Professional Documents

Culture Documents

Corporate

Corporate

Uploaded by

mansuriaasif23Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate

Corporate

Uploaded by

mansuriaasif23Copyright:

Available Formats

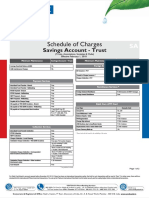

Schedule of Charges for Corporate Current Accounts

CACOR# CAESC* CASPL

Monthly Average Balance (MAB) OR Average Quarterly Balance (AQB) MAB MAB MAB

Metro & Urban (in Rs.) Nil Nil Nil

Semi-Urban & Rural Branches (in Rs.) Nil Nil Nil

Rural Branches (in Rs.) Nil Nil Nil

Charges for Non Maintenance Nil Nil Nil

Penal Charges Nil Nil Nil

Annual Charges Nil As communicated by Bank Nil

One time set up cost Nil As communicated by Bank Nil

Cash Deposit CACOR CAESC CASPL

Home Branch free limit

Customized free limit - Unlimited

Non-Home Branch free limit

Home Branch Cash Deposit Charges

3/1000 - Nil

Non-Home Branch Cash Deposit Charges

Cash Withdrawal CACOR CAESC CASPL

Home Branch free limit

Free - Nil

Non-Home Branch free limit

Home Branch Cash Withdrawal Charges

Nil - Nil

Non-Home Branch Cash Withdrawal Charges

Account Maintenance CACOR CAESC CASPL

Charges Nil - Nil

DD/PO Issuance CACOR CAESC CASPL

Free Limit Free - Free

Charges Nil - Nil

Cheque Book Indent CACOR CAESC CASPL

Free Leaves Free - Free

Charges Nil - Nil

NEFT/RTGS CACOR CAESC CASPL

Free Limit Free Free Free

Charges Nil Nil Nil

Other Common Charges

CACOR CAESC CASPL

Speed Clearing Free - -

ECS Return (Charges/penalties levied by destination branches for ECS (debit) returns due to

Rs.25/- per record

non-availability of funds in customer ) - -

Upto Rs.50000 - Rs.50 per instrument; Rs.50000 to 1 lac - Rs.100 per

Cheques Deposited at any Axis Bank branch for outstation collection (Drawn on Axis Bank

instrument, above Rs.1 lac - Rs.150 per instrument (Charges inclusive

locations)

of postage) - -

Cheques Deposited at any Axis Bank branch for outstation collection (Drawn on non-Axis Bank

locations) - - -

Demand Drafts ( payable at Correspondent Bank locations under Desk Drawing arrangement) Re.1.00/1000 ; Min Rs.25 per DD Re.1.00/1000 ; Min Rs.25 per DD

-

Demand Drafts purchased from other banks Actual + Rs.0.50/1000; Min Rs.50 per DD Actual + Rs.0.50/1000; Min Rs.50 per DD -

DD drawn on Axis Bank branches- Cancellation, Reissuance or Revalidation Rs.100/- per instance Rs.50/- per instance -

DD drawn on Correspondent Bank branches- Cancellation, Reissuance or Revalidation Rs.100/- per instance+ other bank's charges at actuals if any Rs.100/- per instance+ other bank's charges at actuals if any -

Signature Verification Certificate Nil 100 per verification -

Certificate of Balance Free Current Year : Free, Previous year: Rs.200 -

Retrieval of old records More than 1 year old : Rs.100 per record/ query More than 1 year old : Rs.100 per record/ query -

Account Closure Charges Less than 6 months: Rs.500, Older than 6 months: Rs.250 - -

Standing Instructions Free Free -

Stop Payment Charges Per Instrument : Rs.100, Per Series: Rs.250 - -

Mobile Alerts Free - -

Scheme Code Conversion Charges (Only on conversion to lower scheme code) Rs.150 per instance - -

Cheque Return - Issued by Customer Rs.100 / cheque - -

Cheque Return - Deposited by Customer Rs.100 / cheque Rs.125 / cheque -

50% of OSC commission; Minimum Rs.50 / cheque + Other bank 50% of OSC commission; Minimum Rs.50 / cheque + Other bank

Cheque Return - Deposited by Customer for Outstation Collection

charges if any charges if any -

Debit Card Charges Business Platinum Card -Free No Debit Card Facility -

Account Statement - By post and e-mail Free Free -

Account Statement - Duplicate statement from Branch Free Rs.50/- per statement -

*

Maximum non home branch cash deposit shall be Rs.2,00,000 per day. Maximum third party deposit up to Rs.50,000 per day. (CAPOA)

*

Maximum non home branch cash withdrawal shall be Rs.5,00,000 per day.

*

Non cash transactions includes anywhere banking and demand drafts/pay orders

*

Total free transactions include all Cash, Clearing and Transfer transactions .Outstation Cheque Collection , NEFT/RTGS , ATM and I-connect transactions are outside the purview of these charges

*

Maximum Rs.50,000 per transaction for third party Non Home Branch Cash Withdrawal

# Maximum Non Home Branch Cash deposit shall be Rs.1,00,000 per day. Maximum third party deposit up to Rs.50,000 per day. Beyond this the cash may be accepted at the discretion of branch head where the cash is being deposited.

Upfront charges of Rs.100/txn shall be charged on Non Home Branch Cash deposit for Normal and Business Advantage

# Maximum Non Home Branch Cash withdrawal shall be Rs.1,00,000 per day. Maximum third party withdrawal up to Rs.50,000 per day. Beyond this the cash may be withdrawn at the discretion of branch head where the cash is being withdrawn.

# Non Cash Services includes Local Clearing, Fund Transfer, Anywhere Banking (Cheque collection and clearing at Axis Bank locations) and Demand Drafts/Pay Order issuance

# Total Free transactions include all Cash, Clearing,Transfer and DD/PO issuance transactions. (Exclusions - Outstation Cheque Collection, NEFT/RTGS, ATM and I-connect transactions are outside the purview of these charges)

# Maximum Rs.50,000 per transaction for third party Non Home Branch Cash Withdrawal

You might also like

- Bank of CyprusDocument7 pagesBank of CyprusLoizos LoizouNo ratings yet

- MBA FinanceDocument11 pagesMBA Financeranjithc240% (1)

- Non OperativeDocument1 pageNon OperativejoyfulsenthilNo ratings yet

- Allied Islamic Current A/C (Fcy) Allied Islamic Saving A/C (Fcy)Document3 pagesAllied Islamic Current A/C (Fcy) Allied Islamic Saving A/C (Fcy)Jerry RajputNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Savings Account SOC W e F 1st May 2023Document2 pagesSavings Account SOC W e F 1st May 2023saurav katarukaNo ratings yet

- Caart PDFDocument2 pagesCaart PDFvinodNo ratings yet

- CapoaDocument1 pageCapoajai vanamalaNo ratings yet

- For Customer ReferenceDocument4 pagesFor Customer ReferenceMaheshkumar AmulaNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- CA Start Up GSFC Wef 01st September 2023Document5 pagesCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaNo ratings yet

- Au Abhi 31-MarchDocument2 pagesAu Abhi 31-MarchShubhra Kanti GopeNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- HDFCDocument2 pagesHDFCrocowi4677No ratings yet

- Sba 2.0Document1 pageSba 2.0Operation BluepayNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service Charges South Indian BankDocument18 pagesService Charges South Indian Bankmuthoot2009No ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges Newganesh gowthamNo ratings yet

- General Schedule of Features and Charges (GSFC) : For Retail Current Accounts (W.e.f. 1st July, 2017)Document2 pagesGeneral Schedule of Features and Charges (GSFC) : For Retail Current Accounts (W.e.f. 1st July, 2017)hareesh008No ratings yet

- Schedule of Charges Yes Bank 5Document1 pageSchedule of Charges Yes Bank 5Sayantika MondalNo ratings yet

- Priority Banking Soc Con Nov 2019Document1 pagePriority Banking Soc Con Nov 2019sundarkspNo ratings yet

- Midxix Republic Salary AccountDocument1 pageMidxix Republic Salary Accountsagar khareNo ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges NewMuhammad Al javadNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- Yes First Eclectic Debit Card SocDocument2 pagesYes First Eclectic Debit Card Socraghav mehraNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Value Based Schedule of Charges For Current Account 01112020Document2 pagesValue Based Schedule of Charges For Current Account 01112020J ANo ratings yet

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Document2 pagesWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ANo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- GSFC Revision For Current Account Elegance 1 July 2019Document1 pageGSFC Revision For Current Account Elegance 1 July 2019Kim Jong YungNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- KFS HBL@ Work Conventional AccountsDocument6 pagesKFS HBL@ Work Conventional AccountsArslan BaigNo ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges NewSamskruti TrendzNo ratings yet

- Au Royale: Schedule ofDocument2 pagesAu Royale: Schedule ofsahilNo ratings yet

- JIFI Charges PDFDocument2 pagesJIFI Charges PDFRamesh SinghNo ratings yet

- IDBI Trade Current Account 2022Document4 pagesIDBI Trade Current Account 2022majhi.deepashreeNo ratings yet

- Kotak Bank General Accounts and ChargesDocument5 pagesKotak Bank General Accounts and ChargesCraig DsouzaNo ratings yet

- NMB Tariff Guide 2021Document2 pagesNMB Tariff Guide 2021Adul MahmoudNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Yes Bank India ChargesDocument2 pagesYes Bank India ChargesRKNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- Kolkata Lb3Document2 pagesKolkata Lb3India TreadingNo ratings yet

- Stanbicpricingguide2022 2023Document1 pageStanbicpricingguide2022 2023Yaseen QariNo ratings yet

- DCB Benefit Savings AccountDocument2 pagesDCB Benefit Savings AccountDesikanNo ratings yet

- MITC Premium 15 6 2016Document6 pagesMITC Premium 15 6 2016raop3651No ratings yet

- DollarOne TradeCharges 1nov2020Document1 pageDollarOne TradeCharges 1nov2020Pratik IngaleNo ratings yet

- Gross Amount Rebate: For Immediate AssistanceDocument2 pagesGross Amount Rebate: For Immediate AssistanceAhana SarkarNo ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Bid Letter - Micro Inks PDFDocument18 pagesBid Letter - Micro Inks PDFGaneshNo ratings yet

- Intern Report On NRB Global BankDocument34 pagesIntern Report On NRB Global BankMuhammad Hossain Sumon100% (3)

- Banking MoralesDocument39 pagesBanking MoralesJerome MoradaNo ratings yet

- 3-1int 2003 Dec QDocument6 pages3-1int 2003 Dec Qjalan1989No ratings yet

- Salon Booth LeaseDocument4 pagesSalon Booth Lease1982roniNo ratings yet

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- DemonetizationDocument11 pagesDemonetizationkajlbeheraNo ratings yet

- Share Application FormDocument2 pagesShare Application FormKrishna Chaitanya SamudralaNo ratings yet

- CARE Outstanding Rating Oct 2013Document250 pagesCARE Outstanding Rating Oct 2013sh_niravNo ratings yet

- Project ReportDocument21 pagesProject Reportbhagya100% (1)

- Chilli Teja PN Mar16 19022016Document22 pagesChilli Teja PN Mar16 19022016Anurag KushwahaNo ratings yet

- Organization of Commerce and Management March 2018 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesOrganization of Commerce and Management March 2018 STD 12th Commerce HSC Maharashtra Board Question PaperJijo AbrahamNo ratings yet

- Accounting I Chapter 5Document34 pagesAccounting I Chapter 5Kara HornNo ratings yet

- Ocwen ConsentDocument8 pagesOcwen ConsentForeclosure Fraud100% (1)

- Inside Job Movie ReviewDocument2 pagesInside Job Movie ReviewVivek ParmarNo ratings yet

- Lombard Risk - Regulation in HONG KONGDocument3 pagesLombard Risk - Regulation in HONG KONGLombard RiskNo ratings yet

- Highlights of Proposed Ability-To-Repay RulesDocument3 pagesHighlights of Proposed Ability-To-Repay RulesForeclosure FraudNo ratings yet

- Test Bank For Auditing A Business Risk Approach 8th Edition by RittenburgDocument12 pagesTest Bank For Auditing A Business Risk Approach 8th Edition by RittenburgfredeksdiiNo ratings yet

- PPP - in Infrastructure Development - A PrimerDocument114 pagesPPP - in Infrastructure Development - A PrimerMick MullayNo ratings yet

- Carol Info - Exit LOF and FormDocument24 pagesCarol Info - Exit LOF and FormAmigo GraciosoNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Perez Vs CA DIGESTDocument1 pagePerez Vs CA DIGESTReginaNo ratings yet

- State Bank of IndiaDocument7 pagesState Bank of Indiajay_kanjariaNo ratings yet

- Risk Management System in BanksDocument50 pagesRisk Management System in Banksersudhirthakur100% (1)

- Landbank Iaccess General Terms and ConditionsDocument9 pagesLandbank Iaccess General Terms and ConditionsALLAN H. BALUCANNo ratings yet

- Implementasi Syariah Governance Serta Implikasinya Terhadap Reputasi Dan Kepercayaan Bank SyariahDocument25 pagesImplementasi Syariah Governance Serta Implikasinya Terhadap Reputasi Dan Kepercayaan Bank SyariahLeliNo ratings yet

- Application Form For Inflation Indexed National Savings Security - Cumulative (Iinss-C)Document12 pagesApplication Form For Inflation Indexed National Savings Security - Cumulative (Iinss-C)autocrats 207No ratings yet

- Banking Service and Investment Product of HDFC Bank Gurav2Document87 pagesBanking Service and Investment Product of HDFC Bank Gurav2Sami Zama100% (1)