Professional Documents

Culture Documents

Homework 2

Uploaded by

zahir abdellahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

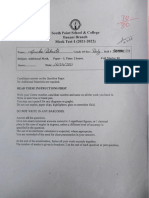

Homework 2

Uploaded by

zahir abdellahCopyright:

Available Formats

Institute of Actuarial and Financial Mathematics WiSe 2023/24

Leibniz University Hannover

Prof. Dr. Stefan Weber, M.Sc. Sören Bettels

Quantitative Risk Management - Homework 2

Homework 2.1 - Properties of LSE 2 + 3p

Let β̂ be the least squares estimator of the classical linear model

y = Xβ + ε,

where X ∈ Rn×k+1 is the design matrix, β ∈ Rk+1 is the unknown parameter and ε ∈ Rn

are the centered errors with Cov(ε) = σ 2 I. Proof the following claims:

a) β̂ is an unbiased estimator for β.

b) Cov(β̂) = σ 2 (X T X)−1 when conditioned to X and Cov( d β̂) = σ̂ 2 (X T X)−1 is an

1

unbiased estimator for Var(β̂), where σ̂ 2 = n−k−1 ε̂T ε̂.

Homework 2.2 - Linearizable Regression Functions 2 + 2 + 2p

Consider the regression model

yi = f (zi , β, εi ),

for a suitable function f , i ∈ {1, . . . , n} and arbitrary error random variables εi .

Show that for the following functions f (zi , β, εi ) the regression model can be transformed

to a linear model and derive an estimator for β ∈ R2 from the least squares estimator of

the transformed model under the assumption that the after the transformation resulting

additive errors are centred and independent in i.

(a) f (zi , β, εi ) = β1 ziβ2 εi ,

(b) f (zi , β, εi ) = exp(−β1 zi1 exp(−β2 zi2 )εi ),

(c) f (zi , β, εi ) = β1 zi /(β2 + zi + β1 zi εi ).

Homework 2.3 - Empirical Properties of Financial Data 2 + 2 + 2p

Analyze the log returns of the Volkswagen stock from October 27th, 2015, until October

27th, 2020 in MATLAB:

a) Extract the stock price data from a source of your choice (for example: from Yahoo

Finance, stock VOW3.DE, closing value) and plot the log returns against time.

b) Fit a normal distribution in mean and variance to the log returns and sample a

time series as i.i.d. samples from the fitted normal distribution. Secondly compare

the log returns in (a) to the fitted normal distribution with a QQ-plot.

c) Calculate skewness and kurtosis of the log returns and perform a Jarque-Bera

test. Is a normal distribution in your opinion an appropriate choice to model the

Volkswagen log returns?

d) Extract BMW stock price data (BMW.DE) for the same time period and calculate

the corresponding log returns. Compare the BMW and Volkswagen log returns

time series and draw a pairwise scatter plot.

Homework 2.4 - Classical Linear Regression 1 + 2p

Consider the process St , t ∈ {1, . . . , 254} describing the daily closing prices of the german

market index DAX. We assume that the relative increments of St are independent in

time and stationary, such that

St+1 St+1 d Ss+1

|=

St and = ,

St St Ss

where s ̸= t, s, t ∈ {1, . . . , 253}.

a) Download the historical closing prices of the DAX from StudIP and plot the data

and returns SSt+1

t

against time.

b) Assume that St = β0 + β1 t + εt and calculate the least squares estimator for

(β0 , β1 )T to estimate the deterministic drift of log(St ) in the last year. Is this a

good approach to estimate the expected behavior of the DAX?

The solutions to the homework are to be handed in until the 6th of November at 12:15

p.m. via email to azuka.isaac@stud.uni-hannover.de

You might also like

- The 5 Core ToolDocument17 pagesThe 5 Core ToolRajesh GhoshNo ratings yet

- Noise: How To Overcome The High, Hidden Cost of Inconsistent Decision MakingDocument15 pagesNoise: How To Overcome The High, Hidden Cost of Inconsistent Decision MakingLino GabrielNo ratings yet

- H2 Math (Pure Math Consultation)Document22 pagesH2 Math (Pure Math Consultation)terrygoh100% (1)

- IIA - Test4prep - Iia CIA Part2.v2019!02!04.by - Paul.275qDocument122 pagesIIA - Test4prep - Iia CIA Part2.v2019!02!04.by - Paul.275qAhmad Tawfiq DarabsehNo ratings yet

