Professional Documents

Culture Documents

4FI3 F19 Siam 1

Uploaded by

Arash MojahedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4FI3 F19 Siam 1

Uploaded by

Arash MojahedCopyright:

Available Formats

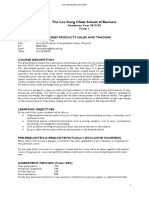

Commerce 4FI3

Market Trading with Futures and Forwards

Fall 2019 Course Outline

Finance and Business Economics

DeGroote School of Business

McMaster University

COURSE OBJECTIVES

The experimental course attempts to develop practical skills in trading financial securities with a focus

on risk management and return enhancement through role playing. The course deals comprehensively

with the increased importance played by risk and uncertainty in today’s financial markets.

INSTRUCTOR AND CONTACT INFORMATION

Instructor: Dr. John J. Siam TA: Lynda Xu

Office Hours: Office Hours:

Tuesdays 10:30 – 11:30 DSB 306 Tuesdays 2:30 – 3:30

Wednesdays 1:30 – 2:30 RJC 126

and by appointment

Email: siamj@mcmaster.ca

Tel: (905) 525-9140 x27028

Class location: DSB 122A, Allen H. Gould Trading Floor (GTF)

Course Website: http://avenue.mcmaster.ca

COURSE ELEMENTS

Credit Value: 3 Leadership: Yes IT skills: Yes Global view: Yes

Avenue: Yes Ethics: Yes Numeracy: Yes Written skills: Yes

Participation: Yes Innovation: Yes Group work: Yes Oral skills: Yes

Evidence-based: Yes Experiential: Yes Final Exam: No Guest speaker(s): Yes

SELECTION CRITERIA FOR THE COURSE

Prerequisites: Completion of Commerce 3FA3 (Introduction to Finance) in good standing,

enrolment is limited to a maximum of 20 students.

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 1 of 11

COURSE DESCRIPTION

This experiential course, students are introduced to theoretical and empirical issues of different

financial instruments, their valuation methodology, and their institutional uses in risk management.

Market microstructure knowledge provides students guidance in implementing their trading

strategies. Students are able to trade money market instruments, bonds, equities, indices, ETFs,

currencies, commodities and their corresponding futures and forwards; focusing on trading strategies

that minimize market exposure through risk measurement. Pedagogically, students are assigned

securities and their corresponding futures and forwards to trade subject to financial markets outlook

and their expectations. Fictional accounts of one million dollar per currency (Canadian/US) are

created and evaluated at the end of the course. In addition, students are divided into subgroups that

act as individual investment/trading firms.

COURSE ORGANIZATION

The experiential course uses a combination of lectures, presentations, supervised and unsupervised

trading. The class meets once per week for a three-hour session. Classes and trading sessions are

conducted at the Allen H. Gould Trading Floor (GTF). Supervised trading and weekly trading cases

(see below) are conducted during class time; the students are expected to justifying their trading

positions/decisions using due diligence and market microstructure. The trading sessions are used to

systematically evaluate students’ trading positions and offer suggestions and recommendations.

Trading sessions are followed by lectures where trading strategies are scrutinized. In addition,

students are responsible for trading their portfolio a maximum of four hours per week (at times of

their choice). All trades will be logged to prevent falsification of trading histories.

LECTURES CONTENT

The aim of the course is to provide a comprehensive treatment of financial risk and uncertainty faced

by firms and individuals exposed to financial markets. The course attempts to develop practical skills

by focusing on hedging and hedging strategies, financial engineering, risk management (market risk),

measuring and monitoring market risk across complex and volatile financial market.

Lectures

The course includes lectures that review stocks, bonds, money and currency markets, as well as, the

derivatives markets. The focus is on trading and trading strategies that utilize cash securities in

combination with derivatives. Students are introduced to different financial instruments, institutional

details, back office, markets microstructure, exchange and over-the-counter derivatives, principles of

valuation, risk management and hedging techniques. Speculative strategies are also discussed and are

examined in detail. The specific topics cover: exchange and over-the-counter trading, market

microstructure, reading the “signs” and “pulse” of the market, understanding the electronic book,

risk/reward analysis, arbitrage, government and corporate securities, selection criteria, basis risk vs.

price risk, degrees of trading aggressiveness, uses of futures and forwards, such as, managing interest

rate exposure, futures and forward hedging, futures arbitrage, various advanced and exotic futures

spreads.

