Professional Documents

Culture Documents

Rate Calcuation

Rate Calcuation

Uploaded by

cvjgdjkkbmncnnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rate Calcuation

Rate Calcuation

Uploaded by

cvjgdjkkbmncnnCopyright:

Available Formats

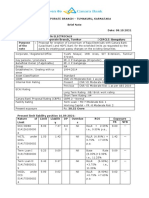

Rate of Interest on Lending With Effect From: 01.11.

2023

RATES

Sl. Categories & Sub Categories (SC) of Lending

(per annum)

1 Agriculture

SC-1. Agriculture Loan-Primary Customer (Maximum Rate) 9.93%

SC-2. Agriculture Loan-MFI Linkage (Maximum Rate) 9.93%

2 Term Loan (Large & Medium Scale Industry)

SC-1. Term Loan (Large & Medium Scale Industry)-Manufacturing 10.93%

SC-2. Term Loan (Large & Medium Scale Industry)-Non Manufacturing 10.93%

3 Term Loan (Small Scale Industry) 10.93%

4 Working Capital (Large & Medium Scale Industry)

SC-1. Working Capital (Large & Medium Scale Industry)-Manufacturing 10.93%

SC-2. Working Capital (Large & Medium Scale Industry)-Non Manufacturing 10.93%

5 Working Capital (Small Scale Industry) 10.93%

6 Export Pre-Shipment (Maximum Rate) 9.93%

7 Trade Financing (Commercial)

SC-1. Trade Financing (Large & Medium Scale Industry) 10.93%

SC-2. Trade Financing (Small Scale Industry) 10.93%

SC-3. Bills Purchased & Discounted 10.93%

8 Housing Loan

SC-1. Commercial House Building Loan 10.93%

SC-2. Residential House Building Loan 10.93%

9 Consumer Credit

SC-1. Auto Loan 10.93%

SC-2. Other Consumer Credit 10.93%

Flexi Loan 10.93%

Salary Loan 10.93%

Premium Overdraft 10.93%

Aamar Account Overdraft - Secured 10.93%

Aamar Account Overdraft - Unsecured 10.93%

Term Loan 10TK AC Holder 10.93%

10 Credit Card 20.00%

11 Credit to Non Bank Financial Institution (NBFI) 10.93%

12 Others: Lease Finance 10.93%

13 Lending against Financial Obligation

SC-1. Lending against Fixed Deposit (FD)/Deposit Scheme (DS)

10.43%

of IFIC Bank

SC-2. Lending against Other Financial Obligation (FO)

(Govt. Approved Securities /ICB Unit Certificate/ 10.93%

WEDB)

***1% supervision charge will be applicable yearly for CMSME Loan, Personal loan and Auto Loan under Consumer Fiancing

You might also like

- Sanction Letter V2Document3 pagesSanction Letter V2SRINIVASREDDY PIRAMALNo ratings yet

- RM Quiz 4 Chappa ContentDocument66 pagesRM Quiz 4 Chappa ContentMurad Ahmed Niazi100% (1)

- 11 - Interest Rate On Lending Wef 20.12.2022Document1 page11 - Interest Rate On Lending Wef 20.12.2022Kazi ShohanNo ratings yet

- New Interest Rate Policy For New To BankDocument13 pagesNew Interest Rate Policy For New To Banknishan1187No ratings yet

- Financing Current AssetsDocument9 pagesFinancing Current Assetspbelim100% (1)

- Service Charges W.E.F 18.11.2022Document58 pagesService Charges W.E.F 18.11.2022anandNo ratings yet

- SBI Life - Flexi Smart Insurance - 111N080V01 - Terms - and - Conditions - Website - UploadDocument18 pagesSBI Life - Flexi Smart Insurance - 111N080V01 - Terms - and - Conditions - Website - UploadBisen VikasNo ratings yet

- So 3Document7 pagesSo 3Nandha KrishnanNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- Individual Car Loan Agreement SampleDocument32 pagesIndividual Car Loan Agreement Sampleey019.aaNo ratings yet

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuNo ratings yet

- Interest Rate: Head OfficeDocument19 pagesInterest Rate: Head Officeapi-19792705No ratings yet

- Shri/ Smt/Kum Kamehand - Ra.. Nag.: RS, L - Rs. L Six Evem - Kaidne.OrlqDocument2 pagesShri/ Smt/Kum Kamehand - Ra.. Nag.: RS, L - Rs. L Six Evem - Kaidne.Orlqatulram1No ratings yet

- Loan AgreementMITC - 1705588392880Document24 pagesLoan AgreementMITC - 1705588392880844501abhayNo ratings yet

- LIC Housing Finance LTD FDDocument6 pagesLIC Housing Finance LTD FDBiswa Jyoti GuptaNo ratings yet

