Professional Documents

Culture Documents

11 - Interest Rate On Lending Wef 20.12.2022

Uploaded by

Kazi ShohanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11 - Interest Rate On Lending Wef 20.12.2022

Uploaded by

Kazi ShohanCopyright:

Available Formats

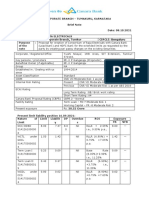

Rate of Interest on Lending With Effect From: 20.12.

2022

RATES

Sl. Categories & Sub Categories (SC) of Lending

(per annum)

1 Agriculture

SC-1. Agriculture Loan-Primary Customer (Maximum Rate) 8.00%

SC-2. Agriculture Loan-MFI Linkage (Maximum Rate) 8.00%

2 Term Loan (Large & Medium Scale Industry)

SC-1. Term Loan (Large & Medium Scale Industry)-Manufacturing 9.00%

SC-2. Term Loan (Large & Medium Scale Industry)-Non Manufacturing 9.00%

3 Term Loan (Small Scale Industry) 9.00%

4 Working Capital (Large & Medium Scale Industry)

SC-1. Working Capital (Large & Medium Scale Industry)-Manufacturing 9.00%

SC-2. Working Capital (Large & Medium Scale Industry)-Non Manufacturing 9.00%

5 Working Capital (Small Scale Industry) 9.00%

6 Export (Maximum Rate) 7.00%

7 Trade Financing (Commercial)

SC-1. Trade Financing (Large & Medium Scale Industry) 9.00%

SC-2. Trade Financing (Small Scale Industry) 9.00%

SC-3. Bills Purchased & Discounted 9.00%

8 Housing Loan

SC-1. Commercial House Building Loan 9.00%

SC-2. Residential House Building Loan 9.00%

9 Consumer Credit

SC-1. Auto Loan 10.00%

SC-2. Other Consumer Credit 9.00%-10.00%

Flexi Loan 10.00%

Salary Loan 11.00%

Premium Overdraft 10.00%

Aamar Account Overdraft - Secured 10.00%

Aamar Account Overdraft - Unsecured 11.00%

Term Loan 10TK AC Holder 9.00%

10 Credit Card 20.00%

11 Credit to Non Bank Financial Institution (NBFI) 9.00%

12 Others: Lease Finance 9.00%

13 Lending against Financial Obligation

SC-1. Lending against Fixed Deposit (FD)/Deposit Scheme (DS) FD/DS Rate +

of IFIC Bank 2.00%

SC-2. Lending against Other Financial Obligation (FO)

(Govt. Approved Securities /ICB Unit Certificate/ 9.00%

WEDB)

You might also like

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Rate CalcuationDocument1 pageRate CalcuationcvjgdjkkbmncnnNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- New Interest Rate Policy For New To BankDocument13 pagesNew Interest Rate Policy For New To Banknishan1187No ratings yet

- Interest Rate: Head OfficeDocument19 pagesInterest Rate: Head Officeapi-19792705No ratings yet

- Chase Investor Preso 11.4.09Document31 pagesChase Investor Preso 11.4.09ychartsNo ratings yet

- STC-NMB BANK - May 2020 PDFDocument13 pagesSTC-NMB BANK - May 2020 PDFaashish koiralaNo ratings yet

- Structured Products: (Market Linked Debentures)Document1 pageStructured Products: (Market Linked Debentures)ghodababuNo ratings yet

- Lending Rates Effective From April 01 2021 WEBDocument2 pagesLending Rates Effective From April 01 2021 WEBWahidNo ratings yet

- March 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDocument10 pagesMarch 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDillon CollierNo ratings yet

- Audit Case - Audit of Noncurrent LiabilitiesDocument6 pagesAudit Case - Audit of Noncurrent LiabilitiesKristine Lirose BordeosNo ratings yet

- Schedule of Bank Charges SOBC - 1st Jan To 30th June 2019 (English)Document26 pagesSchedule of Bank Charges SOBC - 1st Jan To 30th June 2019 (English)Maria FayyazNo ratings yet

- L&T Finance Holdings - GeojitDocument4 pagesL&T Finance Holdings - GeojitdarshanmadeNo ratings yet

- The Schemes of National Horticulture Board (NHB) With Agriculture Infrastructure Funds (AIF)Document4 pagesThe Schemes of National Horticulture Board (NHB) With Agriculture Infrastructure Funds (AIF)Jaspreet SinghNo ratings yet

- Raja Electricals Consortium Brief Note 08 10 2021Document3 pagesRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUNo ratings yet

- Islamic SOBC Jan To Jun 2020 WebsiteDocument22 pagesIslamic SOBC Jan To Jun 2020 WebsiteAqsa SonoNo ratings yet

- Asif Ali: Account StatementDocument5 pagesAsif Ali: Account StatementASIF ALINo ratings yet

- Drivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCDocument8 pagesDrivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCAdib RashidNo ratings yet