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 2 of 11

SKILL BUILDING TOOLS OF THE TRADE

“Trading Centres put emphasis on experiential learning and encourage critical reasoning and creative

thinking. Intensive workshops, team projects, and real world experience with traditional lectures

establishes a dynamic forum for producing competent managers. Partnerships with industry ensure

that the skills and competencies developed are relevant in today’s marketplace” (Siam 1). The course

uses a number of tools that provide core and discipline specific competencies that link education and

workplace. Students who are able to build industry tools are more valuable in the workplace and open

new career opportunities for themselves.

I. Real-time Trading Sessions

At the beginning of the course each student is assigned equities, fixed income securities (together,

the “cash securities”) and a fictional account of one million dollars. During the first four weeks,

students trade the cash securities. In week five, students are assigned futures on each of their

underlying securities. After receiving their futures, students begin trading the cash securities and

their futures. Risk minimizing strategies typically involve trading combinations of cash and

derivatives securities.

II. Group Monthly Market and Securities (MMSA) Analysis

Students are advised to form groups (Maximum five members), and work on Monthly Market

and Securities Reports (MMSA). The reports present each group’ outlook for relevant markets

(Debt, Commodities, Currencies, Equity Markets…etc.), plus detailed fundamental and market

microstructure analysis of the securities assigned to each member of the group. The reports

include recommendations (buy, sell, hold), and present the basis of the individual trading

strategies. These reports will assist students in building their individual Final Report. The reports

are optional and may be submitted to the TA for consultation and form the basis of the Final

Report.

III. Tutorials

A number of tutorials designed to transfer technical and professional knowledge and knowhow as

part of the experiential learning process. These interactive and specialized tutorials are used to

teach by examples the use of software like Thomson Reuters’ Eikon, Bloomberg professional,

Financial Trading System (FTS) software and tutor trading processes and techniques2.

IV. Trading Cases

A number of trading cases are assigned throughout the course. The objectives of the trading cases

is to provide an understanding of important market microstructure concepts, such as, trading,

market making, market taking, price discovery, bid-ask spreads/width and market depth, trading

frequency and trading volume. An ECN (Electronic Communications Network) installed at the

HIDC network that forms a dealing system that allows the instructor to run cases using the

students as the trading crowd. Each case poses a different trading question. The trading problem

1

Siam, J. (2005), “University Trading Centers and their Role in Business Education”, Journal of Financial Education,

Vol. 31 Lead Article.

2

See Course Outline.

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 3 of 11

is designed so students can apply finance concepts in formulating their trading strategies.

Typically, before each trading session the students are quizzed on the assigned case.

V. Individual Final Project

The individual final project is a record of the student trading activities, trading justifications,

summary of return(s) on trading positions, analysis of market risk (inherent in your trading),

collection of students acquired market insight and savvy. The report must build on the student

group assignments with emphases on individual reasoning and value added. The report starts

with executive summary followed by an economic review detailing; universal economic outlook,

markets outlook and outlook of your trading horizon. The final report summarizes weekly

expectations in a coherent manner, includes in-depth analysis and justification for the trading

activities. The grade received is based on the final value of the portfolio, return on investment,

market and securities analysis, individual reasoning, risk management applications and “the

manner” in which the wealth was accumulated.

Participation and Conduct

Strict adherences to the codes of conduct established by the Educational Trading Center are pre-

requisites. Students are reminded that they must adhere to the standards of academic ethics of the

University. The standards are discussed in the booklet of Senate Policy Statements provided to

you at registration and also are available from the Senate Office. Any deviations from the norms

may lead to disciplinary actions.

LEARNING OUTCOMES

Upon completion of this course, students will be able to complete the following key tasks:

Play the role of the decision maker(s) as trader or/and as a portfolio manager. In two setting: as

an individuals and as part of your group (firm);

Use different platforms (Reuters, Bloomberg…etc) to assess information to evaluate the

performance of markets and individual companies and develop the ability to forecast market

direction and companies prospects;

Calculate all necessary industry metrics, marketing information, financial ratios and trends to

defend your market view and recommendations;

Identify important market opportunities and challenges facing a market/firm and setting out a

course of action (strategy) to benefit from them;

Implement changes (risk management techniques), as necessary, in order to enhance and protect

your allocated capital;

Acquire and develop networking skill through the TiR visits that might open career doors in

financial services industry.

