Professional Documents

Culture Documents

PT3 English

PT3 English

Uploaded by

mns2k19Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PT3 English

PT3 English

Uploaded by

mns2k19Copyright:

Available Formats

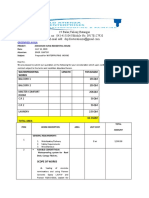

Charter of Citizens

1) Department Name : - Property tax Department

2) Subject : - 40% discount on Annual ratable value for self-use of

Residential property.

3) Essential documents :- A) No objection letter from society for self-occupied

Property (if society)

B) Voter Identity Card / Passport / Driving License /

Gas Card / Ration Card etc.

C) Property tax bill copy of any other property exists in

Pune corporation limit

4) Application Form : - Taxation Department PT3

5) Time required for final decision : - One month to two months from submission of

Application

6) Government decisions, orders, circulars,

Resolutions etc. :- 2) Hon. Municipal Commissioner's resolution No. 6/77

Dated. 04/05/2023

7) Decision Making Officer:-

Level Designation Time taken for decision

Level 1 Civic Center 1 day

Level 2 Section Inspector 20 days

Level 3 Divisional inspector 5 days

Level 4 Assistant Head of Assessor and Collector of Taxes 4 days

Level 5 Head of Assessor and Collector of Taxes 5 days

Level 6 Computer Department (Preparation of Dakhala Bill) 2 days

Level 7 Delivery of a bill to a citizen by the bill department 5 days

Note: - (Xerox copy must be authenticated)

8) Essential fee and its circular : - Amount Rs. 25/- (Standing Committee Resolution)

Deputy Commissioner and

Head of Assessor and Collector of Taxes

Pune Municipal Corporation

Cooperate by paying Property tax on time.

Civic Center PT 3

Pune Municipal Corporation

Property Tax Department

Application for self-use rebate of 40% in Residential property arv

For office use

Acceptance Distribution

Name of Regional Office : Dakhala No :

Inward No. and Date : Dakhala Date :

Date of Departure : Dakhala Distribution Date:

Site Inspector Name : Signature of Receipt :

Name :

(a) Applicant Information

Surname Name Father/Husband Name Sex M

Name of Applicant F

Residential Address : Age

Property Id No _____/____/______/___________________

Mobile No Email id

Assessor and Collector of Taxes

Pune Municipal Corporation

to these

Pune, Peth……………………………………………………… House No./S.No./C.S.No........................ Bungalow No. / Flat

No................ Society / Building No....................................... and Name ................................................................ ...................

................... Dated / / of this Residential Taxable Value ................... ....... that's it. I am using the said

property for self-maintenance from / /

However, it is requested to get 40% self-occupied exemption as per rules in the residential taxable value of the said

property with effect from / /

All the above information is true and correct as posted and myself is responsible for the information filled.

Applicant Signature............................................................

Applicant Name ...................................................................

Date:

For office use

Documents to be attached with the application :-

1) Current year property tax bill

2) Property tax No dues certificate

Comment :- Recommended for inspection as application is complete / incomplete.

Site Inspector Divisional Inspector

Property tax department Property tax department

Pune Municipal Corporation Pune Municipal Corporation

You might also like

- California Infrastructure Projects: Legal Aspects of Building in the Golden StateFrom EverandCalifornia Infrastructure Projects: Legal Aspects of Building in the Golden StateNo ratings yet

- New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]From EverandNew York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]No ratings yet

- Citizen'S Charter Service Request Form: Department of The Interior and Local GovernmentDocument3 pagesCitizen'S Charter Service Request Form: Department of The Interior and Local GovernmentGiezlRamos-Polca100% (3)

- FLOWER SHOP MANAGEMENT SYSTEM FullDocument25 pagesFLOWER SHOP MANAGEMENT SYSTEM FullMohamed64% (11)

- Builder Handover ProcessDocument8 pagesBuilder Handover Processseshadrimn seshadrimnNo ratings yet

- Tenant NOC Process and FormsDocument13 pagesTenant NOC Process and FormsMukesh Padwal67% (3)

- Citizen'S Charter Service Request Form: Department of The Interior and Local GovernmentDocument2 pagesCitizen'S Charter Service Request Form: Department of The Interior and Local GovernmentCarlo Francis Garol80% (5)