- Myconstant From ForumDocument14 pagesMyconstant From ForumAnneNo ratings yet

- Pakistan 3Document26 pagesPakistan 3syedqamarNo ratings yet

- Practical Problems: Lustration 1 After 8Document4 pagesPractical Problems: Lustration 1 After 8Kiran Kumar KBNo ratings yet

- Banks Sectorial Credit SR 01022024-01-February-2024-1165838419Document20 pagesBanks Sectorial Credit SR 01022024-01-February-2024-1165838419Rushil KhajanchiNo ratings yet

- NBFC Nov-23 Amended NotesDocument9 pagesNBFC Nov-23 Amended Notesrtaxhelp helpNo ratings yet

- GoldmanSachs MaterialsDocument6 pagesGoldmanSachs MaterialsThe Wrap100% (1)

- Dsoc Sept 30Document11 pagesDsoc Sept 30Mary Ann PacariemNo ratings yet

- Calculation SheetDocument9 pagesCalculation SheetPrashant PatilNo ratings yet

- Schedule of Bank Charges - Jan To Jun 2021 - English PDFDocument27 pagesSchedule of Bank Charges - Jan To Jun 2021 - English PDFImran AliNo ratings yet

- Application For H. O. Limits Branch: Corporate Credit DateDocument7 pagesApplication For H. O. Limits Branch: Corporate Credit DatehasanthakNo ratings yet

- PF 1-4 2023 - RescheduledDocument240 pagesPF 1-4 2023 - RescheduledZJ XNo ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceHhh LlllNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- People's Leasing & Financial Services Limited: UnimedDocument16 pagesPeople's Leasing & Financial Services Limited: Unimedrim267No ratings yet

- Exam Practice QuestionsDocument6 pagesExam Practice Questionssir bookkeeperNo ratings yet

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuNo ratings yet

- Competitive Effects of Basel II On U.S. Bank Credit Card LendingDocument24 pagesCompetitive Effects of Basel II On U.S. Bank Credit Card Lending230128No ratings yet

- DRW 2021 Cash001cajj018598 V1Document8 pagesDRW 2021 Cash001cajj018598 V1Russell Chyle100% (1)

- CEMEX ExhibitDocument16 pagesCEMEX ExhibitIwan SetiawanNo ratings yet

- Service Charges W.E.F 18.11.2022Document58 pagesService Charges W.E.F 18.11.2022anandNo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Table of Content: Schedule of Bank Charges (Exclusive of FED)Document30 pagesTable of Content: Schedule of Bank Charges (Exclusive of FED)ahsanNo ratings yet

- ch13 Kieso IFRS4 PPTDocument101 pagesch13 Kieso IFRS4 PPTĐức Huy100% (2)

- Application Form For Mses: Name of The BankDocument5 pagesApplication Form For Mses: Name of The BankRITESH GUPTANo ratings yet

- Sdoc 05 30 SiDocument18 pagesSdoc 05 30 Sijabulile.mhlengiNo ratings yet

- Acorns Securities LLC: Tax Information Account 01233072633386B1Document8 pagesAcorns Securities LLC: Tax Information Account 01233072633386B1Silvia GloverNo ratings yet

- REFI - CMBS 101 - Trepp's Essential Guide To Commercial Mortgage-Backed SecuritiesDocument7 pagesREFI - CMBS 101 - Trepp's Essential Guide To Commercial Mortgage-Backed SecuritiespierrefrancNo ratings yet

- MicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Document6 pagesMicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Jan RootsNo ratings yet

- Financial Planning Case 22 - 10 - 07Document9 pagesFinancial Planning Case 22 - 10 - 07888 BiliyardsNo ratings yet

- Leasing Company Financial ModelDocument2,679 pagesLeasing Company Financial ModelFadi GhassanNo ratings yet

- KPI - Nov 2019 - Area164Document9 pagesKPI - Nov 2019 - Area164AAKP Law FirmNo ratings yet

- Bank NII and NIM Scenarios Case StudyDocument8 pagesBank NII and NIM Scenarios Case Studynedhul50No ratings yet

- PSAK 71 Instrumen Keuangan 23052021Document102 pagesPSAK 71 Instrumen Keuangan 23052021Marcellindo Brilliant100% (1)

- Office Note - Abdul FarukDocument3 pagesOffice Note - Abdul FarukFoysal RezviNo ratings yet

- Service-Charges 01.01.2022 WEBDocument58 pagesService-Charges 01.01.2022 WEBRenesh RNo ratings yet

- Gist of Various Policies From Examination Point of View For Detailed Information and Further Clarification Please Refer The POLICY Guidelines Corporate Loan PolicyDocument19 pagesGist of Various Policies From Examination Point of View For Detailed Information and Further Clarification Please Refer The POLICY Guidelines Corporate Loan PolicyAshok KumarNo ratings yet

- Chapter 6 Solutions To Problems and CasesDocument24 pagesChapter 6 Solutions To Problems and Caseschandel08No ratings yet

