Professional Documents

Culture Documents

Issue Price Bonds - Payable

Uploaded by

Kyla Gacula NatividadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Issue Price Bonds - Payable

Uploaded by

Kyla Gacula NatividadCopyright:

Available Formats

REVIEW QUESTIONS

Compute for the total amount received to issue the bonds under the following independent situations: (Round off

present value factors to four decimal places)

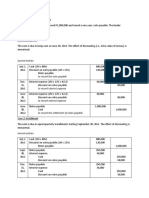

Situation 1:

Face value P1,000,000

Date of bonds January 1, 20x22

Date of maturity January 1, 20x25

Issue date January 1, 20x22

Nominal rate 10%

Effective rate 12%

Interest payment date January 1

Nominal 12%

Effective 10%

PV of 1 0.7462 = 1.05^-6

PV OA 5.0757 = (1-(1.05^-3))/0.05

Principal 1,000,000

Interest 60,000 = 1M x 6%

PV of Principal 746,200

PV of Interest 304,542

PRESENT VALUE 1,050,742

AMORTIZATION TABLE

Interest paid Interest expense Premium Amortization Carrying Amount

Jan. 1, 20x22 1,050,742

Jul. 1, 20x22 60,000 52,537 7,463 1,043,279

Jan. 1, 20x23 60,000 52,164 7,836 1,035,443

Jul. 1, 20x23 60,000 51,772 8,228 1,027,215

Jan. 1, 20x24 60,000 51,361 8,639 1,018,576

Jul. 1, 20x24 60,000 50,929 9,071 1,009,505

Jan. 1, 20x25 60,000 50,475 9,505 1,000,000

Situation 2

Face value P1,000,000

Date of bonds January 1, 20x22

Date of maturity January 1, 20x25

Issue date January 1, 20x22

Nominal rate 12%

Effective rate 10%

Interest payment dates January 1 and July 1

Nominal 10%

Effective 12%

PV of 1 0.7118 = 1.12^-3

PV OA 2.4018 = (1-(1.12^-3))/0.12

Principal 1,000,000

Interest 100,000 = 1M x 10%

PV of Principal 711,800

PV of Interest 240,180

PRESENT VALUE 951,980

AMORTIZATION TABLE

Interest paid Interest expense Discount Amortization Carrying Amount

Jan. 1, 20x22 951,980

Jan. 1, 20x23 100,000 114,238 14,238 966,218

Jan. 1, 20x24 100,000 115,946 15,946 982,164

Jan. 1, 20x25 100,000 117,837 17,837 1,000,000

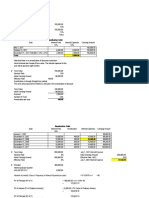

Situation 3

Face value P1,000,000

Date of bonds January 1, 20x22

Date of maturity January 1, 20x25

Issue date March 1, 20x22

Nominal rate 10%

Effective rate 12%

Interest payment dates January 1 and July 1

Nominal 10%

Effective 12%

PV of 1 0.705 = 1.06^-6

PV OA 4.9173 = (1-(1.06^-6))/0.06

Principal 1,000,000

Interest 50,000 = 1M x 5%

PV of Principal 705,000

PV of Interest 245,865

PV, 1/1/22 950,865

Add: Discount Amortized

950,865 x 6% x 2/6 19,017

1,000,000 x 5% x 2/6 (16,667) 2,351

PV 3/1/22 953,216

Add: Accrued Interest

1,000,000 x 5% x 2/6 16,667

PRESENT VALUE 969,882

AMORTIZATION TABLE

Interest paid Interest expense Discount Amortization Carrying Amount

Jan. 1, 20x22 950,865

Jul. 1, 20x22 50,000 57,052 7,052 957,917

Jan. 1, 20x23 50,000 57,475 7,475 965,392

Jul. 1, 20x23 50,000 57,924 7,924 973,315

Jan. 1, 20x24 50,000 58,399 8,399 981,714

Jul. 1, 20x24 50,000 58,903 8,903 990,617

Jan. 1, 20x25 50,000 59,383 9,383 1,000,000

Situation 4

Face value P3,000,000

Date of bonds January 1, 20x22

Date of maturity P1,000,000 annually starting December 31, 20x22

Issue date January 1, 20x22

Nominal rate 10%

Effective rate 12%

Interest payment date December 31

Nominal 10%

Effective 12%

PV of 1 0.8929 = 1.12^-1

0.7972 = 1.12^-2

0.7118 = 1.12^-3

Principal 3,000,000

Interest 300,000 = 3M x 10%

Date Principal Interest Total PV @ 12% PV 1/1/22

12/31/22 1,000,000 300,000 1,300,000 0.8929 1,160,770

12/31/23 1,000,000 200,000 1,200,000 0.7972 956,640

12/31/24 1,000,000 100,000 1,100,000 0.7118 782,980

3,000,000 600,000 3,600,000 2,900,390

PRESENT VALUE 2,900,390

AMORTIZATION TABLE

Interest paid Interest expense Discount Amortization Serial payment Carrying Amount

