Professional Documents

Culture Documents

Test 1 Maf603

Uploaded by

NFN FaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 1 Maf603

Uploaded by

NFN FaraCopyright:

Available Formats

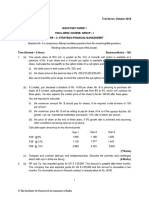

UNIVERSITI TEKNOLOGI MARA

TEST 1

COURSE : CORPORATE FINANCE

COURSE CODE : MAF603

DATE : NOVEMBER 2023

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of one (1) question.

2. Submission is due on 19 November 2023

3. Your answer must be handwritten.

QUESTION

The Finance Manager of Indah Bhd proposes two risky securities for investment consideration

currently traded on the stock exchange. The following information relates to the securities of

Taurus Bhd and Virgo Bhd, in different economic conditions.

State of economy Recession Normal Boom

Probability 0.30 0.40 0.30

Estimated return (%)

Taurus Bhd -12 13 18

Virgo Bhd 11 10 8

Additional information:

The treasury bill yield and the market's expected returns is 5% and 13%, respectively.

The correlation between security Taurus Bhd and Virgo Bhd is -0.82.

Required:

i. Calculate the expected return and standard deviation of each security Taurus Bhd

and Virgo Bhd.

ii. Calculate the expected return and standard deviation for the following alternative

portfolio below:

a) 60% in Taurus Bhd and 40% in Virgo Bhd

b) 50% in Taurus Bhd and 50% in Virgo Bhd

c) 90% in Taurus Bhd and 10% in Virgo Bhd

iii. Based on your answers in (ii) above, which alternatives would you choose? Explain

your recommendation.

iv. Assuming the CAPM holds and security Taurus Bhd's beta is 1.2 and security Virgo

Bhd's beta is less than security Taurus Bhd's beta by 0.3. Calculate the following: -

a) Beta for all portfolios available in (ii).

b) Required return for all portfolios available in (ii).

v) Evaluate whether all portfolios available are correctly priced or otherwise.

vi) Advise the good choice of investment for Indah Bhd. Explain your answer.

(50 marks)

(CALCULATE YOUR ANSWER IN TWO DECIMAL PLACES)

GOOD LUCK

You might also like

- Chapter 1 - Solution Manual CabreraDocument2 pagesChapter 1 - Solution Manual CabreraClarize R. Mabiog67% (12)

- Partnership and Corporation Accounting ReviewerDocument9 pagesPartnership and Corporation Accounting ReviewerMarielle ViolandaNo ratings yet

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- EXERCISE MEETING 1 - MAF603 Oct 2020Document3 pagesEXERCISE MEETING 1 - MAF603 Oct 2020nurul syakirinNo ratings yet

- Meeting 1 - Maf603Document2 pagesMeeting 1 - Maf603Liyana IzyanNo ratings yet

- Tutorial 2 NopeDocument6 pagesTutorial 2 NopeNFN FaraNo ratings yet

- Test 1 - Okt 2023 - QQDocument4 pagesTest 1 - Okt 2023 - QQhudahanihasram031203No ratings yet

- QQ Test 1 Dec2022Document4 pagesQQ Test 1 Dec2022WAN MOHAMAD ANAS WAN MOHAMADNo ratings yet

- Ac Maf603 Dec16Document6 pagesAc Maf603 Dec16MOHAMMAD NOOR AIMAN AHMADNo ratings yet

- 12.feb 2022Document8 pages12.feb 2022paan tiktokNo ratings yet

- Test 1 Maf603 - Submit This Sunday Before MidnghtDocument3 pagesTest 1 Maf603 - Submit This Sunday Before MidnghtsahaomarNo ratings yet

- Fe2305-0573 20230903121830Document9 pagesFe2305-0573 20230903121830broken swordNo ratings yet

- Faculty Accountancy 2021 Session 1 - Degree Maf603 2Document12 pagesFaculty Accountancy 2021 Session 1 - Degree Maf603 2Hadi DahalanNo ratings yet

- Mock Final ExamDocument3 pagesMock Final ExamRukhsar Abbas Ali .No ratings yet

- Gujarat Technological UnversityDocument20 pagesGujarat Technological UnversityUrvashi RNo ratings yet

- Finance of International Trade and Related Treasury Operations S 22Document2 pagesFinance of International Trade and Related Treasury Operations S 22muhammadNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- BLaw 9-11-2020Document2 pagesBLaw 9-11-2020Abhishake ChhetriNo ratings yet