- Cgtmse LatestDocument40 pagesCgtmse LatestRajkot academyNo ratings yet

- Project Finance: Tool For GrowthDocument22 pagesProject Finance: Tool For Growthanildavson1No ratings yet

- DBN Sheet Recovery Schemes ComparisonDocument1 pageDBN Sheet Recovery Schemes Comparisonvictoria upindiNo ratings yet

- DRW 2021 Cash001cazc017382 V1Document8 pagesDRW 2021 Cash001cazc017382 V1AresNo ratings yet

- Chap 008Document5 pagesChap 008hasnat sakibNo ratings yet

- A Study On Working Capital Management of Keltron Equipments in TrivandrumDocument9 pagesA Study On Working Capital Management of Keltron Equipments in Trivandrumalkanm750No ratings yet

- Summary of The Catalyst - Jonah BergerDocument9 pagesSummary of The Catalyst - Jonah BergeremailtumbalanNo ratings yet

- 10 Must Read Books For Stock Market Investors in India - Trade BrainsDocument35 pages10 Must Read Books For Stock Market Investors in India - Trade BrainsCHANDRAKISHORE SINGHNo ratings yet

- Chapter 14 Developing Pricing Strategies and ProgramsDocument40 pagesChapter 14 Developing Pricing Strategies and ProgramsA_Students100% (1)

- Poa T - 12Document4 pagesPoa T - 12SHEVENA A/P VIJIANNo ratings yet

- Dawood Family Takaful LTDDocument2 pagesDawood Family Takaful LTDTaimoor AhmmedNo ratings yet

- Netflix Financial AnalysisDocument26 pagesNetflix Financial Analysismskrier67% (3)

- Final PaperDocument12 pagesFinal PaperSami JankinsNo ratings yet

- CH 5 Case 4Document3 pagesCH 5 Case 4Hazem HalabiNo ratings yet

- LabChapt 4 Meisya Vianqa ADocument7 pagesLabChapt 4 Meisya Vianqa AMeisya VianqaNo ratings yet

- 7AWEFuG2YT3f4RAMH9WLx9raea6HTUSUhcTmRSg1 PDFDocument24 pages7AWEFuG2YT3f4RAMH9WLx9raea6HTUSUhcTmRSg1 PDFNguyễn Thị Hường 3TC-20ACNNo ratings yet

- CFAS Finals Handout 1 Shareholders EquityDocument2 pagesCFAS Finals Handout 1 Shareholders EquityalexanndrabernalNo ratings yet

- Mdi 0618Document24 pagesMdi 0618macc407150% (2)

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- Hasil Diskusi 8 Manajemen KeuanganDocument4 pagesHasil Diskusi 8 Manajemen KeuanganTtsani TsaniNo ratings yet

- PR Emet 2 PDFDocument2 pagesPR Emet 2 PDFgleniaNo ratings yet

- Gujarat Petrosynthese LimitedDocument58 pagesGujarat Petrosynthese LimitedContra Value BetsNo ratings yet

- Dear Colleague LetterDocument3 pagesDear Colleague LettergirishkulkNo ratings yet

- SPMD - Valuation - Final Report - 22032017 - Ver10 PDFDocument27 pagesSPMD - Valuation - Final Report - 22032017 - Ver10 PDFSivas SubramaniyanNo ratings yet

- Seminar 1A - Group Reporting: (A) Power Over The InvesteeDocument44 pagesSeminar 1A - Group Reporting: (A) Power Over The InvesteeJasmine TayNo ratings yet

- Editor in chief,+EJBMR 1033+R300821Document7 pagesEditor in chief,+EJBMR 1033+R300821BigPalabraNo ratings yet

- SeedrsDocument3 pagesSeedrsfinanz101No ratings yet

- A Study On Mutual Funds With Due Reference To Sbi Mutual FundsDocument8 pagesA Study On Mutual Funds With Due Reference To Sbi Mutual FundskomalNo ratings yet

- QuestionsDocument7 pagesQuestionsMyra RidNo ratings yet

- Course File HMD Quality Service Revised SecondDocument63 pagesCourse File HMD Quality Service Revised SecondRoy CabarlesNo ratings yet

- Owed Money Unclaimed PropertyDocument15 pagesOwed Money Unclaimed PropertyKyle SanfordNo ratings yet

- Of Permanent Value: The Story of Warren Buffett. Chapter 201Document2 pagesOf Permanent Value: The Story of Warren Buffett. Chapter 201Alex Bossert100% (1)

- Bankable-Projects in Uganda - 2021-2022Document99 pagesBankable-Projects in Uganda - 2021-2022Kaleb TibebeNo ratings yet

- Format of Internship ReportDocument32 pagesFormat of Internship ReportMuhammad BilalNo ratings yet

- Global Insurance Trends Analysis 2016Document29 pagesGlobal Insurance Trends Analysis 2016Rahul MandalNo ratings yet