Professional Documents

Culture Documents

Homework Chapter 22

Uploaded by

namhua54Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework Chapter 22

Uploaded by

namhua54Copyright:

Available Formats

Homework Chapter 22

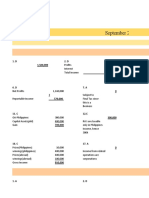

E22-1 a) Net income =

700 000 ,

-

(700 000 ,

+ 20 % )

= $560 ,

000

3) Dr Construction in

process

:

$190 000 ,

Cr Deferred tax liability : $38 ,

000

Cr Retained earnings :

$152 ,

000

EGL-2 al Weighted average -

cost to FiFo

Dr Inventory :

$14 ,

000 (A)

C Retained $14 000

earnings

:

(* ) =

Inet income using Fifo -

Net income using WA

=

67 008

,

-

33 000,

= $14 ,

000

b) As we

changed from average - cost to Fifo

Net income FiFo

using

2018 $ 19 000,

2019 $23 000 ,

2028 $) 25 ,

888

c) LiFo to FiFo

Dr

Inventory :

$24 000 , (xx)

C Retained $24 000

earnings :

,

(x) I FiFo I LiFo

net income

using net income

using

-

=

67 000 ,

-

33 008 ,

- $ 24 ,

008

E22-3 a) Income statement

using LiFo

2018 2019 2020

Sales 3 000

,

3 000

,

3 000

,

lost of goods sold 800 1 , 000 1 130,

Operating expense 1000 1000 1000

Net income 1 200

,

1 ,

000 870

Income statement

using FiFo

2018 2019 2020

Sales 3 000

,

3 000

,

3 000

,

lost of goods sold 828 948 1 100

,

Operating expense 1000 1000 1000

Net income 1 ,

180 1 ,

060908

b) Change from LiFo to FiFa

2019 2028

Sales $) 3000 $) 3000

Cost of goods sold 940 1 100 ,

Operating expenses 1 000

,

1 000

,

Net income 1 068

,

908

c) Note for financial statements

2019 2020

Sheet

dance LIFO FIFO Difference LIFO FIFO Difference

Inventory 200 248 40 320 398 70

Retained Earnings 2 200

,

2 240, 48 3 070

,

3 148 ,

78

Income statement

Cost of goods sold

Net income

1888/msl or

60

sir "g I 30

30

Statement of Cash flows

d) Retained statement

earnings

2019 2020

Retained

earnings ,

as Jan 1

reported , $1200 $ 2 240 ,

Less Adjustment for cumulative effect of

applying FIF8 (20)

:

Retained Jan 1 as adjusted $ 1 , 188 $ 2 240

earnings , , ,

Net income $ 1 , 868 $908

Retained earnings Dec 31 , $ 2 248

, $ 3 140,

E22-8 *

Depreciation of equipment under SLM

Depreciation for each year =

693 800

, =

23 , 100/year

30

First 3 years depreciation =

23 100 , x 3 =

69 300 ,

Balance depreciated value = 693 %00 ,

-

69 300 ,

=

623 700 ,

New depreciation =

623 700 , = $16 ,

836 76 .

140 -3)

Depreciation value =

Cost of machine -

Salvage value

=$510 ,

000

5/13

5510 000 ,

170 , 080 =>

Depreciation value of asset after 3 years =

102 000

,

4510 000 ,

4/15 136 000 ,

1 =

68 000 ,

+

34 ,

000) as there's no change in salvage value

3 510 000

,

3/13 102 000 ,

This's to be depreciated for the period of 2 years with SLM

2510 000

,

2/15 68 000 , =

182 800 , x

2 =

51

,

000 + 2 =

182 000,

for 2 years

1 510 000,

1/1534 ,

000

2

a) Depreciation for year under SLM

Dr Depreciation Alc $510 000 :

,

Cr Equipment Alc : $510 ,

000

b) Depreciation for year after change in estimated life

Dr Depreciation Alc $16 836 76 :

, .

CrBuilding A/c : $16 ,

856 76 .

E22-15 - Journal entries

① Dr Accumulated Depreciation Equipment $23 ,

400

C Depreciation expense :

$8 ,

500

C Retained earnings : $ 17 000 ,

& Du Retained earnings $45 000 :

G Salaries and wages expense : $45 000 ,

③ No entry The loss was considered to be remote in earlier

->

year

④ Dr Amortization expense (Current Year) $2 250 ( $4500020) : , =

Dr Retained earnings (Prior Year) $4 500 ( $45 000/20 2) : ,

=

,

x

Cr Copyrights $6 750 : ,

③ Dr Inventory Write off :

$87 ,

000

C Retained earnings :

$87 000 ,

x Correction for books

Prior Years (2019+ 2020) Current Year (2021)

Depreciation incorrectly charged $170 000 ( , =

85 000

,

+ 2)$05 ,

000

CorrectDepreciation charged $153 000( ,

=

$76 500 2)$76 500

,

x .

Depreciation excess charged $ 17 008 ,

# 8 300 ,

E 22 16

-

x

Correting entries (Calender-year basis)

① Du Salaries and wages expense $3 ,

400

C Salaries and wages payable $3 400 ,

② Du Salaries and wages expense $31 100 ,

Cr Salaries and wages payable $ 31 100 ,

③ Dr Prepaid insurance $2 ,

200 ( =

$40 x 10) (Nor1)

Cr Insurance expense $2 ,

200

④ Dr Sale revenue $120 ,

000 ( _

$2- 6i)

G Sale tax payable $120 ,

000

Dr Sale tax payable $103 ,

400

G Sale tax

expense $103

400 ,

E22-19 a) Adjusting entries at Dec 31 ,

2021 (Not closed (

① Dr Supplies expense ($1 600( , =

$2 700 ,

-

1 ,

100)

C Supplies $1 600 ,

② Du Salaries and wages expenses $2 900( , = $4 ,

400 -

1 ,

500)

Cr Salaries and wages payable $2 ,

900

③ Dr Interest revenue $750 ( $5100

=

-

4350)

C Interest receivable

$750

④ Dr Insurance

expense $25 000 ( $190

000 ,

=

,

-

65 ,

000)

C Prepaid insurance $25 000 ,

⑤ Du Rent revenue $14 ,

000 ( =

$28 000/2) ,

C Unearned Rent revenue $14 ,

000

⑧ Dr Depreciation expenses $15 000 ( , =

$50 000-5 000) , ,

Cr Accumulated Depreciation -

Equipment $45 000 ,

⑦ Dr Accumulated Depreciation Equipment $7

-

,

200

C Prior Period expenses $7 200 ,

b) Adjusting entries at Dec 31 2021 ,

(Closed)

① Dr Retained earnings :

$1 ,

600

C Supplies $1 600

: ,

② Dr Retained earnings :

$2 900 ,

C Salaries and payable $2 900

wages

:

③ Dr Retained earnings :

$750

C Interest receivable :

$750

④ Dr Retained earnings $25 000 :

Cr Prepaid insurance $25 000 :

,

⑤ Dr Retained earnings $14 000 :

Cr Unearned revenue :

$14 ,

000

⑥ Dr Retained earnings $45 000 :

CrAccumulated Depreciation equipment $45 000 -

:

,

⑦ Dr Retained earnings $7 200 :

C Accumulated Depreciation $7 200

equipment

-

:

,

Apply 40 % tax rate (Not closed)

d)

⑥ Dr Income tax refundable $18 000 ,

( =

45 000

,

x 40 % )

Cr Retained earnings $18 000 ,

⑦ Dr Income tax refundable $2 880( ,

=

7 200

,

x 40 % )

Cr Retained earnings $2 800 ,

You might also like

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Webinar 6 and 7 Revision CGT and Tax Computation Indiv QuestionsDocument4 pagesWebinar 6 and 7 Revision CGT and Tax Computation Indiv QuestionsOlivia KhumaloNo ratings yet

- Division of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsDocument7 pagesDivision of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsJuliana Cheng100% (3)

- Company Profit and LossDocument6 pagesCompany Profit and LossFazal Rehman Mandokhail50% (2)

- Pebble - Crystal Acquired 60000 of The 100000 Shares in PebbleDocument3 pagesPebble - Crystal Acquired 60000 of The 100000 Shares in PebbleTống Ngọc Gia Thư100% (1)

- Lecture-12 Capital Budgeting Review Problem (Part 2)Document2 pagesLecture-12 Capital Budgeting Review Problem (Part 2)Nazmul-Hassan SumonNo ratings yet

- IA 3 Chapter 20 River CoDocument1 pageIA 3 Chapter 20 River CoPrytj Elmo QuimboNo ratings yet

- Assignment 3 1Document6 pagesAssignment 3 1Siying GuNo ratings yet

- FinancialDocument7 pagesFinancial4fp2dkn77tNo ratings yet

- Chapter16 Substantive Tests of Income Statement Accounts - Unlocked PDFDocument7 pagesChapter16 Substantive Tests of Income Statement Accounts - Unlocked PDFabc xyzNo ratings yet

- MJ17 - Hybrids - P6UK - AMENDED AnswersDocument12 pagesMJ17 - Hybrids - P6UK - AMENDED AnswersHassan jalilNo ratings yet

- 07.2 UPDATED Capital Investment DecisionsDocument6 pages07.2 UPDATED Capital Investment DecisionsMilani Joy LazoNo ratings yet

- The Statement of Comprehensive Income: Profit For The YearDocument4 pagesThe Statement of Comprehensive Income: Profit For The YearPlawan GhimireNo ratings yet

