Professional Documents

Culture Documents

Larsen

Uploaded by

Migs CruzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Larsen

Uploaded by

Migs CruzCopyright:

Available Formats

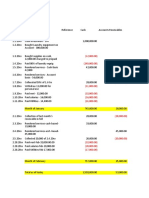

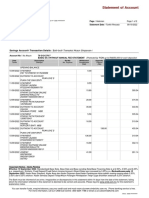

Larsen Company Larsen Company

Balance Sheet Balance Sheet

As of December 31, 19x5 As of December 31, 19x5

Asset Asset

Current Assets Sales (1,920,000.00)

Cash 80,000.00 COGS 1,240,000.00

Accounts Receivable 160,000.00 Gross Profit (35%) (680,000.00)

Inventory of materials 500,000.00 Opex:

Total Current Assets 740,000.00 Selling, G&A Expenses 430,000.00

PNL before tax (250,000.00)

Non-Current Assets:

New Equipment 250,000.00

Old Plant and Equipment 80,000.00

AD Old Plant (80,000.00)

New Plant and Equipment 700,000.00

AD New Plant (120,000.00)

Total Non-Current Assets 830,000.00

Total Assets 1,570,000.00

Liabilities & Equity

Current Liabilities

Accounts Payable (40,000.00)

Total Current Liabilities (40,000.00)

Non -Current Liabilities

Accounts Payable (230,000.00)

Total Non-Current Liabilities (230,000.00)

Shareholders Equity

Common Stock (900,000.00)

Retained Earnings (400,000.00)

Total Shareholder's Equity (1,300,000.00)

Total Liabilities and SHE (1,570,000.00)

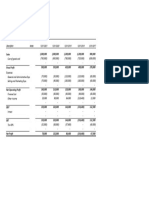

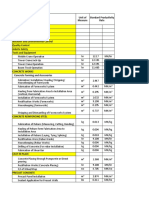

19x4 Adjustment 1995 19x4 19x5

Asset Ending Balances Dr Cr Should be Ending Balance Dr Cr Ending Balances

Cash 40,000.00 40,000.00 1,920,000.00 (1,880,000.00) 80,000.00

Accounts Receivable 80,000.00 80,000.00 80,000.00 160,000.00

Inventory of materials 250,000.00 250,000.00 650,000.00 (400,000.00) 500,000.00

Total Current Assets 370,000.00 - - 370,000.00 740,000.00

Plant and Equipment

New Equipment - - 250,000.00 250,000.00

Old Plant and Equipment - 80,000.00 80,000.00 80,000.00

AD Old Plant - (80,000.00) (80,000.00) (80,000.00)

New Plant and Equipment 700,000.00 700,000.00 700,000.00

AD New Plant - - (120,000.00) (120,000.00)

Total Assets 1,070,000.00 80,000.00 (80,000.00) 1,070,000.00 1,570,000.00

Liabilities and Equities

Accounts Payable (20,000.00) (20,000.00) (20,000.00) (40,000.00)

Plant equipment loan - - 20,000.00 (250,000.00) (230,000.00)

Common Stock (900,000.00) (900,000.00) (900,000.00)

Retained Earnings (150,000.00) 80,000.00 (80,000.00) (150,000.00) (400,000.00)

Total Liab and Equity (1,070,000.00) 80,000.00 (80,000.00) (1,070,000.00) (1,570,000.00)

Income statement

Sales (1,600,000.00) - (1,920,000.00) (1,920,000.00)

COGS 1,040,000.00 - 1,240,000.00 1,240,000.00

OPEX GP (560,000.00) - - - (680,000.00)

Selling, G&A Expenses 390,000.00 - 430,000.00 430,000.00

Net PnL (170,000.00) - - - (250,000.00)

checking 320,000.00 (320,000.00) 4,590,000.00 (4,590,000.00)

Should be zero - -

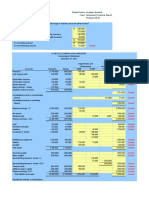

JE# JE: Dr Cr

1 Old Plant and Equipment 80,000.00 19x5 Unadj Ending Bal Should be doubled Req Adj

RE(COGS) (80,000.00) Cash 410,000.00 80,000.00 (330,000.00)

Accounts Receivable 80,000.00 80,000.00 (80,000.00)

2 RE(COGS-DEP) 80,000.00 Inventory of materials 250,000.00 250,000.00 (250,000.00)

Adjust computation in JE#11

AD Old Plant (80,000.00)

COGS 19x5

3 COGS-DEP 120,000.00 Beg Materials 250,000.00

AD New Plant (120,000.00) Purchases 400,000.00

Ending Materials (250,000.00)

4 COGS - Salaries Wages 280,000.00 Materials for COGS w/o Mark up 400,000.00

Cash (280,000.00) 120% Mark-up 1.2

COGS Materials 480,000.00

5 Material 400,000.00 COGS - Dep 120,000.00

Cash (400,000.00) COGS - Salaries Wages 280,000.00

COGS - FOH 360,000.00

6 COGS - Materials 480,000.00 Total COGS 1,240,000.00

Materials (480,000.00)

(400,000*1.2) as GP% must still the same and movement same with Sales

19x5 Unadj Ending Bal Should be doubled Req AdjADJ

7 COGS - FOH 360,000.00 Accounts Payable (20,000.00) (40,000.00) (20,000.00)

Cash (360,000.00) -

-

8 Selling, G&A Expenses 430,000.00 Adjust computation in JE#12

Cash (430,000.00)

9 Cash 1,920,000.00

Sales (1,920,000.00)

(1,600,000*1.2) increases in sales forecast 120%

10 New Equipment 250,000.00

Plant equipment loan (250,000.00)

11 Accounts Receivable 80,000.00

Inventory of materials 250,000.00

Cash (330,000.00)

to reclass the should be as per instruction doubled the amount from Beg Bal in Current Assets

See note 11

12 Plant equipment loan 20,000.00

Accounts Payable (20,000.00)

13 PNL 250,000.00

Retained Earnings (250,000.00)

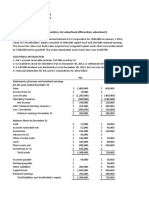

Ratio Formula 19x4 19x5

Debt Ratio TL/TA 2% 3% This good since 1:0.17 means that we have still more assets than liabilities and can cover it debt Good

Equity Ratio TE/TA 98% 83% This is fine, and understandable that the Larsen company will acquire new equipment by having the said loan. Bad, Neutral

Debt to Equity Ratio TL/TE 2% 3% Since it acquired equipment for the improvement of its production, the next years/months should lowered the DER by the time of payment Bad, Neutral

debt has incurred and as profit increased with the new eq..

Gross Revenue 100% 100% ok

COGS -65% -65% ok

Gross profit Ratio 35% 35% ok

Operating Margin 11% 13% Increased in OM means that the company can pay its fix expenses like interest and debt

Therefore we conclude that based on the FS - BS and IS forecast, I would suggest that Larsen company can obtain a loan up to his profit $240,000 but since there was an

additional in AP of $20,000 increase in the short term loan the suggested loan would be $230,000 to give allowances in the short term loan.

The quick asset is a total of $230,000 which is enough and sufficient in the new loan to cover.

You might also like

- LarsenDocument4 pagesLarsenMigs CruzNo ratings yet

- IIlustration - CFS Special ProblemDocument4 pagesIIlustration - CFS Special ProblemMarion MalabananNo ratings yet

- IIlustration - Combined Financial StatementsDocument6 pagesIIlustration - Combined Financial StatementsMarion Malabanan100% (1)

- Consolidated Financial Statement AdjustmentsDocument1 pageConsolidated Financial Statement Adjustmentskate trishaNo ratings yet

- ABC Co Acquisition of XYZ Inc ConsolidationDocument3 pagesABC Co Acquisition of XYZ Inc ConsolidationLabLab ChattoNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- LQ3 FinalDocument6 pagesLQ3 FinalRaz MahariNo ratings yet

- Bekky's Balance Sheet 2012Document48 pagesBekky's Balance Sheet 2012vipinkala1100% (1)

- Partnership Formation ProblemsDocument128 pagesPartnership Formation ProblemsCharisse VisteNo ratings yet

- Afar Partnership LiquidationDocument42 pagesAfar Partnership LiquidationKrizia Mae Uzielle PeneroNo ratings yet

- Vending Machines SolutionDocument6 pagesVending Machines SolutionizquierdofacturaNo ratings yet

- Consolidated Fiancial StatementsDocument15 pagesConsolidated Fiancial StatementsChristie SabidorNo ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- Lopez, Patrcia-AC213 Guided-Activity 2Document8 pagesLopez, Patrcia-AC213 Guided-Activity 2leonel hipolitoNo ratings yet

- chp3 Practice Problem 1Document1 pagechp3 Practice Problem 1api-557861169No ratings yet

- Audit Journal Entries GuideDocument7 pagesAudit Journal Entries Guidereina maica terradoNo ratings yet

- Badvac1x - Mod 3 TemplatesDocument42 pagesBadvac1x - Mod 3 TemplatesKyla de SilvaNo ratings yet

- ACCTG 029 MOD 3 Conso Subsequent TemplateDocument40 pagesACCTG 029 MOD 3 Conso Subsequent TemplateBetty Santiago67% (3)

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Accounting AssignmentDocument5 pagesAccounting AssignmentVivek SinghNo ratings yet

- Law Office Break Even Analysis Shows 10,147 Clients NeededDocument7 pagesLaw Office Break Even Analysis Shows 10,147 Clients NeededJude Español JorsaNo ratings yet

- Business Combination Date of Acquisition Suggested SolutionDocument3 pagesBusiness Combination Date of Acquisition Suggested SolutionMelissa SenonNo ratings yet

- a 1. formationDocument3 pagesa 1. formationmartinfaith958No ratings yet

- FS ANALYSIS QuizDocument2 pagesFS ANALYSIS QuizDivineDavisNo ratings yet

- Income Statment SampleDocument1 pageIncome Statment Samplewaqas akramNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- Bizcom Problem 3-2Document1 pageBizcom Problem 3-2kate trishaNo ratings yet

- Badvac1x - Mod 3 TemplatesDocument44 pagesBadvac1x - Mod 3 TemplatesRezhel Vyrneth TurgoNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Exercício Adicionais DFCDocument6 pagesExercício Adicionais DFCLeonardo CunhaNo ratings yet

- Solution - Chapter 31, 32, 33, 34 and 41Document10 pagesSolution - Chapter 31, 32, 33, 34 and 41Aeron Arroyo IINo ratings yet

- Pension Cash Pension Plan Expense Contributionasset/Liability Dbo AssetsDocument1 pagePension Cash Pension Plan Expense Contributionasset/Liability Dbo AssetsNam TranNo ratings yet

- Case 1Document6 pagesCase 1Nicolyn Rae EscalanteNo ratings yet

- Case 1Document6 pagesCase 1Nicolyn Rae EscalanteNo ratings yet

- Absor Pvt. LTDDocument4 pagesAbsor Pvt. LTDsam50% (2)

- Hardware Partnership FormationDocument13 pagesHardware Partnership FormationAllen GonzagaNo ratings yet

- Analyzing Business Transactions Using ExcelDocument30 pagesAnalyzing Business Transactions Using ExcelPhaelyn YambaoNo ratings yet

- 3. interco trans ansDocument5 pages3. interco trans ansmartinfaith958No ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- ARA Galleries Financial ReportsDocument4 pagesARA Galleries Financial ReportsBáchHợpNo ratings yet

- ABC Inc. acquires XYZ Co. and recognizes goodwillDocument15 pagesABC Inc. acquires XYZ Co. and recognizes goodwillLyca Mae CubangbangNo ratings yet

- Tutorial4 - Sol - New UpdateDocument13 pagesTutorial4 - Sol - New UpdateHa NguyenNo ratings yet

- Manuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementDocument5 pagesManuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementP De GuzmanNo ratings yet

- Financial Statement Analysis Live ProjectDocument6 pagesFinancial Statement Analysis Live ProjectAnand Shekhar MishraNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Halo-Kola Class Template ReorgDocument1 pageHalo-Kola Class Template Reorgadithi.manjunath1No ratings yet

- Paw & Saw Downstream ConsolidationDocument3 pagesPaw & Saw Downstream ConsolidationLorie Roncal JimenezNo ratings yet

- Actbfar Exercise #2Document8 pagesActbfar Exercise #2Janela Venice SantosNo ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Angel Corporation Acquisition AdjustmentDocument5 pagesAngel Corporation Acquisition AdjustmentJoebet DebuyanNo ratings yet

- Quicky Profit and LossDocument1 pageQuicky Profit and LossBea GarciaNo ratings yet

- Castro, Geene - Activity 1 - Bsma 3205Document6 pagesCastro, Geene - Activity 1 - Bsma 3205Geene CastroNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Christian Company (Manufactured)Document2 pagesChristian Company (Manufactured)Reginald MundoNo ratings yet

- Assignment 3 11 6 DreyDocument4 pagesAssignment 3 11 6 DreyAbigail BombalesNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- Polo Corporation Acquires Solo Company StockDocument10 pagesPolo Corporation Acquires Solo Company StockJaira ClavoNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Tugas Konsold - Inf. Keu - Yohanes Anindra Bagas W - 142180132Document8 pagesTugas Konsold - Inf. Keu - Yohanes Anindra Bagas W - 142180132Yohanes BagasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Prem Mandal Flipkart InvoiceDocument1 pagePrem Mandal Flipkart Invoiceviratrohitrahul18451No ratings yet

- Barangay Budget Preparation Form No. 1Document5 pagesBarangay Budget Preparation Form No. 1Yza Belle100% (1)

- List of Real Properties and Transportations - TemplateDocument2 pagesList of Real Properties and Transportations - Templatejharel jay pizarro100% (1)

- Slick LineDocument7 pagesSlick LineHosamMohamedNo ratings yet

- Public Tender 3907 T: Ceylon Petroleum CorporationDocument19 pagesPublic Tender 3907 T: Ceylon Petroleum CorporationIndunil WarnasooriyaNo ratings yet

- Assignment OTDocument2 pagesAssignment OTshalukpr100% (3)

- Annex 30 - BRSDocument1 pageAnnex 30 - BRSLikey PromiseNo ratings yet

- Task 1: Arithmetic & Geometric Sequence: TH TH RD THDocument2 pagesTask 1: Arithmetic & Geometric Sequence: TH TH RD THSarah RanduNo ratings yet

- Falex 400 Fuel Thermal Oxidation Test Machine Operation ManualDocument49 pagesFalex 400 Fuel Thermal Oxidation Test Machine Operation ManualΓΙΩΡΓΟΣ ΓεωNo ratings yet

- ECON1220 Problem Set 2 SolutionsDocument6 pagesECON1220 Problem Set 2 SolutionsRuiying XiaoNo ratings yet

- Chapter 5: Figures: PreviewDocument3 pagesChapter 5: Figures: PreviewMoli CatNo ratings yet

- Productivity RateDocument5 pagesProductivity RateSarah TolineroNo ratings yet

- Answer To The Question No 1Document2 pagesAnswer To The Question No 1Nafiul haqueNo ratings yet

- Essential Characteristics of Contract of SaleDocument5 pagesEssential Characteristics of Contract of SaleShiela BasadreNo ratings yet

- Merritt Morning Market 3739 - Sept 23Document2 pagesMerritt Morning Market 3739 - Sept 23Kim LeclairNo ratings yet

- University of ZimbabweDocument4 pagesUniversity of ZimbabwefaraiNo ratings yet

- Bramall - Industrialization of Rural ChinaDocument437 pagesBramall - Industrialization of Rural ChinaMatthew ChalkNo ratings yet

- Biermann's Handbook of Pulp and Paper - Cap 01Document18 pagesBiermann's Handbook of Pulp and Paper - Cap 01chau_riberNo ratings yet

- MCQ On Marketing ManagementDocument2 pagesMCQ On Marketing ManagementCharu Modi67% (3)

- Principles of Managerial Finance: Risk and ReturnDocument57 pagesPrinciples of Managerial Finance: Risk and ReturnJoshNo ratings yet

- Bt5 Lecture 1Document32 pagesBt5 Lecture 1Marrielle BalagotNo ratings yet

- Interest CalculationDocument23 pagesInterest CalculationKeshava PalisettiNo ratings yet

- Affidavit of Adverse Claim BlankDocument2 pagesAffidavit of Adverse Claim BlankWinly SupnetNo ratings yet

- Principles of Macroeconomics 12th Edition by Karl e Case Ebook PDFDocument41 pagesPrinciples of Macroeconomics 12th Edition by Karl e Case Ebook PDFmarla.gregg258100% (30)

- UnknownDocument2 pagesUnknownAng Xin JuinNo ratings yet

- Purchase Order ThreadDocument2 pagesPurchase Order ThreadSHALOM THREAD WORKS100% (1)

- MGT1500 HI AssignmentDocument1 pageMGT1500 HI Assignmentishaankakade21No ratings yet

- Warning: This Life Expectancy Template Is of Course Only For Information and Not To Be Taken Too SeriouslyDocument9 pagesWarning: This Life Expectancy Template Is of Course Only For Information and Not To Be Taken Too SeriouslyEshaq Al-BishiNo ratings yet

- Lesson 3 The Structure of Globalization The Global EconomyDocument43 pagesLesson 3 The Structure of Globalization The Global EconomyREX MARVIN LLENANo ratings yet