Professional Documents

Culture Documents

Problem 3 & 4 - Acctg 7

Uploaded by

Nyster Ann RebenitoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 3 & 4 - Acctg 7

Uploaded by

Nyster Ann RebenitoCopyright:

Available Formats

Problem 3

ETC Products Company manufactures several different products. One of the firm’s principal products

sells for P20 per unit. The sales manager of ETC Products has stated repeatedly that he could sell

more units of this product if they were available. In an attempt to substantiate his claim, the sales

manager conducted a market research study last year at a cost of P44,000 to determine potential

demand for this product. The study indicated that ETC Products could sell 18,000 units of this product

annually for the next five years.

The equipment currently in use has the capacity to produce 11,000 units annually. The variable

production costs are P9 per unit. The equipment has a book value of P60, 000 and a remaining useful

life of five years. The salvage value of the equipment is negligible now and will be zero in five years.

A maximum of 20,000 units could be produced annually on the new machinery which can be

purchased. The new equipment costs P300,000 and has an estimated useful life of five years with no

salvage value at the end of the five years. ETC Product’s production manager has estimated that the

new equipment would provide increased production efficiencies that would reduce the variable

production costs to P7 per unit.

ETC Products Company uses straight-line depreciation on all of its equipment for tax purposes. The

firm is subject to a 40 percent tax rate, and its after-tax cost of capital is 15 percent.

The sales manager felt so strongly about the need for additional capacity that he attempted to

prepare an economic justification for the equipment, although this was not one of his responsibilities.

His analysis, presented on the next page, disappointed him because it did not justify acquiring the

equipment.

Required Investment

Purchase price of new equipment P300,000

Disposal of existing equipment

Loss on Disposal P60,000

Less: Tax benefit (40%) 24,000 36,000

Cost of market research study 44,000

Total Investment P380,000

Annual Returns

Contribution margin from product

Using the new equipment

[18,000 x (P20 – 7)] P234,000

Using the existing equipment

[11,000 x (P20 – 9)] 121,000

Increase in contribution margin P113,000

Less: Depreciation 60,000

Increase in before-tax income P 53,000

Income tax (40%) 21,200

Increase in income P 31,800

Less: 15% cost of capital on the additional investment

required (0.15 x 380,000) 57,000

Net annual return of proposed investment in new equipment P (25,200)

Required:

1. The controller of ETC Products Company plans to prepare a discounted cash flow analysis for

this investment proposal. The controller has asked you to prepare corrected calculations of:

a) The required investment in the new equipment

Purchase price of new equipment P300,000

Disposal of existing equipment:

Selling price P 0

Book value 60,000

Loss on disposal P60,000

Tax rate 0.4

Tax benefit of loss on disposal 24,000

Required Investment P 276,000

b) The recurring annual cash flows

New Equipment:

Contribution Margin [18,000 (P20 – 7)] P234,000

Less: Depreciation on new equipment (P300,000/5) 60,000

Income before tax 174,000

Less: Income tax ( 174,000 * 40%) 69,600

Net Income P104,400

Add: Depreciation 60,000

Cash Inflow P164,400

Old/Present Equipment:

Contribution Margin [11,000 (P20 – 9)] P121,000

Less: Depreciation on new equipment (P60,000/5) 12,000

Income before tax 109,000

Less: Income tax (109,000 * 40%) 43,600

Net Income P65,400

Add: Depreciation 12,000

Cash Inflow P77,400

Recurring annual cash flows

164,400 – 77,400 = P 87,000

Explain the treatment of each item of your corrected calculations that is treated differently from

the original analysis prepared by the sales manager.

The new equipment is capable of producing 20,000 units, but ETC Product Company

can sell only 18,000 units annually. The sales manager made several errors in his

calculations of required investment and annual cash flows. Concerning the required

investment, the sales manager made two errors: First, the cost of the market research

study ($44,000) is a sunk cost because it was incurred last year and will not change

regardless of whether the investment is made or not.

