Professional Documents

Culture Documents

Freshizy mtf1

Freshizy mtf1

Uploaded by

hadin0151Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Freshizy mtf1

Freshizy mtf1

Uploaded by

hadin0151Copyright:

Available Formats

MTF + OHLC

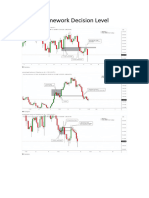

To mold the view or perspective of a price chart using MTF & DLS, one must unlearn things that have they have used before.

In order to introduce this view scope to your vision of a price chart

MTF also known as Storyline, Direction, or Market Flow (all same) will help initiate your trend that start from entry

point to intra turned swing.

OHLC will show you the organic, algorithmic creation of a candle that forms at key levels. We understand that every candle

has an open, high, low, and close. But we often overlook these simple yet powerful details.

How these candles are being formed ON HTF using Absolute Real Time .... Using Real time, we track the closure: Breakout

(BrO) or Rejection (Rej) in LTF candles to track continuation or pullback.

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

OHLC:

| If Bullish, candle should open and go down first. |

| | <‐‐‐‐‐‐‐‐ Keep it simple. Buy low or Sell High :)

| If Bearish, candle should open and go up first. |

For Example: with an open mind just think ......

zy

How will a new weekly candle open if you are in an overall bearish market?

The idea is, H1 H4 Daily should go UP FIRST during the early part of the week, tap into a key level DL that was either

broken or rejected and continue to move price towards the intended MTF direction.

The question to ask yourself is, if there is a BrO or Rej of a key DL, how do the candles open and eventually close

using real time.

The observations that you need to make using real time and MTF are the creation of DLs and how they have formed

after the interaction of the DL.

This will give us insight to determine continuation or reversal.

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

To be well‐prepared, operate and maneuver in the market with two narratives always. the Buys and the Sells. Identify DLs

the market will do.

hi

on both ends. Doing so will allow you to be flexible and not operate with expectations that your psychology generated in

prospects to be met. Do not formulate your analysis based off your imagination ...

Do not use words like " I think, I expect, I speculate ", etc. in contention to support your belief of what you think that

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

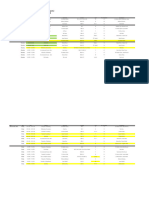

MTF:

We need to establish the Direction for HTF (M + WD (Even tho monthly is on top, I like to play WD because pf their precise

calendar closures. The week will always end at the end of the week and daily completes the week .... Monthly closures do

es

not align with Weekly Daily but Monthly levels are still important!))

We must observe Where are we going and where are we coming from?

1. In General, the key for MTF is to identify the BrO or Rej of one of the signatures DLs; *We start at Monthly*.

a. We only care for closed candles which provide the info on BrO or Rej. Thus, using OHLC, we observe how the NEXT

candle opens and the formation of it is left for us to process, ascertain, and opportunity.

b. We need to adapt and react to the information of candlestick‐to‐candlestick analysis from its origin and

potential ending point. This is also why HTF (MWD) levels are essential for our examination because they hold more

force for the push that you are looking for.

2. Which DL was broken, and Which DL broke it? (Mark your levels)

a. What direction is MWD? (Make Note of this)

3. HTF DLS will ALWAYS generate some type of reaction REGARDLESS how many times price broke through and rejected them.

a. This is why HTF DLs are special, and I tend to focus on them much more than LTF. These levels from the past,

Fr

specifically, HTF DLs that were rejected multiple times, which led to a swing, then broken through recurrently CAN

indeed be traded from again at current market Price. They can offer you a reaction to pullback or reverse price.

b. Within the monthly decision, there is always going be a weekly, daily, h4, h1.... Mark them with Timeframe labels

4. We need to observe Each of these timeframes and how they are closing

*this is fractal for h1 to h4 to daily .... daily to weekly*

a. From a technical standpoint it is just a game of cat and mouse.

5.

a. If Closure with BrO or Rej then where did it come from?

b. If BrO, identify DL that caused the break. Break and Retest.

c. If Rej, there is two steps:

Observe how the next candle forms using OHLC theory.

Identify the DL that took price to the trade Level and observe if it breaks. If so, then prices will

continue.

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

* Important Note *

Even though Monthly is Highest of timeframe of order, Monthly closures are not constant and can be misleading. Many times,

Monthly will close in the middle of the week, while the weekly candle is still printing.

4b. This is where things begin to get interesting.

You might also like

- 2022 ICT Mentorship Notes (Public)Document59 pages2022 ICT Mentorship Notes (Public)Hasbullah Turbo Insta86% (22)

- Silver Bullet HourDocument7 pagesSilver Bullet HourDT92% (12)

- ICT 2022 Mentorship - Free DownloadableDocument297 pagesICT 2022 Mentorship - Free DownloadableSlw habbos100% (5)

- ICT Condensed - Forex Trading - T - Iwene MichaelDocument53 pagesICT Condensed - Forex Trading - T - Iwene MichaelAndrea Pittavino91% (11)

- DieraTheGolddiggerDocument35 pagesDieraTheGolddiggerhadin0151100% (2)

- Standard Deviation + Power of ThreeDocument14 pagesStandard Deviation + Power of Threezanoah.beazley100% (4)

- Part 1 - Ict Trading Bible FinalDocument275 pagesPart 1 - Ict Trading Bible FinalEsa KurniawanNo ratings yet

- Economics For Managers Global Edition 3rd Edition Farnham Solutions ManualDocument16 pagesEconomics For Managers Global Edition 3rd Edition Farnham Solutions Manualchristinetayloraegynjcxdf100% (11)

- Mastering Liquidity Your Key To Successful TradingDocument7 pagesMastering Liquidity Your Key To Successful TradingTheo HerineanNo ratings yet

- 4.0-Set - Forget Vs Confirmation TradesDocument9 pages4.0-Set - Forget Vs Confirmation TradesVăn Thắng HoàngNo ratings yet

- Inside The Circle: Market Maker: @spungvaDocument31 pagesInside The Circle: Market Maker: @spungvaNabeel Sarwar100% (3)

- Trade PlanDocument10 pagesTrade Planquentin oliver67% (3)

- Trading Summit: A Modern Look to Trading Strategies and MethodsFrom EverandTrading Summit: A Modern Look to Trading Strategies and MethodsNo ratings yet

- 1.0-The Realignment, The Sequence and Nested ZonesDocument8 pages1.0-The Realignment, The Sequence and Nested ZonesYvette Zitou100% (2)

- Patricks Trading StrategyDocument11 pagesPatricks Trading StrategyShardul Negi100% (1)

- Canalta Orifice Fitting Parts & Accessories: Precision Machined Accuracy Reliability PerformanceDocument90 pagesCanalta Orifice Fitting Parts & Accessories: Precision Machined Accuracy Reliability Performanceray mojicaNo ratings yet

- ZCFX PDF (Free)Document71 pagesZCFX PDF (Free)Ricky Wijaya100% (3)

- Inner Circle Trader - TPDS 3Document9 pagesInner Circle Trader - TPDS 3Kasjan MarksNo ratings yet

- Armstrong Economics Manual ModelsDocument93 pagesArmstrong Economics Manual ModelsLotus NagaNo ratings yet

- 3S Code EbookDocument14 pages3S Code EbookCapitanu IulianNo ratings yet

- Könyvek - Jenkins & Gann - Complete Stock Market TradingDocument307 pagesKönyvek - Jenkins & Gann - Complete Stock Market TradingTőzsdeOkosságok92% (79)

- Turtle Soup 1Document32 pagesTurtle Soup 1julian barreroNo ratings yet

- Swing AnalysisDocument3 pagesSwing AnalysisRichard AsiimweNo ratings yet

- Trading Forex Crypto (Smar - (Z-Library)Document120 pagesTrading Forex Crypto (Smar - (Z-Library)briangonopeNo ratings yet

- Welcome To The Continuation of The Module 4 of The Elliott Wave Vertical. This Is Putting It All TogetherDocument21 pagesWelcome To The Continuation of The Module 4 of The Elliott Wave Vertical. This Is Putting It All TogetherDuy DangNo ratings yet

- Toshimoku's Trading Tips & Tricks - #SatoshiMoku - MediumDocument48 pagesToshimoku's Trading Tips & Tricks - #SatoshiMoku - MediumsoodvisheshNo ratings yet

- My Favorite Ways For Predicting Market TurnsDocument7 pagesMy Favorite Ways For Predicting Market TurnsPiet NijstenNo ratings yet

- Sample Trading HandbookDocument18 pagesSample Trading HandbookAkhil Chaudhary0% (1)

- Pivot Com CandleDocument57 pagesPivot Com Candlefgaluppo100% (8)

- Inner Circle Trader - Sniper Course, Escape & EvasionDocument3 pagesInner Circle Trader - Sniper Course, Escape & EvasionKute HendrickNo ratings yet

- Delgado - Forex: How To Build Your Trading Watch List.Document13 pagesDelgado - Forex: How To Build Your Trading Watch List.Franklin Delgado VerasNo ratings yet

- Volume Profile 部分17Document5 pagesVolume Profile 部分17xufdddNo ratings yet

- Jagadeesh's PA Twitter ThreadDocument28 pagesJagadeesh's PA Twitter Threadpjivan1208No ratings yet

- ICT Notes Begin Below:: Inner Circle Trader NotesDocument31 pagesICT Notes Begin Below:: Inner Circle Trader NotesAbi100% (1)

- Duffy, Joe - BULL'S EYE TRADING - A Trading Champion's Guide To Pinpointing Tops and Bottoms in Any MarketDocument18 pagesDuffy, Joe - BULL'S EYE TRADING - A Trading Champion's Guide To Pinpointing Tops and Bottoms in Any Marketwilliamsdw1No ratings yet

- Trading PlanDocument10 pagesTrading PlanLuiz TelesNo ratings yet

- The Trader's Guide to Crypto: A Beginners Guide to Trading Cryptocurrency: Basics of Patterns, Platforms, Coins, and More!From EverandThe Trader's Guide to Crypto: A Beginners Guide to Trading Cryptocurrency: Basics of Patterns, Platforms, Coins, and More!No ratings yet

- There Are No Secrets in ForexDocument30 pagesThere Are No Secrets in Forexnoemi6296100% (3)

- Teknik BORCDocument6 pagesTeknik BORCMd YusofNo ratings yet

- Wyckoff Support Level Auction TheoryDocument65 pagesWyckoff Support Level Auction Theorymoby_rahman100% (8)

- PIE RedswordDocument310 pagesPIE RedswordEko Setiono100% (1)

- Thelcoin WhitepaperDocument19 pagesThelcoin WhitepapervchsrikanthNo ratings yet

- Point Zero: Trading ManualDocument23 pagesPoint Zero: Trading ManualBhisamS SallehNo ratings yet

- Trend Structure.. Part 1..: October 4, 2016Document12 pagesTrend Structure.. Part 1..: October 4, 2016David VenancioNo ratings yet

- At 11 06 21 Candlestick Charting - LoganDocument18 pagesAt 11 06 21 Candlestick Charting - LoganJoseph MarshallNo ratings yet

- 2.0-Multiple Timeframe AnalysisDocument6 pages2.0-Multiple Timeframe AnalysisOntiretse Ngwako100% (1)

- OA Mentorship YTDocument38 pagesOA Mentorship YTflaviensa1284No ratings yet

- Market StructureDocument19 pagesMarket StructureAdekunle Joseph100% (8)

- Forex NewDocument20 pagesForex NewHariyanto ChowNo ratings yet

- AHG Bible Full VersionDocument100 pagesAHG Bible Full Versionbarber bobNo ratings yet

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Day Trading With PivotsDocument8 pagesDay Trading With PivotsSiva Sankari100% (1)

- FX FTMM Systems 20Document34 pagesFX FTMM Systems 20emilis galindo80% (5)

- NidubawusavoDocument2 pagesNidubawusavomarksuudi2000No ratings yet

- Brilliant Charts User ManualDocument27 pagesBrilliant Charts User ManualKuru Govind0% (1)

- Stoic TradingDocument21 pagesStoic Tradingbruno.m.spyraNo ratings yet

- Yuri Shramenko - Trade ExecutionDocument40 pagesYuri Shramenko - Trade ExecutionBảo KhánhNo ratings yet

- 2022 ICT Mentorship Ep 10 - Implement Economic CalendarDocument58 pages2022 ICT Mentorship Ep 10 - Implement Economic CalendarBarbara MartinsNo ratings yet

- Stock Trading - Volume Trade - Part1Document9 pagesStock Trading - Volume Trade - Part1Eugen DiaconuNo ratings yet

- (EN) Smart Money Concept-Forex MarketDocument115 pages(EN) Smart Money Concept-Forex MarketekawatNo ratings yet

- 04-Block IV-The Core RulesDocument45 pages04-Block IV-The Core RulespeterapellaNo ratings yet

- Session 2 - Zones and EntriesDocument39 pagesSession 2 - Zones and Entrieshadin0151No ratings yet

- Presentation 1Document8 pagesPresentation 1hadin0151No ratings yet

- Home Work DL 2Document7 pagesHome Work DL 2hadin0151No ratings yet

- Homework Decision LevelDocument7 pagesHomework Decision Levelhadin0151No ratings yet

- ECON 251: Exam 2 Review: Spring 2020 Kelly BlanchardDocument21 pagesECON 251: Exam 2 Review: Spring 2020 Kelly Blanchardbrinda mehtaNo ratings yet

- Ef100t-1 Ficha TecnicaDocument4 pagesEf100t-1 Ficha TecnicaJuan Carlos UrrutiaNo ratings yet

- Final Term DSDocument7 pagesFinal Term DSTaimoor WaraichNo ratings yet

- 2015 Saln FormDocument2 pages2015 Saln FormMark LariosaNo ratings yet

- BC639Document9 pagesBC639abolfazlNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateJeetNo ratings yet

- Fire Protection Management: Guideline For The Persons Responsible in The Plant and CompanyDocument16 pagesFire Protection Management: Guideline For The Persons Responsible in The Plant and CompanyMarwenNo ratings yet

- E-Invoice Data DictionaryDocument124 pagesE-Invoice Data DictionarySaquib.MahmoodNo ratings yet

- Swamy Handbook 2023Document287 pagesSwamy Handbook 2023aksiasavinashNo ratings yet

- Escape The Low Cost TrapDocument9 pagesEscape The Low Cost TrapMarteenz MarteenzzNo ratings yet

- 1171-Article Text-3137-1-10-20170917Document13 pages1171-Article Text-3137-1-10-20170917Pitri JannahNo ratings yet

- Analisis Studi Kelayakan Bisnis Pada Kelompok UsahDocument11 pagesAnalisis Studi Kelayakan Bisnis Pada Kelompok UsahPermana Bagas SatriaNo ratings yet

- Project Charter Template v1.0Document6 pagesProject Charter Template v1.0JESUS HERNANDO OSPINA PAVANo ratings yet

- Shaffer - Gender, Poverty and Deprivation Evidence From The Republic of GuineaDocument17 pagesShaffer - Gender, Poverty and Deprivation Evidence From The Republic of GuineaOptimus__PrimeNo ratings yet

- GEODRILL MALI Proforma - 10th Oct, 2022Document1 pageGEODRILL MALI Proforma - 10th Oct, 2022Deepak Kumar GuptaNo ratings yet

- Lesson 02 - Market Failure, Public Goods & ExternalitiesDocument19 pagesLesson 02 - Market Failure, Public Goods & ExternalitiesMetoo ChyNo ratings yet

- Design of Wall Footing: W Allow B S 3 T C 3 DL LL T eDocument30 pagesDesign of Wall Footing: W Allow B S 3 T C 3 DL LL T eZamantha Louline RespicioNo ratings yet

- Module 2 LodgingDocument10 pagesModule 2 LodgingEDETH SUBONG100% (1)

- 10-Column Worksheet FormDocument2 pages10-Column Worksheet FormImran ZulfiqarNo ratings yet

- Englesko Srpski Recnik Privrede A O PDFDocument48 pagesEnglesko Srpski Recnik Privrede A O PDFDraganNo ratings yet

- T Bulkowski - Broadening PatternsDocument5 pagesT Bulkowski - Broadening PatternsMarius ENo ratings yet

- Management Accounting ProjectDocument23 pagesManagement Accounting ProjectFaisal AzizNo ratings yet

- Acct Statement - XX6002 - 22112023Document23 pagesAcct Statement - XX6002 - 22112023sanchitNo ratings yet

- Solman of Cost AccountingDocument337 pagesSolman of Cost AccountingClaire BarbaNo ratings yet

- Order Blocks BTMM Ict Deatailedlearn How To Identify Order BlocksDocument21 pagesOrder Blocks BTMM Ict Deatailedlearn How To Identify Order Blocksmotto_ph100% (1)

- Operations Management Chapter 5Document72 pagesOperations Management Chapter 5Kayla Shelton100% (1)

- Idx Monthly Mar 2018Document106 pagesIdx Monthly Mar 2018nadiladlaNo ratings yet

- 7.tender Preparation and Tendering ProcessDocument12 pages7.tender Preparation and Tendering ProcessNicholas KinotiNo ratings yet