Professional Documents

Culture Documents

Cymru KID

Uploaded by

oyetunde ogundiwin0 ratings0% found this document useful (0 votes)

2 views1 pageThis document outlines key information about an employment relationship including pay, holidays, and benefits. It provides details on pay rates, deductions, holiday entitlement of 28 days per year, and contacts for the Employment Agency Standards Inspectorate for raising concerns. Holiday pay can either be accrued and paid out separately or rolled up and included in weekly pay amounts.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines key information about an employment relationship including pay, holidays, and benefits. It provides details on pay rates, deductions, holiday entitlement of 28 days per year, and contacts for the Employment Agency Standards Inspectorate for raising concerns. Holiday pay can either be accrued and paid out separately or rolled up and included in weekly pay amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCymru KID

Uploaded by

oyetunde ogundiwinThis document outlines key information about an employment relationship including pay, holidays, and benefits. It provides details on pay rates, deductions, holiday entitlement of 28 days per year, and contacts for the Employment Agency Standards Inspectorate for raising concerns. Holiday pay can either be accrued and paid out separately or rolled up and included in weekly pay amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Key Information Document

This document sets out key information about your relationship with us, including details about pay, holiday

entitlement and other benefits.

Further information can be found at ITS (Cymru) Ltd

The Employment Agency Standards (EAS) Inspectorate is the government authority responsible for the enforcement

of certain agency worker rights. You can raise a concern with them directly on 020 7215 5000 or through the Acas

helpline on 0300 123 1100, Monday to Friday, 8am to 6pm.

GENERAL INFORMATION

Your name: A N Other

Name of employment business: ITS (Cymru) Ltd

Your employer (if different from the employment

N/A

business):

Type of contract you will be engaged under: Contract of Services

Who will be responsible for paying you (if

N/A

different from your employer):

How often you will be paid: Weekly

Expected or minimum rate of pay: £10.42

Deductions from your pay required by law: Tax NI Pension unless opted out

Any other deductions or costs from your pay (to

N/A

include amounts or how they are calculated):

Any fees for goods or services: N/A

Holiday entitlement and pay: 28 days per annum, inclusive of bank holidays for full time

workers, pro rata for part time workers

You can choose to have holiday pay accrued and paid when

holiday is taken or ‘rolled up’ and paid together with your

basic pay on a weekly basis. If you choose to have holiday

pay ‘rolled up’, you acknowledge that no further payment

will be made when time off is taken.

Additional benefits: N/A

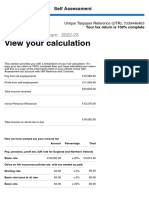

EXAMPLE PAY ACCRUED HOLIDAY

Example rate of pay: £416.80

Deductions from your wage required by law: Tax £34.80 NI £20.98

Any other deductions or costs from your wage: N/A

Any fees for goods or services: N/A

Accrued holiday pay to be paid when taken £50.31 (tax and NI to be taken off when paid)

Example net take home pay: not including

£361.02

holiday pay

EXAMPLE PAY ROLLED UP HOLIDAY

Example rate of pay: £416.80

Holiday pay £49.97

Total pay £467.11

Deductions from your wage required by law: Tax £45.00 NI £27.01

Any other deductions or costs from your wage: N/A

Any fees for goods or services: N/A

Example net take home pay including rolled up

£395.10 (£361.02 net basic pay + £34.08 net holiday pay)

holiday pay

Version 7

You might also like

- Sociology of Health EssayDocument10 pagesSociology of Health EssayChris Horvath100% (3)

- Compensation IncomeDocument18 pagesCompensation IncomeMoon KimNo ratings yet

- Income, Benefits, and Taxes (Chapter 2)Document29 pagesIncome, Benefits, and Taxes (Chapter 2)Jeff TongNo ratings yet

- BELSONDRA - BT Retail Case AnalysisDocument4 pagesBELSONDRA - BT Retail Case AnalysisSim BelsondraNo ratings yet

