Professional Documents

Culture Documents

Merged Past Papers Suggested

Uploaded by

aditimujumdar2710Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merged Past Papers Suggested

Uploaded by

aditimujumdar2710Copyright:

Available Formats

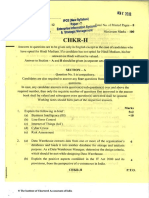

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS AND STRATEGIC MANAGEMENT

SECTION – A: ENTERPRISE INFORMATION SYSTEMS

Question No. 1 is compulsory.

Answer any three questions from the rest.

Question 1

(a) Business managers use MIS reports in the decision-making process. MIS reports need to

ensure that it meets certain criteria to make information most useful. Explain any three

such criteria. (3 Marks)

(b) Distinguish between Connection Oriented and Connectionless Networks. (2 Marks)

Answer

(a) MIS Reports need to ensure that it meets the following criteria to make the information

most useful:

• Relevant: MIS reports need to be specific to the business area they address. This is

important because a report that includes unnecessary information might be ignored.

• Timely: Managers need to know what’s happening now or in the recent past to make

decisions about the future. Be careful not to include information that is old. An example

of timely information might be customer phone calls and emails going back 12 months

from the current date.

• Accurate: Managers and others who rely on MIS reports can’t make sound decisions

with information that is wrong. It’s critical that numbers add up and that dates and

times are correct. Financial information is often required to be accurate to the dollar.

In other cases, it may be OK to round off numbers.

• Structured: Information in an MIS report can be complicated. Making that information

easy to follow helps management understand what the report is saying. Try to break

long passages of information into more readable blocks or chunks and give these

chunks meaningful headings.

(b) Difference between Connection Oriented Networks and Connectionless Networks are as

follows:

Connection Oriented Networks Connectionless Networks

It refers to the computer network It refers to the computer network where no prior

wherein a connection is first connection is made before data exchanges.

established between the sender and Data which is being exchanged in fact has a

the receiver and then data is complete contact information of recipient and at

exchanged. each intermediate destination, it is decided how

to proceed further.

For example - telephone networks. For example - postal networks.

© The Institute of Chartered Accountants of India

2 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

Question 2

(a) Data is a critical resource that must be organized, controlled and managed properly. In

order to achieve the same purpose, XYZ Ltd. decided to transform all its data into digitized

form. As a Database Administrator of the company, you are required to suggest major

advantages of Database Management Systems (DBMS) to the top management. (6 Marks)

(b) Briefly explain the advantages of business policy “Bring Your Own Device ” (BYOD).

(4 Marks)

Answer

(a) Major advantages of Database Management Systems (DBMS) are as follows:

• Permitting Data Sharing: One of the principle advantages of a DBMS is that the

same information can be made available to different users.

• Minimizing Data Redundancy: In a DBMS, duplication of information or redundancy

is, if not eliminated, carefully controlled or reduced i.e. there is no need to re peat the

same data repeatedly. Minimizing redundancy significantly reduce the cost of storing

information on storage devices.

• Integrity can be maintained: Data integrity is maintained by having accurate,

consistent, and up-to-date data. Updates and changes to the data only must be made

in one place in DBMS ensuring Integrity.

• Program and File consistency: Using a DBMS, file formats and programs are

standardized. The level of consistency across files and programs makes it easier to

manage data when multiple programmers are involved as the same rules and

guidelines apply across all types of data.

• User-friendly: DBMS makes the data access and manipulation easier for the user.

DBMS also reduces the reliance of users on computer experts to meet their data

needs.

• Improved security: DBMS allows multiple users to access the same data resources

in a controlled manner by defining the security constraints. Some sources of

information should be protected or secured and only viewed by select individuals.

Using passwords, DBMS can be used to restrict data access to only those who should

see it. Security will only be improved in a database when appropriate access

privileges are allotted to prohibit unauthorized modification of data.

• Achieving program/data independence: In a DBMS, data does not reside in

applications, but databases program and data are independent of each other.

• Faster Application Development: In the case of deployment of DBMS, application

development becomes fast. The data is already therein databases, application

developer must think of only the logic required to retrieve the data in the way a user

needs.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 3

(b) The advantages of Bring Your Own Device (BYOD) are as follows:

• Happy Employees: Employees love to use their own devices when at work. This also

reduces the number of devices an employee has to carry; otherwise, s/he would be

carrying his/her personal as well as organization provided devices.

• Lower IT budgets: Could involve financial savings to the organization since

employees would be using the devices, they already possess thus reducing the outlay

of the organization in providing devices to employees.

• IT reduces support requirement: IT department does not have to provide end user

support and maintenance for all these devices resulting in cost savi ngs.

• Early adoption of new Technologies: Employees are generally proactive in

adoption of new technologies that results in enhanced productivity of employees

leading to overall growth of business.

• Increased employee efficiency: The efficiency of employees is more when an

employee works on his/her own device. In an organization provided devices,

employees have to learn and there is a learning curve involved in it.

Question 3

(a) Human Resource Management (HRM) plays an important role in the effective and efficient

management of the human resources in any enterprise. As an HR Manager of XYZ Ltd.,

which typical stages of HR life cycle will you implement in the company?

(6 Marks)

(b) Categorize the different kinds of business risks that any enterprise faces. (4 Marks)

Answer

(a) The stages of Human Resource (HR) Cycle are as follows:

• Recruiting and On-boarding: Recruiting is the process of hiring a new employee.

The role of the human resources department in this stage is to assist in hiring. This

might include placing the job ads, selecting candidates whose resumes look

promising, conducting employment interviews and administering assessments such

as personality profiles to choose the best applicant for the position. In a small

business where the owner performs these duties personally, the HR person would

assist in a support role. In some organizations, the recruiting stage is referred to as

“hiring support.” On-boarding is the process of getting the successful applicant set up

in the system as a new employee.

• Orientation and Career Planning: Orientation is the process by which an employee

becomes a member of the company’s work force through learning his/her new job

duties, establishing relationships with co-workers and supervisors and developing a

niche. Career planning is the stage at which the employee and his/her supervisors

work out her long-term career goals with the company. The human resource

© The Institute of Chartered Accountants of India

4 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

department may make additional use of personality profile testing at this stage to help

the employee determine his/her best career options with the company.

• Career Development: Career development opportunities are essential to keep an

employee engaged with the company over time. After an employee has established

himself/herself at the company and determined his long-term career objectives, the

human resources department should try to help him/her meet his/her goals, if they

are realistic. This can include professional growth and training to prepare the

employee for more responsible positions with the company. The company also

assesses the employee’s work history and performance at this stage to determine

whether he has been a successful hire.

• Termination or Transition: Some employees will leave a company through

retirement after a long and successful career. Others will choose to move on to other

opportunities or be laid off. Whatever the reason, all employees will even tually leave

the company. The role of HR in this process is to manage the transition by ensuring

that all policies and procedures are followed, carrying out an exit interview if that is

company policy and removing the employee from the system. These stages can be

handled internally or with the help of enterprises that provide services to manage the

employee life cycle.

(b) Different kinds of Business Risks are as follows:

• Strategic Risks: These are the risks that would prevent an organization from

accomplishing its objectives (meeting its goals). Examples include risks related to

strategy, political, economic relationship issues with suppliers and global market

conditions; also could include reputation risk, leadership risk, brand risk, and

changing customer needs.

• Financial Risks: Financial risks are those risks that could result in a negative

financial impact to the organization (waste or loss of assets). Examples include risks

from volatility in foreign currencies, interest rates, and commodities, credit risk,

liquidity risk, and market risk.

• Regulatory (Compliance) Risks: This includes risks that could expose the

organization to fines and penalties from a regulatory agency due to non -compliance

with laws and regulations. The examples include violation of laws or regulations

governing areas such as environmental, employee health and safety, lack of due

diligence, protection of personal data in accordance with global data protection

requirements and local tax or statutory laws. New and emerging regulations can have

a wide-ranging impact on management’s strategic direction, business model and

compliance system. It is, therefore, important to consider regulatory requirements

while evaluating business risks.

• Operational Risks: Operational risks include those risks that could prevent the

organization from operating in the most effective and efficient manner or be disruptive

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 5

to other operations due to inefficiencies or breakdown in internal processes, people ,

and systems. Examples include risk of loss resulting from inadequate or failed internal

processes, fraud or any criminal activity by an employee, business continuity, channel

effectiveness, customer satisfaction and product/service failure, efficiency, capacity,

and change integration.

• Hazard Risks: Hazard risks include risks that are insurable such as natural disasters;

various insurable liabilities; impairment of physical assets; terrorism etc.

• Residual Risks: This includes any risk remaining even after the counter measures

are analyzed and implemented. An organization’s management of risk should

consider these two areas: Acceptance of residual risk and Selection of safeguards.

Even when safeguards are applied, there is probably going to be some residual risk.

The risk can be minimized, but it can seldom be eliminated. Residual risk must be

kept at a minimal, acceptable level. As long as it is kept at an acceptable level, (i.e.

the likelihood of the event occurring or the severity of the consequence is sufficiently

reduced) the risk can be managed.

Question 4

(a) Controlling Module is one of the business process modules of the Enterprise Resources

Planning (ERP) systems. It facilitates coordinating, monitoring and optimizing all the

processes in an organization. In the light of these statements, describe any six key features

of Controlling Module of ERP system. (6 Marks)

(b) Briefly explain the Web Server and Proxy Server. (2 + 2 = 4 Marks)

Answer

(a) The key features of Controlling Module of Enterprise Resource Planning (ERP) Systems

are as under:

• Cost Element Accounting: This component provides overview of the costs and

revenues that occur in an organization. The cost elements are the basis for cost

accounting and enable the user the ability to display costs for each of the accounts

that have been assigned to the cost element. Examples of accounts that can be

assigned are Cost Centres, Internal Orders, WBS (Work Breakdown Structures).

• Cost Centre Accounting: This provides information on the costs incurred by the

business. Cost Centres can be created for such functional areas as Marketing,

Purchasing, Human Resources, Finance, Facilities, Information Systems,

Administrative Support, Legal, Shipping/Receiving, or even Quality. Some of the

benefits of Cost Centre Accounting are that the managers can set budget / cost

Centre targets; Planning; Availability of Cost allocation methods; and Assessments /

Distribution of costs to other cost objects.

• Activity-Based-Accounting: This analyses cross-departmental business processes

and allows for a process-oriented and cross-functional view of the cost centres.

© The Institute of Chartered Accountants of India

6 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

• Internal Orders: Internal Orders provide a means of tracking costs of a specific job,

service, or task. These are used as a method to collect those costs and business

transactions related to the task. This level of monitoring can be very detailed but

allows management the ability to review Internal Order activity for better -decision

making purposes.

• Product Cost Controlling: This calculates the costs that occur during the

manufacture of a product or provision of a service and allows the management the

ability to analyse their product costs and to make decisions on the optimal price(s) to

market their products.

• Profitability Analysis: This allows the management to review information with

respect to the company’s profit or contribution margin by individual market segment.

• Profit Centre Accounting: This evaluates the profit or loss of individual, independent

areas within an organization.

(b) Web Server

• The Web Server is used to host all web services and internet related software. All the

online requests and websites are hosted and serviced through the web server.

• A Web server is a program that uses Hypertext Transfer Protocol (HTTP) to serve the

files that form Web pages to users, in response to their requests, which are forwarded

by their computers’ HTTP clients.

• Dedicated computers and appliances may be referred to as Web servers as well. All

computers that host websites must have Web server programs.

Proxy Server

• A Proxy Server is a computer that offers a computer network service to allow clients

to make indirect network connections to other network services.

• A client connects to the proxy server, and then requests a connection, file, or other

resource available on a different server.

• The proxy server provides the resource either by connecting to the specified server

or by serving it from a cache and hence is often used to increase the speed and

managing network bandwidth.

• In some cases, the proxy may alter the client’s request or the server’s response for

various purposes. It serves as an intermediary between the users and the websites

they browse for.

Question 5

(a) Core Banking System/Solution (CBS) has become a mandatory requirement in the banking

system. CBS are usually running 24 x 7 to support Internet banking, Mobile banking, ATM

services, etc. with the help of its various modules. Most of the key modules of CBS are

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 7

connected to a Central Server. As an IT expert, discuss any three Back End Applications/

Modules and any three Front End Applications/Modules of CBS. (3 + 3 = 6 Marks)

(b) What is Mobile Computing? Explain the key components of Mobile Computing.

(1 + 3 = 4 Marks)

OR

Describe any four characteristics of Infrastructure as a Service (IaaS). (4 Marks)

Answer

(a) The Back End Applications of Core Banking Systems (CBS) are as follows:

• Back Office: The Back Office is the portion of a company made up of administration

and support personnel, who are not client-facing. Backoffice functions include

settlements, clearances, record maintenance, regulatory compliance, accounting and

IT services. Back Office professionals may also work in areas like monitoring

employees' conversations and making sure they are not trading forbidden securities

on their own accounts.

• Data Warehouse: Banking professionals use data warehouses to simplify and

standardize the way they gather data - and finally get to one clear version of the truth.

Data warehouses take care of the difficult data management - digesting large

quantities of data and ensuring accuracy - and make it easier for professionals to

analyze data.

• Credit-Card System: Credit card system provides customer management, credit

card management, account management, customer information management and

general ledger functions; provides the online transaction authorization and service of

the bank card in each transaction channel of the issuing bank; support in the payment

application; and at the same time, the system has a flexible parameter system,

complex organization support mechanism and product factory based design concept

to speed up product time to market.

