Professional Documents

Culture Documents

M.3.1 Noncurrent Asset Held For Sale

Uploaded by

Melita CarriedoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M.3.1 Noncurrent Asset Held For Sale

Uploaded by

Melita CarriedoCopyright:

Available Formats

COLLEGE OF COMMERCE

MODULE 3 PACKET

AE 17 - INTERMEDIATE ACCOUNTING 3

MODULE 3.1 NONCURRENT ASSET HELD FOR SALE

Welcome to Module 3.1

In this module, we will discuss the nature, recognition, classification, measurement and presentation of

noncurrent asset held for sale. You are also expected to differentiate the ordinary noncurrent asset from

the noncurrent asset held for sale. During the discussion, you will be required to actively participate by

illustrating the transactions and the corresponding journal entries affecting the recognition as well as the

cessation of recognition of noncurrent asset held for sale.

When you see this symbol that is shown across the printed discussion, this represents an important

point for discussion or appreciation/appraisal to be rendered by the student. At the end of this module,

you will be answering multiple choice questions and straight problems focusing on the requirements to be

disclosed in the notes to the financial statements.

CONSULTATION HOURS:

Virtual time: During your class schedule

Phone or Messenger: Mondays to Fridays (5 PM to 7 PM)

LEARNING OUTCOMES:

By the end of this module, the students will be able to:

1. Discuss the nature, recognition, conditions for the classification, measurement and presentation of

noncurrent asset held for sale.

2. Differentiate the ordinary noncurrent asset from noncurrent asset held for sale and the reason for

separate presentation

3. Understand the effect of noncurrent asset held for sale in the financial position of an entity

4. Analyze how the presentation of noncurrent asset impacts the statement of financial position.

ASSESSMENT PLAN:

1. Graded recitation through interactive participation in a question and answer format during discussion

2. Problem solving games (points awarded to the first 5 students who can submit the correct answer

and solution)

3. Individual Submission and discussion of homework or learning tasks through research online

4. Summative examinations in multiple choice question format

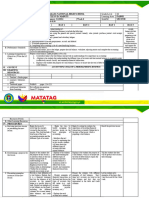

LEARNING PLAN/SCHEDULE OF ACTIVITIES

STRATEGIES/DESCRIPTION/TOPICS/ TIME TO

ACTIVITIES

COURSE CONTENT COMPLETE

A. Assigned Reading 1. Read the definition and the nature of 0.5 hours

Read noncurrent asset and noncurrent asset held for

1. Conceptual sale. 2.0 hours

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 1 of 15

COLLEGE OF COMMERCE

Framework on 2. Discuss your understanding of the transactions

recognition of assets relating to noncurrent asset held for sale.

2. Basic Accounting on 3. Illustrate the journal entries required in

the chapter relating accounting for noncurrent asset held for sale

to assets 4. Analyze the impact on the statement of

3. Intermediate financial position of a separate presentation for

Accounting on the noncurrent asset held for sale from the ordinary

recognition, noncurrent asset.

classification,

measurement and

presentation of

noncurrent asset and

noncurrent asset

held for sale

B. Lecture discussion 1. Define noncurrent asset classified as held for 0.5 hours

1. Read Chapter 8 of IA3 sale 4.0 hours

2. Watch Video 2. Distinguish between ordinary noncurrent asset

and noncurrent asset held for sale

3. Interactive participation 1.0 hour

3. Discuss the accounting i.e. recognition,

thru Q&A classification and measurement for noncurrent 2.0 hours

4. Graded recitation asset held for sale

4. Illustrate the journal entries in recording the 1.5 hours

transactions relating to noncurrent asset held

for sale.

5. Distinction of abandoned noncurrent asset from

temporarily abandoned noncurrent asset

6. Description of abandoned discontinued

operation

7. Explain the presentation of noncurrent asset

held for sale in the financial statements.

8. Define of discontinued operation

9. Illustrate the presentation of discontinued

operation in the financial statements

C. Synthesize the main points 1. Teacher summarizes the main points 1.5 hours

Graded recitation discussed.

2. Students will be required to recite by sharing 1.0 hour

their understanding/learnings specifically

pointing out the important aspects that have

just been discussed regarding the journal

entries to record the different phases affecting

the noncurrent asset held for sale.

3. This will validate the achievement of learning

outcomes.

D. Assignment 1. Prepare a learning guide to illustrate the 2.0 hours

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 2 of 15

COLLEGE OF COMMERCE

different phases and the corresponding journal

entries affecting the noncurrent asset held for

sale.

2. Answer all questions and solve all problems

from the textbook.

E. Summative Quiz 1. Take multiple question quiz for (to be 1 hour

announced)

PRINTED REFERENCES

1. Valix, C. T., Peralta, J. F. & Valix, C. A. M. (2022). Conceptual framework and accounting

standards. 2022 edition. Manila : GIC Enterprises & Co., Inc.

2. Cabrera, M.E.B, Ocampo, R. R. & Cabrera, G. A (2018). Conceptual framework and accounting

standards. 2018-2019 edition. Manila : GIC Enterprises & Co., Inc.

