Professional Documents

Culture Documents

Notice To Vat Registered Persons 31 08 2022

Notice To Vat Registered Persons 31 08 2022

Uploaded by

Madurika0 ratings0% found this document useful (0 votes)

6 views1 pageThe Inland Revenue Department issued a notice announcing changes to Value Added Tax (VAT) rates in Sri Lanka effective September 1, 2022. Specifically, the VAT rate on the import of certain fabrics was reduced to 0% while the standard VAT rate on all other imports and domestic goods and services was increased from 12% to 15%. Additionally, the VAT rate on supplies by hotels, restaurants, and other tourism-related businesses was also increased from 0% to 15%.

Original Description:

Original Title

notice_to_vat_registered_persons_31_08_2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Inland Revenue Department issued a notice announcing changes to Value Added Tax (VAT) rates in Sri Lanka effective September 1, 2022. Specifically, the VAT rate on the import of certain fabrics was reduced to 0% while the standard VAT rate on all other imports and domestic goods and services was increased from 12% to 15%. Additionally, the VAT rate on supplies by hotels, restaurants, and other tourism-related businesses was also increased from 0% to 15%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageNotice To Vat Registered Persons 31 08 2022

Notice To Vat Registered Persons 31 08 2022

Uploaded by

MadurikaThe Inland Revenue Department issued a notice announcing changes to Value Added Tax (VAT) rates in Sri Lanka effective September 1, 2022. Specifically, the VAT rate on the import of certain fabrics was reduced to 0% while the standard VAT rate on all other imports and domestic goods and services was increased from 12% to 15%. Additionally, the VAT rate on supplies by hotels, restaurants, and other tourism-related businesses was also increased from 0% to 15%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

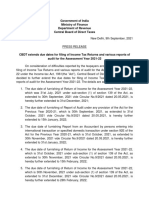

PN/VAT/2022-03

31.08.2022

INLAND REVENUE DEPARTMENT

Notice to VAT Registered Persons

Change of Value Added Tax (VAT) Rate

As per the Extraordinary Gazette Notification No. 2295/08 dated August 31, 2022, published

under section 2A of the Value Added Tax Act, No. 14 of 2002, VAT rate has been revised with

effect from September 01, 2022 as set out below.

Description VAT Rate

(a) Import of goods (Fabrics)

Import of fabrics set out in the H.S. Code and description specified

in Column I and II of Schedule of the Extraordinary Gazette Zero per centum

Notification No. 2095/20 dated November 1, 2018 (0%)

(b) Standard Rate

Import and/or supply of goods or supply of services, other than Fifteen per centum

import of goods as referred to under above paragraph [paragraph (a)] (15%)

Including,

supply of services by a hotel, guest house, restaurant or other

similar businesses providing similar services, registered with Fifteen per centum

the Sri Lanka Tourism Development Authority, (for which (15%)

VAT rate on such supply was at 0% from December 01, 2019

to May 31, 2022)

Further, VAT Rate applicable on supply of financial services remains unchanged at

Eighteen per centum (18%)

Commissioner General of Inland Revenue

You might also like

- KPMG-Technical Update May 22 enDocument3 pagesKPMG-Technical Update May 22 enbryanmark2512No ratings yet

- Dojstru 1Document35 pagesDojstru 1Bhupendra CharanNo ratings yet

- G.R. No. 180345 November 25, 2009 San Roque Power Corporation, Petitioner, Commissioner of Internal Revenue, RespondentDocument110 pagesG.R. No. 180345 November 25, 2009 San Roque Power Corporation, Petitioner, Commissioner of Internal Revenue, Respondentsolutio indebtiiNo ratings yet

- General JournalDocument3 pagesGeneral JournalLyra Ivy ManaligodNo ratings yet

- YYC July NewsletterDocument11 pagesYYC July NewsletterCatherine ChuaNo ratings yet

- Adm Guidelines Cov 19 LevyDocument12 pagesAdm Guidelines Cov 19 LevyFuaad DodooNo ratings yet

- Notice To The Taxpayers: Change of Value Added Tax Rate Income TaxDocument1 pageNotice To The Taxpayers: Change of Value Added Tax Rate Income Taxamicoindustries984No ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- ACW291 CHP 10 SST - 231117 - 154211Document70 pagesACW291 CHP 10 SST - 231117 - 154211hemaram2104No ratings yet

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDocument23 pagesTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenNo ratings yet

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument2 pagesGovernment of India Ministry of Finance Department of Revenue Central Board of Direct Taxeslakshmi kasthuriNo ratings yet

- WWW - Incometax.gov - In: Ress EleaseDocument14 pagesWWW - Incometax.gov - In: Ress EleaseJanani SubramanianNo ratings yet

- STP 07 - 2020Document1 pageSTP 07 - 2020Fiza. MNorNo ratings yet

- PressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFDocument2 pagesPressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFSaBoNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- Tax Code and Period CodeDocument1 pageTax Code and Period CodeThiruNo ratings yet

- GNV Tax News February 2022Document5 pagesGNV Tax News February 2022BenjaminNo ratings yet

- GST Changes Effective From January 01, 2022Document9 pagesGST Changes Effective From January 01, 2022p.kunduNo ratings yet

