Professional Documents

Culture Documents

3CB Min

3CB Min

Uploaded by

Ruloans Vaishali0 ratings0% found this document useful (0 votes)

7 views17 pagesOriginal Title

3CB-min

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views17 pages3CB Min

3CB Min

Uploaded by

Ruloans VaishaliCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 17

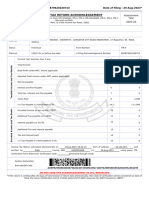

| yeMI JAIN & ASSOCIATES

KAGLA BHAWAN,NAVEEN MANDIMALPURA,

count DIST. TONK RAJASTHAN 304502,

| ghartered Accountant O Ph. 414340060

. -mall: CANEMIUAIN@GMAIL COM

. FORM NO. 3CB

om

Place :MALPURA, DIST. TONK

Bete: 26r0evz023,

[See rule 6G(1)(6))

Aus oper under section 4648 ofthe inome-Tax ee) inthe guee of person roforred to in

lause (b) of sub-rule (1) of rule 6G

, [have examined the Balance Sheet ac en 91-MARL 204: ih Acceu pera

"APR Ez endrgon a a yt 8 PO Ls sur par basin fon

DKTRADERS (Pronvietor: “MavaTa Guptm)

‘Show At Plot NO. 174/115 RHEE PRATAP NAGAR, SANGANER.JAIR ur

Sep x Pao, 14 \GAR, SANGANER JAIPUR JAIPUR Joi

Heres aphoe arent Sheot ond tne Profit and Loss Account are in agreement With the boots of account maintained at

the head offs at Shop At Piot No, 174/198 PRATAP NAGAR FRHB,SANGANER IAPUR.IAPUR, Jaipur and Nil Branches:

3 (a) Topo he folowing observstonsicomméntstzcrepenceataconsstencie; it any

Subject © Notes on Accounts,

(@) Subject to above -

A A ceceotleings al the Information ond expanaiins which, to tie bee of my knowledye-and beset, were

eceesary forthe purpose ofthe audi.

tere eemeat Proper books af account have been kept by theincod office eo lr as appears tem my examination

of the books

(6) fos apron arte the best of my iformaron ard eccorcng to ine explanations given tome, the said count,

read with notes thereon, f any give a tue and fai view

(1 the case ofthe Balance Sheet. ofthe siste oho atfis of the assesses at a 31-MAR-2023; and

(i) In the case of the Profi_and Loss Account of the prof athe aseessee forthe year ended on that date

4. "The statement of particulars retired to be furnished under secfan &4ABiis snnoxed herewith i Form No. 30D.

5 fey coi and othe best of my inermation and according te explanations glen ina, the patculars given in the sae

Fon No 360 ere tre and eottect subjée| a folowing cbs envatons/gvalicaiona, any.

SH + __Quaification Type. ‘Chocrvations/Guailfications

1” [Greditors under Micro, Sma and Medium Entarprces |The ifemmatin regarding applcablly of EMELINE 0G

Development Act, 2006 are not astern the warious supe iersinari isnot available wit the acoaese,

hence information a5 requited vide Clause 22 of Chapter W of

. SHED Act. 2008 isnot been glen, |

2 Recarde produced for ve ification of payments The aasessee has not matte any payineris exceeding he Tan

rough account payee cheque were not suficlont | in eecton 404(3|20898 208" n Caan However h ioare

[possible for us to verify whether tne payments in excess tha

specified lint in section 404(3) 26958/298T have been mace

jthewise than by acccunt nayee checue or account payse

‘bank deaf, as the necessary evidence are not in poss2esian of

‘he sssessee

111s hot possible o determine braai-op of otal expendiure of

iitos ropisteved or not registered under the GST, as

ecastary infermation is not maintained by the assessee in its

books of accounts

For NEMI JAIN & ASSOCIATES.

Chartered Accountant

(Firm-Regn No.: 0023374C)

Nel

*] MENT CHAN JAIN)

Propriotor

Membership No: 493271

UDIN: 2340327 1BGRDSIS04s :

FORM NO. 3CD

[See rute 6G(2)]

Statement of particulars required to be furnished undor

section 44AB of the Income-tax Act, 1961

Parta

Oi [Namie ofthe accessea yK TRADERS (Proprietor: MAMI 7

[02 [Adéress = Shop At Plot No. 174/118, RHS,PRATAP

Pee ee NAGAR SANGANERJAIPURJAIPUR,Jaipur |

[08 [Pecnanent Accounl Namber PANT AINPGO2O6F -

| OF |Whethes the assesses ie tabi la pay areal Ia Ike exchoe duly Vee

| [Semvion Wx. sales tax, goods and sence tax.customs duly ec.

yews Please Tumis the recictraton number ar GST number 0 ary

|__{otheridentfeation number aloted forthe same Sp

= Name of Aet ‘Sia “Cir iagaaton Ra | Basen ttl)

[Gods and service ax |RAIASTRAN AMP RIDGE

(Sets — a

| 98 [Previcus year trom 1-APR-2022 te 31-MAR-2023

(OF [Assessment year raoaeze

iz fSrsodad aN over Teton GAEUGeT WE ie aw Ts Es] lat Se TGR AB Hc WN AS

ine ARB To! wsls/turiove grees roles

business exceeding specified its

No

(O8s/ Whether the assestee Tes opted tor vavaton Un

A UI se ene

= PartB.

SI] frm “Gr essodiaton of persons, indicate nares ol] Wane relt sharing rita

Dortnersimamters and the proft sharing aos. £4)

Wi

3] there is any Ganga im Bie partners or members oF Te|No

2 | profi shering rato since the last date of the preceding year, the

| | (periulars of such change

Name of Oats efehango) Type of change | Ota pro | Naw BEAT Reman]

PartinerMeniber shering | Sharing

‘abo | “Rato™ |

l

+ [10 [3)|Nature of business or profession Gf more than one Business or

| [profession t= earned on during the previous yapt, nature of

12st business or poisson)

“Soca Sub Seetar Cade

[WHOLESALE AND RETAIL TRADE Wotesale of ather products mae [06027

WHOLESALE AND RETAIL TRADE - Retail sale of other products nec [00038

| [By] there ie any change i the nature af Buuiness 6 pjteosion [No

he patculars of such change _

| Business | ‘Sector Sw Sector Cate Remarks any:

T

11 [@) | Whether books of account are preceribed under section 44AA,|No

lityes, fat of books so prescioed. _

Bj Ust of books of occount maintained and the address. at which|Shop at Plot No. GASH BOOK BANC

‘fe books of accounts are kept. (in case books cf account ere| 74149, RAB, BOOK, JOURNAL,

‘maintained in a computer system, mention the books of account| PRATAP NAGAR, _ |LEDGER (Computerized)

[pansrated by such Gomsputer system if the books of sccounts |SANGANER, JAISUR,

sve nol kept at one incaton, please furs the adtressex @PRIRNUR,

locations along wih tw details of Books of eccouris mai

st each locaton, ) ‘ Na

Ust of books of socount and nalure of relevant a i ‘BANK BOOK, JOURNAL, LEDGER

exarined

& ———————

12 [Whether the pref and lass eccount ineludes any profile and gains] Nav

astescable on predumplive basis yes, indicate the amount and

the relevant! gection (44D, 44ADA, a4AE, 44AF, 440, 4400,

44984, 44888 Chapter XII-G, Fist Schedule or any other rolovant

a

g

||immedistety preceding pravious year

section a Al

ection ‘Amount | Remarks any.

I

Method of accounting amplayed ih the previous year [Mercantile ayatem

[Winether there had boon any change In the motiod of|No

Accounting employed vis-a-vis the method employed in the,

answer to (b) above is in the affirmative, ge delale of such)

| change, and the effect theresf on the profi. or loss.

“= Pariculars increase in profi (3)

Decrease in proft(Rs.)

er |

__, afd disclosure standards nesified under section 145

Whether any adjustment is required a be made fo the profits or Ne

Hess for complying with the provisions of fneame computation

riswer lo (2) above isin the afirmative, give details of such

| sqwustrienis :

Particulars

Thaeace inprofi] Decrease in

Net efectiAs.)

Remarks Fanys

WR)

proits.)

Disciodure as per IOS

Tei

Decbawe

TCDS T-Kecouniing Poncies

[As par nczouniing policies & notes to Rnanclal statemerits

TODS 1- Valuation ofimentories

TES lil- Construction Contracts wa

[Rs per accounting policive & holes to Rnanclal statements

TCDS 1V= Ravens Recognition

[ISOS W-Tangibte Fined Assets}

’As par accounting poles © notes fo financial wtarmonts

5 par Fixed Assets and Oepraclation Chart annexed in FOR

TES Vi Governments Grane NA

[TCDS IR- Borrowing Costs

[Aa Be abscinting polices Blas ta nancll siaiementa me

Provision, Centingenl Linbillies and Assets have ban disclosed By way of noms

ICDS X- Provisions. Contingort Labiiten

ana Contingent Ass is Total [in the notes on aceourss, If required,

FEDS Vi-Ciianges in Foreign EAGhange

Bates |

[eS Wil: Securities a

ala

year.

Method of valsation of eleting stock ersoloyed in the previous] Finished Goods > Cost or NRV Whichewer Is

ower

oy

|i case of deviation from the mlethod of valuation presctbed|No

lund’ section 745A, are the effect thereof en the prfit oF Inss,

turnsh:

Particulars: __ [increase in profit (Rej] Decrease in profitta) Remarks Wary:

15 /Give the teliowing particulars of the capital asset converted inlo[NA.

slockin-trade

Description of Baie at Costet | Armount at Remarks Hany:

‘Capial Asscts | Acquisition | Acquistion | which

capital

eects

- . converted

= | into steck -

16 [Amounts not credited tothe proftand loss aezourt Baing, ~

1¢ Hers failing within the scope of section 28; cy

Description Brun Romerke Wary:

by

Iie proforma credit, drawbacks, refunds of duly of eusianis or| fil

lexcine or service tax or unde of sales tax or value sted tax

lor Goods & Service Taxwihere such credits » drawn

‘eds are admitted as due by the authorities ox

Description Remar rany

6} [sscalaton caine: scoepied during the prewo:

Deseripion Remark Tay

Pr

i

‘

“minsunt Remarks Wang

ir

‘amount

Where “any land or buiking or boih w tansiemed dunng the|No

previous year fer a consideration loss. than vale adopted of

lassessed oF assessable by ary authority of a Stale Goverment

referred to in section 43CA or OC, furnish

Betais |Conside) Value [Remark | Country | Address [Address [Pincade] Clty or [Local]! Past ] Slaie | Apply

of | ‘ration | adopted | 9 it any: Line 1} Line 2 ‘Town or| yor | Office nd

property| receive | or District | Ama provi:

dor _|assessa ool

avowed] dor CAL

assessa ‘jar

bie _ ath

« provi

oto

8120

1G [Portcularé of doprecistion allowable as per tne Incometax Act,

1951 in respect ef each asset or block of assets, as tho case may)

be nthe following farm = +

'8) [Describon of assettiock of assets INA

[BD [Rate offdepreciation.

