Professional Documents

Culture Documents

Chapter 1 - Revision

Uploaded by

Hiểu MinhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Revision

Uploaded by

Hiểu MinhCopyright:

Available Formats

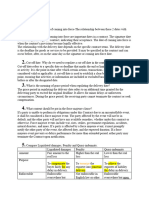

Chapter 1

1. Signature date – Date of coming into force – The relationship between these 2

dates with Delivery date.

2. Cut-off date. Why do we need to regulate a cut-off date in the contract?

3. What is the meaning of grace period when regulating the delivery date?

4. What content should be put in the force majeure clause?

5. Compare Liquidated damages, Penalty and Quasi – indemnity.

6. Negotiable B/L vs. Non-negotiable B/L.

7. Examples about notes on B/L that makes it ‘unclean’.

8. Examples about notes on B/L that DO NOT make it ‘unclean’.

9. The point at which there is a transfer of risk, title and insurance from Seller to

Buyer. (FOB, CIF, EXW, DDP).

10. Compare Insurance policy, certificate of insurance, letter of insurance.

11. Floating policy vs. Open cover.

12. Explain the Institute Maintenance of Class Clause. Why does the insurance

company often add this clause to their agreement with the insured under floating

policy or open cover?

13. Valued policy vs. Unvalued policy.

14. Time Policy vs. Voyage Policy.

15. Cargo Clause A, B and C. What do they have in common and how are they

different? (p.63)

You might also like

- TACN2Document8 pagesTACN2K58 TRAN ANH VANNo ratings yet

- NIDA ArtsLaw StudentNotes 2016Document6 pagesNIDA ArtsLaw StudentNotes 2016Ray PittmanNo ratings yet

- Textbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterNo ratings yet

- Contract Checklist For International Sale of GoodsDocument8 pagesContract Checklist For International Sale of GoodsVanessa JamesNo ratings yet

- What Law Would Be Applicable For A Contract?Document4 pagesWhat Law Would Be Applicable For A Contract?Jupiter SchwarzNo ratings yet

- Assignment: Final Exam: Mohammad Tasadduk Ali MiahDocument6 pagesAssignment: Final Exam: Mohammad Tasadduk Ali MiahMd. Mustak shahorear shihab (212051029)No ratings yet

- CRM in Bank NotesDocument12 pagesCRM in Bank NotesTahir RehmaniNo ratings yet

- Dynamic Business Law The Essentials 3rd Edition Kubasek Solutions ManualDocument16 pagesDynamic Business Law The Essentials 3rd Edition Kubasek Solutions Manualsiamangforcezwp8100% (20)

- Convertible Debt PDFDocument10 pagesConvertible Debt PDFNazmulNo ratings yet

- 07 LasherIM Ch07Document29 pages07 LasherIM Ch07Mohamed El Ghandour100% (1)

- Canadian Business and The Law Canadian 6th Edition Duplessis Solutions ManualDocument36 pagesCanadian Business and The Law Canadian 6th Edition Duplessis Solutions ManualCindyCurrydwqzr100% (83)

- Solution Manual For Business Law Today The Essentials 12th Edition Roger Leroy MillerDocument14 pagesSolution Manual For Business Law Today The Essentials 12th Edition Roger Leroy MillerCameronHerrerayfep100% (45)

- Mock Questions On L4M3Document13 pagesMock Questions On L4M3pearl100% (1)

- Question & Answers: Commercial ContractingDocument13 pagesQuestion & Answers: Commercial ContractingpearlNo ratings yet

- Câu trả lời cho câu hỏi ôn tập sau slideDocument7 pagesCâu trả lời cho câu hỏi ôn tập sau slideChaunguyen94No ratings yet

- PCG Standard Wording or AmendmentDocument4 pagesPCG Standard Wording or AmendmentRichard CoxNo ratings yet

- Learning Benchmarks 1Document1 pageLearning Benchmarks 1Tricia MontoyaNo ratings yet

