Professional Documents

Culture Documents

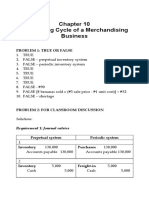

Problem 4 - Example

Problem 4 - Example

Uploaded by

Ginalyn BisongaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 4 - Example

Problem 4 - Example

Uploaded by

Ginalyn BisongaCopyright:

Available Formats

a.

Materials 180,000

Accounts Payable 180,000

b. WIP 60,000

FOH control 20,000

WHT Payable 11,200

SSS Premium Payable 2,400

PHIC Payable 375

Pagibig Cont. Payable 1,620

Accrued Payroll 64,405

c. Materials 20,000

Accounts Payable 20,000

d. FOH control 5,595

SSS Premium Payable 3,600

PHIC Payable 375

Pagibig Fund Payable 1,620

e. WIP 120,000

FOH control 10,000

Materials 130,000

f. Accounts Payable 5,000

Materials 5,000

g. Accrued Payroll 64,405

Accounts Payable 83,895

Cash 148,300

h. FOH control 24,900

Accounts Payable 24,900

i. WIP 72,000

FOH applied 72,000

(60,000 x 120%)

j. Finished Goods 180,000

WIP 180,000

k. Accounts Receivable 210,000

Sales 210,000

Cost of Goods Sold 140,000

Finished Goods 140,000

COGS statement:

DM 120,000

DL 60,000

FOH-applied 72,000

TMC 252,000

+ WIP, beg 0

- WIP, end 72,000

CGM 180,000

+FG, beg

-FG, end 40,000

COGS-normal 140,000

- Overapplied FOH 11,505

COGS-actual 128,495

FOH control (debit) 60,495

FOH applied (credit) 72,000

Over applied 11,505

You might also like

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Banitog - Chapter 6 (Problem 1)Document3 pagesBanitog - Chapter 6 (Problem 1)MyunimintNo ratings yet

- Chapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyDocument4 pagesChapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyCertified Public AccountantNo ratings yet

- Sol. Man. - Chapter 10 - Cash To Accrual Basis of Acctg.Document7 pagesSol. Man. - Chapter 10 - Cash To Accrual Basis of Acctg.KATHRYN CLAUDETTE RESENTE100% (1)

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Quiz 1 - SolutionDocument8 pagesQuiz 1 - SolutionAyra BernabeNo ratings yet

- Chapter 5 AssignmentDocument10 pagesChapter 5 AssignmentJohnray ParanNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- 61oq678rf - CD - CHAPTER 10 - ACCTG CYCLE OF A MERCHANDISING BUSINESSDocument17 pages61oq678rf - CD - CHAPTER 10 - ACCTG CYCLE OF A MERCHANDISING BUSINESSLyra Mae De BotonNo ratings yet

- 61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument17 pages61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonNo ratings yet

- Cost AcctgDocument5 pagesCost AcctgJerome MonserratNo ratings yet

- 1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Document14 pages1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Shien Angel Delos ReyesNo ratings yet

- I. Entries For The Transaction of Ram CompanyDocument4 pagesI. Entries For The Transaction of Ram CompanyHafida TOMAWISNo ratings yet

- Cash Basis To Accrual Basis of Accounting: Problem 1: For Classroom DiscussionDocument9 pagesCash Basis To Accrual Basis of Accounting: Problem 1: For Classroom DiscussionPaula BautistaNo ratings yet

- M4 Answer Key 1 Nad 3Document11 pagesM4 Answer Key 1 Nad 3JOSCEL SYJONGTIANNo ratings yet

- Name: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Document5 pagesName: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Cherry MaeNo ratings yet

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument40 pagesChapter 10 Accounting Cycle of A Merchandising BusinessOmelkhair YahyaNo ratings yet

- Journal Entries (COST)Document2 pagesJournal Entries (COST)CarlNo ratings yet

- Job Order Costing Process Costing Batch Costing Contract Costing Marginal CostingDocument8 pagesJob Order Costing Process Costing Batch Costing Contract Costing Marginal CostingHamza AsifNo ratings yet

- Myco Paque InventoriesDocument5 pagesMyco Paque InventoriesMYCO PONCE PAQUENo ratings yet

- Answer c20Document7 pagesAnswer c20Võ Huỳnh BăngNo ratings yet

- Integrated Accounting AssignmentDocument4 pagesIntegrated Accounting Assignmentjustinmajok8No ratings yet

- Toaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRDocument12 pagesToaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRMeg Lorenz DayonNo ratings yet

- Cost Accounting FNLDocument13 pagesCost Accounting FNLImthe OneNo ratings yet

- Answer Key Midterm Exam Cost Acounting With Solutions PART IIDocument7 pagesAnswer Key Midterm Exam Cost Acounting With Solutions PART IINoel Carpio100% (1)

- Questions On ALOBIDocument3 pagesQuestions On ALOBIGlory Nicol OrapaNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- Chapter 3 Comp. ProblemsDocument9 pagesChapter 3 Comp. ProblemsIrish Gracielle Dela CruzNo ratings yet

- Quiz 2Document4 pagesQuiz 2Nicole Kyle AsisNo ratings yet

- Business Combination MergerDocument108 pagesBusiness Combination Mergergojo satoruNo ratings yet

- Additional Answers Exercises COGM-COGS-JEs PDFDocument2 pagesAdditional Answers Exercises COGM-COGS-JEs PDFNicola Erika EnriquezNo ratings yet

- Corp. BankruptcyDocument7 pagesCorp. BankruptcyLorifel Antonette Laoreno TejeroNo ratings yet

- Activity 4 Job Order CostingDocument4 pagesActivity 4 Job Order CostingJOSCEL SYJONGTIANNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Answer Key MFTG ActivityDocument5 pagesAnswer Key MFTG ActivityMayo7jomelNo ratings yet

- Chapter 9Document28 pagesChapter 9mastersepai01No ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- Practical Accounting 2 1Document24 pagesPractical Accounting 2 1NCTNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Class Assignment Excel Pertemuan 3 JOB COSTINGDocument6 pagesClass Assignment Excel Pertemuan 3 JOB COSTINGMarcia Gretchen LynneNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Balance SheetDocument8 pagesBalance SheetCaryl Joyce OmboyNo ratings yet

- JOB ORDER-Rework Spoilage and EntriesDocument17 pagesJOB ORDER-Rework Spoilage and EntriesxjammerNo ratings yet

- Bus. Combi Probs and SolnDocument3 pagesBus. Combi Probs and SolnRyan Prado AndayaNo ratings yet

- Chapter 4 Receivables and Related RevenuesDocument12 pagesChapter 4 Receivables and Related Revenuesjohn condesNo ratings yet

- Cost Bookkeeping With AnswersDocument9 pagesCost Bookkeeping With AnswersHafsa HayatNo ratings yet

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument37 pagesChapter 10 Accounting Cycle of A Merchandising BusinessArlyn Ragudos BSA1No ratings yet

- Cost Bookkeeping AnswersDocument9 pagesCost Bookkeeping AnswersMuhammad Hassan Uddin100% (1)

- Fine Manufacturing CompanyDocument4 pagesFine Manufacturing CompanyexquisiteNo ratings yet

- PDF Sol Man Chapter 10 Cash To Accrual Basis of Acctg - CompressDocument9 pagesPDF Sol Man Chapter 10 Cash To Accrual Basis of Acctg - CompressFrost GarisonNo ratings yet

- Journal Entries A. Purchase of Raw MaterialsDocument3 pagesJournal Entries A. Purchase of Raw MaterialsAngel PasaholNo ratings yet

- Acct HW3Document11 pagesAcct HW3Natalie ChoiNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Accounting For Raw MaterialsDocument5 pagesAnsay, Allyson Charissa T. - BSA 2 - Accounting For Raw Materialsカイ みゆきNo ratings yet

- QuestionsDocument1 pageQuestionsGinalyn BisongaNo ratings yet

- What Is TeamDocument2 pagesWhat Is TeamGinalyn BisongaNo ratings yet

- TundraDocument1 pageTundraGinalyn BisongaNo ratings yet

- PartnershipDocument117 pagesPartnershipGinalyn BisongaNo ratings yet

- Ramirez Learning Module in Taxation Income Taxation TRAIN Law Updated - Lesson 1Document20 pagesRamirez Learning Module in Taxation Income Taxation TRAIN Law Updated - Lesson 1Ginalyn BisongaNo ratings yet

- Income TaxDocument69 pagesIncome TaxGinalyn BisongaNo ratings yet

- Activity Inventory Cost Flow and LCNRVDocument3 pagesActivity Inventory Cost Flow and LCNRVGinalyn BisongaNo ratings yet