Professional Documents

Culture Documents

ICS - Example I.14 E26.2 Replacement 2023-07-13

ICS - Example I.14 E26.2 Replacement 2023-07-13

Uploaded by

cullerbent0wOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICS - Example I.14 E26.2 Replacement 2023-07-13

ICS - Example I.14 E26.2 Replacement 2023-07-13

Uploaded by

cullerbent0wCopyright:

Available Formats

Hochschule RheinMain University of Applied Sciences

Wiesbaden Business School

Master of Arts in International Management (MIM)

72212 (PO 2016) International Capital Structure

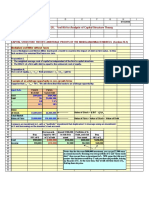

Slide I.14, Berk/DeMarzo (2014), p. 891, Example 26.2

I Working Capital Managemement

Example: Estimating the Effective Cost of Trade Credit

Assumptions

Trade credit, terms of 1/15, Net 40 Berk/DeMarzo (2014), 3rd edition Trade credit, terms of 2/10, Net 30

Invoice amount for purchase of goods 100.00 $ Alternative parameters

Trade discount s= 2% 2% 1%

First days for a zero-interest loan 10 days 10 15

Term to pay invoice for purchase of goods 30 days 30 40

Solution for an annual percentage rate with simple interest 1 + d·r

Loan amount 98.00 $

Interest 2.00 $

Term of the loan 20 days

Day count fraction A/365 d= 0.0548

1/d = 18.2500

Effective annual rate r = s/(1-s)*1/d

= 0,0204*18,25

= 0.3724

= 37.24%

Loan amount plus interest = 98·(1+d·r)

= 98·(1+0,02040752)

= 98·1,0204

= 100.00 $

Solution for an annual percentage rate with compounded interest (1 + r)^d

Loan amount 98.00 $

Interest 2.00 $

Term of the loan 20 days

Day count fraction A/365 d= 0.0548

1/d = 18.2500

Effective annual rate r = 1/(1-s)^1/d - 1

= 1,0204^18,25 -1

= 1,4459 -1

= 44.59%

Loan amount plus interest = 98·(1+r)^d

= 98·(1+0,4459)^0,0548

= 98·(1,4459^0,0548

= 98·1,0204

= 100.00 $

You might also like

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Case of Bond Valuation Kelompok 1Document2 pagesCase of Bond Valuation Kelompok 1kota lainNo ratings yet

- Can One Size Fit All CLASS CASE COST OF CAPITALDocument9 pagesCan One Size Fit All CLASS CASE COST OF CAPITALMariaAngelicaMargenApeNo ratings yet

- M Fin 202 CH 13 SolutionsDocument9 pagesM Fin 202 CH 13 SolutionsNguyenThiTuOanhNo ratings yet

- Food Materials Science Principles and PracticeDocument608 pagesFood Materials Science Principles and PracticeMario de los SantosNo ratings yet

- FM Group 4Document21 pagesFM Group 4Jerus CruzNo ratings yet

- Pinky Sharon Shilaluke - 7817580 - 0Document7 pagesPinky Sharon Shilaluke - 7817580 - 0Tawanda MakombeNo ratings yet

- FM Eco May 23 Exam Solution @cainterlegendsDocument19 pagesFM Eco May 23 Exam Solution @cainterlegendsAditiNo ratings yet

- Chapter 9 SolutionsDocument16 pagesChapter 9 SolutionsIsah Ma. Zenaida Felisilda50% (2)

- MILLAN CHAPTER 6 Receivables - Additional ConceptsDocument16 pagesMILLAN CHAPTER 6 Receivables - Additional Concepts밀크milkeuNo ratings yet

- Annuity Sequence of Payments at Equal Iterval of TimeDocument2 pagesAnnuity Sequence of Payments at Equal Iterval of TimeZahid MehmoodNo ratings yet

- (Round To The Nearest Cent.) : 1 1 (1+r) T + (1+r) TDocument5 pages(Round To The Nearest Cent.) : 1 1 (1+r) T + (1+r) TRizza L. MacarandanNo ratings yet

- Issue Price Bonds - PayableDocument3 pagesIssue Price Bonds - PayableKyla Gacula NatividadNo ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Sol. Man. - Chapter 7 Leases Part 1Document12 pagesSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- Components of Capital StructureDocument3 pagesComponents of Capital StructureNahidul Islam IUNo ratings yet

- Ia 2 Final Exam Answer KeyDocument17 pagesIa 2 Final Exam Answer KeyIrene Grace Edralin AdenaNo ratings yet

- Dividend Policy Question and AnswerDocument7 pagesDividend Policy Question and AnswerBella CynthiaNo ratings yet