• Automated Teller Machines (ATM): An ATM is an electronic banking outlet that

allows customers to complete basic transactions without the aid of a branch

representative or teller. Anyone with a credit card or debit card can access most

ATMs. ATMs are convenient, allowing consumers to perform quick, self-serve

transactions from everyday banking like deposits and withdrawals to more complex

transactions like bill payments and transfers.

The Front-End Applications of Core Banking Systems (CBS) are as follows:

• Internet Banking also known as Online Banking, is an electronic payment system

that enables customers of a bank or other financial institution to conduct a range of

financial transactions through the financial institution's website accessed through any

browser. The online banking system offers over 250+ services and facilities that give

© The Institute of Chartered Accountants of India

8 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

us real-time access to our bank account. We can make and receive payments to our

bank accounts, open Fixed and Recurring Deposits, view account details, request a

cheque book and a lot more, while you are online.

• Mobile Banking is a service provided by a bank or other financial institution that

allows its customers to conduct financial transactions remotely using a mobile device

such as a smartphone or tablet. Unlike the related internet banking, it uses software,

usually called an app, provided by the financial institution for the purpose. The app

needs to be downloaded to utilize this facility. Mobile banking is usually available on

a 24-hour basis.

• Phone Banking is a functionality through which customers can execute many of the

banking transactional services through Contact Centre of a bank over phone, without

the need to visit a bank branch or ATM. Registration of Mobile number in account is

one of the basic perquisites to avail Phone Banking. Account related information,

Cheque Book issue request, stop payment of cheque, Opening of Fixed deposit etc.

are some of the services that can be availed under Phone Banking.

• Branch Banking: CBS are the bank’s centralized systems that are responsible for

ensuring seamless workflow by automating the frontend and backend processes

within a bank. CBS enables single view of customer data across all branches in a

bank and thus facilitate information across the delivery channels. The branch confines

itself to various key functions such as creating manual documents capturing data

required for input into software; internal authorization; initiating Beginning -Of-Day

(BOD) operations; End-Of-Day (EOD) operations; and reviewing reports for control

and error correction.

(b) Mobile Computing refers to the technology that allows transmission of data via a computer

without having to be connected to a fixed physical link. Mobile data communication has

become a very important and rapidly evolving technology as it allows users to transmit

data from remote locations to other remote or fixed locations even when they are on move

i.e. mobility. In general, Mobile Computing is a versatile and strategic technology that

increases information quality and accessibility, enhances operational efficiency, and

improves management effectiveness.

The key components of Mobile Computing are as follows:

• Mobile Communication: The Mobile Communication refers to the infrastructure put

in place to ensure that seamless and reliable communication goes on. This would

include communication properties, protocols, data formats and concrete

technologies.

• Mobile Hardware: Mobile Hardware includes mobile devices or device components

that receive or access the service of mobility. They would range from Portable

laptops, Smart Phones, Tablet PCs, and Personal Digital Assistants (PDA) that use

an existing and established network to operate on. At the back end, there are various

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 9

servers like Application Servers, Database Servers and Servers with wireless

support, WAP gateway, a Communications Server and/or MCSS (Mobile

Communications Server Switch) or a wireless gateway embedded in wireless carrier’s

network. The characteristics of mobile computing hardware are defined by the size

and form factor, weight, microprocessor, primary storage, secondary storage, screen

size and type, means of input, means of output, battery life, communications

capabilities, expandability and durability of the device.

• Mobile Software: Mobile Software is the actual program that runs on the mobile

hardware and deals with the characteristics and requirements of mobile applications.

It is the operating system of that appliance and is the essential component that makes

the mobile device operates. Mobile applications popularly called Apps are being

developed by organizations for use by customers, but these apps could represent

risks, in terms of flow of data as well as personal identification risks, introduction of

malware and access to personal information of mobile owner.

OR

Characteristics of Infrastructure as a Service (IaaS) are as follows:

• Web access to the resources: The IaaS model enables the IT users to access

infrastructure resources over the Internet. When accessing a huge computing power,

the IT user need not get physical access to the servers.

• Centralized Management: The resources distributed across different parts are

controlled from any management console that ensures effective resource

management and effective resource utilization.

• Elasticity and Dynamic Scaling: Depending on the load, IaaS services can provide

the resources and elastic services where the usage of resources can be increased or

decreased according to the requirements.

• Shared infrastructure: IaaS follows a one-to-many delivery model and allows

multiple IT users to share the same physical infrastructure and thus ensures high

resource utilization.

• Metered Services: IaaS allows the IT users to rent the computing resources instead

of buying it. The services consumed by the IT user will be measured, and the users

will be charged by the IaaS providers based on the amount of usage.

© The Institute of Chartered Accountants of India

10 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

SECTION –B: STRATEGIC MANAGEMENT

Question No. 6 is compulsory

Answer any three questions from the rest.

Question 6

Inspite of high commodity inflation, shortage of components and the threat of third wave of

COVID-19 pandemic in India, manufacturers of packaged goods, home appliances and

consumer electronics are expecting the business to grow by 12 to 25 percent in the coming

months. After one-and-a-half years of disruption, manufacturers are now confident about

managing their inventories better, keeping their supply channels well-stocked and preparing

themselves to minimalize the impact of any COVID related restrictions even as they gear up for

the festive season, which usually accounts for 25 to 35 percent of their yearly sales.

The home appliances sector could be an example. After a dismal April-June quarter in the year

221; producers of air conditioners, refrigerators and washing machines are expecting their

business to grow by 15-20 percent in the months to come. All the companies operating in the

sector have geared up to grab the opportunities available in the market.

A leading company in the home appliances domain, XXP India, is planning to launch various

innovative product designs and offer loyalty programmes to lure consumers.

With reference to Michael Porter’s generic strategies, identify which strategy XXP India has

planner for? Explain how this strategy will be advantageous to the company to remain

profitable? (5 Marks)

Answer

According to Michael Porter, strategies allow organizations to gain competitive advantage from

three different bases: cost leadership, differentiation, and focus. Porter called these base

generic strategies.

XXP India Ltd. has planned for Differentiation Strategy. The company is planning to launch

various innovative product designs and offer loyalty programmes to lure customers.

Differentiation strategy should be pursued only after a careful study of buyers’ needs and

preferences to determine the feasibility of incorporating one or more differentiating features into

a unique product that features the desired attributes. A successful differentiation strategy allows

a firm to charge a higher price for its product and to gain customer loyalty, because consumers

may become strongly attached to the differentiated features.

Advantages of Differentiation Strategy

A differentiation strategy may help an organisation to remain prof itable even with rivalry, new

entrants, suppliers’ power, substitute products, and buyers’ power.

1. Rivalry - Brand loyalty acts as a safeguard against competitors. It means that customers

will be less sensitive to price increases, as long as the firm can satisfy the needs of its

customers.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 11

2. Buyers – They do not negotiate for price as they get special features, and they have fewer

options in the market.

3. Suppliers – Because differentiators charge a premium price, they can afford to absorb

higher costs of supplies as the customers are willing to pay extra too.