- West Godavari District Officer Phone Numbers - Mobile Numbers Andhra Pradesh StateDocument5 pagesWest Godavari District Officer Phone Numbers - Mobile Numbers Andhra Pradesh StateSRINIVASARAO JONNALANo ratings yet

- Pagbabasa at Pagsusuri11 q3 m3 Tekstong Persuweysib v3Document37 pagesPagbabasa at Pagsusuri11 q3 m3 Tekstong Persuweysib v3Marison Samaniego100% (3)

- PT3 EnglishDocument3 pagesPT3 Englishmanishasurywanshi91No ratings yet

- Bhs 18 9723Document20 pagesBhs 18 9723lafarge lafargeNo ratings yet

- Standard District Rezoning Application PackageDocument8 pagesStandard District Rezoning Application PackageStephanieNo ratings yet

- NOC For Property TaxDocument1 pageNOC For Property TaxInteract peopleNo ratings yet

- Cirular PDFDocument17 pagesCirular PDFSandeep Pareekshit100% (1)

- PMC Sarathi Faq in EnglishDocument16 pagesPMC Sarathi Faq in Englishregpras5No ratings yet

- LMC Rental AgreementDocument2 pagesLMC Rental AgreementJosephNo ratings yet

- Subscription Proposal: Recurring CostDocument3 pagesSubscription Proposal: Recurring CostGeneral ManagerNo ratings yet

- Imprest Voucher Format 04.04.17Document11 pagesImprest Voucher Format 04.04.17chief engineer CommercialNo ratings yet

- Sop 18 08Document5 pagesSop 18 08Aslam MondalNo ratings yet

- R.A. 9048 Petition For Correction of Clerical ORDocument2 pagesR.A. 9048 Petition For Correction of Clerical ORMarianne Grace de VeraNo ratings yet

- Offer To Leases KDocument3 pagesOffer To Leases KNana MarNo ratings yet

- Municipal Assessor'S Office External ServicesDocument10 pagesMunicipal Assessor'S Office External ServicesMarven JuadiongNo ratings yet

- Sop Allocation Short Code Content Based Services 08032021Document8 pagesSop Allocation Short Code Content Based Services 08032021aamir shahzadNo ratings yet

- Application For Real Property Tax Exemption and Remission: General InstructionsDocument4 pagesApplication For Real Property Tax Exemption and Remission: General InstructionsAnthony Juice Gaston BeyNo ratings yet

- Statement of Personal Property FormDocument18 pagesStatement of Personal Property FormASDFGHJKNo ratings yet

- Dated This DAY OF - APRIL 2015: Tenancy AgreementDocument3 pagesDated This DAY OF - APRIL 2015: Tenancy AgreementHerry DamianzNo ratings yet

- City Treasurer's OfficeDocument17 pagesCity Treasurer's OfficekokiNo ratings yet

- Unified Application For OccupancyDocument1 pageUnified Application For Occupancyristration2No ratings yet

- Land Lord VerificationDocument1 pageLand Lord Verificationjohn yorkNo ratings yet

- CCSRF-service RenderedDocument3 pagesCCSRF-service RenderedByron Patrick Marquez Bronce IIINo ratings yet

- 1E ECSA Candidate AppformDocument8 pages1E ECSA Candidate AppformBlessingNo ratings yet

- Extension Request: Montgomery County Planning DepartmentDocument1 pageExtension Request: Montgomery County Planning DepartmentM-NCPPCNo ratings yet

- AB041Document1 pageAB041mohammadhashourzadehNo ratings yet

- Government of Andhra Pradesh Municipal Administration DepartmentDocument6 pagesGovernment of Andhra Pradesh Municipal Administration Departmentuttamreddy8244266No ratings yet

- Application Form For Community Broadcasting Licence 1Document15 pagesApplication Form For Community Broadcasting Licence 1euniceNo ratings yet

- Application Form For Residential Plots 15-08-2020Document2 pagesApplication Form For Residential Plots 15-08-2020rashid793No ratings yet

- Room Rental Agreement 1Document2 pagesRoom Rental Agreement 1farfa112No ratings yet