2. Calculate the net present value of the proposal investment in the new equipment.

Present value of future cash flows (87,000 x 3.35216) P291,637.92

Less: Required Investment 276,000.00

Net present value P 15,637.92

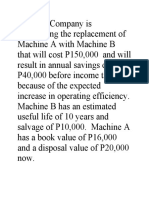

Problem 4

Notting Hall Hospital needs to expand its facilities and desires to obtain a new building on a piece of

property adjacent to its present location. Two options are available to Notting Hill, as follows:

Option 1: Buy the property, erect the building, and install the fixtures at a total cost of P600,000. This

cost would be paid off in five installments: an immediate payment of P200,000, and a payment of

P100,000 at the end of each of the next four years. The annual cash operating costs associated with

the new facilities are estimated to be P12,000 per year. The new facilities would be occupied for

thirteen years, and would have a total resale value of P300,000 at the end of the 13-year period.

Option 2: A leasing company would buy the property and construct the new facilities for Notting Hill

which would then be leased back to Notting Hill at an annual lease cost of P70,000. The lease period

would run for 13 years, with each payment being due at the BEGINNING of the year. Additionally, the

company would require an immediate P10,000 security deposit, which would be returned to Notting

Hill at the end of the 13-year period. Finally, Notting Hill would have to pay the annual maintenance

cost of the facilities, which is estimated to be P4,000 per year. There would be no resale value at the

end of the 13-year period under this option.

The hospital uses a discount rate of 14% and the total-cost approach to net present value analysis in

evaluating its investment decisions. Ignore income taxes in this problem.

Required:

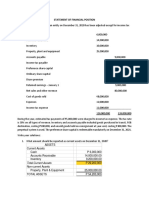

1. What is the net present value of all cash flows under Option 1 (rounded to the nearest

thousand pesos)?

Present value of installment payment

(100,000 x 2.91371) P(291,371)

Immediate Payment (200,000)

Present value of resale value

(300,000 x 0.18207) 54,621

Present value of operating cost

(12,000 x 5.84236) (70,108)

Net Present Value P (506,858)

(rounded to the nearest thousand) P 507,000

2. What is the net present value of all the annual lease payments of P70,000 under Option 2

(rounded to the nearest hundred pesos)?

Net present value of annual lease payment

(70,000 x 1) P 70,000.00

(70,000 x 5.66029) 396,220.30

Net Present Value P466,220.30

(rounded to the nearest hundred) P466,200

3. What is the present value of all cash flows associated with the maintenance costs under

Option 2 (rounded to the nearest hundred pesos)?

Net present value of annual maintenance cost

(4,000 x 5.84236) P 23,369.44

(rounded to the nearest hundred) P 23,400

You might also like

- Acctg 7 - Problem 3&4Document5 pagesAcctg 7 - Problem 3&4Nyster Ann RebenitoNo ratings yet

- Chapter 13Document5 pagesChapter 13Kirsten FernandoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 20 - Answer PDFDocument6 pagesChapter 20 - Answer PDFCarmila BaltazarNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingNike ColeNo ratings yet

- MODULE 8 Capital BudgetingDocument16 pagesMODULE 8 Capital BudgetingKatrina Peralta FabianNo ratings yet

- 05.02 - ProblemSolvingChapter16.docx-2Document5 pages05.02 - ProblemSolvingChapter16.docx-2Murien Lim100% (1)

- Investment in AssetsDocument21 pagesInvestment in AssetsAlthon JayNo ratings yet

- Sample ComputationDocument9 pagesSample ComputationJhao Mico TamayoNo ratings yet

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- 8 Capital Budgeting - Problems - With AnswersDocument15 pages8 Capital Budgeting - Problems - With AnswersIamnti domnateNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Ch08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFDocument10 pagesCh08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFjdiaz_646247No ratings yet

- Capital Budgeting IiiDocument25 pagesCapital Budgeting IiiRanu AgrawalNo ratings yet

- Ma2 CapbudDocument17 pagesMa2 CapbudMangoStarr Aibelle Vegas67% (3)

- Lesson 5 Capital BudgetingDocument18 pagesLesson 5 Capital BudgetingklipordNo ratings yet

- Capital Budgeting 2022Document7 pagesCapital Budgeting 2022ChrysNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada80% (5)