- Financial Markets and Instiutions Wcmw4e8ThMDocument3 pagesFinancial Markets and Instiutions Wcmw4e8ThMKhushi SangoiNo ratings yet

- TBchap 008Document81 pagesTBchap 008DemianNo ratings yet

- Maf253 Fa Q Aug 2020Document12 pagesMaf253 Fa Q Aug 2020alisatasnimNo ratings yet

- 5 - Portfolio Management - Assignment (14-05-19)Document6 pages5 - Portfolio Management - Assignment (14-05-19)AakashNo ratings yet

- Part II Workout Question: - Possible Rate of Return ProbabilityDocument4 pagesPart II Workout Question: - Possible Rate of Return ProbabilitySamuel Debebe100% (4)

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- Portfolio Management and SAPM Book Tybms and TybfmDocument40 pagesPortfolio Management and SAPM Book Tybms and TybfmRahul VengurlekarNo ratings yet

- Mid-Term: Time: 90 MinutesDocument7 pagesMid-Term: Time: 90 MinutesAtishya JainNo ratings yet

- FOI Assignment 2023Document3 pagesFOI Assignment 2023Rohan MauryaNo ratings yet

- Finance of International Trade and Related Treasury OperationsDocument2 pagesFinance of International Trade and Related Treasury OperationsmuhammadNo ratings yet

- Faculty - Applied Sciences - 2022 - Session 2 - Degree - Asc637Document5 pagesFaculty - Applied Sciences - 2022 - Session 2 - Degree - Asc637Atifah RozlanNo ratings yet

- Finance of International Trade Related Treasury OperationsDocument2 pagesFinance of International Trade Related Treasury OperationsmuhammadNo ratings yet

- AEB301-Financial Management-27JAN2022Document3 pagesAEB301-Financial Management-27JAN2022MIRUGI STEPHEN GACHIRINo ratings yet

- Tutorial Chapter 4Document13 pagesTutorial Chapter 4Amirul ZikrieyNo ratings yet

- MAF653 TEST 1 NOV 2022 QuestionDocument11 pagesMAF653 TEST 1 NOV 2022 QuestionAyunieazahaNo ratings yet

- Portfolio Analysis PDFDocument4 pagesPortfolio Analysis PDFFitness JourneyNo ratings yet

- FIN546Document4 pagesFIN546Florarytha RebaNo ratings yet

- Investement AssDocument2 pagesInvestement Assbona birra0% (1)

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- Finance of International Trade and Related Treasury OperationsDocument2 pagesFinance of International Trade and Related Treasury OperationsfurybtcNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument25 pagesPaper - 2: Strategic Financial Management Questions Security ValuationPalisthaNo ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- Practice Questions Set 1Document3 pagesPractice Questions Set 1ALBRIGHT PHANUELLA GLOVERNo ratings yet

- New Format Exam Q Maf620 - Oct 2009Document5 pagesNew Format Exam Q Maf620 - Oct 2009kkNo ratings yet

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Roll No. ..................................... : Part-ADocument7 pagesRoll No. ..................................... : Part-Akevin12345555No ratings yet

- Accounts - 12Document8 pagesAccounts - 12Md TariqueNo ratings yet

- QP Xi BST PDFDocument8 pagesQP Xi BST PDFJohn JoshyNo ratings yet

- CORPORATE FINANCE Test 3Document6 pagesCORPORATE FINANCE Test 3AnanditaKarNo ratings yet

- The Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveDocument15 pagesThe Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveGokul dnNo ratings yet

- FM End Term 42Document1 pageFM End Term 42ParasNo ratings yet

- FOI Hons TestDocument1 pageFOI Hons Testriya YadavNo ratings yet

- Islamic Finance S 22Document1 pageIslamic Finance S 22muhammadNo ratings yet

- FAR 3 Midterm QuestionDocument4 pagesFAR 3 Midterm Questionfaiez jamilNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- CM2ADocument5 pagesCM2AMike KanyataNo ratings yet

- Far160 Pyq July2023Document8 pagesFar160 Pyq July2023nazzyusoffNo ratings yet

- CB1 Business FinanceDocument7 pagesCB1 Business FinanceVasudev PurNo ratings yet

- Financial-Planning-and-Budgeting-S-22 PaperDocument3 pagesFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985No ratings yet

