Professional Documents

Culture Documents

The Company About Thompson Telescopes

Uploaded by

gooddj4022Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Company About Thompson Telescopes

Uploaded by

gooddj4022Copyright:

Available Formats

The company

Although Thompson had grown rapidly after it had established UK manufacturing facilities, sales

turnover had flattened in recent years. Table 29.1 shows the profit/loss statement, and Table 29.2

the balance sheet for this period. Thompson is currently regarded as a poor performer within

Murray, and finds it difficult to attract investment for the further growth in sales the company

believes is possible. The organisation chart for Thompson is shown in Figure 29.1, and the main

functions can briefly be explained as follows.

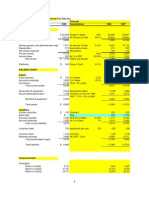

Table 29.1

Consolidated profit and loss account (£000) 1996 1997 1998 1999 2000 2001 Turnover 2784 4192

6462 8961 8349 9073 Cost of sales 1953 2934 4394 5735 5594 6069 Gross profit 831 1258 2068

3226 2755 3004 Admin expenses 1011 1360 1807 2320 2210 2720 Trading profit (180) (102) 261 906

545 284

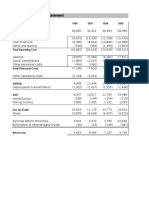

Table 29.2

Consolidated balance sheet (£000) 1996 1997 1998 1999 2000 2001 Fixed assets Tangible assets 270

1021 1507 2294 2095 1943 Current assets Stocks 1189 1487 1589 1907 2288 2794 Debtors 565 979

1152 1356 1648 2010 Cash in hand (200) (103) (53) 752 505 230 Creditors 432– 621– 1207– 1564–

1156– 1023– Net current assets 1122 1742 1481 2451 3285 4011 Costing (3) Payroll (1) Accounts (4)

Finance Director Peter Nuttall Sales (6) Sales (8) Support Sales Manager Reg Fox Design (4) Drawing

Office (6) Engineering Directo

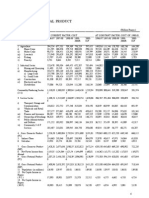

Figure 29.1 Thompson Telescopes: organisation chart

Managing Director John Tulk

Costing (3) Payroll (1) Accounts (4) Finance Director Peter Nuttall Sales (6) Sales (8) Support Sales

Manager Reg Fox Design (4) Drawing Office (6) Engineering Director Jack Rule Production (2)

Engineering Buying (2) Stock (3) Controller Warehouse (3) Controller Works (25) Manager

Manufacturing Manager Bronwen Curtess

You might also like

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdeNo ratings yet

- Calaveras Vineyards ExhibitsDocument9 pagesCalaveras Vineyards ExhibitsAbhishek Mani TripathiNo ratings yet

- Energy GelDocument4 pagesEnergy Gelchetan DuaNo ratings yet

- Diamond Chemicals Case ExhibitsDocument2 pagesDiamond Chemicals Case Exhibitsabhi422100% (1)

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Kohler DCFDocument1 pageKohler DCFJennifer Langton100% (1)

- Number Crunching File For Markstrat ProjectDocument35 pagesNumber Crunching File For Markstrat ProjectNishant Kumar100% (1)

- Student: Assumptions / InputsDocument10 pagesStudent: Assumptions / InputsAnuj BhattNo ratings yet

- Eastboro Machine Tools Corporation: Exhibit 1Document10 pagesEastboro Machine Tools Corporation: Exhibit 1Angela Lopez100% (1)

- United Parcel Services IPODocument16 pagesUnited Parcel Services IPOsriharshakalidasu0% (1)

- Froid Accounting CaseDocument11 pagesFroid Accounting Caselouiegoods2450% (2)

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Palamon Capital PartnersDocument9 pagesPalamon Capital PartnersIngridHoernigCubillos0% (1)

- Salem Co.Document18 pagesSalem Co.abhay_prakash_ranjan75% (4)

- ( ) (% Sales) ( ) (% Sales) ( ) (%sales) : AssetsDocument7 pages( ) (% Sales) ( ) (% Sales) ( ) (%sales) : Assetsslp42No ratings yet

- Microsoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)Document5 pagesMicrosoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)sabah8800No ratings yet

- Press Release Sony Ericsson Reports Second Quarter Results: July 16, 2009Document11 pagesPress Release Sony Ericsson Reports Second Quarter Results: July 16, 2009it4728No ratings yet

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupNo ratings yet

- SifirGaji J29 J32 J38Document6 pagesSifirGaji J29 J32 J38Fazleen Farahanim Bt HanafiNo ratings yet

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- The Business Environment and Business EconomicsDocument28 pagesThe Business Environment and Business EconomicsAbhinav GoyalNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- 21 Profit and Loss AccountDocument1 page21 Profit and Loss AccountAhmad KhanNo ratings yet

- Excel Presentation Files: Jim Colville, CPA 858-682-9668Document17 pagesExcel Presentation Files: Jim Colville, CPA 858-682-9668வந்தனா வைரமுத்துNo ratings yet

- Sears Vs Wal-Mart Case ExhibitsDocument8 pagesSears Vs Wal-Mart Case ExhibitscharlietoneyNo ratings yet

- Week 10 Tutorial Problem 1) : Income Statement For Years Ended 30 JuneDocument2 pagesWeek 10 Tutorial Problem 1) : Income Statement For Years Ended 30 JuneHasan MahfoozNo ratings yet

- Measuring International CompetitivenessDocument3 pagesMeasuring International Competitivenessshish789No ratings yet

- Measuring International CompetitivenessDocument3 pagesMeasuring International Competitivenessshish789No ratings yet

- East West University: Assignment - 1Document2 pagesEast West University: Assignment - 1naimulehasanNo ratings yet

- 128 34 2 en ArcelormittalReportsThirdQuarter2010ResultsDocument21 pages128 34 2 en ArcelormittalReportsThirdQuarter2010ResultsmithunsarangalNo ratings yet

- ECSH 3Q 2009 Announcement 111109Document16 pagesECSH 3Q 2009 Announcement 111109WeR1 Consultants Pte LtdNo ratings yet

- Tata Motors PresentationDocument5 pagesTata Motors Presentationakshay!No ratings yet

- Case 51 Palamon Capital Partners Team System SPADocument10 pagesCase 51 Palamon Capital Partners Team System SPAcrs50% (2)

- KAMAZ Group International Financial Reporting Standards Consolidated Condensed Interim Financial Information (Unaudited) 30 June 2009Document24 pagesKAMAZ Group International Financial Reporting Standards Consolidated Condensed Interim Financial Information (Unaudited) 30 June 2009anovcNo ratings yet

- Assignment Home DepotDocument21 pagesAssignment Home DepotM UmarNo ratings yet

- Practice Sheet - 02 - KMBN 104 (UNIT - II) NewDocument8 pagesPractice Sheet - 02 - KMBN 104 (UNIT - II) New75227sumitNo ratings yet

- Excel Module 1Document292 pagesExcel Module 1Vansh GargNo ratings yet

- Data AnalysisDocument6 pagesData AnalysisBhaswani0% (1)

- 2.1 Gross National ProductDocument8 pages2.1 Gross National Productshoaib625No ratings yet

- TM 5-3895-369-24PDocument512 pagesTM 5-3895-369-24PAdvocateNo ratings yet

- Games Data Log TransformationDocument2 pagesGames Data Log TransformationIzreen FaraNo ratings yet

- 2009 H1 Presentation PDFDocument36 pages2009 H1 Presentation PDFTimBarrowsNo ratings yet

- Holly FashionDocument6 pagesHolly FashionAndreea MNo ratings yet

- Accounting Level 3/series 2 2008 (Code 3001)Document16 pagesAccounting Level 3/series 2 2008 (Code 3001)Hein Linn Kyaw67% (3)

- Bentley Motors LimitedDocument2 pagesBentley Motors LimitedDivyajeevNo ratings yet

- N Division After Sales Presentation: ZF Friedrichshafen AGDocument13 pagesN Division After Sales Presentation: ZF Friedrichshafen AGAbhishek kumarNo ratings yet

- News Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsDocument25 pagesNews Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsRobert Edward BallNo ratings yet

- Martin Engegren Sony Ericsson q1 2009Document9 pagesMartin Engegren Sony Ericsson q1 2009martin_engegrenNo ratings yet

- Directors Report Year End: Mar '10: Explore Tata Steel ConnectionsDocument15 pagesDirectors Report Year End: Mar '10: Explore Tata Steel ConnectionsChetan PatelNo ratings yet

- 5 Herman Miller Presentation Group Final 1Document31 pages5 Herman Miller Presentation Group Final 1lynklynkNo ratings yet

- Yanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109Document31 pagesYanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109WeR1 Consultants Pte LtdNo ratings yet

- Ucb (Report)Document3 pagesUcb (Report)Shruti VasudevaNo ratings yet

- Study Unit 15 - Solution Q 1, 2 3Document5 pagesStudy Unit 15 - Solution Q 1, 2 3dumisaniNo ratings yet

- Mindtree ValuationDocument74 pagesMindtree ValuationAmit RanderNo ratings yet

- Adecco Sa'S Acquisition of Olsten CorpDocument18 pagesAdecco Sa'S Acquisition of Olsten CorpAditya AnandNo ratings yet

- Half-Year Report 2010: Swatch Group - Record Half-Year Results in Terms of Both Sales and ProfitDocument15 pagesHalf-Year Report 2010: Swatch Group - Record Half-Year Results in Terms of Both Sales and ProfitMan Tan CheongNo ratings yet

- TN 7Document11 pagesTN 7patternprojectNo ratings yet

- Irwin/Mcgraw Hill Step-By-Step Problem: Student Name: Instructor ClassDocument6 pagesIrwin/Mcgraw Hill Step-By-Step Problem: Student Name: Instructor ClassKris NandoNo ratings yet