- Marriage Reg PDFDocument2 pagesMarriage Reg PDFamit jadhavNo ratings yet

- Malir Development Authority: Application FormDocument2 pagesMalir Development Authority: Application FormWaqas Ahmed100% (1)

- CSR Compliance ChecklistDocument8 pagesCSR Compliance ChecklistProject HeadNo ratings yet

- K.P.W 24 Hand Receipt Claim No: 325238 Bill No: 12 of 11/2021Document2 pagesK.P.W 24 Hand Receipt Claim No: 325238 Bill No: 12 of 11/2021mithunNo ratings yet

- EOI - Hiring For Office SpaceDocument24 pagesEOI - Hiring For Office Spaceabhi_kavi0032004No ratings yet

- Parking Sticker Application Form: Requested By: Phone / Mobile: Email: Unit / Floor: Date / HoursDocument1 pageParking Sticker Application Form: Requested By: Phone / Mobile: Email: Unit / Floor: Date / HoursMey SarahNo ratings yet

- Tendernotice 1Document2 pagesTendernotice 1ATMA SALESNo ratings yet

- Office of The Mayor Vice-Mayor City AdministratorDocument41 pagesOffice of The Mayor Vice-Mayor City AdministratorErnan BaldomeroNo ratings yet

- CSP Application FormDocument7 pagesCSP Application FormgtcesevaNo ratings yet

- Chakan Municipal Council Chakan: Tender DocumentDocument10 pagesChakan Municipal Council Chakan: Tender DocumentAjay SinghNo ratings yet

- Document ChecklistDocument2 pagesDocument ChecklistSuresh IndhumathiNo ratings yet

- Change in Ownership of Water ConnectionDocument1 pageChange in Ownership of Water ConnectionsachingnNo ratings yet

- Sec. 226, Local Board of Assessment Appeals.: Guide Notes On Real Property Taxation (Part 2)Document17 pagesSec. 226, Local Board of Assessment Appeals.: Guide Notes On Real Property Taxation (Part 2)Anton SingeNo ratings yet

- Application For Constrution of House - Flat and Extension To Existing HouseDocument4 pagesApplication For Constrution of House - Flat and Extension To Existing HousecharNo ratings yet

- Form 2A - Application For Provisional RegistrationDocument6 pagesForm 2A - Application For Provisional Registrationchadchankar chadchankarswamiNo ratings yet

- NGAAF APPLICATION FORM IB County Wide Projects Revised 2021 1Document7 pagesNGAAF APPLICATION FORM IB County Wide Projects Revised 2021 1FAN PAGE CYBERNo ratings yet

- Taytay Immigration Field OfficeDocument43 pagesTaytay Immigration Field OfficeJudith CortezNo ratings yet

- SYNOPSISDocument3 pagesSYNOPSISKarukrit Legal CellNo ratings yet

- Documents Required For Registration Under Service TaxDocument7 pagesDocuments Required For Registration Under Service TaxVinay SinghNo ratings yet

- Deemed Conveyance CircularsDocument17 pagesDeemed Conveyance Circularssales leotekNo ratings yet

- The South Indian Bank LTD.: Head Office: ThrissurDocument4 pagesThe South Indian Bank LTD.: Head Office: Thrissursurya managementNo ratings yet

- Sbi Mudra Loan Application Form PDFDocument4 pagesSbi Mudra Loan Application Form PDFRaviTeja KvsnNo ratings yet

- Common Application Form Kerala Revenue Department PDFDocument4 pagesCommon Application Form Kerala Revenue Department PDFShivani Nair0% (1)

- Application For Registration of New HomestayDocument3 pagesApplication For Registration of New HomestayAashish GuptaNo ratings yet

- EOI Penyiapan Izin Operasi Bendungan PDFDocument12 pagesEOI Penyiapan Izin Operasi Bendungan PDFmelati jayagiriNo ratings yet

- RTB 5Document6 pagesRTB 5shop securityNo ratings yet

- For Business Information, Annual Reports, Laws, Ordinances, Regulations and ArticlesDocument28 pagesFor Business Information, Annual Reports, Laws, Ordinances, Regulations and ArticlesPrince AdyNo ratings yet

- Expansion and Bleeding of Freshly Mixed Grouts For Preplaced-Aggregate Concrete in The LaboratoryDocument3 pagesExpansion and Bleeding of Freshly Mixed Grouts For Preplaced-Aggregate Concrete in The LaboratoryFatah FatahNo ratings yet

- Vig Manual Vol IDocument150 pagesVig Manual Vol ISamanjit Sen GuptaNo ratings yet

- Basis DavidsonDocument12 pagesBasis DavidsonDonald Mark UdeNo ratings yet

- Course: MKT425 (International Marketing) : Zarin Tasnim ID:16304136 Section: 3 Date: August 14, 2020Document7 pagesCourse: MKT425 (International Marketing) : Zarin Tasnim ID:16304136 Section: 3 Date: August 14, 2020Zarin TasnimNo ratings yet

- Zambia Decentralisation PolicyDocument35 pagesZambia Decentralisation PolicyMaugahn Muff-Wheeler100% (1)

- BusinessenvironmentDocument4 pagesBusinessenvironmentTaha SanawadwalaNo ratings yet

- Accepted ManuscriptDocument18 pagesAccepted ManuscriptYASHASVI SHARMANo ratings yet

- Audit MCQ PDFDocument141 pagesAudit MCQ PDFAnjiNo ratings yet

- Toyotafinalpresentation1 190127071123 PDFDocument78 pagesToyotafinalpresentation1 190127071123 PDFShabaz ShaikhNo ratings yet

- FS - Laptop Table Bag - BSIE Section 4Document108 pagesFS - Laptop Table Bag - BSIE Section 4Julian Geofrey AlcantaraNo ratings yet

- Case StudyDocument5 pagesCase StudyCarlo CapunoNo ratings yet

- Maintenance EngineerDocument2 pagesMaintenance EngineerAakash BarotNo ratings yet

- The Influence of Compensation and Rewards On Employee Performance in Public Universities in KenyaDocument37 pagesThe Influence of Compensation and Rewards On Employee Performance in Public Universities in KenyaBoonaa Sikkoo MandooNo ratings yet

- Loan Sanction-Letter With kfs345937221866371454Document4 pagesLoan Sanction-Letter With kfs345937221866371454Palaka PrasanthNo ratings yet

- MP2 Hacks For Advance InvestorsDocument18 pagesMP2 Hacks For Advance InvestorsChristopher BrownNo ratings yet

- Actual Days of Attendance To Work Actual Time Log Accomplishment/OutputDocument4 pagesActual Days of Attendance To Work Actual Time Log Accomplishment/Outputcharry ruayaNo ratings yet

- Risk Management and GovernanceDocument118 pagesRisk Management and GovernanceAltansukhDamdinsurenNo ratings yet

- Chapter1 Managing Service EnterprisesDocument19 pagesChapter1 Managing Service EnterprisesPatrick StarrNo ratings yet

- 19 Balas, Talisay, Batangas Tel. No: 043-4151045/mobile No. 09178127920Document2 pages19 Balas, Talisay, Batangas Tel. No: 043-4151045/mobile No. 09178127920Llester D. AtienzaNo ratings yet

- AFM-Assignment-2021: Trial Balance As On 31 March 2015Document1 pageAFM-Assignment-2021: Trial Balance As On 31 March 2015SILLA SAIKUMARNo ratings yet

- Form Interrogatories - General Responses To Request For Admissions 030222Document5 pagesForm Interrogatories - General Responses To Request For Admissions 030222CYNTHIA CORNATTNo ratings yet

- Question 2.1 SolutionDocument2 pagesQuestion 2.1 SolutionnhloniphointelligenceNo ratings yet

- Silao Remediation Course - 2021 07 07Document6 pagesSilao Remediation Course - 2021 07 07Aristegui NoticiasNo ratings yet

- Financial Management Mba (Syllabus)Document2 pagesFinancial Management Mba (Syllabus)lini liniNo ratings yet

- Beyond Advertising and PublicityDocument19 pagesBeyond Advertising and PublicityMarcelo RibaricNo ratings yet

- Module 2 - Strategic Business AnalysisDocument10 pagesModule 2 - Strategic Business AnalysisPrime Johnson FelicianoNo ratings yet

![New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/661176503/149x198/6cedb9a16a/1690336075?v=1)