Professional Documents

Culture Documents

Allied Islamic Current A/C (Fcy) Allied Islamic Saving A/C (Fcy)

Uploaded by

Jerry RajputOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allied Islamic Current A/C (Fcy) Allied Islamic Saving A/C (Fcy)

Uploaded by

Jerry RajputCopyright:

Available Formats

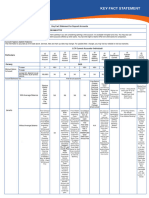

Key Fact Statement for Deposit Accounts

Date DD- MM-YYYY

Allied Bank Limited,

Aitebar Islamic Banking

IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may

--------Branch, City.

also use this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for

comparison.

Account Types & Salient Features :

This information is accurate as of the date above. Services, fees and Profit rates may change on periodic basis. Schedule of Charges is revised biannually and Profit Rates are declared on monthly basis. For

updated fees/charges, you may visit our website "www.abl.com" or visit our branches.

Allied Aitebar Islamic Banking Group (ABL-IBG)

Particulars

ALLIED ISLAMIC CURRENT A/C (FCY) ALLIED ISLAMIC SAVING A/C (FCY)

Currency (PKR, US, EUR, etc.) USD, EUR, GBP USD, EUR, GBP

Minimum Balance To open 100 100

for Account (if any, provide the To keep Nill Nill

amount)

Account Maintenance Fee (if any, provide the amount) Nill Nill

Is Profit Paid on account

(Yes/No) NO Yes

Subject to the applicable tax rate

Indicative Profit Rate. (%) Nill 0.10%

Profit Payment Frequency (Daily, Monthly, Quarterly, Half yearly and yearly) Nill half yearly

Provide example: (On each Rs.1000, you can earn Rs on given periodicity) Nill 0.5

Premature/ Early

Nill Nill

Encashment/Withdrawal Fee (If any, provide amount/rate)

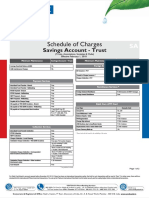

Service Charges

IMPORTANT: This is a list of the main service charges for this account. It does not include all charges. You can find a full list at [our branches, on our website at www.abl.com”]. Please note

that all bank charges are exclusive of applicable taxes.

Allied Aitebar Islamic Banking Group (ABL-IBG)

Services Modes

ALLIED ISLAMIC CURRENT A/C (FCY) ALLIED ISLAMIC SAVING A/C (FCY)

Intercity Nill Nill

Intra-city Nill Nill

Cash Transaction

Own ATM withdrawal Nil Nil

Other Bank ATM Nil Nil

ADC/Digital Nil Nil

SMS Alerts Clearing Nill Nill

For other transactions Nill Nill

VISA Debit Card (VDC) Classic Nill Nill

VDC Sapphire Nill Nill

VDC Premium Debit Card Nill Nill

Debit Cards

UPI PayPak co-badged Classic Debit Card Nill Nill

UPI PayPak co-badged Gold Debit Card Nill Nill

FCY Accounts, US $ 5 per cheque book of

FCY Accounts, US $ 5 per cheque book of 25 leaf or

Issuance 25 leaf or equivalent in other Foreign

equivalent in other Foreign Currencies.

Currencies.

Cheque Book US$ 10/- per instruction for FC Accounts

US$ 10/- per instruction for FC Accounts (or equivalent

Stop payment (or equivalent in other Foreign currencies)

in other Foreign currencies) and FC Cheques / Drafts

and FC Cheques / Drafts

Loose cheque N/A N/A

_______________________________________________________

Allied Aitebar Islamic Banking Group (ABL-IBG)

Services Modes

ALLIED ISLAMIC CURRENT A/C (FCY) ALLIED ISLAMIC SAVING A/C (FCY)

Remittance (Local) Banker Cheque / Pay Order Nill Nill

a) Flat US$ 5/- per item upto value of US $

1000 or its equivalent.

a) Flat US$ 5/- per item upto value of US $ 1000 or its b) 0.25% per item for value of over US $

equivalent. 1000 or its equivalent, Minimum US$ 10/-,

b) 0.25% per item for value of over US $ 1000 or its Maximum US $ 100.

equivalent, Minimum US$ 10/-, Maximum US $ 100. c) if charges code is "OUR" for any foreign

c) if charges code is "OUR" for any foreign currency, currency, US$40/- (flat) Eqv. in any

US$40/- (flat) Eqv. in any currency to be recovered currency to be recovered from the applicant

from the applicant and amount should be parked in and amount should be parked in respective

Foreign Demand Draft

respective Nostro account Nostro account

Plus Additional Charges @ 0.25%, Minimum US $ 5 Plus Additional Charges @ 0.25%,

(or equivalent currency) to be recovered where Minimum US $ 5 (or equivalent currency)

remittance is effected within 15 days of cash deposits. to be recovered where remittance is

Plus applicable Dispatch / Communication Charges as effected within 15 days of cash deposits.

per tariff in Section H of ABL-IBG SOC. Plus applicable Dispatch / Communication

Charges as per tariff in Section H of ABL-

Remittance Foreign IBG SOC.

a) Flat US$ 5/- per item upto value of US $

1000 or its equivalent.

a) Flat US$ 5/- per item upto value of US $ 1000 or its

b) 0.25% per item for value of over US $

equivalent.

1000 or its equivalent, Minimum US$ 10/-,

b) 0.25% per item for value of over US $ 1000 or its

Maximum US $ 100.

equivalent, Minimum US$ 10/-, Maximum US $ 100.

Plus Additional Charges @ 0.25%,

Plus Additional Charges @ 0.25%, Minimum US $ 5

Minimum US $ 5 (or equivalent currency)

Wire Transfer (or equivalent currency) to be recovered where

to be recovered where remittance is

remittance is effected within 15 days of cash deposits.

effected within 15 days of cash deposits.

Plus applicable Dispatch / Communication Charges as

Plus applicable Dispatch / Communication

per tariff in Section H of ABL-IBG SOC.

Charges as per tariff in Section H of ABL-

IBG SOC.

Annual Free Free

Half Yearly Free Free

Statement of Account Rs. 35 inclduing FED

Rs. 35 inclduing FED

Duplicate For FCY Accounts, rupee equivalent of

For FCY Accounts, rupee equivalent of charges will be

charges will be deducted from FCY

deducted from FCY Account

Account

Fund Transfer ADC/Digital Channels N/A N/A

Internet Banking subscription (one-time & annual) N/A N/A

Digital Banking

Mobile Banking subscription (one-time & annual) N/A N/A

Clearing Normal Free Free

USD 5/- including NIFT & collecting Bank

Intercity USD 5/- including NIFT & collecting Bank Charges

Charges

Same Day Nill Nill

US$ 12/- or equivalent from the currencies other than US$ 12/- or equivalent from the currencies

Closure of Account Customer request US $ or whatever minimum balance is available in other than US $ or whatever minimum

Account. balance is available in Account.

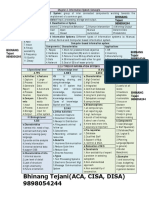

You Must Know

Requirements to open an account: To open the account you will need to satisfy Unclaimed Deposits: In terms of Section 31 of Banking Companies Ordinance, 1962 all deposits which have not been

some identification requirements as per regulatory instructions and banks' internal operated during the period of last ten years, except deposits in the name of a minor or a Government or a court of law,

policies. These may include providing documents and information to verify your are surrendered to State Bank of Pakistan (SBP) by the relevant banks, after meeting the conditions as per provisions of

identity. Such information may be required on a periodic basis. Please ask us for law. The surrendered deposits can be claimed through the respective banks. For further information, please contact your

more details. nearest branch or ABL Helpline/ Call center at 111-225-225.

Cheque Bounce: Dishonoring of cheques is subject to a criminal trial in Pakistan

Closing this account: In order to close your account, please render your request to your Account maintaining

as per Pakistan Penal Code (PPC) 489-F. Accordingly, you should be writing

branch/Parent branch along with Debit card and unutilized cheques and cancel the standing instructions, if any.

cheques with utmost prudence.

Safe Custody: Safe custody of access tools to your account like ATM cards, PINs,

Cheques, e-banking usernames, passwords; other personal information, etc. is your

responsibility. Bank cannot be held responsible in case of a security lapse at the How can you get assistance or make a complaint?

customer’s end. Never share your Debit Card Number, PIN, OTP or any other

sensitive information about your account with anyone. ABL will never call for such

details. Allied Bank Limited

Complaint Management Division

Allied Bank, Head Office, 2nd Floor, 3-4 Tipu Block, New Garden Town,

Lahore

Tel : 042-35880043

Record updation: Always keep profiles/records updated with the bank to avoid Helpline: 111-225-225

missing any significant communication. You can contact your nearest branch of Email: complaint.management@abl.com

ABL Helpline/Call center111-225-225 to update your information. Website: www.abl.com

What happens if you do not use this account for a long period? If your account

If you are not satisfied with our response, you may contact:

remains inoperative for 12 months, it will be treated as dormant. If your account

Banking Mohtasib Pakistan

becomes dormant, certain restrictions apply such as debit transactions and

5th floor, Shaheen Complex, M. R. Kiyani Road, Karachi.

withdrawals shall not be allowed until the account is activated on customer's

(+92 21) 99217334-38 (5 lines)

request. Accounts dormant since one year and with Zero balane will be closed. To

Fax (+92 21) 99217375

activate your account you must request your parent branch. Overseas customers

Email: info@bankingmohtasib.gov.pk

may also send their request using Banks procedure for dormancy activation.

(Portion to be used for the post-shopping stage)

I ACKNOWLEDGE RECEIVING AND UNDERSTAND THIS KEY FACT STATEMENT

Customer Name: Date:

Product Chosen:

Mandate of account: Single/Joint/Either or Survivor

Address :

Contact No: Mobile No. Email Address

Customer Signature: Signature Verified

You might also like

- Indemnity Cum Appropriation Letter For Advance Against Duplicate Term DepositDocument2 pagesIndemnity Cum Appropriation Letter For Advance Against Duplicate Term DepositOggy and the Coackroaches67% (12)

- Bankruptcy OutlineDocument63 pagesBankruptcy OutlinezumiebNo ratings yet

- Objective of StudyDocument91 pagesObjective of StudyKamalakanta Das100% (1)

- Indian Financial SystemDocument16 pagesIndian Financial Systemshankarinadar100% (1)

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- KFS LCY Saving Accounts Individuals and Entities 01Document3 pagesKFS LCY Saving Accounts Individuals and Entities 01Mysterious PerformerNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Priority Banking Soc Con Nov 2019Document1 pagePriority Banking Soc Con Nov 2019sundarkspNo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- CorporateDocument1 pageCorporatemansuriaasif23No ratings yet

- Kina Bank Fees Charges ScheduleDocument15 pagesKina Bank Fees Charges SchedulemarcialitovivaresNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- KFS Full Freelancer ConventionalDocument1 pageKFS Full Freelancer Conventionalshaistarasheed9622No ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- KFS HBL Conventional Current Account-07-Nov-2022Document6 pagesKFS HBL Conventional Current Account-07-Nov-2022Faique MemonNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- Saving Accounts: Key Fact StatementDocument6 pagesSaving Accounts: Key Fact StatementAfaq YousafNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- DollarOne TradeCharges 1nov2020Document1 pageDollarOne TradeCharges 1nov2020Pratik IngaleNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- NMB Tariff Guide 2021Document2 pagesNMB Tariff Guide 2021Adul MahmoudNo ratings yet

- KFS HBL@ Work Conventional AccountsDocument6 pagesKFS HBL@ Work Conventional AccountsArslan BaigNo ratings yet

- KFS HBL Conventional Saving Account-SeptemberDocument6 pagesKFS HBL Conventional Saving Account-Septembermaya aliNo ratings yet

- Au Royale: Schedule ofDocument2 pagesAu Royale: Schedule ofsahilNo ratings yet

- KFS HBL Conventional Saving Account 28-12-2023Document6 pagesKFS HBL Conventional Saving Account 28-12-2023Awais PanhwarNo ratings yet

- Mahana MunafaDocument2 pagesMahana Munafaalimurtaza6582No ratings yet

- Non OperativeDocument1 pageNon OperativejoyfulsenthilNo ratings yet

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocument3 pagesKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadNo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Nri SocDocument1 pageNri SocSaadia KhanNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- NMB Tariff Guide - 2022Document2 pagesNMB Tariff Guide - 2022doplapesa dpNo ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- CapoaDocument1 pageCapoajai vanamalaNo ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Nri SocDocument1 pageNri SocRavi AhujaNo ratings yet

- ATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditDocument4 pagesATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditTanmoy HasanNo ratings yet

- For Customer ReferenceDocument4 pagesFor Customer ReferenceMaheshkumar AmulaNo ratings yet

- Key Fact Statement H1 2023Document8 pagesKey Fact Statement H1 2023H&H PRODUCTIONSNo ratings yet

- GSFC Kotak811 Apr17Document1 pageGSFC Kotak811 Apr17karthip08No ratings yet

- NMB Tariff Guide 2023Document2 pagesNMB Tariff Guide 2023MabulaNo ratings yet

- General Charges of Kotak BankDocument2 pagesGeneral Charges of Kotak BankSarafraj BegNo ratings yet

- SafariDocument1 pageSafariLeo SaimNo ratings yet

- Key Fact Statement For Deposit Accounts: To OpenDocument4 pagesKey Fact Statement For Deposit Accounts: To OpenMaqsood akhtarNo ratings yet

- Demat SOA RetailDocument1 pageDemat SOA Retailamol.harshpalNo ratings yet

- Retail Customers: Schedule of Charges ForDocument1 pageRetail Customers: Schedule of Charges ForGaurav MishraNo ratings yet

- UBA Tarrifs and FeesDocument7 pagesUBA Tarrifs and Feesedward mpangileNo ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- Value Based Schedule of Charges For Current Account 01112020Document2 pagesValue Based Schedule of Charges For Current Account 01112020J ANo ratings yet

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Document2 pagesWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ANo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- Digital Banking Tariff Guide 2018Document9 pagesDigital Banking Tariff Guide 2018Kalimbwe TutaNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Sole ProprietorDocument19 pagesSole ProprietorJerry RajputNo ratings yet

- State Bank Officers Training Scheme (SBOTS) 25th Batch (Screening Test)Document1 pageState Bank Officers Training Scheme (SBOTS) 25th Batch (Screening Test)Jerry RajputNo ratings yet

- Government/Semi-Government/Autonomous/ Semi-Autonomous Institution Account Opening FormDocument4 pagesGovernment/Semi-Government/Autonomous/ Semi-Autonomous Institution Account Opening FormJerry RajputNo ratings yet

- The Bank of Khyber: (Please Write Your Data in Capital Letters and Use Black Pen)Document2 pagesThe Bank of Khyber: (Please Write Your Data in Capital Letters and Use Black Pen)Jerry RajputNo ratings yet

- CRM Six Strategies For Loan Portfolio Growth During A Recession - CU ManagementDocument6 pagesCRM Six Strategies For Loan Portfolio Growth During A Recession - CU ManagementIstiaque AhmedNo ratings yet

- HDFC BankDocument122 pagesHDFC BankHemal Nisar100% (3)

- 11 Jan Bbit ProposalDocument27 pages11 Jan Bbit ProposalHamzaNo ratings yet

- NI ActDocument237 pagesNI ActMishra DPNo ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Banking Midterms AUF SOLDocument29 pagesBanking Midterms AUF SOLGodofredo SabadoNo ratings yet

- Analiza Corporate CafminDocument9 pagesAnaliza Corporate CafminyayaNo ratings yet

- Breach of Trust (Past Papers)Document2 pagesBreach of Trust (Past Papers)adnanshah030000413No ratings yet

- Rammisha Pract AttachmentDocument24 pagesRammisha Pract AttachmentnaolwithjesusNo ratings yet

- 40 Bachrach Vs TalisayDocument3 pages40 Bachrach Vs TalisayCharm Divina LascotaNo ratings yet

- Isca Chap 2 Revision ChartDocument2 pagesIsca Chap 2 Revision ChartKumar SwamyNo ratings yet

- Step by Step: Corporate Governance Models in ChinaDocument35 pagesStep by Step: Corporate Governance Models in ChinaHing BoNo ratings yet

- Camel AnalysisDocument12 pagesCamel AnalysisvineethkmenonNo ratings yet

- Finmar Q2Document18 pagesFinmar Q2Tatyanna KaliahNo ratings yet

- BPI vs. Fernandez, GR. No. 173134, September 2, 2015Document3 pagesBPI vs. Fernandez, GR. No. 173134, September 2, 2015Charmaine Valientes CayabanNo ratings yet

- Memorandum of Agreement Amongst: (Nabard)Document19 pagesMemorandum of Agreement Amongst: (Nabard)reldly sammiNo ratings yet

- Learn Why Bankers Have Forgiven Loans BankFreedomDocument2 pagesLearn Why Bankers Have Forgiven Loans BankFreedomdbush2778No ratings yet

- Estatement20221213 000475984Document10 pagesEstatement20221213 000475984AHMAD HAFIZUDDIN BIN HASHIM STUDENTNo ratings yet

- Schengen Visa Requirements 2024Document4 pagesSchengen Visa Requirements 2024Jeff DagpinNo ratings yet

- Cover-Up of Corruption at The Center of The World's Financial System Twitter1.26.19Document27 pagesCover-Up of Corruption at The Center of The World's Financial System Twitter1.26.19karen hudesNo ratings yet

- Local No. 1 in Nation in Tetrathlon: Inside This IssueDocument16 pagesLocal No. 1 in Nation in Tetrathlon: Inside This IssueelauwitNo ratings yet

- Ft2020czech RepublicDocument11 pagesFt2020czech RepublicvisegaNo ratings yet

- Questionnaire: Current A/c Saving A/cDocument2 pagesQuestionnaire: Current A/c Saving A/clucadNo ratings yet

- Co Operative BankDocument39 pagesCo Operative BankAkshay Kumbhare50% (2)

- Urban Land - 08 AUG 2009Document116 pagesUrban Land - 08 AUG 2009jumanleeNo ratings yet

- AffairsCloud Monthly Banking CA-February 2022Document118 pagesAffairsCloud Monthly Banking CA-February 2022Anjita SrivastavaNo ratings yet