Professional Documents

Culture Documents

7 Audit Report 2020-21

7 Audit Report 2020-21

Uploaded by

Ashwani Kumar0 ratings0% found this document useful (0 votes)

6 views18 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views18 pages7 Audit Report 2020-21

7 Audit Report 2020-21

Uploaded by

Ashwani KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 18

Om na

‘SANJEET & ASSOCIATES ‘Address.: ANANOPUR!

WEST BORING CANAL ROAD

CHARTERED ACCOUNTANTS: WEST BORING Cava

INDEPENDENT AUDITORS' REPORT

TO,

‘THE MEMBERS OF NAVRATAN PIPE AND PROFILE LIMITED

Report on the Financial Statements

We have audited the accompanying financial statements of NAVRATAN PIPE AND PROFILE:

LIMITED, which comprise the Balance Sheet as at 31/03/2021, the Statement of Profit and Loss,

for the year then ended, and a summary of the significant accounting policies and other explanatory

information.

Auditor's Opinion

In our opinion and to the best of our information and according to the explanations given to usy

the aforesaid financial statements give the information required by the Act in the manner so

required and give a true and fair view in conformity with the accounting principles generally

accepted in India, of the state of affairs of the Company as at 31/03/2021, and its Loss for the

year ended on that date,

Basis for Opinion

We conducted our audit in accordance with the Standards on Auditing (SAs) specified under section

143(10) ofthe Companies Act, 2013. Our responsibilities under those Standards are further deseribed

in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report, We

are independent of the Company in accordance with the Code of Ethics issued by the Institute of

Chartered Accountants of India together with the ethical requirements that are relevant to our audit of

the financial statements under the provisions of the Companies Act, 2013 and the Rules there under,

and we have fulfilled our other ethical responsibilities in accordance with these requirements and the

Code of Ethics, We believe that the audit evidence we have obtained is sufficient and appropriate to

provide a basis for our opinion.

Information Other than the Standalone Financial Statements and Auditor’s Report Thereon

‘The Company’s Board of Directors is responsible for the preparation of the other information. The

other information comprises the information included in the Management Discussion and Analysis,

Board's Report including Annexures to Board’s Report, Business Responsibility Report, Corporate

Governance and Shareholder’s Information, but does not include the standalone financial statements

and our auditor’s report thereon,

Cur opinion on the standalone financial statements does not cover the other information and we do

not express any form of assurance conclusion thereon.

In connection with our audit of the standalone financial statements, our responsibility is to read the

cther information and, in doing so, consider whether the other information is materially inconsistent

& Email :- sksarjeet38@gmail.com

SANJEET & ASSOCIATES Adress: AMANOPUR oan

ING CANAL

(CHARTERED ACCOUNTANTS WEST BORING CANA

withthe standalone financial statements or our knowledge obtained during the course of our audit or

otherwise appears to be materially misstated.

When we read such other information as and when made available to us and if we conclude that there

is a material misstatement therein, we are required to communicate the matter to those charged with

governance

Responsibility of Management and Those Charged with Governance (TCWG)

‘The Company's Board of Directors is responsible for the matters stated in Section 134(5) of the

Companies Act, 2013 (“the Act") with respect to the preparation of these financial statements that

give a true and fair view of the financial position , financial performance and cash flows of the

Company in accordance with the accounting principles generally accepted in India, including the

‘Accounting Standards specified under Section 133 of the Act, read with Rule 7 of the Companies

(Accounts) Rules, 2014, This responsibility also includes maintenance of adequate accounting

records in accordance with the provisions of the Act for safeguarding of the assets of the Company

‘and for preventing and detecting frauds and other irregularities; selection and application of

‘appropriate accounting policies; making judgments and estimates that are reasonable and prudent;

and design, implementation and maintenance of adequate internal financial controls, that were

operating effectively for ensuring the accuracy and completeness of the accounting records, relevant

to the preparation and presentation of the financial statements that give a true and fair view and are

free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company's ability

to continue as a going concem, disclosing, as applicable, matters related to going concern and using

the going concern basis of aecounting unless management either intends to liquidate the Company or

to cease operations, or has no realistic alternative but to do so.

‘The Board of Directors are also responsible for overseeing the Company's financial reporting

process.