@

(Acival ost or witien Gown value, as the cave may ba

ay

11SBACN158AD

[Adjusiment made to tie writen down value under section

assessment year 2021-2022 ont

‘Adjustment made to wmitan dawn value cf intangible osseh

jeby

ey

@

|sny addition of am assot, date put to use;

fon account oF =

dueto value of ‘ofa business or 0

[Adjusted writen down value

NA

(Aaiciionsideductons duiing the yearwith dates; in the eace af]

inchuding adjustment

7

he Central Excise Rules, 1944, in respect

| lacquired on of after 13t March, 1894,

(Central Value Added Tax credit claimed and atiowad under|

of assets,

ip [change rate of exchange of curency, and

Dy

‘Subsidy OF grant oF reimbursement, by Whatever aie

caled,

2} [Depression allowabie,

7 [Willan down value al the end ofthe year.

Amouils e@iissible under secions

‘Seclion

@

per te

[Amount debited to PEL] Amount admissible

|

of

the Income-tax Act,

1954

provisions

20 |a) [Any eum paid te an employee as Gonus or comm

[hit a profits or dividend, [Section 38(1)i))

sovvices rendered, where such sum. was otherwise payable to

jgsian for] aT

Besctiofion

‘Amount

tunes ee referred to in section 36(}(va):

[Details of coninbutions received rom employees for varus)

‘Name of Fund

@)]Plesse Taman the detsis of amounts debied to phe

|adverticamert expenainsre ete

T [expenditure of capital nature,

Pariiculars

T Remarks f any:

Th I

— Of personal nature, [Ni >

Pariculars ‘Amountin Rs, Remar i way

3 [expenditure on advertisement in any souvent, broc

|pariet crn ike, published by a poical pa

FL > Particulars

aie W any

4 /Expenditure inoured at chs being enkance fees andl]

subscriptions

Farieulars “Arount n Re Tersaris Tany:

5 | Expenditure incurred al clubs being cow for Gub eenvioee and] Ni

facies user.

Parhiculare ‘Ameuntn Re, Remarks fany: 4

& [Expedite by way of penally or fe Tor wolation of any Ta] Nl

Hor the time boing free

Parisians TRanauni Re Raman Wang:

= | 7 |Exindiuce by way of any omer penal ar tne nal covered fil

faa Serr]

Particulars ‘Amount mR Ramarks any

| [0 [Expenditure "Wicurred for any porpose which is an offence ce] Nal

which is prohibited by law

\-E ern a Fama Wang

) [Amounts inadmissible under section a0Va}~

T | Bayer fo ronvesident reterede Raub CaS

|*[Ostas of rayment on whi ix snot deducted a

Dale /Ariou iitur | Name [PAN of] Aacha | Courit [Addres | Adarezs | Pinco | Gly [Locall] Fost [Stale] Remar

of | ater oftha | the |'arno| “y /etina|Lne2 | de | or

paym | paym | paym | peyes | payee 1 Tow | Area | ©

rent |ent | vom nor

[ I =

L |& etala of payment on which lax has been deducted bul has] NI

Not bein paid during the previous year or in the-subsequant] _

Yes te te ray tie anc uae aon

| Date of Amo | Natu] Nam] PAN |Aadha] Coun | Adore | Addre | Pine [iy or]Local] Fost [Siale| Amo [Remark

peyment |'unt |rwat| ear | of |'arno | iy | ae”) se" | ogo | Teun [erat] omen

ct | pay | the | the tine 4) ine 2 or | aca

peym| ment | paye | paye Diane

mate (Te

I LC

T [a pant ie alana GL Seay

[8] Datals ol paymeel on which tx i not daaucied ra

Bate of | Amou | Nature | Name | PAN [Aadha [Couni] Addr] Adaress | Pinca Clty

peynort| tet | at | elte [atte [res | oy | eae] Gree | oe

res wate |e e to

ae ie , ee

a

: - a

. ‘5 Deiaits of payment Of which tax has been deduc wut hes

ot been pat ono bee wat dae peeps eg -

section (1) of section 129. os

SF

fees]

& Date of Amo [Natur] Name | PAN |Aadh [Count] Add | Adar] Pine] Cy |Localil| Post | Stare ‘osha

payme| unt | eat | ofthe | of | aar | ry |ress] ess] ode] or | yor | Offic

st | of pay) payee | tne | no Line} Line Tow | Area

pay | ent Paye CMe n

meat e oe

W [as payment referred io i sub-clause (0)

A] Details ef payment an which levy is nal deducted: i

Date of [Amo | Naiur] Nam | PAN |Aaume [Coun |Addre | Addre | Pinc [City or

payment | unt |reot}eot| of | arno| ty | ss | ss | ode | Town

‘ of_| pay | the | tne Line + Line 2 or

é paymi| ment | paye| paye Distrie

‘ent ele 1

|

B|Detais of payment on which levy has been deducted bul] Nil

has not been aid on or belare the due date specified in|

sub section (1) of section 138.

