Professional Documents

Culture Documents

Template Key Information Document PAYE No Deductions V9

Uploaded by

Arubayi AbonereOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Template Key Information Document PAYE No Deductions V9

Uploaded by

Arubayi AbonereCopyright:

Available Formats

Key Information Document

This document sets out key information about your relationship with us, including details about pay, holiday

entitlement and other benefits. Further information can be found in your contract and worker handbook. Specific

information relating to your assignment will be issued to you in your Worker Assignment Schedule.

We welcome any questions you wish to raise on the information in this document. Please contact us to discuss these.

Should you have a confidential query or complaint you can contact us by emailing us at

helpline@cordantgroup.com.

The Employment Agency Standards (EAS) Inspectorate is the government authority responsible for the

enforcement of certain agency worker rights. You can raise a concern with EAS directly or via ACAS

Name of Employment Business The UK Recruitment Co. Limited (t/a The

Recruitment Co.)

(address as per email)

Type of contract you will be Contract For Services

engaged under:

Who will be responsible for paying you: The Recruitment Co.

How often you will be paid Weekly - you will be paid each Friday a week in arrears

Expected or minimum rate of pay: Your minimum rate of pay will be the National Minimum

Wage in effect at the time of work as can be found at

https://www.gov.uk/national-minimum-wage-rates

Deductions from you pay required by law: We are required by law to deduct income tax and national

insurance from your wages.

After three months engagement, we are also required to

deduct pension contributions.

Any other non statutory There are no other deductions to be made.

deductions from your pay:

Any fees for goods or services: There are no fees for goods or services

Holiday entitlement: You are entitled to 5.6 weeks annual holiday accrued in

proportion to the hours that you work. If you work at one

client for more than 12 weeks, you might be entitled to

additional holiday entitlement to match that of their directly

employed workers.

Your Worker Assignment Schedule will provide these

details.

Holiday pay: Payment for your holidays will be made at the average rate

of pay you have earned over the 52 weeks worked prior to

your holiday (on or the

TRC-KID uncontrolled if printed 30/03/2023 V9

number of weeks worked up to 52 if you have not yet

completed 52 weeks work).

Your average rate will include the standard hours you work.

Depending on the client and the assignment this may also

include voluntary overtime.

For more information on how holidays are accrued, booked

and paid, please see your worker handbook.

Additional benefits: None - unless confirmed as part of your booking

Example Pay with pension deductions

Below is a representative example statement showing gross pay, costs and deductions, any fees charged and

net pay for a week's work. This is an example only and the amounts are dependent upon the pay rate and the

hours that you actually work.

Example rate of pay: 39 hours a week @ £10.42 per hour = £406.38

Deductions from your wage Tax: £31

required by law: National Insurance: £23

Pension: £19

Any other non statutory deductions from None

your pay:

Any fees for goods or services: None

Example net take home pay: Take home pay: £333.38

I confirm I have received a copy of the Key Information Document

Print Name: ABONERE ARUBAYI

Signed: Dated: 28/11/2023

TRC-KID uncontrolled if printed 30/03/2023 V9

You might also like

- Employee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsFrom EverandEmployee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsRating: 5 out of 5 stars5/5 (1)

- FACT17 Key Information Document Nexus PAYE 2Document3 pagesFACT17 Key Information Document Nexus PAYE 2Alex IonuțNo ratings yet

- The CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRFrom EverandThe CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRNo ratings yet

- 463 Key Information Document PayeDocument1 page463 Key Information Document Payesawuni953No ratings yet

- Key info on pay and benefitsDocument11 pagesKey info on pay and benefitsTahir SamadNo ratings yet

- Key Information Document: What Type of Contract Will I Be Engaged In?Document74 pagesKey Information Document: What Type of Contract Will I Be Engaged In?Towfiquzzaman ShummoNo ratings yet

- Experis Key InformationDocument10 pagesExperis Key InformationManimekalaiNo ratings yet

- Key Information Document (KID) 2023-2024 Updated 05.06.2023 (No Signature)Document2 pagesKey Information Document (KID) 2023-2024 Updated 05.06.2023 (No Signature)xdogg40No ratings yet

- Key Information Document - PAYE MonthlyDocument1 pageKey Information Document - PAYE MonthlynddkNo ratings yet

- ARM KID Umbrella SapphireDocument2 pagesARM KID Umbrella SapphireJan Christian NIkko BaesNo ratings yet

- Cymru KIDDocument1 pageCymru KIDoyetunde ogundiwinNo ratings yet

- 621571-Uddin 2Document12 pages621571-Uddin 2masumuddin440No ratings yet

- Vikaskumar Baburao NaikDocument9 pagesVikaskumar Baburao NaikPARIKSHIT GHODKENo ratings yet

- Spencer Ogden Key Information Document: Compliances & Contractor ServicesDocument1 pageSpencer Ogden Key Information Document: Compliances & Contractor Servicescristiano soaresNo ratings yet

- Summer RoseDocument9 pagesSummer Rosesummer absolomNo ratings yet

- Deepanshu Bhardwaj - Offer LetterDocument4 pagesDeepanshu Bhardwaj - Offer Letter4424qpzkzmNo ratings yet

