Professional Documents

Culture Documents

HW9

HW9

Uploaded by

lidibarv0 ratings0% found this document useful (0 votes)

8 views2 pagesThe document summarizes the taxable and non-taxable revenue sources for a company as well as the direct and administrative costs associated with each. It then calculates what percentage of total activities are exempt to determine if separate accounting is required. Finally, it shows the recoverable and non-recoverable input VAT amounts based on the allocation of direct and administrative costs to taxable and exempt activities.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the taxable and non-taxable revenue sources for a company as well as the direct and administrative costs associated with each. It then calculates what percentage of total activities are exempt to determine if separate accounting is required. Finally, it shows the recoverable and non-recoverable input VAT amounts based on the allocation of direct and administrative costs to taxable and exempt activities.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesHW9

HW9

Uploaded by

lidibarvThe document summarizes the taxable and non-taxable revenue sources for a company as well as the direct and administrative costs associated with each. It then calculates what percentage of total activities are exempt to determine if separate accounting is required. Finally, it shows the recoverable and non-recoverable input VAT amounts based on the allocation of direct and administrative costs to taxable and exempt activities.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

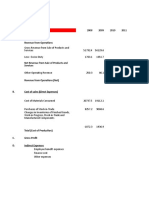

Taxable revenue

Non-taxable (exempt) revenue – services to foreign customers

Non-taxable (exempt) revenue from sale of securities

Direct current purchases related to taxable activities

Direct current purchases related to non-taxable activities

Administrative indirect depreciation, gross salaries and obligatory insurance contributions (IC)

Administrative indirect current purchases

RR 5% test (significance) RR

242400000 Costs directly related to exempt sales 1800000

84000000 Share of admin related to exempt sales 37.85%

39000000 Admin costs related to exempt sales 75503076.92

12000000 Total costs related to exempt sales 77303076.92

1800000 Total costs for Q1 211300000

237000000 Share of exempt activities 36.58% >5%

2400000

Separate accounting

Recoverable input VAT: RR

On direct costs 2000000

On administrative costs 24799384.62

Total recoverable input VAT 26799384.62

Non-recoverable VAT on purchases: RR

On direct costs 300000

On administrative costs 15100615.38

Total non-recoverable input VAT 15400615.38

You might also like

- Class 9Document2 pagesClass 9lidibarvNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Other Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossDocument6 pagesOther Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossKeahlyn BoticarioNo ratings yet

- Optional Standard Deductions ExampleDocument7 pagesOptional Standard Deductions ExampleSandia EspejoNo ratings yet

- Surendra Sir BuscalcualtionDocument3 pagesSurendra Sir BuscalcualtionPrasiddha PradhanNo ratings yet

- Tugas Income StatementDocument4 pagesTugas Income StatementhaniNo ratings yet

- Tax System in BangladeshDocument6 pagesTax System in BangladeshNahid Hussain AdriNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- E4.1 - Compute Income MeasuresDocument3 pagesE4.1 - Compute Income MeasuresMonicaNo ratings yet

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesNo ratings yet

- Tutorial 8-CIT3-2024 - AnswerDocument15 pagesTutorial 8-CIT3-2024 - Answercaduong0109No ratings yet

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Document57 pagesMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- Horizontal AnalysisDocument6 pagesHorizontal AnalysisEttiene Leeam OcampoNo ratings yet

- Chapter 4Document3 pagesChapter 4anhtd13.sscNo ratings yet

- Taller OficialDocument74 pagesTaller OficialDENNIS DEPITA MORONNo ratings yet

- VAT IllustrationsDocument1 pageVAT IllustrationsThu ThuNo ratings yet

- Pajaaaaaaaaaaaaaaaaaaaaaaaaaaaaak MbohDocument2 pagesPajaaaaaaaaaaaaaaaaaaaaaaaaaaaaak MbohSyaiful NizarNo ratings yet

- Havells Income STMT 2009-2013Document11 pagesHavells Income STMT 2009-2013K.GayathiriNo ratings yet

- Nok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Document4 pagesNok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Risma AmeliaNo ratings yet

- PRM41 Sec-D D3 AnalysisDocument6 pagesPRM41 Sec-D D3 AnalysisAnushree PareekNo ratings yet

- Output and Input VAT1Document21 pagesOutput and Input VAT1Eza MayandiaNo ratings yet

- Liabilites 2000 2001 Assets 2000 2001: Balance SheetDocument9 pagesLiabilites 2000 2001 Assets 2000 2001: Balance SheetGiri SukumarNo ratings yet

- Common Size and Comparative Statements Format of Statement of Profit and LossDocument18 pagesCommon Size and Comparative Statements Format of Statement of Profit and LosssatyaNo ratings yet

- Revenue Memorandum Circular 36-2021 v2Document32 pagesRevenue Memorandum Circular 36-2021 v2lizzyNo ratings yet

- Revision For CIT & VAT 2017Document2 pagesRevision For CIT & VAT 2017Ý PhanNo ratings yet

- Case 5-33 (Pittman) - 1Document12 pagesCase 5-33 (Pittman) - 1MOHAK ANANDNo ratings yet

- Finance Quiz 2Document35 pagesFinance Quiz 2Peak ChindapolNo ratings yet

- Excercise ProblemsDocument7 pagesExcercise ProblemsKatherine EderosasNo ratings yet

- Salary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Document5 pagesSalary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Samia AkterNo ratings yet

- Income Taxation 2023 DiscussionsDocument16 pagesIncome Taxation 2023 DiscussionsKenjay SarcoNo ratings yet

- Input TaxDocument18 pagesInput TaxAmie Jane MirandaNo ratings yet

- BFAR Chap 8 Prob 8 Accounting Cycle of A Merchandising BusinessDocument2 pagesBFAR Chap 8 Prob 8 Accounting Cycle of A Merchandising Businessscryx bloodNo ratings yet

- Dreddy FinalDocument11 pagesDreddy FinalNavneet SharmaNo ratings yet

- Tut-1 TaxDocument3 pagesTut-1 Taxbolaemil20No ratings yet

- Principle of Accounting Practical WorkDocument5 pagesPrinciple of Accounting Practical WorkSushmitaNo ratings yet

- Review Problems and Notes in VAT - With Answers and SolutionsDocument27 pagesReview Problems and Notes in VAT - With Answers and SolutionsCPAREVIEWNo ratings yet

- FINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Document44 pagesFINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Srinivas Muchantula100% (4)

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Jawaban E4.11Document2 pagesJawaban E4.11Muhammad RafiNo ratings yet

- SciDocument3 pagesSciDonita BinayNo ratings yet

- SciDocument3 pagesSciJomar VillenaNo ratings yet

- Chapter 3. Exercises Income StatementDocument6 pagesChapter 3. Exercises Income StatementHECTOR ORTEGANo ratings yet

- Nput Vat On Mixed TransactionsDocument15 pagesNput Vat On Mixed TransactionsBSACCBLK1COLEEN CALUGAYNo ratings yet

- Income From Business and Profession: Add: Inadmissiable ExpensesDocument8 pagesIncome From Business and Profession: Add: Inadmissiable ExpensessanamdadNo ratings yet

- Deductions TaxationDocument4 pagesDeductions Taxationramosinducil05No ratings yet

- Group ProjectDocument9 pagesGroup ProjectsnsahaNo ratings yet

- (Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Document5 pages(Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Felicitte Mae Guico LabarosaNo ratings yet

- NRG AUTO LIMITED-5-Year-Financial-PlanDocument21 pagesNRG AUTO LIMITED-5-Year-Financial-Plandariaivanov25No ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- Installed Cost of Proposed Machine 400,000Document5 pagesInstalled Cost of Proposed Machine 400,000Mariame Abasola CagabhionNo ratings yet

- VAT-problems-key by Andrew Gil AmbrayDocument10 pagesVAT-problems-key by Andrew Gil AmbrayMark Gelo WinchesterNo ratings yet

- The Financial Model: InputDocument4 pagesThe Financial Model: InputCarla GonçalvesNo ratings yet