REQUIRED COURSE MATERIALS AND READINGS

THE Trading Manual, Forth Canadian Edition Version 4.0, John J. Siam $120.00

Available at the Allen H. Gould Trading Floor.

Lecture Notes, Assignment and other course content Free

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 4 of 11

Download from the 4FI3 website (http://avenue.mcmaster.ca)

USB drive (at least 256MB) is required to save your trades and information from GTF platforms.

EVALUATION

Learning in this course result from lectures, related readings, assignments, trading simulations,

trading cases, group reports, final project and in class discussions. All work will be evaluated on an

individual basis. Your final grade will be calculated as follows:

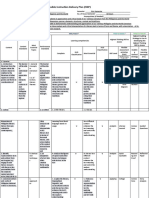

COMPONENTS AND WEIGHTS

The components of the course grade will be weighted as follows, tentatively. The instructor reserves

the right to modify the weightings to adjust for more or less material covered during the semester.

COMPONENTS PERCENT

6 Trading Cases 12

Two Midterm Exams 48

Individual Final Project3 40

Total 100%

Optional Project4 3 Marks

Participating in DeGroote MarketWatch5 3

NOTE: The use of a McMaster standard calculator is allowed during examinations in this course.

See McMaster calculator policy at the following URL:

http://www.mcmaster.ca/policy/Students-AcademicStudies/UndergraduateExaminationsPolicy.pdf

GRADING CONVENTIONS

A standard grading scale will be used. The instructor will inform you of your marks for participation

periodically.

LETTER GRADE PERCENT LETTER GRADE PERCENT

A+ 90-100 C+ 67-69

A 85-89 C 63-66

A- 80-84 C- 60-62

B+ 77-79 D+ 57-59

B 73-76 D 53-56

B- 70-72 D- 50-52

F 00-49

PLACES TO GET HELP WITH YOUR WORK:

3

The Final Project is due one week after end of classes at 5 P.M., the overdue due penalty for the final project is 10%

per day.

4

To be submitted with the Final Project as an Appendix.

5

Upon approval of submitted material/work.

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 5 of 11

Allen H. Gould Trading Floor (MGD 122A) and financial web sites (listed on the Trading Center

web site http://trading.degroote.mcmaster.ca/).

Communication and Feedback

Students who wish to correspond with instructors or TAs directly via email must send messages that

originate from their official McMaster University email account. This protects the confidentiality

and sensitivity of information as well as confirms the identity of the student. Emails regarding course

issues should NOT be sent to the Area Administrative Assistants.

Instructors are required to provide evaluation feedback for at least 10% of the final grade to students

prior to Week #8 in the term.

Instructors may conduct an informal course review with students by Week #4 to allow time for

modifications in curriculum delivery.

Students who wish to have a course component re-evaluated must complete the following form:

http://www.mcmaster.ca/policy/Students-AcademicStudies/Form_A.pdf

In order for the component to be re-read:

• the component must be worth 10% or more of the final grade in the course

• students pay a fee of $50 in Gilmour Hall #209 and the receipt is then brought to Student

Experience - Academic Office (formerly the APO) in DSB 104

• the Area Chair will seek out an independent adjudicator to re-grade the component

• an adjustment to the grade for the component will be made if a grade change of three points

or greater on the 12 point scale (equivalent to 10 marks out of 100) has been suggested by the

adjudicator as assigned by the Area Chair

• if a grade change is made, the student fee will be refunded.

EXTRACURRICULAR ACTIVITIES

7B

DeGroote MarketWatch (http://trading.degroote.mcmaster.ca/degroote-marketwatch/)

The weekly DeGroote MarketWatch (DMW) is financial letter designed to inform/educate

DeGroote and the surrounding communities. The DMW prepared mostly by students and

supervised by myself serves as an experiential training ground allowing dedicated students to gain

hands on experience in concaving to readers market information and commentary. The DMW

tracks the pulse of markets, business news, finance information, commentary, investment tools,

and stories of interest submitted by students. Components of the DMW financial letter are:

Market Indices: Summarizes last week’s major markets’ activities (numbers and charts).

Economic Calendar: Outlines the next week’s major economic releases.

Canadian Market Summary: Highlights last week’s major events.

Market Outlook: Expectations for the upcoming week.

Story of Interest: An article that highlights a recent story submitted either by a student, faculty

member, or an industry professional. To submit a story of interest for a possible publication

in the DeGroote MarketWatch.

It is highly recommended that all students signup to receive the weekly DeGroote MarketWatch

update (at http://trading.degroote.mcmaster.ca/degroote-marketwatch/marketwatch-signup/).

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 6 of 11

ACADEMIC INTEGRITY

You are expected to exhibit honesty and use ethical behaviour in all aspects of the learning process.

Academic credentials you earn are rooted in principles of honesty and academic integrity.

Academic dishonesty is to knowingly act or fail to act in a way that results or could result in unearned

academic credit or advantage. This behaviour can result in serious consequences, e.g. the grade of

zero on an assignment, loss of credit with a notation on the transcript (notation reads: “Grade of F

assigned for academic dishonesty”), and/or suspension or expulsion from the university.

It is your responsibility to understand what constitutes academic dishonesty. For information on the

various types of academic dishonesty please refer to the Academic Integrity Policy, located at:

www.mcmaster.ca/academicintegrity

The following illustrates only three forms of academic dishonesty:

1. Plagiarism, e.g. the submission of work that is not one’s own or for which other credit has

been obtained.

2. Improper collaboration in group work.

3. Copying or using unauthorized aids in tests and examinations

REQUESTING RELIEF FOR MISSED ACADEMIC WORK

Students may request relief from a regularly scheduled midterm, test, assignment or other course

components. Please refer to the policy and procedure on the DeGroote website at the link below;

http://ug.degroote.mcmaster.ca/forms-and-resources/missed-course-work-policy/

STUDENT ACCESSIBILITY SERVICES

Students who require academic accommodation must contact Student Accessibility Services (SAS)

to make arrangements with a Program Coordinator. Academic accommodations must be arranged

for each term of study. Student Accessibility Services can be contacted by phone 905-525-9140 ext.

28652 or e-mail sas@mcmaster.ca.

For further information, consult McMaster University’s Policy for Academic Accommodation of

Students with Disabilities:

http://www.mcmaster.ca/policy/Students-AcademicStudies/AcademicAccommodation-

StudentsWithDisabilities.pdf

ACADEMIC ACCOMMODATION FOR RELIGIOUS, INDIGENOUS OR SPIRITUAL

OBSERVANCES (RISO)

Students requiring academic accommodation based on religious, indigenous or spiritual

observances should follow the procedures set out in the RISO policy. Students requiring a

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 7 of 11

RISO accommodation should submit their request, including the dates/times needing to be

accommodated and the courses which will be impacted, to their Faculty Office normally

within 10 days of the beginning of term or to the Registrar's Office prior to their examinations.

Students should also contact their instructors as soon as possible to make alternative

arrangements for classes, assignments, and tests.

https://multifaith.mcmaster.ca/riso

POTENTIAL MODIFICATIONS TO THE COURSE

The instructor reserves the right to modify elements of the course during the term. There may be

changes to the dates and deadlines for any or all courses in extreme circumstances. If either type of

modification becomes necessary, reasonable notice and communication with the students will be

given with explanation and the opportunity to comment on changes. It is the responsibility of the

student to check their McMaster email and course websites weekly during the term and to note any

changes.

RESEARCH USING HUMAN SUBJECTS

All researchers conducting research that involves human participants, their records or their biological

material are required to receive approval from one of McMaster’s Research Ethics Boards before (a)

they can recruit participants and (b) collect or access their data. Failure to comply with relevant

policies is a research misconduct matter. Contact these boards for further information about your

requirements and the application process.

McMaster Research Ethics Board (General board): https://reo.mcmaster.ca/

Hamilton Integrated Research Ethics Board (Medical board): http://www.hireb.ca/

ACKNOWLEDGEMENT OF COURSE POLICIES

Your enrolment in Commerce 4FI3 will be considered to be an implicit acknowledgement of the

course policies outlined above, or of any other that may be announced during lecture and/or on

A2L. It is your responsibility to read this course outline, to familiarize yourself with the course

policies and to act accordingly.