Auditor's Responsibili

Cur objectives are to obtain reasonable assurance about whether the financial statements as a whole

are free from material misstatement, whether due to fraud or error, and to issue an auditor's report

that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee

that an audit conducted in accordance with SAs will always detect a material misstatement when it

exists,

Misstatements ean arise from fraud or error and are considered material if, individually or in the

‘aggregate, they could reasonably be expected to influence the economic decisions of users taken on

the basis of these financial statements.

|As part of an audit in accordance with SAs, we exercise professional judgement and maintain

professional skepticism throughout the audit. We al

OX Email: sksarjet38@gmai.com

SANJEET & ASSOCIATES Eres. TA BORING CANAL ROAD

ts

CHARTERED ACCOUNTANTS PATNA, BIHAR - 00001

«Identify and assess the risks of material misstatement of the financial statements, whether due to

fraud or error, design and perform audit procedures responsive to those risks, and obtain audit

evidence that is sufficient and appropriate to provide a basis for our opinion.The risk of not

detecting a material misstatement resulting from fraud is higher than for one resulting from error,

as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override

of internal control

+ Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances. Under section 143(3)() of the Companies

‘Ket, 2013, we are also responsible for expressing our opinion on whether the company has

‘adequate internal financial controls system in place and the operating effectiveness of such

controls.

«Evaluate the appropriateness of accounting policies used and the reasonableness of accounting

estimates and related disclosures made by management.

«Conclude on the appropriateness of management's use of the going concern basis of accounting

and, based on the audit evidence obtained, whether a material uncertainty exists related to events

‘or conditions that may cast significant doubt on the Company's ability to continue as a going

Concern. If we conclude that a material uncertainty exists, we are required to draw attention in our

suditor’s report to the related disclosures in the financial statements or, if such disclosures are

inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up

to the date of our auditor’s report. However, future events or conditions may cause the Company

to cease to continue as a going concern.

«Evaluate the overall presentation, structure and content ofthe financial statements, including the

disclosures, and whether the financial statements represent the underlying transactions and events

ina manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned

scope and timing of the audit and significant audit findings, including any significant deficiencies in

internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant

cthical requirements regarding independence, and to communicate with them all relationships and

other matters that may reasonably be thought to bear on our independence, and where applicable,

related safeguards.

From the matters communicated with those charged with governance, we determine those matters that

were of most significance in the audit of the financial statements of the current period and are

therefore the key audit matters. We describe these matters in our auditor’s report unless law or

regulation precludes public diselosure about the matter or when, in extremely rare circumstances, we

determine that a matter should not be communicated in our report because the adverse consequences

fof doing so would reasonably be expected to outweigh the public interest benefits of such

communication.

Report on Other Legal and Regulatory Requirements

‘As required by the Companies (Auditors! Report) Order,2016(‘the Order”) issued by the

a Eat -ssad6@anatcan

‘SANJEET & ASSOCIATES ‘Address.: ANANOPURI

WEST BORING CANAL ROAD

CHARTERED ACCOUNTANTS: WEST BORING CANAL

Central Government of India in terms of sub section (11) of section 143 of the Companies Act,

2013. We give in the Annexure A statements on the matters specified in paragraphs 3 and 4 of

the order, to the extent applicable.

‘As required by Section 143 (3) of the Act, we report that:

(@) We have sought and obtained all the information and explanations which to the best of our

knowledge and belief were necessary for the purposes of our audit.

(6) In our opinion, proper books of account as required by law have been kept by the Company

so far as it appears from our examination of those books.

(©) The Balance Sheet, the Statement of Profit and Loss, and dealt with by this Report are in

agreement with the books of account.

(@ In our opinion, the aforesaid financial statements comply with the Accounting Standards

specified under Section 133 of the Act, read with Rule 7 of the Companies (Accounts) Rules,

2014.

(e) On the basis of the written representations received from the directors as on 31/03/2021 taken

‘on record by the Board of Directors, none of the directors is disqualified as 31/03/2021 from

being appointed as a director in terms of Section 164 (2) of the Act.

(® With respect to the adequacy of the internal financial controls over financial reporting of the

Company and the operating effectiveness of such controls, refer to our separate report in

“Annexure B’,

(g) With respect to the other matter fo be included in the Auditor’s Report in accordance with

Rule 11 of the Companies (Audit and Auditors) Rules, 2014, in our opinion and to the best of

ur information and according to the explanations given to ust

i, The Company has disclosed the i

its financial statements.

.pact of pending litigations on its financial po:

ii. The Company has made provision, as required under the applicable law or accounting

standards, for material foreseeable losses, if any, on long-term contracts including

derivative contracts.

fii, There has been no delay in transferring amounts, required to be transferred, to the

Investor Education and Protection Fund by the Company.

Wm

SANJEET & ASSOCIATES

CHARTERED ACCOUNTANTS

Email :- sksarjoet38@gmail.com

‘Address.; ANANDPURI

WEST BORING CANAL ROAD

PATNA, BIHAR - 200001

Date 03/05/2022

Place : DELHI

FOR SANJEET & ASSOCIATES

(Chartered s

Proprietor

M.No. : 539199

UDIN : 22539199AMAMHQSS60

A Ema = uoeest garam

SANJEET & ASSOCIATES ‘Address,: ANANOPURI

WEST BORING CANAL ROAD

(CHARTERED ACCOUNTANTS PATNA, BIHAR - 200001

“Annexure B” to the Independent Auditor’s Report of even date on the Standalone Financial

‘Statements of NAVRATAN PIPE AND PROFILE LIMITED.

Report on the Internal Financial Controls under Clause () of Sub-section 3 of Section 143 of

the Companies Act, 2013.

‘We have audited the internal financial controls over financial reporting of NAVRATAN PIPE AND

PROFILE LIMITED as of March 31, 2021 in conjunction with our audit ofthe standalone financial

statements of the Company for the year ended om that date.

‘Management's Responsibility for Internal Financial Controls

‘The Company's management is responsible for establishing and maintaining internal financial

controls based on the internal control over financial reporting criteria established by the Company

considering the essential components of internal control stated in the Guidance Note on Audit of

Internal Financial Controls over Financial Reporting issued by the Institute of Chartered Accountants

of India. These responsibilities include the design, implementation and maintenance of adequate

internal financial controls that were operating effectively for ensuring the orderly and efficient

conduct ofits business, including adherence to company’s policies, the safeguarding of its assets, the

prevention and detection of frauds and errors, the accuracy and completeness of the accounting

records, and the timely preparation of reliable financial information, as required under the Companies

Act, 2013

Auditors’ Responsibility

‘Our responsibility is to express an opinion on the Company's internal financial controls over financial

reporting based on our audit, We conducted our audit in accordance with the Guidance Note on Audit

of Internal Financial Controls Over Financial Reporting (the “Guidance Note”) and the Standards on

Auditing, issued by ICAI and deemed to be preseribed under section 143(10) of the Companies Act,

2013, to the extent applicable to an audit of internal financial controls, both applicable to an audit of

Internal Financial Controls and, both issued by the Institute of Chartered Accountants of India. Those

Standards and the Guidance Note require that we comply with ethical requirements and plan and

perform the audit to obtain reasonable assurance about whether adequate internal financial controls

over financial reporting was established and maintained and if such controls operated effectively in

all material respects.

‘Our audit involves performing procedures to obtain audit evidence amout the adequacy of the internal

financial control system over financial reporting and their operating effectiveness. Our audit of

internal financial controls over financial reporting, assessing the risk that a material weakness exists,

and operating effectiveness of internal control based on the assessed risk. The procedures selected

depend upon on the auditor's judgment, including the assessment of the risks of material misstatement

of the financial statements, whether due to fraud or error.

‘We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis

for our audit opinion on the Company's internal financial controls system over financial reporting.

‘Meaning of Internal Financial Controls over Financial Reporting

A cnet staesgnatcn

SANJEET & ASSOCIATES ‘idroes TEST BORING CANAL ROAD

(CHARTERED ACCOUNTANTS PATNA, BINAR 0000"

‘A company’s internal financial control over financial reporting is a process designed to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles. A

‘company’s internal financial control over financial reporting includes those policies and procedures

that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect

the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that

transactions are recorded as necessary to permit preparation of financial statements in accordance

with generally accepted accounting principles, and that receipts and expenditures of the company are

being made only in accordance with authorizations of management and directors of the company; and

(3) provide reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use, or disposition of the company's assets that could have a material effect on the

financial statements.

Inherent Limitations of Internal Financial Controls over Financial Reporting

Because of the inherent limitations of internal financial controls over financial reporting, including,

the possibility of collusion or improper management override of controls, material misstatements due

to error or fraud may occur and not be detected, Also, projections of any evaluation of the internal

financial controls over financial reporting to future periods are subject to the risk that the internal

financial control over financial reporting may become inadequate because of changes in conditions,

or that the degree of compliance with the policies or procedures may deteriorate.

Opinion

In our opinion, the Company has, in all material respects, an adequate internal financial controls

system over financial reporting and such internal financial controls over financial reporting were

operating effectively as at March 31, 2021, based on the internal control over financial reporting

criteria established by the Company considering the essential components of internal contro state

the Guidance Note on Audit of Internal Financial Controls over Financial Reporting issues by the

Institute of Chartered Accountants of India,

FOR SANJEET & ASSOCIATES

(Chartered Accountants)

Date : 03/08/2022

Place : DELHI

UDIN : 22539199AMAMHQSS60

NAVRATAN PIPE ANO PROFILE LIMITED

(CIN-: U27106D12005PLC138856)

Regd Office : 19, COMMUNITY CENTRE, 3RD FLOOR, MAYAPURI PHASE - 2, MAYAPURI PHASE - 2, DELHI-110064,

Contact No:-, Emall: sales@navratanpipes.com

DELHI

Balance Sheet as on 31st March, 2021

(amountin s)

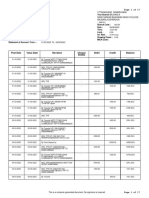

PARTICULARS NOTENO | CURRENT YEAR| PREVIOUS EAR

TW EGUITY AND ABIES

(a) SHAREHOLDERS FUNDS

(A) HARE CAPITAL 2 4492,24900.00| 4.9224,00000

(9) RESERVES AND SURPLUS 3 1157,42,720.49 | 4,03,60,192.00

(CI MONEY RECEIVED AGAINST SHARE WARRANTS : -

(2) SHARE APPLICATION MONEY PENDING ALLOTMENT Z :

(@) Now-cyaRenr UAaiuTies

(a) LONG Team BORROWINGS 4 4.35,3,560.00| —,35,32560.00

(o} DEFERRED Tax LIABIATES (NEN 5 ‘558,038.00 | 53,51,380.00

(OTHER LONG TERM UABITIES : -

(0) LONG-TERM PROVISIONS : :

(a) cunRenr uapiumies

(a) SHORTTeRM BORROWINGS - :

(0) TRADE PaVABLES 6 14,4438.00 | 16,68,287.00

(C)oTHER cuRRENT UABIUTIES 7 324090000 130,700.00

(0) SHORT-TERM PROMISIONS ‘ 2 -

Torat 359807995640 | 15,0867030.00

(uy assers

{3]NON-CURRENT ASSETS

(a) PROPERTY, PLANT AND EQUIPMENT : -

(9 TANGIOLE ASSETS 8. | 12;0243,24349 | 14,12,90283.00

(ay WvTaniLe ASSETS : :

{uw caorrat workan-PRogREss - -

(WV) WVTANGIBLE ASSETS UNDER DEVELOPMENT é 2

{o)Now-cuRReNT nivesTMENTS : :

(C)oeFERRED TAX ASSETS (NET)

(©).0NG TERM LOANS AND ADVANCES :

(@) OTHER NON-CURRENT ASSETS : :

(2) cunRENT assers

(]) CURRENT INVESTMENTS : ¢

(oy1wvenTonies - .

(C)TRabe Recervastes 9 2724796600 | 2,7926120.00

{0) CASH AND BANK BALANCES: 10 aza7s.oo | 1,65,152.00

{€) SHORT TERM LOANS AND ADVANCES n a775372.00| — 1,14,80564.00

(Fy OTHER CURRENT ASSETS : -

TorAL 3599,75 95608 | 16 08,07,829.00

SIGNIFICANT ACCOUNTING POLICIES T

FOR NAVRATAN PIPE AND PROFILE LIMITED

For NAVRAYAN PIPE & P2CFILE LIE

DAWU Bhur J v0 :

ae RARCTOR ‘SURESH BHARDWRIRECTOR

(o1v-osese7a3) 7 pees

(ow-06030355)

Place :DELKI

Date : 0305/2022

For NAVRAYAN PIPE & BPLOFILE LIITED

a OD

For NAVRAYAN PIPE & @°CFILE LINTED

NAVRATAN PIPE AND PROFILE LIMITED

{ciN-: y271060L2005PLC138856)

Regd Office :10, COMMUNITY CENTRE, 3RD FLOOR, MAYAPURI PHASE - 1, MAYAPURI PHASE - 2, DELHI-110064,

DELHI

Contact No: -, Email: sales@navratanpipes.com

‘Statement of Profit And Loss for the year ending 31st March, 2024

(Amount in Rs.)

PARTICULARS

NOTE

No

‘AMOUNT

current ear | AMOUNT

PREVIOUS YEAR

TD REVENUE FROM OPERATIONS

(WOTHERINCONE

(il) TOTAL REVENYE (14)

(iv) Expenses

(1) COST OF MATERIALS CONSUMED

(2) STORES & SPARES CONSUMED

(3) PURCHASES OF STOCK-IN-TRADE

(4) CHANGES IN INVENTORIES OF FINISHED

‘GOODS, WIP AND STOCKANCTRADE

(5) EMPLOYEE BENEFITS EXPENSE

(6) FINANCE CosTS

(7) DEPRECIATION AND AMORTIZATION EXPENSE

(e) OTHER ExPENSES

TOTAL EXPENSES

(V) PROFIT BEFORE EXCEPTIONAL AND

EXTRAORDINARY ITEMS AND TAX (I-IV)

(EXCEPTIONAL ITEMS

(vil PROFIT BEFORE EXTRAORDINARY ITEMS AND

TAK (VAI)

(vy ExTRAOROINARY ITEMS

(0x) PROFIT BEFORE TAK (VIEVIN)

(0) TAX EXPENSE:

(a) CURRENT TAX

(2) DEFERRED TAK

(0%) PROFIT/(LOSS) FOR THE PERIOD FROM

CONTINUING OPERATIONS (14%)

(0) ROFIT/ (LOSS) FROM DISCONTINUING

‘OPERATIONS

(xl) TAX EXPENSE OF DISCONTINUING

(OPERATIONS

(x1v) PROFIT/(LOSS) FROM DISCONTINYING

‘OPERATIONS (AFTER TAX) (IL-XI)

[Xv] PROFIT (LOSS) FOR THE PERIOD (XI+XIV)

(vl) EARNINGS PER EQUITY SHARE:

ysasic

(2) ouyreD

i

2

4,81,305.00,

25,72,968.00

31,216.00

2,10,51,139.51

12,10,360.00

242,658.00

51,060.00

111.00

51,171.00,

23,60,000.00

28,725.00

2,57,08,554.

00

040,171.00

2,50,25,984.51,

(249,74,833.51)

(2,49;74,813.51)

(2,49,74,81351)

=| s0918.00

(252,17,471.51)

(2,52,17,471.51)

(5:12)

6.2)

10,2634,405.00

10,25,34,405.00

3,31,33,450.00

6,95,00,955.00

6,95,00,955.00

6,95,00,955.00

6,94,50,090.00

6,94,50,040.00

aaa

aan}

SIGNIFICANT ACCOUNTING POUGIES

FOR NAVRATAN PIPE AND PROFILE Li

Reais Thies dtoe [

ADAGE

(OirectqplRECTOR

(oin-ossse7s3) +

Pace :OEUHl

Date :03/05/2022

(o1N-08030355)

“Membership No :$39199

NAVRATAN PIPE AND PROFILE LIMITED

(CIN-: Y27106D12005PLC138856)

Regd Office : 10, COMMUNITY CENTRE, 3RD FLOOR, MAYAPURI PHASE - 1, MAYAPURI PHASE - 2, DELHI-110064,

DELHI

Contact No: -, Email: sales@navratanpipes.com

Notes to Account for the year ending 31st March, 2021

(amount in Rs.)

1 SIGNIFICANT ACCOUNTING POLICIES

(1) Basis of Accou

“The Assessee has followed Mercantile Basis of accounting

(Ik) Revaluation of Fixed Assets

No Revaluation of Fixed Assets has been done the financial Year.

{ll} Revenue Recognition

Sales has been Stated Net of Tax and Duties.

(WV.) Sundry Debtors

Debtors are subject to confirmation.

(v,) Sundry Creditors

Sundry Creditors are subject to Confirmation.

(Vu) Unsecured Loans

Unsecured Loans are subject to Confirmation,

(vit) Retirement Benefits

1 Retirement Benefits are incorporated on the Cash Basis As And When Paid.

2, Gratuity, other ex-gratia benefits and leave encashment are accounted on cash basis.

(vill) Taxes on income

1. Deforred Tax Assets on Unabsorbed Depreciation And Carty Forward of losses is not recognised unless there is virtual

certainty that there wil be sufficient future taxable income available to realise such Assets.

2, Tax expense comprises both current and deferred taxes. Current tax is provided for on the taxable profit of the year at

‘applicable tax rates, Deferred taxes on income reflect the Impact of timing difference between taxable income and

‘accounting income for the year and raversal of timing differences of earlier years.

(1X4 Contingent Liability

‘No Provision is made for liabilities which are contingent in nature but i material the same are disclosed by way of notes to

the accounts.

2, SHARE CAPITAL

‘The reconltation ofthe Closing amount and Opening amount of Share Capitals even 2s follows:

‘OPENING CLOSING

reas Sante | agonow | emecion | San

SE agiiiec: CRED = aac

ISSUED SHARE CAPITAL

{4922400 EQUITY SHARES OF RS.30.00 EACH.

SUBSCRIBED AND FULLY PAID-UP CAPITAL

482,24,000.00

492,24,000.00

“The reconlation ofthe Closing amount and Opening amount of Reserves & Surplus is given as follows:

14922400 EQUITY SHARES OF RS.10.00 EACH, 4,92,24,000.00 =| 492,24,000.00

Less | CALLS YNPAID : : :

Less: | FORFEITED SHARES : :

TOTAL "4,92,34,000.00 : = [4,92,24,000.00

(1) USTs OF SHAREHOLDERS HOLDING MORE THAN 59 OF SHARES

‘Te name ofthe shareholder's holding more than $% shares a onthe balance sheet date Is glven below

'SENo. [Name ofthe shorcholder [[t, of shares held Heat ataresheld

2 | Abbhishek setico 3400,

2 [achia Ghardvay 783500, 26,00

3 | nigun hada S060" 20.00

| Siresh Bhardua 5iso00" 10.8

5 [Ram Naresh $eases 700

Total 3325168 7.6

3, RESERVES & SURPLUS

PaTCULARS cuAnENTVEAR BREWiOUS TEAR

SCunTgS PREMIUM RESERVE

OPEHING BALANCE 15,8788 00000 1s,8756¢0000

00: | ao0m0Ns : :

15,87,56,000.00 | 15,87,56,000.00

uss. oroucvoxs =| s5975600000 =| 15.87s600000

sunpwus

OPENING BALANCE (a1.7795,0800) tas72.4s..00

00; | xo0mONs : 6945091000

779500800 (i.7795,80800

uss: ocoucrions 2sai747.51 | (14303327959) =| (2177$5,80800)

Tora Taran as0a52.00

4, LONG TERM BORROWINGS

‘The reconelistion ofthe Closing amount and Opening amount of Long term Borrowings Is given as follows

PARTICULARS ‘CURRENT YEAR. PREVIOUS YEAR

LOANS AND ADVANCES FROM

RELATIVES

‘UNSECURED 8,35,22,$60.00 | 8,35,32,560.00] 8,35,32,560.00] 8,35 32,560.00

TOTAL 3735,32,560.00, 8,35 32,560.00

5. DEFERRED TAX

‘The reconcation ofthe Closing amount and Opening amount of Deferred Toxs given as follows

aS Bua aaaas

gro oman

[ es aiaerrOR ey

7. OTHER CURRENT LIABILITIES

The reconciliation of the Closing amount and Opening amount of Other Current Liabilities 1s elven as follows:

“CURRENT

PARTICULARS YEAR PREVIOUS YEAR

‘CHMER PAVABLES

“ADVANCE FROM CUSTOMERS 37,00,000.00

= AUDIT FEES PAVABLE 2 415,000.00

= SALARY PAYABLE, 140,800.00 | 38,40,800.00 | __1,15,700.00| _1.30,700.00

TOTAL 38,40,800.00 | 1,30,700.00

9, TRADE RECEIVABLES

The reconciation of the Closing amount and Ope

sing amount of Teade receivables I given as follows:

PARTICULARS (CURRENT YEAR. PREVIOUS YEAR

AMOUNT OUTSTANDING FORA

PERIOD EXCEEDING 6 MONTHS

UNSECURED, CONSIDERED GOOD | 1,58,85,845.00 :

ousrFUL =| 1,58,85,845.00 : :

2. OTHERS

UNSECURED, CONSIDERED GoD, | 4,13,62,121.00 2,79,26,120.00

DOUBTFUL | 4,13,62,121.00 =| © 2,79,26120.00

TOTAL 2,72,47,966.00, 2,79,25,120.00,

10, CASH AND BANK BALANCES

“Te reconciliation ofthe Closing amount and Opening amount of Cash and Bank Balances fs even as follows:

PARTICULARS ‘CURRENT YEAR PREVIOUS YEAR

‘CASH AND CASH EQUIVALANTS,

+ BALANCES WITH BANK 43,939.00 105,889.00,

CASH ON HAND 68536.00| 112,475.00 60,263.00 166,152.00

TOTAL 312,475.00, 166,152.09

114, SHORT TERM LOANS AND ADVANCES

“Tha reconellation ofthe Closing amount and Opening amount of Short tarm Loans ang advances Is given a flows:

PARTICULARS, ARENT YEAR PREVIOUS YEAR

"ADVANGE TO CUSTOMER

LUNSECYRED, CONSIDERED GOOD 2,75,000.00,

[ALLOWANCE FOR BAD AND

‘ESS: | DOUBTFUL LOANS & ADVANCES epee

cost

UNSECURED, CONSIDERED GOOD 10,34,738.00 10,26,758.00

[ALLOWANCE FOR BAD AND

LESS: |S OaTFUL LOANS & ADVANCES =| 10;34,738.00 10,26,758.00

DUTIES AND TAXES RECEIVABLES.

UNSECURED, CONSIDERED GOOD, 32,56,870.00 32,86,870.00

_ | AUWOWANCE FOR BAD AND i

eA LOANS & ADVANCES =| 32,56,870.00 32,56,870.00

lost

[UNSECURED, CONSIDERED GOOD 138,32,202.00 38,28,385.00

ALLOWANCE FOR BAD AND

Ls: | AO DTFUL LOANS & ADVANCES =| 332,202.00 : 38,28,355.00

“SECURITY DEPOSITS WITH GOVT

‘oDies

UNSECURED, CONSIDERED GOOD 30,97,733.00 30,97,733.00

ALLOWANCE FOR BAD AND

oS A PUILLOANS & ADVANCES. =| © 3097,733.00 : 30,97,733.00,

sost

UNSECURED, CONSIDERED GOOD 2,78,829.00, 270,848.00,

ALLOWANCE FOR BAD AND

Les. STFULLOANS & ADVANCES \ =] 2778,829.00 2,70,888.00

TOTAL 117,75,372.00 3,14,80,568.00

12, REVENUE FROM OPERATIONS

“The rezoncltion ofthe Closing amount and Opening amount of Revenue from oparations Is given as follows,

PARTICULARS "CURRENT YEAR PREVIOUS YEAR

‘REVENUE FROME

=__ SALE OF PRODUCTS 51,060.00 $1,060.00

TOTAL 51,060.00 zi

15, OTHER INCOME

“Te reconciliation ofthe Closing amount and Opening amount of ther Income is gen as follows:

PARTICULARS Ta ‘CURRENT YEAR. PREVIOUS YEAR

PROFIT ON SALE OF FIKED ASSETS

(LAND AND BUILDING) potas

‘SHORT AND EXCESS: 11,00

2 TOTAL 311.00 7026,84,405.00

414, EMPLOYEE BENEFITS EXPENSE

“The reconciliation ofthe losing amount and Opening amount of

Emaloyee Benafits Expenses given as follows:

PARTICULARS, (CURRENT YEAR, PREVIOUS YEAR

‘SALARIES AND WAGES: 24,26,845.00 720,50,000.00

‘STAFF WELFARE EXPENSES 345,178.00 3,10,00000,

TOTAL 25,71, 568.00 33,60,000.00

15, FINANCE COSTS

The ceconcation ofthe Closing amount and Opening amount of Finance costs is given as follows:

PARTICULARS ‘CURRENT VEAR PREVIOUS YEAR

DANK CHARGES 11,216.00 28,725.00

TOTAL 14,216.00 26,725.00

116, OTHER EXPENSES

The reconcliation ofthe Closing amount ang Opening amount of Other Expenses gven as follows:

PREVIOUS

PARTICULARS ‘CURRENT YEAR nnn

‘OTHER EXPENSES ap

= ADVERTISING & PUBLICITY : 135,000.00

AUDIT FEES 2 15,000.00

= BUSINESS PROMOTION EXPENSES 4,290.00, ‘69,540.00

CCAR / BKE RUNNING & MAINTENANCE 108,789.00, 65,870.00

= COMPUTER EXPENSES 3,536.00 ‘340.00

= CONVEYANCE EXPENSES 3,413.00 52,350.00

“= FACTORY EXP 91,774.00 :

+ FREIGHT EXP 10,000.00

= GENERATOR RUNNING EXPENSES : 109,850.00

INCOME TAK AY 201415, 4,816.00 :

= LABOUR CHARGES 1,02,785.00 4,86,910.00

= LAND LEASE RENT PAID TO RFC : 34,38,087.00

= LEGAL & PROFESSIONAL CHARGES 104,200.00 42,500.00

= MEDICAL EXP 323.00 :

= MEMBERSHIP FEES — 40,000.00 :

= OFFICE EXP 73,795.00

= PARKING EXP 10,765.00 :

= POSTAGE ANO COURIER < 11,956.00

= POWER & ELECTRICITY EXPENSES 2,80,702.00 3,28,988.00

| PRINTING & STATIONERY : 136,500.00

“= RECRUITMENT EXPENSES 3,894.00, 12,350.00

RENT / LEASE RENT 11,000.00 72,000.00

“REPAIR & MAINTENANCE 72,238.00 41,14,560.00,

“= ROC FILING FEES 4,460.00 138,400.00

= SECURITY EX? 1,56,526.00 e

“TELEPHONE EXPENSES: ‘44,480.00 8,450.00

TOUR AND TRAVELLING 82,698.00 1,18,560.00

= WATER EXPENSES =| 12,10360.00| _ 12,500.00 | $040,171.00

TOTAL 32,10,360.00 '50/40,073.00

47, OTHER

(0) Figures have been regrouped and rearranged wherever found necessary.

FORNAVRATAN PIPE AND PROFILELIMITED

* pos NAVRATAY PIPE & PACFILE LISTED "For me

Bixtat ards ican

¥ EN ica ca

conosetnag* (ieee) one

(o1n-0s020355) No:

Powe 06

Date :03/05/2022

INAVRATAN PIPE AND PROFILE LIMITED

(ciN:-v27106012005PL¢138856)

Reg Office : 10,COMMUNITY CENTER, 3RD FLOOR|MAYAPURI INDUSTRIAL AREA ,OELHI-110064

‘Contact: Emall : sales@navratanpipes.com

‘Blatamant of Deferred Tax Labilkes =]

Pantculars ‘Amount(Re] | Armour Rs)

ening anonce| SetferedToxusbiig) Sai

Fiingovference forthe Year

ospredaon as per Companies A 2033 ExOET

Deprecation per ncome Tax Act 1862 2836 40

ining Bierce fore Year 85.300)

eared Fx Unis forte yen PAL). ase

tong BaatcfDetered Tax uabiies) EE

(vorseu0)

oLosymauvHs HSRINS

sak AS

asin sus0ue 2 Bale

ee

wrod

tego,

Beaent | w

Senoronas-

izozre/be uo pepue poued aun 10} 39 xe] oulooU J0d se ofqemorre uoHerosidec,

‘ac ‘L~ ASVHd RiNcVAVIN 'L - 3SVHd IUNEVAVIN HOOT GE "SALNO ALINNIWOD * 0

GSLINN FWdOUd GN Sdld NVLVYAVN

‘zoz/s0/e0: sea

nga: 22014

(sse0eo20-wia)

vomzaah-

CSL 5 d0ue td NVIVEAWN 104

» panscunaltt3=200e)

orszral®*/25990%

etna ten

ee kek

qauian swore Sad Neen 08

‘aaLIVNT 314084 ANY Bald NYLVEAYHE HOS

cumin [emam Joumum [oro [amas [vsnoce [amare [arose [wows [eons [roma [sense

sara — foresee [roma [oso —— tooo ——[yraeren~ roosee — ern — [ooo [oo reser a

nn

come [arm [esses fone [ooo ferme [orwnecr [once [ooo [ovo faraneart_| oussmovaviva

“aw ssunaico

roars — [won — poets [aro —— [arora 35 fos rs Sra

SS

vente [ore coo ervon | ovomese a Cee oe

i aaoat

cosowsm | aewiose ee oe wo [oo feormenes | SHO

ree

ee ooo | remesme | ences coo [wo eveconnine | uation

SSE | STORIE tao fos oa fos oe a

Sea ROWE

73t | st

oe ramp | sokowos oasane | ava | Qt, | enmnes

tron ‘rama _| “Sarre

Dona NOLVANOWY /NOUWORTE "oo

STON SPH

IH73G “P9OOTT-IHN3G ‘I - 3SVHd 1ENAVAVIN ‘T - 3SVEHd PINEVAVIN "HO

ANaWdINDA ONY ANVId ‘ALUZEOUd

woo'sodjdueresmeu@sojes 1213 '-:0N eID

1€ “JULN3O ALINMINWOD ‘OT : 2240 POY

(osseetarasoozias0r “zn

G3LINN 31130Nd GN Seid NYLYEAUN

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 20230109130503Document6 pages20230109130503Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun ContactsDocument2 pagesVikas Bhawan Dehradun ContactsAshwani KumarNo ratings yet

- 16 Land Allotment RIICODocument10 pages16 Land Allotment RIICOAshwani KumarNo ratings yet

- NPPL Project Report 50Cr 2022Document76 pagesNPPL Project Report 50Cr 2022Ashwani KumarNo ratings yet

- Aditya Birla Udyog New Pdated Pin Code ListDocument459 pagesAditya Birla Udyog New Pdated Pin Code ListAshwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 2Document4 pagesVikas Bhawan Dehradun Contacts 2Ashwani KumarNo ratings yet

- Aadhar CardDocument2 pagesAadhar CardAshwani KumarNo ratings yet

- Commector Payout Claim DataDocument3 pagesCommector Payout Claim DataAshwani KumarNo ratings yet

- Ubl PolicyDocument28 pagesUbl PolicyAshwani KumarNo ratings yet

- DBS PL LatestDocument160 pagesDBS PL LatestAshwani KumarNo ratings yet

- NPPL Catalog ScaffoldingDocument12 pagesNPPL Catalog ScaffoldingAshwani KumarNo ratings yet

- CASHe LoansDocument7 pagesCASHe LoansAshwani KumarNo ratings yet

- Central Bank Branch List Pan IndiaDocument549 pagesCentral Bank Branch List Pan IndiaAshwani KumarNo ratings yet

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument17 pagesPost Date Value Date Narration Cheque Details Debit Credit BalanceAshwani KumarNo ratings yet

- All Serviceable Pincodes nonGL-Version20 BL&PLDocument717 pagesAll Serviceable Pincodes nonGL-Version20 BL&PLAshwani KumarNo ratings yet

- Banking ...Document8 pagesBanking ...Ashwani KumarNo ratings yet

- ITR AY 20-21 Narinder Bhatia 20Document1 pageITR AY 20-21 Narinder Bhatia 20Ashwani KumarNo ratings yet

- Unlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedDocument6 pagesUnlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedAshwani KumarNo ratings yet

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarNo ratings yet

- Addmission Letter BaksonDocument1 pageAddmission Letter BaksonAshwani KumarNo ratings yet

- Axis Repayment ScheduleDocument4 pagesAxis Repayment ScheduleAshwani KumarNo ratings yet

- ITR AY 22-23 Narinder BhatiaDocument1 pageITR AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- Balance SHEETSDocument9 pagesBalance SHEETSAshwani KumarNo ratings yet

- Banking HPGB 2Document3 pagesBanking HPGB 2Ashwani KumarNo ratings yet

- AllottmentLetterDocument1 pageAllottmentLetterAshwani KumarNo ratings yet

- Loan Letter BaksonDocument1 pageLoan Letter BaksonAshwani KumarNo ratings yet

- College Details For Education LoanDocument7 pagesCollege Details For Education LoanAshwani KumarNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ashwani KumarNo ratings yet

- E BillDocument2 pagesE BillAshwani KumarNo ratings yet

- Compt 23-24Document1 pageCompt 23-24Ashwani KumarNo ratings yet