Professional Documents

Culture Documents

JMaloney-Evaluation and Comparison of Two Funds - VEXPX - BRSVX-1

Uploaded by

jaimebarbarosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JMaloney-Evaluation and Comparison of Two Funds - VEXPX - BRSVX-1

Uploaded by

jaimebarbarosaCopyright:

Available Formats

Evaluation and Comparison of Funds

Instructions: For your research, you will use www.morningstar.com (search for fund symbol)

Both options seek growth through exposure in the U.S. Stock Market. In your analysis you will decide which

option is best for the stock portion of your investment portfolio. Assume you have $3,000 to invest.

60 points total

5 pts

Fund Name Vanguard Explorer Fund Bridgeway Small-Cap Value

Fund

Fund Symbol VEXPX BRSVX

Total Assets of the Fund 23 Bil 207.1 Mil

(Quote tab)

Minimum Initial Investment 3,000.00 2,000.00

(Quote tab)

Load (Price tab) No Load. No Load.

Return VS. Risk (Risk tab, look Risk vs. Category: Average Risk vs. Category: Average

at 3-year) Return vs. Category: Average Return vs. Category: High

Fund Expenses 10 pts

Expense Ratio % (Quote tab) 0.410% 0.940%

Analysis point: $3,000 at 0.410% is $12.30 $3,000 at 0.940% is $28.20

For each fund, on a $3,000

investment, how much of your

money will go to expenses each

year? (show the math)

Explain the risk vs. category and VEXPX has an average variation of BRXVX has an average variation of

the return vs. category ratings monthly returns from similar funds monthly returns from similar funds

for each fund in one complete and an average of excess return over and a high excess over risk-free rate

sentence in your own words. a risk-free rate, again compared to as compared to similar funds.

similar funds.

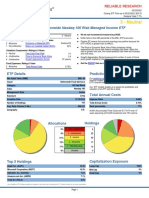

Diversification (Portfolio tab > Asset Allocation) 10 pts

The asset allocation chart shows

you the percent of fund money % US Stock % US Stock

invested in different types of 94.86% of the fund is in US Equity 98.80% of the fund is in US Equity

securities. How much is

invested in U.S. equity?

How many different Equity

Holdings does the fund include? # equity (stock) holdings # equity (stock) holdings

(Portfolio tab, then scroll down 702 115

to Holdings)

List the fund’s five largest Company Name % Company Name %

holdings and its portfolio 1. Five9 Inc 0.97 1. GameStop Corp Class A 1.96

weight: 2. Burlington Stores Inc 0.97 2. Antero Resources Group 1.91

3. Insulet Corp 0.89 3. MISTRAS Group Inc 1.68

4. Icon PLC 0.77 4. Primoris Services Corp 1.64

5. Etsy Inc 0.75 5. CONSOL Energy Inc 1.62

Ordinary Shares

Annual Turnover rate 43% 87%

What does turnover mean?

Which fund has the most The turnover rate is a measure of how much of a funds “Inventory” or

desirable turnover? Be detailed “Assets” that it holds is turned over or sold and purchased in a given time

in your answer. 4 pts period. In this case, VEXPX only sold and purchased stock in companies

equal to 43% of its holdings versus BRSVX which sold and purchased

amounts equivalent to 87% of its holdings. Lower turnover ratios are

indicative of passively managed funds and also indicate that less sales and

purchases are being made in the holdings. This equates to less management

fees and less capital gains and the resulting tax implications being passed

down the line to the individual investor. BRSVX is actively selling and

buying to create get the high Return vs. Category numbers but as such they are

generating costs that are reflected in their much higher expense ratio. Also of

note is the fact that their holdings of 115 different equity stocks lacks the

diversity of VEXPX’s 702, therefore leaving them to work even harder to

garner returns from a smaller pool.

Fund Symbol VEXPX BRSVX

Fund Management (People tab) 3 pts

Date of fund inception Dec 11, 1967 Oct 31, 2003

How many managers run the Eleven managers and they are James Three managers and they are John

fund? List their names. P. Stetler, Ryan Edward Crane, N.R. Montgomery, Elena Khoziaeva,

Daniel J. Fitzpatrick, Chad Meade, and Michael Whipple.

