Professional Documents

Culture Documents

Cash Budget

Uploaded by

Huzaifa Waseem0 ratings0% found this document useful (0 votes)

3 views1 pageThe document provides information to prepare a monthly cash budget for a company called ABC Ltd from November to May. It details ABC Ltd's starting capital, financing obtained, initial equipment purchases, cost structure and selling price for its products. It also provides the company's fixed and variable overhead costs, production and sales forecasts, credit terms, and payment schedules for expenses. The cash budget will use this information to project the company's monthly cash inflows and outflows over the given period.

Original Description:

Cash budget

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information to prepare a monthly cash budget for a company called ABC Ltd from November to May. It details ABC Ltd's starting capital, financing obtained, initial equipment purchases, cost structure and selling price for its products. It also provides the company's fixed and variable overhead costs, production and sales forecasts, credit terms, and payment schedules for expenses. The cash budget will use this information to project the company's monthly cash inflows and outflows over the given period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageCash Budget

Uploaded by

Huzaifa WaseemThe document provides information to prepare a monthly cash budget for a company called ABC Ltd from November to May. It details ABC Ltd's starting capital, financing obtained, initial equipment purchases, cost structure and selling price for its products. It also provides the company's fixed and variable overhead costs, production and sales forecasts, credit terms, and payment schedules for expenses. The cash budget will use this information to project the company's monthly cash inflows and outflows over the given period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

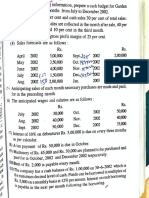

TABANI’S SCHOOL OF ACCOUNTANCY

CASH BUDGET

ABC Ltd started his business on 1 November 2004 with share capital of Rs.200,000. It

received Rs.100,000 in enterprise grants from a regional enterprise company and has

negotiated Rs.325,000 from a local bank. At the commencement of the business the company

bought cutting and sewing machine costing Rs.130,000 and fixture and fittings of Rs.11,000.

ABC will sell a small range of products each with similar cost structure and sold at similar

price.

Selling price Rs. 15

Cost

Direct labour Rs. 6.50

Direct material Rs. 3.25

Variable overhead Rs. 1.50

Fixed overheads are property expenses of Rs.240,000 per annum paid monthly in advance

and energy cost of Rs.115,200 are paid quarterly in arrears in February, May, August and

November. Other fixed costs are estimated at Rs.15,000 per month to be paid monthly.

Forecast unit sales are as follows:

Nov Nil

Dec 20,000 units

Jan 24,000 units

Feb 24,000 units

Mar 22,000 units

Apr 20,000 units

May 26,000 units

The planned production profile is as follows:

Nov 24,000 units

Dec 24,000 units

Jan 22,000 units

Feb 20,000 units

Mar 26,000 units

Apr 26,000 units

May 28,000 units

50% of sales are for cash. The remainders are credit sales. All credit sales will be paid in the

month following sale.

Material purchase are paid for in the month incurred. Variable overheads and direct labour

are paid in the month they are incurred. Bank charges i-e interest on overdraft @ 1% per

month, calculate on the closing balance at the end of the month. Interest is paid on the first

banking day of the following month.

Required:

Prepare monthly cash budget from November to May.

From the desk of Majid Masood Page 1 of 1

You might also like

- 2.-A-Journal & Ledger - QuestionsDocument3 pages2.-A-Journal & Ledger - QuestionsLibrarian 19750% (1)

- Accounting ProblemsDocument2 pagesAccounting Problemssuneel kumarNo ratings yet

- Master Budget With SolutionsDocument12 pagesMaster Budget With SolutionsDea Andal100% (4)

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- BudgetingDocument5 pagesBudgetingKevin James Sedurifa Oledan100% (1)

- Cash Budget . Feb 2020: Q 1 Calgon ProductsDocument11 pagesCash Budget . Feb 2020: Q 1 Calgon Products신두No ratings yet

- Master Budget ProblemsDocument3 pagesMaster Budget ProblemsMelDominiLicardoEboNo ratings yet

- Keys in Manacc Seatwork - BUDGETINGDocument2 pagesKeys in Manacc Seatwork - BUDGETINGRoselie Barbin50% (2)

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Final Exam - Sent StudentsDocument6 pagesFinal Exam - Sent StudentsYến Hoàng HảiNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- Budgeting - 1Document3 pagesBudgeting - 1Muhammad MansoorNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Master Budget AssignmentDocument1 pageMaster Budget AssignmentAbreham AwokeNo ratings yet

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- Cash Budget - QuesDocument3 pagesCash Budget - QuesSaima EliteNo ratings yet

- Programmazione e Controllo Esercizi Capitolo 7aDocument14 pagesProgrammazione e Controllo Esercizi Capitolo 7aMavzky RoqueNo ratings yet

- Budgeting - 2Document4 pagesBudgeting - 2Muhammad MansoorNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- M5 Management of Cash Pract. ProbDocument5 pagesM5 Management of Cash Pract. ProbAmruta PeriNo ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- Assignment #4Document1 pageAssignment #4eromoarughu123No ratings yet

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Case Analysis (1 30)Document3 pagesCase Analysis (1 30)manishadaaNo ratings yet

- Budgeting NumericalsDocument6 pagesBudgeting NumericalsAll in ONENo ratings yet

- Shrawan Bhadra Aswin Kartik: Problem 1Document17 pagesShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Budget Questions Hac1Document5 pagesBudget Questions Hac1odedeyi aishat0% (1)

- Budgeting For Profit PlanningDocument6 pagesBudgeting For Profit Planningmamannish7902No ratings yet

- CVP AnalysisDocument2 pagesCVP Analysisjhean dabatosNo ratings yet

- Modul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662Document30 pagesModul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662hendy DidoNo ratings yet

- Chapter 5-Master Budgeting Offline Quiz-1 PDFDocument2 pagesChapter 5-Master Budgeting Offline Quiz-1 PDFMARY ALODIA BEN YBARZABALNo ratings yet

- Barley Inc Wants A Projection of Cash Receipts and CashDocument1 pageBarley Inc Wants A Projection of Cash Receipts and CashAmit PandeyNo ratings yet

- Preparation of Cash BudgetDocument3 pagesPreparation of Cash BudgetFaye RoceroNo ratings yet

- CP 7 TemplatesDocument13 pagesCP 7 Templatessunnitd10No ratings yet

- Chapter Two: Master Budget and Responsibility AccountingDocument25 pagesChapter Two: Master Budget and Responsibility Accountingweyn deguNo ratings yet

- WCM 14Document3 pagesWCM 14Trianbh SharmaNo ratings yet

- Budgetary ControlDocument6 pagesBudgetary ControlVaibhav SehgalNo ratings yet

- Cash BudgetDocument1 pageCash Budgetzaindd18No ratings yet

- Waterways CaseDocument2 pagesWaterways Caselalitadewi.pNo ratings yet

- Adobe Scan Apr 13, 2023Document6 pagesAdobe Scan Apr 13, 2023Mansi SinghNo ratings yet

- Royal Company Budgeting - With Additional DetailsDocument3 pagesRoyal Company Budgeting - With Additional DetailsSonakshi BhatiaNo ratings yet

- The Master Budget - 1st QTRDocument41 pagesThe Master Budget - 1st QTRqueene50% (4)

- Op Budget SampleDocument2 pagesOp Budget SampleAngelica MalpayaNo ratings yet

- Assignment On Budgeting-MANACDocument3 pagesAssignment On Budgeting-MANACLaksheya KhannaNo ratings yet

- Operational Budgeting ReviewerDocument5 pagesOperational Budgeting ReviewerMilcah Deloso Santos100% (1)

- Chapter Two Master Budget and Responsibility Accounting What Is Budget?Document12 pagesChapter Two Master Budget and Responsibility Accounting What Is Budget?kirosNo ratings yet

- Course Project1 InstructionsDocument4 pagesCourse Project1 InstructionsEnock RutoNo ratings yet

- Final Exam - Sent StudentsDocument5 pagesFinal Exam - Sent StudentsTrần Nguyễn Tuệ MinhNo ratings yet

- KorpratsiDocument4 pagesKorpratsidelgermurun deegiiNo ratings yet

- 2008-11-06 154427 Marsh CompanyDocument8 pages2008-11-06 154427 Marsh CompanyVher DucayNo ratings yet

- Mozammil 029Document4 pagesMozammil 029Iqbal Shan LifestyleNo ratings yet

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- Budgeting Tute 01Document2 pagesBudgeting Tute 01Maithri Vidana KariyakaranageNo ratings yet

- Cash BudgetDocument6 pagesCash BudgetSalahuddin ShahNo ratings yet

- Example Question Financial ManagementDocument3 pagesExample Question Financial ManagementNadhirah NadriNo ratings yet

- Auditing 2019 P S CH 8Document16 pagesAuditing 2019 P S CH 8barakat801No ratings yet

- Questions On Budgets SPPU MBA Sem 1Document7 pagesQuestions On Budgets SPPU MBA Sem 1Ketan IngaleNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- 2017 International Comparison Program for Asia and the Pacific: Purchasing Power Parities and Real Expenditures—Results and MethodologyFrom Everand2017 International Comparison Program for Asia and the Pacific: Purchasing Power Parities and Real Expenditures—Results and MethodologyNo ratings yet