Professional Documents

Culture Documents

Sample Inter Invty

Sample Inter Invty

Uploaded by

Johnallenson DacosinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Inter Invty

Sample Inter Invty

Uploaded by

Johnallenson DacosinCopyright:

Available Formats

Prob.

1

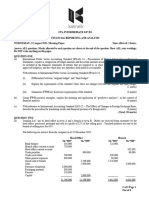

PP Corp owns 70% of SS Co.’s outstanding stocks, acquired on Jan. 1, 2026. SS regularly sales merchandise to PP at 150%

of SS’s cost. PP’s Dec. 31, 2026 and 2027 inventories include goods purchased intercompany of 112,500 and 33,000

respectively. The separate incomes (excluding investment income) of PP and SS for 2027 are summarized below:

PP SS

Sales 1,200,000 800,000

COGS (600,000) (500,000)

Opex (400,000) (100,000)

CI from own operations 200,000 200,000

Consolidated income allocated to Parent ______________ to NCI ______________________

Prob. 2

On Jan. 1, 2026, PP Co. purchased 75% of the outstanding stock of SS at book value. During 2027, SS sold inventory items

costing 50,000 to PP for 75,000. PP resold 60% of this inventory to outsiders during the year for 100,000. For the year

2027, PP had CI from its own operations of 200,000 and paid dividends of 120,000. SS CI for the year was 110,000, it paid

40,000 inn dividends. Consolidated CI attributable to parent _________________________

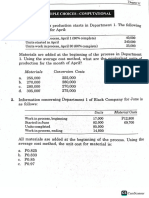

Prob. 3

On Jan. 1, 2026 PP Corp. acquired 80% of SS at book value. The ff. information is available for years 2026 and 2027:

2026 2027

CI from its own operation

PP 500,000 550,000

SS 200,000 225,000

Sales by PP to SS 100,000 120,000

COGS 60,000 60,000

Inventory at billed price – 12/31 20,000 30,000

Consolidated comprehensive income in 2026 ____________________ and 2027 _______________________

Prob. 4

PP purchased 70% of SS voting stock on May 18, 2023 at underlying value. The companies reported the ff. data with

respect to intercompany sales in 2026 and 2027:

Year Purchased by Purchase price Sold to Sale price Unsold at 12/31 Year sold outside

2026 SS 120,000 PP 180,000 45,000 2027

2027 SS 90,000 PP 135,000 30,000 2028

2028 PP 140,000 SS 280,000 110,000 2028

PP reported operating income (excluding dividend income) of 160,000 and 220,000 in 2026 and 2027 respectively. SS

reported CI of 90,000 and 85,000 in 2026 and 2027 respectively.

Consolidated income attributable to PP ____________________

Inventory balance in consolidated SFP at Dec. 31, 2027 _________________

Consolidated COGS in 2027 __________________________

Consolidated CI in 2027 ___________________________

You might also like

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HareNo ratings yet

- Prof. Francis O. Mateos, CPA: Bappaud - Applied AuditingDocument5 pagesProf. Francis O. Mateos, CPA: Bappaud - Applied AuditingElisha Batalla80% (5)

- Company Law BMSDocument125 pagesCompany Law BMSShivraj BSCNo ratings yet

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Document4 pagesComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonNo ratings yet

- Exercise Answers - Intercompany Sale of InventoryDocument3 pagesExercise Answers - Intercompany Sale of InventoryJohn Philip L Concepcion100% (1)

- Consolidated FS QuizDocument4 pagesConsolidated FS QuizCattleya0% (2)

- 14 Consolidated FS Pt1 PDFDocument2 pages14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- Test Bank For Busn 11th Edition Marcella Kelly Chuck WilliamsDocument30 pagesTest Bank For Busn 11th Edition Marcella Kelly Chuck WilliamsJoseph Ellison100% (35)

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Document12 pagesSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- Name: DEC. 17, 2020 Buscom ScoreDocument4 pagesName: DEC. 17, 2020 Buscom ScoreErica DaprosaNo ratings yet

- Intercompny Inventory and FADocument1 pageIntercompny Inventory and FAAngelica MalpayaNo ratings yet

- p2 Guerrero Ch10 CompressDocument1 pagep2 Guerrero Ch10 CompressJohnallenson DacosinNo ratings yet

- Intercompny Inventory and FADocument1 pageIntercompny Inventory and FAJohnallenson DacosinNo ratings yet

- IA2 Prelim Exam Invt in AssocDocument5 pagesIA2 Prelim Exam Invt in AssocJoel RagosNo ratings yet

- NGO Chapter 4 QUESTIONSDocument1 pageNGO Chapter 4 QUESTIONSJohnallenson DacosinNo ratings yet

- Auditing Investments 2Document5 pagesAuditing Investments 2Sabel FordNo ratings yet

- 5th Year Buscom For DiscussionDocument5 pages5th Year Buscom For DiscussionAirille CarlosNo ratings yet

- InvestDocument5 pagesInvestJesselle H. BANAWOLNo ratings yet

- Consolidated FS (Sale of Inventory)Document4 pagesConsolidated FS (Sale of Inventory)Arn KylaNo ratings yet

- Wa0003.Document6 pagesWa0003.joanNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- Auditing Investments 1Document2 pagesAuditing Investments 1Sabel FordNo ratings yet

- Investment in Associate and Joint VentureDocument5 pagesInvestment in Associate and Joint VenturedumpyforhimNo ratings yet

- AFR Mid TermDocument8 pagesAFR Mid TermRizviNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- FA@FV and AC. Initial Subsequent Measurement. ReclassificationDocument4 pagesFA@FV and AC. Initial Subsequent Measurement. ReclassificationMiccah Jade CastilloNo ratings yet

- M36 - Quizzer 4Document5 pagesM36 - Quizzer 4Joshua DaarolNo ratings yet

- Sheldon LTD Group Comprehensive Worked ExampleDocument2 pagesSheldon LTD Group Comprehensive Worked Exampledea.shafa29No ratings yet

- Quiz Chapter7Document3 pagesQuiz Chapter7Christine Jane RamosNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Revision Test Paper: Cap Ii (June 2017)Document12 pagesRevision Test Paper: Cap Ii (June 2017)binuNo ratings yet

- Acct320 LQ5V2Document4 pagesAcct320 LQ5V2laibaNo ratings yet

- JSW Paints Private LimitedDocument8 pagesJSW Paints Private LimitedvineminaiNo ratings yet

- AFU 08501 - Tutorial Set-2021 - DemosntrationDocument5 pagesAFU 08501 - Tutorial Set-2021 - DemosntrationCunningham LazzNo ratings yet

- Fundamentals of Partnership: Gurukul The School, Ghaziabad 1Document2 pagesFundamentals of Partnership: Gurukul The School, Ghaziabad 1ayeshaNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- FAR610 - Test 1-Apr2018-Q PDFDocument3 pagesFAR610 - Test 1-Apr2018-Q PDFIman NadhirahNo ratings yet

- Accounting Review QuestionsDocument34 pagesAccounting Review Questionsjoyce KimNo ratings yet

- Exercise On Csofp - Associates Happy Enjoy Fun - Mixed PDFDocument3 pagesExercise On Csofp - Associates Happy Enjoy Fun - Mixed PDFNoor ShukirrahNo ratings yet

- Conso FS SubsequentDocument1 pageConso FS SubsequentreiNo ratings yet

- Mozammil 029Document4 pagesMozammil 029Iqbal Shan LifestyleNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- GshshshsDocument7 pagesGshshshsMax Dela TorreNo ratings yet

- Partnership Dissolution and Liquidation DrillsDocument6 pagesPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- FNJ 7417frfinalquestionpaperDocument10 pagesFNJ 7417frfinalquestionpaperKv kNo ratings yet

- Seatwork #2: What Is The Capital Balances of All The Partners in The New Partnership?Document4 pagesSeatwork #2: What Is The Capital Balances of All The Partners in The New Partnership?Tifanny MallariNo ratings yet

- Shareholders EquityDocument2 pagesShareholders EquityAudrey LiberoNo ratings yet

- BusCom Intercompany SalesDocument18 pagesBusCom Intercompany SalesCarmela BautistaNo ratings yet

- INTERCOMPANY TRANSACTIONsDocument3 pagesINTERCOMPANY TRANSACTIONsChelle CastuloNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Mixed Sample ProblemsDocument11 pagesMixed Sample ProblemsKathleen MarcialNo ratings yet

- Paper - 1: Advanced AccountingDocument19 pagesPaper - 1: Advanced AccountingZamda HarounNo ratings yet

- Accounts Test 23 Mar QPDocument3 pagesAccounts Test 23 Mar QPnavyabearad2715No ratings yet

- Aud Sample UpdatedDocument36 pagesAud Sample Updatedreynald john dela cruzNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- Audit of Biological AssetsDocument3 pagesAudit of Biological AssetsJohnallenson DacosinNo ratings yet

- THEORY InventoryDocument1 pageTHEORY InventoryJohnallenson DacosinNo ratings yet

- Chapter 6 NGODocument1 pageChapter 6 NGOJohnallenson DacosinNo ratings yet

- Module 9-Dacosin, John Allenson DDocument6 pagesModule 9-Dacosin, John Allenson DJohnallenson DacosinNo ratings yet

- Ethics - Module 8Document4 pagesEthics - Module 8Johnallenson DacosinNo ratings yet

- Lecture 03 FA at FV Through OCIDocument1 pageLecture 03 FA at FV Through OCIJohnallenson DacosinNo ratings yet

- Science 1 - John Allenson Dacosin - Bsa 2aDocument6 pagesScience 1 - John Allenson Dacosin - Bsa 2aJohnallenson DacosinNo ratings yet

- Intercompany AssetsDocument1 pageIntercompany AssetsJohnallenson DacosinNo ratings yet

- General PrinciplesDocument11 pagesGeneral PrinciplesJohnallenson DacosinNo ratings yet

- NGO Chapter 4 QUESTIONSDocument1 pageNGO Chapter 4 QUESTIONSJohnallenson DacosinNo ratings yet

- DeductionsDocument29 pagesDeductionsJohnallenson DacosinNo ratings yet

- AR ClassificationDocument3 pagesAR ClassificationJohnallenson DacosinNo ratings yet

- Chapter 5 in HBO ReviewerDocument11 pagesChapter 5 in HBO ReviewerJohnallenson DacosinNo ratings yet

- Activity Chapter 4Document27 pagesActivity Chapter 4Johnallenson DacosinNo ratings yet

- CPAR Tax On Estates and Trusts Batch 91 HandoutDocument10 pagesCPAR Tax On Estates and Trusts Batch 91 HandoutJohnallenson DacosinNo ratings yet

- Sale or Exchange of PropertyDocument7 pagesSale or Exchange of PropertyJohnallenson DacosinNo ratings yet

- Module 6Document51 pagesModule 6Johnallenson DacosinNo ratings yet

- Activity CostDocument5 pagesActivity CostJohnallenson DacosinNo ratings yet

- RCF (Mp32diuuusl5 (XDocument57 pagesRCF (Mp32diuuusl5 (XJohnallenson DacosinNo ratings yet

- FA 2 ModuleDocument16 pagesFA 2 ModuleJohnallenson DacosinNo ratings yet

- 8196 ICICIPrudential EquityandDebtFund ProductNoteDocument3 pages8196 ICICIPrudential EquityandDebtFund ProductNoteKiranmayi UppalaNo ratings yet

- Strategic Management Chapter 7Document3 pagesStrategic Management Chapter 7Jiann DoNo ratings yet

- Homework TimothyDocument4 pagesHomework TimothyLe Thi Luyen QP1138No ratings yet

- Checklist of Documentation - BBDocument6 pagesChecklist of Documentation - BBMd Rafat ArefinNo ratings yet

- E Corporate Manager June 2022 - FINALDocument90 pagesE Corporate Manager June 2022 - FINALlegal shuruNo ratings yet

- Ifrs-3 ConsolidationDocument17 pagesIfrs-3 ConsolidationAmna HussainNo ratings yet

- Simple Business ConceptDocument6 pagesSimple Business ConceptMikayNo ratings yet

- BlackRock US Equity Index Segregated FundDocument1 pageBlackRock US Equity Index Segregated Fundarrow1714445dongxinNo ratings yet

- Ultratech Cement Shareholders HandbookDocument29 pagesUltratech Cement Shareholders Handbookamer.ms2711No ratings yet

- Profit Loss Discount Trainer-1Document2 pagesProfit Loss Discount Trainer-1Deepak SNo ratings yet

- Acc GR 10 Mid Memo-3Document7 pagesAcc GR 10 Mid Memo-3LegobjeNo ratings yet

- ECON102 Ch4 PracticeDocument11 pagesECON102 Ch4 PracticejasminzheaNo ratings yet

- Structured CreditDocument18 pagesStructured CreditatktaouNo ratings yet

- Essentials of Marketing 15th Edition Ebook PDFDocument41 pagesEssentials of Marketing 15th Edition Ebook PDFerica.jones238100% (35)

- Foro 2 Carlos MongeDocument3 pagesForo 2 Carlos MongeCARLOSNo ratings yet

- Jackson Teaching NoteDocument10 pagesJackson Teaching NoteKhalid SediqiNo ratings yet

- Economics of Money Banking and Financial Markets Global 10th Edition Mishkin Test BankDocument25 pagesEconomics of Money Banking and Financial Markets Global 10th Edition Mishkin Test BankPeterHolmesfdns100% (56)

- Fundamentals of Financial Management 12th Edition Brigham Test BankDocument25 pagesFundamentals of Financial Management 12th Edition Brigham Test BankJacobFloresxbpcn100% (45)

- Maths_practice_questionsDocument98 pagesMaths_practice_questionsofficalNo ratings yet

- 10 1108 - Ijoem 11 2019 1001Document32 pages10 1108 - Ijoem 11 2019 1001sela meleniaNo ratings yet

- Internships Catergories NewDocument104 pagesInternships Catergories NewAnanda Kumar Bokka (CDS)No ratings yet

- Acct Statement - XX2168 - 14102023Document6 pagesAcct Statement - XX2168 - 14102023imad karariNo ratings yet

- MyGUDANG MAS-TUR, As at 9th Jan, 2023Document12 pagesMyGUDANG MAS-TUR, As at 9th Jan, 2023Nazaruddin OthmanNo ratings yet

- Acct Statement - XX3873 - 24082023Document18 pagesAcct Statement - XX3873 - 24082023riddhi .brainlyNo ratings yet

- Website Public Disclosure Mar-2022 BupaDocument101 pagesWebsite Public Disclosure Mar-2022 BupaYash DoshiNo ratings yet

- CHR Report - 06 August 2023Document30 pagesCHR Report - 06 August 2023Venella PatrickNo ratings yet

- Annual Report 2022Document190 pagesAnnual Report 2022mika piusNo ratings yet

- Ishika Jain 2021346 PDFDocument59 pagesIshika Jain 2021346 PDFsanu duttaNo ratings yet