Professional Documents

Culture Documents

PESTEL Scotiabank

Uploaded by

Sridhar PantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PESTEL Scotiabank

Uploaded by

Sridhar PantCopyright:

Available Formats

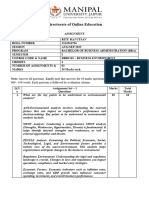

Explain in detail the company’s internal environment integration with the external environment

(PESTEL, Political, Economic, Social, Technological, Environmental, Legal)

Scotiabank is one of the leading banks in the Americas and operates in over 13 countries. Thus, it

must consider how it integrates with its external environments, ensuring smooth and uninterrupted

operation and giving it an edge over its competition.

Following the PESTLE analysis, we shall reveal how well Scotiabank understands its external factors

(focusing on Canada) and adapts to them to promote smooth and uninterrupted operations:

Political:

Scotiabank prioritizes smooth functioning and ensures that its customers have access to its services

despite how the political landscape might change, thus it follows the topmost principle of adhering

to the laws/politics of the province it operates in, whilst trying to maintain standardization of

operations.

- Political Stability: Scotiabank evaluates the political stability of the countries where it does business,

as stable political environments mitigate risks.

- Level of Corruption: Monitors corruption levels, especially in financial regulation, to ensure ethical

practices.

- Government Interference: Analyses government interference in the banking sector and seeks to

maintain autonomy.

- Legal Framework: Ensures contracts are enforceable and abide by host country legal systems.

- Trade Regulations: Navigate trade regulations and tariffs related to finance, seeking favorable terms.

- Anti-trust Laws: Complies with anti-trust laws to prevent monopolistic behavior.

- Pricing Regulations: Adheres to pricing regulations imposed by governments.

- Taxation: Manages tax rates and incentives to optimize financial performance.

- Workforce Regulations: Adheres to labour laws, minimum wage, and employee benefits.

- Industrial Safety: Complies with safety regulations in the financial sector.

- Product Labelling: Meets product labeling requirements in the banking industry.

Economic:

Wherever it works, Scotiabank is essential to enabling healthy economies. It offers nearly 90,000

people across its footprint the skills, opportunities, and training they need to develop to the best

extent possible. They put a lot of effort into giving their diversified clientele financial resources so

they can take part in and prosper in the formal economy. Their ESG department seeks to make

investments in the resiliency of local economies where they reside and operate. Because they think

that thriving communities are more likely to produce successful people, families, and enterprises,

including their own.

- Economic System: Understands the type and stability of economic systems in host countries.

- Government Intervention: Navigates government interventions in financial markets.

- Exchange Rates: Monitors exchange rates and currency stability.

- Financial Market Efficiency: Determines if local markets are suitable for capital raising.

- Infrastructure Quality: Considers the infrastructure quality in the banking sector.

- Comparative Advantages: Evaluate host countries' advantages and those of the financial sector.

- Workforce Skills: Assesses the skill level of the banking industry's workforce.

- Education Levels: Considers the education standards in the economy.

- Economic Growth: Factors in the growth rate and economic cycle.

- Discretionary Income: Analyses consumers' disposable income.

- Unemployment and Inflation: Monitors rates and adjusts strategies accordingly.

- Interest Rates: Responds to fluctuations in interest rates.

Social:

Since Scotiabank operates in a multitude of countries and is headquartered in Canada which is one of

the most diverse countries in the world, they have a strong belief and focus towards creating an

inclusive and diverse work culture, combating racism and any intercultural barriers, increasing access

to opportunities.

- Demographics: Studies population demographics and skill levels.

- Social Hierarchy: Understands social structures and power dynamics.

- Education Standards: Considers education levels and standards relevant to banking.

- Culture: Adapts marketing messages to cultural norms and gender roles.

- Entrepreneurship: Considers the society's attitude towards entrepreneurship.

- Attitudes: Responds to societal attitudes, including those related to health and the environment.

- Leisure Interests: Factors in leisure interests when designing banking services.

Technological:

Scotiabank Bank has received multiple awards for deploying up-to-date technologies to ensure a high

level of security is maintained for its customers and their accounts. In 2021 they received risk. Net’s

Technology Innovation of the Year award was recognized for its delivery of the Bank’s new risk engine

in Global Banking and markets, a system built for valuation adjustment (XVA) calculations that has

resulted in both speed and accuracy improvements for the Bank’s clients.

- Competitor Technology: Tracks technological advancements made by competitors.

- Product Impact: Evaluates how technology impacts banking product offerings.

- Cost Structure: Considers how technology affects cost structures in banking.