- 01 VatDocument29 pages01 VatNaimul KaderNo ratings yet

- Tax Management CIA 1.2Document16 pagesTax Management CIA 1.2Priyanshi Agrawal 1820149No ratings yet

- Alcohol Powder Products Letter To External Stakeholders - 8 August 2022Document2 pagesAlcohol Powder Products Letter To External Stakeholders - 8 August 2022techgurus210No ratings yet

- Input TaxDocument10 pagesInput TaxJan ernie MorillaNo ratings yet

- Quiz For Business TaxDocument5 pagesQuiz For Business TaxAngela WaganNo ratings yet

- Tax Base For VAT: Import StageDocument2 pagesTax Base For VAT: Import StageS. M. Saz Lul HoqueNo ratings yet

- Quarterly National Accounts: GDP and Expenditure ComponentsDocument1 pageQuarterly National Accounts: GDP and Expenditure ComponentsVinay MadgavkarNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- 2017 Amendments To The Tax Code by The TRAIN LawDocument28 pages2017 Amendments To The Tax Code by The TRAIN LawScarlette CooperaNo ratings yet

- 201 Oct To Dec 2011Document4 pages201 Oct To Dec 2011Ishan KhandelwalNo ratings yet

- 2a. SAC Module 200 PG - Dec2022Document139 pages2a. SAC Module 200 PG - Dec2022Irvin Dave AlutayaNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- AFF's Memorandum On Federal & Provincial Finance Acts, 2022Document61 pagesAFF's Memorandum On Federal & Provincial Finance Acts, 2022ABODE PVT LIMITEDNo ratings yet

- Module 7 Chapter 9 Input VATDocument7 pagesModule 7 Chapter 9 Input VATChris SumandeNo ratings yet

- TXROM 2019 Dec ADocument9 pagesTXROM 2019 Dec AKAH MENG KAMNo ratings yet

- Taxable Income: 20% 10000 200000/2 200000000 PIT 200000000 5% 10mDocument32 pagesTaxable Income: 20% 10000 200000/2 200000000 PIT 200000000 5% 10mnga vuNo ratings yet

- Tax232 - Input VatDocument21 pagesTax232 - Input VatClaire Ann ParasNo ratings yet

- Chapter 9 Percentage TaxDocument25 pagesChapter 9 Percentage TaxTrisha Mae BoholNo ratings yet

- E-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement SlipDocument2 pagesE-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement SlipBiswajit SarkarNo ratings yet

- Press Release Extension of Time Limits - 30 12 2020Document2 pagesPress Release Extension of Time Limits - 30 12 2020Sarang BondeNo ratings yet

- Service-Turnover-Tax-Repeal 2020Document3 pagesService-Turnover-Tax-Repeal 2020vaishnaviNo ratings yet

- FGFERWWYEDVSDFGAWERFGDocument2 pagesFGFERWWYEDVSDFGAWERFGMD. ANWAR UL HAQUENo ratings yet

- Zambia 2012 Budget HighlightsDocument10 pagesZambia 2012 Budget HighlightsChola MukangaNo ratings yet

- Change of VAT Rate To 15 GLDocument33 pagesChange of VAT Rate To 15 GLbevinonlineNo ratings yet

- Sales Tax8903728Document42 pagesSales Tax8903728FBR GujranwalaNo ratings yet

- Nepal Budget Highlights - 79-80 - APM & AssociatesDocument89 pagesNepal Budget Highlights - 79-80 - APM & Associatesaasthapoddar155No ratings yet

- RMC No. 23-2007-Government Payments WithholdingDocument7 pagesRMC No. 23-2007-Government Payments WithholdingWizardche_13No ratings yet

- UntitledDocument2 pagesUntitleddtNo ratings yet

- THE Ministry of FinanceDocument19 pagesTHE Ministry of FinancePhương Trần Đỗ NgọcNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- What Are The Restrictions in Claiming Input VAT Adjustment Against Output VAT? (D-16)Document10 pagesWhat Are The Restrictions in Claiming Input VAT Adjustment Against Output VAT? (D-16)Javed AhmedNo ratings yet

- CREATE LAW - Short IntroDocument3 pagesCREATE LAW - Short IntroBenjie DavilaNo ratings yet

- Computations of VATDocument21 pagesComputations of VATMikee TanNo ratings yet

- Tax Expenditure Report 2023 24Document277 pagesTax Expenditure Report 2023 24fazilNo ratings yet

- GST Amendments For June 22 Students by CA Vivek GabaDocument6 pagesGST Amendments For June 22 Students by CA Vivek GabayashNo ratings yet

- Revenue Regulation 21-2018: Prof. Jeanefer ReyesDocument5 pagesRevenue Regulation 21-2018: Prof. Jeanefer Reyesmark anthony espirituNo ratings yet

- Overview of The Amendments-Train LawDocument23 pagesOverview of The Amendments-Train LawCha GalangNo ratings yet

- Social Security Contribution LevyDocument5 pagesSocial Security Contribution LevyNews CutterNo ratings yet

- Sales Tax6684159Document6 pagesSales Tax6684159HummayounNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet