 31 March. Provisional tax is also due this *NRWT rate for interest is 0% if payment is made by an approved issuer and 2% approved

May 7 date for certain balance dates per Table 1. Auckland Private bag 115033 Ph +64 (0) 9 303 0700

Hamilton PO Box 17 Ph +64 (0) 7 838 4800 issuer levy (AIL) is paid.

Annual basis or final quarter FBT return and payment. (NB Income Year FBT return and Rotorua PO Box 12003 Ph +64 (0) 7 343 1050 Follow us on Twitter

May 31 **Applicable rate depends on various conditions including whether dividend

payment for close companies is due on relevant terminal tax date). Wellington PO Box 1990 Ph +64 (0) 4 470 3500 @DeloitteNZTax

Christchurch PO Box 248 Ph +64 (0) 3 363 3800 is fully imputed and the level of direct voting interest held by shareholder.

PAYE, ESCT and terminal tax payments ordinarily due on 5 or 7 January and provisional tax

Jan 15 Queenstown PO Box 794 Ph +64 (0) 3 901 0570

and GST payments ordinarily due 28 December are extended to 15 January.

Dunedin PO Box 1245 Ph +64 (0) 3 474 8630

tax@hand Non-resident Contractors’ Tax (NRCT)

Note 1 – If the due date for a tax payment falls on a day that is not a ‘working day’ such as the weekend or national public holiday visit: taxathand.com Withholding tax deducted from contract payments made to non-resident contractors

www.deloitte.co.nz

then the payment can be made on the following working day.

for use of equipment or services undertaken in NZ:

Note 2 – Employers and intermediaries who file employment information electronically will file this information within 2 working days © 2022. Deloitte Limited (as trustee for the Deloitte Trading Trust).

of payday. Payment dates are per the table above, although payment can be made at the same time as the information is filed. This calendar is of a general nature and does not cover all scenarios. It should not be referred to If an IR 330C is completed – minimum rate is 15% (unless a special rate is applied for).

Note 3 – Payers of investment income (such as interest and dividends) who file electronically are generally required to provide income as a substitute for specific professional advice. While this information was correct as at 28 March If an IR 330C is not completed – company 20%

investment information by the 20th of the month following the month the investment income was paid. Other filing dates may apply 2022 and has been obtained from sources which are considered reliable, we recommend that you

to other payers depending on the income type, paying entity and recipient. Please seek advice for your situation as to when returns contact your Deloitte advisor before making any final decisions on matters referred to herein. If an IR 330C is not completed – not a company 45%

are due to be filed. Payment dates are per the table above, although payment can be made at the time information is filed. Rates may be subject to modification by a double tax agreement.

You might also like

- Income-Taxation Edt 2023 Solman-2Document35 pagesIncome-Taxation Edt 2023 Solman-2bth chee100% (2)

- 2023 Calendar and Project PlannerDocument127 pages2023 Calendar and Project Plannerพัชรี ติปยานนท์No ratings yet

- Philam Asset Management, Inc V CirDocument2 pagesPhilam Asset Management, Inc V CirNeph MendozaNo ratings yet

- 2019 Weekly Planner Monday PDFDocument97 pages2019 Weekly Planner Monday PDFRose Pena Rios100% (1)

- Arcadis Annual Construction Cost HandBook India 2016 PDFDocument114 pagesArcadis Annual Construction Cost HandBook India 2016 PDFkapilsharma404No ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- 2022 goals and dreams journalDocument201 pages2022 goals and dreams journalDhika DewantiNo ratings yet

- Deen Diary 2024Document894 pagesDeen Diary 2024khadidja BenouarNo ratings yet

- 2022 Vintage Planner (MW) - 3Document72 pages2022 Vintage Planner (MW) - 3John WongNo ratings yet

- Taskus India Private LimitedDocument1 pageTaskus India Private LimitedPranjal AgrawalNo ratings yet

- Excel Budget Template Guidance and TipsDocument8 pagesExcel Budget Template Guidance and TipsVanaa MohanNo ratings yet

- Personal Training at NHYC PDFDocument6 pagesPersonal Training at NHYC PDFMithun0% (1)

- Income Declaration FormDocument1 pageIncome Declaration FormPhilip JosephNo ratings yet

- 2019 digital planner under 40 charsDocument96 pages2019 digital planner under 40 charsnamyrcomNo ratings yet

- Semesters 1-3 and Summer School Academic CalendarDocument1 pageSemesters 1-3 and Summer School Academic CalendarQiyao LeongNo ratings yet