Jan. 1, 20x22 2,900,390

Jan. 1, 20x23 300,000 348,047 48,047 1,000,000 1,948,437

Jan. 1, 20x24 200,000 233,812 33,812 1,000,000 982,249

Jan. 1, 20x25 100,000 117,751 17,751 1,000,000 0

You might also like

- Series 7 NotesDocument13 pagesSeries 7 NotesColin Ford100% (3)

- Finance 100Document865 pagesFinance 100jhamez16No ratings yet

- LLQP: Quickfact Formulas: Underwriting & Claims Need For InsuranceDocument2 pagesLLQP: Quickfact Formulas: Underwriting & Claims Need For Insurancepkgarg_iitkgp100% (2)

- 2a.notes PayableDocument8 pages2a.notes PayableDia rielNo ratings yet

- (Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanDocument24 pages(Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- MILLAN CHAPTER 6 Receivables - Additional ConceptsDocument16 pagesMILLAN CHAPTER 6 Receivables - Additional Concepts밀크milkeuNo ratings yet

- Lesson 4 Partnership DissolutionDocument17 pagesLesson 4 Partnership DissolutionheyheyNo ratings yet

- (Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanDocument17 pages(Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Finacle Menu and TablesDocument72 pagesFinacle Menu and TablesVikash Palhan54% (13)

- 6TH Notes PayableDocument9 pages6TH Notes PayableAnthony DyNo ratings yet

- Intermediate Accounting 3 Valix Chapter 12 ProblemsDocument9 pagesIntermediate Accounting 3 Valix Chapter 12 ProblemsAlicia Summer100% (1)

- Notes PayableDocument10 pagesNotes PayableMia Casas100% (5)

- Capitalized Cost: Case 1: No Replacement, Only Maintenance and or Operation Every PeriodDocument3 pagesCapitalized Cost: Case 1: No Replacement, Only Maintenance and or Operation Every PeriodErina SmithNo ratings yet

- Monetary Policy and CB Module-8Document17 pagesMonetary Policy and CB Module-8Eleine Taroma AlvarezNo ratings yet

- World Around Us Level 3 FinalDocument60 pagesWorld Around Us Level 3 FinalMitali BadkulNo ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Sol. Man. - Chapter 7 Leases Part 1Document12 pagesSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Ia 2 Final Exam Answer KeyDocument17 pagesIa 2 Final Exam Answer KeyIrene Grace Edralin AdenaNo ratings yet

- Lease Acctg ExerciseDocument12 pagesLease Acctg ExerciseIts meh SushiNo ratings yet

- Due Date Revised Payments PV of 1 @12%, N 0 1 and 2 Present ValueDocument2 pagesDue Date Revised Payments PV of 1 @12%, N 0 1 and 2 Present ValueCamille HornillaNo ratings yet

- PracticeSet BondsPayableDocument5 pagesPracticeSet BondsPayablearabelle contrerasNo ratings yet

- Intacc2 Chapter 3 Answer KeysDocument24 pagesIntacc2 Chapter 3 Answer KeysATHALIAH LUNA MERCADEJASNo ratings yet

- Chapter 3: Bonds Payable and Other ConceptsDocument23 pagesChapter 3: Bonds Payable and Other ConceptsAndrei BernardoNo ratings yet

- Computing Present Value For Unequal Periodic PaymentsDocument2 pagesComputing Present Value For Unequal Periodic PaymentsCJ GranadaNo ratings yet

- Illustration 1 (Notes Payable)Document4 pagesIllustration 1 (Notes Payable)DM MontefalcoNo ratings yet

- Acc 106 P3 LessonDocument6 pagesAcc 106 P3 LessonRowella Mae VillenaNo ratings yet

- ACC106 Notes Receivable IllustrationsDocument23 pagesACC106 Notes Receivable IllustrationsJohn MaynardNo ratings yet

- Answer Key Remedial ExercisesDocument10 pagesAnswer Key Remedial ExercisesAlizah Lariosa BucotNo ratings yet

- Book 1Document2 pagesBook 1Shiela DimaculanganNo ratings yet

- Module 7 Loans Receivable and Impairment of ReceivablesDocument10 pagesModule 7 Loans Receivable and Impairment of Receivablesshaira doctorNo ratings yet

- Chapter 7 Leases Part 1Document10 pagesChapter 7 Leases Part 1Thalia Rhine AberteNo ratings yet

- Intacc1A M5Assignment KeyDocument9 pagesIntacc1A M5Assignment KeyGabriel AfricaNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Compilation First Prelim Period SolutionDocument12 pagesCompilation First Prelim Period SolutionHarvyn Kuster AcedilloNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Investment 1Document2 pagesInvestment 1Siska TriandriyaniNo ratings yet

- Quiz 4 With SolutionDocument5 pagesQuiz 4 With SolutionKarl Lincoln TemporosaNo ratings yet

- Initial Measurement:: Year Lease Payment Discount Factor Present Value of Lease PaymentDocument4 pagesInitial Measurement:: Year Lease Payment Discount Factor Present Value of Lease PaymentTuan Huy Cao pcpNo ratings yet

- ICS - Example I.14 E26.2 Replacement 2023-07-13Document1 pageICS - Example I.14 E26.2 Replacement 2023-07-13cullerbent0wNo ratings yet

- Intermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Document5 pagesIntermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Yuki BarracaNo ratings yet

- Bonds PayableDocument4 pagesBonds PayableyelzNo ratings yet

- FM Group 4Document21 pagesFM Group 4Jerus CruzNo ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Acquisition Cost 941726 Face Amount 1000000 Discount - 58274: Problem 2 1)Document9 pagesAcquisition Cost 941726 Face Amount 1000000 Discount - 58274: Problem 2 1)garlian baldomeroNo ratings yet

- PV Factor 1/1.1 0.909091 .909091/1.1 0.826446 .826446/1.1 0.751315 133,100.00 100,000.00Document5 pagesPV Factor 1/1.1 0.909091 .909091/1.1 0.826446 .826446/1.1 0.751315 133,100.00 100,000.00Allyna Jane EnriquezNo ratings yet

- PA2 X ESP HW11 G1 Revanza TrivianDocument10 pagesPA2 X ESP HW11 G1 Revanza TrivianRevan KonglomeratNo ratings yet

- Bonds Payable DiscussionDocument6 pagesBonds Payable DiscussionDanica JaneNo ratings yet

- Corporation: SolutionDocument6 pagesCorporation: Solutionibrahim mohamedNo ratings yet

- Corporation: ExampleDocument3 pagesCorporation: Exampleibrahim mohamedNo ratings yet

- Learning Materials - Chapters 4, 5, and 7Document12 pagesLearning Materials - Chapters 4, 5, and 7Kyla Joy T. SanchezNo ratings yet

- Pinky Sharon Shilaluke - 7817580 - 0Document7 pagesPinky Sharon Shilaluke - 7817580 - 0Tawanda MakombeNo ratings yet

- Group Activities in Receivable FinancingDocument2 pagesGroup Activities in Receivable FinancingTrisha VillegasNo ratings yet

- HW - Case 8-2 Pp. 240-241Document4 pagesHW - Case 8-2 Pp. 240-241rajo_onglaoNo ratings yet

- Notes Payable: Problem 1: True or FalseDocument16 pagesNotes Payable: Problem 1: True or FalseKim HanbinNo ratings yet

- Intermediate Accounting Unit4 - Topic2Document12 pagesIntermediate Accounting Unit4 - Topic2Lea Polinar100% (1)

- Receivables - Additional Concepts Credit Impaired Financial AssetsDocument2 pagesReceivables - Additional Concepts Credit Impaired Financial Assetsfinn mertensNo ratings yet

- BAT Unit 5 AssignmentDocument14 pagesBAT Unit 5 AssignmentTalhah WaleedNo ratings yet

- Exercise 3 - Long-Term Liabilities - Jeremy MichaelDocument12 pagesExercise 3 - Long-Term Liabilities - Jeremy MichaelJeremy Michael HariantoNo ratings yet

- Bloan CalculatorDocument8 pagesBloan CalculatorLEE KAR WEINo ratings yet

- Solutions Guide: This Is Meant As A Solutions GuideDocument4 pagesSolutions Guide: This Is Meant As A Solutions GuideVivienne Lei BolosNo ratings yet

- M8learning Activity 2Document11 pagesM8learning Activity 2Kyla Gacula NatividadNo ratings yet

- m6 Learning Activity 2Document1 pagem6 Learning Activity 2Kyla Gacula NatividadNo ratings yet

- m7 Learning ActivityDocument1 pagem7 Learning ActivityKyla Gacula NatividadNo ratings yet

- Managerial EconomicsDocument2 pagesManagerial EconomicsKyla Gacula NatividadNo ratings yet

- EXERCISE 1 (Intermediate Accounting 3)Document2 pagesEXERCISE 1 (Intermediate Accounting 3)Kyla Gacula NatividadNo ratings yet

- Exported TableDocument1 pageExported TableKyla Gacula NatividadNo ratings yet

- BSA2201 - BED - Natividad, Jane Kyl G. - Exercise 1-Employee Benefits - Definition of TermsDocument3 pagesBSA2201 - BED - Natividad, Jane Kyl G. - Exercise 1-Employee Benefits - Definition of TermsKyla Gacula NatividadNo ratings yet

- 2dd3c613 1670283438180Document8 pages2dd3c613 1670283438180Kyla Gacula NatividadNo ratings yet

- All About Interest Rates in IndiaDocument27 pagesAll About Interest Rates in IndiaNitinAggarwalNo ratings yet

- Chapter 14 Interest Rate and Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument15 pagesChapter 14 Interest Rate and Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsBijay AgrawalNo ratings yet

- Revision Pack 4 May 2011Document27 pagesRevision Pack 4 May 2011Lim Hui SinNo ratings yet

- Cash Management-ProblemsDocument2 pagesCash Management-ProblemsNagma ParmarNo ratings yet

- a. the money supply falls. b. interest rates rise.: Trắc Nghiệm Câu 1. Other things the same, as the price level falls,Document7 pagesa. the money supply falls. b. interest rates rise.: Trắc Nghiệm Câu 1. Other things the same, as the price level falls,Kim Yen KhuuNo ratings yet

- Macroeconomics 2Document9 pagesMacroeconomics 2Bảo Châu VươngNo ratings yet

- Bangladesh Tax Handbook 2015-2016Document128 pagesBangladesh Tax Handbook 2015-2016Syed Tamjidur RahmanNo ratings yet

- Lessons Learned From Decentralised Finance (Defi)Document22 pagesLessons Learned From Decentralised Finance (Defi)alexander benNo ratings yet

- RD Trading SolutionDocument10 pagesRD Trading SolutionPurveshNo ratings yet

- CH 2 SSQ Bak - Answers OnlyDocument8 pagesCH 2 SSQ Bak - Answers OnlypkehmerNo ratings yet

- Statement Jul 21 XXXXXXXX5823Document1 pageStatement Jul 21 XXXXXXXX5823Gaurav MishraNo ratings yet

- The Role of Financial Institution in Enhancing Business Activities in NigeriaDocument54 pagesThe Role of Financial Institution in Enhancing Business Activities in Nigeriaenbassey100% (5)

- Account Statement 030523 021123Document37 pagesAccount Statement 030523 021123manish thakurNo ratings yet

- Question and Answer - 40Document30 pagesQuestion and Answer - 40acc-expertNo ratings yet

- Financial Management Presentation Part I - Summer Class 2017Document44 pagesFinancial Management Presentation Part I - Summer Class 2017Juan Sebastian Leyton ZabaletaNo ratings yet

- Financial ManagementDocument12 pagesFinancial Managementmani_1813No ratings yet

- Credit Management and Credit Risk ManagementDocument23 pagesCredit Management and Credit Risk Managementsagar7No ratings yet

- Granzo DLL Genmathmath11 Week1Document14 pagesGranzo DLL Genmathmath11 Week1KIMBERLYN GRANZONo ratings yet

- A Tobin's Q Model of House PricesDocument28 pagesA Tobin's Q Model of House PriceskobiwNo ratings yet

- Stakeholder Agency TheoryDocument24 pagesStakeholder Agency TheoryLaura ArdilaNo ratings yet

- Design and Implementation of Loan Scheme Management SystemDocument6 pagesDesign and Implementation of Loan Scheme Management SystempoltergeistNo ratings yet

- A Project Report On Mutual Fund As An Investment Avenue at NJ India InvestDocument16 pagesA Project Report On Mutual Fund As An Investment Avenue at NJ India InvestYogesh AroraNo ratings yet