- Topic 1 Introduction To Mathematical EconomicsDocument7 pagesTopic 1 Introduction To Mathematical EconomicsMazwan ManselahNo ratings yet

- Principles and Methods of Law and Economics Enhancing Normative Analysis Oct 2005 PDFDocument394 pagesPrinciples and Methods of Law and Economics Enhancing Normative Analysis Oct 2005 PDFMarcelo Mardones Osorio100% (3)

- Mathematical Tripos: at The End of The ExaminationDocument27 pagesMathematical Tripos: at The End of The ExaminationDedliNo ratings yet

- HW3Document2 pagesHW3SNo ratings yet

- Assignment 3Document3 pagesAssignment 3Cricket FeverNo ratings yet

- Lease Squares MethodDocument10 pagesLease Squares Methodsuraj poudelNo ratings yet

- 307 Ode Notes 2020 2021Document148 pages307 Ode Notes 2020 2021Sam BolduanNo ratings yet

- U X U Y: Homework 1Document2 pagesU X U Y: Homework 1Nadeem ShaukatNo ratings yet

- Sgta 2Document3 pagesSgta 2Mannan WayneNo ratings yet

- Expt. 2 Graphing and Curve-FittingDocument5 pagesExpt. 2 Graphing and Curve-Fittinguri choiNo ratings yet

- 2021 EE769 Tutorial Sheet 1Document4 pages2021 EE769 Tutorial Sheet 1raktionNo ratings yet

- Ksjahcdgcfkusdhcgy 6769Document40 pagesKsjahcdgcfkusdhcgy 6769Gaming SukantNo ratings yet

- Assignment 5: E1 244 - Detection and Estimation Theory (Jan 2023) Due Date: April 02, 2023 Total Marks: 55Document2 pagesAssignment 5: E1 244 - Detection and Estimation Theory (Jan 2023) Due Date: April 02, 2023 Total Marks: 55samyak jainNo ratings yet

- Assignment 1Document2 pagesAssignment 1karthikvs88No ratings yet

- Alg Exercises 3Document3 pagesAlg Exercises 3Cayuss Andrei MihăițoaiaNo ratings yet

- Assignment 2 (2015F)Document8 pagesAssignment 2 (2015F)iamnuaiNo ratings yet

- Math 422 Winter 2007 - Final Exam: 1 2 T 2 3 t+1 T T 1 t+1 t+2Document3 pagesMath 422 Winter 2007 - Final Exam: 1 2 T 2 3 t+1 T T 1 t+1 t+2AmrAraagNo ratings yet

- Cu Stat3008 Assignment 1Document2 pagesCu Stat3008 Assignment 1Jim Hack0% (1)

- Depicting Qudit Quantum Mechanics and Mutually Unbiased Qudit TheoriesDocument24 pagesDepicting Qudit Quantum Mechanics and Mutually Unbiased Qudit TheoriesGrâce Dorcas Akpéné AMOUZOUNo ratings yet

- 2011 Daa End-RegularDocument4 pages2011 Daa End-Regular8207dayaan BashirNo ratings yet

- 002 DcproblemsDocument8 pages002 DcproblemsTayyab UsmanNo ratings yet

- Math2111 2009 ExamDocument7 pagesMath2111 2009 ExamRaymond YeNo ratings yet

- The Challenges of Multivalued FunctionsDocument14 pagesThe Challenges of Multivalued FunctionsGus CostaNo ratings yet

- CS260: Algorithms: First Exercise Sheet (To Be Discussed in Week 2 Seminars)Document5 pagesCS260: Algorithms: First Exercise Sheet (To Be Discussed in Week 2 Seminars)dragutu danNo ratings yet

- 1 Computation Questions: STA3002: Generalized Linear Models Spring 2023Document3 pages1 Computation Questions: STA3002: Generalized Linear Models Spring 2023Owen DengNo ratings yet

- Sample Problems of Experimental MathematicsDocument7 pagesSample Problems of Experimental MathematicsSaifuddin AriefNo ratings yet

- Homework 0Document6 pagesHomework 0jerryNo ratings yet

- Vmls Additional ExercisesDocument66 pagesVmls Additional ExercisesmarcosilvasegoviaNo ratings yet

- Assignment 5 - Due November 1: 2 B A B A 2 2 0 0Document1 pageAssignment 5 - Due November 1: 2 B A B A 2 2 0 0Harsh Vardhan DubeyNo ratings yet

- The Arithmetic Derivative and AntiderivativeDocument17 pagesThe Arithmetic Derivative and AntiderivativeAmund EllingsenNo ratings yet

- MATH5340M Risk Management in TemplateDocument6 pagesMATH5340M Risk Management in TemplateShedrine WamukekheNo ratings yet

- 18.03SCF11 Text - 18.03SC Final ExamDocument4 pages18.03SCF11 Text - 18.03SC Final ExambvgfNo ratings yet

- MTH 600: Assignment 2: Due March. 19 (Thursday), in LabDocument3 pagesMTH 600: Assignment 2: Due March. 19 (Thursday), in LabArJitYaDavNo ratings yet

- MPZ4230-Assignment 01-04Document10 pagesMPZ4230-Assignment 01-04surangabongaNo ratings yet

- NonlinearequationsDocument22 pagesNonlinearequationsdeepNo ratings yet

- Proj 1Document3 pagesProj 1lorentzongustafNo ratings yet

- The W Hashing FunctionDocument20 pagesThe W Hashing FunctionSri Chandan KalavapudiNo ratings yet

- Ad Math P1 mck1Document14 pagesAd Math P1 mck1apurbodebnath5belyNo ratings yet

- Unit 2Document17 pagesUnit 2Sagnik GangulyNo ratings yet

- MATH LinearAlgebra HW1 - 094568Document2 pagesMATH LinearAlgebra HW1 - 094568Nam PhamNo ratings yet

- Exponent Function Walid YahyaDocument43 pagesExponent Function Walid Yahyawalid yahyaNo ratings yet

- MATH3161/MATH5165 Optimization: The University of New South Wales School of JviathematicsDocument4 pagesMATH3161/MATH5165 Optimization: The University of New South Wales School of JviathematicsWayne YangNo ratings yet

- Problem Set #1. Due Sept. 9 2020.: MAE 501 - Fall 2020. Luc Deike, Anastasia Bizyaeva, Jiarong Wu September 2, 2020Document3 pagesProblem Set #1. Due Sept. 9 2020.: MAE 501 - Fall 2020. Luc Deike, Anastasia Bizyaeva, Jiarong Wu September 2, 2020Francisco SáenzNo ratings yet

- HW 02 PDFDocument3 pagesHW 02 PDFQFTWNo ratings yet

- Assignment 1Document2 pagesAssignment 1Satwik JaiswalNo ratings yet

- GATE Paper CS-2006Document28 pagesGATE Paper CS-2006Vijaya GoelNo ratings yet

- Scilab 6Document9 pagesScilab 6souvik5000No ratings yet

- m314w24 hw1Document2 pagesm314w24 hw1fpbmfkh5mtNo ratings yet

- Assignment 4Document4 pagesAssignment 4PaperCurlNo ratings yet

- I A2Document20 pagesI A2Neha SinghNo ratings yet

- Block 4 MEC 003 Unit 9Document18 pagesBlock 4 MEC 003 Unit 9Abhishek PatraNo ratings yet

- 103 ExercisesDocument70 pages103 Exerciseshungbkpro90No ratings yet

- Practical Solution of Partial Differential Equations in Finance PDFDocument27 pagesPractical Solution of Partial Differential Equations in Finance PDFyuzukiebaNo ratings yet

- Quantitative Risk Management WS1920 Assignment 6Document2 pagesQuantitative Risk Management WS1920 Assignment 6Ka Wing HoNo ratings yet

- Penney Kronig ModelDocument10 pagesPenney Kronig ModelsarmasarmatejaNo ratings yet

- Weekend Assignment 2Document5 pagesWeekend Assignment 2ilias bthNo ratings yet

- Homework 1Document2 pagesHomework 1Vu LeNo ratings yet

- 9.1 Intro To C9 and QuadraticsDocument4 pages9.1 Intro To C9 and QuadraticsChunesh BhallaNo ratings yet

- 3008 Assignment 1 - Due Oct 9th RevisedDocument3 pages3008 Assignment 1 - Due Oct 9th RevisedOliver LockwoodNo ratings yet

- Chapter 08 - ANOVA MANOVADocument33 pagesChapter 08 - ANOVA MANOVAfrappuccino latteNo ratings yet

- AI Lab 12 & 13Document8 pagesAI Lab 12 & 13Rameez FazalNo ratings yet

- Polyfit PDFDocument5 pagesPolyfit PDFdarafehNo ratings yet

- Crafting CasesDocument9 pagesCrafting CasesNourNo ratings yet

- University Malaysia Sarawak: Faculty Cognitive Sciences and Human DevelopmentDocument19 pagesUniversity Malaysia Sarawak: Faculty Cognitive Sciences and Human DevelopmentHero DecNo ratings yet

- Jurnal 3Document6 pagesJurnal 3Irfan RisdaNo ratings yet

- ANOVA Gage R & RDocument12 pagesANOVA Gage R & RHemant ChaudharyNo ratings yet

- Tmp1a04 TMPDocument138 pagesTmp1a04 TMPFrontiersNo ratings yet

- Chapter 2 Students-Sta408Document59 pagesChapter 2 Students-Sta408Amirah AzlanNo ratings yet

- DP - MATH2349 Semester 2, 2019Document15 pagesDP - MATH2349 Semester 2, 2019Sujay KamalNo ratings yet

- Quanti ImradDocument5 pagesQuanti Imradderek.loNo ratings yet

- Research Proposal Using The CHED-GIA Format: Ida H. Revale Bicol University Research & Development CenterDocument45 pagesResearch Proposal Using The CHED-GIA Format: Ida H. Revale Bicol University Research & Development CenterMichael B. TomasNo ratings yet

- AD P M C L V P: EEP Robabilistic Odel For Ustomer Ifetime Alue RedictionDocument17 pagesAD P M C L V P: EEP Robabilistic Odel For Ustomer Ifetime Alue RedictionDounia SolaiNo ratings yet

- E9 205 - Machine Learning For Signal Processing: Practice Midterm ExamDocument4 pagesE9 205 - Machine Learning For Signal Processing: Practice Midterm Examrishi guptaNo ratings yet

- Advance Statistics SyllabusDocument21 pagesAdvance Statistics SyllabusRey Arcales AñonuevoNo ratings yet

- Worksheet N0. 5.1 B Test On One Sample MeanDocument14 pagesWorksheet N0. 5.1 B Test On One Sample MeanMarleen Aguinaldo BalimbinNo ratings yet

- Research PraposalDocument34 pagesResearch Praposalswatisingla786No ratings yet

- Investigating The Impact of Strategic Flexibility On Organizational InnovationDocument5 pagesInvestigating The Impact of Strategic Flexibility On Organizational InnovationM SukmanegaraNo ratings yet

- Optimal Number of Trials For Monte Carlo SimulationDocument4 pagesOptimal Number of Trials For Monte Carlo SimulationgonvazNo ratings yet

- Alexandre Bucquet (Bucqueta@stanford - Edu) Vishnu Sarukkai (Sarukkai@stanford - Edu)Document1 pageAlexandre Bucquet (Bucqueta@stanford - Edu) Vishnu Sarukkai (Sarukkai@stanford - Edu)Hoang PhamNo ratings yet

- Guidelines For Immunoassay Data Processing1: Dudley, 2 P. P. Eklns, 3 D. J. and R. P. C. Rodgers6Document8 pagesGuidelines For Immunoassay Data Processing1: Dudley, 2 P. P. Eklns, 3 D. J. and R. P. C. Rodgers6Cristina PatrinichiNo ratings yet

- Odds Ratio, Hazard Ratio and Relative Risk: Janez Stare Delphine Maucort-BoulchDocument9 pagesOdds Ratio, Hazard Ratio and Relative Risk: Janez Stare Delphine Maucort-BoulchYoga Alfian NoorNo ratings yet

- Occupational Safety and Health Risk Assessment of Workers in The Manufacturing IndustryDocument15 pagesOccupational Safety and Health Risk Assessment of Workers in The Manufacturing IndustryCj SesnorioNo ratings yet

- Uts StatistikaDocument7 pagesUts StatistikaRivania PutriNo ratings yet

- Evaluation of Pavement Condition Index by Different MethodsDocument8 pagesEvaluation of Pavement Condition Index by Different Methodsتغريد رياض وداعهNo ratings yet