3. Valix, C. T., Peralta, J. F. & Valix, C. A. M. (2021). Financial Accounting Volume 1 2021. Manila :

GIC Enterprises & Co., Inc..

4. Valix, C. T., Peralta, J. F. & Valix, C. A. M. (2021). Financial Accounting Volume 2 2021. Manila :

GIC Enterprises & Co., Inc..

5. Valix, C. T., Peralta, J. F. & Valix, C. A. M. (2021). Financial Accounting Volume 2 2021. Manila :

GIC Enterprises & Co., Inc..

6. Valix, M. E. B, Cabrera, G. A. & Cabrera, B. A. (2022). Financial Accounting and Reporting

Fundamentals 2022 Edition. Manila : GIC Enterprises & Co., Inc..

7. Millan, Z. V (2022). Intermediate Accounting 3. 2022 Edition. Baguio City: Bandolin Enterprise

Web and Other Learning Resources

1. Overall Review of Financial Statements:

Mahutova, S., 2020. IAS 1 Presentation of Financial Statements: Summary. [online] Youtube.com.

Available at: <https://www.youtube.com/watch?v=Q1m76iMIepU> [Accessed 16 August 2022].

2. Accounting Changes:

Mahutova, S., 2022. IAS 8 Accounting Policies, Changes in Accounting Estimates, Errors. [image]

Available at: <https://www.youtube.com/watch?v=0tMHK8QeqTU&list=PLf-

MINbacZi0Du5nHaJWKKvlFCPp7D7NL&index=7> [Accessed 16 August 2022].

3. Provisions & Contingencies:

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 3 of 15

COLLEGE OF COMMERCE

Mahutova, S., 2022. IAS 37 Provisions, Contingent Liabilities and Contingent Assets - summary.

[image] Available at: <https://www.youtube.com/watch?v=cM9YQUegKUs&list=PLf-

MINbacZi0Du5nHaJWKKvlFCPp7D7NL&index=8> [Accessed 16 August 2022].

4. Statement of Cash Flows:

Mahutova, S., 2022. IAS 7 Statement of Cash Flows: Summary. [image] Available at:

<https://www.youtube.com/watch?v=AXZmlI7XUj0&list=PLf-

MINbacZi0Du5nHaJWKKvlFCPp7D7NL&index=14> [Accessed 16 August 2022].

5. Financial Reporting in Hyperinflationary Economies:

Mahutova, S., 2022. IAS 29 Financial Reporting in Hyperinflationary Economies: Summary.

[image] Available at: <https://www.youtube.com/watch?v=55luVuTYLY8&list=PLf-

MINbacZi0Du5nHaJWKKvlFCPp7D7NL&index=19> [Accessed 16 August 2022].

COURSE CONTENT DISCUSSION

3.1.1 NONCURRENT ASSET HELD FOR SALE

✓ What is a noncurrent asset ?

A noncurrent asset is an asset that does not meet the definition of a current asset.

❖ The noncurrent asset may be an individual asset, like land and building, or a disposal

group.

❖ What is a disposal group?

• It is a group of assets to be disposed of, by sale or otherwise, together as a group in a

single transaction, and liabilities directly associated with those assets that will be

transferred in the transaction.

✓ What is a noncurrent asset held for sale?

PFRS 5 paragraph 6 provides that a noncurrent asset or disposal group is classified as held for

sale if the carrying amount will be recovered PRINCIPALLY through a SALE transaction

rather than through continuing use.

a. What does this mean?

1. The entity does NOT intend to use the asset for its business operations; AND

2. The assets are intended to be sold to recover the carrying amount.

What conditions should be present for a noncurrent asset to be classified as held for sale?

1. The asset or disposal group is available for immediate sale in the present condition

subject only to terms that are usual and customary for sale of such assets for disposal group.

a. The current condition of the asset should be adequate to be effectively “sold as seen” or

“as is, where is.”

2. The sale must be highly probable.

b. When can a sale be considered as highly probable?

• When the following conditions must be met:

1. Management must be committed to a plan to sell the asset or disposal group

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 4 of 15

COLLEGE OF COMMERCE

2. An active program to locate a buyer and complete the plan must have been

initiated

3. The sale is expected to be completed sale within one year from the date of

classification as held for sale

o An extension of the one-year period does not preclude the asset or disposal

group from being classified as held for sale if the delay is caused by events or

circumstances beyond the entity's control.

4. The asset or disposal group must be actively marketed for sale at a sale price

that is reasonable in relation to the fair value.

5. Actions required to complete the plan indicate that it is unlikely that the plan will

be significantly changed or withdrawn.

How is asset held for sale measured for accounting purposes?

❖ PFRS 5 paragraph 15 provides that an entity shall measure a noncurrent asset or disposal

group classified as held for sale at the LOWER of carrying amount or fair value less cost

of disposal.

• What is a carrying amount ?

o It is the transaction price at the time of the acquisition of the noncurrent asset that is

held for sale.

• What is a fair value ?

o It is the current valuation at which the noncurrent asset can be traded in a market for

such kind or type of asset where there is a willing seller and a willing buyer.

o For example, an appraisal value determined by an independent appraiser may be

used to establish the fair value of a noncurrent asset held for sale.