Brian A. Schaub, Binbin Guo, Brian

M. Angerame, Aram E. Green,

Jeffrey J. Russell, Matthew Lilling,

and Cesar Orosco

Which fund has the longest Longest serving manager started in BRSVX has the longest serving

serving managers? February of 2012. Just over 9 years.manager starting in October of 2003.

Just shy of 18 years.

Fund Performance (On Morningstar.com click on the performance tab, scroll down to trailing returns. Look

at the total return % for the fund for each time frame, the numbers are percentages) 12 pts

Fund performance over last 3 21.83% 16.86%

years

Fund performance over last 5 21.26% 16.53%

years

Fund performance over last 10 14.18% 11.66%

years

Fund performance over last 15 10.61% 7.15%

years

Analysis point: Which fund has

the better performance over the VEXPX consistently has the better performance over the range above. What is

past 3, 5, 10 & 15 years? also key is that the numbers above adjusted for expense ratio, show an even

(Note: each percentage is an greater rate of return for VEXPX.

average per year over the given

number of years)

Note: Morningstar Performance figures, expressed in percentage terms, are determined by taking the change in price,

reinvesting, if applicable, all income and capital gains distributions during the period, and dividing by the starting price.

Unless otherwise noted, Morningstar does not adjust total returns for sales charges (such as front-end loads, deferred loads,

and redemption fees), preferring to give a clearer picture of performance. Total returns do account for the expense ratio,

which includes management, administrative, 12b-1 fees, and other costs that are taken out of assets. Three, five, ten, and

15-year returns are annualized. BE SURE TO READ THIS

Net Asset Value (Quote tab) 8 pts

Net Asset Value $145.64 $34.38

TTM (trailing twelve month) Yield 0.11% 0.60%

Analysis point: Explain what The TTM Yield refers to the percentage of income the portfolio has returned to

this 12-month yield means. investors.

Based on the above information, explain which of these two funds would best help you achieve your

investment goals? Explain your answer IN DETAIL here using at least four pieces of information from

above to justify your answer. Please number your answers 1, 2, 3, and 4. You should have a short paragraph for

each of the four, explaining why each piece of information is important for your decision. 12 pts

VEXPX is my choice for the following reasons:

1. The inception of this fund was in 1967 and it has asset holdings in of 23 Billion dollars. This

demonstrates maturity and the size of its holdings tells me that it is a trusted fund and has many

investors.

2. Vanguard in general has some of the lowest if not the lowest expense ratios and this coupled with

the number of people on their management team means that it has more eyes on its holdings at a

cheaper cost to me.

3. It has also shown consistently higher returns as evident to the TTM Yield, again with an

adjustment of expense ratio it becomes and even better performer.

4. Lastly, it has 702 companies in its holdings which shows great diversity and gives me a feeling of

safety as the market rises and falls along with the fact that it has a lower turnover ratio. These

two points in the end give me better returns at an average risk that is spread over a greater portion

of the market.

Hint: Do not use NAV as a reason to buy or not buy a fund.

You might also like

- Money Master The Games WorksheetsDocument88 pagesMoney Master The Games WorksheetsAvil86% (7)

- Quantitative Styles & MultiSector BondsDocument18 pagesQuantitative Styles & MultiSector Bondsdoc_oz3298No ratings yet

- CACS1Document152 pagesCACS1rajkumarvpost6508No ratings yet

- Risk Return Analysis of Mutual FundsDocument23 pagesRisk Return Analysis of Mutual FundsAnand Mishra100% (1)

- Stable CoinsDocument140 pagesStable CoinsJuJu PrimeNo ratings yet

- Test Bank Chapter 12 Investment BodieDocument32 pagesTest Bank Chapter 12 Investment BodieTami DoanNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- MID-TERM Examination # 1 (30%) : Interest Paid 6 MillionDocument7 pagesMID-TERM Examination # 1 (30%) : Interest Paid 6 MillionTimbas TNo ratings yet

- Factors and Factor Exposures: InsightsDocument6 pagesFactors and Factor Exposures: InsightsYashas IndalkarNo ratings yet

