Professional Documents

Culture Documents

QP Financial Planning and Wealth Management

Uploaded by

Harpreet KaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QP Financial Planning and Wealth Management

Uploaded by

Harpreet KaurCopyright:

Available Formats

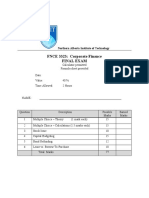

MST 1 (2022)

Financial planning and Wealth Management

Total Time: 40 mins Total Marks: 20 Marks

● Each section is compulsory, try to attempt all.

● The question paper has 3 sections. All sections are compulsory.

Section 1

● This section consists of Multiple Choices questions

● Answer all the questions (1 X 10= 10 Marks)

1. Capital markets denote the places where funds are swapped between

a) suppliers of capital

b) Borrower of capital

c) Those who request capital investments.

d) Both (a) & (b)

2. The capital market in India is controlled by-

a) SEBI b) IRDA c) RBI d) ICRA

3. ____________ is also called zero coupon bond.

(a) Trade bills (b) Call money (c) Treasury bills (d) Commercial papers

4. Stock exchange is known as __________ market for securities.

(a) Primary market (b) Secondary market (c) Capital market (d) None of the above

5. Which of the following statements is not true with regard to money market?

(a) It involves low market risk.

(b) It is situated at specific locations.

(c) Deals in unsecured and short-term debt instruments.

(d) The instruments traded are highly liquid.

6. The Full form of UHNW IS_________

a) High net worth customers b) Huge net worth customers c)None of the above d)Heavy net worth customers

7. The statement of cash flow clarifies cash flows according to

A) Operating and Non-operating Flows

B) Inflow and Outflow

C) Investing and Non-operating Flows

D) Operating, Investing, and Financing Activities

8. Which item comes under financial activities in cash flow?

A) Redemption of Preference Share

B) Issue of Preference Share

C) Interest Paid

D) All the above

9. Cash equivalent includes______________

a) Stock b) debtors c) Cash d)None of the above

10. Wealth management is a ____________process

a) Advisory b) Consultative

C) Customized d) All of the above

Section 2

Short Answer Type Questions

This section carries short answer questions, answer any 2 out of 3 (2 X 2=4 Marks)

1. Write the difference between Money and Capital market instruments.

2. Write about the components of Wealth management.

3. Write about the methods to improve and maximize cash flows of an organization.

Section 3

This section carries Case Study/ Numerical questions (1X 6 = 6 Marks)

1. Snehil worked as a senior manager in Pearl Ltd. And earns a salary of Rs.70,000 monthly. She is single

and planning to get married in the upcoming month of January,2023. She has past saving worth Rs. 10

lakhs and has inherited net assets worth Rs.20 lakhs.

You are Aviraj, her financial planner, Create a financial plan that will suit her requirements based upon her

current status and financial planning process analysis.

2. After doing a course in online trading, Abhimanyu started an online portal for stock trading under the name

‘Investment Time’. His wife was going to a bank for opening a Demat account. Abhimanu urged his wife

to invest in the forthcoming IPO of a blue chip companies whereas his wife was inclined to buy existing

securities of the other companies to build her investment portfolio.

1. Identify the two different types of capital market being referred to in the above case.

2. State any 6 differences between the two different types of capital markets.

You might also like

- Fun Run ProposalDocument16 pagesFun Run ProposalJaena Marie Santos100% (2)

- Final Report On Electric Car JackDocument30 pagesFinal Report On Electric Car JackAmit Raj73% (22)

- Caiib Sample QuestionsDocument15 pagesCaiib Sample QuestionsVijay25% (4)

- Introduction To Financial Products - Mid Term Set 1Document3 pagesIntroduction To Financial Products - Mid Term Set 1Harsha OjhaNo ratings yet

- IFS End Term 2015Document6 pagesIFS End Term 2015SharmaNo ratings yet

- Quiz 1 FI - PaperDocument4 pagesQuiz 1 FI - PaperZaheer Ahmed Swati100% (1)

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDocument5 pagesGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385No ratings yet

- University of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterDocument4 pagesUniversity of Engineering & Management, Jaipur: University Examination MBA, 1 Year, 2 SemesterSupriyo BiswasNo ratings yet

- 553 Question PaperDocument2 pages553 Question PaperPacific TigerNo ratings yet

- PGDM Semester - I (2020-2022) End Term Examination: InstructionsDocument2 pagesPGDM Semester - I (2020-2022) End Term Examination: InstructionsAbhinavNo ratings yet

