Professional Documents

Culture Documents

Memo SG 9.7 2023

Uploaded by

nhloniphointelligenceOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Memo SG 9.7 2023

Uploaded by

nhloniphointelligenceCopyright:

Available Formats

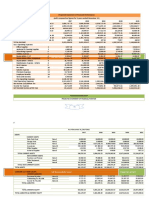

9.

Inventory

Balance 84 600 Cost of Sales (C5) 267 000

Purchases 1/3 to 30/6 252 000 Purchases returns1/3-30 23 400

Sales returns1/3 to 30/6 (C3) 28 500 Purchases returns1/7-4/7 250 (287,5*100/115)

Sales returns 1 to 4 July (C4) 440 Donations 6 600 (9487,5 x 100/143,75)

Inventory loss 52 690

Balance (C1) 15 600

365 540 365 540

Calculation 1

Inventory on hand 4 March 20.19

Marked price Cost

Inventory on hand R22 425,00 15 600 (22425 x 100/143,75)

15 600

Calculation 2

Relationship between Cost GP and SP Sale

CP 100,000 100 100

GP 25,000 25 10

SP 125,000 125 110

VAT 15% 18,750 16,5

143,750 126,5

Calculation 3

Sales returns (At SP excl VAT) 35 625

Calculation of sales returns at Cost 28 500 (35625X 100/125)

Calculation 4

Returns in 632,5

Returns in excluding at cost 440 (632,5x100/143,75)

Calculation 5 Cost of sales

Calculation of cost of sales

Total sales from 1 March to 30 June 315 700

Less: Sales at discounted selling price ex -13 200 (15180*100/115)

Total sales from 1 March to 30 June

excluding vat at normal SP 302 500

Cost of sales of sales at normal mark-up 242000

Cost of sales at discounted price 12 000 (15180 x 100/126,5) or (13200x100/110)

Cost of sales 1-4 June 18687,5 13 000 (18687,5 x 100/143,75) (6612,50+12075)

Total cost of sales 267 000

Calculation 6

Theoretical inventory

Actual inventory on hand 15 600

Inventory loss 52 690

Inventory on hand was there no loss 68 290

Insured for 60 000

Amount from insurance company = 60 000 x 52 690 6 396

68 290

Incl VAT VAT

= 46 294 53 238 6 944

Dr Insurance company 53 238

Dr Loss on inventory / COS 6 396

Cr Output VAT 6 944

Cr Inventory 52 690

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Basic Concept of Business PlanDocument10 pagesBasic Concept of Business PlanRoshiel Ann BarredoNo ratings yet

- The Maid Sisekelo S3Document165 pagesThe Maid Sisekelo S3nhloniphointelligence85% (26)

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- Sales of Goods Act, 1930Document13 pagesSales of Goods Act, 1930Shubhi MittalNo ratings yet

- Starbucks Case Analysis With Cover Page v2Document18 pagesStarbucks Case Analysis With Cover Page v2Mohamed TarekNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Case Analysis 2 Friendship in BusinessDocument4 pagesCase Analysis 2 Friendship in BusinessJP Ramos DatinguinooNo ratings yet

- Forbidden Love Lwazi& LumiDocument801 pagesForbidden Love Lwazi& Luminhloniphointelligence0% (1)

- T12 - ABFA1153 (Extra)Document2 pagesT12 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Accounting 2020 P1 MemoDocument11 pagesAccounting 2020 P1 MemoodiantumbaNo ratings yet

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13Document20 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13KabeerMalikNo ratings yet

- Chapter 9Document12 pagesChapter 9Ruthchell CiriacoNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- Solution AP Test Bank 1Document8 pagesSolution AP Test Bank 1ima100% (1)

- Ap Solutions 2016Document15 pagesAp Solutions 2016Shariefia MagondacanNo ratings yet

- Answers To PreboardDocument7 pagesAnswers To PreboardCodeSeekerNo ratings yet

- Solution - Auditing Problems Test Bank 1: Problem 1 - Tanying CorpDocument3 pagesSolution - Auditing Problems Test Bank 1: Problem 1 - Tanying CorpJayvee BalinoNo ratings yet

- Hayleys Surpasses Rs 100 BN Turnover in 1HFY18/19Document18 pagesHayleys Surpasses Rs 100 BN Turnover in 1HFY18/19Janitha DissanayakeNo ratings yet

- Goodwill: (Note 1)Document10 pagesGoodwill: (Note 1)SHi MiNNo ratings yet

- Profit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aDocument1 pageProfit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aM Arif RahmanNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- Income StatementDocument2 pagesIncome StatementNatalia Casas CorderoNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Document34 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 2 Prob 10 15Makoy BixenmanNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Business Research FsDocument7 pagesBusiness Research FsJohnric ArtilloNo ratings yet

- Profit & Loss Account of Infosys - in Rs. Cr.Document2 pagesProfit & Loss Account of Infosys - in Rs. Cr.Samta Sukhdeve100% (1)

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- ACP312 Intercompany-Sale-Of-Inventory-QuizDocument31 pagesACP312 Intercompany-Sale-Of-Inventory-QuizJocelyn GorospeNo ratings yet

- Financial Statement - Is and NotesDocument31 pagesFinancial Statement - Is and NotesAlvin James OlayaNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountAnonymous HAkNRaNo ratings yet

- Pand LDocument1 pagePand Lvihanjangid223No ratings yet

- Financial Feasib3Document41 pagesFinancial Feasib3api-3838281No ratings yet

- Profit & Loss (Accrual)Document1 pageProfit & Loss (Accrual)SMK ASY-SYAFI'IYYAHNo ratings yet

- Marta's Financial AspectDocument20 pagesMarta's Financial AspectMarvin GamboaNo ratings yet

- Evi12 104945Document1 pageEvi12 104945Al QadriNo ratings yet

- Jaxworks Dashboard1Document26 pagesJaxworks Dashboard1Bob MasonNo ratings yet

- Cost and Management Accounting: Page 1 of 8Document8 pagesCost and Management Accounting: Page 1 of 8Ibtehaj KayaniNo ratings yet

- Irma12 104932Document1 pageIrma12 104932Al QadriNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintUTSAVNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionMisbah SajidNo ratings yet

- MJ20 FR Sample - Suggested Solutions and Marking Schemes v1.0 PDFDocument9 pagesMJ20 FR Sample - Suggested Solutions and Marking Schemes v1.0 PDFfatehsalehNo ratings yet

- Navana CNG Limited IncomeDocument4 pagesNavana CNG Limited IncomeHridoyNo ratings yet

- Fit Deli TODAY Version 1.xlsb 1Document17 pagesFit Deli TODAY Version 1.xlsb 1Micah Valerie SaradNo ratings yet

- MARCH 2020 AnswerDocument16 pagesMARCH 2020 AnswerXianFa WongNo ratings yet

- Cpa Reviewschool of The Phlppnes Man It A Auditeng Problems Fena Pre-Board Examination Problem2 - Everlasting CompanyDocument6 pagesCpa Reviewschool of The Phlppnes Man It A Auditeng Problems Fena Pre-Board Examination Problem2 - Everlasting CompanyLexuz Mar DyNo ratings yet

- ENTREPDocument14 pagesENTREProbinjohnroqueNo ratings yet

- Paler, Karlo Dave - INCOME STATEMENT June 26, 2020Document7 pagesPaler, Karlo Dave - INCOME STATEMENT June 26, 2020Karlo PalerNo ratings yet

- Lucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiDocument21 pagesLucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiMuhammad AreebNo ratings yet

- Add: Purchases Net of Scheme Cost (Including F. Goods Purchases)Document12 pagesAdd: Purchases Net of Scheme Cost (Including F. Goods Purchases)rinku10431No ratings yet

- FS February 2022Document5 pagesFS February 2022Rommel GunioNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- #75 Busns CombinationDocument3 pages#75 Busns CombinationJon Dumagil InocentesNo ratings yet

- Tugas Pertemuan 4Document6 pagesTugas Pertemuan 4Nisrina ChairunnisaNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Test 3 FinaccDocument8 pagesTest 3 FinaccPaul ChavundukaNo ratings yet

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNo ratings yet

- Bayern Publisher DataDocument24 pagesBayern Publisher DataDipiNo ratings yet

- WAPO 2019 Final Draft XXXDocument229 pagesWAPO 2019 Final Draft XXXRenatus shijaNo ratings yet

- Statement / Invoice Tuition Fee Account: Student No. 2023783075 28/02/2023Document3 pagesStatement / Invoice Tuition Fee Account: Student No. 2023783075 28/02/2023nhloniphointelligenceNo ratings yet

- Study Guide 6.6Document1 pageStudy Guide 6.6nhloniphointelligenceNo ratings yet

- Manchester City Financial Report 2022 23Document54 pagesManchester City Financial Report 2022 23nhloniphointelligenceNo ratings yet

- PricelistDocument2 pagesPricelistnhloniphointelligenceNo ratings yet

- Fa Ii Chapter 1 InventoryDocument23 pagesFa Ii Chapter 1 InventoryAbdi Mucee TubeNo ratings yet

- Marketing Mix of Flair PensDocument11 pagesMarketing Mix of Flair PensJayagokul SaravananNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)M. Sadiq. A. PachapuriNo ratings yet

- 3 Year Strategic Plan TemplateDocument5 pages3 Year Strategic Plan TemplateMitchel DannyNo ratings yet

- A. $800,000 B. $600,000 C. $440,000 D. $200,000Document15 pagesA. $800,000 B. $600,000 C. $440,000 D. $200,000sino akoNo ratings yet

- Basic Income StatementsDocument2 pagesBasic Income StatementsTanjim BhuiyanNo ratings yet

- College Accounting A Contemporary Approach 4th Edition Haddock Solutions ManualDocument16 pagesCollege Accounting A Contemporary Approach 4th Edition Haddock Solutions Manualeugenedermot52n3ny100% (31)

- Aggregate Planning PDFDocument13 pagesAggregate Planning PDFShimanta EasinNo ratings yet

- Presentation On Recent Trends in Sales ManagementDocument6 pagesPresentation On Recent Trends in Sales ManagementKumar amritNo ratings yet

- Marketing Information System and Sales Order ProcessDocument33 pagesMarketing Information System and Sales Order ProcessHassan KhanNo ratings yet

- Sourav Kumar Sinha CEC 3Document26 pagesSourav Kumar Sinha CEC 3Sourav SinhaNo ratings yet

- Evaluate Marketing Opportunities Submission Details: 1. Manufacture and Sell Own BrandDocument4 pagesEvaluate Marketing Opportunities Submission Details: 1. Manufacture and Sell Own BrandanushaNo ratings yet

- Tesco Ara2019 Full Report Web PDFDocument190 pagesTesco Ara2019 Full Report Web PDFMadeforthisthat1 SkloNo ratings yet

- Strategic Marketing SummaryDocument21 pagesStrategic Marketing SummaryMariam KhailanyNo ratings yet

- Punyak SatishDocument2 pagesPunyak Satish45Punyak SatishPGDM RMIIINo ratings yet

- Markup and Margin ExplainedDocument4 pagesMarkup and Margin ExplainedRafael RiveraNo ratings yet

- TLE 6-Quarter 1-Week 1Document3 pagesTLE 6-Quarter 1-Week 1April Jane Polangco RamosNo ratings yet

- Argus AmmoniaDocument8 pagesArgus AmmoniaPhaniNo ratings yet

- Resume - Logan Ramsey 8Document2 pagesResume - Logan Ramsey 8api-708306289No ratings yet

- Bus 4407 Learning Journal Unit 2Document2 pagesBus 4407 Learning Journal Unit 2Li Mei YouNo ratings yet

- MDSI - Inventory MGTDocument12 pagesMDSI - Inventory MGTalexraposa22No ratings yet

- Organization of The Sales ForceDocument23 pagesOrganization of The Sales ForceArsalan AliNo ratings yet

- Ski Manufacturing 12-09Document59 pagesSki Manufacturing 12-09Life BloggerNo ratings yet

- Consignment Account PDFDocument13 pagesConsignment Account PDFAyush KumarNo ratings yet

- Carpentry Pro Plan v1664134062229Document30 pagesCarpentry Pro Plan v1664134062229jweremaNo ratings yet

- P & G:Organisational StructureDocument7 pagesP & G:Organisational StructureZas AroraNo ratings yet