- Value Chain: Understands the impact on the financial sector's value chain.

- Rate of Technological Change: Adapts to the speed of technological disruption.

Environmental:

Scotiabank is aware of its responsibility to the environment and feels that immediate environmental

action is required to save the planet's future. As a major financial organization, they think that

sustained environmental protection and long-term economic growth are mutually exclusive. By

lowering our environmental impact, funding sustainable solutions, exchanging knowledge, and

advancing the global dialogue on climate change, they show our commitment to sustainable

development and the shift to a low-carbon economy.

- Environmental Regulations: Compliance with laws related to pollution and waste management.

- Recycling: Incorporates recycling practices into operations.

- Support for Renewable Energy: Responds to attitudes and incentives related to renewable energy.

Legal:

The Scotiabank is dedicated, in line with legal and regulatory duties, to providing prompt,

accurate and balanced disclosure and fair and fair access to all relevant information

relating to this Bank.

- Anti-trust and Discrimination: Ensures compliance with anti-trust and discrimination laws.

- Intellectual Property: Protects intellectual property rights.

- Consumer Protection: Adheres to consumer protection and e-commerce laws.

- Employment and Safety: Complies with employment and safety regulations.

- Data Protection: Safeguards customer data and privacy.

You might also like

- VDR G4 Manual Steinsohn PDFDocument185 pagesVDR G4 Manual Steinsohn PDFVariya Dharmesh100% (1)

- PESTLE Analysis of ONGCDocument5 pagesPESTLE Analysis of ONGCZubairKhan0% (1)

- PESTEL Analysis of Mother EarthDocument9 pagesPESTEL Analysis of Mother EarthSreyasNo ratings yet

- Probability in 40 CharactersDocument13 pagesProbability in 40 CharactersSridhar PantNo ratings yet

- Sysco's Supply Chain Management StrategiesDocument11 pagesSysco's Supply Chain Management StrategiesNeelam 123No ratings yet

- Innovation AssegnDocument5 pagesInnovation AssegnTariku GutaNo ratings yet

- International BusinessDocument25 pagesInternational BusinesssharmilajoyNo ratings yet

- Business Environment-HA 3Document3 pagesBusiness Environment-HA 3SrinivasNo ratings yet

- Marketing Environment - Class2Document41 pagesMarketing Environment - Class2Manjunath ShettigarNo ratings yet

- Business Environment Notes Bba by Sachin AroraDocument42 pagesBusiness Environment Notes Bba by Sachin AroraSimi GogoiNo ratings yet

- Social Segment-WPS OfficeDocument9 pagesSocial Segment-WPS OfficeLove KarenNo ratings yet

- LSO - Operating EnvironmentsDocument10 pagesLSO - Operating Environmentsdozza56No ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementAneeqUzZamanNo ratings yet

- MBAOL JAN 2022 SESSION STUDENT DETAILSDocument6 pagesMBAOL JAN 2022 SESSION STUDENT DETAILSLAKSHAY SHARMANo ratings yet

- U1 EstimatDocument6 pagesU1 EstimatLaeek PatelNo ratings yet

- Impact of Economic Environment on BusinessDocument6 pagesImpact of Economic Environment on BusinessMKaihnsaNo ratings yet

- Culture's effect on business and McDonalds India caseDocument2 pagesCulture's effect on business and McDonalds India caserichard jarabeNo ratings yet

- Strat MGMT NotesDocument7 pagesStrat MGMT NotesHannah GarciaNo ratings yet

- Drivers of Corporate Social ResponsibilityDocument4 pagesDrivers of Corporate Social ResponsibilityDiana Rose DalitNo ratings yet

- Pestle Analysis For Cebu AirlineDocument9 pagesPestle Analysis For Cebu AirlineKevo KarisNo ratings yet

- Navigating The Complexities of Tax LawDocument2 pagesNavigating The Complexities of Tax LawReign Dela CruzNo ratings yet

- Mini Project - On Rural Based CompanyDocument21 pagesMini Project - On Rural Based CompanyShivam JadhavNo ratings yet

- Fom 2Document95 pagesFom 2danishkbarwaee21b732No ratings yet

- Document (1)Document10 pagesDocument (1)Ishu RanaNo ratings yet

- CSR in BankingDocument4 pagesCSR in Bankingtiberiu_bacsNo ratings yet

- Chapter 3Document4 pagesChapter 3Casper VillanuevaNo ratings yet

- Business EnvironmentDocument14 pagesBusiness EnvironmentAxiiNo ratings yet

- Sustainable Value Creation and Relations Among Financial, Environmental and Social Inforamtaion/KpisDocument6 pagesSustainable Value Creation and Relations Among Financial, Environmental and Social Inforamtaion/KpisSaid Ismail SaidNo ratings yet