- 29 December 2021 Shubham Kumar Behind Hotel Corbet Madhuban Nag Ar Kashipur Dear ShubhamDocument6 pages29 December 2021 Shubham Kumar Behind Hotel Corbet Madhuban Nag Ar Kashipur Dear ShubhamShubham ChauhanNo ratings yet

- Know Your Rights - Qatar As of Aug 14Document12 pagesKnow Your Rights - Qatar As of Aug 14bassith rahman MahmoodNo ratings yet

- OfferCover BarclaysDocument22 pagesOfferCover BarclaysMohamed FirdausNo ratings yet

- Essential InformationDocument14 pagesEssential InformationdavemuncNo ratings yet

- Hawkinge Employment ContractDocument7 pagesHawkinge Employment ContractMadalina Maria MNo ratings yet

- CONTRACT OF EMPLOYMENT DutiesDocument6 pagesCONTRACT OF EMPLOYMENT DutiesJax EsiNo ratings yet

- Client InformationDocument18 pagesClient Informationserena.dhavalNo ratings yet

- Attachment 2Document10 pagesAttachment 2asheesh_aashuNo ratings yet

- Offer Letter - Prajakta P-convertedDocument2 pagesOffer Letter - Prajakta P-convertedprajaktaNo ratings yet

- Hospitality Job Offer Letter TemplateDocument4 pagesHospitality Job Offer Letter TemplateDibyendu BiswasNo ratings yet

- Work Experience DocumentsDocument6 pagesWork Experience Documentsraosanjayrao1997No ratings yet

- Job Terms Draft - Netsole - June 2011Document6 pagesJob Terms Draft - Netsole - June 2011NetsoleNo ratings yet

- TandCs - ZurichDocument32 pagesTandCs - ZurichskylerboodieNo ratings yet

- Amber Boudreau - Employee AgreementDocument6 pagesAmber Boudreau - Employee AgreementAmber BoudreauNo ratings yet

- Employment Contract - Support Group (Reviewed by A A - 31-01-2020) (00603329)Document19 pagesEmployment Contract - Support Group (Reviewed by A A - 31-01-2020) (00603329)Syarifah NordinNo ratings yet

- Contract of Employment - Valentin Ganchev - 220729 - 150023Document9 pagesContract of Employment - Valentin Ganchev - 220729 - 150023Valentin GanchevNo ratings yet

- Granville Agreement Letter-3 Months PDFDocument3 pagesGranville Agreement Letter-3 Months PDFDanjelaNo ratings yet

- 6Document22 pages6FaKerMaGeNo ratings yet

- Software Engineer Offer LetterDocument6 pagesSoftware Engineer Offer Letteryashika swamiNo ratings yet

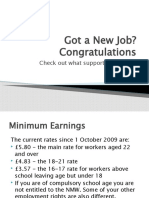

- Got A New Job-Here Are Some ResourcesDocument13 pagesGot A New Job-Here Are Some ResourcesjohnfairestNo ratings yet

- HIGA LOA - Other Than Managerial - FINAL - July 14Document25 pagesHIGA LOA - Other Than Managerial - FINAL - July 14Yejira KionNo ratings yet

- Rishabh Malhotra - Offer LetterDocument4 pagesRishabh Malhotra - Offer LetterrishabhNo ratings yet

- Your pension plan explainedDocument32 pagesYour pension plan explainednazy1983No ratings yet

- KID Umbrella - Sterling Solutions LimitedDocument3 pagesKID Umbrella - Sterling Solutions LimitedOkie RezkianNo ratings yet

- OfferDocument6 pagesOfferMohd Tufail (ALEX)No ratings yet

- Payroll Study SheetsDocument2 pagesPayroll Study SheetsNatalie DeLazzari VerberkNo ratings yet

- 5.1.4. Career CounselingDocument57 pages5.1.4. Career CounselingankitNo ratings yet

- Appointment Letter DetailsDocument4 pagesAppointment Letter DetailsParveshJakharNo ratings yet

- UntitledDocument7 pagesUntitledLaure M. CRISTAUNo ratings yet

- 6Document22 pages6FaKerMaGeNo ratings yet

- Pradeep Kumar Kanakadandi 155224Document12 pagesPradeep Kumar Kanakadandi 155224Amarjeet SinghNo ratings yet

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- Employment Offer Letter for Customer Service RoleDocument4 pagesEmployment Offer Letter for Customer Service RoleJack SwordNo ratings yet

- EOffer ContentDocument11 pagesEOffer ContentManmeet KaurNo ratings yet

- RBT Hourly PT Employment Offer LetterDocument5 pagesRBT Hourly PT Employment Offer LetteriridescentspacesNo ratings yet

- UNIT-5 Pay Structure: Basic Pay, DA, HRA, Gross Pay, Take Home Pay, EtcDocument22 pagesUNIT-5 Pay Structure: Basic Pay, DA, HRA, Gross Pay, Take Home Pay, EtcMitali MishraNo ratings yet

