Professional Documents

Culture Documents

Syllabus AssetManagement

Syllabus AssetManagement

Uploaded by

marapopsq0 ratings0% found this document useful (0 votes)

4 views1 pageThis 3 credit course covers asset management and is taught over 7 classes of 4 hours each. It is taught by PD Dr. Alexandre Ziegler and Prof. Dr. Thorsten Hens at the University of Zurich Department of Banking and Finance. The course aims to provide students with theoretical and empirical foundations of key facets of modern asset management and introduce advanced quantitative tools. Upon completion, students should be able to formulate asset allocation strategies, assess portfolio performance, develop investment strategies across different asset classes, and evaluate the profitability and risk of investment strategies.

Original Description:

Original Title

Syllabus-AssetManagement

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis 3 credit course covers asset management and is taught over 7 classes of 4 hours each. It is taught by PD Dr. Alexandre Ziegler and Prof. Dr. Thorsten Hens at the University of Zurich Department of Banking and Finance. The course aims to provide students with theoretical and empirical foundations of key facets of modern asset management and introduce advanced quantitative tools. Upon completion, students should be able to formulate asset allocation strategies, assess portfolio performance, develop investment strategies across different asset classes, and evaluate the profitability and risk of investment strategies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageSyllabus AssetManagement

Syllabus AssetManagement

Uploaded by

marapopsqThis 3 credit course covers asset management and is taught over 7 classes of 4 hours each. It is taught by PD Dr. Alexandre Ziegler and Prof. Dr. Thorsten Hens at the University of Zurich Department of Banking and Finance. The course aims to provide students with theoretical and empirical foundations of key facets of modern asset management and introduce advanced quantitative tools. Upon completion, students should be able to formulate asset allocation strategies, assess portfolio performance, develop investment strategies across different asset classes, and evaluate the profitability and risk of investment strategies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

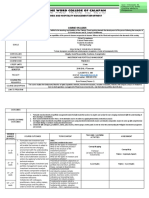

Course title: Asset Management

Course Basic Information

Academic Unit: University of Zurich, Department for Banking and Finance

(University/Department)

Course title: Asset Management

Level: Master of Science UZH ETH in Quantitative Finance

Course Status: Core FIN

Year of Study: Fall Semester

Number of Classes per Week: 2h (Lectures) (7 classes of 4 hours)

ECTS Credits: 3 ECTS

Time /Location: According to the timetable in UZH course catalogue

Lecturer: PD Dr. Alexandre Ziegler and Prof. Dr. Thorsten Hens

Content

Content of the course The first part of the course covers financial market theory,

the theoretical underpinnings of behavioral, quantitative,

and macroeconomic approaches to portfolio

management, strategic and tactical asset allocation,

performance measurement and attribution, and ESG

investing. The second part describes methods used in the

development of investment strategies. The third part

reviews a wide range of investment strategies spanning

risk premium harvesting, exploiting return predictability,

and taking advantage of patterns in the cross-section of

expected returns for different asset classes. Equity, bond,

currency, and options markets are considered in detail.

Course’s objectives: The aim of this lecture is to provide students with the

theoretical and empirical foundations of the key facets of

modern asset management and to introduce them to

advanced tools for quantitative asset management.

The expected outcomes: On successful completion of this module, students should

be able to:

- Formulate a strategic and tactical asset allocation;

- Assess a portfolio’s performance;

- Develop investment strategies in different asset

classes;

- Assess the profitability and risk profile of

investment strategies.

You might also like

- University College Dublin: Bachelor of Science (Singapore)Document34 pagesUniversity College Dublin: Bachelor of Science (Singapore)kyawNo ratings yet

- Investment Management AgreementDocument8 pagesInvestment Management AgreementPuja NairNo ratings yet

- FRM Part 2 TopicsDocument4 pagesFRM Part 2 Topicschan6No ratings yet

- Fin 4663 Structure of Case Study Invest - Policy Hewlett FoundationDocument4 pagesFin 4663 Structure of Case Study Invest - Policy Hewlett FoundationAngelRodriguezNo ratings yet

- Course Syllabus ACCO 20093 Financial Markets v2019Document6 pagesCourse Syllabus ACCO 20093 Financial Markets v2019Rizza100% (1)