- This Study Resource Was: (Question)Document3 pagesThis Study Resource Was: (Question)Mir Salman AjabNo ratings yet

- Tax 2 Final Cheat Sheet 1.2Document2 pagesTax 2 Final Cheat Sheet 1.2HelloWorldNowNo ratings yet

- Finals Quiz 2Document9 pagesFinals Quiz 2Shane TorrieNo ratings yet

- MT2 Ch02Document24 pagesMT2 Ch02api-3725162No ratings yet

- Andrew B. Abel, Ben S. Bernank Global Edition-Pearson (2023) 99Document1 pageAndrew B. Abel, Ben S. Bernank Global Edition-Pearson (2023) 99jane91030No ratings yet

- T11 Ans. 1Document1 pageT11 Ans. 1PUI TUNG CHONGNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2021Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2021Maham IlyasNo ratings yet

- Problem Set - Exclusions From Gross Income: Directal 7520,000Document3 pagesProblem Set - Exclusions From Gross Income: Directal 7520,000Ciana SacdalanNo ratings yet

- CorrectionDocument2 pagesCorrectionLEE SIN YINo ratings yet

- Leverage QuestionsDocument8 pagesLeverage QuestionsMidhun George VargheseNo ratings yet

- Grading Sheet 1&2 GA1 Group2Document9 pagesGrading Sheet 1&2 GA1 Group205 - Trần Mai AnhNo ratings yet

- REVENUE (Average) : 100.00% Gross Sales 1201000 1,201,000 Less: 0 Net Revenue 116,000Document2 pagesREVENUE (Average) : 100.00% Gross Sales 1201000 1,201,000 Less: 0 Net Revenue 116,000Saiyid Ali Haider RazaNo ratings yet

- Kuliah #7 Akl MaksiDocument18 pagesKuliah #7 Akl MaksiMuhammad Tamul FikriNo ratings yet

- National IncomeDocument12 pagesNational Incomekasturisahoo20No ratings yet

- Financial Management Assignment NotesDocument3 pagesFinancial Management Assignment NotesDaniyal AliNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- Internal Reconstruction 02 - Class NotesDocument21 pagesInternal Reconstruction 02 - Class NotesRaghav PrajapatiNo ratings yet

- Questions - Cost of Capital and Sources of FinanceDocument3 pagesQuestions - Cost of Capital and Sources of Financepercy mapetereNo ratings yet

- Prime Company Lane Company: RequiredDocument8 pagesPrime Company Lane Company: RequiredSinta AnnisaNo ratings yet

- 01 - Financial StatementsDocument6 pages01 - Financial Statementsjoubert andresNo ratings yet

- Found Errors in Solution? : Search More Solutions!Document3 pagesFound Errors in Solution? : Search More Solutions!Hồ Trần Minh ThưNo ratings yet

- Acca Approved Content ProviderDocument1 pageAcca Approved Content ProviderbesterNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- Ans 31 To 41Document2 pagesAns 31 To 41Mallet S. GacadNo ratings yet

- 6 AdvacDocument4 pages6 AdvacAlayka LorzanoNo ratings yet

- Entity Y: Problem 4: Activity 2Document11 pagesEntity Y: Problem 4: Activity 2Christine Eunice RaymondeNo ratings yet

- FM Notes PDFDocument40 pagesFM Notes PDFSai Krishna TejaNo ratings yet

- Material - Gestión Financiera - Excel Master Class Investment Decision MakingDocument8 pagesMaterial - Gestión Financiera - Excel Master Class Investment Decision MakingjessicaNo ratings yet

- 11 - Decision Making Fe Part 3 FeDocument54 pages11 - Decision Making Fe Part 3 Fetejaswani poduguNo ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Aiyani NabihahNo ratings yet

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Individual Chargeable Income (Section 4a To 4d) Tax Computation FormatDocument1 pageIndividual Chargeable Income (Section 4a To 4d) Tax Computation FormatHaananth SubramaniamNo ratings yet

- Kasus 4Document1 pageKasus 4iron manNo ratings yet

- Finance Act 2018 UK-TaxDocument77 pagesFinance Act 2018 UK-TaxSolongo DavaakhuuNo ratings yet

- CHP 4Document16 pagesCHP 4Beenish JafriNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- CosoldatedDocument11 pagesCosoldatedShafiqNo ratings yet

- 4 1 Question - 1Document7 pages4 1 Question - 1McAndah JoeNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Introduction To Accounting and Business: Discussion QuestionsDocument46 pagesIntroduction To Accounting and Business: Discussion QuestionsCyyyNo ratings yet

- Income Tax Volume 2 Answer KeyDocument137 pagesIncome Tax Volume 2 Answer KeyManish RajNo ratings yet

