Professional Documents

Culture Documents

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Uploaded by

Tax LalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Uploaded by

Tax LalaCopyright:

Available Formats

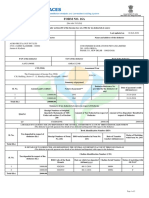

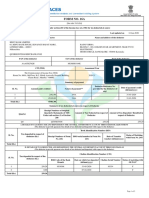

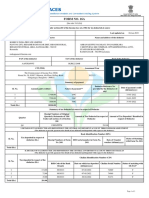

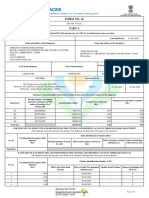

SAM Hash 00000000000000001813 File Hash 00000000000040801431 Copy to be retained

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum Token GSTIN of Receipt no.(note i) (to

Number

Name of Deductor be quoted on TDS

Deductor/Collector

339809600018103 MADARSA ANSAR JUNIOR HIGH SCHOOL NISWAN NA QVEYJBJA

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

02 January 2023 KNPM02473C KNPWT951 24Q Q3 Regular 2022-23

No. of Upload Fees (`) 42.37

No. of Total challan Total tax deposited as per

challans Total tax deducted (`) CGST 9 % -

challans amount(`) deductee details (`)

unmatche

SGST 9 % -

3 3 135000.00 135000.00 135000.00 IGST 18 % (`) 7.63

No. of deductee records Total (Rounded off) (`) 50.00

No. of deductee No. of deductee

where tax deducted at UTTAR PRADESH (09)

records records with PAN

higher rate

39 39 - On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

No. of salary records as Net taxable income as per Annexure II FC Managed by NSDL e-Gov) (SAC: 998319)

per Annexure II (Salary (Salary details)(`) TIN-FC ID: 33980

Religare Broking Limited

M/S Tax Solution & Consultancy Services, Shop No-17, First Floor

0 - Palika Supar Market, Etawah Road

Auraiya - 206122

*This is a computer generated Receipt and does not require signature UTTAR PRADESH

SAM 1.00

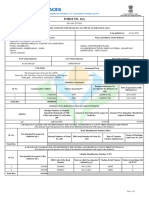

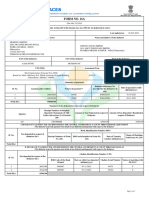

SAM Hash 00000000000000001813 File Hash 00000000000040801431 Deductor's Copy

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum Token GSTIN of Receipt no.(note i) (to

Number

Name of Deductor be quoted on TDS

Deductor/Collector

339809600018103 MADARSA ANSAR JUNIOR HIGH SCHOOL NISWAN NA QVEYJBJA

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

02 January 2023 KNPM02473C KNPWT951 24Q Q3 Regular 2022-23

No. of

Total challan Total tax deposited as per

Upload Fees (`) 42.37

No. of

challans Total tax deducted (`) CGST 9 %

challans amount(`) deductee details (`) -

unmatche

SGST 9 % -

3 3 135000.00 135000.00 135000.00

IGST 18 % (`) 7.63

No. of deductee records

No. of deductee No. of deductee Total (Rounded off) (`) 50.00

where tax deducted at UTTAR PRADESH (09)

records records with PAN

higher rate

39 39 - On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

No. of salary records as Net taxable income as per Annexure II FC Managed by NSDL e-Gov) (SAC: 998319)

per Annexure II (Salary (Salary details)(`) TIN-FC ID: 33980

Religare Broking Limited

M/S Tax Solution & Consultancy Services, Shop No-17, First Floor

0 - Palika Supar Market, Etawah Road

Auraiya - 206122

*This is a computer generated Receipt and does not require signature UTTAR PRADESH

SAM 1.00

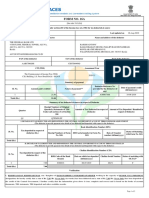

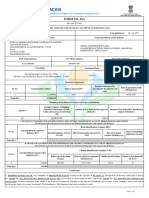

*Caution: The details above are as per the particulars reported by the deductor. Figures in this receipt is/are no confirmation of their correction/verification of data

from Tax Information Network. Details of discrepancies, if any, are available at www.tin-nsdl.com (TDS/TCS Statement Status).

Notes:

i. Receipt No. is valid only if the TDS Statement is accepted at the TIN Central system.

ii. Verify status of the TDS Statement through the TDS/TCS Statement Status facility.

iii. File correction Statement to rectify error including deductee PAN.

iv. Provide latest mobile number in the TDS/TCS Statement to facilitate SMS alerts regarding TDS/TCS Statements.

You might also like

- 2021 Turbo Tax ReturnDocument10 pages2021 Turbo Tax ReturnIvette Hoffman75% (4)

- Project - Impact of GST On Indian Economy - Logistic SectorDocument63 pagesProject - Impact of GST On Indian Economy - Logistic SectorParveen Dsouza75% (8)

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961aapka.kapil3758No ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Chapt-13 Income Taxes - Partnerships, Estates & TrustsDocument11 pagesChapt-13 Income Taxes - Partnerships, Estates & Trustshumnarvios100% (6)

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Dy ManagerNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961karvypandataNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961GST JINo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- TDS BalamuruganDocument1 pageTDS Balamuruganbharani.mudomsNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961karvypandataNo ratings yet

- TCS Ack. Q4 FY 1718Document1 pageTCS Ack. Q4 FY 1718Ravi kantNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961krishnaNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961karvypandataNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToEr Sumit SiwatchNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToShankara NarayananNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPridex Medical Technologies LLNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q3 - Ay202223Document2 pagesSomya Amritanshu - Arcpa1206b - Q3 - Ay202223Sourabh PunshiNo ratings yet

- Akdpn3820e Q3 2023-24Document3 pagesAkdpn3820e Q3 2023-24truth.astrology0751No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Ayfpv2618c Q1 2021-22Document2 pagesAyfpv2618c Q1 2021-22sandeep kumarNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAkriti JhaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPravin AwalkondeNo ratings yet

- Form 16 FY 2018-19 PDFDocument9 pagesForm 16 FY 2018-19 PDFSujata ChoudharyNo ratings yet

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- BBGPV1509K Q2 2019-20 Vandana S PrasadDocument2 pagesBBGPV1509K Q2 2019-20 Vandana S PrasadKapil PandeyNo ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSharad VermaNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q2 - Ay202223Document3 pagesSomya Amritanshu - Arcpa1206b - Q2 - Ay202223Sourabh PunshiNo ratings yet

- Aacca3193k Q3 2024-25Document3 pagesAacca3193k Q3 2024-25Yogesh KanojiyaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRichardNoelFernandesNo ratings yet

- FSMPP1416G Q1 2023-24Document3 pagesFSMPP1416G Q1 2023-24Parvez AhmadNo ratings yet

- Form No. 16A: From ToDocument1 pageForm No. 16A: From ToShail MehtaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AGnana SekarNo ratings yet

- TDS CertificateDocument2 pagesTDS CertificateJyoti MeenaNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Victor Singh - CWCPS5027H - Q1 - Ay202223 - 16aDocument2 pagesVictor Singh - CWCPS5027H - Q1 - Ay202223 - 16agitu sorgtNo ratings yet

- FY2022 23 Form16 PF FormDocument3 pagesFY2022 23 Form16 PF FormJoydip MukhopadhyayNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tomuinbaig11No ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- BBGPV1509K Q1 2019-20 Vandana S PrasadDocument2 pagesBBGPV1509K Q1 2019-20 Vandana S PrasadKapil PandeyNo ratings yet

- Form No. 16A: From ToDocument1 pageForm No. 16A: From ToShail MehtaNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementaditya_kavangalNo ratings yet

- Ahnpp9921f Q4 2023-24Document3 pagesAhnpp9921f Q4 2023-24ps245702No ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRomendro ThokchomNo ratings yet

- Form No 16 FY 19-20Document10 pagesForm No 16 FY 19-20Snehal RanawareNo ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- It 000130389542 2023 11Document1 pageIt 000130389542 2023 11Muneeb ChaudhryNo ratings yet

- Private YofDocument9 pagesPrivate YofSasi KumarNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 525402640240619 Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 525402640240619 Assessment Year: 2019-20రాకేష్ బాబు చట్టిNo ratings yet

- 2 - CIR vs. de LaraDocument9 pages2 - CIR vs. de LaraJeanne CalalinNo ratings yet

- Bradley, We'Ve Received Your Income-Based Repayment (Ibr) Plan Application From Studentaid - GovDocument2 pagesBradley, We'Ve Received Your Income-Based Repayment (Ibr) Plan Application From Studentaid - Govborn2dive 9702No ratings yet

- Sneha Truck Wheel Alignment-Damaracherla RevDocument1 pageSneha Truck Wheel Alignment-Damaracherla Revreddy_575729486No ratings yet

- Income Tax For IndividualsDocument90 pagesIncome Tax For IndividualsRubyjane Kim100% (1)

- State and Local Sales Tax Rates, Midyear 2016: Fiscal FactDocument7 pagesState and Local Sales Tax Rates, Midyear 2016: Fiscal FactrkarlinNo ratings yet

- Tax 1 Reviewer Atty. Bolivar NotesDocument121 pagesTax 1 Reviewer Atty. Bolivar NotesRauden Bacerdo Panotes100% (1)

- 36 Loss DisallowanceDocument159 pages36 Loss DisallowanceCourt RobertsNo ratings yet

- 2.6 Commissioner V PhilAmLifeDocument5 pages2.6 Commissioner V PhilAmLifeJayNo ratings yet

- GST in India Concept and Swot AnalysisDocument10 pagesGST in India Concept and Swot AnalysisAditya RajNo ratings yet

- Chapter 12 FAR Millan Chapter 12 FAR MillanDocument4 pagesChapter 12 FAR Millan Chapter 12 FAR MillanJoanah AquinoNo ratings yet

- Bpi Pera FaqDocument7 pagesBpi Pera FaqHana DumpayanNo ratings yet

- Auditing The Payroll and Personnel Cycle: Prepared By: Nur Ellina BT Shamsuri (2014270102)Document21 pagesAuditing The Payroll and Personnel Cycle: Prepared By: Nur Ellina BT Shamsuri (2014270102)MahediNo ratings yet

- Course Outline - Income Tax - 2020Document9 pagesCourse Outline - Income Tax - 2020Mayank AameriaNo ratings yet

- Employer Specail Wage Report Social-Security-Form-SSA-131Document2 pagesEmployer Specail Wage Report Social-Security-Form-SSA-131DellComputer99No ratings yet

- SLT eBill-00388129090718ImageDocument1 pageSLT eBill-00388129090718ImageYasas Amarashinghe CICRA CampusNo ratings yet

- Tally - Erp 9 SyllabusDocument4 pagesTally - Erp 9 Syllabusmr_harshahsNo ratings yet

- Investing Can Make You A Millionaire! - Ankur WarikooDocument9 pagesInvesting Can Make You A Millionaire! - Ankur WarikooHassel RockNo ratings yet

- Your Invoice No. RE200143606Document1 pageYour Invoice No. RE200143606Erick MetzNo ratings yet

- GENERAL FORMULA: Selling Price - Cost of Property Gain or LossDocument4 pagesGENERAL FORMULA: Selling Price - Cost of Property Gain or LossTrisha Sargento EncinaresNo ratings yet

- Lesson 2 Taxation of IndividualsDocument40 pagesLesson 2 Taxation of IndividualsQuenie De la CruzNo ratings yet

- VAT and SD Act 2012 EnglishDocument91 pagesVAT and SD Act 2012 EnglishMonjurul HassanNo ratings yet

- Employee No Location Name Department Father Name Designation Gender CostcenterDocument5 pagesEmployee No Location Name Department Father Name Designation Gender CostcenterKomal KhanNo ratings yet

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1Document5 pagesRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1ela alan100% (2)

- 30 Day DiaryDocument2 pages30 Day Diaryapi-3711938No ratings yet

- ACR FormDocument8 pagesACR Formwrite2hannanNo ratings yet

- Tech MahindraDocument4 pagesTech Mahindranisha_pranshuNo ratings yet