Professional Documents

Culture Documents

Receipt

Uploaded by

Ian Kahuthia0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

352435062-Receipt

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesReceipt

Uploaded by

Ian KahuthiaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

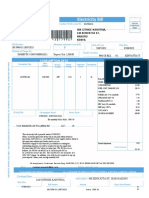

For General Tax Questions

e-Return Acknowledgment Contact KRA Call Centre

Tel: +254 (020) 4999 999

Receipt Cell: +254(0711)099 999

Email: callcentre@kra.go.ke

www.kra.go.ke

Personal Information and Return Filing Details

PIN A006891537Z Return Period 15/07/2022 - 15/07/2023

Name Ian Githige Kahuthia

Address

Kenyatta Avenue

Wamaingi Apartments Room 6B

Nakuru

20100

PIN of Wife Name of Wife

N.A N.A

(If Applicable) (If Applicable)

Tax Income Tax Resident

Obligation(Form Individual (IT1) Original or Amended Original

Name)

Station Nakuru Acknowledgement 15/07/2023 15:18:01

Return Number KRA201704649300

Barcode

Return Summary

Sr. No. Particulars Self Amount (Ksh) Wife Amount (Ksh)

1. Adjusted Taxable Income 0.00 0.00

2. Employment Income 266504.00 0.00

3. Income from Estate(s)/Trust(s) / 0.00 0.00

Settlement(s)

4. Gross Total Income 266504.00 0.00

5. Deductions 0.00 0.00

6. Taxable Income 266504.00 0.00

7. Tax Payable 61295.00 0.00

8. Reliefs 0.00 0.00

9. Tax Credits 0.00 0.00

10. Tax Due / (Refund Due) 0.00 0.00

11. Tax Due / (Refund Due) (Combined) 61295.00

Note : We acknowledge receiving your Return through KRA web Portal. This data has been forwarded to the

concerned area officer for further processing. You can track your status by using search code from web Portal.

Search Code: 558491952657LCV

Notice: Employers are reminded that the due date for PAYE Returns and remittance is the ninth day of each calendar month.

You might also like

- ReceiptDocument1 pageReceiptIan KahuthiaNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptKen NjorogeNo ratings yet

- ReceiptDocument1 pageReceiptfrankline nyabutoNo ratings yet

- Receipt 1Document2 pagesReceipt 1evansasanda4No ratings yet

- ReceiptDocument1 pageReceiptjosepholuyaNo ratings yet

- NICHOLASDocument1 pageNICHOLASvera atienoNo ratings yet

- NasadDocument1 pageNasadBhonhieNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNo ratings yet

- Income Tax Individual ResidentDocument1 pageIncome Tax Individual ResidentBengale Wa MangaleNo ratings yet

- ReceiptDocument1 pageReceiptkevin knoxNo ratings yet

- ReceiptDocument1 pageReceiptMr TuchelNo ratings yet

- ReceiptDocument1 pageReceiptjohn belhaNo ratings yet

- Hillan Kipchumba Ronoh's KRA Tax Returns 2022Document1 pageHillan Kipchumba Ronoh's KRA Tax Returns 2022Alvin RoddyNo ratings yet

- ReceiptDocument1 pageReceiptJully MwongeliNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFAnne MainaNo ratings yet

- KRA e-Return Acknowledgment for General Tax QuestionsDocument1 pageKRA e-Return Acknowledgment for General Tax QuestionsIan OmwambaNo ratings yet

- Receipt 1Document1 pageReceipt 1geotech cyberNo ratings yet

- ReceiptDocument1 pageReceiptCynthia MarimbuNo ratings yet

- E Return Sammy WachiraDocument1 pageE Return Sammy WachiraShortageNo ratings yet

- ReceipjhkjtDocument1 pageReceipjhkjtJoseph ChegeNo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- receipt (14)Document1 pagereceipt (14)samwel ndunguNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsPeter JumreNo ratings yet

- Receipt 4Document1 pageReceipt 4Titus Odenyo OthienoNo ratings yet

- ReceiptDocument1 pageReceiptEugene MmarengeNo ratings yet

- Receipt MUNYASYA ELIZABETHDocument1 pageReceipt MUNYASYA ELIZABETHAngellah MutisyaNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsHebron OdhiamboNo ratings yet

- KRA202301353274Document1 pageKRA202301353274Musyoka UrbanusNo ratings yet

- Kenya Tax ReceiptDocument1 pageKenya Tax ReceiptVictor OsodoNo ratings yet

- ReceiptDocument1 pageReceiptEvaristus Lokuruka EkadeliNo ratings yet

- ReceiptDocument1 pageReceiptCOLLINS KIPROPNo ratings yet

- ReceiptDocument1 pageReceiptNdavi KiangiNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailssimon kinuthiaNo ratings yet

- HalimaDocument1 pageHalimavera atienoNo ratings yet

- ReceiptDocument1 pageReceiptvera atienoNo ratings yet

- ReceiptDocument1 pageReceiptisaiahkipkosgei36No ratings yet

- Hajj Omar Gari Returns 2017Document1 pageHajj Omar Gari Returns 2017manarnoldiNo ratings yet

- TOROITICHDocument1 pageTOROITICHtoroitich Titus markNo ratings yet

- ReceiptDocument1 pageReceiptFull Gospel KanduyiNo ratings yet

- Receipt 7Document1 pageReceipt 7Agnes WanjaNo ratings yet

- Receipt 2Document1 pageReceipt 2camilliancomputersNo ratings yet

- ReceiptDocument1 pageReceiptDennis MwangiNo ratings yet

- Lenah KraDocument1 pageLenah KraKameneja LeeNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsOderoNo ratings yet

- Receipt 9Document1 pageReceipt 9evansasanda4No ratings yet

- KRA e-Return Acknowledgment for Tax Year 2021Document1 pageKRA e-Return Acknowledgment for Tax Year 2021Stephen kioko.mNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsCharles WaombaNo ratings yet

- ReceiptDocument1 pageReceiptexperttech4259No ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- ReceiptDocument1 pageReceiptstevenkanyanjua1No ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- Vitalis KraDocument1 pageVitalis Kravera atienoNo ratings yet

- KRA e-Return Acknowledgment for Tax FilingDocument1 pageKRA e-Return Acknowledgment for Tax FilingCarolyne OkwembaNo ratings yet

- ReceiptDocument1 pageReceiptGeorge LordsNo ratings yet

- NaomiDocument1 pageNaomiADMINNo ratings yet

- Kra ReturnsDocument1 pageKra Returnspenina Chepkemoi0% (1)

- Receipt 27Document1 pageReceipt 27MUSA WANGILANo ratings yet

- Receipt - 2023-12-28T121554.861Document1 pageReceipt - 2023-12-28T121554.861mainaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ReceiptDocument1 pageReceiptBRANDONNo ratings yet

- Dedan Kimathi University of TechnologyDocument14 pagesDedan Kimathi University of TechnologyIan Kahuthia100% (1)

- Assignment 1Document1 pageAssignment 1Ian KahuthiaNo ratings yet

- Postal AdressDocument1 pagePostal AdressIan KahuthiaNo ratings yet

- Train LawDocument2 pagesTrain LawMicah AtienzaNo ratings yet

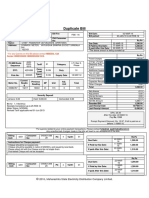

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CalldineshsirasatNo ratings yet

- Tax Incentives for Pioneer Status ExplainedDocument22 pagesTax Incentives for Pioneer Status ExplainedchukanchukanchukanNo ratings yet

- PT PRIMA ELEKTRONIK Sales RecordsDocument12 pagesPT PRIMA ELEKTRONIK Sales RecordsNi'matul Mukarromah100% (1)

- Istilah Akuntansi DLM Bhs. InggrisDocument6 pagesIstilah Akuntansi DLM Bhs. InggrisBugawatiNo ratings yet

- Reduce: Bharti Infratel Bhin inDocument11 pagesReduce: Bharti Infratel Bhin inashok yadavNo ratings yet

- Solved Indigo Inc A Personal Service Corporation Has The Following TypesDocument1 pageSolved Indigo Inc A Personal Service Corporation Has The Following TypesAnbu jaromiaNo ratings yet

- June Pay StubDocument1 pageJune Pay Stub76xzv4kk5vNo ratings yet

- Notice of DiscrepancyDocument4 pagesNotice of DiscrepancyMartin PagtanacNo ratings yet

- Annexure III&IIIA-Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- BLO2206 S2 2020 Sample Letter of AdviceDocument11 pagesBLO2206 S2 2020 Sample Letter of AdviceRuby LeeNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- Unit 3 Assignment: A Simple BudgetDocument5 pagesUnit 3 Assignment: A Simple BudgetNguyên KhánhNo ratings yet

- GNP CH 3 MCQ 1-10 From Text BookDocument4 pagesGNP CH 3 MCQ 1-10 From Text Booksamuel debebeNo ratings yet

- Sanchay Par Advantage - Deferred IncomeDocument3 pagesSanchay Par Advantage - Deferred Incomesushant KumarNo ratings yet

- Income Tax Schemes, Accounting Periods, Accounting Methods, and ReportingDocument6 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods, and ReportingAilene MendozaNo ratings yet

- CIR vs PAGCOR Ruling on Taxability of Employee Fringe BenefitsDocument2 pagesCIR vs PAGCOR Ruling on Taxability of Employee Fringe BenefitsendpointNo ratings yet

- Cpa Review School of The Philippines ManilaDocument11 pagesCpa Review School of The Philippines ManilaSophia PerezNo ratings yet

- GST Session 43Document20 pagesGST Session 43manjulaNo ratings yet

- A150397344964c909acb5a56 - Personal - 10018644 - SalarySlip - July 2023Document1 pageA150397344964c909acb5a56 - Personal - 10018644 - SalarySlip - July 2023Nitin KhodifadNo ratings yet

- Assignment 2 - Operating Segment 10 Items TestDocument4 pagesAssignment 2 - Operating Segment 10 Items TestJeane Mae BooNo ratings yet

- Double Taxation Relief Under IT ActDocument4 pagesDouble Taxation Relief Under IT ActRuhul AminNo ratings yet

- ACCOUNTING TUTORIALS (Income Statement)Document1 pageACCOUNTING TUTORIALS (Income Statement)Rizza Christine Thereza UsbalNo ratings yet

- ErrorsDocument31 pagesErrorsmoNo ratings yet

- Computerised Accounting and e Filing of Tax ReturnsDocument8 pagesComputerised Accounting and e Filing of Tax ReturnsBishal BhandariNo ratings yet

- Proforma Appointment of ValuerDocument2 pagesProforma Appointment of ValuerKrishnaa LaxmiNarasimhaa AnanthNo ratings yet

- Payslip 2022 2023 8 10025116 AISATSDocument1 pagePayslip 2022 2023 8 10025116 AISATSAshok Yadav100% (1)

- PDF - 28-09-23 07-02-29Document18 pagesPDF - 28-09-23 07-02-29jalodarahardik786No ratings yet

- High Potential Wound Care ProductsDocument27 pagesHigh Potential Wound Care ProductsIsabel HigginsNo ratings yet

- CPA journal entries assignmentDocument2 pagesCPA journal entries assignmentMara Shaira Siega100% (1)