- Excel Budget Template: Project Start Date Scroll To Week #Document5 pagesExcel Budget Template: Project Start Date Scroll To Week #Abdesslam MezdariNo ratings yet

- PF Interest CalculatorDocument6 pagesPF Interest CalculatorSelvan KstNo ratings yet

- Assignment I (Individual Task)Document5 pagesAssignment I (Individual Task)Ashana ChandNo ratings yet

- Anexo Proyecto Información La Granja de Juan 2018-2Document33 pagesAnexo Proyecto Información La Granja de Juan 2018-2Fernanda HurtadoNo ratings yet

- Scurve Draft TargetDocument377 pagesScurve Draft Targetjoy lauria mae autorNo ratings yet

- Calender Nielsen Media 2020Document1 pageCalender Nielsen Media 2020Angela LeviraNo ratings yet

- 2019 20 School CalendarDocument1 page2019 20 School Calendarapi-346299352No ratings yet

- TS PDFDocument1 pageTS PDFAmbrosius asly ToronNo ratings yet

- IRIEEN CalendarDocument1 pageIRIEEN CalendarNiteshNo ratings yet

- Worcester Public Schools 2019-20 CalendarDocument1 pageWorcester Public Schools 2019-20 CalendarSamantha MercadoNo ratings yet

- Cakupan Kia KristinDocument25 pagesCakupan Kia KristinefendiNo ratings yet

- ACADEMIC CALENDAR TITLEDocument1 pageACADEMIC CALENDAR TITLEherdijantoNo ratings yet

- Academic Calendar Odd 2018 2019 BIDocument1 pageAcademic Calendar Odd 2018 2019 BIEunhaNo ratings yet

- StaffhouseDocument1 pageStaffhouseVic ValdezNo ratings yet

- Yearly School Calendar Model 1 - Free VersionDocument6 pagesYearly School Calendar Model 1 - Free VersionPedro CastilloNo ratings yet

- Hedged Strategy CheatsheetDocument2 pagesHedged Strategy CheatsheetAdam100% (3)

- Elemental Schedule (2019-04-12T14.12.39 1) 2Document2 pagesElemental Schedule (2019-04-12T14.12.39 1) 2Ann Grace GarduqueNo ratings yet

- Academic CalendarDocument2 pagesAcademic Calendarbarada.andhi25No ratings yet

- 150419Document1 page150419pedroa_sanchezmNo ratings yet

- Construction of Nuwakot District Hospital at Nuwakot District, NepalDocument1 pageConstruction of Nuwakot District Hospital at Nuwakot District, Nepalnitin lagejuNo ratings yet

- Market Reflection Report AUG'22Document23 pagesMarket Reflection Report AUG'22Komal RaneNo ratings yet

- What-If-Analysis & ForecastDocument6 pagesWhat-If-Analysis & ForecastuzairNo ratings yet

- January 2020: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument12 pagesJanuary 2020: Sunday Monday Tuesday Wednesday Thursday Friday SaturdayglenNo ratings yet

- English Essay PlannerDocument24 pagesEnglish Essay PlannerMrDeviNo ratings yet

- Full Year Calendar from WinCalendarDocument3 pagesFull Year Calendar from WinCalendarRidzuan MamatNo ratings yet

- Forex Rate 2020-2021Document110 pagesForex Rate 2020-2021Jhilik PradhanNo ratings yet

- Cheltuieli Investitie NR - Crt. Denumire Pret DescriereDocument6 pagesCheltuieli Investitie NR - Crt. Denumire Pret DescriereadNo ratings yet

- Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri SatDocument6 pagesSun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri SatPRAMODNo ratings yet

- First Semester Second Semester Summer: College of NursingDocument1 pageFirst Semester Second Semester Summer: College of NursingJohn Ford VisoriaNo ratings yet

- STAYC 2022 diary highlights their yearDocument28 pagesSTAYC 2022 diary highlights their yearPloy PloypilinNo ratings yet

- Monthly Marketing Metrics Calendar - Conversion: Conversion JAN FEB MAR APR MAYDocument6 pagesMonthly Marketing Metrics Calendar - Conversion: Conversion JAN FEB MAR APR MAYgoten25No ratings yet

- Cisco 2023 fiscal year calendarDocument1 pageCisco 2023 fiscal year calendarMahendran MoorthyNo ratings yet

- Exponential Appreciation Fund, LP: December 2021Document2 pagesExponential Appreciation Fund, LP: December 2021Moiz SaeedNo ratings yet

- Notes: December FebruaryDocument12 pagesNotes: December FebruaryPluvio PhileNo ratings yet

- 19-20 - Calendar - REVISED 8-8-19 - PDFDocument1 page19-20 - Calendar - REVISED 8-8-19 - PDFcascada2404No ratings yet