Will the noncurrent asset held for sale be depreciated just like the ordinary noncurrent assets?

❖ Paragraph 25 provides that a noncurrent asset classified as held for sale shall not be

depreciated.

If noncurrent asset held for sale will not be depreciated, being a noncurrent asset, how will the

amount be measured and presented in the statement of financial position?

❖ The noncurrent asset held for sale shall be subjected to

a. WRITEDOWN to FAIR VALUE LESS COST OF DISPOSAL.

• What is the treatment for a writedown?

1. If the fair value less cost of disposal is lower than carrying amount of the asset or

disposal group, the write down to fair value less cost of disposal is treated as an

impairment loss.

o An impairment loss is recognized because the amount reflected in the

statement of financial position (carrying amount) is higher or overstated

than what is actually realizable if the noncurrent asset is sold at the time of

valuation or writedown.

2. If the noncurrent asset is a disposal group, the impairment loss is apportioned

across the asset based on carrying amount after writing off any goodwill first.

b. SUBSEQUENT INCREASE IN FAIR VALUE

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 5 of 15

COLLEGE OF COMMERCE

• If subsequently there is an increase in the fair value less cost of disposal, PFRS 5

paragraph 21 provides that an entity shall recognize a gain but not in excess of any

impairment loss previously recognized.

Illustration 1

On January 1 2019 an entity acquired an equipment at a cost of 5,000,000 to be used. The

equipment has an estimated useful life of 10 years in a residual value of 500,000

On January 1 2022, the equipment was classified as held for sale. Search date, less was

at one 1,900,000. On June 30 2022 the equipment was for sold for 1,500,000

1. To remove the equipment from property, plant and equipment and classify it as

held for sale on January 1 2022

Equipment held for sale 3,650,000

Accumulated depreciation 1,350,000

Equipment 5,000,000

Cost 5,000,000

Accumulated depreciation 1,350,000

Carrying amount - January 1, 2022 3,650,000

2. To measure the equipment held for sale at a lower of carrying amount and fair

value less cost of disposal on January 1, 2022

Impairment loss 1,750,000

Equipment held for sale 1,750,000

Carrying amount 3,650,000

Fair value less cost of disposal 1,900,000

Impairment loss 1,750,000

3. To record the sale of the equipment on June 30 2022

Cash 1,500,000

Loss on sale of equipment 400,000

Equipment held for sale 1,900,000

Note that the equipment held for sale is no longer depreciated from January 1 to

June 30 2022

Illustration 2

On January1, 2019, an entity acquired an equipment at the cost of 4,000,000 to be used

in the ordinary course of business. The equipment has an estimated useful life of 5 years

and has no residual value.

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 6 of 15

COLLEGE OF COMMERCE

On December 31, 2020, the equipment was classified as equipment held for sale. On such

date, the fair value less cost of disposal was 3,000,000. On July 1, 2021 the equipment

was sold for 2,900,000.

1. To remove the equipment from property, plant and equipment and classify it as held

for sale on December 31 2020.

Equipment held for sale 3,650,000

Accumulated depreciation 1,350,000

Equipment 5,000,000

Cost

Accumulated depreciation

Carrying amount - January 1, 2022

2. To measure the equipment held for sale at the lower of carrying amount and fair value

less cost of disposal on December 31, 2020.

No entry is required because the equipment held for sale is measured at the carrying

amount of 2,400,000 which is lower than fair value less cost of disposal.

Fair value less cost of disposal

Carrying amount

Expected gain

The gain is not recognized at this point because any game should not be anticipated at

the point of classification as held for sale.

3. To record the sale of equipment on July 1, 2021

Cash

Equipment held for sale

Gain on sale of equipment

c. REVALUED ASSET CLASSIFIED AS HELD FOR SALE

• PFRS 5 paragraph 18 provides the entity adopts the revaluation model for the

measurement of assets.

o Any asset classified as held for sale should be revalued to fair value

immediately prior to the classification as held for sale.

• What is the accounting treatment for the effects of the revaluation of assets?

1. If the fair value at the classification date less the carrying amount at that date

results in an excess of the revaluation amount, the excess shall be treated as

additional revaluation surplus.

Revaluation amount xx

Less: Fair value at classification date xx

Revaluation Surplus xx

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 7 of 15

COLLEGE OF COMMERCE

2. Any cost of disposal at classification date should be recognized as impairment

loss for the period and deducted from the asset held for sale.

3. At subsequent year end, the revalued asset classified as held for sale shall be

measured at the lower of carrying amount and fair value less cost of disposal.

Illustration 3

On January 1, 2019 an entity acquired land at the cost of 2,500,000.

The land is measured at fair value in accordance with the revaluation model.

On December 31, 2019 the fair value of the land was 3,000,000.

On June 30, 2020, the land was classified as held for sale.

On such date, the fair value was estimated at 3,500,000 and the cost of disposal at

100,000.

On December 31, 2020, the land was sold for 3,350,000.

Journal entries

1. To record the acquisition of land on January 1, 2019

Land 2,500,000

Cash 2,500,000

2. To revalue the land at fair value on December 31, 2019

Land 500,000

Revaluation surplus 500,000

Fair value - December 31, 2019 3,000,000

Cost 2,500,000

Revaluation surplus 500,000

3. To revalue the land at fair value on the date of classification as held for sale on June

30, 2020

Land 500,000

Revaluation surplus 500,000

Fair value - June 30, 2020 3,500,000

Carrying amount - December 31, 2019 3,000,000

Additional revaluation surplus 500,000

4. To remove the land from property, plant and equipment and classify it as held for sale

on June 30, 2020

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 8 of 15

COLLEGE OF COMMERCE

Land held for sale 3,500,000

Land 3,500,000

5. To recognize the cost of disposal as impairment loss on June 30, 2020

Impairment loss 100,000

Land held for sale 100,000

6. To record the sale of land on December 31, 2020

Cash 3,350,000

Loss on sale of land 50,000

Land held for sale 3,400,000

7. To transfer the revaluation surplus to retained earnings

Revaluation surplus 1,000,000

Retained earnings 1,000,000

What is an abandoned noncurrent asset?

❖ PFRS 5 paragraph 13 provides that an entity shall not classify as held for sale a non-current

asset or disposal group that is to be abandoned.

❖ What is the abandoned noncurrent asset cannot be classified as asset held for sale?

• This is because the carrying amount will be recovered principally through continuing

use or the noncurrent asset is to be used until the end of its economic life.

❖ How should a temporarily abandoned noncurrent asset be treated?

• PFRS five paragraph 14 provides that an entity shall not account for a noncurrent asset

that has been temporarily taken out of use as if it had been abandoned.

o For example, an entity ceases to use a manufacturing plant because demand for its

products has declined.

o However, the plant is maintained in workable condition and is expected that it will be

brought back into use if demand picks up.

o In this case, the plant is not regarded as abandoned.

❖ Is a change in classification from held for sale to noncurrent asset or disposal group

permitted?

• This situation usually happens when there is a decision not to sell the non-current assets

anymore, thus, the criteria for being classified as held for sale may no longer be met.

• FRS 5 paragraph 27 provides that the entity shall measure the noncurrent asset that

ceases to be classified as held for sale at the lower of:

a. Carrying amount before the asset was classified as held for sale adjusted for any

depreciation or amortization that would have been recognized if the asset had not

been classified as held for sale

b. Recoverable amount at the date of the subsequent decision not to sell

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 9 of 15

COLLEGE OF COMMERCE

Illustration

An entity purchased equipment for 5,000,000 on January 1, 2019 with a useful life of 10

years and no residual value.

On December 31, 2020 the entity classified the asset as held for sale. The fair value of the

equipment on December 31, 2020 is 3,300,000 and the cost of disposal is 100,000.

On December 31, 2021 the fair value of the equipment is 3,800,000 and the cost of

disposal is 200,000.

On the same date, the entity believed that the criteria for classification as held for sale can

no longer be met. Accordingly, the entity decided not to sell the asset but to continue to

use it.

1. To record the purchase of equipment on January 1, 2019

Equipment 5,000,000

Cash 5,000,000

2. To record depreciation for 2019

Depreciation (5,000,000 / 10 years) 500,000

Accumulated depreciation 500,000

3. To record depreciation for 2020

Depreciation (5,000,000 / 10 years) 500,000

Accumulated depreciation 500,000

4. To remove the asset from property, plant and equipment and classify it as held for

sale on December 31, 2020

Equipment held for sale 4,000,000

Accumulated Depreciation 1,000,000

Equipment 5,000,000

5. To measure the equipment held for sale at the lower of fair value less cost of disposal

and carrying amount on December 31, 2020

Impairment loss 800,000

Equipment held for sale 800,000

Carrying amount 4,000,000

Fair value less cost of disposal (3,300,000 – 100,000) 3,200,000

Impairment Loss 800,000

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 10 of 15

COLLEGE OF COMMERCE

6. To measure the equipment that ceases as held for sale at the lower of carrying amount

adjusted for depreciation that would have been recognized had the equipment not

been classified as held for sale and the recoverable amount on December 31, 2021

Equipment held for sale 300,000

Gain on reclassification 300,000

Carrying amount - December 31, 2020 4,000,000

Depreciation that would have been recognized in 2021 (500,000)

Carrying amount - December 31, 2021 3,500,000

Recoverable amount (3,800,000 – 200,000) 3,600,000

Measurement of equipment - lower 3,500,000

Carrying amount per book - December 31, 2020 3,200,000

Gain on reclassification 300,000

Notes:

o On December 31, 2021, the equipment is measured at 3,500,000 because this is

lower than the fair value less cost of disposal of 3,600,000

o PFRS 5 paragraph 28 states that any adjustment to the carrying amount of a non-

current asset that ceases to be classified as held for sale should be included in profit

or loss.

o However, if the noncurrent asset is measured using the revaluation model before it

was classified as held for sale, any adjustment shall be treated as a revaluation

increase or decrease.

7. To reclassify the asset as property, plant and equipment on December 31, 2021

Equipment 3,500,000

Equipment held for sale 3,500,000

8. To record depreciation for 2022

Depreciation 500,000

Accumulated depreciation (3,500,000 / 7 years remaining) 500,000

How is asset classified as held for sale presented in the statement of financial position?