- Loan Documentation - 20231215065004Document13 pagesLoan Documentation - 20231215065004souljarsmile7No ratings yet

- Offer LetterDocument14 pagesOffer LetterPramod KumarNo ratings yet

- Key Information Document 2Document1 pageKey Information Document 2Gymy ChiforNo ratings yet

- 7 - Fair-Work-Information-Statement - Nov 2021Document3 pages7 - Fair-Work-Information-Statement - Nov 2021Eza BerezzaNo ratings yet

- Furlough Letter - 1381 - D.garrity24 PDFDocument3 pagesFurlough Letter - 1381 - D.garrity24 PDFDean GarrityNo ratings yet

- Private & ConfidentialDocument7 pagesPrivate & ConfidentialamitkumarpatniNo ratings yet

- Sample Job Offer LetterDocument3 pagesSample Job Offer LetterEmre KAYABASNo ratings yet

- (E2079) Ackn Wage InfoDocument1 page(E2079) Ackn Wage InfoJim TatNo ratings yet

- Topic 9 PartnershipDocument24 pagesTopic 9 PartnershipWong Yong Sheng WongNo ratings yet

- Abandonment of Imported GoodsDocument19 pagesAbandonment of Imported GoodsArellano AureNo ratings yet

- Sales Tax Registration RequirementsDocument6 pagesSales Tax Registration RequirementsBilal ShaikhNo ratings yet

- Revenue Officer Training Unit 1, Form #09.064Document98 pagesRevenue Officer Training Unit 1, Form #09.064Sovereignty Education and Defense Ministry (SEDM)No ratings yet

- Invoice ManishDocument1 pageInvoice ManishNupurNo ratings yet

- Taxation & Economics PresentationDocument21 pagesTaxation & Economics PresentationDanica Mae SerranoNo ratings yet

- CA Final Direct Tax Flow Charts May 2017 2SDMBZA2Document92 pagesCA Final Direct Tax Flow Charts May 2017 2SDMBZA2Meet Mehta100% (1)

- Life Insurance Corporation of India - Policyholder Information FormDocument1 pageLife Insurance Corporation of India - Policyholder Information FormSri RamNo ratings yet

- Orpys Львов Ukraine Online fassou.paradisiaque2018@gmai 621427888 Online fassou.paradisiaque2018@gmai 621427888Document1 pageOrpys Львов Ukraine Online fassou.paradisiaque2018@gmai 621427888 Online fassou.paradisiaque2018@gmai 621427888Fassou LamahNo ratings yet

- Economics, Govt BudgetDocument28 pagesEconomics, Govt BudgetRajinder SinghNo ratings yet

- LDNID, Supplier Registration Form Ver. 5.2 (2020) - SignDocument1 pageLDNID, Supplier Registration Form Ver. 5.2 (2020) - SigniraNo ratings yet

- Apoorva Studio & VideoDocument4 pagesApoorva Studio & VideoYASIR HUSSAINNo ratings yet

- Our Lady of Piat High School Piat, CagayanDocument13 pagesOur Lady of Piat High School Piat, CagayanRostiff Franzlyn SiringanNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Estate Tax Chapter SummaryDocument4 pagesEstate Tax Chapter SummaryPJ PoliranNo ratings yet

- Script AuditingReportDocument3 pagesScript AuditingReportElaine Joyce GarciaNo ratings yet

- Solved Paris Corporation Holds A 100 000 Unrealized Net Capital GainDocument1 pageSolved Paris Corporation Holds A 100 000 Unrealized Net Capital GainAnbu jaromiaNo ratings yet

- Withholding Tax On Rental Services: Guide 01Document2 pagesWithholding Tax On Rental Services: Guide 01Abdul NafiNo ratings yet

- AIPGE Membership Application FormDocument1 pageAIPGE Membership Application Formjoecil mayorNo ratings yet

- Salary Slip: Employee Name: Month Designation: Year OrganisationDocument3 pagesSalary Slip: Employee Name: Month Designation: Year Organisationshakti.iyyappanNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- Maharashtra GST invoice for religious books and itemsDocument2 pagesMaharashtra GST invoice for religious books and itemsDhiraj MehtreNo ratings yet

- The Problem With Our Tax System and How It Affects UsDocument65 pagesThe Problem With Our Tax System and How It Affects Ussan pedro jailNo ratings yet

- Sri Lanka PAYE Income Tax TablesDocument14 pagesSri Lanka PAYE Income Tax Tableskahatadeniya0% (1)

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- Disclaimers - PNB MetLife Aajeevan Suraksha - tcm47-69311Document2 pagesDisclaimers - PNB MetLife Aajeevan Suraksha - tcm47-69311Vandita KhudiaNo ratings yet

- Taxation Material 1Document11 pagesTaxation Material 1Shaira Bugayong100% (1)

- Tax 605Document5 pagesTax 605NhajNo ratings yet

- Tax Digest: Alas, Oplas & Co., CpasDocument4 pagesTax Digest: Alas, Oplas & Co., CpasNico NicoNo ratings yet

- Assignment Taxation 2Document6 pagesAssignment Taxation 2Alexander Steven ThemasNo ratings yet