- Syjc Ocm PrelimDocument3 pagesSyjc Ocm PrelimjaijaibambholeNo ratings yet

- Examination Paper - Principles and Practices of Banking & Financial ServicesDocument9 pagesExamination Paper - Principles and Practices of Banking & Financial ServicesJesjames123No ratings yet

- Financial Markets and Institutions 26mLkeG0NODocument2 pagesFinancial Markets and Institutions 26mLkeG0NOKhushi SangoiNo ratings yet

- 1044 Question PaperDocument2 pages1044 Question PaperPacific TigerNo ratings yet

- Money and Banking-Question BankDocument6 pagesMoney and Banking-Question BankHari prakarsh NimiNo ratings yet

- (ECO) Chapter 9 Money Market and Capital MarketDocument12 pages(ECO) Chapter 9 Money Market and Capital MarketMehfooz PathanNo ratings yet

- Sample Paper 11 Term 1 - ACCOUNTANCY 2023 Grade 11Document12 pagesSample Paper 11 Term 1 - ACCOUNTANCY 2023 Grade 11Suhaim SahebNo ratings yet

- Jaiibbanking Test 1Document9 pagesJaiibbanking Test 1imshwezNo ratings yet

- MN3002-Financial Accounting (2019-20) - FYBBADocument4 pagesMN3002-Financial Accounting (2019-20) - FYBBAVivek AyreNo ratings yet

- 306 FIn Financial System of India Markets & ServicesDocument6 pages306 FIn Financial System of India Markets & ServicesNikhil BhaleraoNo ratings yet

- KVS Mumbai XI ACC SQP & SMS SET-II (Annual Exam) (22-23)Document23 pagesKVS Mumbai XI ACC SQP & SMS SET-II (Annual Exam) (22-23)ishitaNo ratings yet

- Sample Q P Set2 AccDocument9 pagesSample Q P Set2 AccJohn JoshyNo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- 1st Sem PapersDocument66 pages1st Sem PapersJanvi 86 sec.BNo ratings yet

- Tybcom II Term ObjectivesDocument15 pagesTybcom II Term Objectivesganeshkhale708950No ratings yet

- Financial Markets and Instiutions Wcmw4e8ThMDocument3 pagesFinancial Markets and Instiutions Wcmw4e8ThMKhushi SangoiNo ratings yet

- 1 Book-Keeping IntroductionDocument10 pages1 Book-Keeping IntroductionnonameshockyNo ratings yet

- Xi See Acc 2021 Set 2 QPDocument8 pagesXi See Acc 2021 Set 2 QPs1672snehil6353No ratings yet

- Class - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Document9 pagesClass - Xii - Entrepreneurship - Sample Paper - Solved No.2 - 2018-19Rishav BhattNo ratings yet

- QP CODE: 21100520: Reg No: NameDocument2 pagesQP CODE: 21100520: Reg No: NameOnline Class, CAS KPLYNo ratings yet

- CFI1201200307 Financial Mathematics IIDocument2 pagesCFI1201200307 Financial Mathematics IIranganaitinotenda1No ratings yet

- I.F.M.mba Que PaperDocument3 pagesI.F.M.mba Que PaperbabadhirubabaNo ratings yet

- Introduction To Financial ServicesDocument2 pagesIntroduction To Financial ServicesDr.Pratixa JoshiNo ratings yet

- IFS Suggested Questions by GKJDocument5 pagesIFS Suggested Questions by GKJNayanNo ratings yet

- Indi Securities MarketDocument5 pagesIndi Securities MarketsunilsoniaguptaNo ratings yet

- Bba 304Document4 pagesBba 304hodmbaalpineNo ratings yet

- IFS Suggestion GKJDocument6 pagesIFS Suggestion GKJAN-DROID GAMER RATULNo ratings yet

- MFD Model Test Questions-Aug2018Document16 pagesMFD Model Test Questions-Aug2018Pravin PawarNo ratings yet

- UntitledDocument11 pagesUntitledhariNo ratings yet

- CBSE Sample Papers For Class 11 Accountancy Set 2 With SolutionsDocument24 pagesCBSE Sample Papers For Class 11 Accountancy Set 2 With Solutionsruhiagarwal2916No ratings yet

- Commercial Banking Assignment - 1Document7 pagesCommercial Banking Assignment - 1kismat yadavNo ratings yet

- Commercial Banking Assignment - 1Document7 pagesCommercial Banking Assignment - 1kismat yadavNo ratings yet

- L0 BankingDocument20 pagesL0 BankingChetan DekateNo ratings yet

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document136 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- Winter 2014 SolutionDocument15 pagesWinter 2014 SolutionGurveen KaurNo ratings yet

- Bba 502Document4 pagesBba 502Innocent BwalyaNo ratings yet

- General Awareness For Sbi Clerk and Ibps ExamsDocument34 pagesGeneral Awareness For Sbi Clerk and Ibps ExamsRanjit RajendranNo ratings yet

- CompreDocument5 pagesCompreadityaagr2910No ratings yet

- Investment Banking QP - PGDM - TRIM 3Document6 pagesInvestment Banking QP - PGDM - TRIM 3SharmaNo ratings yet

- DMGT207 8Document1 pageDMGT207 8rjaggi0786No ratings yet

- Accoutancy Sample Paper 2023Document44 pagesAccoutancy Sample Paper 2023Yashabh JosephNo ratings yet

- Money and Banking Worksheet 2023-24Document3 pagesMoney and Banking Worksheet 2023-24Hadhi SharafNo ratings yet

- Economics Chapter 15 - SEBI and Other Institutions MCQDocument6 pagesEconomics Chapter 15 - SEBI and Other Institutions MCQJyotsna JadaunNo ratings yet

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Document4 pagesUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Supriyo BiswasNo ratings yet

- Revision Notes For Class 12 Macro Economics Chapter 3 - Free PDF DownloadDocument7 pagesRevision Notes For Class 12 Macro Economics Chapter 3 - Free PDF DownloadVibhuti BatraNo ratings yet

- MB 104 Basics of Accounting and FinanceDocument3 pagesMB 104 Basics of Accounting and FinancerajeshpatnaikNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Summary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-week Program That WorksFrom EverandSummary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-week Program That WorksNo ratings yet

- Summary: I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-week Program That Works: I Will Teach You to Be RichFrom EverandSummary: I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-week Program That Works: I Will Teach You to Be RichNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- Answer Sheet of Business Economics For Manager by Harpreet KaurDocument5 pagesAnswer Sheet of Business Economics For Manager by Harpreet KaurHarpreet KaurNo ratings yet

- Lecture 24 - Manage Stress To Improve Work-Life BalanceDocument14 pagesLecture 24 - Manage Stress To Improve Work-Life BalanceHarpreet KaurNo ratings yet

- Assessment 11-15 by HarpreetDocument2 pagesAssessment 11-15 by HarpreetHarpreet KaurNo ratings yet

- Data of Pharma Companies .Document3 pagesData of Pharma Companies .Harpreet KaurNo ratings yet

- Assesment 5 Financial ProductDocument3 pagesAssesment 5 Financial ProductHarpreet KaurNo ratings yet

- Answer Sheet of Business Communication by Harpreet KaurDocument7 pagesAnswer Sheet of Business Communication by Harpreet KaurHarpreet KaurNo ratings yet

- Finanical ProductsDocument19 pagesFinanical ProductsHarpreet KaurNo ratings yet

- Assessmet 3 Human Resource ManagementDocument2 pagesAssessmet 3 Human Resource ManagementHarpreet KaurNo ratings yet

- LAWS IN HRM by Harpreet KaurDocument25 pagesLAWS IN HRM by Harpreet KaurHarpreet KaurNo ratings yet

- Factors Affecting Consumer Awareness and The Purchase of Eco-Friendly Vehicles: Textual Analysis of Korean MarketDocument17 pagesFactors Affecting Consumer Awareness and The Purchase of Eco-Friendly Vehicles: Textual Analysis of Korean MarketHarpreet KaurNo ratings yet

- Presentation On Mbo & Organisational StructureDocument8 pagesPresentation On Mbo & Organisational StructureHarpreet KaurNo ratings yet

- Assessment 1 Professional CommunicationDocument3 pagesAssessment 1 Professional CommunicationHarpreet KaurNo ratings yet

- Assignment For Session 6 Reporting ToolsDocument553 pagesAssignment For Session 6 Reporting ToolsDebarghya DasNo ratings yet

- Brand Name:-By Diksha Sahwney: Coca - ColaDocument3 pagesBrand Name:-By Diksha Sahwney: Coca - ColaHarpreet KaurNo ratings yet

- Assessment 3 OmDocument5 pagesAssessment 3 OmHarpreet KaurNo ratings yet

- Fab HotelsDocument12 pagesFab HotelsHarpreet KaurNo ratings yet

- Welcome To Our Presentation: Dining EtiquetteDocument9 pagesWelcome To Our Presentation: Dining EtiquetteHarpreet KaurNo ratings yet