; [Date of Amo | Natur| Name | PAN |Aadh |Count|Add] Addr] Pine] Cy | Local

payme| uni | eof | ofthe | of | sar | ry ress} ess | ode) or | yor

at | of |paym) payee | the | no {Line Line Tow | Area

i pay | ent Paye 1] 2 nor

k ment e | Dist

a

[Fringe Benefit tax under sub-clause fie)

[Wealt tax under eub-alause (aay

FRoyally, license fee, service fee ete, under sub cause (a0)

Selory payable ouiside Indiaiio a non resident without TDS el. il

under sub-clause

ste of | Armou| Name | FAN eT |Aacha| oh

|| | Pavment| nt of | ofthe | the | arno | y | Line

say | payee | payer

ett

I

Via [Payment ta PF other fund ele. under sub-dause fw)

i [Tax paid by orployer for perquisites under sub-Giause Ww)

Ariauris debited Yo peofl ard loss account being, inirest salary, |NA

eons, cemimission 0: remuneration inadmissible under schon

|0(eyda(ba) and computation erect,

Pariculsts | Section es Cabied] Description “Amount Amount Remacks

$0 PAL A admissible | inadmissible

pera

Zl

Saln/svceeatod mor uncer ection CATS

7 JOn the basi of the examination of books of account and othe Yee

relevant documentvevidence, wheter the expenditure

covered under eaction 4GA(3) read with née GDO wers rade

by account payee chaque draw. on m ban or aoeaurt payee

[nk drat. not, please funish the dots

Date of | Nature of payenent’ | Amount] Name ofthe | PAN atthe | Asahaar Hemante Fany:

payment ayes payee | no

eee el

Sh coma meres

lone serene

sce eabamac see at ona

paren maaan

Flemarks any

pes") ERs

B

Pe

Ti

a

yg

ile

2

Ul

any air pad By fre Baas we =

eens ‘employer nel aawabie under =

[partculars of avy liabilily of @ coningent nature Ni -

[Nate et Gibiily | “arent Remais fany

|

‘amount of eduction inadmissible in terms of aeclion 14A invespect [Nil

ot te" axponturaInerted in relation to come which der

__ form pan ofthe total incarre,

Particulars ‘Ammaunt Remarks itary: =|

aroun acrisbleueder te panna W SSCRON GAT a —_

ri oe advan ca cos 2a Te He

8 Devel a

a ef payments made to persons spedited unger sechon [Nit

Relation Date] Payment Nature of | PAN of Relaied | Aadhaarna

made (amount) transection Party

jArvourte deemed jo be rohit and galas ui

ESSE gains under section S2AC or 32RD] Nil -

[Section Desciistion ‘Amount Remarks any:

E

"Any emount” of profit chargeable To tx under secon 41 and] NT

[eomputation thereot,

Neme of Pany Thoin a Sedion cipson of | Campulation # any | Remarks any

e Income: ‘rarsaction

Tin respect of any sum reterted tain clause fe) {E) ate) fe) Vor G@) al section 420, the [ably far whiche=

‘A |preented on the Tet day of te previous year but was not

e jatowed in the assessment of any preceding previous year and -

wae

|| | Siang te previo pears wil

WUE of Lakigy Fanaa Remarks any: Section

7B) [not paid during the previous year

Nit

‘Nature of Liability Amount ‘Remarks i any: Section

ttt

B |was incurred i the previous year andwes

'a) [Paid on oF before the due cate for fumiching the return of] NP

income of the previous er section 1361):

‘Amount Romarke any ‘Seefion

[bj [not pald on er before the sforesaid date, it

Wature of Labilty Amount Romarkeitany Secon

‘Siate whither sales tax.goods & service Tay, customs duly, excsie] No

jauly or any other incivect tax.levy,cess.impost etcis passed

[thresh the prefs and lows seesunt

Fa} Jrount of Central Value Added Tar credte availed of er ullised| No

during the previous year and its treatment in the profit and loss

account and treatnent of outstanding Central Value Added Tax

credits inthe accounts, .

Pariculars of income oF expendiure of prior period qieated or NA

detited to the prof-and toss accaunt,

“Typ Portouars ‘Anaant Priorpeiod to which | Remariee #any-

- relatea(Yoarin yyry-ny

feat

her cg the tredous year Ta sasesage Ral coe

ropedy, being share of a company nat being a cofmeary ia

bic “are substantisly interested, without consider

Hane @ Oe ae Aedhaarne]” Name ofthe | CiNafthe [ No. of Fair Market | Remars

person on company whose | company | Shares | considerali| value of the) if any

which shares shares are Received | onpad | shares

roveived, reeaived

Fiwnether Gung «Ihe previous year the assessee received any[NA

eansoeraton fo insur of shares which eaceeds the fa mavkel value

[ofte shares os referred to in section S6(Z) (vib, yes, please furnish

[tv details of the same. I He: vie

‘Name ofthe person from | PAN of the person [Aadhearno] No.of | Amount of] Fai Market Remarks Wen,

whom consideration Shares | considerat| value of he

received for issue of shares Issued | ion shares

swcaived

T 1 I

[Whiter any amount t to be inchdow ay Ineame Chageabe]WA

under the head income from oor sources es roforod fa in claue

[oof tub section 2 of seciion 56 j

‘Nature of Income ‘Amount Remarke if any:

‘iether any aripant tobe induded at income chargonble wer] WA

‘ine head income from other soureas es rafecred fo in clause (x) cf

sub section 2 of section 56 | ;

Nature of income ‘nun Renarks W any,

||Detais of any smount borrowed on Rundi Gr any smeuri dus thereon [No

[icing terest on the arent rowed) repaid, fendoe then

Itowgh an account payee cheque. [Section 630)

| [Name [Amou]Rtena] PAN [Aadha] Cou] Adcr [Adare | Pine [City | Local] Post | Stat [Date]Amo[Amoy Date of

CJotthe [ont [ris it| ofthe | arno | nity} ess | ss | ode | or | yor Jome| © | of | unt | unl | Repayment

perse | sorta) any: | perso tine | tine 2 ‘Tow| Area | © Bore | due |repa

from | wed a 1 not Jowin| inc |i

‘whem Dest] 9 | ding

amou ict inter

a est

|} beers

wed or

Mepaid + -

ba

und

3] [eet pemnary adjeiments To rareter pce, a8 retard ton 08] WA

4 section (1) of wooten G2CE, as boon made dung the proviout

a 2

Clause under whlchat | Amouflin Rs | Whether the excess | Whether the | Amauni(fs) of

[Sub secion(t} of 32CE| of primary | money evalsble wih | Excess | imputed

rimary adjusimentsis | agjustment | associated enterpne | money has | interest income

‘made Te requediobe | been |on suchexcess

repotaied to Inaia | ropatiated | money wich

sper the provision of | ulthin the | has not been

f subsechon (Zot | prescribed | repatiated

" ‘Section 92CE ‘ime win the

preseribes time

iD] E [Water the scsonseo_ fos wncurred eopandiine airhg” he] Wr

Bresious yea! by way of interes or of simi nature exceeding one

1, lerore rupees as vafered tein eu aaction (}of aaetion BAL

‘aroxrt(ny | “Eamings [Amount (ns)| Ass Yenrof | Amsuntaf | Ase Veer al | Amaunlcf | Remarks W any

Re) of niorest] peters | ofexpenditure | intrest ‘nterost interest | | interest

orsinilar | inisrest, |” bywayot | sxpensitire | expenditure | expendiure | expenditure

nature | tax,doprocati) interest of | brought | broughl forward | ceried | caried

incurred ‘ofand | simiar nature forward forward

‘smortzation |e per() above cared | carried

. EBITDA) »|wtich wanoede forward ae | forward es

during the |" 30% ot persud | por sub

previous year] EBITDA as per section 4) of section (4) of|

en R is) above seston 34.8 | section 948 |

C]Wiher the ascesees Tat eitered Wo an

avoidance anengerest, as releired lo in section £5 Wwulhg

previous yes (This Clause ia Kept in sbeyance Vb

areh;2022)

‘Nature of the impemmisalbte avasance

ae “Amauri tin Res} Remarks i ary:

arrangement | Denefit in the previous year

‘ising. aggregate 10a

= ____| Seis omrasnest

jiadars Of ath loan oF di it

Par Of deposit in an amieunl exceeding We Tal

specified in Section 26088 tayen cr in |

pee accepted curing the preview

Nan ois [Aldiaza cline ieni Rackaar ro ~ |

era | sorte can ae] WhataT |—Waciarn [oar iaiean | waa Re aro

ee Seas apesittaken ar | the imaunt | or deposit as | deposit was taken ex

scene | nartepo| esemany [sone socopad]| access ty aneet

et’ |Rreescta | tyacee” | emote

tures |"“onyane | cukarserme | shtherts tne

sedurmy |_duthgtm. | vefebecvon | “wan tnaner

fhe — | Previous Year| cieanngsysiem | accepted by an

fren Petco | pare

Year eccount cheque or an 1

* social goes ant

fat

jane aAreR #00000) No "200000 [Cheque [Account payee

ion psa — ‘ian

tec me a a i

es

sees | ae) We a TES

Borteuiars of e¥ch speciied sum im an Brno cacaaaiag he A [AT

| cgcied in eaten 2505S taken wr cnawpied aan Tees

{eat

INarw oie paeoa]|AGHEE Sie Nama ve” PAW ata Nome Toa | Whar he irene re

-_fambam | person tom wna seated | gars ieres 3 specifed sum | ‘spaces

setied sama ‘dum is revolved ‘wham specified sumtakea | waslaken ar | sumwes

oreccepted | seceptedby | taken or

‘ebeque ar bark | accepied ny

‘rat oruse et | cheque or

electronic | bank drat,

losing system | wheter the

though a bank | sane was

‘ecaunl | ‘takes of

ccopied by

‘enaccount

. ayte

cheque oF

an account

Payee bank

| — at

5 a] |Pariculars of each receipt iv an amount exceeding the il] Nil

specified In secten 29ST. in aggregate from a person in a

day oF in respect of a single transaction ar in respect of

lransactions relating to ons event ar cccasion from 2 =

person , during the previous year, where such receipt is

therwise than by @ cheque er’ bank draft or use of

clectronic clearing system through a bank aecount.

