Professional Documents

Culture Documents

Costing - As Level

Uploaded by

MUSTHARI KHANOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing - As Level

Uploaded by

MUSTHARI KHANCopyright:

Available Formats

ANSWER THE FOLLOWING:

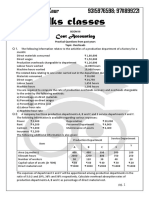

1.The summary of overheads for the three production departments and two service departments of a company

have been provided below.

Department A B C S1 S2

Overheads ($) 20,000 15,000 25,000 18,000 12,000

The service departmental costs are apportioned as follows.

A B C S1 S2

S1 25% 30% 35% - 10%

S2 30% 30% 25% 15% -

Required:

Apportion the service centre costs and determine the total production departments’ overheads after the

apportionment.

2.The following data has been extracted from the operating records of QQQ Ltd for the last two quarters of the

year to 31 December 2020:

Quarter 3 4

Production units 7,000 8,500

Sales units 5,500 9,500

Selling price per unit 100

Variable manufacturing cost per unit:

Direct material cost 20

Direct labour cost 15

Variable overheads 10

Fixed production overheads are budgeted at $ 120,000 for a budgeted production of 8,000 units per quarter.

These overheads are absorbed on per unit of production basis.

Non-production overheads comprised:

Fixed administration expenses $ 40,000 per quarter.

Selling and distribution expenses 10% of sales.

Required:

Prepare a statement of profit or loss for each quarter using:

a) The Marginal Costing technique b) The Absorption Costing technique

MARKING SCHEME

You might also like

- Act 6010 C Fall 2022 Final Sem ExaminationsDocument5 pagesAct 6010 C Fall 2022 Final Sem ExaminationsSimon JosiahNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Review Questions Principles of Cost Accounting - 070850Document7 pagesReview Questions Principles of Cost Accounting - 070850Daniel JuliusNo ratings yet

- MA-II Assignment V - Short Run Decision AnalysisDocument4 pagesMA-II Assignment V - Short Run Decision Analysisshriya2413No ratings yet

- Between The Brackets Write (T) If The Statement Is TRUE or (F) If The Statement IsDocument5 pagesBetween The Brackets Write (T) If The Statement Is TRUE or (F) If The Statement IsAhmed EltayebNo ratings yet

- Bíñüäpü Báárwüúwæ A®Üáwüá - Êýx Gçýé Ë Ýwüwüúwæ Eñü Äôä. ®Ý® & Æäåàwýåêæáà Ç Pýâæárçæàoã Õ E Üáãàxóü Öüá ÜáDocument8 pagesBíñüäpü Báárwüúwæ A®Üáwüá - Êýx Gçýé Ë Ýwüwüúwæ Eñü Äôä. ®Ý® & Æäåàwýåêæáà Ç Pýâæárçæàoã Õ E Üáãàxóü Öüá ÜáSudhir SoudagarNo ratings yet

- U Win Bo Myint Cost and Management Overhead Homework - 2Document3 pagesU Win Bo Myint Cost and Management Overhead Homework - 2Theint Myat KyalsinNo ratings yet

- Chapter 6 OverheadsDocument3 pagesChapter 6 OverheadsDevender SinghNo ratings yet

- 9 Budgets - Budgetary ControlDocument10 pages9 Budgets - Budgetary ControlLakshay SharmaNo ratings yet

- ACCT2522 Past Year In-Class Test ExampleDocument13 pagesACCT2522 Past Year In-Class Test Examplea7698998No ratings yet

- Fima Week 2 ActivitiesDocument9 pagesFima Week 2 ActivitiesKatrina PaquizNo ratings yet

- Materi Untuk Tugas Topik 2Document11 pagesMateri Untuk Tugas Topik 2Violen AmeliaNo ratings yet

- FYMMS Cost and MA AssignmentDocument2 pagesFYMMS Cost and MA AssignmentRahul Nishad100% (1)

- HBC 2117, Hps 2108 Cost AccountingDocument5 pagesHBC 2117, Hps 2108 Cost AccountingBennyhin OduorNo ratings yet

- IPCC Cost - Kol73cck4annhfcjovu6Document17 pagesIPCC Cost - Kol73cck4annhfcjovu6aryanraghuvanshi758No ratings yet

- Mcom QP Amd 40 MarksDocument2 pagesMcom QP Amd 40 Marksirfanahmed.dbaNo ratings yet

- Mba104 - Cost and Management Accounting PDFDocument3 pagesMba104 - Cost and Management Accounting PDFAnurag VarmaNo ratings yet

- Overhead Analysis QuestionsDocument9 pagesOverhead Analysis QuestionsKiri chrisNo ratings yet

- Marginal Costing & Breakeven Analysis - QDocument6 pagesMarginal Costing & Breakeven Analysis - QManav MaistryNo ratings yet

- JobDocument4 pagesJobNeha SmritiNo ratings yet

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- Skans School of Accountancy Cost & Management Accounting - Caf 08 Class Test # 1Document4 pagesSkans School of Accountancy Cost & Management Accounting - Caf 08 Class Test # 1maryNo ratings yet

- Af 211-Assignment 1Document6 pagesAf 211-Assignment 1latifa.haroun100% (1)

- Review Questions-Ac, MC &CVPDocument4 pagesReview Questions-Ac, MC &CVPOctavius MuyungiNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Ch-06 Cost AllocationDocument1 pageCh-06 Cost AllocationEbsa AbdiNo ratings yet

- AFAR Self Test - 9003Document6 pagesAFAR Self Test - 9003King MercadoNo ratings yet

- Class Notes On CVP AnalysisDocument2 pagesClass Notes On CVP AnalysisEdson MungaNo ratings yet

- 7 2010 Jun QDocument8 pages7 2010 Jun QWeezy360No ratings yet

- Applied Cost AccountingDocument2 pagesApplied Cost AccountingamaljacobjogilinkedinNo ratings yet

- Prepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsDocument6 pagesPrepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsMiljane PerdizoNo ratings yet

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- Cost Accounting BBS - 2200 Test 2Document5 pagesCost Accounting BBS - 2200 Test 2PAULNo ratings yet

- Quiz For Cost AccountingDocument2 pagesQuiz For Cost AccountingNico Bicaldo100% (2)

- Ge02 Model Question - Cma June 2018 - PacademiaDocument6 pagesGe02 Model Question - Cma June 2018 - PacademiaSumon Kumar DasNo ratings yet

- CA FINAL Transfer PricingDocument11 pagesCA FINAL Transfer Pricingjkrapps100% (1)

- Chapter 13 WordDocument12 pagesChapter 13 WordAmanda ClaroNo ratings yet

- Mas Quizzer - Anaylysis 2021 Part 2Document9 pagesMas Quizzer - Anaylysis 2021 Part 2Ma Teresa B. CerezoNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Mba MGT ACCT (ILLUSTRATION QUESTIONS)Document13 pagesMba MGT ACCT (ILLUSTRATION QUESTIONS)biggykhairNo ratings yet

- Chapter 4 Overhead ProblemsDocument5 pagesChapter 4 Overhead Problemsthiluvnddi100% (1)

- 1) Answer Any Five Question From The Following .Each Question Carries Two MarksDocument14 pages1) Answer Any Five Question From The Following .Each Question Carries Two Marksmanasa k pNo ratings yet

- Tutorial OverheadDocument6 pagesTutorial OverheadImran FarhanNo ratings yet

- M 2010 Jun PDFDocument35 pagesM 2010 Jun PDFMoses LukNo ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- GEN292 2 Prod Assignment 1 2023Document3 pagesGEN292 2 Prod Assignment 1 2023Mohamed GamalNo ratings yet

- RVU CMA Work Sheet March 2019Document12 pagesRVU CMA Work Sheet March 2019Henok FikaduNo ratings yet

- MA hw6Document5 pagesMA hw6Caleb BuddNo ratings yet

- Management Accounting Problem Unit 5Document7 pagesManagement Accounting Problem Unit 5princeNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- ADDITIONAL PROBLEMS Variable and Absorption and ABCDocument2 pagesADDITIONAL PROBLEMS Variable and Absorption and ABCkaizen shinichiNo ratings yet

- Marginal Costing Decision MakingDocument3 pagesMarginal Costing Decision MakingDhanesh PatilNo ratings yet

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vii (UNIT-V)Document7 pagesSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vii (UNIT-V)Jaya BharneNo ratings yet

- Cost Management AssignmentDocument29 pagesCost Management AssignmentInanda MeitasariNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Lcci - Higher - 2022 - QPDocument20 pagesLcci - Higher - 2022 - QPMUSTHARI KHANNo ratings yet

- Retirement of Partner - A LevellDocument3 pagesRetirement of Partner - A LevellMUSTHARI KHANNo ratings yet

- Standard Costing - A LevelDocument3 pagesStandard Costing - A LevelMUSTHARI KHANNo ratings yet

- Abc 1Document2 pagesAbc 1MUSTHARI KHANNo ratings yet

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- Activity Based Costing - A Level - No MSDocument3 pagesActivity Based Costing - A Level - No MSMUSTHARI KHANNo ratings yet

- A2 Accounting - Topicwise Past Paper QuestionsDocument5 pagesA2 Accounting - Topicwise Past Paper QuestionsMUSTHARI KHANNo ratings yet