- bKash strategic analysisDocument8 pagesbKash strategic analysisFarhana ShUmiNo ratings yet

- Introduction To International BusinessDocument45 pagesIntroduction To International BusinessVivek AdateNo ratings yet

- Assignment - DBB1103 - BBA 1 - Set-1 and 2 - Aug-Sep. 2023Document10 pagesAssignment - DBB1103 - BBA 1 - Set-1 and 2 - Aug-Sep. 2023Rituraj UtsavNo ratings yet

- 14th Call For ProposalsDocument3 pages14th Call For ProposalsYayu RamdhaniNo ratings yet

- Strategic Marketing AssignmentDocument7 pagesStrategic Marketing AssignmentSaksham LodhaNo ratings yet

- Banking Sustainability StrategiesDocument10 pagesBanking Sustainability StrategiesPrateek GiriaNo ratings yet

- Be - Unit 1 - Introduction To BeDocument42 pagesBe - Unit 1 - Introduction To BedrashteeNo ratings yet

- Constituents of Business EnvironmentDocument20 pagesConstituents of Business EnvironmentsmartysusNo ratings yet

- Unit1 2environmental AnalysisDocument18 pagesUnit1 2environmental AnalysisyuvarajNo ratings yet

- PUBLIC FINANCIAL MANAGEMENT Intro To Public Sector Budgeting and Accounting 1 1Document72 pagesPUBLIC FINANCIAL MANAGEMENT Intro To Public Sector Budgeting and Accounting 1 1JS ManaguelodNo ratings yet

- Notes On Micro and Macro Factors Affecting International BusinessDocument3 pagesNotes On Micro and Macro Factors Affecting International BusinesskedarambikarNo ratings yet

- Business EnvironmentDocument10 pagesBusiness Environmentali afzalyNo ratings yet

- IBM_Chap 12Document4 pagesIBM_Chap 12dangvietanh63wNo ratings yet

- External Environment External Environment: An External Environment Is Composed of All The Outside Factors orDocument3 pagesExternal Environment External Environment: An External Environment Is Composed of All The Outside Factors orHimanshu DarganNo ratings yet

- ED UNIT 2Document49 pagesED UNIT 2pecmba23No ratings yet

- MMPC 016_ AssignmentDocument15 pagesMMPC 016_ Assignmentadas76333No ratings yet

- Business EnvironmentDocument66 pagesBusiness EnvironmentAGLIN ROSEBINONo ratings yet

- UNIT 2 ENvtDocument8 pagesUNIT 2 ENvtanonymous284.1.11No ratings yet

- Unit-3 - Reporting and AssessmentsDocument41 pagesUnit-3 - Reporting and AssessmentsAniket WaghNo ratings yet

- 3 - Case of SelcoDocument7 pages3 - Case of SelcoTomás RodriguesNo ratings yet

- Global business environmentDocument42 pagesGlobal business environmentkrvatsal03No ratings yet

- Micro Business EnvironmentDocument152 pagesMicro Business EnvironmentYashveer MachraNo ratings yet

- MBA 113 Quiz 1Document3 pagesMBA 113 Quiz 1Bryan BaguisaNo ratings yet

- Integratedsustainability ReportingDocument71 pagesIntegratedsustainability ReportingDane De VeraNo ratings yet

- Chapter 2. International Business EnvironmentDocument3 pagesChapter 2. International Business EnvironmentReshma RaoNo ratings yet

- Nature and Structure of Business EnvironmentDocument32 pagesNature and Structure of Business EnvironmentSahil Gandhi75% (4)

- Organizations: Their Political, Structural and Economic EnvironmentDocument21 pagesOrganizations: Their Political, Structural and Economic EnvironmentMA ValdezNo ratings yet

- Comparative Analysis of Indian Financial System (IFS) and South African Financial SystemDocument13 pagesComparative Analysis of Indian Financial System (IFS) and South African Financial Systemvansharora36691No ratings yet

- CommerceDocument6 pagesCommerceyashvigattani2005No ratings yet

- Constituents of Business EnvironmentDocument20 pagesConstituents of Business EnvironmentPraveen Kumar0% (1)

- Wa0013.Document23 pagesWa0013.Swati DubeyNo ratings yet

- Dynamics of Business Environment: Miss Priti Gera (MBA Lecturer)Document16 pagesDynamics of Business Environment: Miss Priti Gera (MBA Lecturer)Tiffany HansonNo ratings yet