- 6TH Notes PayableDocument9 pages6TH Notes PayableAnthony DyNo ratings yet

- BBFH 202 Business Finance 1Document4 pagesBBFH 202 Business Finance 1tawandaNo ratings yet

- Tutorial - Bond and Their Valuation-AnswerDocument7 pagesTutorial - Bond and Their Valuation-Answerhanatasha25No ratings yet

- Discounted Cah Flow Valuation Chapter 6Document31 pagesDiscounted Cah Flow Valuation Chapter 6Rahul KhadkaNo ratings yet

- FinanceDocument20 pagesFinancemayuraprasadaberathnNo ratings yet

- BBFH 202 Business Finance 1Document4 pagesBBFH 202 Business Finance 1tawandaNo ratings yet

- Kelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4Document9 pagesKelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4RoyNo ratings yet

- Tutorial 3 Bond and Their Valuation-AnswerDocument7 pagesTutorial 3 Bond and Their Valuation-AnswerJune JoysNo ratings yet

- Suppose Comparison Date 8 Years: Worth of 4000 at C .D 4000 5279.71Document6 pagesSuppose Comparison Date 8 Years: Worth of 4000 at C .D 4000 5279.71Javeria Muhammad ArifNo ratings yet

- Tugas 2 ManKeu - Bella Fatma P - 2011070511Document6 pagesTugas 2 ManKeu - Bella Fatma P - 2011070511Bella FatmaNo ratings yet

- Topic 3 2020Document40 pagesTopic 3 2020GloriaNo ratings yet

- Chapter 3: Bonds Payable and Other ConceptsDocument23 pagesChapter 3: Bonds Payable and Other ConceptsAndrei BernardoNo ratings yet

- Recivable Management Bba 3rdDocument54 pagesRecivable Management Bba 3rdMuzameelAshrafNo ratings yet

- Pricing Corporate Bonds: For Possible Losses From Default (Liquidity Is Also A Factor)Document33 pagesPricing Corporate Bonds: For Possible Losses From Default (Liquidity Is Also A Factor)Harry EdwinNo ratings yet

- Lease Acctg ExerciseDocument12 pagesLease Acctg ExerciseIts meh SushiNo ratings yet

- Intacc2 Chapter 3 Answer KeysDocument24 pagesIntacc2 Chapter 3 Answer KeysATHALIAH LUNA MERCADEJASNo ratings yet

- Assignment Cover SheetDocument19 pagesAssignment Cover SheetMd. Ayman IqbalNo ratings yet

- B) Price of Bond When YTM Is 6% 1459.90 Price of BondDocument13 pagesB) Price of Bond When YTM Is 6% 1459.90 Price of BondMasab AsifNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- Quiz 1 SolDocument74 pagesQuiz 1 SolMAYANK JAINNo ratings yet

- Sol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionDocument13 pagesSol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Bonds Payable Issued at A DiscountDocument10 pagesBonds Payable Issued at A DiscountCris Ann Marie ESPAnOLANo ratings yet

- Keputusan PendanaanDocument12 pagesKeputusan PendanaanBro PediaNo ratings yet

- Jun 2007 - AnsDocument10 pagesJun 2007 - AnsHubbak KhanNo ratings yet

- Chapter 20 AnswerDocument11 pagesChapter 20 AnswerjennyNo ratings yet

- FM Se4 SolutionsDocument40 pagesFM Se4 SolutionsOmer ShareefNo ratings yet

- (Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanDocument24 pages(Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Module 7 Loans Receivable and Impairment of ReceivablesDocument10 pagesModule 7 Loans Receivable and Impairment of Receivablesshaira doctorNo ratings yet

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDocument11 pagesChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANo ratings yet

- Chapter 7 Leases Part 1Document10 pagesChapter 7 Leases Part 1Thalia Rhine AberteNo ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- FM 2020 Assignment With Math AnswerDocument10 pagesFM 2020 Assignment With Math AnswerMohammad Zahirul IslamNo ratings yet

- Short-Term Sources For Financing Current AssetsDocument11 pagesShort-Term Sources For Financing Current AssetsAlexandra TagleNo ratings yet

- Math 149 Problem Set (Assignment)Document8 pagesMath 149 Problem Set (Assignment)raddy.tahilNo ratings yet

- 09 Worksheet 4Document2 pages09 Worksheet 4Blue NightNo ratings yet

- 13 Cost of Capital-R2Document14 pages13 Cost of Capital-R2Jay JayNo ratings yet

- Marriott Corporation Cast SolutionDocument5 pagesMarriott Corporation Cast SolutionAbdul Wahab100% (1)

- Ex. Lesson 20-2-2020Document3 pagesEx. Lesson 20-2-2020roberta glionnaNo ratings yet

- Chapter 20 - AnswerDocument11 pagesChapter 20 - AnswerLove FreddyNo ratings yet

- Solutions To Problems: LG 1 BasicDocument13 pagesSolutions To Problems: LG 1 BasicMuwadat Hussain67% (3)

- PracticeSet BondsPayableDocument5 pagesPracticeSet BondsPayablearabelle contrerasNo ratings yet

- Setting Time - Vicat Needle ASTM C 191Document10 pagesSetting Time - Vicat Needle ASTM C 191alex_g00dy100% (1)

- Chapter 15Document77 pagesChapter 15Jocelyn LuiNo ratings yet

- Full Solution Manual For Optoelectronics Photonics Principles Practices 2 E 2Nd Edition Safa O Kasap PDF Docx Full Chapter ChapterDocument32 pagesFull Solution Manual For Optoelectronics Photonics Principles Practices 2 E 2Nd Edition Safa O Kasap PDF Docx Full Chapter Chapterbranlinsuspectnm8l100% (13)

- Horizon Manual - Revised March 2020Document19 pagesHorizon Manual - Revised March 2020dalije6449No ratings yet

- ATI 1144 e Production Equipment/machinery: The Injection Molding of High-Quality Molded PartsDocument16 pagesATI 1144 e Production Equipment/machinery: The Injection Molding of High-Quality Molded PartsRadu Sorin MarinescuNo ratings yet

- Cranfield University: Attempt All QuestionsDocument6 pagesCranfield University: Attempt All QuestionsFabio BosioNo ratings yet

- Sach Lop 9 Ky IDocument366 pagesSach Lop 9 Ky INguyễn Ngọc Huy100% (1)

- LAS For Organization and Management (Grade 11)Document8 pagesLAS For Organization and Management (Grade 11)rosellerNo ratings yet

- Criteria For Evaluating Policy and Policy ProcesDocument12 pagesCriteria For Evaluating Policy and Policy ProcesJhem SuetosNo ratings yet

- InfertilityDocument29 pagesInfertilityCristina StanleeNo ratings yet

- Report On Compensation ManagementDocument30 pagesReport On Compensation ManagementBana Zeeshan100% (1)

- Bài Tập Tiếng Anh Lớp 8 Unit 1: My Friends I - Read the answers and complete the questions in the following conversationDocument179 pagesBài Tập Tiếng Anh Lớp 8 Unit 1: My Friends I - Read the answers and complete the questions in the following conversationMaya NguyenNo ratings yet

- SP-2110 Ii2 Qe 1-0-0Document35 pagesSP-2110 Ii2 Qe 1-0-0Duval FortesNo ratings yet

- HISTORYDocument6 pagesHISTORYElvira Monica SayoNo ratings yet

- Vantage 300Document8 pagesVantage 300Frangus GusNo ratings yet

- Investment Advisory Business Plan TemplateDocument22 pagesInvestment Advisory Business Plan TemplatesolomonNo ratings yet

- Drug ChartDocument8 pagesDrug Chartstudentalwaysstudy100% (1)

- Đề Thi Thử Thptqg Môn Tiếng AnhDocument11 pagesĐề Thi Thử Thptqg Môn Tiếng AnhnguyenngocquynhchiNo ratings yet

- RDL1 Handouts3Document3 pagesRDL1 Handouts3Kylie Nadine De RomaNo ratings yet

- Becoming A Cisco Select Certified Partner-Step by Step GuideDocument7 pagesBecoming A Cisco Select Certified Partner-Step by Step Guidemwaseemno181No ratings yet

- Dissertation Questionnaire Cover Letter ExampleDocument8 pagesDissertation Questionnaire Cover Letter ExamplePayToDoPaperKansasCity100% (1)

- Results of The Fourth Saturn IB Launch Vehicle Test Flight AS-204Document365 pagesResults of The Fourth Saturn IB Launch Vehicle Test Flight AS-204Bob AndrepontNo ratings yet

- Ship SecurityDocument48 pagesShip SecurityFraston DlimaNo ratings yet

- Resume - Daniel Liu Aug 2019 3Document1 pageResume - Daniel Liu Aug 2019 3Daniel LiuNo ratings yet

- REWP (Core) WORKSHOP GTUDocument8 pagesREWP (Core) WORKSHOP GTUjigarNo ratings yet

- Easiest Chopin Nocturne - A Beginner Starter Piece - CMUSEDocument5 pagesEasiest Chopin Nocturne - A Beginner Starter Piece - CMUSEsuoivietNo ratings yet

- Untitled DocumentDocument3 pagesUntitled DocumentMary Blue PohjolaNo ratings yet

- FELIX Bela PozDocument268 pagesFELIX Bela PozcusimaNo ratings yet

- Computer Bus Architecture, Pipelining and Memory ManagementDocument13 pagesComputer Bus Architecture, Pipelining and Memory ManagementniroseNo ratings yet