Professional Documents

Culture Documents

7001 Electra Ka Insurance

Uploaded by

gpsinghvijOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7001 Electra Ka Insurance

Uploaded by

gpsinghvijCopyright:

Available Formats

1

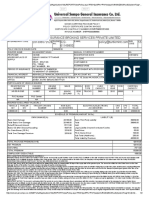

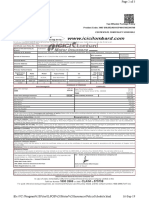

CERTIFICATE OF INSURANCE CUM POLICY SCHEDULE

1

Two Wheeler Vehicles Package Policy

Product Code: 3005 UIN: IRDAN115RP0015V04201425

Name of the Insured : HARMEET SINGH Policy No. : 3005/RF-15067239/00/000

Address : 44-A-NEW LAYALPUR KRISHNA NAGAR Period of Insurance : Jan 03, 2020 12:00:00 to

DELHI 110051 Midnight of Jan 04, 2025

Telephone No : Mobile No: 8882602021 E-Policy No. : 3005/RF-15067239/00/000

Email Address : HARMEETSINGH4500@GMAIL.COM Policy Issued On : Jan 03, 2020

Nominee Name : LEGAL HIRE Named Passenger's Nominee: Covernote No. : 395907206

Relationship : Spouse - RTO Location : DELHI-NEW DELHI

Age : - Hypothecated To :

GSTIN No. (Customer) : Invoice No. : 2006232082779

Servicing Branch Name : Mumbai

Servicing Branch Address : 414, ICICI LOMBARD HOUSE, VEER SAVARKAR MARG, NEAR SIDDHI VINAYAK TEMPLE MAIN GATE, PRABHADEVI, MUMBAI,

400025, MAHARASHTRA

Politically Exposed Person (PEP)/close relative of PEP: No

Vehicle Registration Make Model Type of Body CC/KW Mfg Yr Seating Chassis No. Engine No.

No. Capacity

ROYAL Solo With

NEW VEHICLE BULLET X 350 ES 350 2020 2 ME3U3S5C1LA194377 U3S5C1LA194377

ENFIELD Pillion

Vehicle IDV Side Car Additional Accessories (`) Electrical / Electronic Non Electrical CNG / LPG Unit Total IDV

(`) (`) Accessories (`) Accessories (`) (`) (`)

120,000.00 0.00 0.00 0.00 0.00 0.00 120,000.00

Premium Details

OWN DAMAGE(A) (`) LIABILITY(B) (`)

Basic OD Premium 2587 Basic Third Party Liability 5453

Sub Total 2587 Total 5453

Total Own Damage Premium(A) 3092 Total Liability Premium(B) 5903

Total Package Premium(A+B): 8995

% 0.00

CGST

` 0.00

% 0.00

SGST

` 0.00

% 0.00

UTGST

` 0.00

% 1620

IGST

` 183.60

Total Tax Payable in ` 184.00

Total Premium Payable In ` 10615

Geographical Area: India Applicable IMT Clauses: 7 , 22

Compulsory Deductible: ` 100.00 Voluntary Deductible: ` 0.00

Features of Add-on Covers:

Telematics (Pay-As-You-Use) : Section I -Own Damage, Fire & Theft cover would be available only till the time opted kilometres are not exhausted.

Premium Collection No. 2175785982 Premium Amount ` 10615 Receipt Date 03-01-2020

GSTIN Reg.No 27AAACI7904G1ZN HSN/SAC code 997134 / GENERAL

INSURANCE SERVICES

We hereby declare that though our aggregate turnover in any preceding financial year from 2017-18 onwards is more than the aggregate turnover notified under sub-rule (4) of

rule 48, we are not required to prepare an invoice in terms of the provisions of the said sub-rule.

Limits of Liability: (a) Under Section II-I(i) of the policy: Death of or bodily injury & (b) Under Section II-I(ii) of the policy: Damage to Third Party Property- Such amount as is

necessary to meet the requirements of the Motor Vehicles (Amendment) Act, 2019 ` 1,00,000.00/-; PA Cover for Owner-Driver under Section III: CSI ` 0.00/-. The

Compulsory Personal Accident cover has not been opted in this policy on account that, the Owner driver has a separate existing Personal Accident cover against Death

and Permanent Disability (Total and Partial) for Sum Insured of at least Rs.15 lacs. Limitations as to Use: The Policy covers use of the vehicle for any purpose other than:

Hire or Reward, Carriage of goods (other than samples of personal luggage), Organised racing, Pace Making, Reliability trails or Speed testing, any purpose in Connection

with Motor Trade. Driver's Clause: Any person including the insured: Provided that a person driving holds an effective driving license at the time of the accident and is not

disqualified from holding or obtaining such a license. Provided also that the person holding an effective learner's license may also drive the vehicle and that such a person

satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989. Important Notice: The insured is not indemnified if the vehicle is used or driven otherwise

than in accordance with this schedule. Any payment made by the Company by reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle

Act, 1988 is recoverable from the insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY".

In consideration of the premium for this extension being calculated at a pro-rata proportion of the annual premium, it is hereby declared and agreed by the insured that upon

expiry of this extension, this policy shall be renewed for a period of twelve months, failing which the difference between the extension premium now paid on pro rata basis

and the premium at short period rate shall become payable by the insured.For Legal interpretation, English version will hold good. Disclaimer: Please visit

www.icicilombard.com for the policy wordings, for complete details on terms and conditions governing the coverage and NCB. This document is to be read with the policy

wordings. The policy i s valid subject to realization of cheque. We accept premium only via legally recognized modes. In case of dishonour of premium cheque, the

company shall not be liable under the policy and the policy shall be void ab-initio. In case of any discrepancy with respect to the policy, please revert within 15 days from

the policy start date. This policy i s underwritten on the basis of the information provided by you and as detailed in the Risk Assumption Letter shared with you along with

the policy. On renewal, the benefits provided under the policy and/or terms and conditions of the policy including premium rate may be subject to change. Grievance

CORP/SUP/OPI/2014/1777

Jun 25, 2023

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Kavitha TW NewDocument6 pagesKavitha TW Newrajeshsfc3305No ratings yet

- PolicySoftCopy 104667249Document1 pagePolicySoftCopy 104667249Masum PatthakNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument2 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsUTTAL RAYNo ratings yet

- Pankaj KumarDocument1 pagePankaj KumarKAHANI JINo ratings yet

- Smart Drive Two Wheeler Insurance Policy DetailsDocument1 pageSmart Drive Two Wheeler Insurance Policy Detailshaja immranNo ratings yet

- Wa0005.Document3 pagesWa0005.Zk insorence PointNo ratings yet

- New 1Document1 pageNew 1ss9324490794No ratings yet

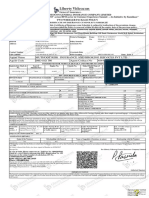

- Agent Name Direct Agent Code Agent Contact No: Private Car Package Policy Liberty General Insurance LimitedDocument1 pageAgent Name Direct Agent Code Agent Contact No: Private Car Package Policy Liberty General Insurance LimitedRidham GuptaNo ratings yet

- Ns 200Document1 pageNs 200Vinod ShresthaNo ratings yet

- 3001 138549004 00 B00 PyDocument2 pages3001 138549004 00 B00 PyAshish KumarNo ratings yet

- Premium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteDocument1 pagePremium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteMahalaxmi AgenciesNo ratings yet

- Two Wheeler Insurance Policy SummaryDocument1 pageTwo Wheeler Insurance Policy SummaryGrace Touch Interior and DesignsNo ratings yet

- Two Wheeler Insurance SummaryDocument1 pageTwo Wheeler Insurance SummaryPrabu ArNo ratings yet

- Wb40au7913 PolicyDocument1 pageWb40au7913 Policyzaid AhmedNo ratings yet

- Motor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesMotor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleAKshay PareekkNo ratings yet

- Goods Carrying Package Policy DetailsDocument2 pagesGoods Carrying Package Policy Detailsanshi75% (4)

- Two Wheeler Insurance Policy SummaryDocument2 pagesTwo Wheeler Insurance Policy SummaryMONU100% (1)

- Policy DocumentDocument7 pagesPolicy DocumentGideon DassNo ratings yet

- Premium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteDocument1 pagePremium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteishaqinvestNo ratings yet

- 2024 RenualDocument7 pages2024 RenualraghulramasamyNo ratings yet

- Komanduri Anantha CharyuluDocument1 pageKomanduri Anantha CharyuluAnanth KomanduriNo ratings yet

- TaxDocument2 pagesTaxnetmaxx200450% (2)

- Policy - Car Insurance SwiftDocument11 pagesPolicy - Car Insurance Swiftavanthi.surNo ratings yet

- Vehicle Policy 22-23Document2 pagesVehicle Policy 22-23Sahana SatishNo ratings yet

- Agent Name & No Airtel Payments Bank LTD (11006207) Agent Contact No 8800688006Document2 pagesAgent Name & No Airtel Payments Bank LTD (11006207) Agent Contact No 8800688006Toufeeq AbrarNo ratings yet

- 3005 53561895 01 000Document1 page3005 53561895 01 000santoshganjure@bluebottle.comNo ratings yet

- Om PrakashDocument2 pagesOm Prakashanshi100% (1)

- Liberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationDocument3 pagesLiberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationAbcNo ratings yet

- UIIC Two Wheeler WorksheetDocument2 pagesUIIC Two Wheeler WorksheetkabilNo ratings yet

- Premium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium QuoteDocument1 pagePremium Computation: Liberty General Insurance Limited Private Car - Package Policy Premium Quoteaseem.bansalNo ratings yet

- TWO WHEELER INSURANCE POLICY DETAILSDocument3 pagesTWO WHEELER INSURANCE POLICY DETAILSRamanuja GanguNo ratings yet

- Policy ScheduleDocument2 pagesPolicy Schedulepou pouNo ratings yet

- Vishal Bhaiya Broker - Policy DetailsDocument2 pagesVishal Bhaiya Broker - Policy Detailsastha shuklaNo ratings yet

- V R Power Equipments PVT LTDDocument3 pagesV R Power Equipments PVT LTDMADHUKAR JHANKALNo ratings yet

- Private car package policy detailsDocument2 pagesPrivate car package policy detailsanshi33% (3)

- Magma HDI General Insurance Co. Ltd.Document1 pageMagma HDI General Insurance Co. Ltd.sarath potnuriNo ratings yet

- Liberty General Insurance Limited: Insured Motor Vehicle DetailsDocument3 pagesLiberty General Insurance Limited: Insured Motor Vehicle DetailsAkash BidhuriNo ratings yet

- Private Car Insurance Certificate and Policy ScheduleDocument1 pagePrivate Car Insurance Certificate and Policy ScheduleHardik RavalNo ratings yet

- Insurrance PageDocument1 pageInsurrance PageSuresh GounderNo ratings yet

- Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPrivate Car Package Policy: Certificate of Insurance Cum Policy ScheduleAman VermaNo ratings yet

- PolicySchedule 520543185Document2 pagesPolicySchedule 520543185ratneshsrivastava7No ratings yet

- Sbi So 2019 0801191801 Detailed-Ad-EnglishDocument1 pageSbi So 2019 0801191801 Detailed-Ad-EnglishHarika VenuNo ratings yet

- Mh01aj5125 PDFDocument7 pagesMh01aj5125 PDFSELVEL SYNDICATENo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931MuraliMohanNo ratings yet

- Broker - Policy DetailsDocument1 pageBroker - Policy DetailsRupendra sainiNo ratings yet

- HDFC ERGO General Insurance Company Limited 2nd Floor, Potluri Castle, Dwarakanagar, VSP, 16, Vishakapatnam - 530 016Document2 pagesHDFC ERGO General Insurance Company Limited 2nd Floor, Potluri Castle, Dwarakanagar, VSP, 16, Vishakapatnam - 530 016Siva rajNo ratings yet

- Agent Name & No Landmark Insurance Brokers PVT (2C000048) Agent Contact No 9833399772Document2 pagesAgent Name & No Landmark Insurance Brokers PVT (2C000048) Agent Contact No 9833399772Naveen VNo ratings yet

- Limite D: Reliance Private Car Package Policy-ScheduleDocument9 pagesLimite D: Reliance Private Car Package Policy-Schedulesukhpreet singhNo ratings yet

- Broker - Policy DetailsRADocument1 pageBroker - Policy DetailsRARupendra sainiNo ratings yet

- Tn22cq1238 Insurance Liberty Videocon 10 Jun 2018Document3 pagesTn22cq1238 Insurance Liberty Videocon 10 Jun 2018Narayanan KrishnanNo ratings yet

- Liberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationDocument3 pagesLiberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationNaveenNo ratings yet

- Activa Insurance DocumentDocument6 pagesActiva Insurance DocumentthakuryaNo ratings yet

- Saurabh TW PolicyDocument2 pagesSaurabh TW Policysaurabh kushwahaNo ratings yet

- Vasi 2Document1 pageVasi 2mobileshop001msNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument2 pagesBroker:: Hero Insurance Broking India Pvt. LTDRohit ChauhanNo ratings yet

- Rjo2ba2549 PDFDocument2 pagesRjo2ba2549 PDFtalvinder singhNo ratings yet

- Private Car Insurance Policy SummaryDocument3 pagesPrivate Car Insurance Policy Summarycommission sompoNo ratings yet

- Mukesh FirDocument1 pageMukesh FirgpsinghvijNo ratings yet

- 30 30303030 PDFDocument3 pages30 30303030 PDFgpsinghvijNo ratings yet

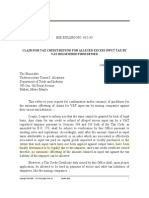

- CH 29Document1 pageCH 29gpsinghvijNo ratings yet

- CH 30Document2 pagesCH 30gpsinghvijNo ratings yet

- Full Download Advanced Accounting 6th Edition Jeter Test BankDocument35 pagesFull Download Advanced Accounting 6th Edition Jeter Test Bankjacksongubmor100% (40)

- Business Ethics Q4 Mod4 Introduction To The Notion of Social Enterprise-V3Document29 pagesBusiness Ethics Q4 Mod4 Introduction To The Notion of Social Enterprise-V3Charmian100% (1)

- Limitations of the IS-LM model and how it is affectedDocument1 pageLimitations of the IS-LM model and how it is affectedRai JiNo ratings yet

- The Signal Report 2022 - FINAL PDFDocument28 pagesThe Signal Report 2022 - FINAL PDFANURADHA JAYAWARDANANo ratings yet

- Marketing Strategy of Samsung Mobile Sector in BangladeshDocument22 pagesMarketing Strategy of Samsung Mobile Sector in BangladeshAtanu MojumderNo ratings yet

- Measuring The Financial Effects of Mitigating Commodity Price Volatility in Supply ChainsDocument15 pagesMeasuring The Financial Effects of Mitigating Commodity Price Volatility in Supply ChainsLejandra MNo ratings yet

- Letter of Enquiry and Response EditedDocument5 pagesLetter of Enquiry and Response EditedMugdhaNo ratings yet

- Chapter 2 - CreditDocument18 pagesChapter 2 - CreditĐỉnh Kout NamNo ratings yet

- HidadfrDocument55 pagesHidadfrArvind JSNo ratings yet

- Artist Management Contract 07Document14 pagesArtist Management Contract 07Yah MCNo ratings yet

- Pak PWDDocument2 pagesPak PWDSheikh BeryalNo ratings yet

- BIR Ruling 415-93Document2 pagesBIR Ruling 415-93Russell PageNo ratings yet

- DSSB Company Profile - Apr 2020 (V10)Document22 pagesDSSB Company Profile - Apr 2020 (V10)Samuel CarlosNo ratings yet

- Presentation 1Document57 pagesPresentation 1Marie TripoliNo ratings yet

- Introduction To Data Mining, 2 Edition: by Tan, Steinbach, Karpatne, KumarDocument95 pagesIntroduction To Data Mining, 2 Edition: by Tan, Steinbach, Karpatne, KumarsunilmeNo ratings yet

- 3rd INTERNATIONAL WORKSHOP ON UI GREENMETRICDocument36 pages3rd INTERNATIONAL WORKSHOP ON UI GREENMETRICNugroho Widyo P, SNo ratings yet

- Indian Footwear Industry: Global Production and Export PowerhouseDocument6 pagesIndian Footwear Industry: Global Production and Export PowerhouseVishal DesaiNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Recent Trends in Operations ManagementDocument5 pagesRecent Trends in Operations Managementmechidream100% (12)

- 2015 SLCC Volunteer Staff AppDocument3 pages2015 SLCC Volunteer Staff AppjoeyjamisonNo ratings yet

- Software Testing Strategies: Software Engineering: A Practitioner's Approach, 7/eDocument33 pagesSoftware Testing Strategies: Software Engineering: A Practitioner's Approach, 7/egarimadhawan2No ratings yet

- MY Price List With CSV SBDocument6 pagesMY Price List With CSV SBNini Syaheera Binti JasniNo ratings yet

- Units: MR Muhammad IntazarDocument2 pagesUnits: MR Muhammad Intazarjamesyum.jy1No ratings yet

- EconDocument12 pagesEconfranz justin kyle syNo ratings yet

- DHL Express - USA Customs Duty InvoiceDocument1 pageDHL Express - USA Customs Duty InvoiceShahid SaleemNo ratings yet

- Attachment 0Document58 pagesAttachment 0Khlif NadaNo ratings yet

- EN-Invitation To Tender-2023-0002-FinalDocument5 pagesEN-Invitation To Tender-2023-0002-FinalOzreniusNo ratings yet

- Phonics Stage 1 PDFDocument50 pagesPhonics Stage 1 PDFMehwish Azmat83% (6)

- Licence Conditions and Codes of PracticeDocument80 pagesLicence Conditions and Codes of PracticeEric GarciaNo ratings yet

- Case For Critical Analysis Elektra Products, Inc.: Management DynamicsDocument11 pagesCase For Critical Analysis Elektra Products, Inc.: Management Dynamicsjojo_p_javierNo ratings yet