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1From EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1No ratings yet

- Infrastructure Finance: The Business of Infrastructure for a Sustainable FutureFrom EverandInfrastructure Finance: The Business of Infrastructure for a Sustainable FutureRating: 5 out of 5 stars5/5 (1)

- Importance of Nonverbal CommsDocument1 pageImportance of Nonverbal CommsSridhar PantNo ratings yet

- Arithmetic ProgressionsDocument12 pagesArithmetic ProgressionsrubensNo ratings yet

- Case Study of AMULDocument11 pagesCase Study of AMULTarina Vaswani100% (5)

- Quadratic !!!Document11 pagesQuadratic !!!Sridhar PantNo ratings yet

- PathFit 1 (Lessons)Document10 pagesPathFit 1 (Lessons)Patawaran, Myka R.No ratings yet

- Classical Fields 2Document2 pagesClassical Fields 2Jonathan SanchezNo ratings yet

- Cebuano LanguageDocument15 pagesCebuano LanguageIsla PageNo ratings yet

- Format of Synopsis - Project - 1Document5 pagesFormat of Synopsis - Project - 1euforia hubNo ratings yet

- Plant Chicago 2Document4 pagesPlant Chicago 2api-321978505No ratings yet

- Neutron SourcesDocument64 pagesNeutron SourcesJenodi100% (1)

- Lecture01 PushkarDocument27 pagesLecture01 PushkarabcdNo ratings yet

- DataSheet IMA18-10BE1ZC0K 6041793 enDocument8 pagesDataSheet IMA18-10BE1ZC0K 6041793 enRuben Hernandez TrejoNo ratings yet

- DTS-00750 Mast Maintenance ManualDocument12 pagesDTS-00750 Mast Maintenance Manualsertecs polNo ratings yet

- HNM Announcement Flyer enDocument2 pagesHNM Announcement Flyer enJali SahiminNo ratings yet

- The Accidental AddictsDocument6 pagesThe Accidental AddictsnorthandsouthnzNo ratings yet

- TM T70 BrochureDocument2 pagesTM T70 BrochureNikhil GuptaNo ratings yet

- 06 Dielectrics Capacitance 2018mkDocument41 pages06 Dielectrics Capacitance 2018mkTrần ĐứcAnhNo ratings yet

- Agent Orange Dioxin Military BasesDocument4 pagesAgent Orange Dioxin Military BasesChildren Of Vietnam Veterans Health AllianceNo ratings yet

- Surge arrester protects electrical equipmentDocument25 pagesSurge arrester protects electrical equipmentSyed Ahsan Ali Sherazi100% (3)

- MNCs-consider-career-development-policyDocument2 pagesMNCs-consider-career-development-policySubhro MukherjeeNo ratings yet

- Nelson Climate Change Plan UpdateDocument37 pagesNelson Climate Change Plan UpdateBillMetcalfeNo ratings yet

- Tle 10 4quarterDocument2 pagesTle 10 4quarterCaryll BaylonNo ratings yet

- Constructivism improves a lesson on nounsDocument6 pagesConstructivism improves a lesson on nounsOlaniyi IsaacNo ratings yet

- Temenos Brochure - FormpipeDocument5 pagesTemenos Brochure - FormpipeDanial OngNo ratings yet

- Optical Fiber Communication Case Study on Material DispersionDocument5 pagesOptical Fiber Communication Case Study on Material DispersionAyush SharmaNo ratings yet

- ZiffyHealth Pitch DeckDocument32 pagesZiffyHealth Pitch DeckSanjay Kumar100% (1)

- Kidney, bladder & prostate pathology slides explainedDocument20 pagesKidney, bladder & prostate pathology slides explainedNisrina Nur AzisahNo ratings yet

- Nettoplcsim S7online Documentation en v0.9.1Document5 pagesNettoplcsim S7online Documentation en v0.9.1SyariefNo ratings yet

- 2020.07.31 Marchese Declaration With ExhibitsDocument103 pages2020.07.31 Marchese Declaration With Exhibitsheather valenzuelaNo ratings yet

- 02 1 Cohen Sutherland PDFDocument3 pages02 1 Cohen Sutherland PDFSarra AnitaNo ratings yet

- The Beggar's Opera by Gay, John, 1685-1732Document50 pagesThe Beggar's Opera by Gay, John, 1685-1732Gutenberg.orgNo ratings yet

- Samsung RAM Product Guide Feb 11Document24 pagesSamsung RAM Product Guide Feb 11Javed KhanNo ratings yet

- Engagement LetterDocument1 pageEngagement LetterCrystal Jenn Balaba100% (1)