Professional Documents

Culture Documents

Balance SHEETS

Balance SHEETS

Uploaded by

Ashwani Kumar0 ratings0% found this document useful (0 votes)

8 views9 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views9 pagesBalance SHEETS

Balance SHEETS

Uploaded by

Ashwani KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

pe aroerevee

6-Sep:

Deemed date of filin

Acknowledgement Number:499879320160922

fildandverifed) 2022-23

{Pease see Rule 12 ofthe come ax Rules, 1962)

PAN AAIFLS1S3

Name LIFE CARE HOMOEO

Adress marNo2DEy GALI NO 6; DABUA GAZIFUR ROAD , DAUA GAZIPUR ROAD NIT, NIT, FARIDABAD ,

sore Eins Form Number TRS

Fed ws 139(4) Belted Retr ied er due date Fling Acknowledgement Number __499679320160922

coment Yeo bins os any ae eee ae

Total Income - — 30,330

4 Book Proftunder MAT, where ppiale 2 °

ajused Toa Income under AMT, wher ppiabe 3 30330

Nem pyabe a 9467

© imerest and Fee Payable s

Total iax. interest and Fee payable 6 10657

Tanes Paid 7 10867

(Tox Pyable Refundable (6-7) 8 (© 20

Accreted Income as per section 115TD- oo 9 c 0

Ean Tax payable we 11570 0 °

Finer pyblews STE u °

Additional Tax and interest payable 2 °

i ‘Tax and interest paid a 3 =

(Tax Payable) Refandsble (12-13) “ °

Income Tax Return submited electronically on 16-Sep-2022 20:31:28 fom IP address 4936.181.50 and verified by NARINDER BHATIA

having PAN AKRPBSOIOC on 16-Sep-2022 using XBMTXRQTII generated through Aadhssr OTP mode

System Generated 7 1

Barcode/QR Code Ut

AAI 459054956793201609229D8820761DFAOSDATSC2IGESFAIOLEDESAIBS91

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

a

(ao7.

129

151

PAN - MMFL3145)

COMPUTATION

AN= 2022-23

Name of the Assesseo LIFE CARE HOMOEO

Status FIRM (Resident)

Date of incorporation 6102/2021,

aie PLOT NO 2 DF , GALI NO 6, DABUA GAZIPUR ROAD , NIT FARIDABAD , HARYANA

121001

Emait LUFECAREHOMOEO2019@6MAILCOM

Contact no, 5 ssg72ts210

Previous Year 2 2021-22

Assessment Year 2 2022-23

Permanent Account No. ARJFLS1483

Ward FARIOABAD

Office File Number

‘Acknowledge No, Na

Date of fiting oN

Business, LIFE CARE HOMOEO

Bank Details

‘Name ofthe Bank | MIGR Code | IFSC Code | Type of Account | Account Number Refund Bank

IBANDHAN BANK 7 = =

mare 110780013}e08L0001779 |curent ror7o0ot08250| Ye

Profit Bofore Tax as per Prof & Loss account

‘Add : Disallowances

Depreciation debited to Prof & Loss AC

Less : Deductions

Deduction under section 32

Grosé Total Income

Taxable Income

‘Tax Due at Normal Rates on Rs. 30333.00

‘Tax Due at Special Rates on Rs. 0.00

‘Total Tax Due on Taxable Income

Surcharge

sous

30333

30333

30333

9103

9103

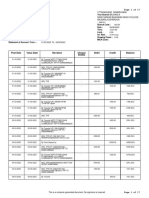

LIFE CARE HOMOEO (P-F.)

Balance Sheet

41-Apr-2021 to 31-Mar-2022

‘Liabilities asal3tMer2022 | Assets

118.00

50,75,112.54] Fixed Assets ed

dapital Account

CAPITAL AC OF MANOJKR GUPTA 23,59,955.74

| COMPUTER A/C 415,600.00

CAPITAL AC OFNARENDER BHATIA) 3,71,747.06 | INVERTOR 24,480.00

CIPTALACOF PAWALKUNARGLPTA) _ 23,50,000.74 | PLANT & MACHINERY 1,92,983.00

_ | vaccum PUMP: 12,825.00

Loans (Liability) | WEIGHING SCALE 56,230.00

Current Liabilities reer Current Assets 63,33,149.68

Provisions 3,15,11400 | "Loans & Advances (Assel) 617,693.78

Sundry Creditors 12,45,041.14 Sundry Debtors 875,208.50

= ‘Cash-in-Hand- 18,173.00

Suspense Alc Bank Accounts 128,624.40

STOCK

Profit & Loss Ale

Opening Balance

Current Period 30,332.54 i

Less: Transferred 30,332.54 |

Total

sce Name - LIFE CARE HOMOEO

PAN AMIFL345) AN 202223

368

Tax Payable Including Surcharge & Education Coss 9467

‘Aad :Interost Under Section 2344/2348 2946

Interest Under Section 234A 170

{Add : Late Fee Under Soction 204F

Late Fee Urs 234F 1000

Less : Prepaid Tax

Tos 361

‘Tax Payable on self assessment 970

Self Assessment Tax Paid 10000

Tax PayableiRefund 230)

Due Date for filing of Return 31/07/2022

Details of Advance Tax and Self Assessment Tax Payments of Income-tax

Details of Advance Tax and Self Assessment Tax Payments of Income-tax

st | BSR Code Date of ‘Serial Number of Challan ‘Amount (Re)

No. DepositODmawyyYY)

1 0510308 ‘10972022 27 70000

Details of Tax Collected at Source (TCS

SI"| Tax Deduction [Name ofthe | Unclaimed TCS brought] TGS of the [Amount outaf (or [Amount out of

No | “and Tax Collector forward (oi) currentfin. |"(6) being claimed |(8) or (6) being

Collection year YYearonlyit |carred forward

[Account Number cerespondina

of the Collector in. Yearin | Amount income is being

oe et aftr fron Oe

collected year)

7 JASHOKA

DDISTILLERS AND 4 867 267 o|

1 Jpevarrzese — /BISTILERS

| [PRIVATE LiwTED

LIFE CARE HOMOEO (P-F.)

Provisions

Group Summary

41-Apr-2024 to 31-Mar-2022

Particulars zi

IMPREST A/C OF NARINDER BHATIA

LEGAL & PROFESSIONAL CHARGES PAYABLE

N.K.FURTURISTIC MANAGEMENT & SERVICES

WAGES PAYABLE

“Grand Total

a 60,478.00

60,000.00

30,000.00

54,636.00

Particulars

Purchase Accounts

PURCHASE @12% (IST)

PURCHASE @ 18% (GST)

PURCHASE @18% (IGST)

PURCHASE @ 5% (GST)

PURCHASE @ 5% (IGST)

Direct Expenses

CONSUMABLE STORE @12.% GST

CONSUMABLE STORE @ 18% GST

FREIGHT & COURIERS CHARGES EXP

PACKING & FORWARDING 12% GST

PACKING 8 FORWARDING 12% GST

PACKING & FORWARDING 18:XGST

PACKING & FORWARONG @ 18% 6ST

POWER & ELECTRICITY EXP AIC

WAGES A/C

Gross Profit clo

Indirect Expenses

LIFE CARE HOMOEO (P.F.)

Profit & Loss Ale

¥-ApE-2021 to 34-Mar-2022

41-Apr-2021 0 31-Mar-2023 Particulars

41,83,631.10/ Sales Accounts

1.27,864.00 SALE @ 12% (GST)

1Senena | Sate Gran coy

6,96.422.00 SALE @ 18% (IGST)

5.87,815.00 SALE @ 5% (IGST)

11,82,922.00 | SALES @ 5% (G7)

29,79,535.20| Direct Incomes

400.00 CLOSING STOCK

1,89,359.00

1,09, 184.00

1,38,176.40

163,895.00

8,54,019.00

2,44,398.60

22,785.00

9,37,801.20

81,00 9867.

Apr 202 to 37-Mar-2022

34,08,717.50

247,314.50

3,93,872.00

2,400.00

20,33,205.50

7,91,925.50

46,92,250.00

46,92,260.00

9,07,468.66] Gross Profit bit 9,37,801.20

ACCOUNTANCY CHARGES AIC 30,000.00

‘ADVERTISE & PUBLICITY EXP AIC. 17,960.00 Indirect Incomes

BANK CHARGES: 219.82

CONVEYANCE 8 TRAVELLING EXP 70,524.00

DEPRECATION 40,434.00

ENTERTAINMENT EXP 2,141.00

‘FREIGHT & CARTAGE OUTWARD 94,754.00

GENRAL EXP 18,671.00

LEGAL & PROFF CHARGES 80,044.00 |

PRINTING & STATIONERY EXPS. 12,850.00

RATES, TAXES & FEES AIC 29,722.84

RENT A\C 1,65,800.00

REPAIR & MAINTANCE EXPS. 33,161.00

REPAIR TO COMPUTER 4,000.00

SALARY TO PARTNERS 2,70,000.00

STAFF & LABOUR WELFARE EXP 36,087.00

TELEPHONE EXPS, 7,10

Nett Profit 30,332.54! a

Total _ ag Total 9,37,801.20

CARE HOMUEU

LIFE CARE HOMOEO (P.F,)

Sundry Creditors

Group Summary

4-Ap-2021 to 31-Mar-2022

Particulars Closing Beene

abit Credit

3P FILTRATION PVT LTD. 1,03,114.00

BA PRINTERS, 6,974.00

CHEN PHARMA DISTRIBUTORS 4,248.00

DURGA TRADING CO. 1,736.00

ENDURANCE INTERNATIONAL GROUP IP.LTD 30,084.00

FINE AIRCON SYSTEMS 27,014.00

HIMALAYA HERB STORES 3,88,684.00

HOMEO PACK PVT LTD 1,86,086.00

'NOUSTRIAL & BUILDING GLASS INDUSTRIES 2,04,848.00

JANTA BARTAN BHANDAR 8,750.00

KHOSLA PRINTERS 54,876.26

KL BHATIA DIGITALS 5,513.00

LOKESH KUMAR & SONS 18,900.00

MAGNUS GRAPHICS 203.68

MEENAKSHI ENTERPRISES 22,939.00

M.K PACKERS 91,347.00

PRATHAM HOMEO AGENCY 501.00

REAL PLASTOCHEM PVT LTD 1,04,248.00

SINGH ELECTRONICS AND COMPUTERS 1,200.00

1.21620

aaron ase ese Seed 12,45,041.44

PAIN rz aR

LIFE CARE HOMOEO (P.F.)

Loans & Advances (Asset)

Group Summary

‘-Apr-2021 to 31-Mar-2022

ogee area fecci sessing Balanoe

eee abt ~_ Credit

ABHISHEK SHUKLA 13,000.00

cst 2,22,338.74

IGst 4:17,970.18

IMPREST AIC OF RITESH CHAND SRIWASTAV (ASM) 5,000.00

PROV CGST 2,233.86,

PROV IGST 31,604.00

PROV SGST 2,233.86

RCM IGST RECOVERABLE 307.70

sGsT 2,22,338.44

TCS RECOVERABLE 1867.00

Grand Total 617,893.78

ae - For LIFE)CARE HOMOEO

eee ee

aye Pp ANS PK k

Name of the Assessee

Complete Address

PAN

Major Head

Minor Head

Taxpayer's Co

LEX XXXE HOMOEO

PLOTNO2 DF GALINO 6

DABUA GAZIPUR ROAD NIT

FARIDABAD HARYANA 121001

AIA

021 - INCOME-TAX (OTHER THAN COMPANIES)

'300- SELF ASSESSMENT TAX

Description of Tax “Amount in Rupees HDFC BANK LIMITED

Basic Tax 10,000.00 Challan No 280

oar oe BSR Code 0510308

‘ducation Ct 0.00

——— Date of Receipt 16/09/2022

Penalty 0.00

iS 00 Challan Serial No 28722

Toteest 0.00 ‘Assessment Year 2022-23

|

TOTAL| 10,000.00 Bank Reference 28722

Drawn On HDFC Bank Netbanking

Rupees (In words) INR TEN THOUSAND ONLY

oN (051030816092226722 5

Debit Account No. (0251000183787 Payment Realization Date | 16/09/2022 20:26:37

unterfoil

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NPPL Catalog Cable TrayDocument4 pagesNPPL Catalog Cable TrayAshwani KumarNo ratings yet

- NPPL Project Report 50Cr 2022Document76 pagesNPPL Project Report 50Cr 2022Ashwani KumarNo ratings yet

- Ubl PolicyDocument28 pagesUbl PolicyAshwani KumarNo ratings yet

- 16 Land Allotment RIICODocument10 pages16 Land Allotment RIICOAshwani KumarNo ratings yet

- NPPL Catalog ScaffoldingDocument12 pagesNPPL Catalog ScaffoldingAshwani KumarNo ratings yet

- 7 Audit Report 2020-21Document18 pages7 Audit Report 2020-21Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun ContactsDocument2 pagesVikas Bhawan Dehradun ContactsAshwani KumarNo ratings yet

- 20230109130503Document6 pages20230109130503Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 3Document6 pagesVikas Bhawan Dehradun Contacts 3Ashwani KumarNo ratings yet

- Commector Payout Claim DataDocument3 pagesCommector Payout Claim DataAshwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 2Document4 pagesVikas Bhawan Dehradun Contacts 2Ashwani KumarNo ratings yet

- Products ListDocument2 pagesProducts ListAshwani KumarNo ratings yet

- DBS PL LatestDocument160 pagesDBS PL LatestAshwani KumarNo ratings yet

- Central Bank Branch List Pan IndiaDocument549 pagesCentral Bank Branch List Pan IndiaAshwani KumarNo ratings yet

- CASHe LoansDocument7 pagesCASHe LoansAshwani KumarNo ratings yet

- Aditya Birla Udyog New Pdated Pin Code ListDocument459 pagesAditya Birla Udyog New Pdated Pin Code ListAshwani KumarNo ratings yet

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument17 pagesPost Date Value Date Narration Cheque Details Debit Credit BalanceAshwani KumarNo ratings yet

- Banking ...Document8 pagesBanking ...Ashwani KumarNo ratings yet

- All Serviceable Pincodes nonGL-Version20 BL&PLDocument717 pagesAll Serviceable Pincodes nonGL-Version20 BL&PLAshwani KumarNo ratings yet

- College Details For Education LoanDocument7 pagesCollege Details For Education LoanAshwani KumarNo ratings yet

- ITR AY 22-23 Narinder BhatiaDocument1 pageITR AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarNo ratings yet

- Aadhar CardDocument2 pagesAadhar CardAshwani KumarNo ratings yet

- Unlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedDocument6 pagesUnlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedAshwani KumarNo ratings yet

- FactoryDocument12 pagesFactoryAshwani KumarNo ratings yet

- Addmission Letter BaksonDocument1 pageAddmission Letter BaksonAshwani KumarNo ratings yet

- Narinder Bhatia 6 Months Bank StatementDocument19 pagesNarinder Bhatia 6 Months Bank StatementAshwani KumarNo ratings yet

- Axis Repayment ScheduleDocument4 pagesAxis Repayment ScheduleAshwani KumarNo ratings yet

- ITR AY 20-21 Narinder Bhatia 20Document1 pageITR AY 20-21 Narinder Bhatia 20Ashwani KumarNo ratings yet

- AllottmentLetterDocument1 pageAllottmentLetterAshwani KumarNo ratings yet