Professional Documents

Culture Documents

CN Fa45966 05122023 05122023

Uploaded by

hemanth1234Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CN Fa45966 05122023 05122023

Uploaded by

hemanth1234Copyright:

Available Formats

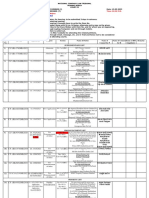

CONTRACT NOTE CUM TAX INVOICE

(Tax Invoice under section 31 of GST Act)

FINVASIA SECURITIES PRIVATE LIMITED

Registered Address : H NO 1108 SECTOR 21 B CHANDIGARH PIN 160022 Phone No.:0172-6670000

Corporate Address : FINVASIA CENTRE D 179, PHASE 8 B, (SECTOR 74) MOHALI PUNJAB PIN - 160055 Phone No.:0172-6670000

Website : WWW.SHOONYA.COM Investor Grievance Email : ccofspl@shoonya.com

SEBI Registration No : INZ000176037 PAN : AABCF6759K CIN : U74992CH2011PTC032718

Member ID's: Nse:14846 Bse:4043 Mcx:55135 Ncdex:01259

AKSHATHA K(FA45966) Dealing Office Address

HALAGERI ROAD NEAR DEVIKA SCHOOL CR,RANEBENNUR,AT PO TQ FINVASIA CENTRE D 179, Phase 8B,(Sector 74),Mohali, Punjab

HAVERI PIN/ZIP Code 160055

HAVERI-581115 Punjab

Karnataka / KA 03AABCF6759K1ZF

India

PAN of Client : DXLPK3809N

UCC of Code : FA45966

Trading Backoffice Code : FA45966

Mobile No : 8660435963

Trade Date 05-12-2023 Name of Clearing Corporation & Cah Segment NCL F & O Segment NCL Currency Segment NCL MCX Segment MCXCCL NCDEX Segment NCCL

Contract Note No. CN/3569138 Segment

Invoice Reference No

Settlement Detail

(IRN)

Exchange Settlement No Settlement Description Sett.Date

NSE FNO 06-12-2023

Sir/ Madam,

I / We have this day done by your order and on your account the following transactions :

Order No. Order Trade Trade Security/Contract Description Buy(B)/ Qty Gross Rate/ Gross Brokerage Net Rate Per Closing Rate Net Total Rema

Time No. Time Sell(S) Trade Price Rate/ Per Unit Unit (Rs.) Per Unit (Only (Before Levies) rks

Per Unit (in Trade (Rs.) For (Rs.)

foreign Price Per Derivative)

currency) Unit (Rs.) (Rs.)

Equity Derivative Segment of National Stock Exchange of India Ltd.

1000000191578038 14:54:13 9015241 14:54:13 OPTIDX NIFTY 07DEC2023 20800.00 S 250 107.2500 0.0000 107.2500 26812.50

CE

1000000191578038 14:54:13 9015239 14:54:13 OPTIDX NIFTY 07DEC2023 20800.00 S 150 107.2500 0.0000 107.2500 16087.50

CE

1000000191578038 14:54:13 9015240 14:54:13 OPTIDX NIFTY 07DEC2023 20800.00 S 400 107.2500 0.0000 107.2500 42900.00

CE

Contract Total Buy Turnover 0.00 Buy Quantity 0 Sell Quantity 800 Net Quantity -800

Sell Turnover 85,800.00 Buy Value/MTM 0.00 Sell Value/MTM 85800.00 Net Value/MTM 85800.00

1100000057363571 11:12:06 88701742 11:12:06 OPTIDX NIFTY 07DEC2023 20800.00 PE S 100 87.0000 0.0000 87.0000 8700.00

1100000057363571 11:12:07 88701813 11:12:07 OPTIDX NIFTY 07DEC2023 20800.00 PE S 650 87.0000 0.0000 87.0000 56550.00

1100000057628697 11:12:32 88708537 11:12:32 OPTIDX NIFTY 07DEC2023 20800.00 PE B 300 86.0000 0.0000 86.0000 -25800.00

Account ID : FA45966 Page 1 of 2

Order No. Order Trade Trade Security/Contract Description Buy(B)/ Qty Gross Rate/ Gross Brokerage Net Rate Per Closing Rate Net Total Rema

Time No. Time Sell(S) Trade Price Rate/ Per Unit Unit (Rs.) Per Unit (Only (Before Levies) rks

Per Unit (in Trade (Rs.) For (Rs.)

foreign Price Per Derivative)

currency) Unit (Rs.) (Rs.)

1100000057628697 11:12:32 88708539 11:12:32 OPTIDX NIFTY 07DEC2023 20800.00 PE B 400 86.0000 0.0000 86.0000 -34400.00

1100000057628697 11:12:32 88708528 11:12:32 OPTIDX NIFTY 07DEC2023 20800.00 PE B 50 86.0000 0.0000 86.0000 -4300.00

Contract Total Buy Turnover 64,500.00 Buy Quantity 750 Sell Quantity 750 Net Quantity 0

Sell Turnover 65,250.00 Buy Value/MTM -64500.00 Sell Value/MTM 65250.00 Net Value/MTM 750.00

Exchange Total Buy Value -64500.00 Sell Value 151050.00

Net Value/MTM 86550.00

Turnover Total Buy Turnover 64,500.00 Sell Turnover 151,050.00

Exchange Pay in/Payout Security Taxable Value IGST @18% SEBI Turnover Exchange Stamp Duty Transaction IPF Brokerage Final Net

Obligation Transaction of Supply Fee Clearing Charges Charges

Tax Charges

NSE FNO 86550.00 94.00 108.00 19.44 0.22 0.00 2.00 107.78 1.08 0.00 86325.48

By Client Net Payable(-)/Receivable(+) 86325.4800

* CGST:-Central GST; SGST: - State GST; IGST:-Integrated GST; UTT: - Union Territory Tax. Details of trade-wise levies shall be provided on request.

@ Converted into INR based on RBI reference rate as on the date of transaction

Transactions mentioned in this contract note cum bill shall be governed and subject to the Rules, Bye-laws, Regulations and Circulars of the respective Exchanges on which trades have been executed and Securities and Exchange Board of India issued from

time to time. It shall also be subject to the relevant Acts, Rules, Regulations, Directives, Notifications, Guidelines (including GST Laws) & Circulars issued by SEBI / Government of India / State Governments and Union Territory Governments issued from

time to time. The Exchanges provide Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). The client may approach its nearest centre, details of which are available on respective Exchange’s website .

Please visit http://www.bseindia.com for BSE, http://www.msei.in for MSEI and http://www.nseindia.com for NSE and http://www.mcxindia.com for MCX.

FINVASIA SECURITIES PRIVATE LIMITED is collects stamp duty and Securities Transaction Tax as a pure agent of investor and hence the same is not consider in the Taxable value of supply of charging GST .

Your faithfully

Date : 05/12/2023

For FINVASIA SECURITIES PRIVATE LIMITED

Place : PUNJAB

Authorized Signatory

Compliance Officer Detail RAMANJEET KAUR

Name RAMANJEET KAUR SAC Code : 997152

Email ccofspl@shoonya.com

GST Service Code : 997152

Service Name : Stock Broking

Phone 172 667 0000

Digitally signed by DS GSTIN Of TM : 03AABCF6759K1ZF

PAN : AABCF6759K

FINVASIA SECURITIES

PRIVATE LIMITED 1

* Trades were executed due to non-compliance by the client towards margin calls made by the Member.

Date: 2023.12.05 P - Open position of the traded contract is to be physically settled.

23:59:17 +05:30

Reason: Billing

Location: PUNJAB

Account ID : FA45966 Page 2 of 2

You might also like

- CN Fa63928 25052023 25052023Document5 pagesCN Fa63928 25052023 25052023thealkpNo ratings yet

- Zebu Share and Wealth Managements Private Limited: Name of The ClientDocument1 pageZebu Share and Wealth Managements Private Limited: Name of The ClientMadhanNo ratings yet

- MH9575 - 2021 10 12 - 2021 10 12Document4 pagesMH9575 - 2021 10 12 - 2021 10 12Abhi JainNo ratings yet

- Visha LDocument2 pagesVisha LUbed QureshiNo ratings yet

- Fyers Securities Private Limited: Rahul Kumar Gupta FR2162 Bangalore Branch Code: Branch NameDocument1 pageFyers Securities Private Limited: Rahul Kumar Gupta FR2162 Bangalore Branch Code: Branch NameAbhishek GuptaNo ratings yet

- Alice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeDocument2 pagesAlice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeKulasekara PandianNo ratings yet

- CCN Qb5769nse Bse2020 03 042020 04 03Document47 pagesCCN Qb5769nse Bse2020 03 042020 04 03HEMANT PARMARNo ratings yet

- Contract Note Cum Tax Invoice (Tax Invoice Under Section 31 of GST Act)Document3 pagesContract Note Cum Tax Invoice (Tax Invoice Under Section 31 of GST Act)atuldeshmukhaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash Memoashwani kumarNo ratings yet

- Duplicate: Alice Blue Financial Services PVT LTDDocument1 pageDuplicate: Alice Blue Financial Services PVT LTDPabitra Kumar PrustyNo ratings yet

- ZerodhaDocument46 pagesZerodhaanicket kabeerNo ratings yet

- Rikhav Securities LTD.: (Tax Invoice Under Section 31 of GST Act)Document1 pageRikhav Securities LTD.: (Tax Invoice Under Section 31 of GST Act)Dhruv Harshal ShahNo ratings yet

- ADTQMAR22080Document1 pageADTQMAR22080Raheel KaziNo ratings yet

- Bill 20190801 6HGQ26 NSE333995 0 PDFDocument1 pageBill 20190801 6HGQ26 NSE333995 0 PDFVenu MadhavNo ratings yet

- 5paisa Capital Limited: Contract Note No. 0004658086Document2 pages5paisa Capital Limited: Contract Note No. 0004658086Bs20mscph013No ratings yet

- Weekly Securities Statement - DLV371Document1 pageWeekly Securities Statement - DLV371stephenraj0692No ratings yet

- Prabhudas Lilladher Pvt. LTD.: NSE CashDocument2 pagesPrabhudas Lilladher Pvt. LTD.: NSE CashYash BanarjeeNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- Tax Invoice: This Invoice Is Not A Valid Travel DocumentDocument2 pagesTax Invoice: This Invoice Is Not A Valid Travel DocumentPraveenNo ratings yet

- DEEPAKDocument1 pageDEEPAKShivangi SaxenaNo ratings yet

- Indra BillDocument1 pageIndra Billarthagarwal09No ratings yet

- Comm P140408 21032024Document2 pagesComm P140408 21032024prabhakardhaddNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raviraj DarisiNo ratings yet

- Tax Invoice: This Invoice Is Not A Valid Travel DocumentDocument2 pagesTax Invoice: This Invoice Is Not A Valid Travel DocumentPraveenNo ratings yet

- CM D59707 10042018 CombmarginDocument1 pageCM D59707 10042018 CombmarginDarshil DilipbhaiNo ratings yet

- Weekly Securities Statement DJY334Document1 pageWeekly Securities Statement DJY334harshraj912295No ratings yet

- Internet WifiDocument1 pageInternet WifiPuneet GuptaNo ratings yet

- Amaze HSRP FormDocument2 pagesAmaze HSRP FormZamirtalent TrNo ratings yet

- Weekly Securities Statement OXA340Document1 pageWeekly Securities Statement OXA340rawatrahul3015No ratings yet

- Lexus Con NT 24 ThuDocument136 pagesLexus Con NT 24 ThuPranat BajajNo ratings yet

- Simaa0349 PDFDocument1 pageSimaa0349 PDFUsha Hasini VelagapudiNo ratings yet

- CM A116188 23082017 CombmarginDocument1 pageCM A116188 23082017 CombmarginGiduthuri AdityaNo ratings yet

- Axis Statement Fy 2020 - 2021Document3 pagesAxis Statement Fy 2020 - 2021ok okNo ratings yet

- Weekly Securities Statement - NVN780Document1 pageWeekly Securities Statement - NVN780gaurav SharmaNo ratings yet

- Weekly Securities Statement ZTK515Document1 pageWeekly Securities Statement ZTK515rahul agarwalNo ratings yet

- Comm G198327 03012022Document2 pagesComm G198327 03012022MUTHYALA NEERAJANo ratings yet

- Alice Blue Financial Services (P) LTD: Name of The ClientDocument4 pagesAlice Blue Financial Services (P) LTD: Name of The ClientPabitra Kumar PrustyNo ratings yet

- 35 Unit1128.invDocument4 pages35 Unit1128.invLaxmikant JoshiNo ratings yet

- Weekly Securities Statement - AP8163Document1 pageWeekly Securities Statement - AP8163Meet PrajapatiNo ratings yet

- Axis Mutual Fund PDFDocument2 pagesAxis Mutual Fund PDFSunil KoricherlaNo ratings yet

- Invoice AmzDocument1 pageInvoice Amzsaket kumarNo ratings yet

- DN No 710 H K SERVICES - MANDYADocument3 pagesDN No 710 H K SERVICES - MANDYAGangaraju T CNo ratings yet

- Nadim Khan Up16ak9563Document1 pageNadim Khan Up16ak9563Sandeep KumarNo ratings yet

- Om Engineering Works: B-186 (A), B-187, RIICO Industrial Area Bhiwadi-3010119Document1 pageOm Engineering Works: B-186 (A), B-187, RIICO Industrial Area Bhiwadi-3010119Srishti GaurNo ratings yet

- CM S197627 10112017 CombmarginDocument1 pageCM S197627 10112017 CombmarginManoj ValeshaNo ratings yet

- P I 91Document1 pageP I 91AshishNo ratings yet

- PI - Ravindra SinghDocument1 pagePI - Ravindra Singharyansingh4517No ratings yet

- Bar Code Scanner - InvoiceDocument1 pageBar Code Scanner - InvoiceArindam HaldarNo ratings yet

- Customer ReprintDocument1 pageCustomer ReprintInderjeet singhNo ratings yet

- Customer ReprintDocument1 pageCustomer ReprintInderjeet singhNo ratings yet

- Invoice 1Document1 pageInvoice 1RamalingeswaraRao AmpalamNo ratings yet

- Pb65u1303 PlateDocument1 pagePb65u1303 PlatevishalNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Navya ShreeNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- Proforma InvoiceDocument1 pageProforma Invoicekarthiinfo1990No ratings yet

- Tax Invoice (182078)Document2 pagesTax Invoice (182078)Paras TyagiNo ratings yet

- Abdul Ghaffar 14-10-19 PDFDocument1 pageAbdul Ghaffar 14-10-19 PDFAyan BNo ratings yet

- 06052019093456Document2 pages06052019093456Ariyanayaka SundaramNo ratings yet

- Box FolderDocument1 pageBox FolderEr Sundeep RachakondaNo ratings yet

- British Pound SterlingDocument2 pagesBritish Pound SterlingAsir Awsaf AliNo ratings yet

- Answer Key - Importing and ExportingDocument4 pagesAnswer Key - Importing and Exportingmaria ronoraNo ratings yet

- FNB Verified StatementDocument3 pagesFNB Verified StatementkvgaelesiweNo ratings yet

- Broker's InviteDocument1 pageBroker's Invitedelphine cazalsNo ratings yet

- CFA Level 1 SyllabusDocument3 pagesCFA Level 1 Syllabusjohn ramboNo ratings yet

- Payment in Cash Total:P 8,200.00: Bersales/Zylene Renz MissDocument1 pagePayment in Cash Total:P 8,200.00: Bersales/Zylene Renz MissTantan Fortaleza Pingoy100% (1)

- PP Asia Monthly Scan ReportDocument15 pagesPP Asia Monthly Scan ReportvenkatspmNo ratings yet

- FTI Tech Trends 2022 Book10Document62 pagesFTI Tech Trends 2022 Book10NicolasMontoreRosNo ratings yet

- Evolution of Industrial Policy in IndiaDocument7 pagesEvolution of Industrial Policy in IndiaNeeraj YadavNo ratings yet

- Study of Financial Literacy and Financial Management: Multiple Case Study of SMEs in Makassar CityDocument12 pagesStudy of Financial Literacy and Financial Management: Multiple Case Study of SMEs in Makassar CityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Rules in Holding Period in Capital GainsDocument39 pagesRules in Holding Period in Capital GainsTrine De LeonNo ratings yet

- Edrine Trading Journal 2Document449 pagesEdrine Trading Journal 2Edrinanimous AnandezNo ratings yet

- 13.05.29 Fedders Lloyed Corp For KUDGIDocument2 pages13.05.29 Fedders Lloyed Corp For KUDGIBasheer AbdulNo ratings yet

- Economic Applications 225 SP 20Document7 pagesEconomic Applications 225 SP 20Muhammad UmarNo ratings yet

- Pilipinas Shell Petroleum Corpo RationDocument12 pagesPilipinas Shell Petroleum Corpo RationCario Mary Cris DaanoyNo ratings yet

- 25 Den A BankDocument54 pages25 Den A BankmajithiyaNo ratings yet

- George Stamper A Credit Analyst With Micro Encapsulators Corp Mec NeededDocument2 pagesGeorge Stamper A Credit Analyst With Micro Encapsulators Corp Mec NeededAmit PandeyNo ratings yet

- ABM-APPLIED-ECONOMICS-12 Q1 W4 Mod4Document25 pagesABM-APPLIED-ECONOMICS-12 Q1 W4 Mod4Yannah LongalongNo ratings yet

- CTM WheatDocument10 pagesCTM WheatVini GoelNo ratings yet

- Building Brand ArchitectureDocument4 pagesBuilding Brand ArchitectureArkabh Mitra0% (1)

- Draft Company Profile Rev3.5 Tanpa JourneyDocument4 pagesDraft Company Profile Rev3.5 Tanpa JourneyAgam GumilangNo ratings yet

- Chapter 3 - Forward and Futures Pricing - 2022 - SDocument63 pagesChapter 3 - Forward and Futures Pricing - 2022 - SĐức Nam TrầnNo ratings yet

- Ogl 230231660900898542Document5 pagesOgl 230231660900898542Manohar NMNo ratings yet

- 15.05.2023 Cause List C - IiDocument6 pages15.05.2023 Cause List C - IiPranay ChauguleNo ratings yet

- Pope - Et - Al 2013 (EIA)Document25 pagesPope - Et - Al 2013 (EIA)alianzacampeonNo ratings yet

- Doing Business in The Philippines 2020Document75 pagesDoing Business in The Philippines 2020rheaNo ratings yet

- JKIL 3644 - MS For Concourse Cross Arm Erection (R4) - CompressedDocument42 pagesJKIL 3644 - MS For Concourse Cross Arm Erection (R4) - CompressedSamved PatelNo ratings yet

- Treasury Securities in BangladeshDocument12 pagesTreasury Securities in BangladeshAmit KumarNo ratings yet

- 2023 11 11 16 29 12 Statement - 1699680552067Document7 pages2023 11 11 16 29 12 Statement - 1699680552067roshansm1978No ratings yet

- Tax Invoice: Treebo Trend Hotel TulipDocument2 pagesTax Invoice: Treebo Trend Hotel TulipAman Ahmad ZaidiNo ratings yet