- Setting The Record Straight: Truths About Indexing: Vanguard Research January 2018Document12 pagesSetting The Record Straight: Truths About Indexing: Vanguard Research January 2018TBP_Think_TankNo ratings yet

- Support Truths About Indexing WP PDFDocument12 pagesSupport Truths About Indexing WP PDFAndy LoayzaNo ratings yet

- Mi - ST - ATH: Invest in This Smallcase HereDocument1 pageMi - ST - ATH: Invest in This Smallcase HerehamsNo ratings yet

- PE Ratio 32.22 23.49 PB Ratio 5.31 3.41 Sharpe Ratio 1.26 1.11 Dividend Yield (%) 1.42 1.48Document1 pagePE Ratio 32.22 23.49 PB Ratio 5.31 3.41 Sharpe Ratio 1.26 1.11 Dividend Yield (%) 1.42 1.48ഓൺലൈൻ ആങ്ങളNo ratings yet

- CoreShares Introduction To Index Investing PDFDocument10 pagesCoreShares Introduction To Index Investing PDFBuyelaniNo ratings yet

- Bamimo 0001Document1 pageBamimo 0001sarha sharma0% (1)

- Rupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHDocument5 pagesRupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHJinesh ShahNo ratings yet

- Invest in This Smallcase Here: Top 100 Stocks With Equity Large CapDocument1 pageInvest in This Smallcase Here: Top 100 Stocks With Equity Large CapKingui DevNo ratings yet

- Hedge-Funds: How Big Is Big?Document11 pagesHedge-Funds: How Big Is Big?a5600805No ratings yet

- Dolphin: Return: 25.87 (8Y CAGR) RISK: LOWDocument5 pagesDolphin: Return: 25.87 (8Y CAGR) RISK: LOWJinesh ShahNo ratings yet

- Estmo 0001Document1 pageEstmo 0001ShahamijNo ratings yet

- Mutual FundsDocument10 pagesMutual FundsSidharth SidduNo ratings yet

- Equity Trading and Analysis A WorkshopDocument41 pagesEquity Trading and Analysis A Workshopsarf_88No ratings yet

- COREGOLDDocument5 pagesCOREGOLDSanjeevNo ratings yet

- CANSLIM-esque stocksDocument1 pageCANSLIM-esque stocksssvivekanandhNo ratings yet

- The Concepts of Return On Investment & RiskDocument16 pagesThe Concepts of Return On Investment & Riskrc_prabirNo ratings yet

- Relatorio Sobre XPDocument5 pagesRelatorio Sobre XPCarlos TresemeNo ratings yet

- CI American Value Fund Class FDocument3 pagesCI American Value Fund Class FMarcelo MedeirosNo ratings yet

- HCLN Fund Facts ENDocument3 pagesHCLN Fund Facts ENYash DoshiNo ratings yet

- Do Stocks Outperform Treasury Bills - 58% Do NotDocument40 pagesDo Stocks Outperform Treasury Bills - 58% Do NotdogajunkNo ratings yet

- Using skewness and kurtosis to find less risky stocksDocument2 pagesUsing skewness and kurtosis to find less risky stocksLakshay GargNo ratings yet

- 3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFDocument3 pages3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFphysicallen1791No ratings yet

- Fallen Angels: Invest in This Smallcase HereDocument1 pageFallen Angels: Invest in This Smallcase HereSahil ChadhaNo ratings yet

- Earnings Per Share-ProDocument3 pagesEarnings Per Share-ProVibhorBajpaiNo ratings yet

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seNo ratings yet

- Turtle Growth: Return: 21.86 (15Y CAGR) RISK: MEDIUMDocument5 pagesTurtle Growth: Return: 21.86 (15Y CAGR) RISK: MEDIUMJinesh ShahNo ratings yet

- On Persistence in Mutual Fund PerformanceDocument27 pagesOn Persistence in Mutual Fund PerformanceMartin McflinNo ratings yet

- Analyse Mutual Fund Portfolio - 7 Important ParametersDocument3 pagesAnalyse Mutual Fund Portfolio - 7 Important Parametersdvg6363238970No ratings yet

- Diwali Picks 2021Document5 pagesDiwali Picks 2021sparksenterprises2023No ratings yet

- Vanguard Small Cap Value ETFDocument4 pagesVanguard Small Cap Value ETFKhalilBenlahccenNo ratings yet

- SCNM 0012Document1 pageSCNM 0012kishoremarNo ratings yet

- Ratio Analysis: An Approach To Understanding Strengths and Weaknesses in A BusinessDocument25 pagesRatio Analysis: An Approach To Understanding Strengths and Weaknesses in A BusinessAsad MazharNo ratings yet

- Nivmo 0001Document1 pageNivmo 0001rav prashant SinghNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)himkecNo ratings yet

- Understanding of Mutual FundDocument20 pagesUnderstanding of Mutual FundshraddhashindeNo ratings yet

- 10 Factors To Consider When Selecting A Stock - ToughNickelDocument8 pages10 Factors To Consider When Selecting A Stock - ToughNickelAnkur ParshavNo ratings yet

- Our Scientific Approach to Investing - Avantis InvestorsDocument8 pagesOur Scientific Approach to Investing - Avantis Investorsd.a.m.ari.onjua.re.z5.98No ratings yet

- MarkowitzPortfolioOptimisation ReportDocument6 pagesMarkowitzPortfolioOptimisation ReportHimanshu PorwalNo ratings yet

- METHODOLOGY AND ProcedureDocument17 pagesMETHODOLOGY AND ProcedureSanjeev JhaNo ratings yet

- PS1Document2 pagesPS1adxyadxyNo ratings yet

- Sure Retirement: April 2021 EditionDocument60 pagesSure Retirement: April 2021 EditionmarsveloNo ratings yet

- Performance: Fund Returns V/s Category AverageDocument25 pagesPerformance: Fund Returns V/s Category AverageBhavesh JoliyaNo ratings yet

- Agbmo 0012Document1 pageAgbmo 0012Anushree AyanavaNo ratings yet

- Methodology: Omkar Vasudev BhatDocument1 pageMethodology: Omkar Vasudev BhataurummaangxinchenNo ratings yet

- Angel One ARQ Prime portfolioDocument1 pageAngel One ARQ Prime portfolioMalavShahNo ratings yet

- Fraud Detection and Expected ReturnsDocument53 pagesFraud Detection and Expected Returnssarah.price19766985No ratings yet

- Rupeeting Core - Conservative: Return: - 1.22 (3M ABS) RISK: LOWDocument5 pagesRupeeting Core - Conservative: Return: - 1.22 (3M ABS) RISK: LOWJinesh ShahNo ratings yet

- SCTR 0014Document1 pageSCTR 0014Sumeet SoniNo ratings yet

- 07 Introduction to Risk, Return, And the Opportunity Cost of CapitalDocument12 pages07 Introduction to Risk, Return, And the Opportunity Cost of Capitalddrechsler9No ratings yet

- Fundamentals of Index Options Types of Stock IndexesDocument11 pagesFundamentals of Index Options Types of Stock IndexesChris Armour100% (1)

- Mean-VarianceAnalysisDefinition,Example,andCalculation_1710956144731Document5 pagesMean-VarianceAnalysisDefinition,Example,andCalculation_1710956144731williamseugine2008No ratings yet

- Financial Analysis On Mutual Fund Schemes With Special Reference To SBI Mutual Fund CoimbatoreDocument6 pagesFinancial Analysis On Mutual Fund Schemes With Special Reference To SBI Mutual Fund CoimbatoreCheruv SoniyaNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement Analysisj.mcleanjackNo ratings yet

- How We Side-Step Bubbles in Double IncomeDocument11 pagesHow We Side-Step Bubbles in Double IncomePIYUSH GOPALNo ratings yet

- Clean and Professional Company Profile PresentationDocument10 pagesClean and Professional Company Profile PresentationAzriel Varrand kNo ratings yet

- Understanding Market Indexes, Portfolios, Risk and the Capital Asset Pricing ModelDocument141 pagesUnderstanding Market Indexes, Portfolios, Risk and the Capital Asset Pricing Modelrow rowNo ratings yet

- 5.1 Rates of Return: Holding-Period Return (HPR)Document31 pages5.1 Rates of Return: Holding-Period Return (HPR)irma makharoblidzeNo ratings yet

- Utkashtripathi 11909588 Finca 2Document12 pagesUtkashtripathi 11909588 Finca 2vinay100% (1)

- An-A6KoKCpvMCiJulwjzu8iNLWm-gEfkQ6ni9QokkCspwkdLa KV nDCrWN0LZH37JXfv6-rVT xD7FWeQdm1YhAYe9cEPOSRtpnjF55bye3CaPMOZlaMTsO6rV M8gDocument34 pagesAn-A6KoKCpvMCiJulwjzu8iNLWm-gEfkQ6ni9QokkCspwkdLa KV nDCrWN0LZH37JXfv6-rVT xD7FWeQdm1YhAYe9cEPOSRtpnjF55bye3CaPMOZlaMTsO6rV M8grNo ratings yet

- Manajemen KeuanganDocument12 pagesManajemen Keuangancoba cobaNo ratings yet

- Swan-Davis Inc. (1) FinalDocument12 pagesSwan-Davis Inc. (1) FinalRomina Isa Losser100% (1)

- Ethics and Regulations in Financial ServicesDocument36 pagesEthics and Regulations in Financial ServicesSajad Azeez0% (3)

- Revison CF 13.07.2023 (All)Document116 pagesRevison CF 13.07.2023 (All)seyon sithamparanathanNo ratings yet

- Audit of SHEDocument13 pagesAudit of SHEarianne chiuNo ratings yet

- Commodity MarketDocument88 pagesCommodity MarketShravan TilluNo ratings yet

- Term MicrolifeDocument1 pageTerm MicrolifeMhd RidwanNo ratings yet

- Corporate Restructuring and Securities LawsDocument9 pagesCorporate Restructuring and Securities LawsLalbee SNo ratings yet

- Chap 020Document18 pagesChap 020stella0616No ratings yet

- US - Municipal - Bond - Risk The US Municipal Bond Risk Model by Oren Cheyette BarraDocument6 pagesUS - Municipal - Bond - Risk The US Municipal Bond Risk Model by Oren Cheyette BarranhornnNo ratings yet

- Cost of debt = Yield (1-tax rate) = 6.38% (1-0.3) = 4.47Document44 pagesCost of debt = Yield (1-tax rate) = 6.38% (1-0.3) = 4.47Aman PoddarNo ratings yet

- CH 14Document53 pagesCH 14muthi'ah ulfahNo ratings yet

- Final Raj TrivediDocument12 pagesFinal Raj TrivediNisha SainiNo ratings yet

- 3 InvestmentsDocument3 pages3 InvestmentsCharielle Esthelin BacuganNo ratings yet

- FIN422 - 1 Spring 2023 Solutions To HW#4 Selected End - of - Chapter 13 ProblemsDocument4 pagesFIN422 - 1 Spring 2023 Solutions To HW#4 Selected End - of - Chapter 13 Problemssama116676No ratings yet

- FX Risk Types and Hedging MethodsDocument20 pagesFX Risk Types and Hedging MethodsanushaNo ratings yet

- Commission NotesDocument2 pagesCommission Notesivanjade627No ratings yet

- Using Order Flow To Understand Where The Banks Have Got Their Trades PlacedDocument10 pagesUsing Order Flow To Understand Where The Banks Have Got Their Trades PlacedcaviruNo ratings yet

- NYSE Technologies SuperFeed Global Connectivity Product SheetDocument2 pagesNYSE Technologies SuperFeed Global Connectivity Product SheetNYSE TechnologiesNo ratings yet

- Hull Chapter 3Document30 pagesHull Chapter 3Harshu RaoNo ratings yet

- Solution Manual For Financial Institutions Markets and Money Kidwell Blackwell Whidbee Sias 11th EditionDocument8 pagesSolution Manual For Financial Institutions Markets and Money Kidwell Blackwell Whidbee Sias 11th EditionAmandaMartinxdwj100% (40)

- Engulfing Candlestick Trading StrategyDocument20 pagesEngulfing Candlestick Trading StrategyAaron AlibiNo ratings yet