- Colombia 2020 Calendar by WinCalendarDocument1 pageColombia 2020 Calendar by WinCalendarAdrian Mauricio VelandiaNo ratings yet

- Exercise Adv Charts and SparklineDocument24 pagesExercise Adv Charts and SparklineGOURAV SHRIVASTAVA Student, Jaipuria IndoreNo ratings yet

- Monthly Calendar OverviewDocument24 pagesMonthly Calendar Overviewgetmeonscribd2No ratings yet

- Sunny Side Music Denton 2020-2021 School Year CalendarDocument1 pageSunny Side Music Denton 2020-2021 School Year CalendarHousi WongNo ratings yet

- 2020 Calendar One PageDocument1 page2020 Calendar One PageDhanang Adi KurniawanNo ratings yet

- 2020 Calendar One PageDocument1 page2020 Calendar One PageAJAY SHINDENo ratings yet

- 2020 Calendar One PageDocument1 page2020 Calendar One PageAnonymous blCTntgUNo ratings yet

- Meat Production Demand ReportDocument21 pagesMeat Production Demand ReportFernanda HurtadoNo ratings yet

- SHPKDocument2 pagesSHPKapi-295060667No ratings yet

- Day Cycle School Calendar 2019-2020Document1 pageDay Cycle School Calendar 2019-2020api-474997818No ratings yet

- DESEMBERDocument4 pagesDESEMBERnensiNo ratings yet

- Project Schedule StructuralDocument14 pagesProject Schedule StructuralAlecsisRoeEstañolFrascoNo ratings yet

- Cakupan LindaDocument25 pagesCakupan LindaNurlindaNo ratings yet

- Balochistan University of Engineering & Technology, Khuzdar: ACADEMIC CALENDAR 2018-2019Document1 pageBalochistan University of Engineering & Technology, Khuzdar: ACADEMIC CALENDAR 2018-2019WaseemNo ratings yet

- Primary School Case StudyDocument22 pagesPrimary School Case StudyRitesh GhodakeNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Fundamentals of Taxes - 2Document34 pagesFundamentals of Taxes - 2Rahul KalyaniNo ratings yet

- CIR v. Consuelo Vda. De Prieto (ViDocument2 pagesCIR v. Consuelo Vda. De Prieto (VivictoriaNo ratings yet

- RMC No 28-2018Document1 pageRMC No 28-2018Lom Ow TenesseeNo ratings yet

- US Internal Revenue Service: f1040 - 1991Document2 pagesUS Internal Revenue Service: f1040 - 1991IRSNo ratings yet

- Evolution of Philippine: AtionDocument15 pagesEvolution of Philippine: AtionRosabel Yanong TiguianNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2notybhardwajNo ratings yet

- TAXESDocument26 pagesTAXESPurchiaNo ratings yet

- Problem 1Document3 pagesProblem 1Shiene MedrianoNo ratings yet

- Income affidavit documentsDocument4 pagesIncome affidavit documentsLawyer Chandresh TiwariNo ratings yet

- Chapter 22 Homework R. CochranDocument3 pagesChapter 22 Homework R. Cochrancochran123No ratings yet

- R450215048 and R450215037 Tax ProDocument13 pagesR450215048 and R450215037 Tax ProSankarSinghNo ratings yet

- Literature Review On Value Added Tax in NigeriaDocument7 pagesLiterature Review On Value Added Tax in Nigeriaea84k86s100% (1)

- 5013 Sa Fill 22eDocument1 page5013 Sa Fill 22ejeetlalwala845No ratings yet

- SDocument3 pagesSSophiaFrancescaEspinosaNo ratings yet

- TDS Rates For AY 10-11 PDFDocument1 pageTDS Rates For AY 10-11 PDFjiten1986No ratings yet

- Taxsynth Page 25Document2 pagesTaxsynth Page 25Anne Marieline BuenaventuraNo ratings yet

- UGC NET Economics NotesDocument4 pagesUGC NET Economics NotesMousumi ChatterjeeNo ratings yet

- BIR Form 1901 ApplicationDocument4 pagesBIR Form 1901 ApplicationAlvin John Benavidez Salvador50% (2)

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Simplified Tosi Flowchart for Split Income Tax RulesDocument1 pageSimplified Tosi Flowchart for Split Income Tax Rulesgurunandanm9838No ratings yet

- SlipDocument1 pageSlipPratikDuttaNo ratings yet

- TDS Manual 2007 BDocument51 pagesTDS Manual 2007 BVijaysreeram TalluruNo ratings yet