Lack of awareness of the course policies cannot be invoked at any point during this course for

failure to meet them. It is your responsibility to ask for clarification on any policies that you do not

understand.

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 8 of 11

Fall 2018 Commerce 4FI3 Course Outline

Market Trading with Futures and Forwards

Lectures Topics Material Covered

Lecture 1: Introduction to Financial Markets Chapters 1 & 2

1 Tutorial 1: Tools of The Trade Appendix 2A &

Avenue Handout

Lecture 2: The Cash Market Chapter 3

2 Appendix 1A & Avenue H.

Tutorial 2:Start Trading

Lecture 3: Market Direction Chapter 4

3 Tutorial 3: FTS Interactive Cases plus RE1s Avenue Handout

Lecture 4: Interest Rates Dynamics and Market Outlook Chapter 5

Tutorial 4: Thomson Reuters Eikon Avenue Handout

4

In class Case RE1s (practice)

Start Trading your Securities in FTS Real Trader

MID-TERM EXAM 1 (During class at 11:30 PM) Duration 80 minutes

5 Tutorial 5: Bloomberg Avenue Handout

In class Case FTS Trading RE1s (practice)

Lecture 5: The Forward and Futures Markets Chapter 12

Tutorial 6: RE2s Avenue Handout

6

In class FTS Trading Case RE1s (practice)

Deadline to Add Securities to FTS Real Time Trader (Oct. 19,2018)

Lecture 6: Trading with Futures: The Basics Chapter 13

7 Tutorial 7: B02as Avenue Handout

In class FTS Trading Case RE2s (for marks)

Lecture 7: Interest Rates Futures Spreads Chapter 14

8 Tutorial 8: B06s Avenue Handout

In class FTS Trading Case B02as (for marks)

Lecture 8: Spreading Index Futures Chapter 15

9 Tutorial 9: B03as Avenue Handout

In class FTS Trading Case B06s (for marks)

MID-TERM EXAM 2 (During class at 11:30 PM) Duration 80 minutes

10

Free Trading

Lecture 9: Arbitrage and Advanced Futures/Forward Strategies Chapter 16

11 Tutorial 10: IN2s Avenue Handout

In class FTS Trading Case B03s (for marks)

Lecture 10: Futures Options Chapter 17

12 Tutorial 11: FX2s Avenue Handout

In class FTS Trading Case IN2s (for marks)

13 Lecture 11: SWAPS Chapter 18

In class FTS Trading Case FX2s (for marks)

FINAL PROJECT DEADLINE: Due on the Monday after the last lecture

http://trading.degroote.mcmaster.ca/ 4FI3 - Fall 2019 - 9 of 11

You might also like

- Technology Entrepreneurship: Creating, Capturing, and Protecting ValueFrom EverandTechnology Entrepreneurship: Creating, Capturing, and Protecting ValueRating: 5 out of 5 stars5/5 (3)

- Fstep Manual Investment Banking FinalDocument208 pagesFstep Manual Investment Banking FinalThiện Phong100% (3)

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi67% (3)

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionRating: 3 out of 5 stars3/5 (2)

- The Life Story InterviewDocument7 pagesThe Life Story Interviewvasile.ada7716No ratings yet

- Human Ecology and Unwitting Anthropological Research For The CIADocument6 pagesHuman Ecology and Unwitting Anthropological Research For The CIABruno BrekaloNo ratings yet

- Peer Review Definition ExplainedDocument3 pagesPeer Review Definition ExplainedShamsol Kahar ShafieNo ratings yet

- Filipino English-Attitudes Towards English and Fil - English Code-Switching Amongst High School Students in Ormoc City, PhilippinesDocument49 pagesFilipino English-Attitudes Towards English and Fil - English Code-Switching Amongst High School Students in Ormoc City, PhilippinesAngie EspesoNo ratings yet

- Undergrad Thesis Template UpdatedDocument18 pagesUndergrad Thesis Template UpdatedGerard Ivan CatapangNo ratings yet

- Shs Eapp Qtr.2 Module 16Document18 pagesShs Eapp Qtr.2 Module 16Roxette MarieNo ratings yet

- Understanding 21st Century LiteratureDocument5 pagesUnderstanding 21st Century Literaturehazel100% (1)

- Benchmarking The University: Learning About ImprovementDocument107 pagesBenchmarking The University: Learning About ImprovementMihaela Maftei100% (1)

- HookPoint GuidetoGoingViral Oct20Document53 pagesHookPoint GuidetoGoingViral Oct20王佑希No ratings yet

- DerivativesDocument3 pagesDerivativesAditya SukhijaNo ratings yet

- Finance Elective BriefingDocument26 pagesFinance Elective Briefingbhagyesh taleleNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Investments Course Outline FinalDocument4 pagesInvestments Course Outline FinalHamza Nasir ChathaNo ratings yet

- Pagbasa at pagsulat tungo sa Pananaliksik (39Document7 pagesPagbasa at pagsulat tungo sa Pananaliksik (39Dondee PalmaNo ratings yet

- Fnce102 Chan SH Ay20-21 t1 (Final)Document5 pagesFnce102 Chan SH Ay20-21 t1 (Final)shanice.ellevinaaNo ratings yet

- Magister Manajemen - Investasi Master in Applied Finance and InvestmentDocument3 pagesMagister Manajemen - Investasi Master in Applied Finance and InvestmentIndra IgunNo ratings yet

- FINS3666 Outline 2019Document6 pagesFINS3666 Outline 2019jake chudnowNo ratings yet

- Intro to Investments & Stock TradingDocument2 pagesIntro to Investments & Stock TradingMr. Sharath Harady BBA - IADCANo ratings yet

- BudgetingDocument52 pagesBudgetingSewale AbateNo ratings yet

- 31st - Vi TrimesterDocument38 pages31st - Vi TrimesterPrasanth SurendharNo ratings yet

- Applied Value Investing (Duggal) FA2016Document3 pagesApplied Value Investing (Duggal) FA2016darwin12No ratings yet

- MGMT 3053 Course OutlineDocument4 pagesMGMT 3053 Course OutlineStephen M. NeilNo ratings yet

- Programme Structure: MSC in Finance and InvestmentDocument2 pagesProgramme Structure: MSC in Finance and InvestmentzorgtotofNo ratings yet

- FMG MBA 2025 Spring - Course Outline Updated 1 Jan 2023 ~ S.M. Ali. (1)Document15 pagesFMG MBA 2025 Spring - Course Outline Updated 1 Jan 2023 ~ S.M. Ali. (1)Umer NaeemNo ratings yet

- FINS1612 Capital Markets and Institutions S12016Document15 pagesFINS1612 Capital Markets and Institutions S12016fakableNo ratings yet

- International Finance Course Covers Global MarketsDocument2 pagesInternational Finance Course Covers Global MarketsmolapauNo ratings yet

- Derivatives Course OverviewDocument6 pagesDerivatives Course Overviewveda20No ratings yet

- A Study On Undestanding Consumer Behaviour Before Opting For Investment Related Courses OnlineDocument44 pagesA Study On Undestanding Consumer Behaviour Before Opting For Investment Related Courses Onlinerushikesh2096No ratings yet

- SMU Structured Products Course OverviewDocument3 pagesSMU Structured Products Course OverviewAlethea TanNo ratings yet

- 112_1 Syllabus of International Investments for Graduate Students 112_1Document15 pages112_1 Syllabus of International Investments for Graduate Students 112_1xinNo ratings yet

- FINANCE COURSES - Student Learning Outcomes: FIN 240: Legal Environment of BusinessDocument18 pagesFINANCE COURSES - Student Learning Outcomes: FIN 240: Legal Environment of BusinessGrant GreenNo ratings yet

- Fnce102 Karen GanDocument5 pagesFnce102 Karen GanYing SunNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- Comm 3FH3 - 2021-1-WDocument9 pagesComm 3FH3 - 2021-1-WAlyssa PerzyloNo ratings yet

- Investment SyllabusDocument6 pagesInvestment SyllabusAshish MakraniNo ratings yet

- Course OutlineDocument7 pagesCourse OutlineleighannNo ratings yet

- Investment Management 2015-16Document6 pagesInvestment Management 2015-16Udayan BhattacharyaNo ratings yet

- MQ Il 12 Ifm 8 Ar QOa X1 T 0 P 7 I Aol OXG7 Jy 6 Rxi BTLCJDocument131 pagesMQ Il 12 Ifm 8 Ar QOa X1 T 0 P 7 I Aol OXG7 Jy 6 Rxi BTLCJayo kunleNo ratings yet

- Applied Security Analysis 2023 - Bidding SyllabusDocument4 pagesApplied Security Analysis 2023 - Bidding SyllabusTrialNo ratings yet

- BAC3684 SIPM March 2011Document7 pagesBAC3684 SIPM March 2011chunlun87No ratings yet

- Counselling LaboratoryDocument22 pagesCounselling LaboratoryAnubhuti TripathiNo ratings yet

- Advanced Financial Instruments and Markets Course Guide BookDocument6 pagesAdvanced Financial Instruments and Markets Course Guide Bookfinancecottage100% (1)

- Investment Analysis and Portfolio ManagementDocument7 pagesInvestment Analysis and Portfolio ManagementrossNo ratings yet

- MBA582 INTERNATIONAL BUSINESS MANAGEMENT - 12 May 2022Document7 pagesMBA582 INTERNATIONAL BUSINESS MANAGEMENT - 12 May 2022taffiekapuyaNo ratings yet

- Course Outline: International Islamic University MalaysiaDocument7 pagesCourse Outline: International Islamic University MalaysiaakbmashNo ratings yet

- CO-MBAX9141-Term 3-MBAX9141 Mergers and Acquisitions - 2021Document8 pagesCO-MBAX9141-Term 3-MBAX9141 Mergers and Acquisitions - 2021naveed azeemNo ratings yet

- FinDerviatives CourseOutlineDocument2 pagesFinDerviatives CourseOutlineShivani Patnaik RajetiNo ratings yet

- Bim 29 V Tri SyllabiDocument26 pagesBim 29 V Tri SyllabishivamusNo ratings yet

- Course OutlineDocument2 pagesCourse Outlinemahbubur_phyNo ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- FIN518 201315 CM I-17 December 2012-Version 1Document27 pagesFIN518 201315 CM I-17 December 2012-Version 1Meng VannaryNo ratings yet

- Name - Prasad Vinod Wagh: Title: Two Days NISM Workshop ReportDocument2 pagesName - Prasad Vinod Wagh: Title: Two Days NISM Workshop ReportPrasad WaghNo ratings yet

- Leading European Business School MBA ProgramDocument2 pagesLeading European Business School MBA ProgramSarah A ANo ratings yet

- PM1Document3 pagesPM1hardikjain1819No ratings yet

- Finance Courses Student Learning Outcomes: Updated August 2015Document19 pagesFinance Courses Student Learning Outcomes: Updated August 2015Mazhar Farid ChishtiNo ratings yet

- Directorate of Distance EducationDocument400 pagesDirectorate of Distance EducationShalini.RNo ratings yet

- Entrep Skills Syllabus Fall 2023Document2 pagesEntrep Skills Syllabus Fall 2023gf2w6rtk6hNo ratings yet

- Technical Analysis of Securities ExplainedDocument5 pagesTechnical Analysis of Securities ExplainedVenu Gopal VegiNo ratings yet

- Finance Courses Student Learning OutcomesDocument18 pagesFinance Courses Student Learning OutcomesKJ VillNo ratings yet

- IBM HandbookDocument20 pagesIBM HandbooksyrianmanNo ratings yet

- FIN301 Outline FinalDocument13 pagesFIN301 Outline FinalArsalan AqeeqNo ratings yet

- FM PDFDocument5 pagesFM PDFShubham SinghNo ratings yet

- 4bfp Brochure-Qatar PDFDocument1 page4bfp Brochure-Qatar PDFMuhammad Usman SaeedNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document10 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- An Introduction to Stocks, Trading Markets and Corporate Behavior: The Investor's GuideFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: The Investor's GuideRating: 5 out of 5 stars5/5 (2)

- 1187-Article Text-2449-1-10-20180412Document19 pages1187-Article Text-2449-1-10-20180412Arash MojahedNo ratings yet

- Market Microstructure Knowledge Needed For Controlling An Intra-Day Trading ProcessDocument33 pagesMarket Microstructure Knowledge Needed For Controlling An Intra-Day Trading ProcessArash MojahedNo ratings yet

