Professional Documents

Culture Documents

Receipt

Uploaded by

josepholuyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receipt

Uploaded by

josepholuyaCopyright:

Available Formats

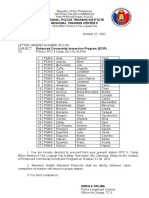

For General Tax Questions

e-Return Acknowledgment Contact KRA Call Centre

Tel: +254 (020) 4999 999

Receipt Cell: +254(0711)099 999

Email: callcentre@kra.go.ke

www.kra.go.ke

Personal Information and Return Filing Details

PIN A016375384E Return Period 01/01/2022 - 31/12/2022

Joseph Oluya Walwang'a

Name and Address

RELIANCE, BONDO, Bondo District, 40615, 81.

PIN of Wife Name of Wife

N.A N.A

(If Applicable) (If Applicable)

Tax Obligation(Form Income Tax Resident

Original or Amended Original

Name) Individual(IT1)

Station Kisumu Acknowledgement 15/02/2023 15:15:43

Return Number KRA202302180588 Barcode

Return Summary

Sr. No. Particulars Self Amount (Ksh) Wife Amount (Ksh)

1. Adjusted Taxable Income 0.00 0.00

2. Employment Income 568,560.00 0.00

3. Income from Estate(s)/Trust(s) / Settlement(s) 0.00 0.00

4. Gross Total Income 568,560.00 0.00

5. Deductions 12,328.00 0.00

6. Taxable Income 556,232.00 0.00

7. Tax Payable 104,269.60 0.00

8. Reliefs 28,800.00 0.00

9. Tax Credits 75,470.00 0.00

10. Tax Due / (Refund Due) 0.00 0.00

11. Tax Due / (Refund Due) (Combined) 0.00

Note : We acknowledge receiving your Return through KRA Web Portal . You can track your status by using search

code from web portal.

Search Code: 330536758757LCV

Notice: Employers are reminded that the due date for PAYE Returns and remittance is the ninth day of each calendar month.

You might also like

- Hillan Kipchumba Ronoh's KRA Tax Returns 2022Document1 pageHillan Kipchumba Ronoh's KRA Tax Returns 2022Alvin RoddyNo ratings yet

- ReceiptDocument1 pageReceiptkevin knoxNo ratings yet

- Receipt MUNYASYA ELIZABETHDocument1 pageReceipt MUNYASYA ELIZABETHAngellah MutisyaNo ratings yet

- Receipt 1Document1 pageReceipt 1geotech cyberNo ratings yet

- ReceiptDocument1 pageReceiptfrankline nyabutoNo ratings yet

- Receipt 7Document1 pageReceipt 7Agnes WanjaNo ratings yet

- ReceiptDocument1 pageReceiptjohn belhaNo ratings yet

- NICHOLASDocument1 pageNICHOLASvera atienoNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptKen NjorogeNo ratings yet

- KRA202301353274Document1 pageKRA202301353274Musyoka UrbanusNo ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- ReceiptDocument2 pagesReceiptIan KahuthiaNo ratings yet

- KRA202310990621Document1 pageKRA202310990621spandyno1No ratings yet

- NasadDocument1 pageNasadBhonhieNo ratings yet

- ReceiptDocument1 pageReceiptDennis MwangiNo ratings yet

- ReceiptDocument1 pageReceiptMr TuchelNo ratings yet

- Kenya Tax ReceiptDocument1 pageKenya Tax ReceiptVictor OsodoNo ratings yet

- ReceiptDocument1 pageReceiptIan KahuthiaNo ratings yet

- HalimaDocument1 pageHalimavera atienoNo ratings yet

- Income Tax Individual ResidentDocument1 pageIncome Tax Individual ResidentBengale Wa MangaleNo ratings yet

- Receipt 27Document1 pageReceipt 27MUSA WANGILANo ratings yet

- ReceiptDocument1 pageReceiptCynthia MarimbuNo ratings yet

- Receipt 9Document1 pageReceipt 9evansasanda4No ratings yet

- ReceipjhkjtDocument1 pageReceipjhkjtJoseph ChegeNo ratings yet

- ReceiptDocument1 pageReceiptEvaristus Lokuruka EkadeliNo ratings yet

- ReceiptDocument1 pageReceiptisaiahkipkosgei36No ratings yet

- TOROITICHDocument1 pageTOROITICHtoroitich Titus markNo ratings yet

- ReceiptDocument1 pageReceiptJully MwongeliNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsPeter JumreNo ratings yet

- ReceiptDocument1 pageReceiptNdavi KiangiNo ratings yet

- E Return Sammy WachiraDocument1 pageE Return Sammy WachiraShortageNo ratings yet

- Receipt 1Document2 pagesReceipt 1evansasanda4No ratings yet

- ReceiptDocument1 pageReceiptvera atienoNo ratings yet

- ReceiptDocument1 pageReceiptFull Gospel KanduyiNo ratings yet

- ReceiptDocument1 pageReceiptEugene MmarengeNo ratings yet

- Hajj Omar Gari Returns 2017Document1 pageHajj Omar Gari Returns 2017manarnoldiNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFAnne MainaNo ratings yet

- Receipt 4Document1 pageReceipt 4Titus Odenyo OthienoNo ratings yet

- KRA e-Return Acknowledgment for Tax FilingDocument1 pageKRA e-Return Acknowledgment for Tax FilingCarolyne OkwembaNo ratings yet

- Lenah KraDocument1 pageLenah KraKameneja LeeNo ratings yet

- receipt (14)Document1 pagereceipt (14)samwel ndunguNo ratings yet

- Kra ReturnsDocument1 pageKra Returnspenina Chepkemoi0% (1)

- Receipt 35Document1 pageReceipt 35MUSA WANGILANo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- KRA e-Return Acknowledgment for General Tax QuestionsDocument1 pageKRA e-Return Acknowledgment for General Tax QuestionsIan OmwambaNo ratings yet

- NaomiDocument1 pageNaomiADMINNo ratings yet

- ReceiptDocument1 pageReceiptGeorge LordsNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsAlfoz Muthyoi0% (1)

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsHebron OdhiamboNo ratings yet

- ReceiptDocument1 pageReceiptstevenkanyanjua1No ratings yet

- Receipt - 2023-12-28T121554.861Document1 pageReceipt - 2023-12-28T121554.861mainaNo ratings yet

- ReceiptDocument1 pageReceiptexperttech4259No ratings yet

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- Vitalis KraDocument1 pageVitalis Kravera atienoNo ratings yet

- Receipt (10)Document1 pageReceipt (10)SHADOW CYBERNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsOderoNo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- UN Police Policy GuideDocument16 pagesUN Police Policy GuideRafael SOaresNo ratings yet

- Iloilo City Regulation Ordinance 2013-064Document4 pagesIloilo City Regulation Ordinance 2013-064Iloilo City CouncilNo ratings yet

- EC 1012 - Lecture 4 - Discharge of ConrtractsDocument22 pagesEC 1012 - Lecture 4 - Discharge of ConrtractsYasmin GaripNo ratings yet

- Supreme Court Hearing on Dacoity CaseDocument18 pagesSupreme Court Hearing on Dacoity CaseMohd TabishNo ratings yet

- The United Nations Explained: Its Purpose, Power and ProblemsDocument3 pagesThe United Nations Explained: Its Purpose, Power and ProblemsResha Mae Gordon OrañaNo ratings yet

- UDHR RightsDocument77 pagesUDHR RightsMaria Fiona Duran MerquitaNo ratings yet

- Letter Order FormatDocument2 pagesLetter Order FormatLauder LouisetteNo ratings yet

- Garcia V Executive SecretaryDocument15 pagesGarcia V Executive SecretaryMeg VillaricaNo ratings yet

- IMO Conventions January 2023Document94 pagesIMO Conventions January 2023Kazem LoveNo ratings yet

- Government Gazette - 6th AprilDocument96 pagesGovernment Gazette - 6th AprilistructeNo ratings yet

- ESTEBAN Affidavit ProtestDocument3 pagesESTEBAN Affidavit ProtestmkabNo ratings yet

- Written Test Admit Card & COVID Safety GuidelinesDocument4 pagesWritten Test Admit Card & COVID Safety Guidelinesshubham vermaNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary EducationDocument8 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary EducationAhmed MahmoudNo ratings yet

- Scale Min FeesDocument23 pagesScale Min Feeslkeok0% (1)

- Accounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Document81 pagesAccounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Layla MainNo ratings yet

- ASSOCHAM BSDC Professional Support Memebrship - Application Form & AdvantagesDocument2 pagesASSOCHAM BSDC Professional Support Memebrship - Application Form & AdvantagesneerajNo ratings yet

- Non-Solicitation AgreementDocument4 pagesNon-Solicitation AgreementAlex Loredo GarciaNo ratings yet

- SENATE BILL 1101 Rank Reclassification of The BFP and BJMPDocument10 pagesSENATE BILL 1101 Rank Reclassification of The BFP and BJMPRoyce Christian EbitNo ratings yet

- SOP - NorthumbriaDocument2 pagesSOP - NorthumbriaMuhammad Bilal AshrafNo ratings yet

- 2014 - 12 - 10 GR 193108Document2 pages2014 - 12 - 10 GR 193108SabNo ratings yet

- Done Big Data Security - SyllabusDocument2 pagesDone Big Data Security - SyllabusArun SharmaNo ratings yet

- SLS, Pune - LL.M. 2022-23Document10 pagesSLS, Pune - LL.M. 2022-23Syed Misbahul IslamNo ratings yet

- Covid Grand Jury DispositionDocument4 pagesCovid Grand Jury DispositionDeanna GugelNo ratings yet

- 5.1-Principle of Lex Rei SitaeDocument119 pages5.1-Principle of Lex Rei SitaeHeartHeartNo ratings yet

- BM75 Itemwise AgendaDocument66 pagesBM75 Itemwise AgendaMUNPL HRNo ratings yet

- Report of The International Law Commission: United NationsDocument406 pagesReport of The International Law Commission: United NationsTurandot 510No ratings yet

- TVS Price List 01 07 2018Document32 pagesTVS Price List 01 07 2018Pradyumna MohapatraNo ratings yet

- ECC Amendment LetterDocument3 pagesECC Amendment LetterBipasan Kong83% (12)

- Name: Nemal Farhat Reg No:41690 Course: Bba-H Day/ Timing: Monday 6:30 To 9:30 Submitted To: DR - Kashif Mehmood Date: 28-April-2020Document2 pagesName: Nemal Farhat Reg No:41690 Course: Bba-H Day/ Timing: Monday 6:30 To 9:30 Submitted To: DR - Kashif Mehmood Date: 28-April-2020Rimsha ShiekhNo ratings yet

- Categories of EntrepreneursDocument2 pagesCategories of EntrepreneursDiether BaldanNo ratings yet