❖ PFRS 5 paragraph 3 provides that assets classified as non-current in accordance with PAS 1

shall not be classified as current assets until they meet the criteria to be classified as held for

sale.

o Simply stated, a noncurrent asset that is already classified as held for sale shall be

presented separately as current asset.

o PFRS 5 paragraph 38 provides that if the noncurrent asset is a disposable group

classified as held for sale, the assets and liabilities of the group shall be presented

separately and cannot be offset as a single amount.

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 11 of 15

COLLEGE OF COMMERCE

o In other words, the assets of the disposal group shall be described as “noncurrent assets

classified as held for sale” presented separately as a single amount under current

assets.

o The liabilities of the disposal group shall be described as “liabilities directly associated

with noncurrent assets classified as held for sale” presented separately as a single

amount under current liabilities.

What is a change in method of disposal?

❖ The IASB amended IFRS 52 clarify the accounting treatment when an entity reclassifies an

asset or disposal group from “held for sale” to “held for distribution to owners” or vice versa

without any time lag.

1. The change in classification is considered a continuation of the original plan of disposal.

2. The entity shall continue to apply the “held for sale” or “held for distribution” accounting.

• In other words, the asset shall be measured at the lower between carrying amount and

fair value less cost of disposal or fair value less cost to distribute.

3. At the time of reclassification, the entity shall recognize any impairment loss or subsequent

increase in fair value less cost of disposal or distribution.

4. The change in classification does not, in, expand in which a sale has to be completed.

3.1.2 DISCONTINUED OPERATION

✓ What is a noncurrent asset ?

A noncurrent asset is an asset that does not meet the definition of a current asset.

Discontinued operations

Under appendix a of pf rs5 a discontinued operation is defined as a component of an entity that either

has been disposed of or is classified as held for sale and

• represents a separate major line of business or geographical area of operations;

• is a part of a single coordinated plan to dispose of a separate major line of business or

geographical area of operations;

• exclusively with a view to resale.

component classified as held for sale

the discontinued operation is accounted for as a “ disposal group classified as held for sale.”

the component of an entity must be available for immediate sale in the present condition and the sale

must be highly probable.

timing of reporting

a component of an entity is classified as discontinued operation at the date:

when the entity has actually disposed of the operation

when the operation meets the criteria to be classified as held for sale

pf rs5 paragraph 12 prohibits the retroactive classification as a discontinued operation when the

discontinued criteria are met after the end of reporting period

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 12 of 15

COLLEGE OF COMMERCE

Stated otherwise, if the discontinued criteria are met after the end of reporting period, an entity shall not

classify the discontinued operation as held for sale in the current financial statements.

component of an entity

A component of an entity maybe a subsidiary, a major line of business or geographical segments whose

operations and cash flows can be clearly distinguished, operationally and for financial reporting

purposes, from the rest of the entity.

the component can be clearly distinguished operationally and for financial reporting purposes if the

assets and the liabilities and the revenue and expenses are directly attributable to the component.

Assets, liabilities, income and expense are directly attributable to the component if they would be

eliminated when component is disposed of.

accordingly, a discontinued operation occurs when the operations and cash flows of the component has

been or will be eliminated from the ongoing operations of the entity and the entity will have no significant

continuing involvement in the component after disposal

examples of discontinued operation

Selling by a diversified entity of a major division that represents the entities only activities in the

electronics industry

selling by a meat packing entity of controlling interest in a furniture entity

all other operations of the entity are in the meatpacking business

selling by an entity of all its radio stations

the entity's remaining activities are television stations and the publishing house.

a conglomerate is engaged in commodity business, real estate, manufacturing and construction

business

selling of any of the four businesses is a discontinued operations

examples which are not discontinued operation

phasing out of product line within a product group

shifting of production or marketing activities for a particular line of business from one location to another

closing of a facility, fact to or saving

Income statement presentation

Pf rs5 paragraph 33 provides that an entity shall disclose a single amount comprising the total of post tax

profit or loss of the discontinued operation and the post tax gain or loss recognized on the measurement

to fair value less to cost of disposal or on the disposal of the assets or disposal group continuing the

discontinued operation

simply stated, the income or loss from discontinued operation, net of tax shall be presented as a single

amount in the income statement below the income from continuing operations

included in discontinued operation

The amount of revenue, expense and income or loss attributable to the discontinued operation during

the current period and the related income tax

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 13 of 15

COLLEGE OF COMMERCE

an impairment loss is recognized when the fair value less cost of disposal of the discontinued operation

is lower than the carrying amount of the net assets

if the fair value less the cost of disposal is higher than the carrying amount, the expected gain

is not recognized.

any gain or loss from the actual disposal of the assets and settlement of the liabilities of a discontinued

operation is recognized on the date of sale or the date of settlement

the termination costs of employees and other costs which are directly incurred as a result of the

discontinuance.

