Professional Documents

Culture Documents

Joint-Arrangements PracticeQuestions

Uploaded by

Ampeloquio Macky B.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joint-Arrangements PracticeQuestions

Uploaded by

Ampeloquio Macky B.Copyright:

Available Formats

JOINT ARRANGEMENT

Problem Solving:

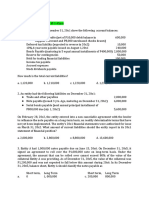

1. On January 1, 2021, Entity A, a public entity, and Entity B, a public entity, incorporated Entity C which

has its fiscal and operational autonomy. The contractual agreement of the incorporating entities

provided that the decisions on relevant activities of Entity C will require unanimous consent of both

entities. Entity A and Entity B will have rights to the net assets of Entity C.

Entity A and Entity B invested P 1,000,000 and P 1,500,000, respectively, equivalent to 40:60 capital

interest of Entity C. The financial statements of Entity C provided the following date for its two-year

operation:

Net income (loss) Dividends declared

2021 200,000 100,000

2022 (2,000,000) -

1. What is the balance of Investment in Entity C to be reported by Entity A in its Statement of Financial

Position on December 31, 2022?

a. 1,080,000

b. 1,040,000

c. 240,000

d. 200,000

2. What is the balance of Investment in Entity C to be reported by Entity B in its Statement of Financial

Position on December 31, 2022?

a. 1,500,000

b. 1,620,000

c. 360,000

d. 900,000

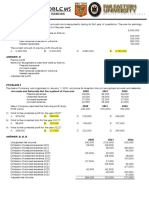

Solution:

You might also like

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Alom Ia FoDocument18 pagesAlom Ia FoLea Yvette SaladinoNo ratings yet

- Far-Single Entry PDFDocument7 pagesFar-Single Entry PDFJanica June FiscalNo ratings yet

- Events After Reporting DATE - FSDocument5 pagesEvents After Reporting DATE - FSAngela MartiresNo ratings yet

- Aud Application 2 - Handout 4 Gov. Grant (UST)Document2 pagesAud Application 2 - Handout 4 Gov. Grant (UST)RNo ratings yet

- Individual AssignmentDocument3 pagesIndividual AssignmentLoveness NyakurimwaNo ratings yet

- 8904 - Partnership LiquidationDocument4 pages8904 - Partnership Liquidationxara mizpahNo ratings yet

- Partnership LiquidationDocument4 pagesPartnership LiquidationBianca Iyiyi100% (1)

- SEMISDocument2 pagesSEMISEg CachaperoNo ratings yet

- Revised FAR PROBLEMS (PART 2) With AnswersDocument17 pagesRevised FAR PROBLEMS (PART 2) With AnswersBergNo ratings yet

- 6883 - Statement of Financial PositionDocument2 pages6883 - Statement of Financial PositionMaximusNo ratings yet

- ACC 121 Chapter 55Document4 pagesACC 121 Chapter 55Mohammad saripNo ratings yet

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- Bemidji School Board Budget ProjectionsDocument1 pageBemidji School Board Budget ProjectionsinforumdocsNo ratings yet

- S Partnership LiquidationDocument2 pagesS Partnership Liquidationandzie09876No ratings yet

- Cpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesDocument15 pagesCpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesSophia PerezNo ratings yet

- 2019 Intacc2A MA1 CLiabilitiesDocument1 page2019 Intacc2A MA1 CLiabilitiesAlyssa MabalotNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJoyce Anne DugayNo ratings yet

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- QuizDocument1 pageQuizedward didelesNo ratings yet

- Test 2 FarDocument3 pagesTest 2 FarMa Jodelyn RosinNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Final Exam 2021-2022Document10 pagesFinal Exam 2021-2022Clarito, Trisha Kareen F.No ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaKyrie Gwynette OlarveNo ratings yet

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- Government Grant and ImpairmentDocument4 pagesGovernment Grant and ImpairmentJohn FloresNo ratings yet

- Prelim ReviewDocument41 pagesPrelim ReviewKrisan Rivera100% (1)

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- 8919 - Consolidation Subsequent To The Date of AcquisitionDocument4 pages8919 - Consolidation Subsequent To The Date of AcquisitionFayehAmantilloBingcangNo ratings yet

- Investment Quizzers Investment QuizzersDocument16 pagesInvestment Quizzers Investment QuizzersAnna Taylor0% (1)

- Afar 01Document11 pagesAfar 01Raquel Villar DayaoNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- FAR139 FAR 139 Cash and Accrual BasisDocument4 pagesFAR139 FAR 139 Cash and Accrual BasisJuniah MyreNo ratings yet

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- Income Taxes Batch 4 (Repaired)Document10 pagesIncome Taxes Batch 4 (Repaired)Lealyn Martin BaculoNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- Drill 1 - MidtermDocument3 pagesDrill 1 - MidtermcpacpacpaNo ratings yet

- FAR 03-19 Loans and Receivables DiscussionDocument20 pagesFAR 03-19 Loans and Receivables DiscussionHana Grace MamangunNo ratings yet

- Topic - Accumulated Profits (Losses)Document3 pagesTopic - Accumulated Profits (Losses)Kaye ArsadNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsXienaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsXiena50% (2)

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsJEFFERSON CUTENo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- Income Taxes (Module 8)Document8 pagesIncome Taxes (Module 8)Paulo Emmanuel SantosNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesAccounting For Government Grants and Disclosure of Government AssistanceCristine Jane Granaderos OppusNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Investment in Associate ActivityDocument2 pagesInvestment in Associate Activitybrmo.amatorio.uiNo ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- Seatwork-Liabilities1st2023 StudentDocument5 pagesSeatwork-Liabilities1st2023 StudentpadayonmhieNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- Entity Y: Problem 4: Activity 2Document11 pagesEntity Y: Problem 4: Activity 2Christine Eunice RaymondeNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet