Professional Documents

Culture Documents

BIR - Ruling DA-026-00 (11 January 2000)

Uploaded by

josephine.t.ycongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR - Ruling DA-026-00 (11 January 2000)

Uploaded by

josephine.t.ycongCopyright:

Available Formats

January 11, 2000

BIR RULING [DA-026-00]

Ms .Marilyn B. Angeles

21 Apollo St., Acropolis

Quezon City

Madam:

This refers to your letter dated November 24, 1999 stating that you are

presently paying a four-year installment plan under the Contract to Sell for a

condominium unit of 37.28 sq. m. (Unit 2725) of "The Mega Plaza", a building

project of City & Land Developers, Inc. located at Bo. Oranbo, Pasig City; that

the contract price of aforesaid condominium unit is Nine Hundred Thirty

Eight Thousand Eight Hundred Twenty One Pesos (P938,821.00) (excluding

interest) of which you have already paid Six Hundred Sixty Two Thousand

Four Hundred Forty Seven Pesos (P662,447.00) [P187,764.20 as

downpayment plus P474,682.80 equivalent to twenty four (24) months

amortization]; that at present you are assigning your rights under this

contract to Mr. Gerardo J. Espina., Jr. because of financial reasons; that in

consideration of the transfer of rights, Gerardo J. Espina, Jr. will pay you back

the payments you have made for the said condominium unit; and that in this

regard, the developer, City & Land Developers, Inc. requires the payment of

capital gains tax of six percent (6%) and documentary stamp tax of one and

one-half percent (1.5%)

Based on the foregoing representation and documents submitted, you

are now requesting for a ruling that you are exempted from the payment of

capital gains tax and documentary stamp tax on your Assignment of Rights

with Assumption of Obligations in the Contract to Sell in favor of Gerardo J.

Espina, Jr. cdasia

In reply, please be informed that under Section 24(D)(1) of the Tax

Code of 1997, a final tax of six percent (6%) based on the gross selling price

or current fair market value as determined in accordance with Section 6(E)

of the Tax Code of 1997, whichever is higher, is imposed upon capital gains

presumed to have been realized from the sale, exchange, or other

disposition of real property located in the Philippines classified as capital

asset including pacto de retro sales and other forms of conditional sales, by

individuals, including estates and trust.

In the instant case, however, the transfer of your property in favor of

Gerardo J. Espina, Jr. was not a sale, exchange or disposition of real property

classified as capital asset located in the Philippines but rather an assignment

of right pertaining to such property, hence, not included within the provision

of Section 24(D)(1) of the Tax Code of 1997. This is so, considering that in

assignment of right, the assignee merely steps into the shoes of the assignor

without acquiring a better right than what the assignor had in the property to

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

which the assigned right pertains.

Moreover, a Deed of Assignment of Right is not a Deed of Sale because

what is conveyed by the assignor is not the property itself but the rights

pertaining to such property. It is however understood, that the gain derived

by the assignor from and as a consequence thereof, is subject to income tax.

Accordingly, the assignment by Marilyn B. Angeles, married to

Leonardo C. Angeles in favor of Gerardo J. Espina, Jr. of her rights over the

said property is not subject to the capital gains tax imposed under Section

24(D)(1) of the Tax Code of 1997, nor to the documentary stamp tax

prescribed under Section 196 of the same Code. The notarial

acknowledgment of the deed however, is subject to P15.00 documentary

stamp tax pursuant to Sec. 188 of the Tax Code of 1997. cdll

This ruling is being issued on the basis of the foregoing facts as

represented. However, if upon investigation, it will be disclosed that the

facts are different, then this ruling shall be considered null and void.

Very truly yours,

Commissioner of Internal Revenue

By:

(SGD.) SIXTO S. ESQUIVIAS IV

Deputy Commissioner

Legal and Enforcement Group

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Bankruptcy Outline - 24 June 2018Document36 pagesBankruptcy Outline - 24 June 2018Ma FajardoNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- The Concept of Gross Income - Cir vs. Filinvest Development CorporationDocument4 pagesThe Concept of Gross Income - Cir vs. Filinvest Development CorporationKath LeenNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- BIR Ruling DA-162-08 (DST On Issuance of Shares, Suspensive Condition)Document6 pagesBIR Ruling DA-162-08 (DST On Issuance of Shares, Suspensive Condition)Hailin QuintosNo ratings yet

- 12.01.13 MOCK - Real Estate Taxation SolutionsDocument4 pages12.01.13 MOCK - Real Estate Taxation SolutionsMiggy Zurita100% (5)

- 5 Fort Bonifacio Development Corporation vs. CIR - ConsolidatedDocument45 pages5 Fort Bonifacio Development Corporation vs. CIR - ConsolidatedGoodyNo ratings yet

- Bir Ruling (Da - (C-104) 328-08)Document3 pagesBir Ruling (Da - (C-104) 328-08)E ENo ratings yet

- SEND Q2 GM Week 1Document37 pagesSEND Q2 GM Week 1wilzl sarrealNo ratings yet

- Investment and UtilityDocument37 pagesInvestment and UtilityDrShailesh Singh ThakurNo ratings yet

- Dizon v. CtaDocument2 pagesDizon v. CtaChing DauzNo ratings yet

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- Basic MF Development Model v1.1Document4 pagesBasic MF Development Model v1.1AlexNo ratings yet

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- Dizon Vs CIRDocument3 pagesDizon Vs CIRRay John Uy-Maldecer AgregadoNo ratings yet

- BIR Ruling No. 522-2017Document7 pagesBIR Ruling No. 522-2017liz kawiNo ratings yet

- Revision Grid BTEC Business Unit 3 Learning Aim ADocument3 pagesRevision Grid BTEC Business Unit 3 Learning Aim AChrisNo ratings yet

- BIR Ruling DA-648-04Document2 pagesBIR Ruling DA-648-04Phoebe SpaurekNo ratings yet

- TAX - Documentary Stamp Tax CasesDocument9 pagesTAX - Documentary Stamp Tax CasesMarife Tubilag ManejaNo ratings yet

- GR No. 166786 M Lhuillier V CIR (Good Faith)Document10 pagesGR No. 166786 M Lhuillier V CIR (Good Faith)Jerwin DaveNo ratings yet

- Ate Riah 2014 Tax Bar Q and ADocument19 pagesAte Riah 2014 Tax Bar Q and Adnel13No ratings yet

- BIR - Ruling DA-263-00 (20 June 2000)Document2 pagesBIR - Ruling DA-263-00 (20 June 2000)josephine.t.ycongNo ratings yet

- BIR Ruling DA-C-179 464-09 (18 August 2009)Document3 pagesBIR Ruling DA-C-179 464-09 (18 August 2009)josephine.t.ycongNo ratings yet

- Bir Ruling (Da - (C-179) 464-09)Document4 pagesBir Ruling (Da - (C-179) 464-09)E ENo ratings yet

- Bir Ruling (Da-042-04)Document3 pagesBir Ruling (Da-042-04)E ENo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- Petitioner Vs Vs Respondents: First DivisionDocument37 pagesPetitioner Vs Vs Respondents: First DivisionmarkcatabijanNo ratings yet

- 1.1 Cta - 00 - CV - 06218 - D - 2002dec04 - RefDocument13 pages1.1 Cta - 00 - CV - 06218 - D - 2002dec04 - RefKate VanessaNo ratings yet

- Wise & Co., Inc. v. Meer (30 June 1947)Document31 pagesWise & Co., Inc. v. Meer (30 June 1947)KTNo ratings yet

- Mar 0 S: Republic of The Philippines Court of Tax Appeals Quezon CityDocument10 pagesMar 0 S: Republic of The Philippines Court of Tax Appeals Quezon Citycatherine martinNo ratings yet

- Bir Vat (Case)Document16 pagesBir Vat (Case)Jay Ryan Sy BaylonNo ratings yet

- BIR Ruling 091-99 PDFDocument6 pagesBIR Ruling 091-99 PDFleahtabsNo ratings yet

- 136222-1984-Manila Wine Merchants Inc. v. CommissionerDocument12 pages136222-1984-Manila Wine Merchants Inc. v. CommissionerAstina85No ratings yet

- Francia vs. IAC, G.R. No. L-67649, June 28, 1988Document8 pagesFrancia vs. IAC, G.R. No. L-67649, June 28, 1988KidMonkey2299No ratings yet

- CIR V Filinvest PDFDocument24 pagesCIR V Filinvest PDFJoyce KevienNo ratings yet

- Silicon Phil. Vs CIRDocument8 pagesSilicon Phil. Vs CIRGladys BantilanNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- Silicon Philippines, Inc. vs. Commissioner Internal RevenueDocument13 pagesSilicon Philippines, Inc. vs. Commissioner Internal RevenueEunice AmbrocioNo ratings yet

- L-48231 Wise & Co V MeerDocument18 pagesL-48231 Wise & Co V Meersteth16No ratings yet

- Fort Bonifacio Vs CIRDocument23 pagesFort Bonifacio Vs CIRpyulovincentNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- Francia Vs IACDocument6 pagesFrancia Vs IACVeah CaabayNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- CasesDocument221 pagesCasesnbragasNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- Commissioner - of - Internal - Revenue - V.20190603-5466-Tba1xd PDFDocument9 pagesCommissioner - of - Internal - Revenue - V.20190603-5466-Tba1xd PDFClarence ProtacioNo ratings yet

- I. Fort Bonifacio Development Corp. vs. CIR, G.R. No. 175707, November 19, 2014Document28 pagesI. Fort Bonifacio Development Corp. vs. CIR, G.R. No. 175707, November 19, 2014Christopher ArellanoNo ratings yet

- BIR RULING NO. 018-97: R.S. Bernaldo & AssociatesDocument2 pagesBIR RULING NO. 018-97: R.S. Bernaldo & AssociatesLouisse Salazar InguilloNo ratings yet

- 04 CIR v. S.C. Johnson and Son, Inc.Document10 pages04 CIR v. S.C. Johnson and Son, Inc.ada mae santoniaNo ratings yet

- Cir v. Nickel Case DigestDocument92 pagesCir v. Nickel Case DigestCheryl OlivarezNo ratings yet

- Bir Ruling 332-12Document3 pagesBir Ruling 332-12Neil MayorNo ratings yet

- 2000 ITAD RulingsDocument409 pages2000 ITAD RulingsJerwin DaveNo ratings yet

- Francia v. Iac - 162 Scra 753 (1988)Document6 pagesFrancia v. Iac - 162 Scra 753 (1988)Nikki Estores GonzalesNo ratings yet

- 10 - 133302-1988-Francia v. Intermediate Appellate Court20210505-11-X0x5r9Document7 pages10 - 133302-1988-Francia v. Intermediate Appellate Court20210505-11-X0x5r9liliana corpuz floresNo ratings yet

- Corporate Taxation CasesDocument20 pagesCorporate Taxation CasesMarianne Hope VillasNo ratings yet

- Placer DomeDocument18 pagesPlacer DomeMaisie ZabalaNo ratings yet

- GR No. 153793Document9 pagesGR No. 153793Milette Abadilla AngelesNo ratings yet

- En Banc Commissioner OF Internal Revenue, G. R. No. 163653Document12 pagesEn Banc Commissioner OF Internal Revenue, G. R. No. 163653ecinue guirreisaNo ratings yet

- 116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFDocument12 pages116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFVener Angelo MargalloNo ratings yet

- Revenue Regulation Implementing RP-Singapore Tax TreatyDocument15 pagesRevenue Regulation Implementing RP-Singapore Tax Treatybianca.denise.dawisNo ratings yet

- Obl Icon Cases 3Document3 pagesObl Icon Cases 3cmdelrioNo ratings yet

- 84 A - GaronDocument6 pages84 A - GaronBibi JumpolNo ratings yet

- State Investment House Inc. v. Court of Appeals G.R. No. 90676 June 19 1991 275 PHIL 433 446Document10 pagesState Investment House Inc. v. Court of Appeals G.R. No. 90676 June 19 1991 275 PHIL 433 446rggconde11No ratings yet