- Equity Method: Amortization of Allocated ExcessDocument4 pagesEquity Method: Amortization of Allocated ExcesseiaNo ratings yet

- September 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)Document8 pagesSeptember 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)anitaNo ratings yet

- M2 005. All Costing Statement IllustrationDocument36 pagesM2 005. All Costing Statement Illustrationhanis nabilaNo ratings yet

- Afar Solution 2700Document4 pagesAfar Solution 2700EphraimNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chương 19Document2 pagesChương 19namhua54No ratings yet

- Cách Mô Tả Xu Hướng Trong Ielts Writing Task1Document7 pagesCách Mô Tả Xu Hướng Trong Ielts Writing Task1namhua54No ratings yet

- Đề Thi Giữa Kì Của HưngDocument15 pagesĐề Thi Giữa Kì Của Hưngnamhua54No ratings yet

- BTKTDNVN Chương 6Document3 pagesBTKTDNVN Chương 6namhua54No ratings yet

- Bài tập về nhà - Trang tính1Document4 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- Sanima Bank - CSDDocument32 pagesSanima Bank - CSDalan maharjanNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2017Document34 pagesCBSE Class 12 Accountancy Question Paper 2017gajendra kumarNo ratings yet

- Financial Statements and Their Analysis - Service and Merchandising BusinessDocument21 pagesFinancial Statements and Their Analysis - Service and Merchandising BusinessJoana Marie DonatoNo ratings yet

- Intangible Assets NotesDocument11 pagesIntangible Assets NotesHayes HareNo ratings yet

- 8567 1st AssignmentDocument14 pages8567 1st AssignmentUbedullah DahriNo ratings yet

- Ac2091 ZB - 2019Document15 pagesAc2091 ZB - 2019duong duongNo ratings yet

- Facebook Financial AnalysisDocument12 pagesFacebook Financial AnalysisKennedy Gitonga ArithiNo ratings yet

- NZF Zakat-on-Business GuideDocument16 pagesNZF Zakat-on-Business GuideshirazimamNo ratings yet

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- SMChap 004Document49 pagesSMChap 004Rola KhouryNo ratings yet

- 1 Discuss Briefly About Fair Value Measurement and ImpairmentDocument13 pages1 Discuss Briefly About Fair Value Measurement and ImpairmentBosena TadegeNo ratings yet

- Sa Sept10 Ias16Document7 pagesSa Sept10 Ias16Muiz QureshiNo ratings yet

- Tanya Space Portfolio PDFDocument20 pagesTanya Space Portfolio PDFTanya SpaceNo ratings yet

- MAXIMO 6.0 Student ManualDocument103 pagesMAXIMO 6.0 Student ManualRanjan ShankarNo ratings yet

- Final Examination Advanced Accounting 1 & 2 Part I. Choose The Letter of The Best Answer. (1 Point Each)Document9 pagesFinal Examination Advanced Accounting 1 & 2 Part I. Choose The Letter of The Best Answer. (1 Point Each)MingNo ratings yet

- Fnce2121 PeDocument20 pagesFnce2121 Pechristianorsf1No ratings yet

- IAS 19 Employee BenefitsDocument5 pagesIAS 19 Employee Benefitshae1234No ratings yet

- Chaptersin BUSINESS COMBDocument29 pagesChaptersin BUSINESS COMBalmira garcia100% (1)

- Bus MGT Acctg Luz P Ch2 Ratios Gresola RevDocument19 pagesBus MGT Acctg Luz P Ch2 Ratios Gresola RevChan WoosungNo ratings yet

- Finance 210 Engag 2Document8 pagesFinance 210 Engag 2Mhmd KaramNo ratings yet

- CAS 22 Manufacturing CostDocument12 pagesCAS 22 Manufacturing CostPawan KumarNo ratings yet

- Chapter 8 (T - F) FlashcardsDocument8 pagesChapter 8 (T - F) FlashcardsMaryane AngelaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Loveness Mphande100% (1)

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- FROM 2012 She Sent FAC4861 - 2013 - TL - 102 - 0 - BDocument136 pagesFROM 2012 She Sent FAC4861 - 2013 - TL - 102 - 0 - Bgavinskymail@gmail.comNo ratings yet

- ch09 Analyzing Fixed AssetsDocument82 pagesch09 Analyzing Fixed AssetsMinh Duy HoàngNo ratings yet

- A14 Ipsas - 05Document13 pagesA14 Ipsas - 05Marius SteffyNo ratings yet

- English Accounting TermsDocument8 pagesEnglish Accounting TermsRobiMuhammadIlhamNo ratings yet

- IB Business and Management: 3.5 Balance SheetsDocument31 pagesIB Business and Management: 3.5 Balance SheetsKrish BhatiaNo ratings yet

- Basic Financial Statement AnalysisDocument21 pagesBasic Financial Statement AnalysisLouise BattungNo ratings yet