Professional Documents

Culture Documents

HCLN Fund Facts EN

Uploaded by

Yash DoshiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HCLN Fund Facts EN

Uploaded by

Yash DoshiCopyright:

Available Formats

ETF Facts

Harvest Clean Energy ETF - Class A Units (HCLN)

Manager: Harvest Portfolios Group Inc.

November 1, 2022

This document contains key information you should know about Harvest Clean Energy ETF - Class A Units. You can find more details about this exchange-

traded fund (ETF) in its prospectus. Ask your representative for a copy, contact Harvest Portfolios Group Inc. (“Harvest”) at 1-866-998-8298 or

info@harvestportfolios.com, or visit www.harvestportfolios.com.

Before you invest, consider how the ETF would work with your other investments and your tolerance for risk.

Quick Facts

Date ETF started: January 7, 2021 Fund manager: Harvest Portfolios Group Inc.

Total value on September 30, 2022: $51,915,518 Portfolio manager: Harvest Portfolios Group Inc.

Management expense ratio (MER): 0.69% Distributions: Annually, if any

Trading Information (12 months ending September 30, 2022)

Ticker symbol: HCLN Average daily volume: 19,374 units

Exchange: Toronto Stock Exchange (TSX) Number of days traded: 251 out of 251 trading days

Currency: CAD

Pricing Information (12 months ending September 30, 2022)

Market price: $11.48 - $17.32 Average bid-ask spread: 0.47%

Net asset value: $11.52 - $17.36

What does the ETF invest in?

The ETF seeks to provide holders of Class A Units (the “Unitholders”) with the opportunity for capital appreciation. The Harvest Clean Energy ETF

primarily invests in issuers that are engaged in clean energy related businesses that are listed on a regulated stock exchange in select North American,

Asian or European countries.

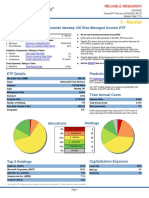

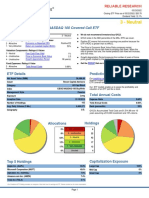

The charts below give you a snapshot of the ETF’s investments on September 30, 2022. The ETF’s investments will change.

% of net % of net

Top Ten Investments (September 30, 2022) Investment Mix (September 30, 2022)

asset value asset value

1. First Solar, Inc. 4.7% Utilities 55.2%

2. SunPower Corporation 3.7% Information Technology 22.4%

3. Enphase Energy, Inc. 3.5% Industrials 16.4%

4. Shoals Technologies Group, Inc. 3.3% Energy 5.3%

5. Plug Power Inc. 3.2% Cash and Other Assets and Liabilities 0.7%

6. Sunrun Inc. 3.1%

7. VERBIO Vereinigte BioEnergie AG 2.9%

8. Ormat Technologies, Inc. 2.8%

9. Infratil Limited 2.7%

10. RWE AG 2.7%

Total percentage of top 10 investments: 32.6%

Total number of investments: 42

How Risky is it? Risk Rating

The value of the ETF can go down as well as up. You could lose money. Harvest has rated the volatility of this ETF as medium to high.

One way to gauge risk is to look at how much the ETF’s returns change The rating is based on how much the ETF’s returns have changed from year

over time. This is called “volatility”. to year. It doesn’t tell you how volatile the ETF will be in the future. The

rating can change over time. An ETF with a low risk rating can still lose

In general, ETFs with higher volatility will have returns that change more money.

over time. They typically have a greater chance of losing money and may

have a greater chance of higher returns. ETFs with lower volatility tend Low to Medium to

to have returns that change less over time. They typically have lower Low medium Medium high High

returns and may have a lower chance of losing money.

For more information about the risk rating and specific risks that can affect

the ETF’s returns, see the “Risk Factors” section of the ETF’s prospectus.

No guarantees

ETF’s do not have any guarantees. You may not get back the amount of

money you invest.

For dealer use only: CUSIP 41754G106

Harvest Clean Energy ETF (HCLN)

How has the ETF performed? Best and worst 3-month returns

This section tells you how Class A Units of the ETF have performed over This section shows the best and worst returns for the Class A Units of the

the past years, with the returns calculated using the ETF’s net asset value ETF in a 3-month period over the past calendar years. However, this

(NAV). However, some of this information is not available because the information is not available because the ETF has not yet completed a

ETF has not yet completed a calendar year. calendar year.

Year-by-year returns Average return

This section tells you how Class A Units of the ETF have performed over A person who invested $1,000 in the Class A Units of the ETF since inception

the past calendar years. However, this information is not available would have had $630 as of September 30, 2022. This is equal to an annual

because the ETF has not yet completed a calendar year. compounded return of approximately -23.54%.

Trading ETFs Net asset value (NAV)

ETFs hold a basket of investments, like mutual funds, but trade on Like mutual funds, ETFs have a NAV. It is calculated after the close

exchanges like stocks. Here are a few things to keep in mind when

of each trading day and reflects the value of an ETF’s investments at

trading ETFs: that point in time.

NAV is used to calculate financial information for reporting purposes

Pricing – like returns shown in this document.

ETFs have two sets of pricing: market price and net asset value (NAV).

Orders

Market price There are two main options for placing trades: market orders and limit

ETFs are bought and sold on exchanges at the market price. The orders. A market order lets you buy or sell units at the current market price.

market price can change throughout the trading day. Factors like A limit order lets you set a price at which you are willing to buy or sell units.

supply, demand, and changes in the value of the ETF’s investments

can affect the market price. Timing

You can get price quotes any time during the trading day. Quotes In general, market prices of ETFs can be more volatile around the start and

have two parts: bid and ask. end of the trading day. Consider using a limit order or placing a trade at

The bid is the highest price a buyer is willing to pay if you want to another time during the trading day.

sell your ETF units. The ask is the lowest price a seller is willing to

accept if you want to buy ETF units. The difference between the

two is called the “bid-ask spread”.

In general, a smaller bid-ask spread means the ETF is more liquid.

That means you are more likely to get the price you expect.

Who is this ETF for? A word about tax

Investors who: In general, you’ll have to pay income tax on any money you make on an

ETF. How much you pay depends on the tax laws where you live and whether

are looking for exposure to clean energy related business equities.

or not you hold the ETF in a registered plan such as a Registered Retirement

want a medium to long-term investment. Savings Plan, or a Tax-Free Savings Account.

can handle the ups and downs of stock markets.

Keep in mind that if you hold your ETF in a non-registered account,

distributions from the ETF are included in your taxable income, whether you

get them in cash or have them reinvested.

For dealer use only: CUSIP 41754G106

Harvest Clean Energy ETF (HCLN)

How much does it cost?

This section shows the fees and expenses you could pay to buy, own and sell Class A Units of the ETF. Fees and expenses – including trailing commissions

- can vary among ETFs. Higher commissions can influence representatives to recommend one investment over another. Ask about other ETFs and

investments that may be suitable for you at a lower cost.

1. Brokerage Commissions

You may have to pay a commission every time you buy and sell Class A Units of the ETF. Commissions may vary by brokerage firm. Some brokerage

firms may offer commission-free ETFs or require a minimum purchase amount.

2. ETF expenses

You don’t pay these expenses directly. They affect you because they reduce the ETF’s returns.

As of June 30, 2022, the Fund’s expenses were 0.84% of its value. This equals $8.40 for every $1,000 invested.

Annual rate (as a %

of the ETF’s value)

Management expenses ratio (MER)

This is the total of the ETF’s management fee operating expenses 0.69%

(Harvest Portfolios Group Inc. waived some of the ETF's expenses. If it had not done so, the MER would have been higher.)

Trading expense ratio (TER)

These are the ETF’s trading costs 0.15%

ETF Expenses 0.84%

ETF expenses is the total of all ongoing expenses set out herein and is not a separate expense charged to the ETF.

3. Trailing commission

A trailing commission is an ongoing commission. It is paid for as long as you own the ETF. It is for the services and advice that your representative and

their firm provide to you. This ETF doesn’t have a trailing commission.

Other Fees

FEES WHAT YOU PAY

Other Fee: The Manager may charge exchanging or redeeming Unitholders of the Harvest ETFs, at its discretion, a fee of up to 2% of

the exchange or redemption proceeds to offset certain transaction costs associated with the exchange or redemption of

Class A Units. The Manager will publish the fee, if any, on its website, www.harvestportfolios.com.

The fee will not be charged to a Unitholder in connection with the buying or selling of Class A Units on the TSX.

What if I change my mind? For more information

Under securities law in some provinces and territories, you have the right Contact Harvest or your representative for a copy of the ETF’s prospectus

to cancel your purchase within 48 hours after you receive confirmation of and other disclosure documents. These documents and the ETF Facts

purchase. make up the ETF’s legal documents.

In some provinces and territories, you also have the right to cancel a

purchase, or in some jurisdictions, claim damages, if the prospectus, ETF

Harvest Portfolios Group Inc. Toll-free: 1-866-998-8298

facts or financial statements contain a misrepresentation. You must act

610 Chartwell Road, Suite 204 Website: www.harvestportfolios.com

within the time limit set by the securities law in your province or territory.

4

Oakville, Ontario L6J 4A5 Email: info@harvestportfolios.com

For more information, see the securities law of your province or territory

or ask a lawyer.

For dealer use only: CUSIP 41754G106

You might also like

- PBW - Invesco WilderHill Clean Energy ETF Fact SheetDocument2 pagesPBW - Invesco WilderHill Clean Energy ETF Fact SheetRahul SalveNo ratings yet

- ETF Facts Harvest Global Gold Giants Index ETF (HGGG) : Manager: Harvest Portfolios Group IncDocument3 pagesETF Facts Harvest Global Gold Giants Index ETF (HGGG) : Manager: Harvest Portfolios Group IncAsNo ratings yet

- Invesco MSCI Sustainable Future ETF: Growth of $10,000Document3 pagesInvesco MSCI Sustainable Future ETF: Growth of $10,000sarah martinNo ratings yet

- 2015 Ci Harbour F ClassDocument3 pages2015 Ci Harbour F ClassMarcelo MedeirosNo ratings yet

- 3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFDocument3 pages3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFphysicallen1791No ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)shoaib zamanNo ratings yet

- 3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFDocument3 pages3 - Neutral: Global X Funds: Global X NASDAQ 100 Covered Call ETFphysicallen1791No ratings yet

- 9-14-2021 DoubleLine Total Return Webcast With Jeffrey Gundlach - Slide DeckDocument80 pages9-14-2021 DoubleLine Total Return Webcast With Jeffrey Gundlach - Slide DeckZerohedgeNo ratings yet

- BMO Low Volatility US Equity ETF-EN-CAD UnitsDocument4 pagesBMO Low Volatility US Equity ETF-EN-CAD Unitsmaxime1.pelletierNo ratings yet

- P Smallcap Ar EngDocument43 pagesP Smallcap Ar EngKuanChau YapNo ratings yet

- Ishares Core Equity Etf Portfolio (Xeqt)Document4 pagesIshares Core Equity Etf Portfolio (Xeqt)Janko JerinićNo ratings yet

- Vanguard Information Technology ETF Summary ProspectusDocument8 pagesVanguard Information Technology ETF Summary ProspectusVERONICA MEJMONo ratings yet

- 6-8-2021 DoubleLine Webcast Slides 'Clampdown' With Jeffrey Gundlach and Andrew Hsu-UnlockedDocument64 pages6-8-2021 DoubleLine Webcast Slides 'Clampdown' With Jeffrey Gundlach and Andrew Hsu-UnlockedZerohedge100% (1)

- PDSF Ar EngDocument25 pagesPDSF Ar EngSeudonim SatoshiNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)himkecNo ratings yet

- SPDR S&P 500 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkDocument2 pagesSPDR S&P 500 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkRob ReyesNo ratings yet

- 57 - Rakshit Raj - DissertationDocument26 pages57 - Rakshit Raj - DissertationRAKSHIT RAJNo ratings yet

- QQQ 2Document2 pagesQQQ 2Dominic angelNo ratings yet

- Invesco DB Oil Fund: Growth of $10,000Document2 pagesInvesco DB Oil Fund: Growth of $10,000Rutvik BNo ratings yet

- Fact Sheet - HSBC Islamic Global 2021equity Index Fund Legal General Pension PMC HSBC Islamic Global Equity Index Fund 3Document3 pagesFact Sheet - HSBC Islamic Global 2021equity Index Fund Legal General Pension PMC HSBC Islamic Global Equity Index Fund 3umairNo ratings yet

- CI American Value Fund Class FDocument3 pagesCI American Value Fund Class FMarcelo MedeirosNo ratings yet

- Balanced Portfolio 2019-2 FCDocument3 pagesBalanced Portfolio 2019-2 FCA RNo ratings yet

- VT PDFDocument6 pagesVT PDFSRGNo ratings yet

- Victory Market Neutral Income 2022 - 1QDocument2 pagesVictory Market Neutral Income 2022 - 1Qag rNo ratings yet

- Cambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsJexNo ratings yet

- Fundsmith Equity Fund EUR AccDocument4 pagesFundsmith Equity Fund EUR AccSrinivasa Rao KanaparthiNo ratings yet

- Jepi 03.23.22Document3 pagesJepi 03.23.22physicallen1791No ratings yet

- Utilities 2Q 2022Document3 pagesUtilities 2Q 2022ag rNo ratings yet

- Definition of ETF, .........................Document4 pagesDefinition of ETF, .........................pratikNo ratings yet

- Etgearx 350 1031303Document80 pagesEtgearx 350 1031303Frank PereiraNo ratings yet

- Dollarbull ETF Handbook (Dec 2022)Document24 pagesDollarbull ETF Handbook (Dec 2022)Jai HiralalNo ratings yet

- Invesco QQQ Trust: Growth of $10,000Document2 pagesInvesco QQQ Trust: Growth of $10,000TotoNo ratings yet

- RBC Emerging FundsDocument3 pagesRBC Emerging FundsNikal upNo ratings yet

- Sure Retirement: April 2021 EditionDocument60 pagesSure Retirement: April 2021 EditionmarsveloNo ratings yet

- RBC Canadian Small & Mid-Cap Resources Fund - Series FDocument3 pagesRBC Canadian Small & Mid-Cap Resources Fund - Series FNikal upNo ratings yet

- Risk Return UploadDocument15 pagesRisk Return UploadGauri TyagiNo ratings yet

- Global Multi-Asset Fund - Brochure - BancassuranceDocument3 pagesGlobal Multi-Asset Fund - Brochure - BancassuranceJeffrey Ru LouisNo ratings yet

- Corporate. Finance. AssignmentDocument5 pagesCorporate. Finance. AssignmentkeelyNo ratings yet

- Fidelity Funds - China Opportunities Fund: 31 July 2018 年年7⽉月31⽇日Document2 pagesFidelity Funds - China Opportunities Fund: 31 July 2018 年年7⽉月31⽇日silver lauNo ratings yet

- Mutual Funds For 2023 by RecipeDocument11 pagesMutual Funds For 2023 by RecipeMAKE FUN OFF OFFICIALNo ratings yet

- Mi - ST - ATH: Invest in This Smallcase HereDocument1 pageMi - ST - ATH: Invest in This Smallcase HerehamsNo ratings yet

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNo ratings yet

- Glacier Global Stock Feeder FundDocument2 pagesGlacier Global Stock Feeder FundMarkoNo ratings yet

- Fs PDFDocument1 pageFs PDFJuhaizan Mohd YusofNo ratings yet

- 12-8-2020 TR No End in Sight - FinalDocument93 pages12-8-2020 TR No End in Sight - FinalZerohedge100% (4)

- Vanguard Small Cap Value ETFDocument4 pagesVanguard Small Cap Value ETFKhalilBenlahccenNo ratings yet

- Cecchetti 6e Chapter08 SMDocument8 pagesCecchetti 6e Chapter08 SMyuyu4416No ratings yet

- SP Ishares Core Msci Total International Stock Etf 7 31Document16 pagesSP Ishares Core Msci Total International Stock Etf 7 31colt williamsNo ratings yet

- Exchange Trade of FundDocument4 pagesExchange Trade of Fundnidhi thakurNo ratings yet

- CAMBRIA - SYLD Income and Growth ETFDocument9 pagesCAMBRIA - SYLD Income and Growth ETFcloudsandskyeNo ratings yet

- Rupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHDocument5 pagesRupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHJinesh ShahNo ratings yet

- DiversificationPremium PDFDocument7 pagesDiversificationPremium PDFCorey PageNo ratings yet

- BMO Aggregate Bond Index ETF BMO - Aggregate - Bond - Index - ETF-EN-CAD - UnitsDocument4 pagesBMO Aggregate Bond Index ETF BMO - Aggregate - Bond - Index - ETF-EN-CAD - UnitsNikal upNo ratings yet

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearDocument3 pagesTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seNo ratings yet

- BlackRock IsharesDocument7 pagesBlackRock IsharesBenNo ratings yet

- SCTR 0014Document1 pageSCTR 0014Sumeet SoniNo ratings yet

- POFP-Group 3 - Final ReportDocument21 pagesPOFP-Group 3 - Final Report何日明HarryNo ratings yet

- Key Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesDocument2 pagesKey Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesAl BoscoNo ratings yet

- Estmo 0001Document1 pageEstmo 0001ShahamijNo ratings yet

- ETF Investing: Create Passive Income And Retire Early With Etf StrategyFrom EverandETF Investing: Create Passive Income And Retire Early With Etf StrategyNo ratings yet

- Capital Gains - JBIMSDocument107 pagesCapital Gains - JBIMSYash DoshiNo ratings yet

- 4.29 Masters in Human Resources Development Management (MHRDM)Document83 pages4.29 Masters in Human Resources Development Management (MHRDM)vprakash7972No ratings yet

- Belbin ProfilingDocument21 pagesBelbin ProfilingYash Doshi100% (1)

- Law Assignment2 MH17Document25 pagesLaw Assignment2 MH17Yash DoshiNo ratings yet

- Depreciation Is What Kind of CostDocument1 pageDepreciation Is What Kind of CostYash DoshiNo ratings yet

- Gerald Rehn - The Power of Diversified InvestingDocument48 pagesGerald Rehn - The Power of Diversified InvestingKiril YordanovNo ratings yet

- Fallen Angels: Invest in This Smallcase HereDocument1 pageFallen Angels: Invest in This Smallcase HereSahil ChadhaNo ratings yet

- SGB - Product Note With PriceDocument9 pagesSGB - Product Note With PriceYash SoniNo ratings yet

- UssymsDocument149 pagesUssymsmgsalesNo ratings yet

- Mutual Funds and Exchange-Traded FundsDocument59 pagesMutual Funds and Exchange-Traded FundsThu Huong PhamNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument41 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Market Timing Via Monthly and Holiday PatternsDocument10 pagesMarket Timing Via Monthly and Holiday PatternsSteven KimNo ratings yet

- Comparative Study On Equity Schemes of Various Mutual Fund CompaniesDocument58 pagesComparative Study On Equity Schemes of Various Mutual Fund CompaniesChethan.sNo ratings yet

- Vested Advisory AgreementDocument14 pagesVested Advisory AgreementKarthik BhandaryNo ratings yet

- Gold Etf ProjectDocument3 pagesGold Etf ProjectBhavanams RaoNo ratings yet

- Lista de Acoes Mundiais e OutrosDocument86 pagesLista de Acoes Mundiais e Outrosamjr1001No ratings yet

- Chapter5 Shariah-Compliant Stocks and ValuationDocument72 pagesChapter5 Shariah-Compliant Stocks and ValuationOctari NabilaNo ratings yet

- Derivative SeiesDocument18 pagesDerivative SeiesCourage Craig KundodyiwaNo ratings yet

- CH 3 (Qamar Abbas) - Investment and Security Analysis or Portfolio ManagmentDocument18 pagesCH 3 (Qamar Abbas) - Investment and Security Analysis or Portfolio Managmentفہد ملکNo ratings yet

- Smart BetaDocument24 pagesSmart BetaAbhishek GuptaNo ratings yet

- Bitcoin Investment Trust Spencer NeedhamDocument8 pagesBitcoin Investment Trust Spencer NeedhamPete Rizzo100% (1)

- Rbi 247 Marathon Session 2Document161 pagesRbi 247 Marathon Session 2Jerry ZaidiNo ratings yet

- Unicredit Bank Ag: Benchmark Statement - UC Fund-Risk-Control Benchmark FamilyDocument8 pagesUnicredit Bank Ag: Benchmark Statement - UC Fund-Risk-Control Benchmark FamilyRobertNo ratings yet

- Hedge Fund Replication PDFDocument218 pagesHedge Fund Replication PDFKuang SkNo ratings yet

- FIN 103 - I.A Financial Markets & Financial InstitutionsDocument8 pagesFIN 103 - I.A Financial Markets & Financial InstitutionsJosef Ira AngelesNo ratings yet

- Vaneck Etfs Distributions Schedule 2023Document2 pagesVaneck Etfs Distributions Schedule 2023Jéferson AlegreNo ratings yet

- Nism Series III A Securities Intermediaries Compliance Non Fund Exam WorkbookDocument214 pagesNism Series III A Securities Intermediaries Compliance Non Fund Exam Workbookpiyush_rathod_13No ratings yet

- Economics Homework HelpDocument25 pagesEconomics Homework HelpLucas MillerNo ratings yet

- Complete Overview: The Value Line 600Document20 pagesComplete Overview: The Value Line 600janeNo ratings yet

- 3bursa Lizan26May09pg61 90Document30 pages3bursa Lizan26May09pg61 90AbdullahNo ratings yet

- UMDocument216 pagesUMAaron ひろき ZhangNo ratings yet

- August 2020Document166 pagesAugust 2020ARGHA PAULNo ratings yet

- Three Momentum AlgorithhmDocument70 pagesThree Momentum AlgorithhmShreekanth HebbarNo ratings yet

- SMAF NFO DECK FinalDocument26 pagesSMAF NFO DECK Finalamudala venkateshNo ratings yet

- September 2019Document100 pagesSeptember 2019ronanNo ratings yet