Professional Documents

Culture Documents

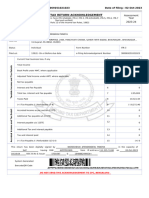

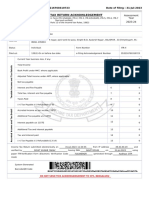

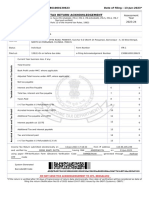

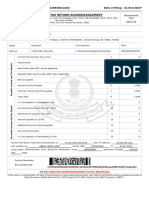

Tax Code and Period Code

Uploaded by

Thiru0 ratings0% found this document useful (0 votes)

12 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageTax Code and Period Code

Uploaded by

ThiruCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

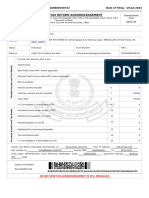

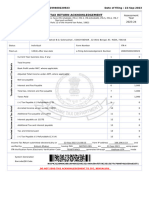

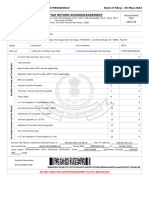

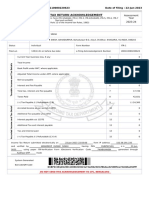

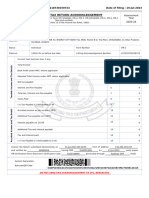

Notice to Taxpayers

Year of Assessment 2022/2023

Make the following tax payments on or before February 15, 2023

Tax Type Tax Type Code Period Code

Corporate Income Tax (CIT) 02 22233

Individual Income Tax (IIT) 05 22233

Partnership Tax (PIT) 09 22233

Advance Income Tax (AIT)/ Withholding Tax 43 23010

(WHT) on Interest

Advance Income Tax (AIT)/ Withholding Tax 44 23010

(WHT) on Fees and Others

Advance Personal Income Tax (APIT) 03 23010

Payment Category S

Do not wait until receiving Paying-in-Slips

Pay due Taxes through Online Tax Payment Platform (OTPP)

For further information - visit www.ird.gov.lk to refer to the notice No. PN/PMT/2021-01 dated February 08, 2021,

Notice No. PN/PMT/2021-04 dated June 08, 2021 Notice No. PN/PMT/2021-04(Revised) dated December 21, 2021 and

the Notice No. PN/PMT/2022-01 dated May 17, 2022

In addition payments for CIT, IIT, PIT & APIT can be made at any branch of

Bank of Ceylon

Payments for AIT & WHT can be made at any branch of People’s Bank

Please write your Taxpayer Identification Number (TIN) on the reverse side of the Cheque and further information is

also available on the reverse side of the paying-in-slip

When the payment is made at the Bank, DIN (number) should be obtained (especially for People’s Bank) from

Customer Supporting & Promotion Unit, if the preprinted paying-in-slip is not available (Tel: 0112134205,

2134280, 2134279, 2134276, 2134274 & 2134278)

Please be informed that the penalty and interest Imposed for non-payment or late payment of Income

Tax will not be waived off or reduced

Refer to the Inland Revenue website for updated information regularly

Commissioner General of Inland Revenue

You might also like

- Withholding Tax (WHT) Advanced Income Tax (AIT) : On or Before January 15, 2023Document1 pageWithholding Tax (WHT) Advanced Income Tax (AIT) : On or Before January 15, 2023ThiruNo ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- JNJ Online Shop BIR Form 2307 CertificateDocument5 pagesJNJ Online Shop BIR Form 2307 CertificateReagan RodriguezNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- GST Times - Vol.1, Issue-3Document22 pagesGST Times - Vol.1, Issue-3Milna JosephNo ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- E-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement SlipDocument2 pagesE-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement SlipBiswajit SarkarNo ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- PLDT 2307 July 2021 Front CorrectedDocument1 pagePLDT 2307 July 2021 Front CorrectedChristopher AbundoNo ratings yet

- Due Date Calendar June 22Document1 pageDue Date Calendar June 22HAKIMI MZNNo ratings yet

- Income Tax Payment Challan: PSID #: 57373338Document1 pageIncome Tax Payment Challan: PSID #: 57373338Kashif NiaziNo ratings yet

- The City Bank Limited, City Bank Center, 28 Gulshan Avenue, Gulshan 1, Dhaka 1212, BangladeshDocument1 pageThe City Bank Limited, City Bank Center, 28 Gulshan Avenue, Gulshan 1, Dhaka 1212, BangladeshMd Jobayer HossainNo ratings yet

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDocument9 pagesPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- PDF 554248680190723Document1 pagePDF 554248680190723Deepika SNo ratings yet

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- Income Tax Payment Challan: PSID #: 57363867Document1 pageIncome Tax Payment Challan: PSID #: 57363867Kashif NiaziNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- 0605 2022 BIR Form NoDocument1 page0605 2022 BIR Form NoChristopher AbundoNo ratings yet

- Income Tax Payment Challan: PSID #: 57372718Document1 pageIncome Tax Payment Challan: PSID #: 57372718Kashif NiaziNo ratings yet

- Tib Vol35 No5Document43 pagesTib Vol35 No5infoNo ratings yet

- Ack 288199400220923Document1 pageAck 288199400220923bapi210280No ratings yet

- ACK_BMBPM0763Q_2022-23_638029220290522_merged (1)Document2 pagesACK_BMBPM0763Q_2022-23_638029220290522_merged (1)deepghosh260897No ratings yet

- PDF 280110080220623Document1 pagePDF 280110080220623AKS SONG SAN SINGHNo ratings yet

- SWG02-Kuljot Walia Income Tax Full Set Assessment Year 2022-23Document13 pagesSWG02-Kuljot Walia Income Tax Full Set Assessment Year 2022-23xqggtxyzhfNo ratings yet

- SkatteoppgjørDocument4 pagesSkatteoppgjørFlorin MirceaNo ratings yet

- Income Tax Payment Challan: PSID #: 57373755Document1 pageIncome Tax Payment Challan: PSID #: 57373755Kashif NiaziNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Document78 pagesIndian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Mohit DuhanNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605KC AtinonNo ratings yet

- Income Tax Payment Challan: PSID #: 164056997Document1 pageIncome Tax Payment Challan: PSID #: 164056997M ZubairNo ratings yet

- RMO No. 34-2020 - DigestDocument1 pageRMO No. 34-2020 - DigestJoel SyNo ratings yet

- Taxjournal July 2020Document60 pagesTaxjournal July 2020Venkatesh PrabhuNo ratings yet

- L& C 1604E 2023 Form AmendedV3Document2 pagesL& C 1604E 2023 Form AmendedV3fitnessarmy2021No ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- ACK953216760310723Document1 pageACK953216760310723krishna salesNo ratings yet

- LA0122001372967Document1 pageLA0122001372967bidda samuelNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- PDF 230861000130623Document1 pagePDF 230861000130623Sunil AccountsNo ratings yet

- Declaration 3966758Document6 pagesDeclaration 3966758mehboob rehmanNo ratings yet

- PDF 586047400291223 231229 125627Document1 pagePDF 586047400291223 231229 125627gnb22061958No ratings yet

- Income Tax PaymentDocument1 pageIncome Tax PaymentKashif NiaziNo ratings yet

- PDF 493238550311023Document1 pagePDF 493238550311023pan.sonarbanglaNo ratings yet

- Final Ready SampleDocument15 pagesFinal Ready SampleachsamirksNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- Tax Card 2020-21 PDFDocument18 pagesTax Card 2020-21 PDFkashansajjadNo ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- 17-Article Text-186-3-10-20220308Document7 pages17-Article Text-186-3-10-20220308Decky SulistyoNo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- PDF 472218730150723Document1 pagePDF 472218730150723pankajNo ratings yet

- INSURBANCEDocument2 pagesINSURBANCE11rj.thakurNo ratings yet

- BIR Form No. 0605 Payment FormDocument1 pageBIR Form No. 0605 Payment FormPAULA TVNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- Group 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnDocument4 pagesGroup 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnVan Joshua NunezNo ratings yet

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

- Tax Filing And/or Payment Guide During The QuarantineDocument47 pagesTax Filing And/or Payment Guide During The QuarantineMaria Rose Giltendez - BartianaNo ratings yet

- Basic Features of Value Added Tax (VAT) For ItesDocument24 pagesBasic Features of Value Added Tax (VAT) For ItesDebashishDolonNo ratings yet

- Mandeep Kaur 2023-2024Document1 pageMandeep Kaur 2023-2024amanghou181206No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Tax Calendar 2023Document5 pagesTax Calendar 2023Sameera NandikaNo ratings yet

- Registration ActivationDocument1 pageRegistration ActivationThiruNo ratings yet

- Registration ActivationDocument1 pageRegistration ActivationThiruNo ratings yet

- SEC 2022 E 05 (Rev)Document4 pagesSEC 2022 E 05 (Rev)hvalolaNo ratings yet

- Budget 2022Document31 pagesBudget 2022ThiruNo ratings yet

- Paye RegostrationDocument5 pagesPaye RegostrationThiruNo ratings yet

- Gen11102023 SDocument1 pageGen11102023 SThiruNo ratings yet

- KPMG 2022 Interim Budget - Tax ProposalDocument27 pagesKPMG 2022 Interim Budget - Tax ProposalThiruNo ratings yet