Professional Documents

Culture Documents

Mezza Overarching Corporate Aim: Positive Factors

Mezza Overarching Corporate Aim: Positive Factors

Uploaded by

Hoàng Trần0 ratings0% found this document useful (0 votes)

3 views3 pagesThe document discusses a proposed project by Mezza Co to develop a new plant in Maienar and the factors to consider. There are positive factors like adding value, improving reputation, and relationships with government officials. However, further investigation is needed to ensure cash flow estimates are realistic and risks are assessed. Locating the plant in Maienar has benefits but could negatively impact local fishermen and the environment. Mezza must carefully manage impacts and relationships to ensure sustainable and ethical development.

Original Description:

Original Title

AFM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses a proposed project by Mezza Co to develop a new plant in Maienar and the factors to consider. There are positive factors like adding value, improving reputation, and relationships with government officials. However, further investigation is needed to ensure cash flow estimates are realistic and risks are assessed. Locating the plant in Maienar has benefits but could negatively impact local fishermen and the environment. Mezza must carefully manage impacts and relationships to ensure sustainable and ethical development.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesMezza Overarching Corporate Aim: Positive Factors

Mezza Overarching Corporate Aim: Positive Factors

Uploaded by

Hoàng TrầnThe document discusses a proposed project by Mezza Co to develop a new plant in Maienar and the factors to consider. There are positive factors like adding value, improving reputation, and relationships with government officials. However, further investigation is needed to ensure cash flow estimates are realistic and risks are assessed. Locating the plant in Maienar has benefits but could negatively impact local fishermen and the environment. Mezza must carefully manage impacts and relationships to ensure sustainable and ethical development.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Mezza

Overarching corporate aim

The main objective of the directors is to maximise the wealth of the shareholders and therefore

any decisions taken should be aligned with this primary objective. However, the company has

other stakeholders and directors should be sensitive to potential negative implications from

implementing the project.

Key issue (1): Will the project add value?

Positive factors

At first glance, it would appear that the project would be adding value, as it is meeting the need

of dealing with climate change with many countries around the world. The project would

potentially lead to an improvement in the company’s reputation as a company with ESG

(Environmental, Social & Governance) investments and therefore an increase in its share price.

Moreover, the company’s relationships with senior government officials in Maienar, who show

interests in the project and support the development of the project and, potentially, future

projects. In addition, the project is being done by its subsidiary, there are likely to be future

opportunities for the subsidiary to work on similar projects.

Other factors to consider

Although the project would add value to the company, further investigations should be carried

out to ensure that the certantity of cash inflows of the project, especially when Mezza Co is

diversifying into new areas. The extent of the risk should be assessed prior to progressing with

the project. Are the current revenue and cost estimates realistics? What is the likelihood of

competitors entering the market and the potential effects on revenue and market share? A full

investigation, using such means as sensitivity analysis and duration, is required to answer such

questions.

Moreover, it is worth noting that the directors’ remuneration package includes share options and

therefore they might take risky decisions regarding this project in order to increase the share

price of the company or effectively their personal wealth. This may against the wishes of

shareholders and other stakeholders who may have a more risk-averse attitude. Therefore, it is

important to ensure that the directors promptly report to shareholders and stakeholders about

relevant information about the project, which would allow them to make necessary decisions

such as direct interventions or selling their shares to put pressure on the directors.

Other factors that must be investigated include the length of time it will take to get the product to

market, any additional infrastructure required and potential expertise needed.

Key issue (2): Plant location

Positive factors

Locating the plant at Maienar appears to be a good decision as Mezza Co has already developed

an infrastructure suitable for the new project and a strong relationship with senior government

officials in Maienar who interests developing new industries. The ties to senior government

officials are likely to be particularly useful when trying to deal with legal and administrative

issues, thus reducing the time between development and production actually starting. However,

there are other factors should be taken into account before carrying out this project as discussed

below.