- Raja Electricals Consortium Brief Note 08 10 2021Document3 pagesRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUNo ratings yet

- Quiz 11Document3 pagesQuiz 11strikertalkshereNo ratings yet

- Loan Sanction LetterDocument4 pagesLoan Sanction Lettermk9778225No ratings yet

- BOM Agri LoanDocument21 pagesBOM Agri LoanPragatiNo ratings yet

- Service Charges: Sno HeadDocument57 pagesService Charges: Sno HeadRakshit Ranjan SinghNo ratings yet

- BAF Group-6Document21 pagesBAF Group-6Amit Halder 2020-22No ratings yet

- 94mso010709 FDocument25 pages94mso010709 FSyed FaisalNo ratings yet

- Franchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®Document2 pagesFranchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®ydjnaxNo ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceHhh LlllNo ratings yet

- 6 File General Term Loan Scheme Oct 2017 2Document1 page6 File General Term Loan Scheme Oct 2017 2Ashwet GaonkarNo ratings yet

- AddendumIAndClarifications28022020 1582900029 PDFDocument83 pagesAddendumIAndClarifications28022020 1582900029 PDFAndy_sumanNo ratings yet

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghNo ratings yet

- MicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Document6 pagesMicroEnterprise Loan (Puhunan Sa Pagbabago at Pag-Asenso - P3 Loan)Jan RootsNo ratings yet

- (Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement DisasterDocument9 pages(Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement Disaster00aaNo ratings yet

- SignatureDocument13 pagesSignatureVee-kay Vicky KatekaniNo ratings yet

- Chase Investor Preso 11.4.09Document31 pagesChase Investor Preso 11.4.09ychartsNo ratings yet

- 1693206071881.FactsheetEnapak PackagingInvoice Financing 2Document1 page1693206071881.FactsheetEnapak PackagingInvoice Financing 2zulfakri saladinNo ratings yet

- Agencies JPMDocument18 pagesAgencies JPMbonefish212No ratings yet

- Sanction Letter Capital FloatDocument2 pagesSanction Letter Capital FloatVinod GhadgeNo ratings yet

- SME Finance Products: Sulabh Vyapar LoanDocument6 pagesSME Finance Products: Sulabh Vyapar LoangsupernaNo ratings yet

- Presentation On Credit: Prepared byDocument32 pagesPresentation On Credit: Prepared bymoidulmktduNo ratings yet

- STC-NMB BANK - May 2020 PDFDocument13 pagesSTC-NMB BANK - May 2020 PDFaashish koiralaNo ratings yet

- Australia and New Zealand Banking Group Limited 6.736 Dated 17 Mar 23Document12 pagesAustralia and New Zealand Banking Group Limited 6.736 Dated 17 Mar 23Mister MisterNo ratings yet

- Service-Charges 01.01.2022 WEBDocument58 pagesService-Charges 01.01.2022 WEBRenesh RNo ratings yet

- Financial Institutions Management - Chap011Document21 pagesFinancial Institutions Management - Chap011sk625218No ratings yet

- Classification N ProvisionDocument37 pagesClassification N ProvisionNur AlahiNo ratings yet

- Icici Mortgage Pacustomer Raj Mandal 7727040114 150923Document6 pagesIcici Mortgage Pacustomer Raj Mandal 7727040114 150923Live lifeNo ratings yet

- UDAY Status and Plans - MoPDocument14 pagesUDAY Status and Plans - MoPShivi TripathiNo ratings yet

- LBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmaDocument35 pagesLBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmazvaibhavNo ratings yet

- Myconstant From ForumDocument14 pagesMyconstant From ForumAnneNo ratings yet

- Applicable MCLR Three-Month MCLRDocument2 pagesApplicable MCLR Three-Month MCLRZaibNo ratings yet

- Revised Schedule SheetDocument2 pagesRevised Schedule SheetDinesh chandra jaiswalNo ratings yet

- Adobe Scan 04 Feb 2023Document3 pagesAdobe Scan 04 Feb 2023Yogesh MalpathakNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJaggu NitheshNo ratings yet

- PNB Electronic Dealer Scheme (PNB E-Dealer) For Indian Oil Corporation (Iocl)Document3 pagesPNB Electronic Dealer Scheme (PNB E-Dealer) For Indian Oil Corporation (Iocl)ndfpwnuteNo ratings yet

- Vongarla Radha: Page 1 of 3Document3 pagesVongarla Radha: Page 1 of 3V RadhaNo ratings yet

- Electric BillDocument2 pagesElectric BillJagannath PanigrahiNo ratings yet

- ESRB Risk DashboardDocument43 pagesESRB Risk DashboardGasimovskyNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJyoti SharmaNo ratings yet

- Cgtmse - 17 01 2023-51-60Document10 pagesCgtmse - 17 01 2023-51-60kamaiiiNo ratings yet

- Varun Agro CAMDocument22 pagesVarun Agro CAMGAURAV NIGAM100% (1)

- Master Circular-Guarantees, Co-Acceptances & Letters of Credit - UcbsDocument14 pagesMaster Circular-Guarantees, Co-Acceptances & Letters of Credit - Ucbskalik goyalNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- AAA - Supplier RelationshipDocument15 pagesAAA - Supplier RelationshipAyush GoyalNo ratings yet

- DSE Corporate Brochure 2017-18 PDFDocument64 pagesDSE Corporate Brochure 2017-18 PDFVishvas JaiswalNo ratings yet

- IRGSTDocument4 pagesIRGSTsivaddsNo ratings yet

- C V-RajeshDocument5 pagesC V-Rajeshstephenking0078916No ratings yet

- Mefa 5 S UnitDocument16 pagesMefa 5 S UnitNaga LakshmiNo ratings yet

- Presentation On SAP Reporting Workshop - FinalDocument113 pagesPresentation On SAP Reporting Workshop - Finallekzite100% (1)

- WIM Pricing GuideDocument54 pagesWIM Pricing Guidemoveee2No ratings yet

- The Impact of Branding On Consumer Buying BehaviorDocument20 pagesThe Impact of Branding On Consumer Buying Behaviorvishudi100% (2)

- Business PlanDocument7 pagesBusiness PlanLGRC RomblonNo ratings yet

- References: AnswersDocument2 pagesReferences: AnswerssukriskbdNo ratings yet

- Overview of Materials ManagementDocument21 pagesOverview of Materials ManagementRuchir ShardaNo ratings yet

- Memo Record - EditDocument10 pagesMemo Record - EditOkikiri Omeiza RabiuNo ratings yet

- Stitch Fix 2019 10-K PDFDocument73 pagesStitch Fix 2019 10-K PDFasdNo ratings yet

- Chapter 1Document45 pagesChapter 1John Carlo LopezNo ratings yet

- Prayer in TLE: St. Mary's Academy of Caloocan City Madre Ignacia Ave., Grace Park, Caloocan CityDocument43 pagesPrayer in TLE: St. Mary's Academy of Caloocan City Madre Ignacia Ave., Grace Park, Caloocan CityNoel Angelo BacaniNo ratings yet

- Lopez Vs Ericta Facts:: Interim Dean On May 1, 1970. The Board of Regents Met and President LopezDocument8 pagesLopez Vs Ericta Facts:: Interim Dean On May 1, 1970. The Board of Regents Met and President LopezcyNo ratings yet

- Application Eori Number Outide European Union Do4381z7foleng PDFDocument2 pagesApplication Eori Number Outide European Union Do4381z7foleng PDFSalah AyoubiNo ratings yet

- Deloitte Global Outsourcing Survey 2021 InfographicDocument1 pageDeloitte Global Outsourcing Survey 2021 InfographicSalma BennaniNo ratings yet

- Cost Accounting: 6 EditionDocument13 pagesCost Accounting: 6 EditionGiannis SalaNo ratings yet

- The Res Perit Domino Rule and The PoliciDocument18 pagesThe Res Perit Domino Rule and The PoliciGlaiza CuizonNo ratings yet

- Worksheet On Introduction To AccountingDocument2 pagesWorksheet On Introduction To AccountingBamidele AdegboyeNo ratings yet

- 13m BRD 001 Sap Erp HCM Solution en v1 1Document12 pages13m BRD 001 Sap Erp HCM Solution en v1 1Abdul Muqeeth100% (1)

- 3 RetrieveDocument11 pages3 RetrieveayushiNo ratings yet

- CBP's Side-by-Side Comparison of FTA'sDocument40 pagesCBP's Side-by-Side Comparison of FTA'sYamilet TorresNo ratings yet

- Chapter Five Staffing 5.1 DefinitionDocument9 pagesChapter Five Staffing 5.1 DefinitionMagarsa BedasaNo ratings yet

- CH 1 - Info System Strategy TriangleDocument4 pagesCH 1 - Info System Strategy TriangleJustin L De ArmondNo ratings yet

- Piramal Enterprises Limited Annual Report 2017 18 1 20Document20 pagesPiramal Enterprises Limited Annual Report 2017 18 1 20lokeshNo ratings yet

- RMS USA Field Employee Handbook - Aug 2020Document35 pagesRMS USA Field Employee Handbook - Aug 2020Esteban TorresNo ratings yet

- Defense (Business Plan)Document2 pagesDefense (Business Plan)Ceind Lorwvic MayanoNo ratings yet

- Johnson & JohnsonDocument130 pagesJohnson & Johnsontyg1992No ratings yet