‘Nar af the payer “Actress ofthe payer Pan attie pave | Aadhaar | Nature oF | Amount | Daleat |

seein aac eset

1b) [Particulars of each receipt in an amaunt exeseding the km] Ni

specified in secton 26957, in aggregate trom a person in a

day of in respect of single Fansaction or in respect of

transaction relsting to one event of occasion from a j

person, received by cheque or bank dtatt, not being an

/BeCOUN payee cheque or an account payee bank deaf,

sacelat

ee] ame adioa ne ‘Amwant at

Particulars ef each payment mada in an amount exceediag [RM

‘te mit specified in section 259ST, In aggregate to 2

person in a day oF in respect of a single tansaction or in

Fespect relating 10 one event oF gccasion 10 @ pet

otherwise than by a cheque or bank draft or

electronic clearing system through a bank accouht

| __|the previous year if

Wame ofthe Payes raaress aaa

e

Ne

Naiuia of | Amami] Ovleat

‘ransaction |" of | payment

payment

Particulars of each pay

[lint speeifed in section

[relating to one event or

209ST, in aggregate to = person in

|2 gar oF In respect of single transaction or in respect

eceapion to 9 person. made by a|

wmeni i ah amount exceedhg the] Nil

a

|eheque or bank draft. not beng the on "

posourt payee

|chague’ of an account payee aoe draft. during the)

[favor yume

Name ofthe Paya | —Aeas altha Payee adnan wa or

| sient

Rareadars of each repaymeni of ano dupe oF any

sbeciiag advance in an amount exceeding the lim spectied it

secion269T made curing ti presen

Meee | ABiiess ctte payee | Asdhaarns [Aoife | — mana | Waaaar ne] —Raaae oe

‘sored | ‘arourt’ [igpeyment wea] topsenen aa

sustanaingn|"""mmoe by | ace Gy che x

the acount |ebequocr ban banker iene

any tne unag |e use | ihe sae wae

ie Predour | eecranie | teoaidby an

Year caarng._| socom gayes

steer tnoah| ‘chegue ore

oe RFU aaa

|

[ARGU KUNRT POR aT

ASHVEINANCE [GamuR =

Bak aear aT

[FANE

oRaRVARE — aay aaa BHWG | Electonle

|rnvest ‘clearing

ss ersten

BiekREDT —lnBaR a OH eiearenie|~

aatog

FUSION HERO IPR ‘wari| Base] Eledeonie |

‘ieanig

comm

[skowrs —— aru TS FER] Elcontc

lsounce cearag

system,

electronic, lasting system

previous year

‘through

[Particulars Of repayment of loan or dapeei or any epeahed] Ni

|Sdvance in an amount exceeding the limit speciied in cecten|

| 2097 received otherwise than by a\cheque ar bonk draft oF usa cf

aa bank account during the!

‘Nasie of tre payer

Takcrass Othe payer

Gi] Pericsors of "ehymert of Woah or deposit of any apeciiad Ni

‘edvan moun! exceeding the limit specified in section

2997 received by & cheque or bank deft which fs not an account|

payee cheque oF Bccount payee bank draft during the provious|

ea

= ‘Name of ine payer ‘Adchess of the payer ‘PAN of the | Asdhaar no | Amount of

ayer tepayrent

of an er

epost or

=

spooties

: Savana

a | eewen by

- aneque a

aback dat

% = racnicest

fm escount

| peyee

- ‘clegue or

peso

Siena

+ * ‘the previous:

Ta [ Olas oF BOUaHT Torwar les or depreciatan aibaanceT Re Gar

a manner, to Meextent available : me ene kd

‘Seial No” [Astesament) Natuig GT | Amouni as | Ail ——[ Armguatar | Amountaa aseesrad | Rear

: Yoor | lost| ‘ratutned’ |lossestttowanc| sdjuied by reference

Deprecston| 4 et alowed | witarasal | relevent oer)

alowance tinge section | fadanal

ISBAAI1 1564 | depreciation

GIISBAD | ‘9m ecourt

tontrg fot

‘ \deaben

unser as

— |. section

I +SBAcIN

ab

| Fens | Oe oe

‘date

|by|hether & change w shoreholdiig of the company nes Taken) NA

place inthe previous year due to which the losses rteued pict

to tte previous year cannot be alowed to be cared Sanwa in

tems of paction 79.

a |Wheter the assesse hax lured any apeculaton lous refered [No

to in section 73 during the previous year, Ifyes, please luriah

tho details ofthe same.

whainer the assosse as incurred any loss referredioin No

jsection 734 in respect of any specified business during the

previous year, if yes, please fumish details of the same_

In case of a company, please slate that whethe’ the corapany [=| NA

ceemed to be canying on a speculation business as refered

errs to secon 73, Tye, paar ursh theca of

speculation loss if any incurred during the previous year

Secton-wise details of deductions, if any, admissible under CI rail ‘si

Wk or Chapter Ill (Secon 10, Section 10AA)

Section “Amount Remarks anv?

i] ihether we asseseos is required to deduel ar cleat tx as per]NO

he provisions of Chaplee XVI or Chapter XVIFE, if yes

please urish

Tax | Section | Nawre of ‘Amount | “Total | Arnount | Amount of

deductio payment Of tax | amount | oftax baal

‘and aetucea| onic | ceaucaa} deused

select or was | or

5 cotecied| educa cotacie | Heced

ico out of) or | on (8) | coped

Number collected tothe

any atlas ced of

man ie Cental

ected ete

Dass meout of

ay () ana.)

7 z 7 7 8 7 0 WT

et

‘Whether tha aisesse Ts required to Turah the statement oF

tax WA

deducted of tax collected. yes please fumish the detaes

‘Tax Geduction | Type of Form | Due dala for | Dale af Wnot, please fumish | Remarks i any

cand collection fumishing | fumisting, pig

‘count furished \detailsfrensactions

number (TAN) which are not

reported

|whelher the aisessee i Table fo pay iierest undar section] WA

201 (1A) oF section 2056(7}. If lease furnish:

‘Tax deduction ‘Amount of Amount pesd

and calection | interest under | ut of exlumn

Account secon @

Number (TAN) | 201 (1Ay2060(7,

is payable -

Inne cage of 8 liading concer, gree quantitative Getells of prineipal ems of guods traded:

Wem Name Tall ‘pening | purchasas during] esles during ine | closing steck | shortage?

F q slow ‘the previous year! previaus year oan if

|| tnx

| [Di]in the case of @ manufacturing concem, give quariialve Gelals of thw pineal Name of vaw materi, Tih

| nd by-products:

| [i [Ra tates I

©| | Pee Ware | Gar ceciaaes [eansunpt] sales) osha | “vildeT | perconag] “sharape7

; “on | orgie [ver] aging | ‘eer | enum | siya | sce

i, ‘previous | during | previous products: any.

yer | ota | | year

penious

Na ~

| |B [Fished peoduts

Ter Noma Tat] opera] purchanes ‘ales daing] Garay | ahomage]

= ‘stock daring the the previous: oweoes, If

previo yar year my

a = ‘|

[= Bypieauers = a

Ten has Oil | epee [purchases | quan sslendrrg | clos slack | ahadaga7

stock” | Oaring ne | manutacarea |e provout cee

reviou yor] during the | yeor ony

vis pe

aR

A [Whether the assessee hag aceived ary amount i the nalure|NA

| [Btalvigends as relerred to in sub-Clavee ( @) of cause(22) af

| |eaaion 2

+ | aroun RecmreaTn Bao a recat I

|

\Wbetier any cost auit was caved out, yas, give the delay WINA

lam, of" disqualifcaion or aisagtemert on any|

uanity 08 moy be reportedidentied by tre

‘32 [Whether any audi was conducied under Wa Cenval Biles AcL|NO 7

104, Wt yes, five me details, if any, of disqualification of

jcisagreement on any matieditemivaive/quanity 2s may be|

re Heportaddentifiod Dy the auditor -

BE [Wheter ary susit was condocled under secton 72k of the| Ro

Finance Act 1054 in rellon to valuation of fanatlo

les. give the deta, ¢ any, of dsqualfeation or nap

any materemivenetquactty as may be reported A

[te suaor A

“WTB rogarcng torover, rots Bra ele Tor

rT ovious year

= Palas Previous Year S| Prataremever #

Matafal cowsumod/inianed

ade producod

ht

‘Aameant Romarks

7 ]Whsiher the assesse le vaquved “slat

Form Not or FornStAsrFemna gig Seer MRA =

Hegome fax | Type of Form | Dus doioof | Date of | Whether ine | inal, please | Remarkafany:

Departrvsnt fumisting | luring, i | form contains | furish tne Hist

Reporting furnished

Eni

Identification ~

Number

1 [Pihthar the Sseossce or is parent enily ar metal reporting [NA

[entiy fs fable to furnish the repert as rfetres tain sub vector

2 of secton 2

‘Whether report | Nem of parent entity | Wane of the Date of | Expected | Romane iany:

‘has baen Aternative reporting | Fumishing | Baia

fuamished by the ‘enityl Applicable) | the Report

assessee cits

parent ently oF

[Breakup of [otal expendilwe of elfes registered or rot]NO

registered under the GST (This Cisuse = kept in abeyance fl 3134

ch.2022)

For NEN JAIN & ASSOCIATES

Chartered Accountant

ee:MALPURA, DIST. TONK

bate: Zo03an23

(BN tans poRDSIEOM

M/s D K TRADERS

Shop at Plot No. 174/119, RHB, Pratap Nagar,

a 3020!

BALANCE SHEET AS ON 31ST MARCH, 2023

S.No.

4,107,987.88 | (As per Schedule) NIL

INVESTMENTS & DEPOSI

33,008.38 ENT ASSE!

173,959.78 |& ADVANCES

[Sundry Debtors 1,519.467.70

1,907,411.40 |Loans & Advances 30,247.00

Closing Stock 1,178,880.01

JGST Receivable 343,296.80

CASH & BANK BALANCES

Balance with Banks NIL

[Cash in Hand 448,697.00

[321,180.54 [TOTAL 3,621,188.51

Marita Gupta

Capital Ac

‘AMOUNT | PARTICULARS ‘AMOUNT

472,610.44 | By Opening Balance bid Tar 670.60

By Net profit 398,877.69

4,197,987:

7,670,598.29 | TOTAL BREE}

TN TERMS OF OUR SEPARATE AUDIT REPORT OF EVEN DATE ANNEKED.

For Ms DC TRADERS: z For M/s NEMI JAIN & ASSOCIATES

“pa OK TRAOERE : ‘Chartered Accountants

Marita. Gupta

Crsiaaey YOGA 7 emt Chan Jain)

Proprietor

Per an no.a03271

26n9ra023 “PR No.0233746

M/s D K TRADERS

Shop at Plot No. 174/119, RHB, Pratap Nagar,

Sangaber, Jaipur » 302033

‘TRADING AND PROFIT & LOSS ACCOUNT

FOR THE VEAR ENDING 31ST MARCH, 2025

For M/s NEMIJAIN &

[AMOUNT [PARTICULARS AMOUNT

679,246.83 [By Sales Account 10,603, 813.00

10,656,050:70 [By Closing Stock 1,178,880,01

447,285.48

11,782,693.01 [TOTAL 11,782,693.01

725,000.00 [By Gross Profit yd 447,285.48

4,808,63 [By Discount Received 26,119.86

19,485.00 |By Rounding OM 2098

21,285.00

998,877.69

(73,426.32 [TOTAL 473,426.32

F GUI SEPARATE AUDIT REPORT OF EVEN DATE ANNEXED.

OCTATES,

Chartered Accountants

MNo. 403271"

FR No.0233746

Mis DK TRADERS

‘Shop at Plot No. 174/119, RHB, Pr Sa

Annexures Forming Part Of Bal,

yr - 302033

eel

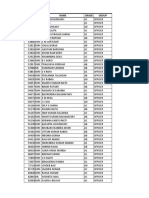

/ANJU KUMARI bese

2 |BHALAFINANGE 626.213.00

a |ASHV FINANCE = 174.641

4 DIGIKREDIT 480,842.40

& DHANVARSH FINVEST 172,445.00

8 [FUSION micro 164,806.00

7 [GROWTH SOURCE

907,411.40

c TOTAL iaent

KHANDELWAL, FER Sur

MAHESHWWARL

NANA FO tas

NS TRADERS,

AMOUNT

15,559.00

38,96800

(26,048.00))

292,409.00

308,874.00

oi a /1 4

Notes on Accounts and Accounting Policies

AacouniTENs PORES

4

2

3

‘The Firm follows mereantile system of accounting.

Fixed assets are stated at cost less depreciation.

Depreciation has been charged on WD V basis as per the rates prescribed in Income.

Tax Rules, 1962.

Inventory are valied at lower of cost or net realizable value o5 estimated and

certified by the proprietar,

Notes on Accounts

&

10.

Theré is no contingent liability as on 31,03.2023 except in respect of pending

Income Tax / GST Assessments.

‘The assessee ig net maintained the doy to day stack records, hence such particular

ore not given. Closing stock ia arrived on the basis of estimation made by assessee at

closing of the yeor:

Debit ond credit balances in Sundry Debtors, Sundry Creditors and other personal

Gecounts are subject to confirmation fram respective parties.

We have verified the transaction in the boaks of accounts with each of the

documentary evidences as were made available and produced before us where such

evidences were net available: the entries recorded in the books have been accepted

* by us,

Previous year figures have. not been provided, a3 there is no any audited data

oveilable for previous year.

‘These accounts caver only the business transaction carried on by Smt Mamta Gupta

under the proprietorship concern in the name and style of *M/s BD K TRADERS"

Other ffansaction / income of the proprietor are net covered by this report.

Provision for Taxation is not made, considering deduction U/a BOC, ete, on the

~ Investment made by assesse.and Income Other then business mentioned above

In terms of our report of even date

For M/s Nemi Jain & Associates "For OK TRADERS

Place: Malpura

For M/s

~ (Momta Gupta)

Proprietor

DATED: 26.09.2023

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Itr 23-24Document1 pageItr 23-24Ruloans VaishaliNo ratings yet

- Itr 22-23Document1 pageItr 22-23Ruloans VaishaliNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Hey Bhanwar,: Here Is Your Credit Report For Jul '23Document31 pagesHey Bhanwar,: Here Is Your Credit Report For Jul '23Ruloans VaishaliNo ratings yet

- Coi 22-23Document2 pagesCoi 22-23Ruloans VaishaliNo ratings yet

- Rent Agreement Shop Sector 17 - MinDocument4 pagesRent Agreement Shop Sector 17 - MinRuloans VaishaliNo ratings yet

- Mis NovemberDocument4 pagesMis NovemberRuloans VaishaliNo ratings yet

- Print - Udyam Registration CertificateDocument5 pagesPrint - Udyam Registration CertificateRuloans VaishaliNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Ruloans VaishaliNo ratings yet

- PDF Scanner 14-07-23 5.03.21Document4 pagesPDF Scanner 14-07-23 5.03.21Ruloans VaishaliNo ratings yet

- IOCL Data 575Document52 pagesIOCL Data 575Ruloans VaishaliNo ratings yet

- Detail Sheet Choudhary Transport CompanyDocument1 pageDetail Sheet Choudhary Transport CompanyRuloans VaishaliNo ratings yet

- HDFCDocument9 pagesHDFCRuloans VaishaliNo ratings yet