Other factors to consider

The development of the project will negatively affect the fishing ground in Maienar and

therefore the life of local fishermen. Because the fishermmen are poor, have little political

influence and small contributions to the economic development of Maienar, it might be unethical

to carry out the project without paying any attention on dealing with the consequences of the

project on the fishermen. Given that Mezza has an excellent corporate image, it is unlikely that it

will want to ignore the plight of the fishermen. Therefore the company might consider, for

example, including the costs of compensation within the costs of the project. Alternatively, it

could offer the fishermen priority on new jobs that are created and emphasise the additional

wealth that the project is likely to create.

Mezza Co should also consider the impacts on the local environment of Maienar. It appears that

the project would adversely affect the coastal area of Maienar, which has many potentials for

developing tourism. There could be a risk that other tourism companies identify the opportunities

of tourism within Maienar and therefore fight against Mezza Co to protect their interests, which

will consequentially increase, for example, legal costs. Therefore, it is necessary to pay attention

on competitive actions of tourism companies.

Mezza Co could also consider alternative locations for the plant, although this is likely to be

expensive, given the need for certain infrastructure already present in Maienar. Alternatively, the

company could try to find an alternative process for growing and harvesting the plant that would

not have adverse effects on wildlife and fish stocks. Again, this is an expensive option and any

such costs would have to be set against expected revenues to determine value added.

Mezza Co will have to manage its relationship with Maienar’s Government very carefully as it

does not want to appear to be influencing government decisions. Mezza needs to make it very

clear that it is following proper legal and administrative procedures – and is working with the

Government to protect and improve the country, rather than exploit it for its own gains.

The impacts of the project on capitals within integrated reporting

Integrated reporting looks at the ability of an organisation to create value and considers

important relationships, both internally and externally. It involves considering the impact of the

proposed project and six capitals as follows.

Financial

The integrated report should explain how commercialising the product should generate revenues

over time, be an important element in diversification and make a significant contribution to the

growth of Mezza Co. The report should also show how Mezza raise finance for this project and

evaluate the cost of, for example, equity, debt or internally generated sources.

Human

Mezza should show how the employment opportunities provided by the new facility link to how

Mezza has been using local labour in Maienar. It should highlight the ways in which the new

facility allows local labor to develop their skills. However, the report also needs to show whether

Mezza is doing anything to help the fishermen with their loss of livelihood, since the adverse

impact on the fishermen would appear to go against Mezza’s strategy of supporting local farming

communities.

Manufactured

The report would identify the new facility as an important addition to Mezza’s productive

capacity. It would also show how the infrastructure that Mezza already has in Maienar will be

used to assist in growing and processing the new plant.

Social and relationship

The development of the plant and the new facility should be reported in the context of Mezza’s

strategy of being a good corporate citizen in Maienar. It should explain how the new plant will

assist economic development there and in turn how this will enhance the value derived to Mezza

from operating in that country.

Intellectual

The report should show how Mezza intends to protect the plant and hence it future income by

some sort of protection, such as the patent. It should also highlight how development of the plant

fulfills the aims of the subsidiary, to develop products that have beneficial impacts on other

capitals

Natural

The report needs to set the adverse impact on the area and the fishing stock in the context of the

longer-term environmental benefits that development of the plant brings. It also needs to show

the commitments that Mezza is making to mitigate environmental damage.

You might also like

- Business Plan Checklist: Plan your way to business successFrom EverandBusiness Plan Checklist: Plan your way to business successRating: 5 out of 5 stars5/5 (1)

- Project Management: Assignment 1 - Manufacturing SectorDocument8 pagesProject Management: Assignment 1 - Manufacturing SectorJunaid Ahmed RahatNo ratings yet

- Entrepreneurship ProjectDocument12 pagesEntrepreneurship ProjectKarthick MuruganNo ratings yet

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- Fintech Policy Tool Kit For Regulators and Policy Makers in Asia and the PacificFrom EverandFintech Policy Tool Kit For Regulators and Policy Makers in Asia and the PacificRating: 5 out of 5 stars5/5 (1)

- SME - Cambodia MSME Project - Case StudyDocument11 pagesSME - Cambodia MSME Project - Case StudySabetNo ratings yet

- Introduction to Project Finance in Renewable Energy Infrastructure: Including Public-Private Investments and Non-Mature MarketsFrom EverandIntroduction to Project Finance in Renewable Energy Infrastructure: Including Public-Private Investments and Non-Mature MarketsNo ratings yet

- Regional Social Accounting: Social Accounting Is A Type of Accounting That A Business Performs ToDocument6 pagesRegional Social Accounting: Social Accounting Is A Type of Accounting That A Business Performs TocarolsaviapetersNo ratings yet

- Submitted To: Prof. Priyanka Chatta Professor Pillais Institute of Management Studies and Research, Panvel Mumbai UniversityDocument18 pagesSubmitted To: Prof. Priyanka Chatta Professor Pillais Institute of Management Studies and Research, Panvel Mumbai UniversityajinkyapolNo ratings yet

- Firm's Environment, Governance and Strategy: Strategic Financial ManagementDocument14 pagesFirm's Environment, Governance and Strategy: Strategic Financial ManagementAnish MittalNo ratings yet

- Strengthening Domestic Resource Mobilization in Southeast AsiaFrom EverandStrengthening Domestic Resource Mobilization in Southeast AsiaNo ratings yet

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaFrom EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNo ratings yet

- Robert Montoya Case LearningsDocument4 pagesRobert Montoya Case Learningsish juneNo ratings yet

- Financial ForecastingDocument85 pagesFinancial ForecastingRavi JoshiNo ratings yet

- Feasibility StudyDocument74 pagesFeasibility StudyAhmad Alawaddin83% (6)

- ProblemsDocument4 pagesProblemsAhmer NaveerNo ratings yet

- Understanding Operating EnvironmentDocument4 pagesUnderstanding Operating EnvironmentTSEGAYE AGEZENo ratings yet

- Sitxfin402 (Anibt 17)Document5 pagesSitxfin402 (Anibt 17)Pahn PanrutaiNo ratings yet

- Blueprint For Regulatory Reforms To Improve The Business Environment Dated December 2017Document486 pagesBlueprint For Regulatory Reforms To Improve The Business Environment Dated December 2017shahista ImranNo ratings yet

- Guide To Revenue ManagementDocument28 pagesGuide To Revenue Managementjohnsm2010No ratings yet

- Table of ContentDocument16 pagesTable of ContentNuwan KumarasingheNo ratings yet

- Assignment 2/0/2018: Financial StrategyDocument13 pagesAssignment 2/0/2018: Financial StrategydevashneeNo ratings yet

- Green Finance for Asian State-Owned Enterprises: An Opportunity to Accelerate the Green TransitionFrom EverandGreen Finance for Asian State-Owned Enterprises: An Opportunity to Accelerate the Green TransitionNo ratings yet

- PESTLE Analysis: Understand and plan for your business environmentFrom EverandPESTLE Analysis: Understand and plan for your business environmentRating: 4 out of 5 stars4/5 (1)

- SBL MOCK 1 Cbe PlatformDocument9 pagesSBL MOCK 1 Cbe PlatformSaahil ShahNo ratings yet

- Somya Garg GSTDocument9 pagesSomya Garg GSTSOMYA GARGNo ratings yet

- Ques - How Politico-Legal Environment Impact Various Business?Document12 pagesQues - How Politico-Legal Environment Impact Various Business?Aniket SinghNo ratings yet

- Financial Accounting and Key Concepts of HRDocument4 pagesFinancial Accounting and Key Concepts of HRarslanshani50% (2)

- Steelathon How Can Corporates Demonstrate Their Environmental CommitmentDocument3 pagesSteelathon How Can Corporates Demonstrate Their Environmental CommitmentSagar MehtaNo ratings yet

- ED Unit 2 and 3Document28 pagesED Unit 2 and 3Rohit NegiNo ratings yet

- ED Note Module-2Document28 pagesED Note Module-2SATYARANJAN PATTANAIKNo ratings yet