4. Entrants – Innovative features are an expensive offer. So, new entrants generally avoid

these features because it is tough for them to provide the same product with special

features at a comparable price.

5. Substitutes – Substitute products can’t replace differentiated products which have high

brand value and enjoy customer loyalty.

Question 7

(a) A Chennai based fast moving consumer goods (FMCG) major CDE Ltd. recently

announced restructuring its business. The company indicated that the business would be

split into mainly four different streams-FMCG, E-commerce, Retail, and Research &

Development. The company management has decided that these four units will operate as

separate businesses. The top corporate officer shall delegate responsibility for day -to-day

operations and business unit strategy to the concerned managers.

Identify the organization structure that CDE Ltd. has planned to implement. Discuss any

four attributes and the benefits the firm may derive by using this organization structure.

(5 Marks)

(b) What are the important aspects of the process of implementation of strategy? (5 Marks)

Answer

(a) CDE Ltd. has planned to implement Strategic Business Unit (SBU) structure. Very

large organisations, particularly those running into several products, or operating at distant

geographical locations that are extremely diverse in terms of environmental facto rs, can

be better managed by creating strategic business units. SBU structure becomes imperative

in an organisation with increase in number, size and diversity.

The attributes of an SBU and the benefits a firm may derive by using the SBU Structure

are as follows:

A scientific method of grouping the businesses of a multi – business corporation which

helps the firm in strategic planning.

An improvement over the territorial grouping of businesses and strategic planning

based on territorial units.

Strategic planning for SBU is distinct from rest of businesses. Products/ businesses

within an SBU receive same strategic planning treatment and priorities.

Each SBU will have its own distinct set of competitors and its own distinct strategy.

© The Institute of Chartered Accountants of India

12 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

The CEO of SBU will be responsible for strategic planning for SBU and its profit

performance.

Products/businesses that are related from the stand point of function are assembled

together as a distinct SBU.

Unrelated products/ businesses in any group are separated into separate SBU s.

Grouping the businesses on SBU lines helps in strategic planning by removing the

vagueness and confusion.

Each SBU is a separate business and will be distinct from one another on the basis

of mission, objectives etc.

(b) Implementation and execution are an operations-oriented activity aimed at shaping the

performance of core business activities in a strategy-supportive manner. To convert

strategic plans into actions and results, a manager must be able to direct organizatio nal

change, motivate people, build and strengthen company’s competencies and competitive

capabilities, create a strategy-supportive work culture, and meet or beat performance

targets. Good strategy execution involves creating strong “fits” between strategy and

organizational capabilities, structure, climate & culture.

In most situations, strategy-execution process includes the following principal

aspects:

1. Developing budgets that steer ample resources into those activities critical to

strategic success.

2. Staffing the organization with the needed skills and expertise, consciously

building and strengthening strategy-supportive competencies and competitive

capabilities and organizing the work effort.

3. Ensuring that policies and operating procedures facilitate rather than impede

effective execution.

4. Using the best-known practices to perform core business activities and pushing for

continuous improvement.

5. Installing information and operating systems that enable company personnel to

better carry out their strategic roles day in and day out.

6. Motivating people to pursue the target objectives energetically.

7. Creating a company culture and work climate conducive to successful strategy

implementation and execution.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 13

Exerting the internal leadership needed to drive implementation forward and keep

improving strategy execution. When the organization encounters stumbling blocks or

weaknesses, management has to see that they are addressed and rec tified quickly.

Question 8

(a) STU’s association with India goes back to 1967, when it played a key role in constructing

a very long highway in India spreading over multiple states. Since then, it is contributing

in many ways to the country’s growth story. Now it is looking at playing an active role in

the key projects taken up by the central government. Suggest few Opportunities and

Threats that the company should consider. (5 Marks)

(b) “There are certain conditions or indicators which point out that a turnaround is needed if

the company has to survive”. Discuss. (5 Marks)

Answer

(a) Faced with a constantly changing environment, each business unit needs to develop a

marketing information system to track trends and developments, which can be cate gorized

as an opportunity or a threat. The company has to review its strength and weakness in the

background of environment’s opportunities and threat, i.e., an organization’s SWOT

analysis.

STU is looking at playing an active role in the key projects taken up by the central

government. Following are the potential opportunities and threats to STU:

Potential STU’s Opportunities:

Alliances or joint ventures with central government that expand the STU’s market

coverage or boost its competitive capability.

Possibilities of working on the future projects of central government.

Serving additional customer groups or expanding into new geographic markets.

Utilizing existing company skills or technological know-how to enter new projects.

Openings to take market share away from rivals.

Openings to exploit emerging new technologies.

Integrating forward or backward.

Potential STU’s Threats:

Due to COVID-19 pandemic, companies can have face the lockdown situation.

Economic factors such as recession etc.

Likely entry of potent new competitors.

© The Institute of Chartered Accountants of India

14 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

Technological changes/innovations in construction equipment.

Costly new regulatory requirements.

Growing bargaining power of suppliers.

Vulnerability to industry driving forces.

(b) Rising competition, business cycles and economic volatility have created a climate where

no business can take viability for granted. Turnaround strategy is a highly targeted effort

to return an organization to profitability and increase positive cash flows to a sufficient

level. Organizations that have faced a significant crisis that has negatively affected

operations requires turnaround strategy. Turnaround strategy is used when both threats

and weaknesses adversely affect the health of an organization so much that its basic

survival is a question. When organization is facing both internal and external pressures

making things difficult then it has to find something which is entirely new, innovative and

different. Being organization’s first objective is to survive and then grow in the market;

turnaround strategy is used when organization’s survival is under threat. Once turnaround

is successful the organization may turn to focus on growth.

Conditions for turnaround strategies: When firms are losing their grips over market,

profits due to several internal and external factors, and if they have to survive under the

competitive environment, they have to identify danger signals as early as possible and

undertake rectification steps immediately. These are certain conditions or indicators whi ch

point out that a turnaround is needed if the company has to survive. These danger signals

are:

Persistent negative cash flow from business.

Uncompetitive products or services.

Declining market share.

Deterioration in physical facilities.

Over-staffing, high turnover of employees, and low morale.

Mismanagement.

Question 9

(a) “Business organizations face countless marketing challenges that affect the success or

failure of strategy implementation”. In light of this statement, discuss some marketing

decisions that require special attention. (5 Marks)

(b) GWA, a leading Japan based automobile company decides to make India a hub for the

company’s 250 cc motorcycle to be manufactured in collaboration with the TPR Group, a

leading Indian motorcycle manufacturer. The production is to be exported to the

company’s home market as well as to other African countries.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 15

What is this growth strategy called? Point out the most important advantages both the

companies expect from such strategy/collaboration. (5 Marks)

Answer

(a) A business organization faces countless marketing challenges that affect the success or

failure of strategy implementation. Some examples of marketing decisions that may require

special attention are as follows:

1. The amount and the extent of advertising to be done. Whether to use heavy or light

advertising. What should be the amount of advertising in print media, television or

internet?

2. Decisions regarding distribution network to be used. Whether to use exclusive

dealerships or multiple channels of distribution.

3. Whether to be a price leader or a price follower?

4. Whether to offer a complete or limited warranty?

5. Whether to limit or enhance the share of business done with a single or a few

customers?

6. Whether to reward sales people based on straight salary, straight commission, or on

a combination of salary and commission?

(b) GWA of Japan and TRP group of India opted for strategic alliance as their growth

strategy. A strategic alliance is a relationship between two or more businesses that

enables each to achieve certain strategic objectives which neither would be able to achieve

on its own. Strategic alliances are often formed in the global marketplace between

businesses that are based in different regions of the world.

Advantages of Strategic Alliance

Strategic alliance usually is only formed if they provide an advantage to all the parties in

the alliance. These advantages can be broadly categorised as follows:

1. Organizational: Strategic alliance helps to learn necessary skills and obtain certain

capabilities from strategic partners. Strategic partners may also help to enhance

productive capacity, provide a distribution system, or extend supply chain. Having a

strategic partner who is well-known and respected also helps add legitimacy and

creditability to a new venture.

2. Economic: There can be reduction in costs and risks by distributing them across the

members of the alliance. Greater economies of scale can be obtained in an alliance,

as production volume can increase, causing the cost per unit to decline. Finally,

partners can take advantage of co-specialization, creating additional value, such as

when a leading computer manufacturer bundles its desktop with a leading monitor

manufacturer’s monitor.

© The Institute of Chartered Accountants of India

16 INTERMEDIATE (NEW) EXAMINATION: DECEMBER, 2021

3. Strategic: Rivals can join together to cooperate instead of competing with each other.

Vertical integration can be created where partners are part of supply chain. Strategic

alliances may also be useful to create a competitive advantage by the pooling of

resources and skills. This may also help with future business opportunities and the

development of new products and technologies. Strategic alliances may also be used

to get access to new technologies or to pursue joint research and development.

4. Political: Sometimes strategic alliances are formed with a local foreign business to

gain entry into a foreign market either because of local prejudices or legal barriers to

entry. Forming strategic alliances with politically influential partners may also help

improve your own influence and position.

Question 10

(a) “Each organization must build its competitive advantage keeping in mind the business

warfare. This can be done by following the process of strategic management.” Considering

this statement, explain major benefits of strategic management. (5 Marks)

(b) Why is strategy evaluation more difficult? Give reasons. (5 Marks)

OR

What are the factors which determine the nature of rivalry in an industry? (5 Marks)

Answer

(a) Each organization has to build its competitive advantage over the competitors in the

business warfare in order to win. This can be done only by following the process of

strategic management. Strategic Management is very important for the survival and growth

of business organizations in dynamic business environment. Other major benefits of

strategic management are as follows:

Strategic management helps organizations to be more proactive rather than reactive

in dealing with its future. It facilitates to work within vagaries of envi ronment and

remains adaptable with the turbulence or uncertain future. Therefore, they are able

to control their own destiny in a better way.

It provides better guidance to entire organization on the crucial point – what it is trying

to do. Also provides frameworks for all major business decisions of an enterprise such

as on businesses, products, markets, organizational structures, etc.

It facilitates to prepare the organization to face the future and act as pathfinder to

various business opportunities. Organizations are able to identify the available

opportunities and identify ways and means as how to reach them.

It serves as a corporate defence mechanism against mistakes and pitfalls. It helps

organizations to avoid costly mistakes in product market choices or investments.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 17

Over a period of time strategic management helps organization to evolve certain core

competencies and competitive advantages that assist in the fight for survival and

growth.

(b) Strategic evaluation involves measuring and evaluating performance. The goals achieved

are compared with the desired goals to identify deviations and make necessary

adjustments in strategies or in the efforts being put to achieve those strategies.

Reasons why strategy evaluation is more difficult today include the following trends:

A dramatic increase in the environment’s complexity.

The increasing difficulty of predicting the future with accuracy.

The increasing number of variables in the environment.

The rapid rate of obsolescence of even the best plans.

The increase in the number of both domestic and world events affecting

organizations.

The decreasing time span for which planning can be done with any degree of

certainty.

OR

The intensity of rivalry in an industry is a significant determinant of an industry’s

attractiveness and profitability. The intensity of rivalry can influence the costs of suppliers,

distribution, and of attracting customers and thus, can directly affect the profitability. “The

more intensive the rivalry, the less attractive is the industry”. Rivalry among competitors

tends to be cutthroat and an industry’s profitability is low when;

(i) An industry has no clear leader. Therefore, continuous war for leadership.

(ii) Competitors in the industry are numerous.

(iii) Competitors operate with high fixed costs. Thus, aiming for better Return on

Investment with more fierce tactics.

(iv) Competitors face high exit barriers, and therefore, continue to fight for market share.

(v) Competitors have little opportunity to differentiate their offerings.

(vi) The industry faces slow or diminished growth.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS AND STRATEGIC MANAGEMENT

SECTION – A: ENTERPRISE INFORMATION SYSTEMS

Question No. 1 is compulsory.

Answer any three questions from the rest.

Question 1

(a) Presently, the flow of information is at an unimaginable high speed for doing any business

and need of information is perceived at various levels of hierarchy. With these objectives

in focus, define:

(i) Enterprise Information System

(ii) Categories of Business Processes (1 + 2 Marks)

(b) What is an operating system? List any four activities performed by an operating system.

(1 + 1 Marks)

Answer

(a) (i) An Enterprise Information System (EIS) may be defined as any kind of information

system which improves the functions of an enterprise business processes by

integration.

Or

An Enterprise Information System (EIS) provides a technology platform that

enables organizations to integrate and coordinate their business processes on a

robust foundation.

Or

An Enterprise Information System (EIS) provides a single system that is central to

the organization that ensures information can be shared across all functional levels

and management hierarchies. It may be used to amalgamate existing applications.

(ii) Depending on the organization, industry, and nature of work; business processes are

often broken up into different categories as below:

• Operational/Primary Processes: Operational or Primary Processes deal with

the core business and value chain. These processes deliver value to the

customer by helping to produce a product or service. Operational processes

represent essential business activities that accomplish business objectives. For

example - Order to Cash (O2C) and Purchase to Pay (P2P) cycles are

associated with revenue generation.

• Supporting/Secondary Processes: Supporting Processes back core

processes and functions within an organization. For example - Accounting,

© The Institute of Chartered Accountants of India

2 INTERMEDIATE EXAMINATION: MAY, 2022

workplace safety and Human Resource (HR) Management that includes

activities like recruitment and staffing, training and development, career

development etc.

• Management Processes: Management Processes measure, monitor and

control the activities related to business procedures and systems. Examples of

management processes include internal communications, governance, strategic

planning, budgeting, and infrastructure or capacity management.

(b) An Operating System (OS) is defined as a set of computer programs that manages

computer hardware resources and acts as an interface with computer application

programs.

Or

An Operating System (OS) is a vital component of the system software that makes the

hardware usable and manage them by creating an interface between the hardware and the

user.

The variety of activities that are executed by an Operating System are as follows:

• Performing hardware functions

• Provide User Interfaces

• Support Hardware Independence

• Memory Management

• Task Management

• Networking Capability

• Logical Access Security

• File management

Question 2

(a) The main business of banks is lending money to the customers. There are certain inherent

risks in lending, and they cannot take more than the calculated risks whenever they lend

money to their customers. List down the various risks involved and their associated

controls in Loans and Advances Process in the banking system. (6 Marks)

(b) The ERP system is like a human body where there are different units and each unit relates

to other units. All the units must work in harmony with other units to generate the desired

result. What are the important points for integration of modules with Financial and

Accounting System? (4 Marks)

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 3

Answer

(a) Various risks and their associated controls in Loan and Advance process in a Banking

system are as follows:

Risks Key Controls

Credit Line setup is The credit committee checks that the financial

unauthorized and not in line with ratios, the net-worth, the risk factors and its

the bank’s policy. corresponding mitigating factors, the credit line

offered and the credit amount etc. are in line with

Credit Risk Policy and that the client can be given

the Credit Line.

Credit Line setup is Access rights to authorize the credit limit in Loan

unauthorized and not in line with Booking system/Core Banking System should be

the bank’s policy. restricted to authorized personnel.

Masters defined for the Access rights to authorize the customer master in

customer are not in accordance Loan Booking system/Core Banking System (CBS)

with the re- Disbursement should be restricted to authorized personnel.

Certificate. Segregation of Duties (SoD) exists in Loan

Disbursement system. The system restricts the

maker having checker rights to approve the

loan/facilities booked by self in Loan Disbursal

System.

Credit Line setup can be Loan Disbursement System/CBS restricts booking

breached in Loan disbursement of loans/ facilities if the limit assigned to the

system/CBS. customer is breached in Loan Disbursement

System/CBS.

Lower rate of interest/ Loan Disbursement System/CBS restricts booking

Commission may be charged to of loans/ facilities if the rate charged to the

customer. customer are not as per defined masters in system.

Facilities/Loan’s granted may Segregation of Duties (SoD) exists in Loan

be unauthorized/in- appropriate. Disbursement system. The system restricts the

maker having checker rights to approve the

loan/facilities booked by self in loan disbursal

system.

Inaccurate interest/charge Interest on fund-based loans and charges for non-

being calculated in the Loan fund-based loans are automatically calculated in

disbursal system. the Loan disbursal system as per the defined

masters.

© The Institute of Chartered Accountants of India

4 INTERMEDIATE EXAMINATION: MAY, 2022

(b) Following points are important for integration of Enterprise Resource Planning (ERP)

modules with Financial and Accounting System:

• Master data across all the modules must be same and must be shared with other

modules where-ever required.

• Common transaction data must be shared with other modules where-ever required.

• Separate voucher types to be used for each module for easy identification of

department recording it.

• Figures and transaction may flow across the department. For example - Closing stock

value is taken to Trading Account as well as Balance Sheet and closing stock quantity

is required by Purchase Department, Stores Department, Accounts Department, and

Production Department, Similarly, salary figures are used by Human Resource

Department and Accounts Department simultaneously. Hence, it is necessary to

design the system accordingly.

Question 3

(a) For doing business, logical access controls play a critical role ensuring the access to

system, data and programs to safeguard against unauthorized access. Towards this,

explain 'Logical Access Control’ and ‘User Access Management Controls’ for Technical

Exposures’. (2 + 4 Marks)

(b) In Accounting language, voucher is an evidence for a transaction. How do you interpret

'voucher' when referred to a computer? Also explain any three types of vouchers pertaining

to accounting. (1 + 3 Marks)

Answer

(a) Logical Access Controls

• These are the controls relating to logical access to information resources such as

operating systems controls, application software boundary controls, networking

controls, access to database objects, encryption controls etc.

• Logical access controls are the system-based mechanisms used to designate who or

what is to have access to a specific system resource and the type of transactions and

functions that are permitted.

• These controls are implemented to ensure that access to systems, data and programs

is restricted to authorized users to safeguard information against unauthorized use,

disclosure or modification, damage, or loss.

• The key factors considered in designing logical access controls include confidentiality

and privacy requirements, authorization, authentication, and incident handling,

reporting and follow-up, virus prevention and detection, firewalls, centralized security

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 5

administration, user training and tools for monitoring compliance, intrusion testing and

reporting.

Controls for technical exposure related to User Access Management are as follows:

• User Registration: Information about every user is documented. Some questions

like why and who is the user granted the access; has the data owner approved the

access, and has the user accepted the responsibility? etc. are answered. The de-

registration process is also equally important.

• Privilege management: Access privileges are to be aligned with job requirements

and responsibilities are to be minimal w.r.t their job functions. For example, an

operator at the order counter shall have direct access to order processing activity of

the application system. Similarly, a business analyst could be granted the access to

view the report but not modify which would be done by the developer.

• User password management: Passwords are usually the default screening point for

access to systems. Allocations, storage, revocation, and reissue of password are

password management functions. Educating users is a critical component about

passwords and making them responsible for their password.

• Review of user access rights: A user’s need for accessing information changes with

time and requires a periodic review of access rights to check anomalies in the user’s

current job profile, and the privileges granted earlier.

(b) In computer language, the word Voucher is a place where transactions are recorded. It is

a data input form for inputting transaction data.

The vouchers pertaining to Accounting module are as follows:

Voucher Type Uses

Contra For recording of four types of transactions as under.

a. Cash deposit in bank.

b. Cash withdrawal from bank.

c. Cash transfer from one location to another.

d. Fund transfers from our one bank account to our own another

bank account.

Payment For recording of all types of payments. Whenever the money is

going out of business by any mode (cash/bank). E.g. Payment of

salary and rent.

Receipt For recording of all types of receipts. Whenever the money is being

received into business from outside by any mode (cash/bank). For

example - Interest received from bank.

© The Institute of Chartered Accountants of India

6 INTERMEDIATE EXAMINATION: MAY, 2022

Journal For recording of all non-cash/bank transactions. For example -

Depreciation, Provision, Write-off, Write-back, Discount

given/received, Purchase/Sale of fixed assets on credit, etc.

Sales For recording all types of trading sales by any mode

(cash/bank/credit).

Purchase For recording all types of trading purchase by any mode

(cash/bank/credit).

Credit Note For making changes/corrections in already recorded

sales/purchase transactions.

Debit Note For making changes/corrections in already recorded

sales/purchase transactions.

Memorandum For recording of transaction which will be in the system but will not

affect the trial balance. In other words, memorandum vouchers are

used to record suspense payments, receipt, sales, purchase etc.

conveyance expenses.

Question 4

(a) Enterprise Risk Management (ERM) framework consists of various interrelated

components that are derived from the way the management runs a business and are

integrated with the management process. Explain any six components of ERM framework.

(6 Marks)

(b) E-Commerce runs through network-connected systems which can have two types of

architecture, namely, two-tier and three-tier architecture. In this context, define three-tier

architecture and write its advantages. (1 + 3 Marks)

Answer

(a) Enterprise Risk Management (ERM) framework consists of eight interrelated components

that are as follows:

(i) Internal Environment: The internal environment encompasses the tone of an

organization and sets the basis for how risk is viewed and addressed by an entity’s

people, including risk management philosophy and risk appetite, integrity and ethical

values, and the environment in which they operate. Management sets a philosophy

regarding risk and establishes a risk appetite. The internal environment sets the

foundation for how risk and control are viewed and addressed by an entity’s people.

The core of any business is its people, their individual attributes including integrity,

ethical values, and competence and the environment in which they operate. They are

the engine that drives the entity and the foundation on which everything rests.

(ii) Objective Setting: Objectives should be set before management can identify events

potentially affecting their achievement. ERM ensures that management has a process

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 7

in place to set objectives and that the chosen objectives support and align with the

entity’s mission/vision and are consistent with the entity’s risk appetite.

(iii) Event Identification: Potential events that might have an impact on the entity should

be identified. Event identification includes identifying factors – internal and external,

that influence how potential events may affect strategy implementation and

achievement of objectives. It includes distinguishing between potential events that

represent risks, those representing opportunities and those that may be both.

Opportunities are channeled back to management’s strategy or objective-setting

processes. Management identifies inter-relationships between potential events and

may categorize events to create and reinforce a common risk language across the

entity and form a basis for considering events from a portfolio perspective.

(iv) Risk Assessment: Identified risks are analysed to form a basis for determining how

they should be managed. Risks are assessed on both an inherent and a residual

basis, and the assessment considers both risk likelihood and impact. A range of

possible results may be associated with a potential event, and management needs to

consider them together.

(v) Risk Response: Management selects an approach or set of actions to align assessed

risks with the entity’s risk tolerance and risk appetite, in the context of the strategy

and objectives. Personnel identify and evaluate possible responses to risks, including

avoiding, accepting, reducing and sharing risk.

(vi) Control Activities: Policies and procedures are established and executed to help

ensure that the risk responses that management selected are effectively carried out.

(vii) Information and Communication: Relevant information is identified, captured, and

communicated in a form and time frame that enables people to carry out their

responsibilities. Information is needed at all levels of an entity for identifying,

assessing and responding to risk. Effective communication also should occur in a

broader sense, flowing down, across and up the entity. Personnel need to receive

clear communications regarding their role and responsibilities.

(viii) Monitoring: The entire ERM process should be monitored, and modifications made

as necessary. In this way, the system can react dynamically, changing as conditions

warrant. Monitoring is accomplished through ongoing management activities,

separate evaluations of the ERM processes or a combination of both.

(b) Three - Tier architecture is a software design pattern and well-established software

architecture having three tiers - Presentation Tier, Application Tier, and Database Tier.

The Three-tier architecture is a client server architecture in which the functional process

logic; data access and computer data storage; and user interface are maintained as

independent modules on separate platforms - Application tier; Database tier; and

Presentation Tier respectively.

The advantages of Three-Tier Architecture are as follows:

© The Institute of Chartered Accountants of India

8 INTERMEDIATE EXAMINATION: MAY, 2022

• Clear separation of user-interface-control and data presentation from

application-logic: Through this separation, more clients can have access to a wide

variety of server applications. The two main advantages for client-applications are

quicker development through the reuse of pre-built business-logic components and a

shorter test phase.

• Dynamic load balancing: If bottlenecks in terms of performance occur, the server

process can be moved to other servers at runtime.

• Change management: It is easy and faster to exchange a component on the server

than to furnish numerous Personal Computers (PCs) with new program versions.

Question 5

(a) Banking is a backbone of a country's economy which keeps the wheels of economy

running. The changes in the banking scenario due to moving over to Core Banking System

(CBS) and IT-based operations have enabled banks to reach customers and facilitate

seamless transactions with lesser dependence on physical infrastructure. In this context,

write down the characteristics of Core Banking System. (6 Marks)

(b) Mobile Apps are commonly used by all for doing electronic transactions. A mobile website

works for all mobile devices and usually costs about same as creating a Mobile App. In

this context, explain any four modules in mobile websites. (4 Marks)

OR

What are the applications of Internet of Things (IOT) in the area of

(i) Smart City

(ii) Health Care

Answer

(a) The characteristics of Core Banking Systems (CBS) are as follows:

• CBS is a centralized Banking Application software that has several components which

have been designed to meet the demands of the banking industry.

• CBS is supported by advanced technology infrastructure and has high standards of

business functionality.

• There is a common database in a central server located at a Data Center which gives

a consolidated view of the bank’s operations.

• Core Banking Solution brings significant benefits such as a customer is a customer

of the bank and not only of the branch.

• CBS is modular in structure and is capable of being implemented in stages as per

requirements of the bank.

• All branches of bank function as delivery channels providing services to its customers.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 9

• A CBS software also enables integration of all third-party applications including in-

house banking software to facilitate simple and complex business processes.

(b) The modules that are included in the Mobile App/Mobile websites are as follows:

• Mobile Store Front Module is an integral part of m-commerce apps, where all

commodities and services are categorized and compiled in catalogues for customers

to easily browse through the items on sale and get essential information about the

products.

• Mobile Ticketing Module is an m-commerce app component that is closely linked to

promotional side of commercial business and enables vendors to attract customers

by distributing vouchers, coupons, and tickets.

• Mobile Advertising and Marketing Module empowers merchants to leverage m-

commerce channels to manage its direct marketing campaigns, which are reported to

be very effective especially when targeted at younger representatives of digital

information consumers.

• Mobile Customer Support and Information Module is a point of reference for

information about a particular retailer, its offerings, and deals. The news about the

company, current discounts, shop locations and other information is either pushed to

users’ m-commerce apps or can be found in m-commerce app itself.

• Mobile Banking is inextricably linked to selling process via m-commerce apps,

because no purchase can be finalized without a payment. There are various options

for executing mobile payments, among which are direct mobile billing, payments via

SMS, credit card payments through a familiar mobile web interface, and payments at

physical Point of Sale (POS) terminals with Near Field Communication (NFC)

technology.

OR

(i) Smart City: Smart city is a big innovation and spans a wide variety of use cases,

from water distribution and traffic management to waste management and

environmental monitoring. For example, many times we wait for a red traffic light in a

totally absurd way, because there is no car or any person around us. With Internet of

Things (IoT), these traffic lights can be connected to a circuit of cameras distributed

throughout the city that identifies the level of traffic and mass movement, thus

avoiding those absurd waits in areas of limited movement.

(ii) Health Care: Internet of Things (IoT) has various applications in healthcare which

are from remote monitoring equipment to advance and smart sensors to equipment

integration. It has the potential to improve how physicians deliver care and keep

patients safe and healthy.

© The Institute of Chartered Accountants of India

10 INTERMEDIATE EXAMINATION: MAY, 2022

PAPER 7 - SECTION – B: STRATEGIC MANAGEMENT

Question paper comprises of 5 questions, Answer Question No. 6 which is compulsory and any 3

out of the remaining 4 questions.

Question 6

Paramount group of companies is having a strong foot print in the areas of Aviation,

Healthcare, Fast moving consumer goods, Home appliances and Electronic goods. Processes,

Technology and Marketing capabilities are different for each business. However, each

business operates among a group of rivals that produce competing products. In order to get

ahead of competition and to contribute for sustained competitive advantages, company

intends to improve customer services and in turn increase its market share. T o achieve this,

company is desirous to analyze its products, processes and service levels for each of its

segments.

Company is studying various trade publications, understanding the taste and preferences of

customers, meeting with suppliers and also using other relevant information available in public

domain for each of its business operations. After studying as above, company wants to

compare diverse range of practices and processes being followed by acknowledged leaders in

the industry, measures its own productivity and identify the gaps. Instead of following bricks-

and-mortar practices, company will be setting goals to be achieved for improvement in its

product, processes and services, based on best practices being followed by the companies on

a regular basis.

Identify the strategic tool to be used by Paramount group of companies. Also explain in brief

the common elements involved in using this tool. (1 + 4 = 5 Marks)

Answer

Paramount group of companies have used Benchmarking as a strategic tool. Benchmarking

is an approach of setting goals and measuring productivity of firms based on best industry

practices or against the products, services and practices of its competitors or other

acknowledged leaders in the industry. Thus, benchmarking is a process of continuous

improvement in search for competitive advantage. Firms can use benchmarking practices to

achieve improvements in diverse range of management functions like product development,

customer services, human resources management, etc.

Some of the common elements of benchmarking process are as under:

• Identifying the need for benchmarking: This step will define the objectives of the

benchmarking exercise. It will also involve selecting the type of benchmarking.

Organizations identify realistic opportunities for improvements.

• Clearly understanding existing decisions processes: The step will involve compiling

information and data on performance. This will include mapping processes.

• Identify best processes: Within the selected framework best processes are identified.

These may be within the same organization or external to it.

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 11

• Comparison of own process and performance with that of others: Benchmarking

process also involves comparison of performance of the organization with performance of

other organization. Any deviation between the two is analysed to make further

improvements.

• Prepare a report and implement the steps necessary to close the performance gap:

A report on benchmarking initiatives containing recommendations is prepared. Such a

report also contains the action plans for implementation.

• Evaluation: Business organizations evaluate the results of the benchmarking process in

terms of improvements vis-à-vis objectives and other criteria set for the purpose. It also

periodically evaluates and reset the benchmarks in the light of changes in the conditions

that impact the performance.

Question 7

(a) Good Health is an Association of Persons (AOP), providing awareness to downtrodden

on immunization, vaccination, sanitation and other health and hygiene issues. It is a not-

for-profit organization, working in coordination with hospitals, medical support centers

and local administration.

You are asked to take over the organization and manage it in a better way. Identify

whether the concept of strategic management is relevant in this connection? And if so,

what basic activities you would perform in order to manage it efficiently?

(1 + 4 = 5 Marks)

(b) "Is it imperative to segregate top level strategies into viable functional plans and

policies?" Do you agree with this statement? Support your answer with reason.

(1 + 4 = 5 Marks)

Answer

(a) The concept of strategic management process is effectively being used by a number of

not-for-profit or charitable organizations. While ‘Good Health’ may have social and

charitable existence, still it has to generate resources and use them wisely to achieve

organisational objectives. Organisation needs to be managed strategically, irrespective

whether they have profit motive. The strategic management at ‘Good Health’ should

essentially cover:

Analyzing and interpreting the strategic intent in terms of vision, mission and

objectives.

Generating required resources in terms of finance and manpower (volunteers, paid

employees).

Undertaking SWOT analysis from time to time.

© The Institute of Chartered Accountants of India

12 INTERMEDIATE EXAMINATION: MAY, 2022

Setting goals in the area of downtrodden. It can be in terms of geographical

coverage and number of downtrodden.

Analyzing the desired future position with the past and present situation.

(b) Yes, it is imperative to segregate the top-level strategies into viable functional plans and

policies that are compatible with each other. Major strategies must be translated to lower

levels to give holistic strategic direction to an organisation. Functional strategies provide

details to business strategy & govern as to how key activities of the business will be

managed. The reasons why functional strategies are needed can be enumerated as

follows:

Functional strategies lay down clearly what is to be done at the functional level.

They provide a sense of direction to the functional staff.

They are aimed at facilitating the implementation of corporate strategies and the

business strategies formulation at the business level.

They act as basis for controlling activities in the different functional areas of

business.

They help in bringing harmony and coordination as they are formulated to achieve

major strategies.

These strategies help the functional managers in handling similar situations

occurring in different functional areas in a consistent manner.

Question 8

(a) XYZ Ltd. is an automobile company that offers diversified products for all customer

segments. Due to COVID-19, the changes took place in the economy forced the

company to change its strategy. Being the CEO of the company, what stages will you

follow for developing and executing the new strategy? (5 Marks)

(b) Due to reoccurrence of various variants of Corona virus, LMN Ltd. is facing unstable

environment and it has started unbundling and disintegrating its activities. It also started

relying on outside vendors for performing these activities. Identify the organisation

structure LMN Ltd. is shifting to. Under what circumstances this structure becomes

useful? (1 + 4 = 5 Marks)

Answer

(a) Today, India has become the outsourcing hub for many of the global automobile

manufacturers. The auto industry comprises of four segments which are passenger

vehicles, commercial vehicles, three wheelers and two wheelers. XYZ Ltd. is an

automobile company that offers diversified products for all customer segments. The

company has already in existence, so it has its own vision, mission and a strategy to

execute for achieving its vision. While developing and executing the strategy, XYZ Ltd.

might have followed the five-stage managerial process as given below:

© The Institute of Chartered Accountants of India

PAPER – 7: ENTERPRISE INFORMATION SYSTEMS & STRATEGIC MANAGEMENT 13

1. Developing a strategic vision.

2. Environmental and organisational analysis.

3. Formulation of strategy.

4. Implementing and executing the strategy.

5. Strategic evaluation and control.

But due to COVID-19, the automobile industry has faced the lockdown situation.

Changes in the economy forced the XYZ Ltd. to change its existing strategy and prepare

the new strategy. The changes in the environmental forces due to COVID-19 requires

XYZ Ltd. to make modifications in their existing strategies and bring out new strategies.

For initiating strategic change, three steps can be followed by the CEO of the company

which are as under:

(i) Recognize the need for change: This is the first step to diagnose facets of the