presentation and statement of financial position

Pf rs5 paragraph 38 provides that an entity shall also present separately on the face of the statement of

financial position the following information:

assets of the component held for sale separately from all other assets

assets of the component held for sale are measured at the lower of fair value less to cost of disposal and

their carrying amount

liabilities of the component separately from all other liabilities

non depreciation - non current assets of the component held for sale shall not be depreciated

pf rs5 paragraph 3 provides that the assets of the component shall be presented as a single amount

under non current assets and the liabilities of the component shall be presented as a single amount

under current liabilities

the assets and liabilities of the component cannot be offset against the other

Pf rs5 paragraph 40 further provides that if a disposal group is classified as held for sale in the current

year, an entity shall not reclassify or re-present the asset and liabilities off the disposal group for the prior

period to reflect the ”held for sale” classification in the statement of financial position as of the end of the

current reporting period.

in other words the presentation of the assets and liabilities of the disposal group in the prior period is not

changed.

cash flow presentation

Psrs five paragraph 33 provides that the net cash flows attributable to the operating, in and financing of a

discontinued operation operation shall be separately presented in the statement of cash flows or

disclosed in the notes

Illustration

.Zeta company has two segments, A and B. on july 1 2019 the board of directors of the Zeta decided to

dispose off segment B, an apparel division.

on october 1 2019, Zeta Company signed a contract to sell segment B but the sale is expected to be

completed by january 31 2018.

on december 31 2019, the carrying amount of the assets of segment B was 3,000,000 and the carrying

amount of the liabilities was 1,800,000.

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 14 of 15

COLLEGE OF COMMERCE

the fair value less cost of disposal of segment B was 1,000,000.

the sale contract required Zeta Company to terminate certain employees of segment B.

the expected termination cost is 150,000 to be paid on june 30 2020.

the accounting records of Zeta Company showed the following information for 2019:

Segment A Segment B

Sales 5,000,000 3,000,000

cost of goods sold 2,500,000 1,400,000

Expenses 1,000,000 500,000

income tax 480,000 240,000

Presentation

The income statement of Zeta Company For the year ended december 31, 2019 will appear as follows:

Zeta Company

Income statement

Year ended december 31, 2019

Sales 5,000,000

cost of sales (2,500,000)

gross income 2,500,000

Expenses (1,000,000)

income before tax 1,500,000

income tax expense 480,000

income from continuing operations 1,020,000

income from discontinued operations, net 510,000

net income 1,530,000

Disclosure

The notes to financial statements should include the following disclosure with respect to the discontinued

operation.

Sales - segment B 3,000,000

cost of goods sold (1,400,000)

gross income 1,600,000

Expenses (500,000)

impairment loss (200,000)

employee termination costs (150,000)

income tax (240,000)

income from discontinued operations 510,000

fair value less cost of disposal of segment B 1,000,000

carrying amount of net assets - segment B (1,200,000)

impairment loss (200,000)

2023-2024 Module Packets for AE 17 (Intermediate Accounting III) | College of Commerce |

University of San Agustin, Iloilo City, 5000, Philippines Page 15 of 15

You might also like

- Module 5 Packet: College OF CommerceDocument16 pagesModule 5 Packet: College OF CommerceCJ GranadaNo ratings yet

- M.2.1 Notes To Financial Statements AE 17 Intermediate Accounting 3Document14 pagesM.2.1 Notes To Financial Statements AE 17 Intermediate Accounting 3Melita CarriedoNo ratings yet

- 3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3Document14 pages3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3CJ Granada100% (1)

- Module 4 Packet: College OF CommerceDocument18 pagesModule 4 Packet: College OF CommerceCJ GranadaNo ratings yet

- M.2.2 Statement of Comprehensive Income AE 17 Intermediate Accounting 3-1-1Document19 pagesM.2.2 Statement of Comprehensive Income AE 17 Intermediate Accounting 3-1-1Melita CarriedoNo ratings yet

- Module 4 Packet: College of CommerceDocument19 pagesModule 4 Packet: College of CommerceRonel CastillonNo ratings yet

- Module 2 Packet: College OF CommerceDocument22 pagesModule 2 Packet: College OF CommerceCJ Granada100% (1)

- Module 7 Packet: College OF CommerceDocument13 pagesModule 7 Packet: College OF CommerceCJ GranadaNo ratings yet

- Module 1 Packet: College OF CommerceDocument14 pagesModule 1 Packet: College OF CommerceCJ GranadaNo ratings yet

- Toaz - Info Ae 17 m8 Cash Amp Accrual Basis PRDocument15 pagesToaz - Info Ae 17 m8 Cash Amp Accrual Basis PRloyd smithNo ratings yet

- M.3.2 Accounting ChangesDocument18 pagesM.3.2 Accounting ChangesMelita CarriedoNo ratings yet

- Module Book-Financial AccountingDocument161 pagesModule Book-Financial AccountingJay LimNo ratings yet

- Teaching Guide: Northern Mindanao Colleges, IncDocument5 pagesTeaching Guide: Northern Mindanao Colleges, IncYara King-PhrNo ratings yet

- University Mission Statement: Fundamentals of Accountancy, Business & Management 2 Abm - Fabm2Document8 pagesUniversity Mission Statement: Fundamentals of Accountancy, Business & Management 2 Abm - Fabm2kieNo ratings yet

- Financial Reporting and AnalysisDocument4 pagesFinancial Reporting and Analysisargie alccoberNo ratings yet

- Module 6 Packet: College OF CommerceDocument18 pagesModule 6 Packet: College OF CommerceCJ GranadaNo ratings yet

- Advanced Accounting 1Document4 pagesAdvanced Accounting 1Ronn CaiNo ratings yet

- DLL-FABM2-ANALYSIS AND INTERPRETATION OF FINANCIAL ANALYSIS W2 LiquidityDocument4 pagesDLL-FABM2-ANALYSIS AND INTERPRETATION OF FINANCIAL ANALYSIS W2 LiquidityArianne Kay Javier-WabanNo ratings yet

- SYLLABUS Financial Accounting and ReportingDocument9 pagesSYLLABUS Financial Accounting and ReportingChristian De GuzmanNo ratings yet

- Fa IiDocument3 pagesFa Iiwudnehkassahun97No ratings yet

- Budget of Work EntrepDocument5 pagesBudget of Work EntrepHannah Joy LontayaoNo ratings yet

- Tomas Del Rosario College: Syllabus in Management 11Document5 pagesTomas Del Rosario College: Syllabus in Management 11vaneknekNo ratings yet

- Republic of The Philippines Department of Education Region II Schools Division Office - Cagayan Semi Detailed Lesson Plan - Senior High School 11/12Document8 pagesRepublic of The Philippines Department of Education Region II Schools Division Office - Cagayan Semi Detailed Lesson Plan - Senior High School 11/12Eleine Taroma AlvarezNo ratings yet

- Sample Obe Syllabus - Intermediate Acctg 3Document9 pagesSample Obe Syllabus - Intermediate Acctg 3arlynajero.ckcNo ratings yet

- Act 142 Course Outline Course Title: Auditing and Assurance: Concepts and Applications 1Document4 pagesAct 142 Course Outline Course Title: Auditing and Assurance: Concepts and Applications 1Cleofe Jane PatnubayNo ratings yet

- Fabm1, Q2 WK6Document8 pagesFabm1, Q2 WK6Evelyn Dionisio MabutiNo ratings yet

- Business Studies Note JS3 Term1Document47 pagesBusiness Studies Note JS3 Term1Eniola AkinpelumiNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 3 QuarterDocument4 pagesFundamentals of Accountancy Business and Management 1 11 3 QuarterMarjealyn Portugal100% (2)

- Eastern Mindanao College of TechnologyDocument2 pagesEastern Mindanao College of TechnologyFrancis Cyril AlsonadoNo ratings yet

- ACCT202 Accounting For Business CombinationsDocument8 pagesACCT202 Accounting For Business CombinationsMiles SantosNo ratings yet

- 2023 Learning Plan FinManDocument2 pages2023 Learning Plan FinManElizabeth Perey Dimapilis-TejoNo ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- ELE UFR Course PlanDocument9 pagesELE UFR Course PlanJaimellNo ratings yet

- Grades 1 To 12 Daily Lesson Log: I. ObjectivesDocument5 pagesGrades 1 To 12 Daily Lesson Log: I. Objectiveszettevasquez8No ratings yet

- Form4 Term 2 Sow - PoaDocument5 pagesForm4 Term 2 Sow - Poapratibha jaggan martinNo ratings yet

- Syll - Basic FinanceDocument5 pagesSyll - Basic FinancevaneknekNo ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For CompaniesDocument4 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Companiesbhumilimbadiya09_216No ratings yet

- Sample Obe Syllabus - FarDocument9 pagesSample Obe Syllabus - FarAmie Jane Miranda100% (1)

- Lp-Fabm1 - Feb 28Document7 pagesLp-Fabm1 - Feb 28Roselyn GabonNo ratings yet

- S1 AfacrDocument3 pagesS1 Afacrmudassar saeedNo ratings yet

- DLL AbmDocument3 pagesDLL AbmMichelle Vinoray PascualNo ratings yet

- Fsa 2021-23 PGDMDocument9 pagesFsa 2021-23 PGDMShaz BhuwanNo ratings yet

- Las Q1 Fabm 2Document20 pagesLas Q1 Fabm 2jeromemallorca10No ratings yet

- Course Outllin MA English Final - Docx2021Document3 pagesCourse Outllin MA English Final - Docx2021islam hamdyNo ratings yet

- Course OutlineDocument7 pagesCourse OutlineBernadette VelasquezNo ratings yet

- Chapter 2 July 15-19Document3 pagesChapter 2 July 15-19Francesnova B. Dela PeñaNo ratings yet

- CHAPTER 2 July 8-12Document4 pagesCHAPTER 2 July 8-12Francesnova B. Dela PeñaNo ratings yet

- Sample Obe Syllabus - Fundamentals of Abm 1Document8 pagesSample Obe Syllabus - Fundamentals of Abm 1Amie Jane MirandaNo ratings yet

- INS3001 - IFRS Financial Accounting 1Document6 pagesINS3001 - IFRS Financial Accounting 1JF FNo ratings yet

- FAR 3 Intermediate Accounting I SyllabusDocument8 pagesFAR 3 Intermediate Accounting I SyllabusABMAYALADANO ,ErvinNo ratings yet

- FORE School of Management Course Outline & Session PlanDocument4 pagesFORE School of Management Course Outline & Session PlanAru RanjanNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument11 pagesConceptual Framework and Accounting Standard SyllabusAnas Aloyodan60% (5)

- Cot 2Document6 pagesCot 2anamayamigoNo ratings yet

- Introduction To Accounting: Universidad de Sta. Isabel Basic Education Department - Senior High School SY 2021 - 2022Document6 pagesIntroduction To Accounting: Universidad de Sta. Isabel Basic Education Department - Senior High School SY 2021 - 2022Mary rose AbayNo ratings yet

- DLL - Abm July 31 - Aug 4Document3 pagesDLL - Abm July 31 - Aug 4Michelle Vinoray Pascual100% (2)

- FABM DLP Nov5Document3 pagesFABM DLP Nov5Mi Cha EL100% (1)

- Initial Public Offerings (IPO): An International Perspective of IPOsFrom EverandInitial Public Offerings (IPO): An International Perspective of IPOsRating: 5 out of 5 stars5/5 (2)

- International Business Control, Reporting and Corporate Governance: Global business best practice across cultures, countries and organisationsFrom EverandInternational Business Control, Reporting and Corporate Governance: Global business best practice across cultures, countries and organisationsRating: 5 out of 5 stars5/5 (2)

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- 3 Years Financial ProjectionDocument11 pages3 Years Financial Projectionoerderm5629No ratings yet

- Assets, Liabilities, Capital, Revenue, and Expenses of The Financial StatementsDocument30 pagesAssets, Liabilities, Capital, Revenue, and Expenses of The Financial StatementsJewell RoseNo ratings yet

- Northgate AR13 WebDocument50 pagesNorthgate AR13 WebJohn HenryNo ratings yet

- Assignment 3Document7 pagesAssignment 3Dat DoanNo ratings yet

- 02.MACRS Depreciation Rate CalculationDocument5 pages02.MACRS Depreciation Rate CalculationDexter LarobisNo ratings yet

- Accounting For Business: Chapter 4: The Statement of Cash FlowsDocument40 pagesAccounting For Business: Chapter 4: The Statement of Cash FlowsegNo ratings yet

- PT Karya Mandiri SejahteraDocument4 pagesPT Karya Mandiri SejahteraImroatul MufidaNo ratings yet

- Intermediate Accounting IDocument35 pagesIntermediate Accounting ICrystal AlcantaraNo ratings yet

- Capital Structure Analysis - Bangladesh (Rezwana Nasreen & M. Shahryar Faiz)Document85 pagesCapital Structure Analysis - Bangladesh (Rezwana Nasreen & M. Shahryar Faiz)Shibli Md. FaizNo ratings yet

- AEC 12 Application 4 - Group 4 ACBDocument55 pagesAEC 12 Application 4 - Group 4 ACBPRINCESS JUDETTE SERINA PAYOTNo ratings yet

- Tally Group ListsDocument3 pagesTally Group ListsKabilan Kabil50% (2)

- Sample Study Materials For Sebi Grade A 2020 PDFDocument36 pagesSample Study Materials For Sebi Grade A 2020 PDFupendarNo ratings yet

- OffentliggorelseDocument23 pagesOffentliggorelseJames RodriguezNo ratings yet

- 15.asset ManagementDocument11 pages15.asset ManagementShasikanta MNo ratings yet

- Mayasheel Retail India Ltd. - UpdatedDocument32 pagesMayasheel Retail India Ltd. - UpdatedBhuvanesh RavichandranNo ratings yet

- Cambridge IGCSE Accounting WorkbookDocument19 pagesCambridge IGCSE Accounting Workbooksupriya45% (11)

- Toa 28 31Document17 pagesToa 28 31honeyjoy salapantanNo ratings yet

- Accounting For PropertyDocument6 pagesAccounting For PropertyBijoy SalahuddinNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- PSAK 16 EnglishDocument21 pagesPSAK 16 EnglishToko Hanafi50% (2)

- JD Fixed Asset Analyst InternDocument2 pagesJD Fixed Asset Analyst InternAngel Alejo AcobaNo ratings yet

- Finance PDFDocument125 pagesFinance PDFRam Cherry VMNo ratings yet

- SEBI Grade A Free Study Material Accountancy Accounting Standards RFDocument15 pagesSEBI Grade A Free Study Material Accountancy Accounting Standards RFshiivam sharmaNo ratings yet

- Team 1 Section 5 Final BPDocument25 pagesTeam 1 Section 5 Final BPapi-607330821No ratings yet

- INTACC2 - Chapter 30Document2 pagesINTACC2 - Chapter 30Shane TabunggaoNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRommel VinluanNo ratings yet

- Reviewer - IntaccDocument36 pagesReviewer - IntaccPixie CanaveralNo ratings yet

- Construction Internal Audit ProgramDocument14 pagesConstruction Internal Audit ProgramCMA Pankaj JainNo ratings yet

- Divisionalized Performance and TPDocument22 pagesDivisionalized Performance and TPNicole TaylorNo ratings yet

- Business Finance Solved MCQ'sDocument21 pagesBusiness Finance Solved MCQ'srao mustafaNo ratings yet