- "Market Microstructure Government Intervention in The Foreign ExchangeDocument47 pages"Market Microstructure Government Intervention in The Foreign ExchangeArash MojahedNo ratings yet

- 02 Micronotes 070907Document21 pages02 Micronotes 070907Arash MojahedNo ratings yet

- Market Microstructure Knowledge Needed For Controlling An Intra-Day Trading ProcessDocument33 pagesMarket Microstructure Knowledge Needed For Controlling An Intra-Day Trading ProcessArash MojahedNo ratings yet

- 1187-Article Text-2449-1-10-20180412Document19 pages1187-Article Text-2449-1-10-20180412Arash MojahedNo ratings yet

- 4FI3 F19 Siam 1Document9 pages4FI3 F19 Siam 1Arash MojahedNo ratings yet

- "Market Microstructure Government Intervention in The Foreign ExchangeDocument47 pages"Market Microstructure Government Intervention in The Foreign ExchangeArash MojahedNo ratings yet

- 02 Micronotes 070907Document21 pages02 Micronotes 070907Arash MojahedNo ratings yet

- ENG 151-4 Fall 2021 SyllabusDocument7 pagesENG 151-4 Fall 2021 SyllabusPj TuavaoNo ratings yet

- Research Proposal: Middlesex University MA International Business ManagementDocument8 pagesResearch Proposal: Middlesex University MA International Business ManagementMuskaan SoniNo ratings yet

- Practical Research Chapter 2Document17 pagesPractical Research Chapter 2Cristine Joy ObenaNo ratings yet

- Research Paper Group ActivitiesDocument7 pagesResearch Paper Group Activitiesgsrkoxplg100% (1)

- Imc Plan Final-2Document38 pagesImc Plan Final-2api-547499284No ratings yet

- Term Paper Chapter 4 FormatDocument6 pagesTerm Paper Chapter 4 Formatdpsjefsif100% (1)

- 460 Ch372actualpaperinijcsshbarcelonaDocument5 pages460 Ch372actualpaperinijcsshbarcelonaChristyNo ratings yet

- Ananomo, Anyamene & NwankwoDocument12 pagesAnanomo, Anyamene & NwankwoDonpedro AniNo ratings yet

- NP 5223 SLR1 PDFDocument246 pagesNP 5223 SLR1 PDFJuan Emanuel VenturelliNo ratings yet

- Data Analysis Exercise For Students: ST NDDocument3 pagesData Analysis Exercise For Students: ST NDNeil NguyenNo ratings yet

- DentalUM Spring/Summer 2010Document36 pagesDentalUM Spring/Summer 2010umdentNo ratings yet

- Practical Research 1Document14 pagesPractical Research 1Jasmine MontemayorNo ratings yet

- The Structural Function of Musical Textu PDFDocument7 pagesThe Structural Function of Musical Textu PDFMarcello Ferreira Soares Jr.No ratings yet

- Review of Research 12-8-16 FinalDocument39 pagesReview of Research 12-8-16 Finalapi-429057374No ratings yet

- Parag Project On Parag Milk PDFDocument99 pagesParag Project On Parag Milk PDFAshish ChaubeyNo ratings yet

- Results and Discussion Thesis PDFDocument7 pagesResults and Discussion Thesis PDFafbteepof100% (1)

- Brain-Based Learning TheoryDocument179 pagesBrain-Based Learning TheoryPsychoPak Official100% (1)

- Tata Kelola Kandang Dan Pakan Serta Implikasinya Pada Penggemukan SapiDocument5 pagesTata Kelola Kandang Dan Pakan Serta Implikasinya Pada Penggemukan SapiSugara LeonardNo ratings yet

- PROJECT REPORT On Eating Out Habit of Youth (BHOPAL)Document50 pagesPROJECT REPORT On Eating Out Habit of Youth (BHOPAL)salil12356100% (1)

- Impact of Accounting Software For Business Performance: January 2017Document7 pagesImpact of Accounting Software For Business Performance: January 2017Christine AbcedeNo ratings yet

- Quality of Life For People With Autism - Raising The Standard For Evaluating Successful Outcomes - Burgess & Gutstein (2007)Document7 pagesQuality of Life For People With Autism - Raising The Standard For Evaluating Successful Outcomes - Burgess & Gutstein (2007)eaguirredNo ratings yet