- Chapter 08Document10 pagesChapter 08julie anne mae mendozaNo ratings yet

- Financial PlanDocument6 pagesFinancial PlanAna Mae CatubesNo ratings yet

- Capital BudgetingDocument67 pagesCapital BudgetingRosanna RosalesNo ratings yet

- CAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalDocument6 pagesCAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalVal SarateNo ratings yet

- Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesIncome Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersolafedNo ratings yet

- Illustration Cap BudDocument2 pagesIllustration Cap Budansari.sl01No ratings yet

- Chapter 17 COSTDocument3 pagesChapter 17 COSTDonna Mae SingsonNo ratings yet

- Problem 2: RequiredDocument3 pagesProblem 2: RequiredJohn Lester C AlagNo ratings yet

- Marjon M. Lucero Bsais-4 Strategic Cost ManagementDocument4 pagesMarjon M. Lucero Bsais-4 Strategic Cost ManagementMarjon Maurillo LuceroNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- COMPREHENSIVE PROBLEMS-lordyDocument8 pagesCOMPREHENSIVE PROBLEMS-lordyLordCelene C MagyayaNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Acceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting DecisionsDocument12 pagesAcceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting Decisionsstannis69420No ratings yet

- BUSE 3 - Practice ProblemDocument8 pagesBUSE 3 - Practice ProblemPang SiulienNo ratings yet

- Investments and Their Financing. It Involves Evaluation ofDocument3 pagesInvestments and Their Financing. It Involves Evaluation ofManwol JangNo ratings yet

- Sources of Income 2016 2017 2018Document5 pagesSources of Income 2016 2017 2018Chabby ChabbyNo ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- Capital Budgeting - May 17, 2022Document7 pagesCapital Budgeting - May 17, 2022Rowena RogadoNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- MADERAZO, Dheine Louise - Quiz 2 - Capital Investment DecisionsDocument2 pagesMADERAZO, Dheine Louise - Quiz 2 - Capital Investment DecisionsDheine MaderazoNo ratings yet

- Acceptance-or-Rejection Decisions: I Methods That Do Not Consider The Time Value of MoneyDocument13 pagesAcceptance-or-Rejection Decisions: I Methods That Do Not Consider The Time Value of MoneyCeceil PajaronNo ratings yet

- Multiple Choice Problems 9Document15 pagesMultiple Choice Problems 9Dieter LudwigNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingSirshajit SanfuiNo ratings yet

- Inclusions To Gross Income Illustrative ExamplesDocument5 pagesInclusions To Gross Income Illustrative ExamplesMary Rose CredoNo ratings yet

- Cash and Receivable Management With SolutionsDocument3 pagesCash and Receivable Management With SolutionsRandy ManzanoNo ratings yet

- Net Cost of Investment: International Business TradeDocument8 pagesNet Cost of Investment: International Business TradevionysusgoghNo ratings yet

- Multiple Choice Answers and Solutions: Reorganization and Troubled Debt Restructuring 135Document9 pagesMultiple Choice Answers and Solutions: Reorganization and Troubled Debt Restructuring 135Nelia Mae S. VillenaNo ratings yet

- Sampling ProceduresDocument17 pagesSampling ProceduresNyster Ann RebenitoNo ratings yet

- Alternative Solution To IP No. 12.5: Step 1Document3 pagesAlternative Solution To IP No. 12.5: Step 1Nyster Ann RebenitoNo ratings yet

- Chapter 4 Report Problems 1 4Document8 pagesChapter 4 Report Problems 1 4Nyster Ann Rebenito100% (1)

- Chap 5 Prob 1 3Document10 pagesChap 5 Prob 1 3Nyster Ann RebenitoNo ratings yet

- Acctg7 Prob4Document3 pagesAcctg7 Prob4Nyster Ann RebenitoNo ratings yet

- H-Beam Catalogue JindalDocument4 pagesH-Beam Catalogue JindalVikram DalalNo ratings yet

- PHY130 Lab Report 2Document7 pagesPHY130 Lab Report 2Declan Gale Anak DellyNo ratings yet