- 39 MBA Final Result Dec2013Document691 pages39 MBA Final Result Dec2013Karan GuptaNo ratings yet

- Course Outline - Investment Analysis and Portfolio ManagementDocument4 pagesCourse Outline - Investment Analysis and Portfolio ManagementMadihaBhatti100% (1)

- FMG MBA 2025 Spring - Course Outline Updated 1 Jan 2023 S.M. Ali.Document15 pagesFMG MBA 2025 Spring - Course Outline Updated 1 Jan 2023 S.M. Ali.Umer NaeemNo ratings yet

- IAPMDocument7 pagesIAPMrossNo ratings yet

- Financial Management 1Document5 pagesFinancial Management 1Nishant ShuklaNo ratings yet

- Course Outline - Investment Management - IIM Ranchi - 2018Document7 pagesCourse Outline - Investment Management - IIM Ranchi - 2018Ankit BhardwajNo ratings yet

- Investment Analysis, Portfolio Management & Wealth ManagementDocument5 pagesInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNo ratings yet

- BBA IV Investment AnanalysisDocument9 pagesBBA IV Investment Ananalysisshubham JaiswalNo ratings yet

- AFW369E 2016-17 Courseoutline HooyCWDocument5 pagesAFW369E 2016-17 Courseoutline HooyCWwilliamnyxNo ratings yet

- Course Outline For Portfolio TheoryDocument4 pagesCourse Outline For Portfolio Theoryshariz500No ratings yet

- Lesson 0 Introduction To Mac2602Document10 pagesLesson 0 Introduction To Mac2602Nombulelo NdlovuNo ratings yet

- PMS TodayDocument3 pagesPMS TodaySakshi MulajkarNo ratings yet

- ADMU Financial Management SyllabusDocument4 pagesADMU Financial Management SyllabusPhilip JosephNo ratings yet

- Bu CoursesDocument3 pagesBu Courseswaleed20_20No ratings yet

- Course Title: Financial Markets and PracticeDocument1 pageCourse Title: Financial Markets and PracticeRuchi KashyapNo ratings yet

- ACCO 20083 - Syllabus On Financial MarketsDocument7 pagesACCO 20083 - Syllabus On Financial MarketsAllyson VillalobosNo ratings yet

- ACCO 20083 Syllabus On Financial MarketsDocument7 pagesACCO 20083 Syllabus On Financial MarketsJenelle88% (8)

- Sapm SyllbusDocument2 pagesSapm SyllbusAaditya JhaNo ratings yet

- GSM687Document11 pagesGSM687icdawar0% (1)

- 4FI3 F19 Siam 1Document9 pages4FI3 F19 Siam 1Arash MojahedNo ratings yet

- Introduction To Investments: Course 2 Financial Market AnalysisDocument23 pagesIntroduction To Investments: Course 2 Financial Market Analysishuat huatNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementRaHul Rathod100% (1)

- FINC765NY Portfolio MASTER SYLLABUS Fall 2020 PDFDocument10 pagesFINC765NY Portfolio MASTER SYLLABUS Fall 2020 PDFRahil VermaNo ratings yet

- Course Outline: Asset Management & Strategic PlanningDocument2 pagesCourse Outline: Asset Management & Strategic PlanningNurul AsyilahNo ratings yet

- Programme Structure: MSC in Finance and InvestmentDocument2 pagesProgramme Structure: MSC in Finance and InvestmentzorgtotofNo ratings yet

- Course Pack For AgBus 174 Investment Management Module 1Document31 pagesCourse Pack For AgBus 174 Investment Management Module 1Mark Ramon MatugasNo ratings yet

- Basic of Stock MarketDocument2 pagesBasic of Stock MarketdigitalsurjeetofficialNo ratings yet

- MF0010Document308 pagesMF0010Abdul Lateef KhanNo ratings yet

- MBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)Document131 pagesMBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)asadNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- PM1Document3 pagesPM1hardikjain1819No ratings yet

- Risk and ReturnDocument121 pagesRisk and Returnrocky raNo ratings yet

- IIM Calcutta Brochure 30 DecDocument13 pagesIIM Calcutta Brochure 30 DecSandeep SinghNo ratings yet

- HMB 4 Business Finance SYLLABUS New HeaderDocument9 pagesHMB 4 Business Finance SYLLABUS New HeaderSam duarteNo ratings yet

- Institute of Management Sciences Peshawar Course Syllabus: Muhammad - Atiq@imsciences - Edu.pkDocument6 pagesInstitute of Management Sciences Peshawar Course Syllabus: Muhammad - Atiq@imsciences - Edu.pkWaqar AhmadNo ratings yet

- Investment ManagementDocument28 pagesInvestment ManagementseemaagiwalNo ratings yet

- Finance Elective Briefing: DR Sharon K JoseDocument26 pagesFinance Elective Briefing: DR Sharon K Josebhagyesh taleleNo ratings yet

- 093 b403103 ShenDocument3 pages093 b403103 ShentuonglaiganNo ratings yet

- 74833bos60509 cp6Document122 pages74833bos60509 cp6parth gorasiaNo ratings yet

- School of Management Internship Diary: Strategy SpecializationDocument10 pagesSchool of Management Internship Diary: Strategy SpecializationRohit YadavNo ratings yet

- Portfolio Investment ProcessDocument17 pagesPortfolio Investment ProcessPrashant DubeyNo ratings yet

- M19MC3250 - Sapm UNIT 2 - 00365Document60 pagesM19MC3250 - Sapm UNIT 2 - 00365ashishNo ratings yet

- Ahore Chool OF Conomics: Investments (FNC-402)Document8 pagesAhore Chool OF Conomics: Investments (FNC-402)muazNo ratings yet

- Letter of Transmittal: Subject: Submission of Term PaperDocument17 pagesLetter of Transmittal: Subject: Submission of Term PaperRifat HelalNo ratings yet

- 57043bos46238cp5 PDFDocument82 pages57043bos46238cp5 PDFVatsal TikiwalaNo ratings yet

- Synopsis: B N Bahadur Institute of Management SciencesDocument5 pagesSynopsis: B N Bahadur Institute of Management SciencesManojkumar KumarNo ratings yet

- Iapm Course Outline UpdatedDocument2 pagesIapm Course Outline UpdatedKumar PrashantNo ratings yet

- Capital Markets 2020-30Document6 pagesCapital Markets 2020-30Andres Saavedra CameranoNo ratings yet

- BAC3684 SIPM March 2011Document7 pagesBAC3684 SIPM March 2011chunlun87No ratings yet

- ACCO 20123 Syllabus On Financial ManagementDocument9 pagesACCO 20123 Syllabus On Financial ManagementAzel Ann AlibinNo ratings yet

- Investing in Stock MarketsDocument2 pagesInvesting in Stock MarketsJobin George100% (1)

- FINN353 - Investments Talha Farrukh Fall 2020Document6 pagesFINN353 - Investments Talha Farrukh Fall 2020Ahmer ChaudhryNo ratings yet

- OBE Personal FinanceDocument6 pagesOBE Personal FinancePrincess Mogul100% (1)

- FINN353 - Investments Talha Farrukh Spring 2022Document5 pagesFINN353 - Investments Talha Farrukh Spring 2022Asad JamilNo ratings yet

- Fin. 8 Investment and Portfolio Management 2018Document5 pagesFin. 8 Investment and Portfolio Management 2018Neri ErinNo ratings yet

- FINN 454-Portfolio Management-Salman KhanDocument5 pagesFINN 454-Portfolio Management-Salman KhanMalik AminNo ratings yet

- Research Paper On Portfolio ManagementDocument2 pagesResearch Paper On Portfolio ManagementSalman KhanNo ratings yet

- BMT6135 - Security-Analysis-And-Portfolio-Management - TH - 1.0 - 55 - BMT6135 - 54 AcpDocument2 pagesBMT6135 - Security-Analysis-And-Portfolio-Management - TH - 1.0 - 55 - BMT6135 - 54 AcpM AnuradhaNo ratings yet

- Mastery in Markets: Advanced Strategies for Seasoned Investors: Investing, #3From EverandMastery in Markets: Advanced Strategies for Seasoned Investors: Investing, #3No ratings yet

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionRating: 3 out of 5 stars3/5 (2)

- Guidance Note On Audit of Banks by IcaiDocument955 pagesGuidance Note On Audit of Banks by IcaiTekumani Naveen Kumar100% (1)

- CFA Magazine Jan - FebDocument60 pagesCFA Magazine Jan - FebHoàng MinhNo ratings yet

- Client Interaction, Analysis & Dealing in Stock Market For Product of Motilal Oswal Securities LTDDocument29 pagesClient Interaction, Analysis & Dealing in Stock Market For Product of Motilal Oswal Securities LTDdeepakNo ratings yet

- Deloitte (2021) IE - SustainableFinanceDisclosureReg - FINALDocument6 pagesDeloitte (2021) IE - SustainableFinanceDisclosureReg - FINALdessyNo ratings yet

- AIMCo 2010-11 Annual ReportDocument67 pagesAIMCo 2010-11 Annual ReportElias LadopoulosNo ratings yet

- Portfolio Management Professional Reference ListDocument1 pagePortfolio Management Professional Reference ListMohammed AlnasharNo ratings yet

- Adaptive Asset AllocationDocument14 pagesAdaptive Asset AllocationQuasiNo ratings yet

- Deloitte Robo SafeDocument5 pagesDeloitte Robo SafeLoro PiancaNo ratings yet

- Not Just Any Portfolio ManagerDocument5 pagesNot Just Any Portfolio ManagerPetraneoNo ratings yet

- Cbi 01 MFS PPT1Document17 pagesCbi 01 MFS PPT1rishi raj modiNo ratings yet

- Hedge Fund Risk Appetite:: A Prospect Theory PerspectiveDocument29 pagesHedge Fund Risk Appetite:: A Prospect Theory Perspectivephuongapo9xNo ratings yet

- Project On Perception Towards Mutual FundDocument71 pagesProject On Perception Towards Mutual FundSanjeet Kumar80% (55)

- Pt. Ravishankar Shukla University MBA SyllabusDocument24 pagesPt. Ravishankar Shukla University MBA SyllabusIllusion DiffusionNo ratings yet

- Chief Investment Officer in San Francisco CA Resume Jim O'DonnellDocument1 pageChief Investment Officer in San Francisco CA Resume Jim O'DonnellJimO'DonnellNo ratings yet

- Brightwater Salary Survey 2023Document97 pagesBrightwater Salary Survey 2023abhy_aramawat100% (1)

- Topic1 Introductionto Financial Market and SecuritiesDocument19 pagesTopic1 Introductionto Financial Market and SecuritiesMirza VejzagicNo ratings yet

- Buku2 Ref Ujian WMIDocument3 pagesBuku2 Ref Ujian WMIEndy JupriansyahNo ratings yet

- Investment Portfolio Management Research PaperDocument8 pagesInvestment Portfolio Management Research Papermoykicvnd100% (1)

- Ark Israel Innovative Technology Etf Izrl HoldingsDocument2 pagesArk Israel Innovative Technology Etf Izrl HoldingsmikiNo ratings yet

- Q3AM Momentum White PaperDocument13 pagesQ3AM Momentum White Paperq3assetmanagementNo ratings yet

- Trends and Practices in Financial Planning in Pune:The Curious Case of Yadnya Investment ServiceDocument51 pagesTrends and Practices in Financial Planning in Pune:The Curious Case of Yadnya Investment ServiceAli SaifyNo ratings yet

- Security Analysis and Portfolo Management-Unit-1-Dr-Asma-KhanDocument48 pagesSecurity Analysis and Portfolo Management-Unit-1-Dr-Asma-KhanSHIVPRATAP SINGH TOMARNo ratings yet

- Abdul Hamid Amini PG 09 002Document2 pagesAbdul Hamid Amini PG 09 002hamidfarahiNo ratings yet

- TYBMS (Sem V &Document134 pagesTYBMS (Sem V &Niket aamitNo ratings yet

- Comparative Analysis of Mutual Fund Scheme in Private and Public SectorDocument98 pagesComparative Analysis of Mutual Fund Scheme in Private and Public Sector20120 SANSKAR MEENANo ratings yet