- Business Plan Company: Solar System InstallationDocument12 pagesBusiness Plan Company: Solar System InstallationOsama FaridNo ratings yet

- Diwakar Pandey GM18090 (BECG Mid Term)Document6 pagesDiwakar Pandey GM18090 (BECG Mid Term)Diwakar PandeyNo ratings yet

- Toward An Understanding of When Executives See Crisis As OpportunityDocument5 pagesToward An Understanding of When Executives See Crisis As OpportunityMaGraciela NovilloNo ratings yet

- Corporate Governance AssignmentDocument10 pagesCorporate Governance AssignmentJon BradNo ratings yet

- Main Body EddDocument18 pagesMain Body Edddave tesfayeNo ratings yet

- Debt On Profitability FinalDocument65 pagesDebt On Profitability FinalRexmar Christian BernardoNo ratings yet

- Value of Infrastructure InvestmentDocument5 pagesValue of Infrastructure InvestmentSTP DesignNo ratings yet

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- An Appraisal On The Economic Reforms of Bangladesh: Finance & EconomicsDocument15 pagesAn Appraisal On The Economic Reforms of Bangladesh: Finance & EconomicssuzzonNo ratings yet

- A Wedding Cake Model For Togolese EntrepreneursDocument13 pagesA Wedding Cake Model For Togolese EntrepreneursTanisha ManawNo ratings yet

- Financial Statements Analysis: Wealth Creation and Wealth Maximisation at Telecom Company From 2010 To 2012Document11 pagesFinancial Statements Analysis: Wealth Creation and Wealth Maximisation at Telecom Company From 2010 To 2012IOSRjournalNo ratings yet

- BSM ProjectDocument26 pagesBSM Projectnarayanmeher07No ratings yet

- Chapter 1 - ThesisDocument8 pagesChapter 1 - ThesisRed SecretarioNo ratings yet

- 10 Financial Strategies for Commercial Construction Companies to Maximize Cash Flow and ProfitsFrom Everand10 Financial Strategies for Commercial Construction Companies to Maximize Cash Flow and ProfitsNo ratings yet

- Financial Crises SuggestionsDocument36 pagesFinancial Crises Suggestions03216055440No ratings yet

- Integrated Reporting Closing The Loop of StrategyDocument16 pagesIntegrated Reporting Closing The Loop of StrategyFrancisco Javier Magallón RojasNo ratings yet

- Corporate Social Responsibility: Management of BusinessDocument5 pagesCorporate Social Responsibility: Management of Businessannisa lemoniousNo ratings yet

- IndustriesDocument24 pagesIndustrieskosmitoNo ratings yet

- Value-based financial management: Towards a Systematic Process for Financial Decision - MakingFrom EverandValue-based financial management: Towards a Systematic Process for Financial Decision - MakingNo ratings yet

- Final ThesisDocument66 pagesFinal ThesisHiromi Ann ZoletaNo ratings yet

- Training Program On Air Polluiton and Modelling PublicityDocument1 pageTraining Program On Air Polluiton and Modelling PublicityPawanNo ratings yet

- Objectives of Business Environment StudyDocument10 pagesObjectives of Business Environment StudyGauri jindalNo ratings yet

- Sở Gd&Đt Phú Thọ: Đề Kiểm Tra Học Kỳ IiDocument43 pagesSở Gd&Đt Phú Thọ: Đề Kiểm Tra Học Kỳ IiLevyNo ratings yet

- BA3510 Integrating Management Business, Leadership and InnovationDocument1 pageBA3510 Integrating Management Business, Leadership and InnovationShaikh Ghassan AbidNo ratings yet

- POWER Point Monthly Timeseries NASA 2013-V1Document12 pagesPOWER Point Monthly Timeseries NASA 2013-V1Hùng Nguyễn CôngNo ratings yet

- Modelling Urban Traffic Air Pollution DispersionDocument6 pagesModelling Urban Traffic Air Pollution DispersionHAMZA ISKSIOUINo ratings yet

- Produc T Guide & A PPL Ic Ation: en Gin Eered Geosyn TH E Tic SolutionsDocument60 pagesProduc T Guide & A PPL Ic Ation: en Gin Eered Geosyn TH E Tic Solutionsgeoteknik utama konstruksiNo ratings yet

- Resources and IndustriesDocument7 pagesResources and IndustriesDance-Off 15No ratings yet

- International Journal of Technical Research and ApplicationsDocument8 pagesInternational Journal of Technical Research and ApplicationsREYLAN BANGOLANNo ratings yet

- 12.0 Ecosystem Ecology Recap: 12.1 Energy Flow and Chemical CyclingDocument5 pages12.0 Ecosystem Ecology Recap: 12.1 Energy Flow and Chemical CyclingOtiosse MyosotisNo ratings yet

- Program Book WPSC-APSA Congress 2022Document103 pagesProgram Book WPSC-APSA Congress 2022Hesti PrawatiNo ratings yet

- Chapter 1 ThesisDocument30 pagesChapter 1 Thesisryline100% (2)

- SITXWHS002 Identify Hazards, Assess and Control Safety Risks Learner Assessment Pack V2.2 - 06 - 2019Document46 pagesSITXWHS002 Identify Hazards, Assess and Control Safety Risks Learner Assessment Pack V2.2 - 06 - 2019Jyoti VermaNo ratings yet

- Speech Test DQ P2Texts and Question - Online TutorialDocument3 pagesSpeech Test DQ P2Texts and Question - Online TutorialRemya RanjithNo ratings yet

- Science - Worm FarmDocument12 pagesScience - Worm Farmapi-377732617No ratings yet

- Investigatory Research TemplateDocument6 pagesInvestigatory Research TemplateMary Florilyn Recla100% (1)

- Hao 2019Document12 pagesHao 2019Aminata DraméNo ratings yet

- Board Gender Diversity and Firm-Level Climate Change ExposureDocument9 pagesBoard Gender Diversity and Firm-Level Climate Change ExposureAbby LiNo ratings yet

- Brochure BUILDEX 2024Document4 pagesBrochure BUILDEX 2024Anis KhanNo ratings yet

- APSC Prelims MCQs 13th March 2023Document11 pagesAPSC Prelims MCQs 13th March 2023mamz4uNo ratings yet

- Science Has Made Modern Life Better But Not Necessary EasierDocument4 pagesScience Has Made Modern Life Better But Not Necessary EasierABCNo ratings yet

- Ras305 Proj 2B - Rembau Retirement VillageDocument7 pagesRas305 Proj 2B - Rembau Retirement Villagefaid hakimiNo ratings yet

- Pefc Conformity AssessmentDocument207 pagesPefc Conformity AssessmentAhmad Deni RojabsaniNo ratings yet

- The DARK-GREEN SCHOOLS PROGRAMDocument22 pagesThe DARK-GREEN SCHOOLS PROGRAMCapale MC100% (1)

- What Role Does Natural Environment Play in Our LifeDocument12 pagesWhat Role Does Natural Environment Play in Our LifeНастя НелипонькаNo ratings yet

- New Zealand White EditionDocument3 pagesNew Zealand White EditionUsha DasotNo ratings yet

- Presentation Albania Nov 2021Document17 pagesPresentation Albania Nov 2021Federico Muñoz CorreaNo ratings yet

- Topic 7Document35 pagesTopic 7fdfdNo ratings yet

- Circularity Gap Report 2021Document37 pagesCircularity Gap Report 2021Seth CoanNo ratings yet

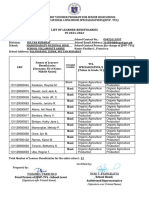

- List of Learner-Beneficiaries SY 2021-2022: Voucher NumberDocument1 pageList of Learner-Beneficiaries SY 2021-2022: Voucher NumberPauline Francisco-LeongNo ratings yet