- EtamolDocument5 pagesEtamolthonyyanmuNo ratings yet

- Cuadernillo de Ingles Grado 4 PrimariaDocument37 pagesCuadernillo de Ingles Grado 4 PrimariaMariaNo ratings yet

- CMS-855B - 04052021Document49 pagesCMS-855B - 04052021Sheldon GunbyNo ratings yet

- CEHNC 1110-1-1 Design Manual Rev 8Document222 pagesCEHNC 1110-1-1 Design Manual Rev 8pastorgeeNo ratings yet

- Youth Worker Course Gold CoastDocument6 pagesYouth Worker Course Gold Coastf5dq3ch5100% (2)

- Isp-1730 OasDocument2 pagesIsp-1730 OasJaiNo ratings yet

- RCB Dealers PHDocument3 pagesRCB Dealers PHJing AbionNo ratings yet

- Directorate of Pension, Provident Fund & Group Insurance: WWW - Wbepension.gov - inDocument37 pagesDirectorate of Pension, Provident Fund & Group Insurance: WWW - Wbepension.gov - inSandipan RoyNo ratings yet

- Regulatory Guide 1.71Document5 pagesRegulatory Guide 1.71Siis IngenieriaNo ratings yet

- Questão 13: Technology Anticipates Fast-Food Customers' OrdersDocument3 pagesQuestão 13: Technology Anticipates Fast-Food Customers' OrdersOziel LeiteNo ratings yet

- Answer The Question According To The ListeningDocument10 pagesAnswer The Question According To The ListeningusuarioNo ratings yet

- Sokkia MagnetDocument9 pagesSokkia Magnetbbutros_317684077No ratings yet

- AWS Abbreviations Oxyfuel Cutting - OFC Oxyacetylene Cutting - OFC-A Oxyfuel Cutting - Process and Fuel GasesDocument8 pagesAWS Abbreviations Oxyfuel Cutting - OFC Oxyacetylene Cutting - OFC-A Oxyfuel Cutting - Process and Fuel GasesahmedNo ratings yet

- Management Information SystemDocument65 pagesManagement Information SystemMuhammad FaizanNo ratings yet

- Leta 2022Document179 pagesLeta 2022Bigovic, MilosNo ratings yet

- Psychology - Masters in Psychology Entrance Examination Book (Power Within Psychology, Amit Panwar) (Z-Library)Document414 pagesPsychology - Masters in Psychology Entrance Examination Book (Power Within Psychology, Amit Panwar) (Z-Library)Suraj100% (12)

- Giki Students Hand Book 08Document75 pagesGiki Students Hand Book 08Jawad Rasheed Sheikh100% (1)

- TCS303 Pumping Station ControllerDocument17 pagesTCS303 Pumping Station ControllerNAdreaNo ratings yet

- Advance Strategic Marketing: Project Report of Nayatel.Document46 pagesAdvance Strategic Marketing: Project Report of Nayatel.Omer Abbasi60% (15)

- 14.victorian Era Inventions and Changes Pupils PDFDocument1 page14.victorian Era Inventions and Changes Pupils PDFSam FairireNo ratings yet

- BOLBOK (1st)Document10 pagesBOLBOK (1st)Mj EndozoNo ratings yet

- CH 7b - Shift InstructionsDocument20 pagesCH 7b - Shift Instructionsapi-237335979100% (1)

- Microtronics Technologies: GSM Based Vehicle Theft Detection SystemDocument3 pagesMicrotronics Technologies: GSM Based Vehicle Theft Detection Systemابراهيم الثوبريNo ratings yet

- Voting BehaviorDocument23 pagesVoting BehaviorWela Paing FallitangNo ratings yet

- Contacts Modeling in AnsysDocument74 pagesContacts Modeling in Ansyssudhirm16100% (2)

- NDC Format For Billing PADDocument3 pagesNDC Format For Billing PADShantkumar ShingnalliNo ratings yet

- CH 121: Organic Chemistry IDocument13 pagesCH 121: Organic Chemistry IJohn HeriniNo ratings yet

- ToRs ESIA Maputo Sewerage System FinalDocument36 pagesToRs ESIA Maputo Sewerage System FinalVirgilio MuandoNo ratings yet