Professional Documents

Culture Documents

Loss Carryforward

Uploaded by

ryanclarke6280 ratings0% found this document useful (0 votes)

11 views1 pageWL Inc. had profits from 2015-2018 but losses in 2019. They can carry the 2019 $6 million loss back to prior years, reducing taxable income. This creates a $1.79 million income tax receivable. WL can also carry the remaining $435,000 loss forward, creating a $693,000 deferred tax asset. In 2020, WL had profits and the deferred tax asset is reduced by $187,000.

Original Description:

Accounting

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWL Inc. had profits from 2015-2018 but losses in 2019. They can carry the 2019 $6 million loss back to prior years, reducing taxable income. This creates a $1.79 million income tax receivable. WL can also carry the remaining $435,000 loss forward, creating a $693,000 deferred tax asset. In 2020, WL had profits and the deferred tax asset is reduced by $187,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageLoss Carryforward

Uploaded by

ryanclarke628WL Inc. had profits from 2015-2018 but losses in 2019. They can carry the 2019 $6 million loss back to prior years, reducing taxable income. This creates a $1.79 million income tax receivable. WL can also carry the remaining $435,000 loss forward, creating a $693,000 deferred tax asset. In 2020, WL had profits and the deferred tax asset is reduced by $187,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

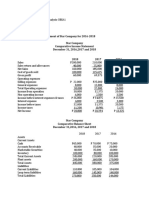

LOSS CARRYFORWARD

Below is the earnings history of Winsim Lossem Inc. (WL) Inc.

Tax Rate

2015 $ 900,000 42%

2016 600,000 40%

2017 1,250,000 40%

2018 2,500,000 42%

2019 (6,000,000) 42%

2020 500,000 44%

WL have consulted you on the use of the loss and the recovery of taxes. What should

WL report on their Statement of Financial Position assuming the entity elects to apply

the loss to prior year and believes it is probable that sufficient taxable income will be

generated in the future to absorb any loss carry-forward. Tax rates were enacted in each

year shown.

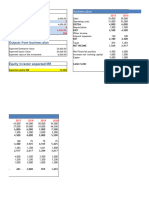

2015 2016 2017 2018 2019 2020

900,000 600,000 1,250,000 2,500,000 (6,000,000) 500,000

4350000 (1650000)

4 years back 0.4 0.4 0.42 1650000 1150000

So no loss 0.42 0.44

240000 500000 1050000 693000 506000

Sum all 3: 1790000 Sum both: 187000

Sum of taxable incomes with loss carry= 4350000

2019

Income tax receivable 1790000

Income tax expense 1790000

Deferred tax asset 693000

Deferred tax expense 693000

2020

Deferred tax expense 187000

Deferred tax asset 187000

You might also like

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- Botanical Garden Business PlanDocument17 pagesBotanical Garden Business Planabhishek.print100% (2)

- Acctg122 Chapter 2 ExercisesDocument5 pagesAcctg122 Chapter 2 ExercisesIce James Pachano100% (1)

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Assignment SolutionDocument5 pagesAssignment SolutionAzmeena FezleenNo ratings yet

- JKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyDocument2 pagesJKL Company Statement of Financial Position For The Year 2015 & 2016 JKL CompanyHazel Gumapon100% (2)

- VIII. Financial Plan: A. Current Funding RequirementsDocument15 pagesVIII. Financial Plan: A. Current Funding RequirementsSaad AkramNo ratings yet

- 001 Trading and PL AccountDocument15 pages001 Trading and PL Accountmrigang shekharNo ratings yet

- BritanniaDocument3 pagesBritanniaDhritiman DuttaNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- Materi - INCOME TAX ACCOUNTING - 26march2021Document18 pagesMateri - INCOME TAX ACCOUNTING - 26march2021Septian Dwi AnggoroNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Operating Profit - 200 2500 2500 2500 2500Document4 pagesOperating Profit - 200 2500 2500 2500 2500Archana J RetinueNo ratings yet

- Ratio and Trend Analysis (FC)Document26 pagesRatio and Trend Analysis (FC)Cindelyn LibodlibodNo ratings yet

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDocument2 pagesNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockMohtasim Bin HabibNo ratings yet

- Rules On Capital Assets Transactions Corporation IndividualDocument2 pagesRules On Capital Assets Transactions Corporation Individualzeref dragneelNo ratings yet

- Financial Analysis For WorlducationDocument2 pagesFinancial Analysis For WorlducationParth PrajapatiNo ratings yet

- Trading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountDocument6 pagesTrading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountNikhil RajNo ratings yet

- Carry Over LossesDocument11 pagesCarry Over LossessamuelNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- AA367Document11 pagesAA367Meena DasNo ratings yet

- Trading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountDocument7 pagesTrading and Profit & Loss Account For The Year Ended 31st March 2020 Debit Amount Credit AmountNikhil RajNo ratings yet

- Capital Budgeting SolutionDocument6 pagesCapital Budgeting SolutionAsad AliNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- ch14 ExercisesDocument10 pagesch14 ExercisesAriin TambunanNo ratings yet

- Just Balance Sheet FinalDocument7 pagesJust Balance Sheet Finalsantosh hugarNo ratings yet

- ST - 21-Fin 1a - N-Fin Man. (Midterm Quiz 2)Document3 pagesST - 21-Fin 1a - N-Fin Man. (Midterm Quiz 2)irish romanNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Cercado April Rose M. 100 Problem 2 To 6 (Elijah Mae)Document4 pagesCercado April Rose M. 100 Problem 2 To 6 (Elijah Mae)Jerome MorenoNo ratings yet

- Dividend Policy QuestionDocument3 pagesDividend Policy Questionraju kumarNo ratings yet

- Economics General Degree Program Faculty of Applied Sciences University of Sri JayewardenepuraDocument19 pagesEconomics General Degree Program Faculty of Applied Sciences University of Sri JayewardenepuraUmesha SavindiNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- Annai Therasa Arts and Science College: Model ExaminationDocument6 pagesAnnai Therasa Arts and Science College: Model ExaminationJayaram JaiNo ratings yet

- Financial Plan: Sales ForecastDocument8 pagesFinancial Plan: Sales ForecastAyush BishtNo ratings yet

- Buscom Subsequent MeasurementDocument6 pagesBuscom Subsequent MeasurementCarmela BautistaNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- Assignment (10-13)Document2 pagesAssignment (10-13)Paulo Timothy AguilaNo ratings yet

- Assumptions:: 11. Financial PlanDocument5 pagesAssumptions:: 11. Financial PlanAkib xabedNo ratings yet

- Apple Inc: ISIN: US0378331005 WKN: 037833100 Asset Class: StockDocument2 pagesApple Inc: ISIN: US0378331005 WKN: 037833100 Asset Class: StockrimNo ratings yet

- Valuation of BusinessDocument2 pagesValuation of BusinessLAKHAN TRIVEDINo ratings yet

- Business Management 1 Memo Preppared by Brilliant. Assignment 1Document4 pagesBusiness Management 1 Memo Preppared by Brilliant. Assignment 1BrilliantNo ratings yet

- Company Valuation Equity Value and IRR Clip 4Document2 pagesCompany Valuation Equity Value and IRR Clip 4aslam810No ratings yet

- Balance Sheet For The Year Ending 31st March 2019 2020 Capital and LiabilitiesDocument1 pageBalance Sheet For The Year Ending 31st March 2019 2020 Capital and LiabilitiesPrasad GharatNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Esno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pageEsno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib DahalNo ratings yet

- CapbudexercisesDocument5 pagesCapbudexercisesJhaister Ashley LayugNo ratings yet

- Pitino Acquired 90 Percent of Brey's Outstanding SharesDocument40 pagesPitino Acquired 90 Percent of Brey's Outstanding SharesKailash KumarNo ratings yet

- 2016 PPDocument13 pages2016 PPumeshNo ratings yet

- Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsDocument6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsGurucharan BhatNo ratings yet

- Income Tax Due and PayableDocument2 pagesIncome Tax Due and PayableJpoy RiveraNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet