Professional Documents

Culture Documents

CB Group 8 MBB in The Stock Market MBB Is One of 10 Banks Listed in The vn30 Portfolio With

CB Group 8 MBB in The Stock Market MBB Is One of 10 Banks Listed in The vn30 Portfolio With

Uploaded by

Nguyệt MinhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CB Group 8 MBB in The Stock Market MBB Is One of 10 Banks Listed in The vn30 Portfolio With

CB Group 8 MBB in The Stock Market MBB Is One of 10 Banks Listed in The vn30 Portfolio With

Uploaded by

Nguyệt MinhCopyright:

Available Formats

lOMoARcPSD|18130719

CB - Group 8 - MBB - In the stock market, MBB is one of 10

banks listed in the VN30 portfolio with

Ngân hàng thương mại (Đại học Kinh tế Quốc dân)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

MINISTRY OF EDUCATION AND TRANING

NATIONAL ECONOMICS UNIVERSITY

GROUP HOMEWORK

Subject: Commercial Banking

Topic: Analysis of some indicators in the financial

statements of Military Commercial Joint Stock Bank

Group : 08

Class : Investment Economics EEP 61

Instructor : Dr. Tran Phuoc Huy

HA NOI – 11/2021

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

MINISTRY OF EDUCATION AND TRANING

NATIONAL ECONOMICS UNIVERSITY

GROUP HOMEWORK

Subject: Commercial Banking

Topic: Analysis of some indicators in the financial

statements of Military Commercial Joint Stock Bank

Group : 08

Class : Investment Economics EEP 61

Instructor : Dr. Tran Phuoc Huy

HA NOI – 11/2021

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

GROUP 08

Name Student ID

Nguyen Viet Anh 11190446

Doan Nam Nhat 11193942

Ngo Quoc Thinh 11194905

Quách Yen Nhi 11194004

Do Vu Nhu Viet 11195778

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

TABLE OF CONTENTS

I. NEWS BRIEF FOR INVESTORS............................................................................................. 1

1. In the stock market................................................................................................................ 1

2. MB launches Innovation Lab digital creativity space.........................................................1

3. MB and Techcombank accompanies PVPower to arrange capital for the first gas-fired

power project in Vietnam.......................................................................................................... 2

II. GENERAL INFORMATION ABOUT MILITARY COMMERCIAL JOINT STOCK BANK 3

III. ANALYSIS OF FINANCIAL INDICATORS..........................................................................5

1. Liquidity.................................................................................................................................. 5

a. CASA ratio Measured by the formula............................................................................5

b. Equity to assets ratio....................................................................................................... 6

c. Earning assets ratio........................................................................................................ 6

d. Loans to assets ratio........................................................................................................ 7

e. Loans to deposits ratio (LDR)......................................................................................... 7

f. Short term liability conversion ratio............................................................................... 8

2. Profitability............................................................................................................................. 9

a. Net Interest Margin........................................................................................................ 9

b. Net Noninterest Margin.................................................................................................. 9

c. Net operating margin.................................................................................................... 10

d. Earning spread.............................................................................................................. 10

e. Return on Equity (ROE)............................................................................................... 11

f. Return on Assets (ROA)................................................................................................ 12

g. Employee Productivity Ratio........................................................................................12

3. Risk........................................................................................................................................ 13

a. Capital Adequacy Ratio (CAR)..................................................................................... 13

b. Nonperforming loans ratio........................................................................................... 14

4. Market Ratio......................................................................................................................... 15

a. Book Value Per Share or BVPS...................................................................................15

b. P to B or PB ratio.......................................................................................................... 16

c. Earning per share (EPS).............................................................................................. 18

d. PE Ratio........................................................................................................................ 19

e. Market to book ratio...................................................................................................... 20

5. Dupont analysis.................................................................................................................... 21

a. Profit Margin analysis.................................................................................................. 21

b. Asset turnover............................................................................................................... 22

c. Equity Multiplier........................................................................................................... 23

IV. COMPARE MB BANK WITH OTHER BANKS...................................................................24

1. Capital Size........................................................................................................................... 24

2. Asset Quality......................................................................................................................... 25

3. Business Results.................................................................................................................... 25

4. Liquidity................................................................................................................................ 27

5. Sensitivity to market risk..................................................................................................... 27

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

I. NEWS BRIEF FOR INVESTORS

1. In the stock market

In the stock market, MBB is one of 10 banks listed in the VN30 portfolio with a

rather large proportion of 5.04%.

Below is the stock price and volume chart for the last 1 month, 6 months and 3

years of MBB

2. MB launches Innovation Lab digital creativity space

Innovation Lab with 4 "digital factories" launched on November 4 is part of

MB's strategy to become a leading digital enterprise in Vietnam.

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

MBB's digital creative space - NEU Digital Hub has just built in lobby A2

3. MB and Techcombank accompanies PVPower to arrange capital for the first

gas-fired power project in Vietnam

Military Bank (MB) is the focal bank supporting the development of bidding

documents, negotiating export credit (ECA) loan conditions, offshore loans and asset

management. , as well as times when financial solutions are needed during

preparation, implementation and operation.

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

II. GENERAL INFORMATION ABOUT MILITARY COMMERCIAL JOINT

STOCK BANK

MB Bank's full name is Military Commercial Joint Stock Bank, commonly

known in transactions as Military Bank, which is a bank directly under the Ministry of

Defence.

The current Chairman of MB is Mr. Le Huu Duc and the General Director is

Mr. Luu Trung Thai

MBB started its operation in 1994 and last November 4th was the 27th

anniversary of the establishment of this bank. Up to now, MBB has become one of the

leading joint-stock commercial banks in Vietnam.

As of early 2020, MB Bank has been present in over 48 provinces and cities

across the country with more than 100 branches and more than 190 transaction offices.

Besides, MB also built an international network with a representative office in Russia

and two branches in Laos and Cambodia.

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

These are members companies of Military Commercial Joint Stock Bank:

- MB Securities Joint Stock Company.

- MB Shinsei Finance Company Limited.

- MB Ageas Life Insurance Company Limited (MBAL).

- MB Investment Fund Management Joint Stock Company.

- Debt Management and Asset Exploitation Company Military Commercial

Joint Stock Bank (AMC).

- Military Insurance Corporation (MIC).

About Military banking products and services:

MB Bank always cares about the customer's experience, so it is constantly

improving technology, improving the quality of products and services to best support

customers.

Like other commercial banks, Military Bank also provides the following

products and services:

- Savings products from MB bank (refer to mbbank's interest rate)

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

- E-banking service MB

- Mortgage loan products

- Bank card service MB

- MB Bank Life Insurance

Is Military Bank (MB) good and reputable?

MB is a bank under the Ministry of National Defence of Vietnam and operates

under the management of the State Bank, so all activities are strictly controlled.

The origin of the establishment from the Ministry of Defense also speaks to the

prestige of Military Commercial Joint Stock Bank, so customers can be completely

assured when transacting here.

During its operation, MB Military Bank has achieved many great achievements,

like list below:

- MBBank App is the only digital banking App for customers in Vietnam to

win the title of "Sao Khue 2019".

- Top 10 high quality products trusted by Vietnamese people.

- Top 40 most valuable brands in Vietnam.

- Top 10 prestigious Vietnamese commercial banks in 2018.

- Typical digital bank 2018.

- Typical Community Bank 2018.

- Top 10 prestigious commercial banks in Vietnam in 2019.

- Continuously present in the top 10 prestigious commercial banks in Vietnam.

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

Finally, during its operation, Military Bank has never encountered bad

information or bad cases that affected its reputation.

III. ANALYSIS OF FINANCIAL INDICATORS

1. Liquidity

a. CASA ratio Measured by the formula

Casa ratio =

2018 = 33,9% 2019= 35,1% 2020= 37%

Years 2018 2019 2020

CASA ratio (%) 33,9 35,1 37

CASA stands for Current Account Savings Account, also known as demand

deposit.

CASA ratio of MBB increases from 33,9% to 37% over the period of 3

consecutive years 2018, 2019, 2020. A high Casa index means a lower cost of capital

inflows. When assessing a bank's Casa index, it is necessary to compare it with other

banks and the industry average. A high Casa index will help the bank improve the Net

Interest Margin ratio and have more competitive conditions for lending interest rates in

the market. On the other hand, this ratio also indirectly reflects the effectiveness of a

commercial bank's policies on product development, utility services, customer base

creation, etc.

b. Equity to assets ratio

Equity to assets ratio =

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

2018= 9,43% 2019= 9,69% 2020= 10,12%

The Equity-To-Asset ratio is a measure of Solvency and is determined based on

information derived from bank’s operations balance sheet. The term Solvency refers to

the ability of bank to pay all of its debt if it were to have to immediately sell the bank

operation

The Equity-To-Asset ratio of MBBank in 3 years has always been kept at a

stable level and tends to increase slightly from 9.43% in 2018 to 9.69% in 2019 and

reaching 10.12% in 2020.

c. Earning assets ratio

Earning assets ratio =

2018= 95,25% 2019= 95,12% 2020= 94,3%

The yield-to-total assets ratio is a formula that banks commonly use to gauge

the ratio of assets of a company that is actively generating income. Included in this

asset class are loans and leases, excluding interest income unearned interest income

MBB have a really high earning asset ratio which remain at 94 - 95%. This

propotion is a high percentage among banking institutions in VN.

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

d. Loans to assets ratio

Loans to assets ratio =

2018= 59,3% 2019= 60,8% 2020=60,3%

The loans to assets ratio measures the total loans outstanding as a percentage of

total assets. The higher this ratio indicates a bank is loaned up and its liquidity is low.

The higher the ratio, the riskier a bank may be to higher defaults.

The loans to assets ratio of MBBank of 3 consecutive years always remain at

about 60%. Specifically, in 3 years 2018, 2019, 2020 this ratio is 59,3%, 60,8% and

60,3%

e. Loans to deposits ratio (LDR)

Loans to deposit ratio =

2018= 89,55% 2019= 91,82% 2020= 95,9%

The loan-to-deposit ratio (LDR) is used to gauge a bank's liquidity by

comparing a bank's total loans to its total deposits over the same period. If the ratio is

too high, it means that the bank may not have enough liquidity to cover any unforeseen

fund requirements. Conversely, if the ratio is too low, the bank may not be earning as

much as it could be.

The loan-to-deposite ratio of MB Bank in 2018 equal 89,5%. It increases a little

to 91,8% in 2019 and up to 95,9% in 2020. Normally, the ideal loan-to-deposit ratio is

8

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

80% to 90%. A loan-to-deposit ratio of 100 percent means a bank loaned one dollar to

customers for every dollar received in deposits it received. The reason MB Bank has

such a high rate is partly due to the influence of the covid-19 epidemic, however, it is

still not too worrisome.

f. Short term liability conversion ratio

Liability conversion ratio =

2018= 2,64% 2019= 2,7% 2020= 2,56%

Years 2018 2019 2020

Liability conversion ratio (%) 2,64 2,7 2,56

Conversion coefficient of short-term capital. The higher the risk because the

bank is using a lot of short-term capital to lend medium and long-term loans.

MBB liability conversion ratio increased from 2.57 to 2.86 over a 3 years

period. Overall, the short-term liability conversion ratio is little bit high so there is

some solvency risk along with this.

2. Profitability

a. Net Interest Margin

2018 = 4.56% 2019 = 4.95% 2020 = 4.8%

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

Net interest margin (NIM) is a measurement comparing the net interest income

a financial firm generates from credit products like loans and mortgages, with the

outgoing interest it pays holders of savings accounts and certificates of deposit (CDs).

Expressed as a percentage, the NIM is a profitability indicator that approximates the

likelihood of a bank or investment firm thriving over the long haul.

Regarding NIM, MB Bank has not changed much after 3 years, growing slightly

from 4.56 % to 4.95 % after that decrease 4.8 % in 2020

b. Net Noninterest Margin

2018 = 0.68% 2019 = 0.5% 2020 = 0.29%

Noninterest margin is the spread between noninterest income and noninterest

expenses of a bank, divided by its total assets or total earning assets.

10

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

The figure shows us that in 2018 the Net noninterest margin index accounted for

3,5 % but then in 2019 it drops a bit to 2,5 %. Following in 2020, the Net noninterest

margin index strongly increase to 4,3 %

c. Net operating margin

2018 = 2.95% 2019 = 3.6% 2020 = 3.36%

The operating margin measures how much profit a company makes on a dollar

of sales after paying for variable costs of production, such as wages and raw materials,

but before paying interest or tax. It is calculated by dividing a company’s operating

income by its net sales. Higher ratios are generally better, illustrating the company is

efficient in its operations and is good at turning sales into profit.

d. Earning spread

2018 = 3.48 2019 = 3.38 2020 = 3.54

In 2018 earning spread was 3.48 but then in 2019, this index remarkably

declined to 3.38. Fortunately, earning spread came back, with 3.54 stat in 2020.

11

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

e. Return on Equity (ROE)

2018 = 17.8% 2019 = 19.6% 2020 = 16.5%

Return on equity (ROE) is a measure of financial performance calculated by

dividing net income by shareholders' equity. Because shareholders' equity is equal to a

company’s assets minus its debt, ROE is considered the return on net assets. ROE is

considered a gauge of a corporation's profitability and how efficient it is in generating

profits.

This index Unstable increase and decrease like ROA, it starts from 17.8% in 2018,

then go up to 19.6% in 2019 and down to 16.5% in 2020.

ROE ratio shows the efficiency when using capital of the business, in other

words, how much profit can be gained from 1 dollar spent.

f. Return on Assets (ROA)

2018 = 1.69% 2019 = 1.9% 2020 = 1.67%

12

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

Return on assets (ROA) measures how much money a company earns by

putting its assets to use. In other words, ROA is an indicator of how efficient or

profitable a company is relative to its assets or the resources it owns or controls.

From 2018 to 2020, ROA index almost unchaned, from 1.69% to 1.67%. In

particular, there was a sharp increase in 2019 (1.9%) and a decrease again.

g. Employee Productivity Ratio

2018 = 709.160.000 2019 = 951.200.000 2020 = 1.131.600.000

13

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

The labor productivity ratio is a metric expressing the number of work units

produced per time worked. productivity ratios essentially quantify output/input, with

input being time worked and output being work units.

Looking at the Employee Productivity Ratio index chart, we can see that this

stat grows better in each year, especially from 2019 to 2020, its quite a remarkable

development.

3. Risk

a. Capital Adequacy Ratio (CAR)

Capital Adequacy Ratio (CAR) = (%)

In 2018 = In 2019 = In 2020 =

- The minimum CAR ratio Vietnam State bank define is

- The CAR ratio of MB Bank:

Due to the COVID-19 pandemic, the CAR ratio had slightly decreased. In

general, the CAR ratio of MB Bank still higher than the default ratio of Vietnam State

bank ().

14

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

MB bank has enough cushion to absorb a reasonable number of losses before

they become insolvent in the last 3 years regardless of the pandemic Maintain the

acceptable risk ratio.

b. Nonperforming loans ratio

NPL ratio =

In 2018 1,21% In 2019 0.98% In 2020

Nonperforming loans considered to be bad debts

In 2020, due to the COVID-19 pandemic, the NPL ratio of MBB had raised to

approximately 1,09% but still lower than the average NPL ratio of the banking system,

which is 1,36%. It showed that MBB had lowered their bad debts and increased their

debt provision in 2020 despite the bad effect of the pandemic.

Nonperforming loan is a loan in which borrowers have not made the scheduled

payments for a specified period. In banking, commercial loans are considered

nonperforming if the borrower is 90 days past due. when banks are unable to collect

the owed interest payments from NPLs, it means that they will have less money

available to create new loans and pay operating costs.

Banks are required by law to report their ratio of non-performing loans to total

loans as a measure of the bank’s level of credit risk and quality of outstanding loans. A

high ratio means that the bank is at a greater risk of loss if it does not recover the owed

loan amounts, whereas a small ratio means that the outstanding loans present a low

risk to the bank.

15

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

4. Market Ratio

a. Book Value Per Share or BVPS.

In theory, the book value of a share represents the total amount earned if the

liquidation of all assets is liquidated and after deducting all of the company's liabilities.

This will be the amount that creditors and shareholders of the company can receive in

the event of dissolved company, bankruptcy, et cetera.

This means that, assuming that in the event that the business in which you are

holding the stock is bankrupt, you will be paid a certain amount of money per share

that you are holding. The total amount you receive per share when your business went

bankrupt is the book value per share, or BVPS.

BVPS is calculated according to the formula

BVPS =

The Book Value per Share Index (BVPS) helps us see the value of each share if

the company pays off debt or defaults, implying what the company actually has now.

Returning to MB Bank's financial statements, I have calculated the value of MB

Bank's BVPS through 3 previous years. The table will show the values we've

calculated:

BVPS Uneven

Value %

2018 15,817

2019 17,150 1,333 8.43

2020 18,066 916 5.34

The chart below reflects the change in BVPS value year by year (from 2018 to 2020)

Book Value Per Share

18,500

18,000

17,500

17,000

16,500

16,000

15,500

15,000

14,500

14,000

13,500

2018 2019 2020

BVPS (VNĐ)

16

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

Here we see, the BVPS index at MB tends to grow steadily over the years.

From 2018 to 2019, the BVPS index increased by about 1,300 VNĐ with a growth rate

of 8.4%. This is a positive signal for MB bank as well as investors who are holding

shares of this business. In addition, the growth rate of 8.43% is a good rate for

investors. This shows that the business situation of this business is quite good.

And from 2019 to 2020, the BVPS index continues to increase, from

VND17,150 (2019) to VND18,066 (2020) with a growth rate of 5.34%. Compared to

the 2018-2019 period, the BVPS in this period saw slower growth. This can be

influenced by the financial situation of the business or the business strategies that MB

Bank had set out. Despite this, the BVPS index still saw an increase in value, an

optimistic signal for investors. The steady growth of the BVPS index makes sense, in

the event of a corporate bankruptcy, the amount that investors receive per share is

trending upward year by year,which is a beneficial thing for investors who are holding

shares in MB.

b. P to B or PB ratio

This is a target that has a close relationship with the BVPS that we mentioned

above.

PB ratio =

Looking at the PB formula, we can see that the BVPS index is one of the two

indicators that make up the PB formula, supporting the calculation of the PB index.

PB ratio is used to compare the actual value of a stock against the book value of the

stock itself. It shows how much stock is worth the company's book value, or in other

words, the PB ratio indicates how much investors are willing to spend to own a

business capital.

Based on the formula, the table presents the pb value results that we had

calculated in 3 previous years:

PB Ratio Uneven

Value %

2018 1.23

2019 1.21 -0.02 -1.63

2020 1.27 0.06 4,96

17

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

PB Ratio

1.28

1.26

1.24

1.22

1.2

1.18

1.16

2018 2019 2020

PB Ratio

Looking at the chart, we can see the change in the PB Ratio year by year.

Overall, MB Bank's PB is consistently greater than 1. This shows that the value of

stocks in the market is higher than the book value of the shares recorded by the

business. In other words, this makes sense that investors are willing to spend more

than 1 coin to own 1 capital of the business, here is MB Bank.

Back to the PB index at MB Bank, we can see that from 2018 to 2019, the PB

index has a slight but negligible decrease (down from 1.23 to 1.21). In the next the PB

saw a comeback, with a rate of nearly 5%. As stated above, the increase in the PB

index in the nearest period for the level of market expectations about mb bank's

business and development capabilities is trending upwards in the future. Because in

2020, the index indicates that investors are willing to spend nearly 2 coin to own 1 MB

Bank. This behavior comes from their positive expectations of MB Bank's business

development prospects.

However, if the PB is too high, investors should not buy. The reason is that the

market outlook is not always accurate. In some cases, businesses are overestimated for

their intrinsic strength as well as their ability to grow production and business,

resulting in the market value of stocks being much higher than their book value. This

does not affect investors well when analyzing and selecting stocks.

18

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

c. Earning per share (EPS)

The EPS is earnings per share, or the underlying profit per share.

For example, if a business has about 1 million shares outstanding, which

corresponds to the company's total earnings of $1 million, then a stock will have an

EPS of about $1.

Eps is calculated according to the formula:

EPS is one of the most important indicators when calculating stock prices.

Besides, it also plays an important role in the PE coefficient that you will present in the

next section.

We also calculated EPS in this table:

EPS Uneven

Value %

2018 3,094

2019 3,596 502 16.22

2020 3,329 -267 -7.42

EPS Ratio

3,700

3,596

3,600

3,500

3,400 3,329

3,300

3,200

3,094

3,100

3,000

2,900

2,800

2018 2019 2020

EPS Ratio

The figure shows that the index of EPS has fluctuated year by year.. In the

period from 2018-2019, the chart line sloped up, indicating the growth trend in the

EPS index in MB with an increase from nearly VND 3,100 to almost VND 3,600. This

is a positive development for a business like MB, a sustainable development.

19

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

However, going to a later stage, we see a decrease of 267 units to 3,329. Although

there is a slight decrease in value but in general,the EPS index is quite good, showing

the positive business situation of MB, which tends to attract investors.

d. PE Ratio

Price-to-earnings (P/E) ratio is one of the important analytical indicators in

investors' investment decisions in securities. Earnings from a stock will have a

decisive influence on the market price of that stock. The P/E ratio measures the

relationship between market price (P) and earnings per share (EPS). PE measures how

many times you will take back all your investment. Income to investors also come

from capital gains

P/E shows how many times a stock's current price is above its earnings, or how

much investors pay for a dollar of earnings. P/E is calculated for each stock and

averaged for all stocks, and this ratio is usually published in the press.

We have PE Ratio in MBBank from 2018 to 2020:

PE Uneven

Value %

2018 6.28

2019 5.78 16.22

2020 6.91 -267 -7.42

PE Ratio

7 6.91

6.8

6.6

6.4 6.28

6.2

6

5.78

5.8

5.6

5.4

5.2

2018 2019 2020

PE Ratio

20

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

Looking at the chart, we can see that the bank maintains a low PE. However,

with a low PE ratio, it is not possible to conclude that this is a positive or negative

signal because there are many reasons for businesses to have low P/E ratios at a time.

Maybe the business is more efficient than before. As a result, earnings per share (EPS)

increased, resulting in a low P/E. In this case, it can be said that the stock is

undervalued and is an opportunity for us to buy. However, a low P/E could be due to

the business earning abnormal profits. But this return will not be sustainable. They do

not come from the core business and do not repeat in the future. Or because the

existing shareholders, they no longer see the development ability of the business,

should decide to sell to take profit that will causes stock prices to fall and leads to low

P/E ratio. In these cases, a low P/E ratio may be maintained for a while, but perhaps

the stock is not considered cheap, because the business's growth prospects are no

e. Market to book ratio

Market to Book Ratio is used to calculate a company's value by comparing its

book value to its market value. The book value of a company is calculated by

reviewing the original cost of the company. The market value of a company is

determined by the price of its shares on the stock market and the number of shares

outstanding, which is its market capitalization.

Here we have Market to Book Ratio of MB Bank in the last 3 years:

Market to Book Ratio

2018 1.22

2019 1.21

2020 1.27

Over the last 3 years, MB Bank's Market to Book Ratio has always been greater

than 1. It shows that the market value of MB Bank shares is higher than their book

value, thereby reflecting the period. Investors' expectations are high and the market for

this bank's stock, in other words, MBB's stock is being appreciated, in line with the

market's outlook for this stock in the future. The high rating shows that the bank is

doing quite well and positively, bringing many optimistic signals to investors.

21

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

5. Dupont analysis

ROE = = x x . This also equals

= Profit Margin x Assets Turnover x Equity multiplier

Through the interpretation of ROE, it can be seen that this indicator is

composed of three main factors. The first is Profit after tax to sales or profit margin

ratio. Secondly, Assets Turnover. And the last one is Asset-to-equity ratio.

a. Profit Margin analysis.

We can see that the profit margin of 2019 increased by about 4.8% compared to

2018 from 0.185 to 0.194, but by 2020, this index will decrease to 0.188, just a little

bit higher than 2018.

Profit margin is a measure of profitability. It is an indicator of a company's pricing

strategy and its level of cost control. As a feature of the Dupont equation, if a

company's profit margin increases, each sale adds more cash to the company's bottom

line, resulting in a return on total equity.

b. Asset turnover

Assets turnover is a financial ratio that measures how efficiently a company

uses its assets to generate sales revenue or sales income for the company. Companies

with low profit margins tend to have high asset turnover, while those with high profit

22

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

margins tend to have low asset turnover. Similar to profit margin, if asset turnover

increases, a company will generate more sales per asset owned, once again resulting in

a higher overall return on equity.

Like the profit margin factor, MBB's asset turnover increased in 2019 but falled

in 2020. Specifically, the asset turnover index in 2018 was 0.091, in 2019 it reached 0.

and 0.089 in. This result is also understandable, because this is the time when the

covid-19 pandemic has a negative impact on the whole economy in general and banks

in particular.

c. Equity Multiplier

MBB's equity multiplier in 2018 is the highest in 3 years. In general, a high

equity multiplier indicates that a bank is using a high amount of debt to finance assets.

It can be seen that MBB’s equity ratio has decreased significantly in 2019 and 2020 as

the bank increased the proportion of total assets as a way to rebalance and reduce risks.

23

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

In general, ROE of the last three years has not changed too much, only a few

units and still higher than 16 during the period.

IV. COMPARE MB BANK WITH OTHER BANKS

This section includes the main criteria to help evaluate the quality of the bank,

from which it is possible to know where MB is standing in the industry and predict the

potential for future development.

In this section, we mainly compare military bank (MB) with 4 strong and

famous banks in Vietnam now, namely Techcombank, ACB, Vietcombank and

VietinBank.

24

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

1. Capital Size

Capital size is the basis for maintaining the bank's business, and large capital

means that the ability to attract capital for investors in the bank has high potential and

is guaranteed.

As of December 31, 2020, Military bank's capital reached nearly 51,000 trillion VND.

With this amount of capital, MB Bank has the fourth largest capital scale out of 5

banks under consideration which are: Techcombank with (74.6 trillion VND), ACB

with (35.4 trillion VND), Vietcombank with (98.8 trillion VND), and VietinBank with

(85.9 trillion)

Capital Size (Trillion VND)

120

98.8

100

85.9

80 74.6

60 51

40 35.4

20

0

End of 2020

MB Bank TechcomBank ACB VietcomBank VietinBank

It can be seen that MB is one of the banks with the largest capital scale in

Vietnam, which proves its ability to maintain business and attract capital quite well. A

large capital size also gives MB the opportunity to increase its coverage all over

Vietnam.

2. Asset Quality

Asset quality reflects bad debt in each bank's asset structure, a bank's asset

quality is an important condition for making right investment decisions.

25

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

MB Bank is in the top 5 banks with the lowest bad debt ratio in the banking

system in 2020 with 1.09%. However, compare with 4 other banks, the NPL ratio of

Techcombank, ACB, Vietcombank and Vietinbank was below 1.

Bad Debt (%)

1.2

0.8

0.6

0.4

0.2

0

End of 2020

Standard MB Bank TCB,ACB,VCB,VietinBank

This proves that although the management of loans at MB bank is quite

effective, credit activities have positive results, the reputation of the bank is

maintained and enhanced, the asset quality of MB bank is the worst of the top 5.

3. Business Results

Business performance is an extremely important criterion to evaluate whether a

bank is able to compete and maintain growth in the coming time.

There are many indicators to evaluate a bank's business performance, however,

we choose the two most familiar and understandable ones, which are ROE and ROE.

The first is the ROA indicator. The bank's ROA is at a fairly high level in the

banking system in Vietnam. In 2020, ROA of MB Bank is 1.90%, while Techcombank

is 3.06%, VietinBank is 1.06%, ACB is 1.86%, Vietcombank is 1.45%.

26

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

ROA(%)

3.5

3.06

3

2.5

2 1.9 1.86

1.45

1.5

1.06

1

0.5

0

In 2020

MB Bank TechcomBank ACB VietcomBank VietinBank

Next is the ROE indicator. In 2020 MB Bank's ROE reached 19.13%, which is

quite high in the difficult situation affected by the epidemic. Techcom bank reached

18.41%, VietcomBank reached 20.55%, VietinBank achieved 16.89% and ACB

reached 24.31%.

ROE(%)

30

25 24.31

20.55

20 19.13 18.41

16.89

15

10

0

In 2020

MB Bank TechcomBank ACB

VietcomBank VietinBank

It can be seen that both ROA & ROE of MB bank in the previous year was

quite high, this shows that MB Bank has used a reasonable asset structure, effective

27

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

business policy and asset investment. Moreover, MB Bank's efficiency in exploiting

and using capital is quite good compared to the top banks in Vietnam.

4. Liquidity

This is the ability to meet the disbursement needs of customers, liquidity also

shows that the bank's capital is maintaining at a stable level.

In general, in 2020 MB Bank is a bank with high liquidity with 95.92% while

Techcombank (100.02%), ACB (88.2%), Vietcombank (81.37%), VietinBank

(102.5%).

Liquidity(%)

120

100.02 102.5

100 95.92

88.2

81.37

80

60

40

20

0

In 2020

MB Bank TechcomBank ACB VietcomBank VietinBank

It can be said that MB Bank has stable capital, good circulation, and is able to

respond quickly to customers' needs.

5. Sensitivity to market risk

This indicator reflects the ability of the banking system to withstand the

fluctuations of the market economy.

In this criterion, we use the interest – sensitive rate. MB Bank also ranks very

high with a rate of nearly 1. while Techcombank has a ratio of 0.97, ACB with 0.94,

Vietcombank with 0.96, among the banks that we compare, only VietinBank has this

ratio greater than 1, specifically 1.03.

28

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

lOMoARcPSD|18130719

The interest – sensitive rate

1.04 1.03

1.02

1

1

0.98 0.97

0.96

0.96

0.94

0.94

0.92

0.9

0.88

In 2020

MB Bank TechcomBank ACB VietcomBank VietinBank

It can be seen that MB Bank is able to withstand the effects of the market quite

well with stable growth. This ability will help the bank create trust in many customers.

- - - END - - -

29

Downloaded by Nguy?t Minh (phungnguyet0311@gmail.com)

You might also like

- Group 7 - Final ReportDocument68 pagesGroup 7 - Final ReportHung NguyenNo ratings yet

- CF Assignment 1 Grade 8Document21 pagesCF Assignment 1 Grade 8Giang Ho HoangNo ratings yet

- Tut 3 Group 15 Vietcombank ReportDocument22 pagesTut 3 Group 15 Vietcombank ReportNgọc LinhNo ratings yet

- TRM Assignment Group k20Document25 pagesTRM Assignment Group k20hoangthingoclinhNo ratings yet

- Group Assignment - ECO121 - IB1807Document11 pagesGroup Assignment - ECO121 - IB1807Tran Vo Van Anh (K17 HCM)No ratings yet

- Treasury Management Fasa SF A F 1rf1f Qs Q F A A Qu Qu SF QF Uqwf Qu Qu Quqw F C Q1wag DFB BDocument21 pagesTreasury Management Fasa SF A F 1rf1f Qs Q F A A Qu Qu SF QF Uqwf Qu Qu Quqw F C Q1wag DFB BhoangthingoclinhNo ratings yet

- Commercial Banking: Banking Academy Banking FacultyDocument30 pagesCommercial Banking: Banking Academy Banking FacultyLê Cẩm TúNo ratings yet

- FPT Financial AnalysisDocument20 pagesFPT Financial AnalysisDaomyNo ratings yet

- Vu ASM1 574Document19 pagesVu ASM1 574Ha Tran Doan Thuc (FGW DN)No ratings yet

- Final Assignment Internship ReportDocument18 pagesFinal Assignment Internship ReportĐỗ LinhNo ratings yet

- Fin45a01 Group 2Document16 pagesFin45a01 Group 2Hoàng Việt VũNo ratings yet

- 076 Mscom 017Document25 pages076 Mscom 017Rukesh GhimireNo ratings yet

- End-Module Assignment: Analysis of Macro, Micro Environment and Competitive Advantages of Vinamilk CompanyDocument15 pagesEnd-Module Assignment: Analysis of Macro, Micro Environment and Competitive Advantages of Vinamilk CompanyNguyen Do Minh AnhNo ratings yet

- Group 1 Financial ReportDocument58 pagesGroup 1 Financial ReportÁnh NguyễnNo ratings yet

- Distributions&Logistics Management-TRAN MINH PHUONG-E2300099Document9 pagesDistributions&Logistics Management-TRAN MINH PHUONG-E230009921070168No ratings yet

- CF Final Report Group 7 MWGDocument23 pagesCF Final Report Group 7 MWGCat Tran Luu GiaNo ratings yet

- TRM Group 1 VietcombankDocument29 pagesTRM Group 1 VietcombankHuế HoàngNo ratings yet

- PRESENTATION GROUP 1 (bản chưa chỉnh xong)Document30 pagesPRESENTATION GROUP 1 (bản chưa chỉnh xong)nguyên vũ khôiNo ratings yet

- BCTC Nguyên Khánh LinhDocument37 pagesBCTC Nguyên Khánh LinhLong Trương QuangNo ratings yet

- Introduction To MacroeconomicDocument119 pagesIntroduction To MacroeconomicDAVID MWAMODONo ratings yet

- FinalDocument24 pagesFinalNgọc Hoàng Thị BảoNo ratings yet

- The New Banker Team-TechcombankDocument27 pagesThe New Banker Team-TechcombankHuế HoàngNo ratings yet

- Commercial Banking - Group 1Document27 pagesCommercial Banking - Group 1Hoàng MạnhNo ratings yet

- Royal University of Phnom Penh Institute of Foreign Languages Department of International RelationsDocument15 pagesRoyal University of Phnom Penh Institute of Foreign Languages Department of International Relationshakseng lyNo ratings yet

- Assignment 1 Front Sheet: Date Received (1 Submission)Document13 pagesAssignment 1 Front Sheet: Date Received (1 Submission)Trang PhuongNo ratings yet

- Assignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessDocument21 pagesAssignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessPhan Phu Truong (FGW HCM)No ratings yet

- Assignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessDocument21 pagesAssignment 1 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessPhan Phu Truong (FGW HCM)No ratings yet

- Intl InvestmentGROUP 3 TOPIC 2Document35 pagesIntl InvestmentGROUP 3 TOPIC 2Hoàng Nhiên TrầnNo ratings yet

- LEGO Invest in Vietnam To Build It's First Carbon Neutral PlantDocument29 pagesLEGO Invest in Vietnam To Build It's First Carbon Neutral PlantNguyễn Kỳ MinhNo ratings yet

- Group 1 - Quản trị ngân hàng thương mạiDocument18 pagesGroup 1 - Quản trị ngân hàng thương mạiGia Khương ĐinhNo ratings yet

- Chapter 1 IntroductionDocument15 pagesChapter 1 IntroductionlinhphammatlzNo ratings yet

- Marketing Principles-Situation Analysis-Unilever-Group report-MKTG1205 Marketing Principles-Situation Analysis-Unilever-Group report-MKTG1205Document16 pagesMarketing Principles-Situation Analysis-Unilever-Group report-MKTG1205 Marketing Principles-Situation Analysis-Unilever-Group report-MKTG1205Đặng Lê Khánh LinhNo ratings yet

- BTL KDQT DL DoneDocument17 pagesBTL KDQT DL DoneHà MyyNo ratings yet

- Viettel PostDocument34 pagesViettel PostHoàng PhúcNo ratings yet

- BMOB5103 - Assignment 2 - Full-1Document21 pagesBMOB5103 - Assignment 2 - Full-1Mùi Mùi LêNo ratings yet

- Tieu Luan Dao Tao Va Phat Trien Nhan Luc Vietnam AirlinesDocument28 pagesTieu Luan Dao Tao Va Phat Trien Nhan Luc Vietnam AirlinesHằng TrầnNo ratings yet

- END-MODULE StrategyDocument23 pagesEND-MODULE StrategyNguyen Do Minh AnhNo ratings yet

- Application of 10 Principles of Economics in The Real Estate IndustryDocument11 pagesApplication of 10 Principles of Economics in The Real Estate IndustryArminAhsanNo ratings yet

- Vinhomes Ocean Park 2 Group AssignmentDocument21 pagesVinhomes Ocean Park 2 Group AssignmentHà Phương VũNo ratings yet

- Banking Sector in CambodiaDocument9 pagesBanking Sector in Cambodiaសួន សុខាNo ratings yet

- Group 11 Project Proposal 1Document12 pagesGroup 11 Project Proposal 1Đào Huyền Trang 4KT-20ACNNo ratings yet

- 12-093 - Nguyen Thi Kim Hoang - MKT 601 - Final AssignmentDocument28 pages12-093 - Nguyen Thi Kim Hoang - MKT 601 - Final AssignmentKim PhượngNo ratings yet

- BCTTGK 2022Document33 pagesBCTTGK 2022FTU.CS2 Nguyễn Ngọc Kim NgânNo ratings yet

- 12-00879 - Hoang Van Nhuan - ECO 601 - Final AssignmentDocument23 pages12-00879 - Hoang Van Nhuan - ECO 601 - Final AssignmentLeon BrianNo ratings yet

- Final ThesisDocument75 pagesFinal ThesisThảo PhươngNo ratings yet

- T Ngo I NG Chuyên NgànhDocument4 pagesT Ngo I NG Chuyên NgànhNga hoang thiNo ratings yet

- Economic Workbook and Data: A Tutorial Volume for StudentsFrom EverandEconomic Workbook and Data: A Tutorial Volume for StudentsNo ratings yet

- Internship Report BD - SonDocument61 pagesInternship Report BD - Sonthanh nguyenNo ratings yet

- Viettel Telecom Corporation Marketing Plan in Cambodia: Prepared By: Group 4 MembersDocument26 pagesViettel Telecom Corporation Marketing Plan in Cambodia: Prepared By: Group 4 MembersJonathan Vuong NguyenNo ratings yet

- End-Module Assignment: Tiki AnalysisDocument12 pagesEnd-Module Assignment: Tiki AnalysisTrọng LinhNo ratings yet

- Macroeconomics - Staicu&PopescuDocument155 pagesMacroeconomics - Staicu&PopescuŞtefania Alice100% (1)

- The Role of Express Delivery Services in Cross Border E-Commerce in Africa: Case of The Cemac Sub RegionDocument77 pagesThe Role of Express Delivery Services in Cross Border E-Commerce in Africa: Case of The Cemac Sub RegionasimNo ratings yet

- English Bussiness Translation1Document60 pagesEnglish Bussiness Translation1Mai Sương NguyễnNo ratings yet

- DTQT - Nhóm 5 - FDI in Digital EconomyDocument31 pagesDTQT - Nhóm 5 - FDI in Digital EconomyBảo NhiNo ratings yet

- Group 12 Midterm Report TCHE303.1Document37 pagesGroup 12 Midterm Report TCHE303.1K59 NGUYEN KHANH LINHNo ratings yet

- 09 Myanmar Economy RieffelDocument24 pages09 Myanmar Economy RieffelDimple EstacioNo ratings yet

- Trần Tiến Thịnh - 01701025807 - Đề Cương Chi Tiết KltnDocument38 pagesTrần Tiến Thịnh - 01701025807 - Đề Cương Chi Tiết KltnTrần Tiến ThịnhNo ratings yet

- Trần Tiến Thịnh - 01701025807 - Đề Cương Chi Tiết KltnDocument38 pagesTrần Tiến Thịnh - 01701025807 - Đề Cương Chi Tiết KltnTrần Tiến ThịnhNo ratings yet

- Đầu tư QT - metroDocument66 pagesĐầu tư QT - metroMaiNo ratings yet

- Dtue310 21.07Document15 pagesDtue310 21.07Mai SươngNo ratings yet

- C-TPAT QuestionnarieDocument11 pagesC-TPAT QuestionnarieSan ThisaNo ratings yet

- Chapter 3 Bonds Payable Other ConceptsDocument20 pagesChapter 3 Bonds Payable Other ConceptsThalia Rhine AberteNo ratings yet

- Operating Instructions: Instrucciones de OperaciónDocument48 pagesOperating Instructions: Instrucciones de OperaciónJose AcevedoNo ratings yet

- Vertical AnalysisDocument5 pagesVertical AnalysisMica Ann MatinaoNo ratings yet

- Saudi Aramco Typical Inspection Plan: Coating Application On Concrete Surfaces SATIP-H-003 - 01 27-Jan-19Document10 pagesSaudi Aramco Typical Inspection Plan: Coating Application On Concrete Surfaces SATIP-H-003 - 01 27-Jan-19Moghal AliNo ratings yet

- Case Study - International Real Estate ConsultingDocument2 pagesCase Study - International Real Estate Consultingvrjs44fsydNo ratings yet

- Entrepreneurship 2nd Q.exam OktcindyDocument8 pagesEntrepreneurship 2nd Q.exam OktcindyDaryl MacatbagNo ratings yet

- High Level Credit BlueprintDocument72 pagesHigh Level Credit BlueprintFree Panthera100% (1)

- Step by StepDocument22 pagesStep by Stepsap78% (9)

- Presales ConsultantDocument2 pagesPresales Consultantakshita chhabra100% (1)

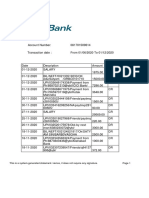

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument11 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signaturesatyam singhNo ratings yet

- Digital Marketing For Beginner'sDocument719 pagesDigital Marketing For Beginner'ssandyNo ratings yet

- Fxloan PrimerDocument2 pagesFxloan PrimerHenry AunzoNo ratings yet

- Senior Housing in KenyaDocument2 pagesSenior Housing in KenyaJOSEPH KARANJANo ratings yet

- How To Check If A Company Is ISO 9001 CertifiedDocument13 pagesHow To Check If A Company Is ISO 9001 CertifiedPavel Solis PerezNo ratings yet

- Types of Rooms Alloted For FILM and BROADCASTDocument240 pagesTypes of Rooms Alloted For FILM and BROADCASTlulu dooNo ratings yet

- Pricing Products: Pricing Considerations, Approaches, and StrategyDocument32 pagesPricing Products: Pricing Considerations, Approaches, and StrategyJocky AryantoNo ratings yet

- Welcome To The October 5, 2006 Book Club ForumDocument14 pagesWelcome To The October 5, 2006 Book Club ForumxkaernNo ratings yet

- Apparel Merchandising, Costing and Export DocumentationDocument2 pagesApparel Merchandising, Costing and Export DocumentationKarthikNo ratings yet

- Free Beer Vouchers Free Beer Vouchers Free Beer VouchersDocument3 pagesFree Beer Vouchers Free Beer Vouchers Free Beer VouchersImaHanoi IeltsNo ratings yet

- Chapter Three - Accounting For Merchandising EnterpriseDocument6 pagesChapter Three - Accounting For Merchandising Enterpriseሔርሞን ይድነቃቸውNo ratings yet

- UPSC Exam Syllabus 2017 For Mains - Subjects & PapersDocument5 pagesUPSC Exam Syllabus 2017 For Mains - Subjects & Paperssaurav chandanNo ratings yet

- 8 Buslawreg Foreign Week 14-15Document13 pages8 Buslawreg Foreign Week 14-15Jane DizonNo ratings yet

- Sison vs. Ancheta (130 SCRA 654, July 25, 1984)Document5 pagesSison vs. Ancheta (130 SCRA 654, July 25, 1984)Jennilyn Gulfan YaseNo ratings yet

- 2339-Article Text-3941-1-10-20220401Document8 pages2339-Article Text-3941-1-10-20220401quintiza anugerahNo ratings yet

- Cfa Quan (R1-7)Document182 pagesCfa Quan (R1-7)vietnamese850No ratings yet

- Transit Long Range Financial Plan UpdateDocument17 pagesTransit Long Range Financial Plan UpdateCTV OttawaNo ratings yet

- Analysis of Effect of Microfinance On The Performance of Mses in Amhara National Regional State, EthiopiaDocument26 pagesAnalysis of Effect of Microfinance On The Performance of Mses in Amhara National Regional State, EthiopiaEdlamu AlemieNo ratings yet

- Instructions For Form 1120Document31 pagesInstructions For Form 1120A.F. GRANADANo ratings yet

- CHP 3Document23 pagesCHP 3Laiba SadafNo ratings yet