- RR 17-03Document15 pagesRR 17-03firstdummyNo ratings yet

- Taxation I CasesDocument135 pagesTaxation I CasesETHEL JOYCE BAUTISTA. SUMERGIDONo ratings yet

- Rate Agreed Upon Shall Take: Supreme CourtDocument6 pagesRate Agreed Upon Shall Take: Supreme CourtXyrus BucaoNo ratings yet

- This Time: Q & A Woods SquareDocument19 pagesThis Time: Q & A Woods SquareChen YishengNo ratings yet

- 2015.12 2016.01 Q&A P1 Eng FinalDocument24 pages2015.12 2016.01 Q&A P1 Eng FinalKxlxm KxlxmNo ratings yet

- Promissory NoteDocument1 pagePromissory NoteRico EdureseNo ratings yet

- RCBC-vs-CA-289-SCRA-292Document9 pagesRCBC-vs-CA-289-SCRA-292Yvon BaguioNo ratings yet

- How Big Is China's Real Estate Bubble and Why Hasn't It Burst Yet? PDFDocument10 pagesHow Big Is China's Real Estate Bubble and Why Hasn't It Burst Yet? PDFEdivaldo PaciênciaNo ratings yet

- 1370-1379 - Interpretation of ContractsDocument1 page1370-1379 - Interpretation of ContractsSarah Jane UsopNo ratings yet

- Heirs of Zoilo Espiritu vs. LandritoDocument5 pagesHeirs of Zoilo Espiritu vs. LandritoPACNo ratings yet

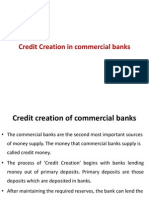

- Credit Creation in Commercial BanksDocument12 pagesCredit Creation in Commercial BanksprasanthmctNo ratings yet

- Little Blue Book, 2016 EditionDocument146 pagesLittle Blue Book, 2016 EditiongiovanniNo ratings yet

- FM ReportDocument2 pagesFM Reportcaiden dumpNo ratings yet

- DPC IiDocument13 pagesDPC Iishailesh latkarNo ratings yet

- Jpso 040315Document9 pagesJpso 040315The AdvocateNo ratings yet

- Kenya Digital RegsDocument6 pagesKenya Digital RegsThanasis DimasNo ratings yet

- Calculation of EMI With Prepayment OptionDocument12 pagesCalculation of EMI With Prepayment OptionYokesh GaneshNo ratings yet

- ACCT601 - Prelim Examination PDFDocument10 pagesACCT601 - Prelim Examination PDFSweet EmmeNo ratings yet

- HKABE 2014-15 Paper 2B AnswerDocument6 pagesHKABE 2014-15 Paper 2B AnswerChan Wai KuenNo ratings yet

- Rutas Group 5Document17 pagesRutas Group 5akshatNo ratings yet

- University of Technology Sarawak Semester 1, 2021/2022: Risk Management Assignment 2Document7 pagesUniversity of Technology Sarawak Semester 1, 2021/2022: Risk Management Assignment 2Ngiam Li JieNo ratings yet

- Mock Professional PracticeDocument23 pagesMock Professional PracticePrince EG DltgNo ratings yet

- Jennifer Li FEP 107086 S1Document23 pagesJennifer Li FEP 107086 S1Niraj ThapaNo ratings yet

- SSRN Id2206253Document28 pagesSSRN Id2206253Alisha BhatnagarNo ratings yet

- This Content Downloaded From 154.59.124.214 On Wed, 08 Jun 2022 20:42:36 UTCDocument9 pagesThis Content Downloaded From 154.59.124.214 On Wed, 08 Jun 2022 20:42:36 UTCsalem alkaabiNo ratings yet

- The Middleman Economy - IV UnitDocument27 pagesThe Middleman Economy - IV Unitdimpureddy888No ratings yet