- Saturn's Pending Karmas Karma Sunil JohnDocument15 pagesSaturn's Pending Karmas Karma Sunil JohnSmith Farat100% (6)

- Key Information Document 2Document1 pageKey Information Document 2Gymy ChiforNo ratings yet

- Manpower Key InformationDocument2 pagesManpower Key InformationAhmed OUADAHINo ratings yet

- ARM KID Umbrella SapphireDocument2 pagesARM KID Umbrella SapphireJan Christian NIkko BaesNo ratings yet

- Template Key Information Document PAYE No Deductions V9Document2 pagesTemplate Key Information Document PAYE No Deductions V9Arubayi AbonereNo ratings yet

- Experis Key InformationDocument10 pagesExperis Key InformationManimekalaiNo ratings yet

- Key Information Document - PAYE MonthlyDocument1 pageKey Information Document - PAYE MonthlynddkNo ratings yet

- Key Information Document: What Type of Contract Will I Be Engaged In?Document74 pagesKey Information Document: What Type of Contract Will I Be Engaged In?Towfiquzzaman ShummoNo ratings yet

- Fusion People KID Umbrella SMP Mar20Document2 pagesFusion People KID Umbrella SMP Mar20T Arun KumarNo ratings yet

- Experis Key InformationDocument11 pagesExperis Key InformationTahir SamadNo ratings yet

- Key Information Document (KID) 2023-2024 Updated 05.06.2023 (No Signature)Document2 pagesKey Information Document (KID) 2023-2024 Updated 05.06.2023 (No Signature)xdogg40No ratings yet

- 463 Key Information Document PayeDocument1 page463 Key Information Document Payesawuni953No ratings yet

- Cost To The Company - Calculation and ComputingDocument10 pagesCost To The Company - Calculation and ComputingPeneena FloyNo ratings yet

- PHD Stipend vs. Tvöd-13 50% Contract:What Is Different, How Much Is It Really Worth?Document4 pagesPHD Stipend vs. Tvöd-13 50% Contract:What Is Different, How Much Is It Really Worth?Panda BambooNo ratings yet

- RFM PayrollDocument2 pagesRFM PayrollMaica De RoxasNo ratings yet

- Explanatory Notes On Payslip 12 2016Document3 pagesExplanatory Notes On Payslip 12 2016ClipsyNo ratings yet

- FACT17 Key Information Document Nexus PAYE 2Document3 pagesFACT17 Key Information Document Nexus PAYE 2Alex IonuțNo ratings yet

- Payroll Accounting 2021Document19 pagesPayroll Accounting 2021Mtshidi KewagamangNo ratings yet

- Working Out Your Wages 1 2Document10 pagesWorking Out Your Wages 1 213593678No ratings yet

- Pay & Leave Specification InformationDocument5 pagesPay & Leave Specification InformationdennisNo ratings yet

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeDocument8 pagesUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroNo ratings yet

- Lecture 3 - Salary and Wages TaxDocument25 pagesLecture 3 - Salary and Wages TaxMimi kupiNo ratings yet

- Salary Sacrifice Arrangements What Is Salary Sacrifice?Document4 pagesSalary Sacrifice Arrangements What Is Salary Sacrifice?alanNo ratings yet

- Lecture Slides For Mod B WK 2Document31 pagesLecture Slides For Mod B WK 2hcjycjNo ratings yet

- Personal TaxDocument7 pagesPersonal TaxNika JikaiiNo ratings yet

- KID Umbrella - CompassDocument3 pagesKID Umbrella - CompassOkie RezkianNo ratings yet

- Payroll Accounting: Chapter Two Payroll CalculationsDocument20 pagesPayroll Accounting: Chapter Two Payroll Calculations409005091No ratings yet

- Salaries and WagesDocument61 pagesSalaries and WagesSnow WhiteNo ratings yet

- Interview Forms (Without CDQ)Document15 pagesInterview Forms (Without CDQ)Irina BursucNo ratings yet

- Quiz 4 - Gross IncomeDocument6 pagesQuiz 4 - Gross IncomeVanessa Grace100% (1)

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDocument6 pagesTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173No ratings yet

- Income From SalaryDocument6 pagesIncome From SalarySonu KumarNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Module 2 - Income From SalariesDocument22 pagesModule 2 - Income From SalariesAishwarya NNo ratings yet

- IncometaxDocument12 pagesIncometaxje-ann montejoNo ratings yet

- Severance Pay Worksheet - Domestic EmployeeDocument3 pagesSeverance Pay Worksheet - Domestic EmployeeJullion CooperNo ratings yet

- India Offer Letter 2024-02-07Document9 pagesIndia Offer Letter 2024-02-07jagdishkumawat22576No ratings yet

- 4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDocument4 pages4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDannah Celiste ParagasNo ratings yet

- Salary Wage Income BenefitsDocument23 pagesSalary Wage Income BenefitsIan SumastreNo ratings yet

- Theory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument10 pagesTheory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- AJ Bell Youinvest AJ Bell Youinvest SIPP Pre-Retirement Pension Fund IllustrationDocument7 pagesAJ Bell Youinvest AJ Bell Youinvest SIPP Pre-Retirement Pension Fund IllustrationmrudhulrajNo ratings yet

- Pajak Penghasilan Orang Pribadi: by Tri Puji Astuti Ismi Kurnia HayatiDocument17 pagesPajak Penghasilan Orang Pribadi: by Tri Puji Astuti Ismi Kurnia HayatiKenny AndikaNo ratings yet

- Carmela H. Bersonda - 20231209 - 212700 - 0000Document6 pagesCarmela H. Bersonda - 20231209 - 212700 - 0000maricrispedraza.phNo ratings yet

- Payrollandtaxesworkshop ThanemcgrathDocument6 pagesPayrollandtaxesworkshop Thanemcgrathapi-242810131No ratings yet

- Worksheet 5 Q2 TaxationDocument15 pagesWorksheet 5 Q2 TaxationJennifer FabiaNo ratings yet

- Employed With de MinimisDocument20 pagesEmployed With de MinimisMariel BerdigayNo ratings yet

- Spencer Ogden Key Information Document: Compliances & Contractor ServicesDocument1 pageSpencer Ogden Key Information Document: Compliances & Contractor Servicescristiano soaresNo ratings yet

- Credit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa CharyDocument45 pagesCredit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa Charysaumya tiwariNo ratings yet

- Salary Exchange... A Tax Efficient Way To Boost Your Plans For The FutureDocument4 pagesSalary Exchange... A Tax Efficient Way To Boost Your Plans For The FutureStandard Life UKNo ratings yet

- Lu 3Document50 pagesLu 3Vj TjizooNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- Week 8 Inclusions and Exclusions From The Gross Income 2023 24 1Document102 pagesWeek 8 Inclusions and Exclusions From The Gross Income 2023 24 1Arellano Rhovic R.No ratings yet

- AbelDocument12 pagesAbelErmi ManNo ratings yet

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDocument35 pagesTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNo ratings yet

- Salary Income Tax Calculation in EthiopiaDocument4 pagesSalary Income Tax Calculation in EthiopiaMulatu Teshome93% (40)

- Pay Slip: Payroll Basic DataDocument2 pagesPay Slip: Payroll Basic DataAdarsha ChandelNo ratings yet

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Employee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsFrom EverandEmployee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsRating: 5 out of 5 stars5/5 (1)

- instaPDF - in Kargil War Heroes Saheed List With Photo 301Document6 pagesinstaPDF - in Kargil War Heroes Saheed List With Photo 301uruuva phenixNo ratings yet

- The Good Woman of Setzuan LitChartDocument44 pagesThe Good Woman of Setzuan LitChartsimar25122002No ratings yet