- Question & Answers: Commercial ContractingDocument13 pagesQuestion & Answers: Commercial ContractingpearlNo ratings yet

- Mid Term TACN 2Document18 pagesMid Term TACN 2Duyên Uông100% (1)

- TOPIC 4. VALIDATION OF A CLAIM 1 and 2Document27 pagesTOPIC 4. VALIDATION OF A CLAIM 1 and 2Mujo TiNo ratings yet

- Insurance Concepts Book SampleDocument19 pagesInsurance Concepts Book Samplecharul sharmaNo ratings yet

- International Business and TradeDocument2 pagesInternational Business and TradeFloradel De GuzmanNo ratings yet

- Note On Warranties and Indemnities - 11.08.2022Document3 pagesNote On Warranties and Indemnities - 11.08.2022Harshit MehtaNo ratings yet

- CILA Rebuilding CostDocument40 pagesCILA Rebuilding Cost23985811No ratings yet

- Buying and Selling A Business in Colorado - Mastering The Basics SEMINAR 8/7/03 Iv. Drafting Ancillary Documents - Presented by Robert L. Allman, EsqDocument22 pagesBuying and Selling A Business in Colorado - Mastering The Basics SEMINAR 8/7/03 Iv. Drafting Ancillary Documents - Presented by Robert L. Allman, EsqAmine El HamzaouiNo ratings yet

- CSCF T6 - P14Document14 pagesCSCF T6 - P14sk2p7tsf5cNo ratings yet

- 21 Module VIII NotesDocument6 pages21 Module VIII NotesHeri TrionoNo ratings yet

- Survival Clauses & Uncertainty PDFDocument35 pagesSurvival Clauses & Uncertainty PDFVictor DutraNo ratings yet

- Mid Semester Tests - MondayDocument4 pagesMid Semester Tests - Mondaychanlego123No ratings yet

- FIN722 Final Term Subjective Solved Mega FileDocument17 pagesFIN722 Final Term Subjective Solved Mega FileAnonymous 7cjaWUzQRw100% (1)

- Chapter 1 Contract Q A 1Document35 pagesChapter 1 Contract Q A 1Đinh Thị Mỹ LinhNo ratings yet

- M&A Vocabulary - Explained by The Experts - Indemnity vs. Warranty Under Common Law - Rödl & PartnerDocument2 pagesM&A Vocabulary - Explained by The Experts - Indemnity vs. Warranty Under Common Law - Rödl & PartnerDAO9No ratings yet

- A Checklist For Construction Risk ManagementDocument4 pagesA Checklist For Construction Risk ManagementMike KarlinsNo ratings yet

- Advantages of Junk Bonds: Financial Products No CommentsDocument5 pagesAdvantages of Junk Bonds: Financial Products No CommentsRajesh KumarNo ratings yet

- A Guidance Document For Insurance Requirements in Various ContractsDocument63 pagesA Guidance Document For Insurance Requirements in Various ContractsMahmood JafariNo ratings yet

- SG Week 4 LAW 421Document4 pagesSG Week 4 LAW 421Breanne NardecchiaNo ratings yet

- CIPS L5M3 LO1 TranscriptDocument5 pagesCIPS L5M3 LO1 TranscriptTimothy Manyungwa IsraelNo ratings yet

- Summer Class 2022Document5 pagesSummer Class 2022ERMA MAE GABATONo ratings yet

- (Answer) (Đề) C1 - Further practiceDocument13 pages(Answer) (Đề) C1 - Further practiceK59 Huynh Kim NganNo ratings yet

- Intro To Contract Review SlidesDocument19 pagesIntro To Contract Review SlidesBảo Uyên Nguyễn TrầnNo ratings yet

- Claims: A Guide To Reinsurance Law - 1st Edition, 2007 Chapter 7 ClaimsDocument8 pagesClaims: A Guide To Reinsurance Law - 1st Edition, 2007 Chapter 7 ClaimsDean Rodriguez100% (1)

- Keown Perfin5 Im 10Document18 pagesKeown Perfin5 Im 10a_hslrNo ratings yet

- Business Law Today Comprehensive Text and Cases Diverse Ethical Online and Global Environment Miller 10th Edition SolutionsDocument11 pagesBusiness Law Today Comprehensive Text and Cases Diverse Ethical Online and Global Environment Miller 10th Edition SolutionsPatriciaStonebwyrq100% (91)

- Insurance Lecture 1-2015Document7 pagesInsurance Lecture 1-2015Julian KohNo ratings yet

- Workshop. Understanding How To Become A Smart ExplorerDocument6 pagesWorkshop. Understanding How To Become A Smart ExplorerPaola GarciaNo ratings yet

- Credit DerivativesDocument27 pagesCredit DerivativesMalkeet SinghNo ratings yet

- Bo Cau Hoi On Tap Tieng Anh Chuyen Nganh 2 FtuDocument6 pagesBo Cau Hoi On Tap Tieng Anh Chuyen Nganh 2 FtuLe NganNo ratings yet

- Professional Indemnity Insurance: Aims Learning OutcomesDocument12 pagesProfessional Indemnity Insurance: Aims Learning OutcomesPRASENJIT DHARNo ratings yet

- 2 Condition N WarrantyDocument109 pages2 Condition N WarrantyDivya ArunimaNo ratings yet

- Buy Term and Invest The Difference Revis PDFDocument12 pagesBuy Term and Invest The Difference Revis PDFKeyur ThakkarNo ratings yet

- Chap 3 4Document9 pagesChap 3 4Phan JoyceNo ratings yet

- Long-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaDocument10 pagesLong-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaghostbooNo ratings yet

- Surety Bonds in Plain EnglishDocument11 pagesSurety Bonds in Plain English: MacNo ratings yet

- Non Life InsuranceDocument15 pagesNon Life Insurancetausif_baigNo ratings yet

- T. Pentikainen HelsinkiDocument12 pagesT. Pentikainen Helsinkijapan177No ratings yet

- Anatomy of A Stock Purchase AgreementDocument26 pagesAnatomy of A Stock Purchase AgreementBilly LeeNo ratings yet

- Claims.Document3 pagesClaims.Dean RodriguezNo ratings yet

- Key Negotiating Points in Private Acquisition Agreements Comparison ChartDocument7 pagesKey Negotiating Points in Private Acquisition Agreements Comparison ChartLBANo ratings yet

- Circular Business ModelsDocument44 pagesCircular Business ModelsHiểu MinhNo ratings yet

- Trắc Nghiệm MKTQTDocument5 pagesTrắc Nghiệm MKTQTHiểu MinhNo ratings yet

- Bản Sao Mid-Course Internship ReportDocument25 pagesBản Sao Mid-Course Internship ReportHiểu MinhNo ratings yet

- Lecture 3 - Ethics and CSRDocument45 pagesLecture 3 - Ethics and CSRHiểu MinhNo ratings yet

- Entry ModeDocument7 pagesEntry ModeHiểu MinhNo ratings yet

- 10 & 11. Introduction To Law - Topic 2 - Part 2 - Civil Legal RelationsDocument31 pages10 & 11. Introduction To Law - Topic 2 - Part 2 - Civil Legal RelationsHiểu MinhNo ratings yet

- Lecture xstk6 31-05-2022Document9 pagesLecture xstk6 31-05-2022Hiểu MinhNo ratings yet

- The Thickness of The Steel Is About 1Document1 pageThe Thickness of The Steel Is About 1Hiểu MinhNo ratings yet

- Why Is It ImportantDocument2 pagesWhy Is It ImportantHiểu MinhNo ratings yet

- Law-5 5 22Document1 pageLaw-5 5 22Hiểu MinhNo ratings yet

- Chapter 5Document24 pagesChapter 5Hiểu MinhNo ratings yet

- Slide 2. Business Objectives and Theories of FirmsDocument30 pagesSlide 2. Business Objectives and Theories of FirmsHiểu MinhNo ratings yet