- Auto Secure Private Car Package PolicyDocument8 pagesAuto Secure Private Car Package PolicyYOGI NANDESARINo ratings yet

- Campbell Complaint Against Sweet Briar CollegeDocument15 pagesCampbell Complaint Against Sweet Briar CollegeElliott SchuchardtNo ratings yet

- Analysis AGENCY LEADER Contract ProvisionsDocument9 pagesAnalysis AGENCY LEADER Contract ProvisionsJuan Miguel San PedroNo ratings yet

- 8 Facts About Copyright LawDocument1 page8 Facts About Copyright Lawapi-621409233No ratings yet

- Great Pacific Life Ass. CO. vs. CA and Ngo Hing GR No. L 31845 April 30 1979Document5 pagesGreat Pacific Life Ass. CO. vs. CA and Ngo Hing GR No. L 31845 April 30 1979wenny capplemanNo ratings yet

- Blank Books On Demand (BOD) AgreementDocument4 pagesBlank Books On Demand (BOD) AgreementLhem-Mari Japos NavalNo ratings yet

- Victoria Raceli CaseDocument4 pagesVictoria Raceli Casebb yattyNo ratings yet

- Florida Board of Bar Examiners: Florida Bar Examination Study Guide and Selected Answers February 2015 July 2015Document51 pagesFlorida Board of Bar Examiners: Florida Bar Examination Study Guide and Selected Answers February 2015 July 2015Tim ChangNo ratings yet

- Indian Financial SystemDocument4 pagesIndian Financial SystemDivya BhadriNo ratings yet

- Kinds of CompanyDocument4 pagesKinds of CompanyMuhammad UsamaNo ratings yet

- List of Cases and Headnotes For Conspiracy To InjureDocument75 pagesList of Cases and Headnotes For Conspiracy To InjureMalini SubramaniamNo ratings yet

- Javellana v. LimDocument2 pagesJavellana v. LimClaire Balagon LangomezNo ratings yet

- Quotation MHDocument2 pagesQuotation MHsaprin nataNo ratings yet

- Corporation Consideration To Share Capital Quiz 1Document7 pagesCorporation Consideration To Share Capital Quiz 1ycalinaj.cbaNo ratings yet

- NOOL Vs CADocument1 pageNOOL Vs CAEdward Kenneth KungNo ratings yet

- K-PACS EULA EvaluationDocument3 pagesK-PACS EULA EvaluationDidier Manuel Castro vasquezNo ratings yet

- Carlos Pardo de Tavera vs. El Hogar FilipinoDocument4 pagesCarlos Pardo de Tavera vs. El Hogar FilipinoArste GimoNo ratings yet

- 2022 Omnibus Sworn Statement (Revised) - DILGDocument2 pages2022 Omnibus Sworn Statement (Revised) - DILGmaxor4242No ratings yet

- Hire PurchaseDocument14 pagesHire Purchasegdin27No ratings yet

- Al Mooryaat Esport Club CR:1010824740 Filali Zehri Driss in Riyadh, Al Sulimaniyah Street, KSA, On January 7, 2023Document10 pagesAl Mooryaat Esport Club CR:1010824740 Filali Zehri Driss in Riyadh, Al Sulimaniyah Street, KSA, On January 7, 2023Sy KoNo ratings yet

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- URR 725 WordDocument9 pagesURR 725 WordTran TungNo ratings yet

- Tan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Document2 pagesTan, Tiong, Tick vs. American Hypothecary Co., G.R. No. L-43682 March 31, 1938Barrymore Llegado Antonis IINo ratings yet

- 10 19 Case DigestDocument11 pages10 19 Case DigestsophiaNo ratings yet

- Article 1828-1867Document5 pagesArticle 1828-1867ChaNo ratings yet

- Case Digest: (Corporation Defined, Artificial Being)Document6 pagesCase Digest: (Corporation Defined, Artificial Being)Lisley Gem AmoresNo ratings yet

- National University of Study and Research in Law: CoercionDocument6 pagesNational University of Study and Research in Law: CoercionRam Kumar YadavNo ratings yet

- LL. B. V Term Paper - LB - 5034 - Intellectual Property Law - IIDocument9 pagesLL. B. V Term Paper - LB - 5034 - Intellectual Property Law - IIyashNo ratings yet

- Personal Loan Application FormDocument25 pagesPersonal Loan Application FormMahaveer Jain100% (2)