- Fundamental of Islamic Banking ProductsDocument46 pagesFundamental of Islamic Banking ProductsnadeemuzairNo ratings yet

- Introduction To ERP SystemDocument2 pagesIntroduction To ERP SystemLeann BathanNo ratings yet

- Advanced Introduction To Marketing Strategy - George - S - DayDocument145 pagesAdvanced Introduction To Marketing Strategy - George - S - DayAgnese AdijāneNo ratings yet

- Child LeburDocument18 pagesChild LeburravishdongreNo ratings yet

- Gayatris and Other Mantras For AssistanceDocument42 pagesGayatris and Other Mantras For AssistanceBalrajGoulikarNo ratings yet

- Henry F. Carey Romania Since 1989 PoliticsDocument666 pagesHenry F. Carey Romania Since 1989 PoliticsAurora MagdalenaNo ratings yet

- Tos EthicsDocument2 pagesTos EthicsJudemarife RicoroyoNo ratings yet

- Dissertation Sur Laffaire CalasDocument4 pagesDissertation Sur Laffaire CalasDoMyPaperUK100% (2)

- A Close Look at Legal Transplantation It's Effect On Kenyan Customary MarriagesDocument48 pagesA Close Look at Legal Transplantation It's Effect On Kenyan Customary MarriagesAllec hollandNo ratings yet

- Profit MaximizationDocument18 pagesProfit MaximizationMark SantosNo ratings yet

- Business MagazinesDocument22 pagesBusiness Magazinesvivek sharmaNo ratings yet

- General Hospital Level 3Document3 pagesGeneral Hospital Level 3Cloe Dianne SillaNo ratings yet

- Nabi Musa and The MountainDocument2 pagesNabi Musa and The MountainmubeenNo ratings yet

- Flashcards Word PictureDocument34 pagesFlashcards Word PictureNur Lisa Ahmad ZakiNo ratings yet

- Unit 2 Second PortfolioDocument3 pagesUnit 2 Second PortfolioSimran PannuNo ratings yet

- What Is Auditing?: Quality Glossary Definition: AuditDocument4 pagesWhat Is Auditing?: Quality Glossary Definition: AuditArif ullahNo ratings yet

- Daniel Logan ThorneDocument2 pagesDaniel Logan ThorneLoganTNo ratings yet

- Pre-Assessment Test For Auditing TheoryDocument13 pagesPre-Assessment Test For Auditing TheoryPrecious mae BarrientosNo ratings yet

- Gold Pre-First Exit Test: Name - ClassDocument7 pagesGold Pre-First Exit Test: Name - ClassMaría Marta OttavianoNo ratings yet

- SMC vs. Laguesma (1997)Document2 pagesSMC vs. Laguesma (1997)Kimberly SendinNo ratings yet

- Manonmaniam Sundaranar University Tirunelveli - 12: Appendix - Ae24Document39 pagesManonmaniam Sundaranar University Tirunelveli - 12: Appendix - Ae24Gopi KrishzNo ratings yet

- Deferred AnnuityDocument10 pagesDeferred AnnuityYoon Dae MinNo ratings yet

- Q1. Explain The Need For Corporate Governance. Discuss Its Role and Importance in Improving The Performance of Corporate SectorDocument3 pagesQ1. Explain The Need For Corporate Governance. Discuss Its Role and Importance in Improving The Performance of Corporate SectorAkash KumarNo ratings yet

- How It Began: The Chief Girl Scout Medal SchemeDocument7 pagesHow It Began: The Chief Girl Scout Medal SchemeShiarra Madeline RamosNo ratings yet

- 00 - Indicadores para Certificado Sostenible BREEAM-NL para Evaluar Mejor Los Edificios Circulares-51Document1 page00 - Indicadores para Certificado Sostenible BREEAM-NL para Evaluar Mejor Los Edificios Circulares-51primousesNo ratings yet