- Maf 603-T2-PF Mgmt-Exercise 1Document1 pageMaf 603-T2-PF Mgmt-Exercise 1hazlamimalekNo ratings yet

- Last Year PaperDocument7 pagesLast Year PaperVivek ChauhanNo ratings yet

- Mid 1 Questions (Except 405)Document4 pagesMid 1 Questions (Except 405)Raisha LionelNo ratings yet

- Kotak Multi Asset Allocator Fund of Fund Dynamic Leaflet (English)Document4 pagesKotak Multi Asset Allocator Fund of Fund Dynamic Leaflet (English)Sidhartha Marketing CompanyNo ratings yet

- Quiz AppliedDocument12 pagesQuiz AppliedLharissa Ballesteros100% (1)

- The Altucher Guide-InvestingDocument32 pagesThe Altucher Guide-InvestingjoshuaofferNo ratings yet

- Case Study (Portfolio)Document6 pagesCase Study (Portfolio)WinniferTeohNo ratings yet

- TAEL PartnersDocument8 pagesTAEL Partnersloc1409No ratings yet

- Main Objects Clause in MOADocument5 pagesMain Objects Clause in MOApradeep15101981100% (1)

- SdsaDocument3 pagesSdsaPocari OnceNo ratings yet

- Chapter 13Document11 pagesChapter 13Hương LýNo ratings yet

- Chapter16 Buenaventura MC QuestionsDocument5 pagesChapter16 Buenaventura MC QuestionsAnonnNo ratings yet

- Montajes - Joelyn Grace 117848 Seatwork 2Document9 pagesMontajes - Joelyn Grace 117848 Seatwork 2Joelyn Grace MontajesNo ratings yet

- Meghmani Organics Limited Annual Report 2019 PDFDocument254 pagesMeghmani Organics Limited Annual Report 2019 PDFmredul sardaNo ratings yet

- CFA Publication - Guide To ETF Selected SectionDocument58 pagesCFA Publication - Guide To ETF Selected SectionhNo ratings yet

- Accounting For Business: Ratio Analysis 1: Profitability, Efficiency and PerformanceDocument40 pagesAccounting For Business: Ratio Analysis 1: Profitability, Efficiency and PerformanceegNo ratings yet

- Thread: TetherDocument3 pagesThread: TetherALVARO LEITAONo ratings yet

- 5 International Arbitrage and Interest Rate Parity PDFDocument30 pages5 International Arbitrage and Interest Rate Parity PDFshakil zibranNo ratings yet

- Factors Affecting Dividend PolicyDocument11 pagesFactors Affecting Dividend Policyalbinus1385No ratings yet

- Treasury Analysis WorksheetDocument3 pagesTreasury Analysis WorksheetdebashisdasNo ratings yet

- State of The Global Islamic EconomyDocument208 pagesState of The Global Islamic EconomyInayah Hanifatussilmi WulandariNo ratings yet

- CH 5 - Intercompany Transaction - InventoriesDocument14 pagesCH 5 - Intercompany Transaction - InventoriesMutia WardaniNo ratings yet

- Ali Baba Goes PublicDocument29 pagesAli Baba Goes PublicAhmed Magdy Aly HegazyNo ratings yet

- NPTEL Course Financial Management Assignment VDocument2 pagesNPTEL Course Financial Management Assignment VyogeshgharpureNo ratings yet

- Mutual Funds of The Financial Institutions in The PhilippinesDocument13 pagesMutual Funds of The Financial Institutions in The PhilippinesNo NameNo ratings yet

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- Solution Manual For Investments 11th Edition by Bodie: Problem SetsDocument6 pagesSolution Manual For Investments 11th Edition by Bodie: Problem Setssunanda mNo ratings yet

- Attracting Angel InvestorsDocument3 pagesAttracting Angel InvestorsJeyashankar RamakrishnanNo ratings yet

- After Merill Lynch Merger, Julius Baer Grows in LebanonDocument3 pagesAfter Merill Lynch Merger, Julius Baer Grows in Lebanonftacct5No ratings yet

- MRF Tyres LTD OverviewDocument9 pagesMRF Tyres LTD OverviewVivek Mohan KumarNo ratings yet

- France Telecom (Innovacom) Invests in Genesis VenturesDocument13 pagesFrance Telecom (Innovacom) Invests in Genesis VenturesAymerik992% (13)